Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | form8-kforjuly262013eventf.htm |

| EX-99.1 - PRESS RELEASE - HomeStreet, Inc. | fortune_yakimaxrelease.htm |

Building the Franchise: Acquisition of Fortune Bank & Yakima National Bank July 26, 2013 NASDAQ:HMST

Important Disclosures Forward-Looking Statements We may make forward-looking statements in this presentation about our industry, our future financial performance and our plans and objectives. These statements are subject to many risks and uncertainties, and are based on our management's current expectations, beliefs, projections, plans and strategies, anticipated events or trends and similar expressions, as well as a number of assumptions concerning future events. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our Quarterly Report on Form 10-Q for the period ended March 31, 2013. Many of these factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. For instance, our ability to expand our banking operations geographically and across market sectors, grow our franchise and capitalize on market opportunities may be limited due to future risks and uncertainties. Closing of the transactions discussed in this presentation will be contingent on meeting certain conditions, including the receipt of regulatory approval. In addition, integration of the acquired operations may take longer or prove more expensive than we anticipate, and may distract management from our operations. Actual results may fall materially short of our expectations and projections, and we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward-looking statements. All forward looking statements are based on information available to the Company as of the date hereof, and we do not undertake to update or revise any forward looking statements, for any reason. Basis of Presentation of Financial Data Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending June 30, 2013. Non-GAAP Financial Measures Information on any non-GAAP financial measures referenced in today’s presentation, including a reconciliation of those measures to GAAP measures, may also be found in our SEC filings and in the earnings release available on our web site. 2

Overview • On July 26, 2013, HomeStreet Bank entered into separate merger agreements with Fortune Bank and Yakima National Bank Fortune Bank is a $141 million asset Washington state-chartered commercial bank specializing in business banking and SBA lending, with two branches in Seattle and Bellevue Yakima National Bank is a $125 million asset national banking association with four retail bank branches in the Central and Eastern Washington cities of Yakima, Selah, Sunnyside and Kennewick • Anticipated to close in the fourth quarter of 2013, subject to regulatory and shareholder approvals 3

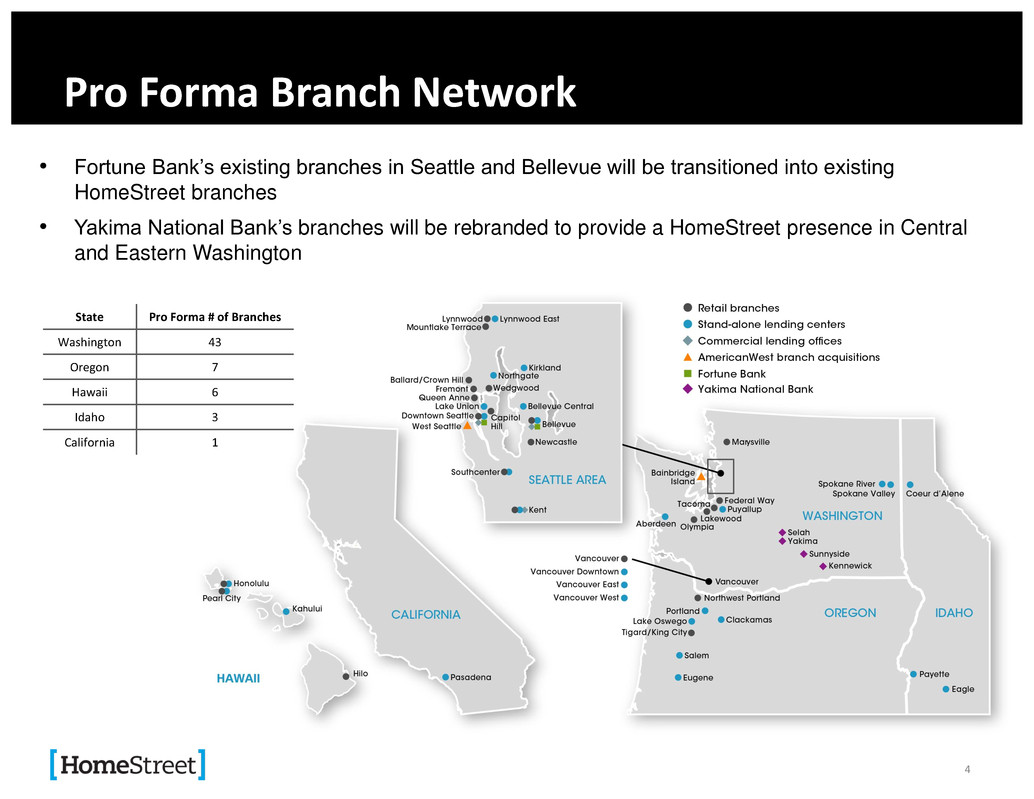

Pro Forma Branch Network • Fortune Bank’s existing branches in Seattle and Bellevue will be transitioned into existing HomeStreet branches • Yakima National Bank’s branches will be rebranded to provide a HomeStreet presence in Central and Eastern Washington State Pro Forma # of Branches Washington 43 Oregon 7 Hawaii 6 Idaho 3 California 1 4

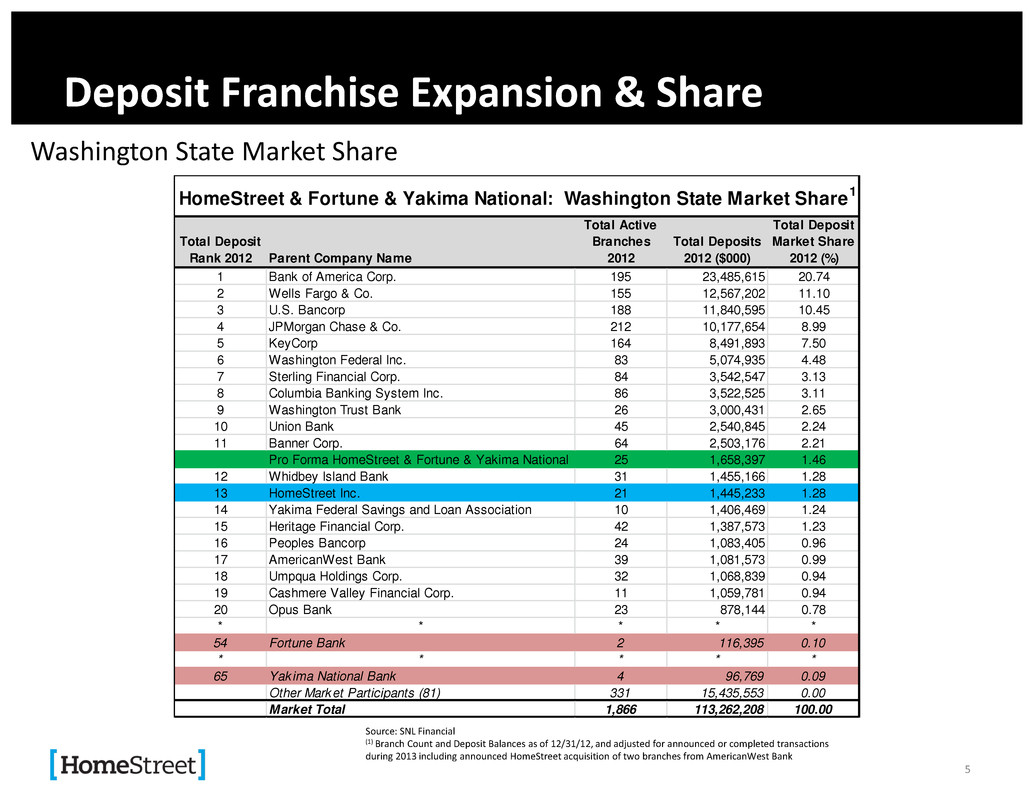

Deposit Franchise Expansion & Share Source: SNL Financial (1) Branch Count and Deposit Balances as of 12/31/12, and adjusted for announced or completed transactions during 2013 including announced HomeStreet acquisition of two branches from AmericanWest Bank Washington State Market Share Total Deposit Rank 2012 Parent Company Name Total Active Branches 2012 Total Deposits 2012 ($000) Total Deposit Market Share 2012 (%) 1 Bank of America Corp. 195 23,485,615 20.74 2 Wells Fargo & Co. 155 12,567,202 11.10 3 U.S. Bancorp 188 11,840,595 10.45 4 JPMorgan Chase & Co. 212 10,177,654 8.99 5 KeyCorp 164 8,491,893 7.50 6 Washington Federal Inc. 83 5,074,935 4.48 7 Sterling Financial Corp. 84 3,542,547 3.13 8 Columbia Banking System Inc. 86 3,522,525 3.11 9 Washington Trust Bank 26 3,000,431 2.65 10 Union Bank 45 2,540,845 2.24 11 Banner Corp. 64 2,503,176 2.21 Pro Forma HomeStreet & Fortune & Yakima National 25 1,658,397 1.46 12 Whidbey Island Bank 31 1,455,166 1.28 13 HomeStreet Inc. 21 1,445,233 1.28 14 Yakima Federal Savings and Loan Association 10 1,406,469 1.24 15 Heritage Financial Corp. 42 1,387,573 1.23 16 Peoples Bancorp 24 1,083,405 0.96 17 AmericanWest Bank 39 1,081,573 0.99 18 Umpqua Holdings Corp. 32 1,068,839 0.94 19 Cashmere Valley Financial Corp. 11 1,059,781 0.94 20 Opus Bank 23 878,144 0.78 * * * * * 54 Fortune Bank 2 116,395 0.10 * * * * * 65 Yakima National Bank 4 96,769 0.09 Other Market Participants (81) 331 15,435,553 0.00 Market Total 1,866 113,262,208 100.00 HomeStreet & Fortune & Yakima National: Washington State Market Share1 5

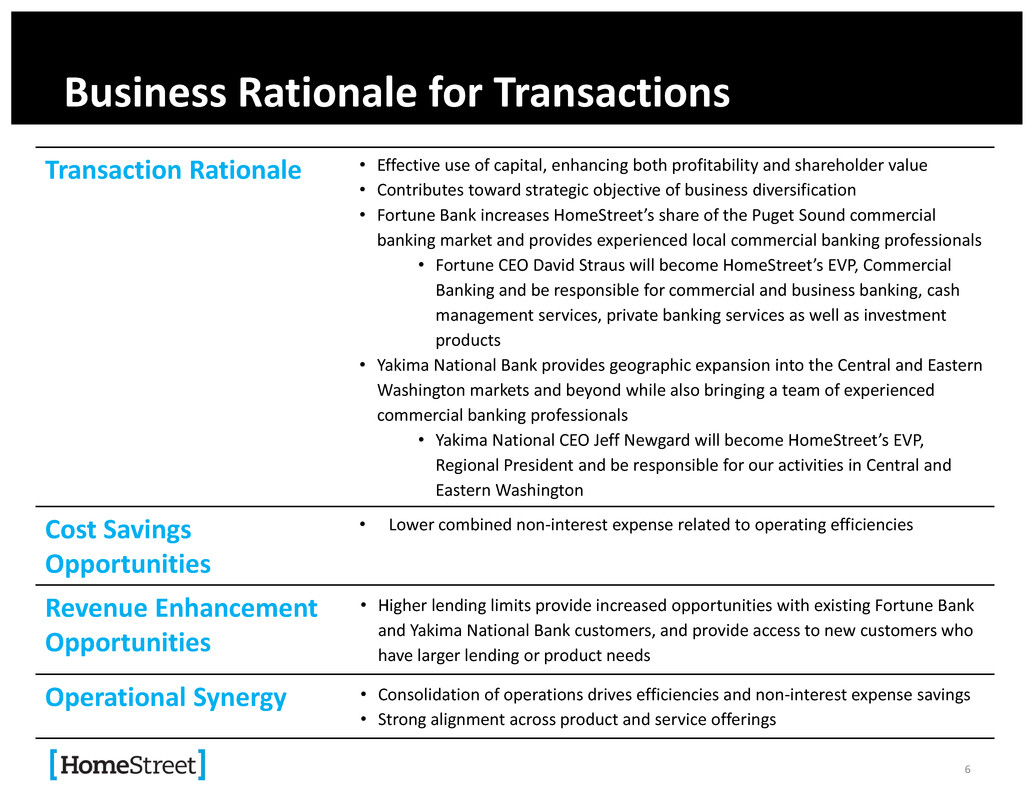

Business Rationale for Transactions Transaction Rationale • Effective use of capital, enhancing both profitability and shareholder value • Contributes toward strategic objective of business diversification • Fortune Bank increases HomeStreet’s share of the Puget Sound commercial banking market and provides experienced local commercial banking professionals • Fortune CEO David Straus will become HomeStreet’s EVP, Commercial Banking and be responsible for commercial and business banking, cash management services, private banking services as well as investment products • Yakima National Bank provides geographic expansion into the Central and Eastern Washington markets and beyond while also bringing a team of experienced commercial banking professionals • Yakima National CEO Jeff Newgard will become HomeStreet’s EVP, Regional President and be responsible for our activities in Central and Eastern Washington Cost Savings Opportunities • Lower combined non-interest expense related to operating efficiencies Revenue Enhancement Opportunities • Higher lending limits provide increased opportunities with existing Fortune Bank and Yakima National Bank customers, and provide access to new customers who have larger lending or product needs Operational Synergy • Consolidation of operations drives efficiencies and non-interest expense savings • Strong alignment across product and service offerings 6

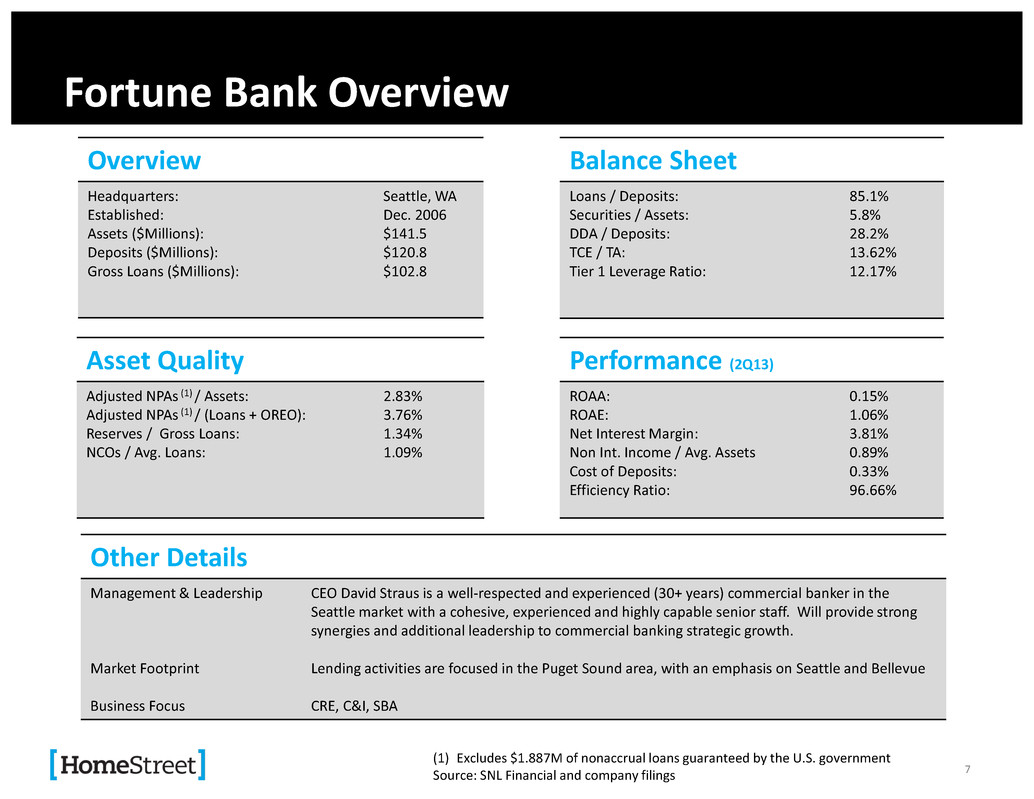

Overview Headquarters: Established: Assets ($Millions): Deposits ($Millions): Gross Loans ($Millions): Seattle, WA Dec. 2006 $141.5 $120.8 $102.8 Fortune Bank Overview Asset Quality Adjusted NPAs (1) / Assets: Adjusted NPAs (1) / (Loans + OREO): Reserves / Gross Loans: NCOs / Avg. Loans: 2.83% 3.76% 1.34% 1.09% Balance Sheet Loans / Deposits: Securities / Assets: DDA / Deposits: TCE / TA: Tier 1 Leverage Ratio: 85.1% 5.8% 28.2% 13.62% 12.17% Performance (2Q13) ROAA: ROAE: Net Interest Margin: Non Int. Income / Avg. Assets Cost of Deposits: Efficiency Ratio: 0.15% 1.06% 3.81% 0.89% 0.33% 96.66% Other Details Management & Leadership Market Footprint Business Focus CEO David Straus is a well-respected and experienced (30+ years) commercial banker in the Seattle market with a cohesive, experienced and highly capable senior staff. Will provide strong synergies and additional leadership to commercial banking strategic growth. Lending activities are focused in the Puget Sound area, with an emphasis on Seattle and Bellevue CRE, C&I, SBA 7 (1) Excludes $1.887M of nonaccrual loans guaranteed by the U.S. government Source: SNL Financial and company filings

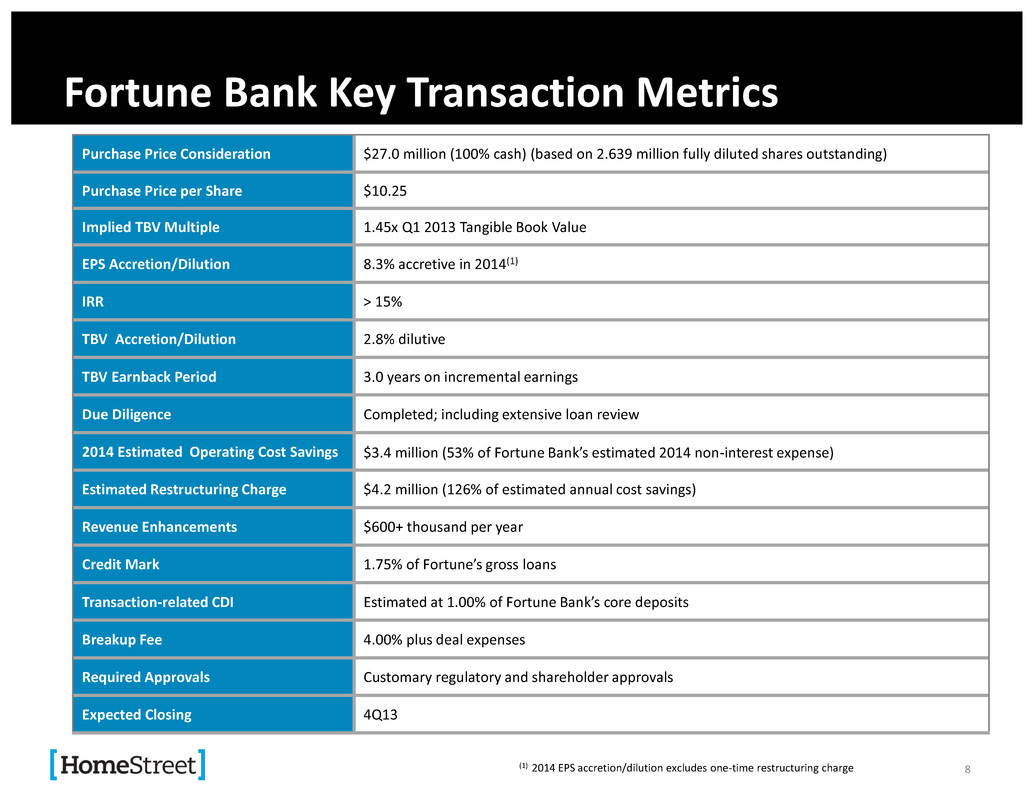

Fortune Bank Key Transaction Metrics Purchase Price Consideration $27.0 million (100% cash) (based on 2.639 million fully diluted shares outstanding) Purchase Price per Share $10.25 Implied TBV Multiple 1.45x Q1 2013 Tangible Book Value EPS Accretion/Dilution 8.3% accretive in 2014(1) IRR > 15% TBV Accretion/Dilution 2.8% dilutive TBV Earnback Period 3.0 years on incremental earnings Due Diligence Completed; including extensive loan review 2014 Estimated Operating Cost Savings $3.4 million (53% of Fortune Bank’s estimated 2014 non-interest expense) Estimated Restructuring Charge $4.2 million (126% of estimated annual cost savings) Revenue Enhancements $600+ thousand per year Credit Mark 1.75% of Fortune’s gross loans Transaction-related CDI Estimated at 1.00% of Fortune Bank’s core deposits Breakup Fee 4.00% plus deal expenses Required Approvals Customary regulatory and shareholder approvals Expected Closing 4Q13 (1) 2014 EPS accretion/dilution excludes one-time restructuring charge 8

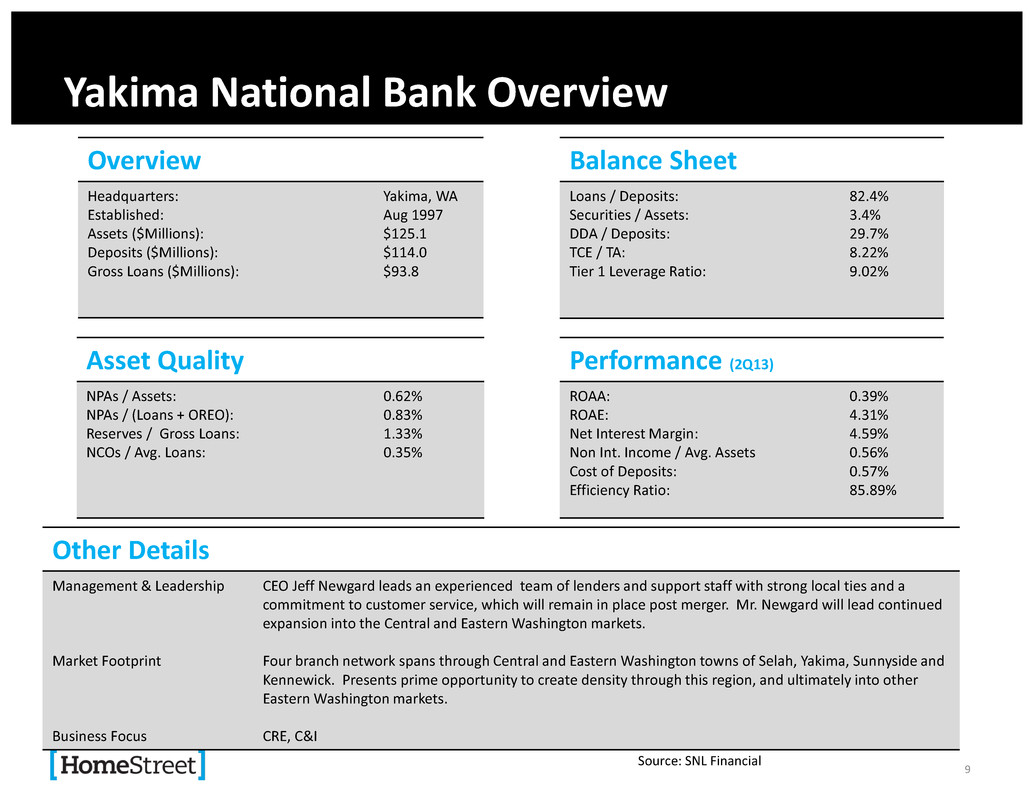

Yakima National Bank Overview Overview Headquarters: Established: Assets ($Millions): Deposits ($Millions): Gross Loans ($Millions): Yakima, WA Aug 1997 $125.1 $114.0 $93.8 Asset Quality NPAs / Assets: NPAs / (Loans + OREO): Reserves / Gross Loans: NCOs / Avg. Loans: 0.62% 0.83% 1.33% 0.35% Balance Sheet Loans / Deposits: Securities / Assets: DDA / Deposits: TCE / TA: Tier 1 Leverage Ratio: 82.4% 3.4% 29.7% 8.22% 9.02% Performance (2Q13) ROAA: ROAE: Net Interest Margin: Non Int. Income / Avg. Assets Cost of Deposits: Efficiency Ratio: 0.39% 4.31% 4.59% 0.56% 0.57% 85.89% Source: SNL Financial Other Details Management & Leadership Market Footprint Business Focus CEO Jeff Newgard leads an experienced team of lenders and support staff with strong local ties and a commitment to customer service, which will remain in place post merger. Mr. Newgard will lead continued expansion into the Central and Eastern Washington markets. Four branch network spans through Central and Eastern Washington towns of Selah, Yakima, Sunnyside and Kennewick. Presents prime opportunity to create density through this region, and ultimately into other Eastern Washington markets. CRE, C&I 9

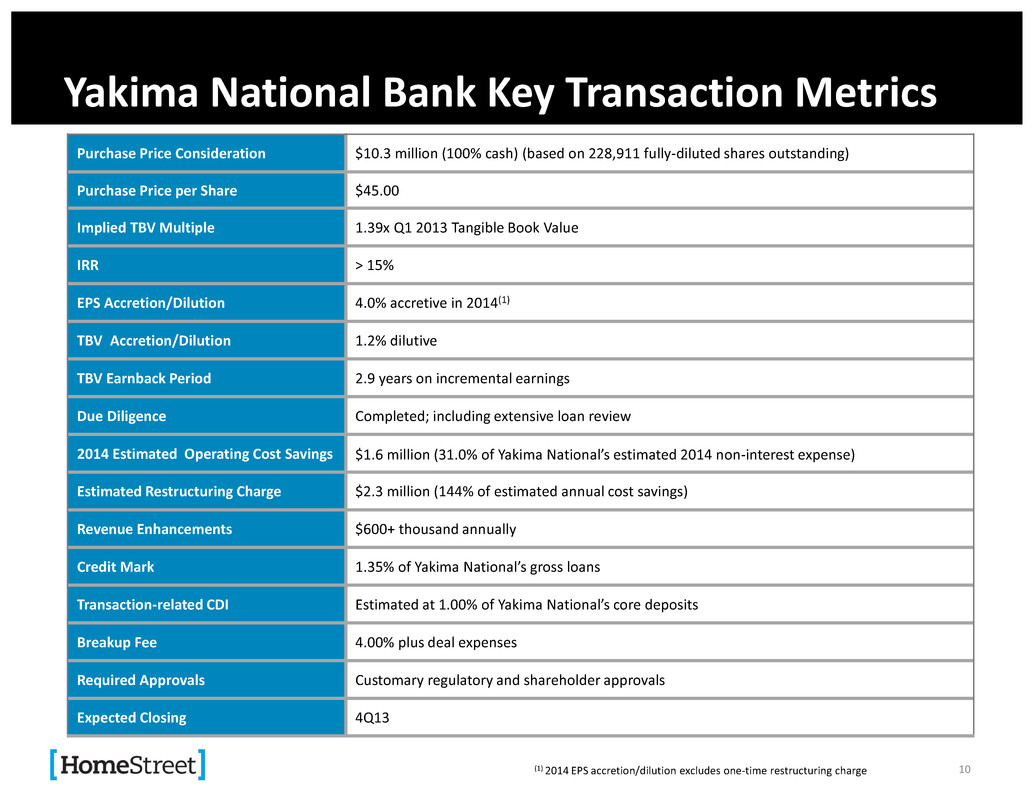

Yakima National Bank Key Transaction Metrics Purchase Price Consideration $10.3 million (100% cash) (based on 228,911 fully-diluted shares outstanding) Purchase Price per Share $45.00 Implied TBV Multiple 1.39x Q1 2013 Tangible Book Value IRR > 15% EPS Accretion/Dilution 4.0% accretive in 2014(1) TBV Accretion/Dilution 1.2% dilutive TBV Earnback Period 2.9 years on incremental earnings Due Diligence Completed; including extensive loan review 2014 Estimated Operating Cost Savings $1.6 million (31.0% of Yakima National’s estimated 2014 non-interest expense) Estimated Restructuring Charge $2.3 million (144% of estimated annual cost savings) Revenue Enhancements $600+ thousand annually Credit Mark 1.35% of Yakima National’s gross loans Transaction-related CDI Estimated at 1.00% of Yakima National’s core deposits Breakup Fee 4.00% plus deal expenses Required Approvals Customary regulatory and shareholder approvals Expected Closing 4Q13 (1) 2014 EPS accretion/dilution excludes one-time restructuring charge 10

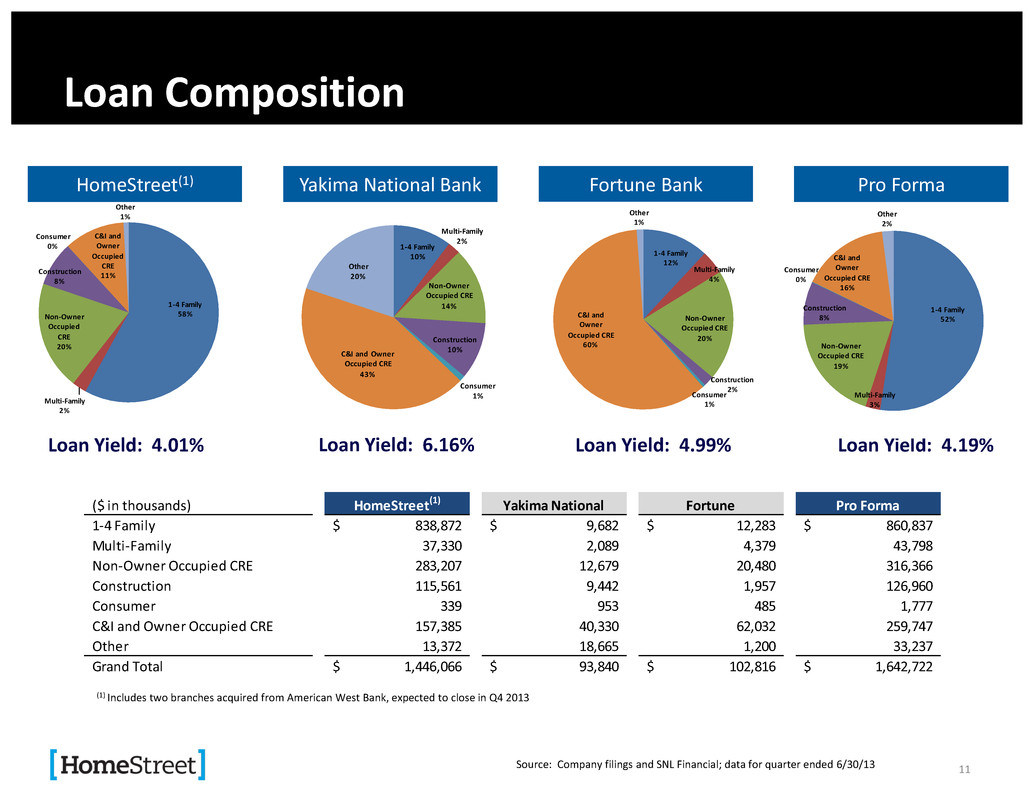

1-4 Family 10% Multi-Family 2% Non-Owner Occupied CRE 14% Construction 10% Consumer 1% C&I and Owner Occupied CRE 43% Other 20% Loan Composition Loan Yield: 4.01% Yakima National Bank Loan Yield: 4.99% Pro Forma Loan Yield: 4.19% Source: Company filings and SNL Financial; data for quarter ended 6/30/13 Fortune Bank Loan Yield: 6.16% ($ in thousands) HomeStreet(1) Yakima National Fortune Pro Forma 1-4 Family 838,872$ 9,682$ 12,283$ 860,837$ Multi-Family 37,330 2,089 4,379 43,798 Non-Ow er Occupied CRE 283,207 12,679 20,480 316,366 Construction 115,561 9,442 1,957 126,960 Consumer 339 953 485 1,777 C&I and Owner Occupied CRE 157,385 40,330 62,032 259,747 Other 13,372 18,665 1,200 33,237 Grand Total 1,446,066$ 93,840$ 102,816$ 1,642,722$ (1) Includes two branches acquired from American West Bank, expected to close in Q4 2013 1-4 Family 58% Multi-Family 2% Non-Owner Occupied CRE 20% Construction 8% Consumer 0% C&I and Owner Occupied CRE 11% Other 1% 1-4 Family 52% Multi-Family 3% Non-Owner Occupied CRE 19% Construction 8% Consumer 0% C&I and Owner Occupied CRE 16% Other 2% 1-4 Family 12% Multi-Family 4% Non-Owner Occupied CRE 20% Construction 2% Consumer 1% C&I and Owner Occupied CRE 60% Other 1% HomeStreet(1) 11

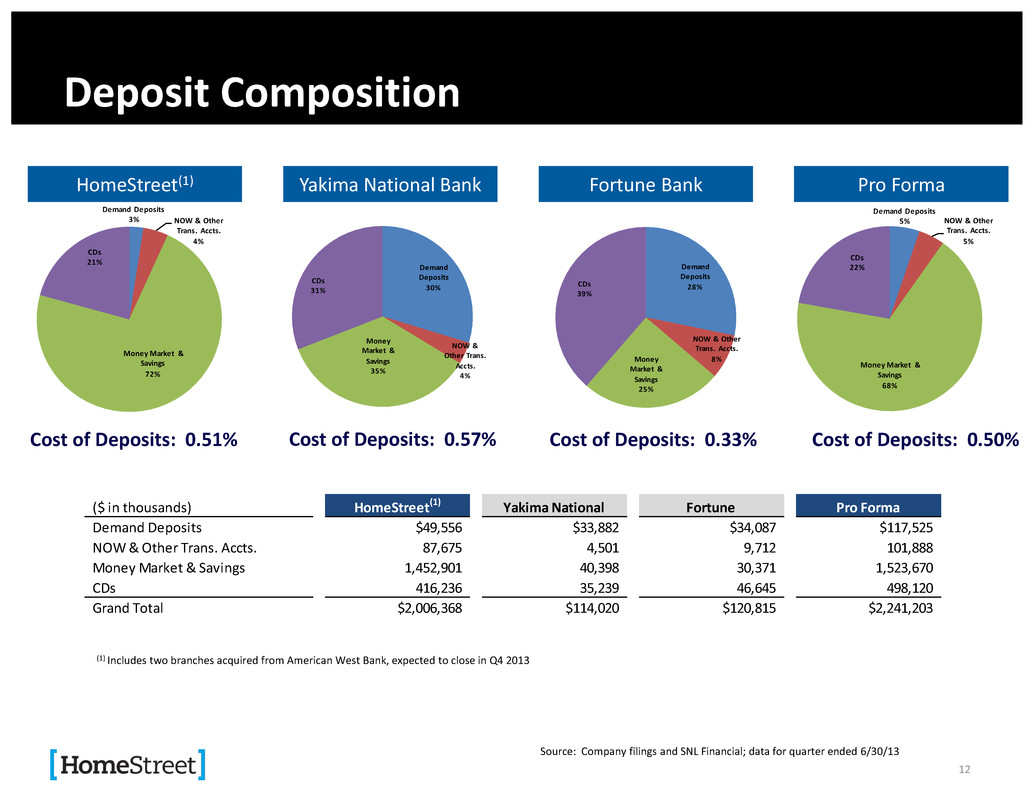

Demand Deposits 5% NOW & Other Trans. Accts. 5% Money Market & Savings 68% CDs 22% Demand Deposits 3% NOW & Other Trans. Accts. 4% Money Market & Savings 72% CDs 21% Deposit Composition ($ in thousands) HomeStreet(1) Yakima National Fortune Pro Forma Demand Deposits $49,556 $33,882 $34,087 $117,525 NOW & Other Trans. Accts. 87,675 4,501 9,712 101,888 Money Market & Savings 1,452,901 40,398 30,371 1,523,670 CDs 416,236 35,239 46,645 498,120 Grand Total $2,006,368 $114,020 $120,815 $2,241,203 (1) Includes two branches acquired from American West Bank, expected to close in Q4 2013 Demand Deposits 30% NOW & Other Trans. Accts. 4% Money Market & Savings 35% CDs 31% Demand Deposits 28% NOW & Other Trans. Accts. 8%Money Market & Savings 25% CDs 39% HomeStreet(1) Cost of Deposits: 0.51% Yakima National Bank Cost of Deposits: 0.33% Pro Forma Cost of Deposits: 0.50% Fortune Bank Cost of Deposits: 0.57% 12 Source: Company filings and SNL Financial; data for quarter ended 6/30/13

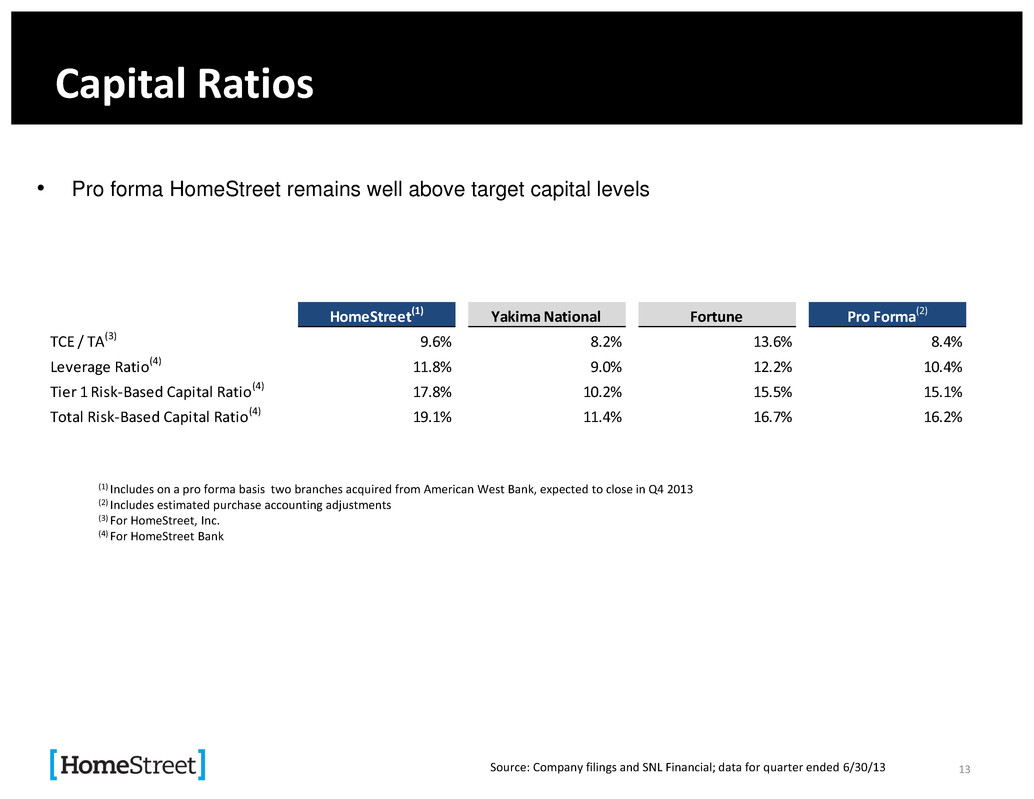

Capital Ratios Source: Company filings and SNL Financial; data for quarter ended 6/30/13 (1) Includes on a pro forma basis two branches acquired from American West Bank, expected to close in Q4 2013 (2) Includes estimated purchase accounting adjustments (3) For HomeStreet, Inc. (4) For HomeStreet Bank 13 HomeStreet(1) Yakima National Fortune Pro Forma(2) TCE / TA(3) 9.6% 8.2% 13.6% 8.4% Leverage Ratio(4) 11.8 9.0 12.2 10.4 Tier 1 Risk-Based Capital Ratio(4) 17.8% 10.2% 15.5% 15.1% Total Risk-Based Capital Ratio(4) 19.1 11.4 16.7 16.2 • Pro forma HomeStreet remains well above target capital levels