Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Genpact LTD | d580368d8k.htm |

| EX-99.1 - EX-99.1 - Genpact LTD | d580368dex991.htm |

Genpact

2

nd

Quarter 2013 Earnings Presentation

August 6, 2013

Ticker (NYSE: G)

Exhibit 99.2 |

Forward

Looking Statements These

materials

contain

certain

statements

concerning

our

future

growth

prospects

and

forward-looking

statements,

as

defined

in

the

safe

harbor

provisions

of

the

U.S.

Private

Securities

Litigation

Reform

Act

of

1995. These statements are based on Genpact’s current expectations and

beliefs, as well as a number of assumptions

concerning

future

events.

These

statements

involve

a

number

of

risks,

uncertainties

and

other

factors that could cause actual results to differ materially from those in such

forward-looking statements. These risks and uncertainties include but

are not limited to a slowdown in the economies and sectors in which

our

clients

operate,

a

slowdown

in

the

BPM

and

IT

Services

sectors,

the

risks

and

uncertainties

arising from our past and future acquisitions, our ability to manage growth,

factors which may impact our cost advantage, wage increases, our ability to

attract and retain skilled professionals, risks and uncertainties regarding

fluctuations in our earnings, general economic conditions affecting our industry as

well as other risks detailed in our reports filed with the U.S. Securities and

Exchange Commission (the “SEC”),

including

the

Company's

Annual

Report

on

Form

10-K.

These

filings

are

available

at

www.sec.gov

or on the investor relations section of our website, www.genpact.com. Genpact may

from time to time make additional written and oral forward-looking

statements, including statements contained in our filings with the SEC. The

Company does not undertake to update any forward-looking statements that may be made from

time to time by or on behalf of the Company.

These materials also include measures defined by the SEC as non-GAAP financial

measures. Genpact believes that these non-GAAP measures can provide

useful supplemental information to investors regarding

financial

and

business

trends

relating

to

its

financial

condition

and

results

of

operations

when

read in conjunction with the Company’s reported results. Reconciliations of

these non-GAAP measures to GAAP are available in this presentation and

in our earnings release dated August 6, 2013. Non-GAAP Financial

Measures |

3

Solid 2

nd

Quarter 2013

We continue to deliver consistent growth which is a reflection of our

differentiated, diversified and resilient business model

Q2 ‘13 versus Q2 ‘12 performance:

Total Revenue:

+14%

Revenue from Global Clients:

+20%

GE Revenue:

-1%

Adjusted Operating Income

(1)

:

+15%

Adjusted

Operating

Income

margin

(1)

of

16.7%

Broad-based growth across industry verticals and service offerings

Smart Decision Services resumed growth

Continued to significantly expand client relationships

Notes:

1)

Adjusted Operating Income is a Non-GAAP Measure. GAAP Operating Income increased 23.5% and GAAP

Operating

Margin was 15%. |

4

Expanding Client Relationships

Notes:

1) Relationship size = Clients representing annual revenues based on rolling

four quarters 41

11

10

55

14

12

0

10

20

30

40

50

60

$5 to $15 MM

$15 to $25 MM

>$25 MM

Relationship Size

(1)

Q2 12

Q2 13 |

5

Our Strategy is Resonating With Clients

Lead

Guide global enterprises to best-in-class through our

proprietary SEP

SM

framework

Example: Selected by large global industrial company to improve its

aftermarket services organization and processes

Expand

Invest in targeted industry verticals and domain expertise

Example:

Won

an

ITO

engagement,

leveraging

our

deep

expertise

in

the

CPG vertical, processes and technology

Allocate

Allocate capital and resources to support sustainable,

profitable growth and shareholder value

Example: Integrated recent acquisition that provided deep domain

expertise in the attractive, high-growth Healthcare market

Deliver

Execute seamlessly for clients across service lines and

geographies

Example: Engaged by large, existing Pharma client to improve end-

consumer experience |

6

Macro-Environment Mixed; Pipeline Healthy

Macro-environment continues to be mixed

Challenges in some geographies and industries, improving in others

Pipeline remains healthy and stable with uptick in larger, transformative deals

U.S. and Europe strong

Growth across verticals led by Capital Markets, CPG, Life Sciences and BFS

Services led by F&A, ITO and Banking Operations

Increased share of large deals in pipeline; extends cycle times

Win rates steady; pricing competitive but stable

Clients’

continued focus on improving business models leading to

more transformative discussions |

7

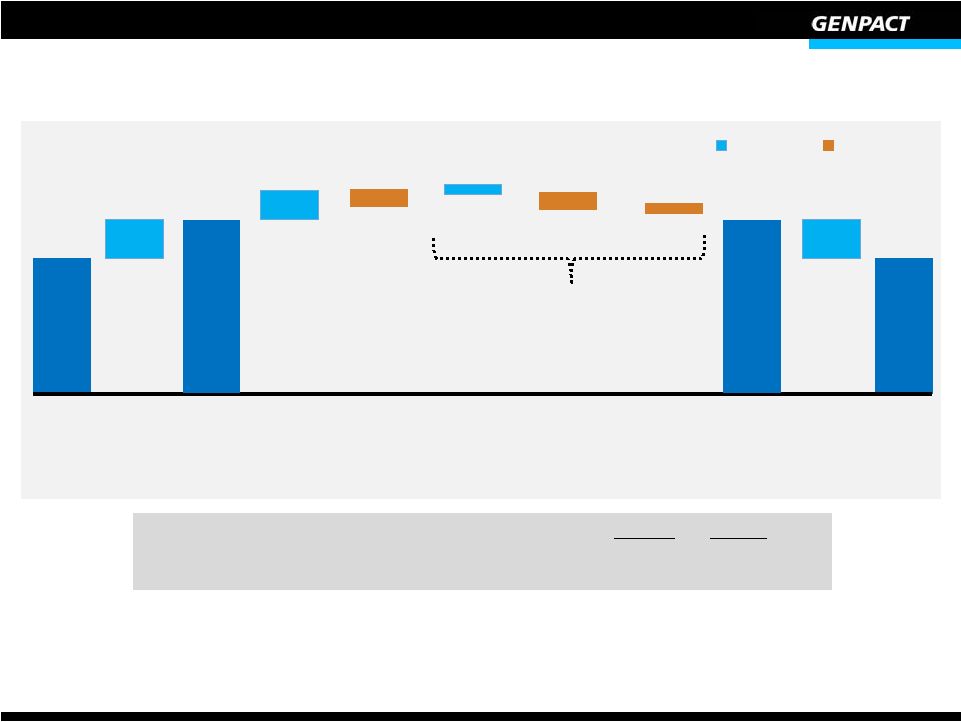

Revenue Growth of 14.4% Driven by Global Clients

Q2 2013 Global Clients

Business Process Management revenues increased 18% while ITO revenues increased

25% Q2 2013 GE

Growth in ITO more than offset by decline in Business Process Management

H1 2013 revenue at $1.039 billion; up 15.0% year over year

Global

Clients

(1)

GE

(1)

BPM

ITO

14.4%

YoY

Growth%

19.8%

(0.9)%

14.4%

20.9%

12.4%

YoY

Growth%

$467.6

$534.8

Q2 ‘12

Q2 ‘13

Q2 ‘12

Q2 ‘13

357.6

401.8

110.0

133.0

$467.6

$534.8

122.8

344.9

121.6

413.2

($ in millions)

Notes:

1) Data adjusted for divestitures from GE

($ in millions) |

8

Adjusted Income From Operations Growth of 14.6%

Q2 ‘12

Q2 ‘13

YoY Growth

Revenue

$467.6

$534.8

14.4%

Cost Of Revenue

285.2

332.7

16.7%

Gross Profit

182.4

202.1

10.8%

Gross Profit % of Revenue

39.0%

37.8%

(120)bps

Selling, general and administrative expenses

114.3

118.4

3.6%

SG&A % of Revenue

24.4%

22.1%

(230)bps

Adjusted Income From Operations

(1)

77.8

89.2

14.6%

Adjusted Income From Operations Margin %

16.6%

16.7%

10 bps

Notes:

($ millions)

1) Adjusted Operating Income is a Non-GAAP Measure. Income from Operations was $63.2 million

in Q2 ‘12 and $78.0 million in Q2 ’13 |

9

EPS Bridge

27

4

Adjusted

Income from

Operations

Q2 ‘12

GAAP

EPS

Q2 ‘12

Q2 ‘13

Adjusted Net Income ($ millions)

72.6

74.7

Diluted

Shares

Outstanding

(millions)

(3)

228

235

(2)

(2)

Higher

Interest

Income/

Others

27

(1)

1

Lesser Fx

Re-

measurement

Gains

Incremental

Interest due

to previous

debt facility

One-time

write off due

to Q2 ‘13

refinance

(2)

Total Net Interest Expense-(2)

(Cents per share)

Net

other

Adjustments

(1)

32

32

5

5

Net

other

Adjustments

(1)

Q2 ‘12

Adjusted

EPS

Q2 ‘13

Adjusted

EPS

Q2 ‘13

GAAP

EPS

Increase Decrease

Notes:

- The above bridge reflects only significant variance items year over year

- EPS = Diluted earnings per share

1)

Adjustments primarily include amortization of intangibles relating to acquisition and share-based

compensation expenses. 2)

One-time write off relating to upfront fees and payment for early termination of previous

debt facility 3)

Weighted average number of diluted shares outstanding |

10

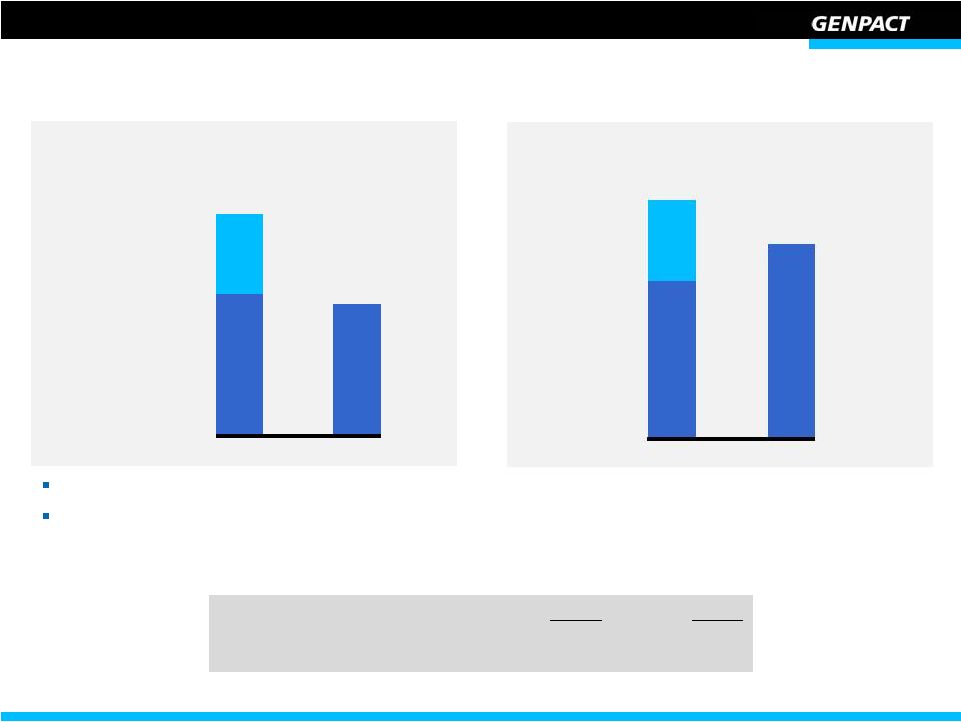

Strong Cash Flow From Operations

One-time upfront client payment distorting year-over-year comparison

Normalizing

for

upfront

client

payment,

2

quarter

cash

flow

from

operations

declined

7%

due

to:

•

Accelerated

payments

from

clients

in

the

1

quarter

2013

•

Timing of employee bonus payments across quarter-end

82

45

Q2 ‘12

Q2 ‘13

(40)%

(7)%

Operating

Performance

Upfront Client

Payment

(One-time)

$127

$76

76

YoY

Growth%

($ in millions)

Q2 ‘12

Q2 ‘13

Days sales outstanding

82

80

Cash

and

Liquid

Assets

($

millions)

(1)

442

536

Notes:

1) Cash and Liquid Assets = Cash and Cash equivalents and short-term

deposits nd

st

H1 ‘12

H1 ‘13

$132

$108

(18)%

24%

YoY

Growth%

87

45

108

($ in millions) |

11

Genpact Helps Clients Navigate Change

Our focus:

Build on strong position in large, under-penetrated target markets

Refine and consistently implement our growth strategy

Differentiate our capabilities and expertise in our targeted vertical markets

Deliver clear measurable business impact for clients |

Q&A |

13

Annexure 1: Reconciliation of Adjusted Income

from Operations

(USD, In Thousands)

2012

2013

Income from operations as per GAAP

$

63,167

$

77,988

Add: Amortization of acquired intangible assets resulting from

Formation Accounting

1,755

767

Add: Amortization of acquired intangible assets relating to

acquisitions

2,627

4,087

Add: Consultancy and legal fees relating to change of shareholding

and capital restructuring

1,687

-

Add: Stock based compensation

9,980

10,093

Add: Other income (expense)

322

(2,236)

Less: Equity-method investment activity, net

(13)

63

Less: Net income attributable to noncontrolling interest

(1,699)

(1,586)

Adjusted income from operations

$

77,826

$

89,176

Three

months

ended

June

30 |

14

Annexure 2: Reconciliation of Adjusted Net Income

(USD, In Thousands, except per share data)

2012

2013

Net income as per GAAP

$

61,100

$

63,876

Add: Amortization of acquired intangible assets resulting from

Formation Accounting

1,755

767

Add: Amortization of acquired intangible assets relating to

acquisitions

2,627

4,087

Add: Stock based compensation

9,980

10,093

Add: Consultancy and legal fees relating to change of shareholding

and capital restructuring

1,687

-

Less: Tax impact on amortization of acquired intangibles resulting

from Formation Accounting

(366)

(158)

Less: Tax impact on amortization of acquired intangibles relating

from acquisitions

(902)

(1,394)

Less: Tax Impact on stock based compensation

(3,059)

(2,605)

Less: Tax impact on consultancy and legal fees relating to change

of shareholding and capital restructuring

(182)

-

Adjusted net income

$

72,640

$

74,666

Adjusted diluted earnings per share

$

0.32

$

0.32

Three

months

ended

June

30 |

Thank

You |