Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GARMIN LTD | v351338_8k.htm |

Garmin Reports Strong Second Quarter 2013 Results and Maintains Full Year Outlook

Schaffhausen, Switzerland / July 31, 2013/ Business Wire

Garmin Ltd. (Nasdaq: GRMN – News) today announced results for the fiscal quarter ended June 29, 2013. Highlights in the quarter include:

| · | Total revenue of $697 million in second quarter 2013 with traditional segments of outdoor, fitness, aviation and marine delivering 51% of total revenues and growing 8% over the year ago quarter |

| · | Operating margin of 24% with 64% of operating profit from traditional segments |

| · | Continued to gain global market share in the PND industry |

| · | Introduced the Monterra™, an Android™ powered outdoor GPS, supporting 3rd party applications for outdoor professionals and enthusiasts |

| · | Announced the expansion of our relationships with Volkswagen and MINI, providing factory- or dealer-installed solutions for the compact car market |

| · | Generated $186 million of free cash flow in second quarter 2013 |

| (in thousands, | 13-Weeks Ended | 26-Weeks Ended | ||||||||||||||||||||||

| except per share data) | June 29, | June 30, | Yr over Yr | June 29, | June 30, | Yr over Yr | ||||||||||||||||||

| 2013 | 2012 | Change | 2013 | 2012 | Change | |||||||||||||||||||

| Net sales | $ | 696,563 | $ | 718,154 | -3 | % | $ | 1,228,520 | $ | 1,274,751 | -4 | % | ||||||||||||

| Automotive/Mobile | 344,701 | 392,124 | -12 | % | 597,290 | 671,393 | -11 | % | ||||||||||||||||

| Outdoor | 106,856 | 100,496 | 6 | % | 183,022 | 177,659 | 3 | % | ||||||||||||||||

| Aviation | 88,042 | 75,932 | 16 | % | 168,511 | 148,819 | 13 | % | ||||||||||||||||

| Fitness | 84,216 | 81,812 | 3 | % | 156,653 | 153,026 | 2 | % | ||||||||||||||||

| Marine | 72,748 | 67,790 | 7 | % | 123,044 | 123,854 | -1 | % | ||||||||||||||||

| Gross profit % | 55 | % | 59 | % | 54 | % | 55 | % | ||||||||||||||||

| Operating profit % | 24 | % | 28 | % | 20 | % | 23 | % | ||||||||||||||||

| Pro forma diluted EPS (1) | $ | 0.76 | $ | 0.98 | -22 | % | $ | 1.16 | $ | 1.43 | -19 | % | ||||||||||||

| Note: 2012 results include one-time royalty fee benefit of $21 million impacting gross margin. | |||||||

| (1) See table on final page for reconciliation of GAAP EPS to Pro forma diluted EPS |

Executive Overview from Cliff Pemble, President and Chief Executive Officer:

“The second quarter of 2013 was highlighted by stronger than expected revenue performance across all segments,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “We were particularly pleased to generate revenue growth in each of our traditional markets. While our performance was strong in second quarter and we believe that the outlook for growth in 2013 for the traditional markets is positive, we also anticipate that declines in the PND market will continue to be a significant headwind. Third quarter will be particularly challenging as we compare against a period of strong prior year sell-in driven by the timing of new product introductions and end-of-life promotions. Given these factors, we are maintaining our full year revenue and EPS guidance. Longer term, our primary focus remains innovation that is expected to fuel sustained revenue and EPS growth.”

Outdoor:

| The outdoor segment posted revenue growth of 6% in the quarter with our golf and dog tracking and training portfolios driving growth. Gross and operating margins within the segment remained strong at 66% and 42%, respectively. During the quarter, we introduced our latest outdoor handheld, the Monterra. This product is Android powered giving the user access to thousands of applications including those targeting outdoor enthusiasts. In addition, the Monterra includes WiFi connectivity, an FM radio and NOAA weather radio. |

Fitness:

The fitness segment posted revenue growth of 3% in the quarter as our latest cycling products, the Edge® 510 and 810, and the Forerunner® 10 sold well. While gross and operating margins were consistent with our expectations at 65% and 35%, respectively, this is a decline from the prior year due to the product mix shifting toward lower priced devices. In the second half of 2013, we anticipate delivering a number of new products to the market, including the Vector power meter, which are expected to accelerate revenue growth.

Aviation:

The aviation segment posted revenue growth of 16% in the quarter as both OEM and aftermarket contributed to revenue improvement. OEM growth was driven by market share gains in the business jet and helicopter markets, as well as increased content with existing OEM partners. The gross margin in aviation was stable year-over-year at 70% while operating margins declined to 23% due to accelerated research and development spending in the quarter. Though we have experienced some delays in the avionics certifications with our business jet partners, we have passed significant milestones in recent weeks and remain confident in our ability to generate 10-15% revenue growth in the segment.

Marine:

The marine segment posted revenue growth of 7% in the quarter driven by the delivery of the new products that had been previously delayed. These deliveries included the GPSMAP® 8000 series glass helms and the 7” GPSMAP and echoMAP combination chartplotter and fishfinder, both of which have been well-received by the industry and are helping us regain market share in the category. With new product deliveries improving product mix in the second quarter, we returned to profitability in the segment with gross and operating margins of 56% and 20%, respectively. We recognize the importance of continued innovation and are working diligently on 2014 product introductions that will further our market share opportunity.

| Automotive/Mobile: | |

| The automotive/mobile segment posted a revenue decline of 12% as declining PND sales were partially offset by growth with our OEM partners. We continue to anticipate PND volumes declining 20% globally. Gross and operating margins in the quarter were 45% and 18%, respectively. This was a decline from 51% and 22% in the prior year primarily related to the $21 million royalty benefit recognized in second quarter 2012. |  |

We do continue to innovate within the segment and have been encouraged by the strong sell-through of the recently released nüvi® 2700 series products. In addition, we have begun to ship the fleet 590, targeting a new market segment in which we hope to gain share.

Additional Financial Information:

Total operating expenses in the quarter were $214 million, a 2% decrease from the prior year. Decreased spending in advertising and selling, general and administrative expenses was partially offset by growing research and development investment in each of our segments. As we have indicated in the past, we anticipate continued research and development investment to fuel both near-term and long-term revenue growth opportunities.

The effective tax rate in second quarter 2013 was 16.5% compared to 10.4% in the prior year due to changes in income mix by tax jurisdiction, as well as reduced tax incentives in Taiwan.

In the second quarter, we generated $186 million of free cash flow which funded our quarterly dividend of $88 million and share repurchase activity of $13 million. We ended the quarter with cash and marketable securities of $2.7 billion.

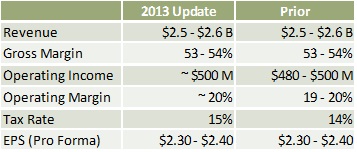

2013 Guidance Update:

Our 2013 guidance remains largely unchanged with operating income and operating margin trending toward the upper end of prior guidance offset by an anticipated 100 basis point increase in the effective tax rate.

Webcast Information/Forward-Looking Statements:

The information for Garmin Ltd.’s earnings call is as follows:

| When: | Wednesday, July 31, 2013 at 10:30 a.m. Eastern |

| Where: | http://www.garmin.com/aboutGarmin/invRelations/irCalendar.html |

| How: | Simply log on to the web at the address above or call to listen in at 888-487-0340 |

An archive of the live webcast will be available until August 30, 2013 on the Garmin website at http://www.garmin.com. To access the replay, click on the Investor Relations link and click over to the Events Calendar page.

This release includes projections and other forward-looking statements regarding Garmin Ltd. and its business. Any statements regarding the Company’s estimated earnings and revenue for fiscal 2013, the Company’s expected segment revenue growth rate, margins, new products to be introduced in 2013 and the Company’s plans and objectives are forward-looking statements. The forward-looking events and circumstances discussed in this release may not occur and actual results could differ materially as a result of risk factors affecting Garmin, including, but not limited to, the risk factors that are described in the Annual Report on Form 10-K for the year ended December 29, 2012 filed by Garmin with the Securities and Exchange Commission (Commission file number 0-31983). A copy of Garmin’s 2012 Form 10-K can be downloaded from http://www.garmin.com/aboutGarmin/invRelations/finReports.html.

Garmin, Edge, Forerunner, GPSMAP and nüvi are registered trademarks and Monterra is a trademark of Garmin Ltd. or its subsidiaries. All other brands, product names, company names, trademarks and service marks are the properties of their respective owners. All rights reserved.

| Investor Relations Contact: | Media Relations Contact: |

| Kerri Thurston | Ted Gartner |

| 913/397-8200 | 913/397-8200 |

| investor.relations@garmin.com | media.relations@garmin.com |

| Garmin Ltd. And Subsidiaries | ||||||||||||||||

| Condensed Consolidated Statements of Income (Unaudited) | ||||||||||||||||

| (In thousands, except per share information) | ||||||||||||||||

| 13-Weeks Ended | 26-Weeks Ended | |||||||||||||||

| June 29, | June 30, | June 29, | June 30, | |||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Net sales | $ | 696,563 | $ | 718,154 | $ | 1,228,520 | $ | 1,274,751 | ||||||||

| Cost of goods sold | 312,923 | 296,341 | 568,747 | 569,180 | ||||||||||||

| Gross profit | 383,640 | 421,813 | 659,773 | 705,571 | ||||||||||||

| Advertising expense | 29,483 | 38,258 | 51,732 | 61,849 | ||||||||||||

| Selling, general and administrative expense | 88,039 | 99,246 | 174,307 | 189,362 | ||||||||||||

| Research and development expense | 96,232 | 80,303 | 183,922 | 160,021 | ||||||||||||

| Total operating expense | 213,754 | 217,807 | 409,961 | 411,232 | ||||||||||||

| Operating income | 169,886 | 204,006 | 249,812 | 294,339 | ||||||||||||

| Other income (expense): | ||||||||||||||||

| Interest income | 8,179 | 8,620 | 17,077 | 18,291 | ||||||||||||

| Foreign currency gains (losses) | 27,451 | (7,771 | ) | 19,102 | (9,760 | ) | ||||||||||

| Other | 1,069 | 2,581 | 2,228 | 4,121 | ||||||||||||

| Total other income (expense) | 36,699 | 3,430 | 38,407 | 12,652 | ||||||||||||

| Income before income taxes | 206,585 | 207,436 | 288,219 | 306,991 | ||||||||||||

| Income tax provision | 34,094 | 21,532 | 27,062 | 34,230 | ||||||||||||

| Net income | $ | 172,491 | $ | 185,904 | $ | 261,157 | $ | 272,761 | ||||||||

| Net income per share: | ||||||||||||||||

| Basic | $ | 0.88 | $ | 0.95 | $ | 1.34 | $ | 1.40 | ||||||||

| Diluted | $ | 0.88 | $ | 0.95 | $ | 1.33 | $ | 1.39 | ||||||||

| Weighted average common | ||||||||||||||||

| shares outstanding: | ||||||||||||||||

| Basic | 195,570 | 194,849 | 195,600 | 194,795 | ||||||||||||

| Diluted | 196,300 | 196,261 | 196,338 | 196,232 | ||||||||||||

| Garmin Ltd. And Subsidiaries | ||||||||

| Condensed Consolidated Balance Sheets | ||||||||

| (In thousands, except share information) | ||||||||

| (Unaudited) | ||||||||

| June 29, | December 29, | |||||||

| 2013 | 2012 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 1,083,490 | $ | 1,231,180 | ||||

| Marketable securities | 142,582 | 153,083 | ||||||

| Accounts receivable, net | 484,246 | 603,673 | ||||||

| Inventories, net | 383,492 | 389,931 | ||||||

| Deferred income taxes | 63,241 | 68,785 | ||||||

| Deferred costs | 54,104 | 53,948 | ||||||

| Prepaid expenses and other current assets | 135,104 | 35,520 | ||||||

| Total current assets | 2,346,259 | 2,536,120 | ||||||

| Property and equipment, net | 410,533 | 409,751 | ||||||

| Marketable securities | 1,475,761 | 1,488,312 | ||||||

| Restricted cash | 249 | 836 | ||||||

| Noncurrent deferred income tax | 95,411 | 93,920 | ||||||

| Noncurrent deferred costs | 37,830 | 42,359 | ||||||

| Other intangible assets, net | 220,531 | 232,597 | ||||||

| Other assets | 12,607 | 15,229 | ||||||

| Total assets | $ | 4,599,181 | $ | 4,819,124 | ||||

| Liabilities and Stockholders' Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 128,078 | $ | 131,263 | ||||

| Salaries and benefits payable | 50,184 | 55,969 | ||||||

| Accrued warranty costs | 34,288 | 37,301 | ||||||

| Accrued sales program costs | 39,083 | 57,080 | ||||||

| Deferred revenue | 251,074 | 252,375 | ||||||

| Accrued royalty costs | 9,444 | 71,745 | ||||||

| Accrued advertising expense | 16,696 | 25,192 | ||||||

| Other accrued expenses | 72,634 | 69,806 | ||||||

| Deferred income taxes | 160 | 332 | ||||||

| Income taxes payable | 24,390 | 32,031 | ||||||

| Dividend payable | 263,704 | 175,932 | ||||||

| Total current liabilities | 889,735 | 909,026 | ||||||

| Deferred income taxes | 1,219 | 2,467 | ||||||

| Non-current income taxes | 173,651 | 181,754 | ||||||

| Non-current deferred revenue | 167,268 | 193,047 | ||||||

| Other liabilities | 951 | 1,034 | ||||||

| Stockholders' equity: | ||||||||

| Shares, CHF 10 par value, 208,077,418 shares authorized and issued; | ||||||||

| 195,317,390 shares outstanding at June 29, 2013 | ||||||||

| and 195,591,854 shares outstanding at December 29, 2012 | 1,797,435 | 1,797,435 | ||||||

| Additional paid-in capital | 83,513 | 72,462 | ||||||

| Treasury stock | (93,587 | ) | (81,280 | ) | ||||

| Retained earnings | 1,514,153 | 1,604,625 | ||||||

| Accumulated other comprehensive income | 64,843 | 138,554 | ||||||

| Total stockholders' equity | 3,366,357 | 3,531,796 | ||||||

| Total liabilities and stockholders' equity | $ | 4,599,181 | $ | 4,819,124 | ||||

| Garmin Ltd. And Subsidiaries | ||||||||||||

| Condensed Consolidated Statements of Cash Flows (Unaudited) | ||||||||||||

| (In thousands) | ||||||||||||

| 26-Weeks Ended | ||||||||||||

| June 29, | June 30, | |||||||||||

| 2013 | 2012 | |||||||||||

| Operating Activities: | ||||||||||||

| Net income | $ | 261,157 | $ | 272,761 | ||||||||

| Adjustments to reconcile net income to net cash | ||||||||||||

| provided by operating activities: | ||||||||||||

| Depreciation | 25,340 | 27,351 | ||||||||||

| Amortization | 16,579 | 23,709 | ||||||||||

| Loss on sale of property and equipment | 28 | 11 | ||||||||||

| Provision for doubtful accounts | 701 | 2,256 | ||||||||||

| Deferred income taxes | 5,599 | (5,268 | ) | |||||||||

| Unrealized foreign currency losses/(gains) | (15,996 | ) | 18,556 | |||||||||

| Provision for obsolete and slow moving inventories | 12,017 | 3,276 | ||||||||||

| Stock compensation expense | 10,978 | 18,043 | ||||||||||

| Realized gains on marketable securities | (2,278 | ) | (1,463 | ) | ||||||||

| Changes in operating assets and liabilities, net of acquisitions: | ||||||||||||

| Accounts receivable | 110,600 | 117,422 | ||||||||||

| Inventories | (12,160 | ) | 10,004 | |||||||||

| Other current and non-current assets | (16,354 | ) | 10,143 | |||||||||

| Accounts payable | (547 | ) | (26,627 | ) | ||||||||

| Other current and non-current liabilities | (95,261 | ) | (103,327 | ) | ||||||||

| Deferred revenue | (25,952 | ) | 15,493 | |||||||||

| Deferred cost | 4,378 | (4,652 | ) | |||||||||

| Income taxes payable | (15,168 | ) | (32,555 | ) | ||||||||

| Net cash provided by operating activities | 263,661 | 345,133 | ||||||||||

| Investing activities: | ||||||||||||

| Purchases of property and equipment | (29,723 | ) | (17,426 | ) | ||||||||

| Proceeds from sale of property and equipment | 64 | 14 | ||||||||||

| Purchase of intangible assets | (674 | ) | (4,682 | ) | ||||||||

| Purchase of marketable securities | (488,515 | ) | (639,612 | ) | ||||||||

| Redemption of marketable securities | 470,086 | 464,329 | ||||||||||

| Advances under loan receivable commitment | (82,020 | ) | - | |||||||||

| Change in restricted cash | 587 | (54 | ) | |||||||||

| Acquisitions, net of cash acquired | (25 | ) | (2,818 | ) | ||||||||

| Net cash used in investing activities | (130,220 | ) | (200,249 | ) | ||||||||

| Financing activities: | ||||||||||||

| Dividends paid | (263,857 | ) | (165,638 | ) | ||||||||

| Purchase of treasury stock under share repurchase plan | (13,353 | ) | - | |||||||||

| Purchase of treasury stock related to equity awards | (7,367 | ) | (6,460 | ) | ||||||||

| Proceeds from issuance of treasury stock related to equity awards | 8,185 | 10,133 | ||||||||||

| Tax benefit from issuance of equity awards | 300 | 1,304 | ||||||||||

| Net cash used in financing activities | (276,092 | ) | (160,661 | ) | ||||||||

| Effect of exchange rate changes on cash and cash equivalents | (5,039 | ) | (3,664 | ) | ||||||||

| Net decrease in cash and cash equivalents | (147,690 | ) | (19,441 | ) | ||||||||

| Cash and cash equivalents at beginning of period | 1,231,180 | 1,287,160 | ||||||||||

| Cash and cash equivalents at end of period | $ | 1,083,490 | $ | 1,267,719 | ||||||||

| Garmin Ltd. And Subsidiaries | ||||||||||||||||||||||||

| Revenue, Gross Profit, and Operating Income by Segment (Unaudited) | ||||||||||||||||||||||||

| Reporting Segments | ||||||||||||||||||||||||

| Auto/ | ||||||||||||||||||||||||

| Outdoor | Fitness | Marine | Mobile | Aviation | Total | |||||||||||||||||||

| 13-Weeks Ended June 29, 2013 | ||||||||||||||||||||||||

| Net sales | $ | 106,856 | $ | 84,216 | $ | 72,748 | $ | 344,701 | $ | 88,042 | $ | 696,563 | ||||||||||||

| Gross profit | $ | 70,387 | $ | 55,071 | $ | 40,938 | $ | 155,363 | $ | 61,881 | $ | 383,640 | ||||||||||||

| Operating income | $ | 44,842 | $ | 29,641 | $ | 14,411 | $ | 60,444 | $ | 20,548 | $ | 169,886 | ||||||||||||

| 13-Weeks Ended June 30, 2012 | ||||||||||||||||||||||||

| Net sales | $ | 100,496 | $ | 81,812 | $ | 67,790 | $ | 392,124 | $ | 75,932 | $ | 718,154 | ||||||||||||

| Gross profit | $ | 66,892 | $ | 56,665 | $ | 43,139 | $ | 200,923 | $ | 54,194 | $ | 421,813 | ||||||||||||

| Operating income | $ | 43,739 | $ | 34,146 | $ | 18,427 | $ | 87,108 | $ | 20,586 | $ | 204,006 | ||||||||||||

| 26-Weeks Ended June 29, 2013 | ||||||||||||||||||||||||

| Net sales | $ | 183,022 | $ | 156,653 | $ | 123,044 | $ | 597,290 | $ | 168,511 | $ | 1,228,520 | ||||||||||||

| Gross profit | $ | 114,862 | $ | 100,039 | $ | 64,285 | $ | 262,483 | $ | 118,104 | $ | 659,773 | ||||||||||||

| Operating income | $ | 66,430 | $ | 49,533 | $ | 11,971 | $ | 80,476 | $ | 41,402 | $ | 249,812 | ||||||||||||

| 26-Weeks Ended June 30, 2012 | ||||||||||||||||||||||||

| Net sales | $ | 177,659 | $ | 153,026 | $ | 123,854 | $ | 671,393 | $ | 148,819 | $ | 1,274,751 | ||||||||||||

| Gross profit | $ | 114,154 | $ | 100,160 | $ | 76,634 | $ | 310,753 | $ | 103,870 | $ | 705,571 | ||||||||||||

| Operating income | $ | 69,648 | $ | 54,797 | $ | 27,205 | $ | 105,043 | $ | 37,646 | $ | 294,339 | ||||||||||||

| Garmin Ltd. And Subsidiaries | ||||||||||||||||||||||||

| Revenue by Geography (Unaudited) | ||||||||||||||||||||||||

| 13-Weeks Ended | 26-Weeks Ended | |||||||||||||||||||||||

| June 29, | June 30, | Yr over Yr | June 29, | June 30, | Yr over Yr | |||||||||||||||||||

| 2013 | 2012 | Change | 2013 | 2012 | Change | |||||||||||||||||||

| Net sales | $ | 696,563 | $ | 718,154 | -3 | % | $ | 1,228,520 | $ | 1,274,751 | -4 | % | ||||||||||||

| Americas | 383,537 | 391,671 | -2 | % | 669,349 | 687,841 | -3 | % | ||||||||||||||||

| EMEA | 256,401 | 269,415 | -5 | % | 447,177 | 468,031 | -4 | % | ||||||||||||||||

| APAC | 56,625 | 57,068 | -1 | % | 111,994 | 118,879 | -6 | % | ||||||||||||||||

EMEA - Europe, Middle East and Africa; APAC - Asia Pacific

Non-GAAP Financial Information

Management believes that net income per share before the impact of foreign currency translation gain or loss and income tax adjustments that materially impact the effective tax rate due to completion of tax audits and/or expiration of statutes is an important measure. The majority of the Company’s consolidated foreign currency gain or a loss result from transactions involving the Euro, the British Pound Sterling and the Taiwan Dollar and from the exchange rate impact of the significant cash and marketable securities, receivables and payables held in U.S. dollars at the end of each reporting period by the Company’s various non U.S. subsidiaries. Such gain or loss is required under GAAP because the functional currency of the subsidiaries differs from the currency in which various assets and liabilities are held. However, there is minimal cash impact from such foreign currency gain or loss. The Company’s income tax expense is periodically impacted by material reserve releases related to completion of audits and/or the expiration of statutes effecting prior periods. This is not reflective of the current effective tax rate. The release of other uncertain tax position reserves, amounting to approximately $10 million in the 2013 periods and $8 million in the 2012 periods, have not been included as pro forma adjustments in the following presentation of pro forma net income as such amounts have been considered immaterial, tend to be more recurring in nature and are comparable between periods. Accordingly, earnings per share before the impact of foreign currency translation gain or loss and income tax adjustments that materially impact the effective tax rate due to completion of tax audits and/or expiration of statutes permits a consistent comparison of the Company’s operating performance between periods.

| Garmin Ltd. And Subsidiaries | ||||||||||||||||

| Net income per share (Pro Forma) | ||||||||||||||||

| (in thousands, except per share information) | ||||||||||||||||

| 13-Weeks Ended | 26-weeks Ended | |||||||||||||||

| June 29, | June 30, | June 29, | June 30, | |||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Net Income (GAAP) | $ | 172,491 | $ | 185,904 | $ | 261,157 | $ | 272,761 | ||||||||

| Foreign currency (gain) / loss, net of tax effects | ($ | 22,920 | ) | $ | 6,965 | ($ | 16,213 | ) | $ | 8,672 | ||||||

| Income tax benefit due to completion of tax audits | ||||||||||||||||

| and/or expiration of statutes | - | - | ($ | 16,536 | ) | - | ||||||||||

| Net income (Pro Forma) | $ | 149,571 | $ | 192,869 | $ | 228,408 | $ | 281,433 | ||||||||

| Net income per share (GAAP): | ||||||||||||||||

| Basic | $ | 0.88 | $ | 0.95 | $ | 1.34 | $ | 1.40 | ||||||||

| Diluted | $ | 0.88 | $ | 0.95 | $ | 1.33 | $ | 1.39 | ||||||||

| Net income per share (Pro Forma): | ||||||||||||||||

| Basic | $ | 0.76 | $ | 0.99 | $ | 1.17 | $ | 1.44 | ||||||||

| Diluted | $ | 0.76 | $ | 0.98 | $ | 1.16 | $ | 1.43 | ||||||||

| Weighted average common shares outstanding: | ||||||||||||||||

| Basic | 195,570 | 194,849 | 195,600 | 194,795 | ||||||||||||

| Diluted | 196,300 | 196,261 | 196,338 | 196,232 | ||||||||||||

Management believes that free cash flow is an important financial measure because it represents the amount of cash provided by operations that is available for investing and defines it as operating cash flow less capital expenditures for property and equipment.

| Garmin Ltd. And Subsidiaries | ||||||||||||||||

| Free Cash Flow | ||||||||||||||||

| (in thousands) | ||||||||||||||||

| 13-Weeks Ended | 26-weeks Ended | |||||||||||||||

| June 29, | June 30, | June 29, | June 30, | |||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Net cash provided by operating activities | $ | 204,298 | $ | 222,905 | $ | 263,661 | $ | 345,133 | ||||||||

| Less: purchases of property and equipment | ($ | 18,107 | ) | ($ | 11,668 | ) | ($ | 29,723 | ) | ($ | 17,426 | ) | ||||

| Free Cash Flow | $ | 186,191 | $ | 211,237 | $ | 233,938 | $ | 327,707 | ||||||||