Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TMS International Corp. | d577833d8k.htm |

| EX-99.1 - EX-99.1 - TMS International Corp. | d577833dex991.htm |

Second Quarter 2013

Earnings Call and Webcast

August 1, 2013

Exhibit 99.2 |

This

presentation includes forward-looking statements within the meaning of Section 27A of the Securities

Act

of

1933,

(the

“Exchange

Act”),

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended, with respect to our financial condition, results of operations and

business and our expectations or beliefs concerning future events. Such

forward-looking statements include the discussions of our business

strategies, estimates of future global steel production, trends toward outsourcing

and other market metrics and our expectations concerning future operations,

margins, profitability, liquidity and capital resources, among others.

Although we believe that such forward-looking statements are reasonable, there can be no assurance

that any forward-looking statements will prove to be correct. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results, performance or

achievements

to

be

materially

different

from

any

future

results,

performance

or

achievements

expressed

or

implied by such forward-looking statements.

Certain areas of this presentation depict Revenue After Raw Materials Costs, EBITDA

and Discretionary Cash Flow, which are non-GAAP

financial measures. Revenue After Raw Materials Costs, EBITDA and

Discretionary Cash Flow are not and should not be considered alternatives to

revenues or net income or any other financial measure under U.S. GAAP. We

reconcile these measurements to GAAP in certain reports we file with the

S.E.C. pursuant to the Exchange Act, including current reports on Form 8-K that contain our

earnings releases and our quarterly and annual reports on forms 10-Q and

10-K. When

we

use

the

term

“North

America

”

in

this

presentation,

we

are

referring

to

the

United

States

and

Canada;

when

we

use

the

term

“International,”

we

are

referring

to

countries

other

than

the

United

States

and

Canada;

when

we

use

the

term

“Latin

America,

”

we

are

referring

to

Mexico,

Central

America,

South

America

and the Caribbean, including Trinidad & Tobago.

Safe Harbor Provision

1 |

REVENUE AFTER RAW MATERIALS COSTS ($MM)

ADJUSTED EBITDA ($MM)

Second Quarter 2013 Results

REVENUE AFTER RAW MATERIALS COSTS ($MM)

ADJUSTED EBITDA ($MM)

2

153.6

153.1

37.8

36.1

155.8

153.1

38.3

36.1

2Q 2012

2Q 2013

2Q 2013

2Q 2012

1Q 2013

1Q 2013

2Q 2013

2Q 2013 |

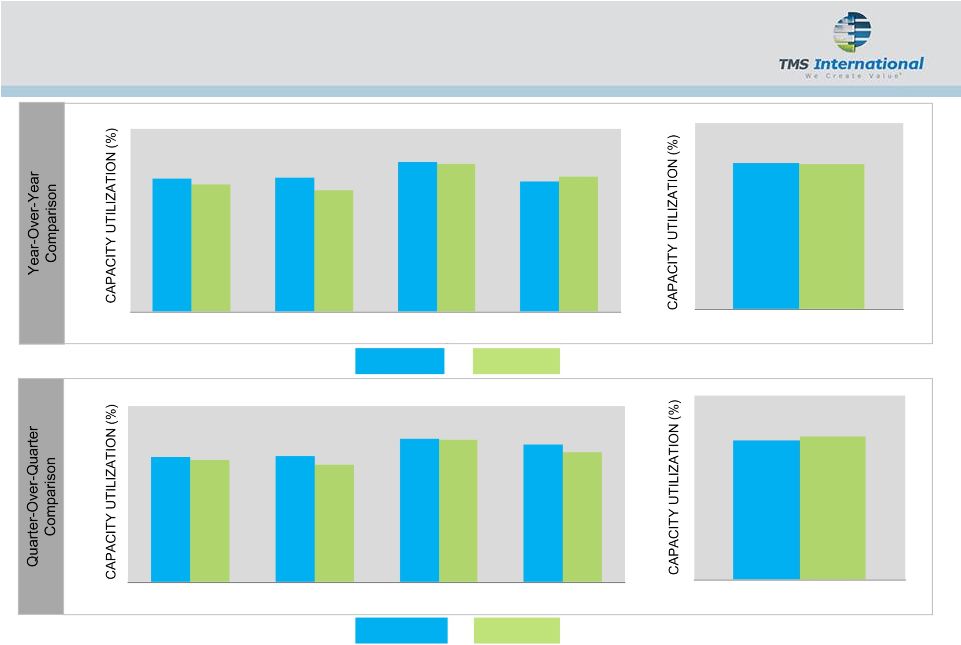

Operating Environment Summary

2Q 2013

2Q 2012

TMS CUSTOMERS BY REGION ¹

TMS CUSTOMERS BY REGION ¹

1Q 2013

2Q 2013

²

²

(1)

Capacity utilization data excludes two greenfield mills (one in North America and

one in Latin America) that are currently ramping up production. (2)

North America capacity utilization decreased during 2Q2013 due to temporary

production outages at three sites. 3

75.7

77.9

77.9

78.6

81.0

86.1

88.8

89.5

73.2

78.5

76.4

78.3

80.1

76.4

80.7

73.2

89.9

88.8

78.0

81.0

TMS Global

North America

Europe

Latin America

U.S. Industry

U.S. Industry

TMS Global

North America

Europe

Latin America |

MSG

Operational Highlights 4

North American same-site results decreased due to three temporary

outages and a non-recurring arbitration award received in 2Q 2012

Increased production year-over-year at customer sites in Latin

America, South Africa and UAE

New contracts continue to perform well

Increased Mexican market penetration with expansion of services at

an existing customer site

New stainless steel recovery system being installed at customer’s

facility in Pennsylvania

Continued contract renewal rate momentum YTD 2013, a testament

to our ongoing value proposition for our customers |

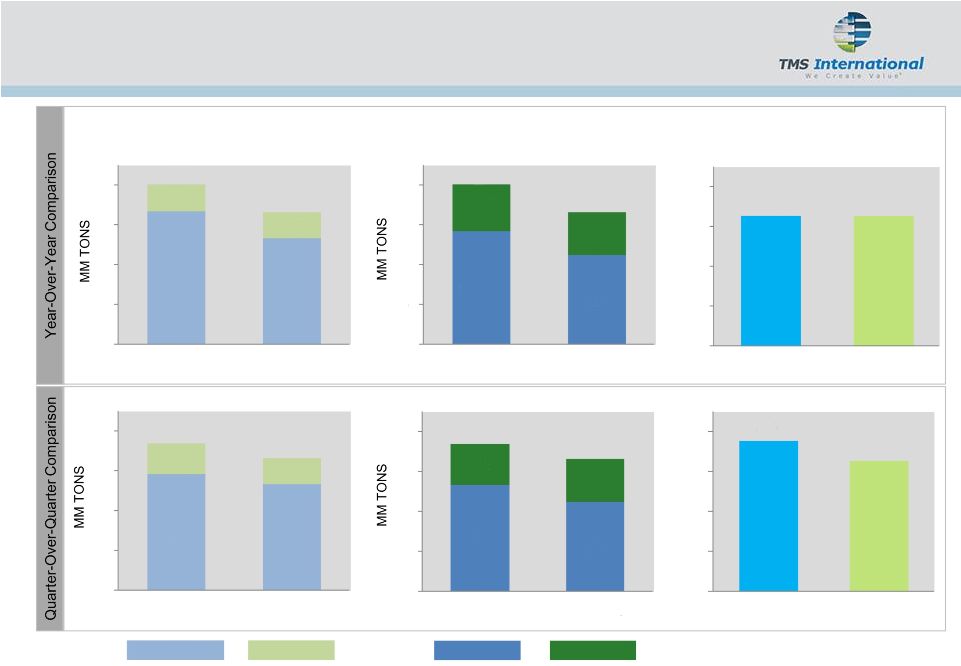

5

RMOG Operational Highlights

VOLUME BY CHANNEL

4.0

NORTH AMERICA

INTERNATIONAL

AGENCY

NON-AGENCY

VOLUME BY GEOGRAPHY

3.3

4.0

3.3

3.7

3.7

3.3

3.3

REVENUE AFTER RAW

MATERIALS COSTS ($MM)

16.4

16.4

18.8

16.4

4

3

2

1

0

4

3

2

1

0

4

3

2

1

0

4

3

2

1

0

2Q 2012

2Q 2013

2Q 2012

2Q 2013

2Q 2012

2Q 2013

1Q 2013

2Q 2013

1Q 2013

2Q 2013

1Q 2013

2Q 2013

$20

$15

$10

$5

$0

$20

$15

$10

$5

$0

0.7

0.7

0.7

3.3

2.7

2.7

1.1

1.2

2.9

2.2

2.2

2.7

1.0

1.1

0.8

2.9 |

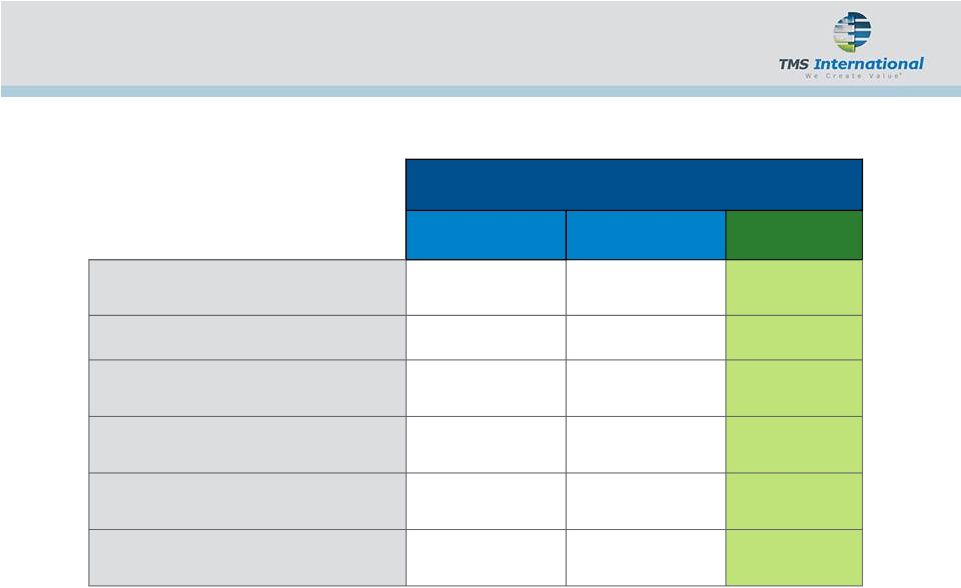

Second Quarter

($MM)

2013

2012

% Change

Revenue After Raw Materials Costs

$153.1

$153.6

(0.3)%

Adjusted EBITDA

$36.1

$37.8

(4.7)%

Discretionary

Cash

Flow

1

$25.7

$28.6

(10.3)%

Growth Capital

$5.0

$12.6

Net Debt

$278.8

$283.5

Net Leverage Ratio

1.9x

2.0x

(1) Adjusted EBITDA less Maintenance Capital Expenditures.

Second Quarter Financial Highlights

6 |

Concluding Remarks

7

2013 Adjusted EBITDA Guidance of $150-$155 million

Challenging quarter due to temporary site outages in North America

and lower volumes in brokerage business

We and our customers are optimistic for improvement in production

volumes in second half of 2013

New contracts continue to perform well

Continued focus on cost discipline and cash flow generation

Pipeline of new projects remains strong and pleased with expansion

of business in Mexico |

|