Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEALED AIR CORP/DE | d578206d8k.htm |

| EX-99.1 - EX-99.1 - SEALED AIR CORP/DE | d578206dex991.htm |

SEALED AIR CORPORATION

Earnings Conference Call Supplement

Second Quarter 2013

(Unaudited Results)

August 2, 2013

Jerome A. Peribere –

President & Chief Executive Officer

Carol P. Lowe –

Senior Vice President & Chief Financial Officer

Exhibit 99.2 |

Safe

Harbor and Regulation G Statement •

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

can

be

identified

by

such

words

as

“anticipates,”

“believes,”

“plan,”

“assumes,”

“could,”

“estimates,”

“expects,”

“intends,”

“may,”

“plans

to,”

“will”

and

similar

expressions.

Examples of these forward-looking statements include 2013 financial

expectations and assumptions associated with

our

restructuring

programs,

availability

and

pricing

of

raw

materials,

success

of

our

growth

programs,

economic conditions, and the success of pricing actions. These statements reflect

our beliefs and expectations as to future events and trends affecting our

business, our consolidated financial position and our results of operations.

A variety of factors may cause actual results to differ materially from these

expectations, including general domestic and international economic and

political conditions affecting packaging utilization; changes in our raw

material and energy costs; credit ratings; competitive conditions and contract

terms; currency translation and devaluation effects, including Venezuela;

the success of our financial growth, profitability and manufacturing

strategies and our cost reduction and productivity efforts; the effects of animal

and food-related health issues; pandemics; environmental matters;

regulatory actions and legal matters; and the successful integration of

Diversey.

For more extensive information, see “Risk

Factors”

and

“Cautionary

Notice

Regarding

Forward-Looking

Statements,”

which

appear

in

our

most

recent

Annual

Report

on

Form

10-K, as filed with the Securities and

Exchange

Commission,

and

as

revised

and

updated

by

our

Quarterly

Reports

on

Form

10-Q

and

Current

Reports

on Form 8-K. While we may elect to update these forward-looking statements

at some point in the future, we specifically disclaim any obligation to do

so, whether as a result of new information, future events, or otherwise.

•

Our management uses non-U.S. GAAP financial measures to evaluate the

Company’s performance, which exclude items we consider unusual or

special items. We believe the use of such financial measures and

information

may

be

useful

to

investors.

We

believe

that

the

use

of

non-U.S. GAAP measures helps investors to

gain

a

better

understanding

of

core

operating

results

and

future

prospects,

consistent

with

how

management

measures and forecasts the Company's performance, especially when comparing such

results to previous periods or forecasts. For important information on our

use of non-U.S. GAAP financial measures and information, including

reconciliations of such non-U.S. GAAP financial measures and information to

comparable U.S. GAAP measures and information, please refer to the

financial tables and information provided in our earnings release. 1

|

2

2

Key Takeaways

Second Quarter 2013

Q2 Performance Summary

•

Sales

$2.0B

-

Up

1.9%

as

reported

-

Up

3.2%

constant

currency

-

Volume

increased

2.4%

-

Price/mix

favorable

0.8%

•

Adj.

EBITDA:

$276.3M,

14.1%

of

sales

•

Adj.

EPS

$0.35;

Reported

EPS

of

$0.26

Excluding SARs

expense:

•

Q2

2013

Adj.

EBITDA:

$276.4M,

14.1%

of

sales

•

Q2

2012

Adj.

EBITDA:

$218.4M,

11.3%

of

sales

•

Q2

2013

Adj.

EPS:

$0.35

•

Q2

2012

Adj.

EPS:

$0.13

•

All divisions reported top line growth despite

global economic challenges

•

Strong growth in AMAT & Latin America,

modest growth in NA; offset by continued

weakness in Europe and Japan/ANZ

•

F&B and I&L delivered EBITDA margin

expansion

•

Seeing benefits from pricing initiatives, cost

synergies & operating efficiency improvements

•

Core Tax Rate of 23.8%

Reported U.S. GAAP Measures

Q2-13 Net Sales: $1.96B; Operating Profit: $169M; Net Income: $56M

Q2-12 Net Sales: $1.92B; Operating Profit: $108M; Net Loss: $21M

Q2-13 Effective tax rate: 25.1%

Please see Sealed Air’s August 2, 2013 earnings press release for important information about the

use of non- U.S. GAAP financial measures, including applicable reconciliations to U.S. GAAP

financial measures. All numbers reflect continuing operations, excluding the impact

of the sale of Diversey Japan. |

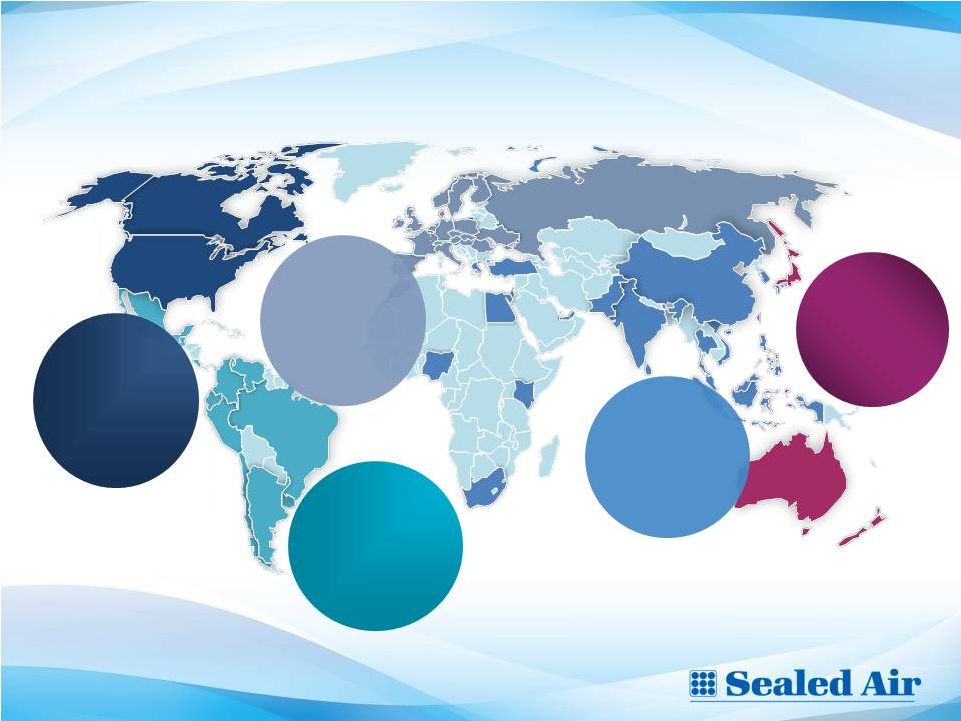

Regional Sales Performance

Second Quarter 2013

Latin

America

Reported: +7.6%

Organic: +11.7%

% of Sales: 10.6%

North

America

Reported: +2.1%

Organic: +2.3%

% of Sales: 39.6%

3

Japan/ANZ

Reported: -3.0%

Organic: -1.3%

% of Sales: 6.7%

Europe

Reported: -1.5%

Organic: -0.1%

% of Sales: 31.7%

AMAT

Reported: +9.4%

Organic: +10.8%

% of Sales: 11.4%

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measures, including

applicable reconciliations to U.S. GAAP financial measures. *

Organic

sales

refers

to

unit

volume

and

price/mix

performance

and

excludes

the

impact

of

currency

translation |

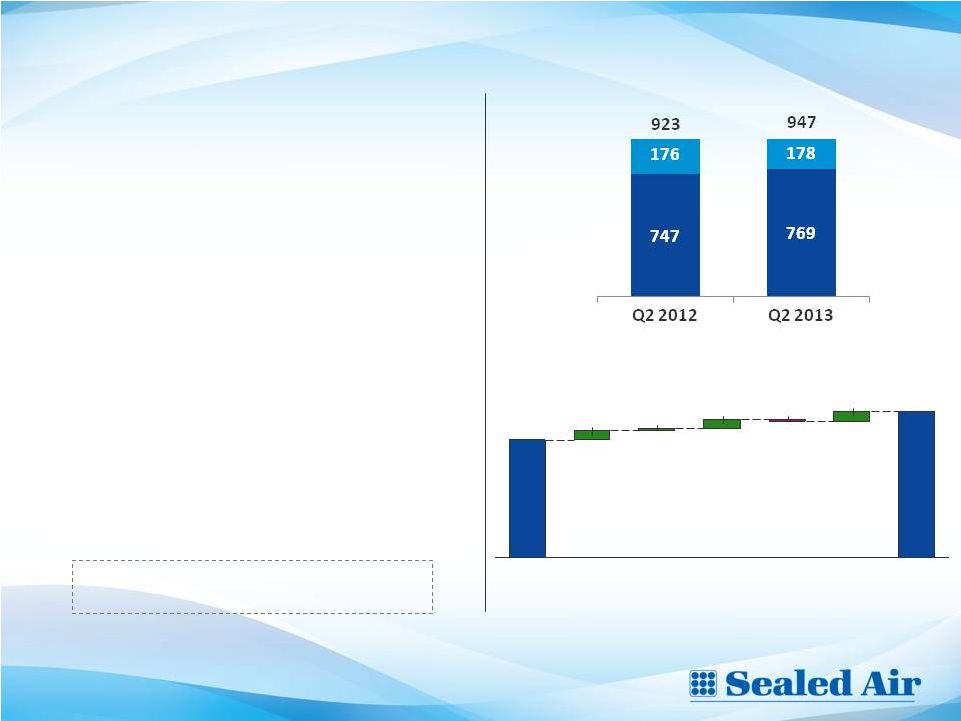

4

Food and Beverage: Achieved Sales and Adj. EBITDA Growth

•

Q2 Net Sales: +2.6%; organic growth: +3.9%

•

Volume increased 2.5%; Price/mix favorable 1.4%

•

Food Packaging organic sales increased 4.0%

•

Hygiene organic sales increased 3.4%

•

Q2 Adj. EBITDA Margin: 14.7%

•

Adjusted EBITDA growth of 24.2%

•

Excluding impact of SARs, growth of 26.9%

•

Key drivers: manufacturing efficiencies, cost

synergies and favorable product mix

•

Q2 Volume Trends by region vs. PY

•

North America: +1.4%

•

AMAT: +16.3%

•

Europe: -1.0%

•

JANZ: -0.5%

•

Latin America: +8.1%

Net Sales ($M)

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measures, including

applicable reconciliations to U.S. GAAP financial measures. Hygiene

Packaging

Solutions

14.2%

Reported U.S. GAAP Measures:

Q2-13 F&B Operating Profit: $103.7M

Q2-12 F&B Operating Profit: $69.8M

Adjusted EBITDA ($M)

+8

Cost

Synergies

Q2

2013

139

SARs

SG&A/

Other*

+10

+2

-2

Mix &

Price/Cost

Spread

Q2

2012

112

Volume

+9

*

Other includes: Q2 2012 unfavorable Argentina labor settlement and facility

closures, consolidations & start-up costs

Largest

growth

drivers:

Fresh

red

meat

and

equipment sales, particularly in Latin America;

customer acceptance of new products and solutions

Challenges:

European

macro

economy;

Beef

volume in North America and Europe

•

• |

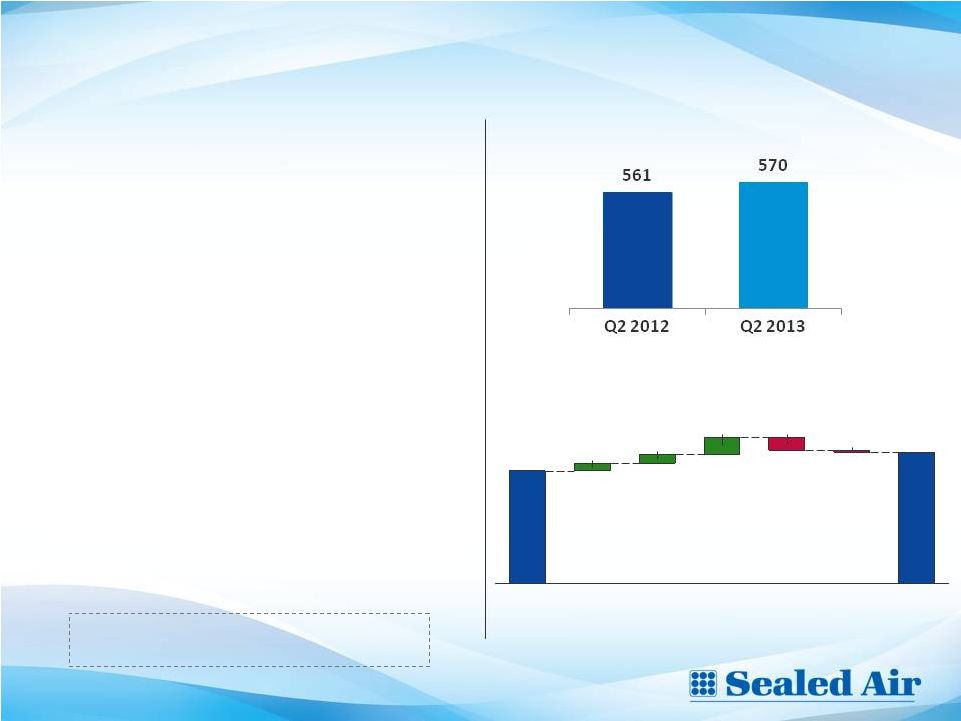

5

Institutional and Laundry: Achieved Sales and Adj. EBITDA Growth

•

Q2 Net Sales: +1.7%; +3.0% organic growth

•

Volume & Price both increased 1.5%

•

Double-digit organic sales growth in LA & AMAT

•

NA organic sales increased 2.5%

•

Europe organic sales declined 1.2%

•

Q2 Adj. EBITDA Margin: 12.4%

•

Adjusted EBITDA growth of 16.6%

•

Excluding impact of SARs, growth of 31.4%

•

Key drivers: Volume growth, cost containment &

cost synergies

•

Q2 Volume Trends by region vs. PY

•

North America: +0.5%

•

AMAT: +8.3%

•

Europe: -1.7%

•

ANZ: +1.3%

•

Latin America: +7.4%

•

Largest

Growth

Drivers:

New

customer

wins

&

account penetration in LA & AMAT; gaining traction in

U.S. with TASKI®

floorcare machine launch & new

customers wins

•

Challenges:

Exposure

to

European

macro

economy

Reported U.S. GAAP Measures:

Q2-13 I&L Operating Profit: $37.2M

Q2-12 I&L Operating Profit: $20.9M

Net Sales ($M)

Adjusted EBITDA ($M)

-1

SARs

-7

Mix &

Price/Cost

Spread

+5

Volume

+4

+9

Q2

2012

61

Cost

Synergies

Q2

2013

71

SG&A/

Other

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measures, including

applicable reconciliations to U.S. GAAP financial measures. |

6

Protective Packaging: Volume Increased, Price/Mix Unfavorable

•

Q2 Net Sales: +0.9%; +1.8% organic change

•

Volume increased 3.8%; Price/mix unfavorable 2.0%

•

NA organic sales increased 2.6%

•

Europe organic sales declined 0.7%

•

Q2 Adjusted EBITDA Margin: 14.2%

•

Adjusted EBITDA declined 2.1%

•

Key drivers: Unfavorable product mix, global economy,

raw material costs

•

Q2 Volume Trends by region v. PY

•

North America: +3.5%

•

AMAT: +11.0%

•

Europe: +2.2%

•

JANZ: +0.7%

•

Latin America: +11.3%

•

Largest

growth

drivers:

E-commerce, retail,

packaging systems

•

Challenges:

Global economic weakness, raw material

volatility

Reported U.S. GAAP Measures:

Q2-13 Protective Packaging Operating Profit: $44.0M

Q2-12 Protective Packaging Operating Profit: $46.7M

Net Sales ($M)

Adjusted EBITDA ($M)

Q2

2013

56

SG&A/

Other

-4

Mix &

Price/Cost

Spread

-4

Volume

+5

+2

Q2

2012

57

Cost

Synergies

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measures, including

applicable reconciliations to U.S. GAAP financial measures. 391

394

Q2 2012

Q2 2013 |

7

Q2 Net Sales Bridge

($ in millions)

1,962

Foreign

Exchange

-23

Price/Mix

+15

Volume

+46

1,925

+2.4%

+0.8%

-1.3%

+1.9%

Q2 2013

Net Sales

Q2 2012

Net Sales |

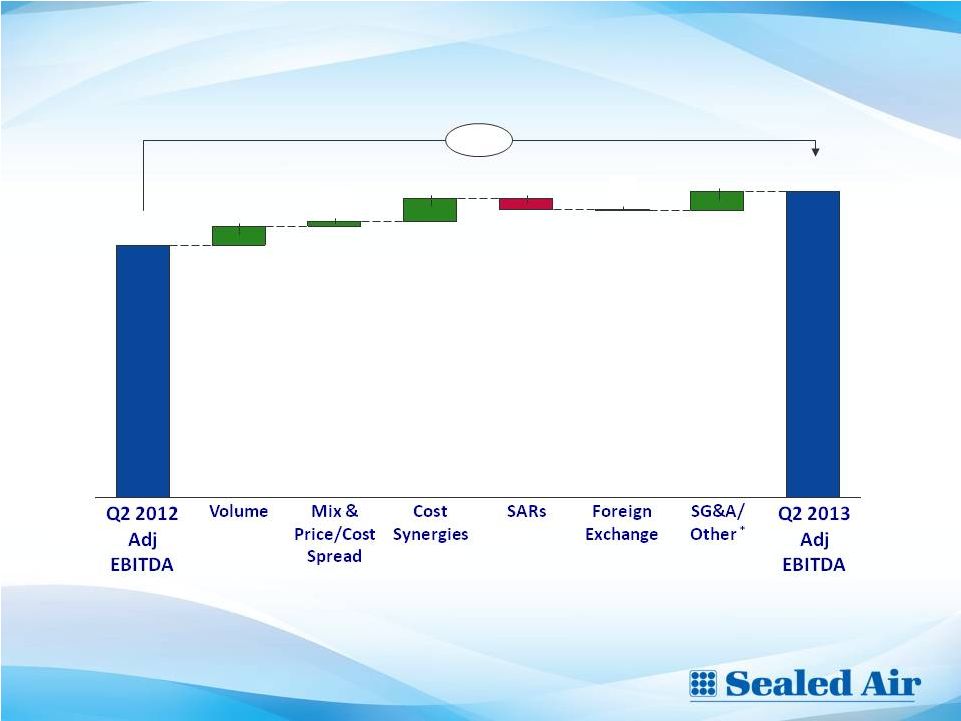

Q2

2013 Adjusted EBITDA Bridge 8

($ millions)

276

+21%

+17

-1

-9

+20

+4

+18

228

*

Other includes: Q2 2012 unfavorable Argentina labor settlement

and facility closures, consolidations & start-up costs

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measures, including

applicable reconciliations to U.S. GAAP financial measures. |

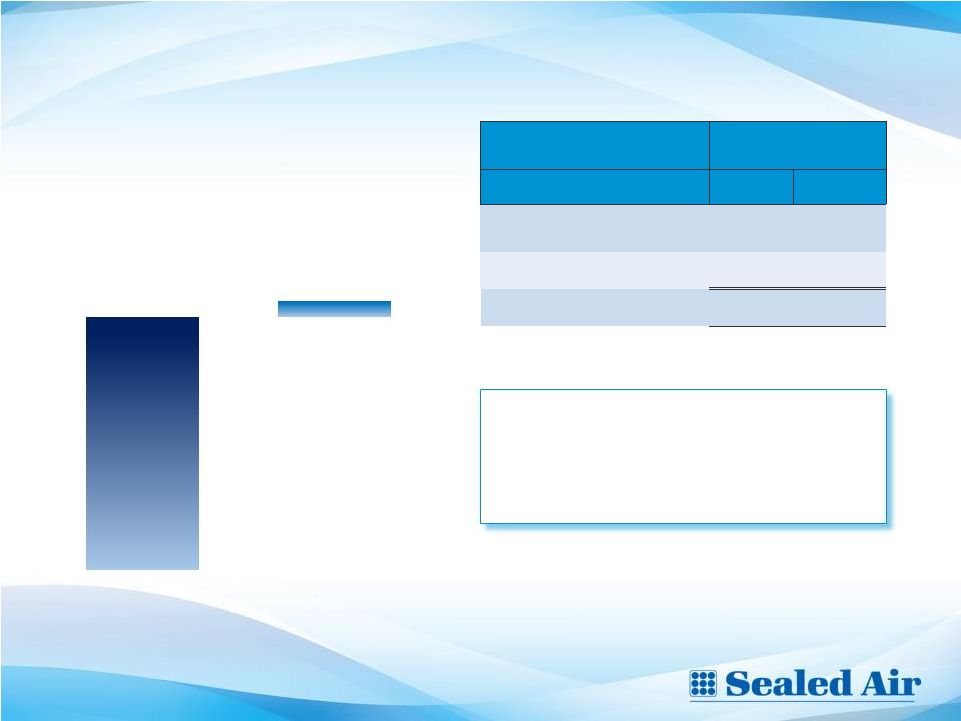

9

9

H1 2013 Free Cash Flow Improved $140 million

($ in millions)

Free Cash Flow Performance

Six Months Ended

June 30,

Free Cash Flow

2012

2013

U.S. GAAP Cash Flow from

Operating Activities

*

$ (62)

$ 63

Capital Expenditures

(66)

(51)

Free Cash Flow

$ (128)

$ 12

H1 2012

H1 2013

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measures, including

applicable reconciliations to U.S. GAAP financial measures. *Six months ended

2012 & 2013, net of restructuring & SARs payments of $63M H1 2013

vs. H1 2012 Improvement Higher

net

earnings

Lower

Capital

Expenditures

•

•

(128)

+12 |

Outlook for Full Year 2013

Management’s full year outlook includes:

•

•

•

•

–

Includes estimated cash costs of $65 million for earnings quality improvement

program and $70 million for the 2011-2014 Integration and Optimization

Program –

Includes 2013 estimated capital expenditures of $160 million

–

Includes higher SARs payments

–

2012 Free Cash Flow was $280 million and was net of $81 million of Integration and

Optimization

cash

payments,

$125

million

of

capital

expenditures

and

$24

million

of

SARs payments

10

Adjusted EPS guidance excludes the impact of special items. It also excludes the

payment of the W. R. Grace settlement, as the exact timing of the settlement

is unknown. Final payment of the W. R. Grace settlement is expected to be accretive to adjusted EPS by approximately

$0.13 annually following the payment date under the assumption of using a substantial

portion of cash on hand for the payment and ceasing to accrue interest on the

settlement amount. Additionally, guidance excludes any non-operating gains or losses that may be recognized in

2013 due to currency fluctuations in Venezuela.

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measures, including

applicable reconciliations to U.S. GAAP financial measures. Net Sales

approximately $7.7 billion to $7.9 billion (No Change) Adjusted EBITDA

tracking toward high-end of previously given guidance of approximately

$1.01 billion to $1.03 billion Earnings Per Share tracking toward

high-end of previously guidance of approximately $1.10 to $1.20 per

share Free Cash Flow approximately $275 million to $325 million (No

Change) |

SEALED AIR CORPORATION

Earnings Conference Call

Second Quarter 2013

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non-U.S. GAAP financial measures,

including applicable reconciliations to U.S. GAAP financial measures. |

SEALED AIR CORPORATION

Earnings Conference Call

Second Quarter 2013

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non-U.S. GAAP financial measures,

including applicable reconciliations to U.S. GAAP financial measures. |

2Q

2013 Adjusted EPS Calculation 13

Reported U.S. GAAP Measures :

Q2 2013 Operating Income: $168.9M; Net Income $56.3M

(1)

Comprised of $44M of property and equipment depreciation, $32M of amortization of

Intangibles and $7M of share-based compensation

(2)

Contributions to be made in Sealed Air common stock

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non-U.S. GAAP financial measures,

including applicable reconciliations to U.S. GAAP financial measures. Adjusted

EBITDA $ 276.3

Depreciation and amortization

(1)

(82.6)

Write down of non-strategic assets, including D&A

4.8

Interest expense

(89.7)

Non-cash profit sharing expense

(2)

(10.0)

Adjusted pre-tax earnings

$ 98.8

Core taxes (23.8%)

(23.5)

Adjusted net earnings

$ 75.3

Diluted Shares

213.6

Adjusted EPS

$ 0.35 |

14

14

Liquidity & Net Debt

($ in millions)

Liquidity

Position

1,546

Net Debt

Higher net debt as a result of:

•

•

•

Please see Sealed Air’s August 2, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measures, including

applicable reconciliations to U.S. GAAP financial measures. Seasonal

inventory growth Certain annual incentive compensation payments

Financing activities

640

700

206

June 2013

4,779

4,843

Dec 2012

June 2013

Cash & Cash Equivalents

Revolving Credit Facility

A/R Securitization |