Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NV ENERGY, INC. | d575846d8k.htm |

| EX-99.1 - EX-99.1 - NV ENERGY, INC. | d575846dex991.htm |

Earnings Report to the

Financial Community

Second Quarter 2013

Table of Contents

Page No.

Conference call slides

2 -7

Quarterly EPS

8

Financial statements and operating statistics

9 -

16

Non-GAAP financial measures

17 -

18

Exhibit 99.2 |

Second

Quarter 2013 Financial Results

July 26, 2013 |

3

Safe Harbor Statement

This

presentation

may

contain

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995

regarding

the

future

performance

of

NV

Energy,

Inc.

and

its

subsidiaries,

Nevada

Power

Company

and

Sierra

Pacific

Power

Company

both

d/b/a

NV

Energy.

Forward-looking

statements

include

earnings

guidance

and

estimates

or

forecasts

of

operating

and

financial

metrics.

These

statements

reflect

current

expectations

of

future

conditions

and

events

and

as

such

are

subject

to

a

variety

of

risks,

uncertainties

and

assumptions

that

could

cause

actual

results

to

differ

materially

from

current

expectations.

These

risks,

uncertainties

and

assumptions

include,

but

are

not

limited

to,

the

risk

that

the

transaction

between

NV

Energy,

Inc.

and

MidAmerican

will

not

be

consummated

due

to

a

failure

to

satisfy

the

closing

conditions

to

the

transaction,

including

the

approval

of

the

transaction

by

NV

Energy

Inc.’s

shareholders

and

the

receipt

of

certain

regulatory

approvals

on

the

proposed

terms

and

schedules

contemplated

by

the

parties,

including,

among

other

regulatory

approvals,

approvals

from

the

Public

Utilities

Commission

of

Nevada

and

the

Federal

Energy

Regulatory

Commission;

the

risk

that

an

event,

effect

or

change

occurs

that

gives

rise

to

a

termination

of

the

definitive

agreement

entered

into

with

MidAmerican;

the

risk

that

NV

Energy

Inc.

or

MidAmerican

will

be

unable

to

perform

certain

obligations

under

the

transaction

agreements;

the

risk

relating

to

unanticipated

difficulties

and/or

expenditures

relating

to

the

transaction;

the

risk

that

legal

proceedings

against

NV

Energy,

Inc.

and

others

related

to

the

definitive

agreement

entered

into

with

MidAmerican

will

be

successful;

the

risk

that

the

proposed

transaction

disrupts

current

plans

and

operations

and

creates

potential

difficulties

in

employee

retention;

and

the

impact

of

delay

or

failure

to

complete

the

merger

with

MidAmerican

on

NV

Energy,

Inc.’s

common

stock

price.

Other

factors

outside

the

control

of

NV

Energy,

Inc.,

include,

but

are

not

limited

to,

NV

Energy

Inc.'s

ability

to

maintain

access

to

the

capital

markets,

NV

Energy,

Inc.'s

ability

to

receive

dividends

from

its

subsidiaries,

the

financial

performance

of

NV

Energy,

Inc.'s

subsidiaries,

particularly

Nevada

Power

Company

and

Sierra

Pacific

Power

Company

both

d/b/a

NV

Energy,

and

the

discretion

of

NV

Energy,

Inc.'s

Board

of

Directors

with

respect

to

the

payment

of

future

dividends

based

on

its

periodic

review

of

factors

that

ordinarily

affect

dividend

policy,

such

as

current

and

prospective

financial

condition,

earnings

and

liquidity,

prospective

business

conditions,

regulatory

factors,

and

dividend

restrictions

in

NV

Energy,

Inc.'s

and

its

subsidiaries'

financing

agreements.

For

Nevada

Power

Company

and

Sierra

Pacific

Power

Company

both

d/b/a

NV

Energy,

these

risks

and

uncertainties

include,

but

are

not

limited

to,

future

economic

conditions,

changes

in

the

rate

of

industrial,

commercial

and

residential

growth

in

their

service

territories,

their

ability

to

procure

sufficient

renewable

energy

sources

in

each

compliance

year

to

satisfy

the

Nevada

Renewable

Energy

Portfolio

Standard,

the

effect

of

future

or

existing

Nevada

or

federal

laws

or

regulations

affecting

the

electric

industry,

changes

in

environmental

laws

and

regulations,

construction

risks,

including

but

not

limited

to

those

associated

with

the

ON

Line

project,

their

ability

to

maintain

access

to

the

capital

markets

for

general

corporate

purposes

and

to

finance

construction

projects,

employee

workforce

factors,

unseasonable

weather,

drought,

wildfire

and

other

natural

phenomena,

explosions,

fires,

accidents,

vandalism,

or

mechanical

breakdowns

that

may

occur

while

operating

and

maintaining

an

electric

and

natural

gas

system,

their

ability

to

purchase

sufficient

fuel,

natural

gas

and

power

to

meet

their

power

demands

and

natural

gas

demands

for

Sierra

Pacific

Power

Company

d/b/a

NV

Energy,

financial

market

conditions,

and

unfavorable

rulings,

penalties

or

findings

in

their

rate

or

other

cases.

Further

risks,

uncertainties

and

assumptions

that

may

cause

actual

results

to

differ

from

current

expectations

pertain

to

weather

conditions,

customer

and

sales

growth,

plant

outages,

operations

and

maintenance

expense,

depreciation

and

allowance

for

funds

used

during

construction,

interest

rates

and

expense,

cash

flow

and

regulatory

matters.

Additional

cautionary

statements

regarding

other

risk

factors

that

could

have

an

effect

on

the

future

performance

of

NV

Energy,

Inc.,

Nevada

Power

Company

and

Sierra

Pacific

Power

Company

both

d/b/a

NV

Energy

are

contained

in

their

Annual

Reports

on

Form

10-K

for

the

year

ended

December

31,

2012,

and

quarterly

reports

on

Form

10-Q

for

the

period

ended

March

31,

2013,

filed

with

the

Securities

and

Exchange

Commission.

NV

Energy,

Inc.,

Nevada

Power

Company

and

Sierra

Pacific

Power

Company

both

d/b/a

NV

Energy

undertake

no

obligation

to

release

publicly

the

result

of

any

revisions

to

these

forward-looking

statements

that

may

be

made

to

reflect

events

or

circumstances

after

the

date

hereof

or

to

reflect

the

occurrence

of

unanticipated

events.

IR Contact

Max Kuniansky

Executive, Investor Relations

(702) 402-5627

mkuniansky@nvenergy.com |

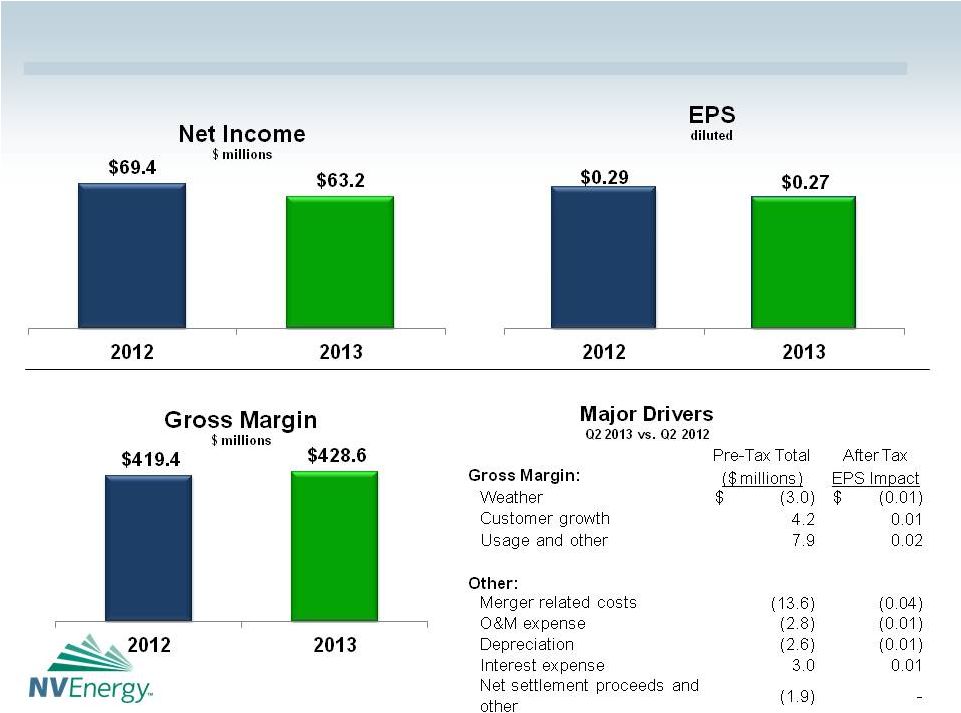

Second

Quarter Financial Results NV Energy Consolidated

4 |

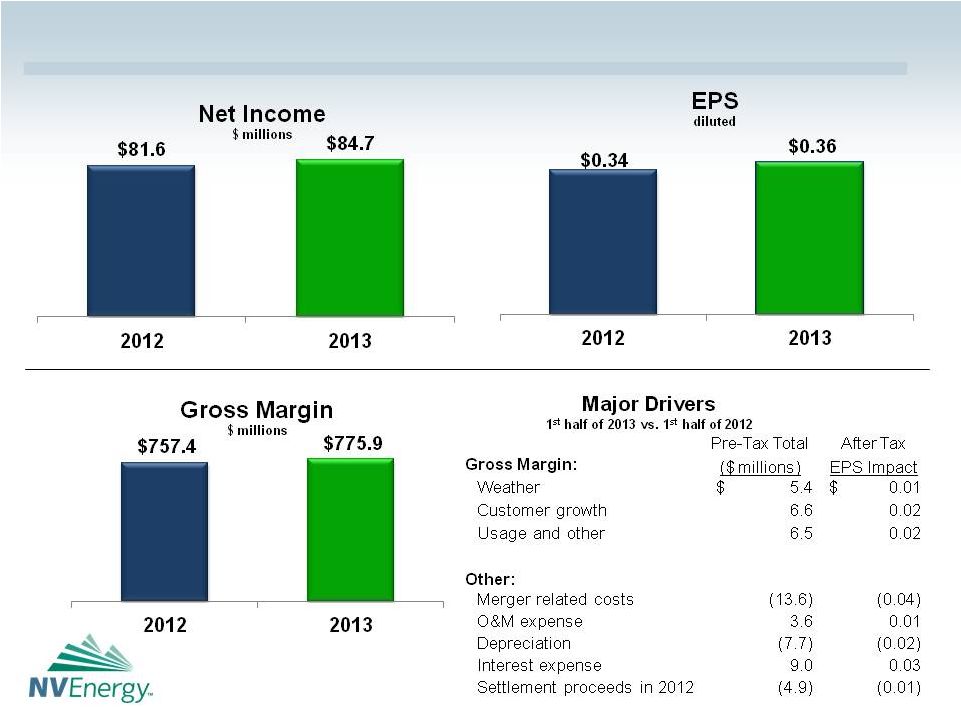

Six Month

Financial Results NV Energy Consolidated

5 |

6

EPS Impact of Weather: Actual vs. Normal

Estimates; normal = 20-year average |

7

2013 Earnings Guidance

EPS: $1.25 -

$1.35

For further information see forward –looking statements and risk factors in

2012 SEC Form 10-K and March 31, 2013 Form 10-Q

|

8

Third Quarter is Key to 12-Month Results

Earnings Per Share (diluted) |

NV ENERGY, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Dollars in Thousands, Except Share Amounts)

(Unaudited)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| OPERATING REVENUES |

$ | 731,638 | $ | 740,698 | $ | 1,315,860 | $ | 1,352,118 | ||||||||

| OPERATING EXPENSES: |

||||||||||||||||

| Fuel for power generation |

188,979 | 112,585 | 336,227 | 229,620 | ||||||||||||

| Purchased power |

170,861 | 164,092 | 292,171 | 281,208 | ||||||||||||

| Gas purchased for resale |

17,274 | 9,492 | 54,894 | 41,109 | ||||||||||||

| Deferred energy |

(86,687 | ) | 10,490 | (165,752 | ) | (1,249 | ) | |||||||||

| Energy efficiency program costs |

12,599 | 24,600 | 22,444 | 44,025 | ||||||||||||

| Merger related costs |

13,552 | — | 13,552 | — | ||||||||||||

| Other operating expenses |

106,798 | 103,371 | 211,470 | 206,972 | ||||||||||||

| Maintenance |

24,046 | 24,650 | 48,952 | 57,176 | ||||||||||||

| Depreciation and amortization |

98,884 | 96,316 | 194,886 | 187,178 | ||||||||||||

| Taxes other than income |

15,846 | 14,266 | 32,322 | 28,775 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

562,152 | 559,862 | 1,041,166 | 1,074,814 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING INCOME |

169,486 | 180,836 | 274,694 | 277,304 | ||||||||||||

| OTHER INCOME (EXPENSE): |

||||||||||||||||

| Interest expense (net of AFUDC-debt: $1,682 , $1,908 , $3,813 and $3,503) |

(73,530 | ) | (74,564 | ) | (146,867 | ) | (152,495 | ) | ||||||||

| Interest income (expense) on regulatory items |

(16 | ) | (1,977 | ) | (843 | ) | (4,179 | ) | ||||||||

| AFUDC-equity |

2,250 | 2,319 | 5,139 | 4,251 | ||||||||||||

| Other income |

3,813 | 6,291 | 7,633 | 10,485 | ||||||||||||

| Other expense |

(4,036 | ) | (4,640 | ) | (8,287 | ) | (7,700 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Other Income (Expense) |

(71,519 | ) | (72,571 | ) | (143,225 | ) | (149,638 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income Before Income Tax Expense |

97,967 | 108,265 | 131,469 | 127,666 | ||||||||||||

| Income tax expense |

34,734 | 38,826 | 46,761 | 46,054 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

63,233 | 69,439 | 84,708 | 81,612 | ||||||||||||

| Other comprehensive income (loss) |

||||||||||||||||

|

Change in compensation retirement benefits liability and amortization |

246 | 154 | 492 | 309 | ||||||||||||

| Change in market value of risk management assets and liabilities |

297 | (229 | ) | 496 | (475 | ) | ||||||||||

| Unrealized net gain/(loss) on investment |

(65 | ) | — | (65 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OTHER COMPREHENSIVE INCOME (LOSS) |

478 | (75 | ) | 923 | (166 | ) | ||||||||||

| COMPREHENSIVE INCOME |

$ | 63,711 | $ | 69,364 | $ | 85,631 | $ | 81,446 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Amount per share basic and diluted |

||||||||||||||||

| Net income per share—basic |

$ | 0.27 | $ | 0.29 | $ | 0.36 | $ | 0.35 | ||||||||

| Net income per share—diluted |

$ | 0.27 | $ | 0.29 | $ | 0.36 | $ | 0.34 | ||||||||

| Weighted Average Shares of Common Stock Outstanding—basic |

235,489,559 | 235,999,750 | 235,342,448 | 235,999,750 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted Average Shares of Common Stock Outstanding—diluted |

237,401,400 | 237,903,276 | 237,204,505 | 237,715,070 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Dividends Declared Per Share of Common Stock |

$ | 0.19 | $ | 0.17 | $ | 0.38 | $ | 0.30 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

9

NV ENERGY, INC.

CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands, Except Share Amounts)

(Unaudited)

| June 30, 2013 |

December 31, 2012 |

|||||||

| ASSETS |

||||||||

| Current Assets: |

||||||||

| Cash and cash equivalents |

$ | 261,068 | $ | 298,271 | ||||

| Accounts receivable less allowance for uncollectible accounts: 2013—$7,150; 2012—$8,748 |

433,336 | 373,099 | ||||||

| Materials, supplies and fuel, at average cost |

130,747 | 138,337 | ||||||

| Deferred energy costs—electric |

30,122 | — | ||||||

| Deferred energy costs—gas |

991 | — | ||||||

| Deferred income taxes |

109,450 | 60,592 | ||||||

| Other current assets |

47,591 | 40,750 | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

1,013,305 | 911,049 | ||||||

|

|

|

|

|

|||||

| Utility Property: |

||||||||

| Plant in service |

12,159,227 | 12,031,053 | ||||||

| Construction work-in-progress |

757,924 | 708,109 | ||||||

|

|

|

|

|

|||||

| Total |

12,917,151 | 12,739,162 | ||||||

| Less accumulated provision for depreciation |

3,448,469 | 3,313,188 | ||||||

|

|

|

|

|

|||||

| Total Utility Property, Net |

9,468,682 | 9,425,974 | ||||||

| Investments and other property, net |

63,387 | 56,660 | ||||||

| Deferred Charges and Other Assets: |

||||||||

| Deferred energy |

81,274 | 87,072 | ||||||

| Regulatory assets |

1,077,364 | 1,132,768 | ||||||

| Regulatory asset for pension plans |

274,200 | 281,195 | ||||||

| Other deferred charges and assets |

75,029 | 89,418 | ||||||

|

|

|

|

|

|||||

| Total Deferred Charges and Other Assets |

1,507,867 | 1,590,453 | ||||||

|

|

|

|

|

|||||

| TOTAL ASSETS |

$ | 12,053,241 | $ | 11,984,136 | ||||

|

|

|

|

|

|||||

(Continued)

10

NV ENERGY, INC.

CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands, Except Share Amounts)

(Unaudited)

| June 30, 2013 |

December 31, 2012 |

|||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||

| Current Liabilities: |

||||||||

| Current maturities of long-term debt |

$ | 480,018 | $ | 356,283 | ||||

| Accounts payable |

333,588 | 332,245 | ||||||

| Accrued expenses |

119,245 | 127,693 | ||||||

| Deferred energy |

— | 136,865 | ||||||

| Other current liabilities |

69,895 | 66,221 | ||||||

|

|

|

|

|

|||||

| Total Current Liabilities |

1,002,746 | 1,019,307 | ||||||

|

|

|

|

|

|||||

| Long-term debt |

4,543,733 | 4,669,798 | ||||||

| Commitments and Contingencies |

||||||||

| Deferred Credits and Other Liabilities: |

||||||||

| Deferred income taxes |

1,564,260 | 1,470,973 | ||||||

| Deferred investment tax credit |

12,430 | 13,538 | ||||||

| Accrued retirement benefits |

167,793 | 162,260 | ||||||

| Regulatory liabilities |

583,217 | 550,687 | ||||||

| Other deferred credits and liabilities |

614,873 | 540,202 | ||||||

|

|

|

|

|

|||||

| Total Deferred Credits and Other Liabilities |

2,942,573 | 2,737,660 | ||||||

|

|

|

|

|

|||||

| Shareholders’ Equity: |

||||||||

| Common stock, $1.00 par value; 350 million shares authorized; 235,999,750 issued for 2013 and 2012; 235,546,924 and 235,079,156 outstanding for 2013 and 2012, respectively |

236,000 | 236,000 | ||||||

| Treasury stock at cost, 452,826 shares and 920,594 shares for 2013 and 2012, respectively |

(8,542 | ) | (16,804 | ) | ||||

| Other paid-in capital |

2,715,358 | 2,712,943 | ||||||

| Retained earnings |

630,521 | 635,303 | ||||||

| Accumulated other comprehensive loss |

(9,148 | ) | (10,071 | ) | ||||

|

|

|

|

|

|||||

| Total Shareholders’ Equity |

3,564,189 | 3,557,371 | ||||||

|

|

|

|

|

|||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ | 12,053,241 | $ | 11,984,136 | ||||

|

|

|

|

|

|||||

(Concluded)

11

NV ENERGY, INC.

FREE CASH FLOW AND CONSOLIDATED OPERATING STATISTICS

(Unaudited)

FREE CASH FLOW

(dollars in thousands)

| Six Months Ended June 30, | ||||||||||||

| 2013 | 2012 | Change from Prior Year |

||||||||||

| Free Cash Flow* |

$ | 36,470 | $ | 31,104 | 17.3 | % | ||||||

| * | Free cash flow is a non-GAAP financial measure as defined by the SEC. See the “Non-GAAP Financial Measures” section for additional information and GAAP reconciliation. |

ELECTRIC SALES—MWh’s

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||

| 2013 | 2012 | Change from Prior Year |

Change in Average Customers |

2013 | 2012 | Change from Prior Year |

Change in Average Customers |

|||||||||||||||||||||||||

| Residential |

2,848 | 2,801 | 1.7 | % | 1.0 | % | 5,088 | 4,937 | 3.1 | % | 0.8 | % | ||||||||||||||||||||

| Commercial |

1,944 | 1,873 | 3.8 | % | 2.4 | % | 3,512 | 3,490 | 0.6 | % | 1.7 | % | ||||||||||||||||||||

| Industrial |

2,767 | 2,727 | 1.5 | % | (0.2 | )% | 5,068 | 5,011 | 1.1 | % | 0.3 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL RETAIL |

7,559 | 7,401 | 2.1 | % | 1.2 | % | 13,668 | 13,438 | 1.7 | % | 0.9 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

GAS SALES—Dth

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||

| 2013 | 2012 | Change from Prior Year |

2013 | 2012 | Change from Prior Year |

|||||||||||||||||||

| Residential |

1,205 | 1,263 | (4.6 | )% | 5,341 | 4,970 | 7.5 | % | ||||||||||||||||

| Commercial |

610 | 685 | (10.9 | )% | 2,686 | 2,565 | 4.7 | % | ||||||||||||||||

| Industrial |

264 | 247 | 6.9 | % | 797 | 723 | 10.2 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL RETAIL |

2,079 | 2,195 | (5.3 | )% | 8,824 | 8,258 | 6.9 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

ELECTRIC SOURCES—MWh’s

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||

| 2013 | 2012 | Change from Prior Year |

2013 | 2012 | Change from Prior Year |

|||||||||||||||||||

| Generated |

5,495 | 5,009 | 9.7 | % | 10,316 | 9,474 | 8.9 | % | ||||||||||||||||

| Purchased |

2,654 | 3,046 | (12.9 | )% | 4,402 | 5,083 | (13.4 | )% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL |

8,149 | 8,055 | 1.2 | % | 14,718 | 14,557 | 1.1 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

DEGREE DAYS

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||||||||

| % Change From | % Change From | |||||||||||||||||||||||||||||||||||||||

| 2013 | 2012 | Normal* | Prior Year | Normal | 2013 | 2012 | Normal* | Prior Year | Normal | |||||||||||||||||||||||||||||||

| SOUTH |

|

|||||||||||||||||||||||||||||||||||||||

| Heating |

34 | 62 | 80 | (45.2 | )% | (57.5 | )% | 1,084 | 986 | 1,105 | 9.9 | % | (1.9 | )% | ||||||||||||||||||||||||||

| Cooling |

1,408 | 1,417 | 1,167 | (0.6 | )% | 20.7 | % | 1,494 | 1,458 | 1,197 | 2.5 | % | 24.8 | % | ||||||||||||||||||||||||||

| NORTH |

||||||||||||||||||||||||||||||||||||||||

| Heating |

489 | 548 | 721 | (10.8 | )% | (32.2 | )% | 2,774 | 2,676 | 2,948 | 3.7 | % | (5.9 | )% | ||||||||||||||||||||||||||

| Cooling |

263 | 235 | 180 | 11.9 | % | 46.1 | % | 263 | 235 | 180 | 11.9 | % | 46.1 | % | ||||||||||||||||||||||||||

| * | Normal = 20-year average |

12

NEVADA POWER COMPANY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Dollars in Thousands)

(Unaudited)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| OPERATING REVENUES |

$ | 537,124 | $ | 553,143 | $ | 908,987 | $ | 948,831 | ||||||||

| OPERATING EXPENSES: |

||||||||||||||||

| Fuel for power generation |

144,246 | 81,258 | 249,777 | 161,807 | ||||||||||||

| Purchased power |

129,396 | 135,276 | 210,804 | 216,807 | ||||||||||||

| Deferred energy |

(63,748 | ) | 5,053 | (109,103 | ) | 7,224 | ||||||||||

| Energy efficiency program costs |

10,842 | 21,200 | 18,809 | 36,974 | ||||||||||||

| Merger related costs |

8,867 | — | 8,867 | — | ||||||||||||

| Other operating expenses |

70,100 | 68,650 | 137,492 | 135,112 | ||||||||||||

| Maintenance |

15,889 | 16,988 | 33,964 | 40,061 | ||||||||||||

| Depreciation and amortization |

70,405 | 69,131 | 139,066 | 134,121 | ||||||||||||

| Taxes other than income |

9,632 | 8,596 | 19,591 | 17,050 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

395,629 | 406,152 | 709,267 | 749,156 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING INCOME |

141,495 | 146,991 | 199,720 | 199,675 | ||||||||||||

| OTHER INCOME (EXPENSE): |

||||||||||||||||

| Interest expense |

(51,643 | ) | (52,602 | ) | (102,902 | ) | (107,007 | ) | ||||||||

| Interest income (expense) on regulatory items |

(181 | ) | (1,849 | ) | (983 | ) | (3,865 | ) | ||||||||

| AFUDC-equity |

1,826 | 1,577 | 4,192 | 2,990 | ||||||||||||

| Other income |

978 | 5,392 | 3,382 | 7,101 | ||||||||||||

| Other expense |

(1,833 | ) | (2,993 | ) | (4,234 | ) | (4,339 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Other Income (Expense) |

(50,853 | ) | (50,475 | ) | (100,545 | ) | (105,120 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income Before Income Tax Expense |

90,642 | 96,516 | 99,175 | 94,555 | ||||||||||||

| Income tax expense |

31,977 | 34,219 | 35,065 | 33,574 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

58,665 | 62,297 | 64,110 | 60,981 | ||||||||||||

| Other comprehensive income |

||||||||||||||||

| Change in compensation retirement benefits liability and amortization |

97 | 64 | 194 | 127 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| COMPREHENSIVE INCOME |

$ | 58,762 | $ | 62,361 | $ | 64,304 | $ | 61,108 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

13

NEVADA POWER COMPANY

CONSOLIDATED OPERATING STATISTICS

(Unaudited)

ELECTRIC SALES—MWh’s

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||

| 2013 | 2012 | Change from Prior Year |

Change in Average Customers |

2013 | 2012 | Change from Prior Year |

Change in Average Customers |

|||||||||||||||||||||||||

| Residential |

2,354 | 2,331 | 1.0 | % | 1.1 | % | 3,965 | 3,867 | 2.5 | % | 0.8 | % | ||||||||||||||||||||

| Commercial |

1,178 | 1,149 | 2.5 | % | 2.1 | % | 2,095 | 2,107 | (0.6 | )% | 1.6 | % | ||||||||||||||||||||

| Industrial |

2,043 | 2,040 | 0.1 | % | (0.2 | )% | 3,677 | 3,691 | (0.4 | )% | 0.3 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL RETAIL |

5,575 | 5,520 | 1.0 | % | 1.2 | % | 9,737 | 9,665 | 0.7 | % | 0.9 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

ELECTRIC SOURCES—MWh’s

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||

| 2013 | 2012 | Change from Prior Year |

2013 | 2012 | Change from Prior Year |

|||||||||||||||||||

| Generated |

4,393 | 3,871 | 13.5 | % | 8,068 | 7,158 | 12.7 | % | ||||||||||||||||

| Purchased |

1,505 | 1,997 | (24.6 | )% | 2,148 | 3,023 | (28.9 | )% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL |

5,898 | 5,868 | 0.5 | % | 10,216 | 10,181 | 0.3 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

14

SIERRA PACIFIC POWER COMPANY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Dollars in Thousands)

(Unaudited)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| OPERATING REVENUES: |

||||||||||||||||

| Electric |

$ | 174,302 | $ | 168,007 | $ | 346,929 | $ | 337,813 | ||||||||

| Gas |

20,208 | 19,544 | 59,937 | 65,466 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Revenues |

194,510 | 187,551 | 406,866 | 403,279 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EXPENSES: |

||||||||||||||||

| Fuel for power generation |

44,733 | 31,327 | 86,450 | 67,813 | ||||||||||||

| Purchased power |

41,465 | 28,816 | 81,367 | 64,401 | ||||||||||||

| Gas purchased for resale |

17,274 | 9,492 | 54,894 | 41,109 | ||||||||||||

| Deferral of energy—electric—net |

(16,963 | ) | 4,314 | (36,298 | ) | (8,356 | ) | |||||||||

| Deferral of energy—gas—net |

(5,976 | ) | 1,123 | (20,351 | ) | (117 | ) | |||||||||

| Energy efficiency program costs |

1,757 | 3,400 | 3,635 | 7,051 | ||||||||||||

| Merger related costs |

3,520 | — | 3,520 | — | ||||||||||||

| Other operating expenses |

36,256 | 33,654 | 72,061 | 70,086 | ||||||||||||

| Maintenance |

8,157 | 7,662 | 14,988 | 17,115 | ||||||||||||

| Depreciation and amortization |

28,479 | 27,185 | 55,820 | 53,057 | ||||||||||||

| Taxes other than income |

6,175 | 5,625 | 12,470 | 11,488 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

164,877 | 152,598 | 328,556 | 323,647 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING INCOME |

29,633 | 34,953 | 78,310 | 79,632 | ||||||||||||

| OTHER INCOME (EXPENSE): |

||||||||||||||||

| Interest expense |

(15,373 | ) | (15,379 | ) | (30,898 | ) | (32,352 | ) | ||||||||

| Interest income (expense) on regulatory items |

165 | (128 | ) | 140 | (314 | ) | ||||||||||

| AFUDC-equity |

424 | 742 | 947 | 1,261 | ||||||||||||

| Other income |

2,518 | 599 | 3,658 | 2,782 | ||||||||||||

| Other expense |

(1,573 | ) | (1,276 | ) | (2,821 | ) | (2,611 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Other Income (Expense) |

(13,839 | ) | (15,442 | ) | (28,974 | ) | (31,234 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income Before Income Tax Expense |

15,794 | 19,511 | 49,336 | 48,398 | ||||||||||||

| Income tax expense |

5,018 | 6,832 | 16,656 | 17,075 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

10,776 | 12,679 | 32,680 | 31,323 | ||||||||||||

| Other comprehensive income |

||||||||||||||||

| Change in compensation retirement benefits liability and amortization |

58 | 43 | 117 | 85 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| COMPREHENSIVE INCOME |

$ | 10,834 | $ | 12,722 | $ | 32,797 | $ | 31,408 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

15

SIERRA PACIFIC POWER COMPANY

CONSOLIDATED OPERATING STATISTICS

(Unaudited)

ELECTRIC SALES—MWh’s

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||

| 2013 | 2012 | Change from Prior Year |

Change in Average Customers |

2013 | 2012 | Change from Prior Year |

Change in Average Customers |

|||||||||||||||||||||||||

| Residential |

494 | 470 | 5.1 | % | 0.8 | % | 1,123 | 1,070 | 5.0 | % | 0.7 | % | ||||||||||||||||||||

| Commercial |

766 | 724 | 5.8 | % | 3.0 | % | 1,417 | 1,383 | 2.5 | % | 1.9 | % | ||||||||||||||||||||

| Industrial |

724 | 687 | 5.4 | % | (0.9 | )% | 1,391 | 1,320 | 5.4 | % | 0.9 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL RETAIL |

1,984 | 1,881 | 5.5 | % | 1.1 | % | 3,931 | 3,773 | 4.2 | % | 0.9 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

GAS SALES—Dth

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||

| 2013 | 2012 | Change from Prior Year |

2013 | 2012 | Change from Prior Year |

|||||||||||||||||||

| Residential |

1,205 | 1,263 | (4.6 | )% | 5,341 | 4,970 | 7.5 | % | ||||||||||||||||

| Commercial |

610 | 685 | (10.9 | )% | 2,686 | 2,565 | 4.7 | % | ||||||||||||||||

| Industrial |

264 | 247 | 6.9 | % | 797 | 723 | 10.2 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL RETAIL |

2,079 | 2,195 | (5.3 | )% | 8,824 | 8,258 | 6.9 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

ELECTRIC SOURCES—MWh’s

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||

| 2013 | 2012 | Change from Prior Year |

2013 | 2012 | Change from Prior Year |

|||||||||||||||||||

| Generated |

1,102 | 1,138 | (3.2 | )% | 2,248 | 2,316 | (2.9 | )% | ||||||||||||||||

| Purchased |

1,149 | 1,049 | 9.5 | % | 2,254 | 2,060 | 9.4 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL |

2,251 | 2,187 | 2.9 | % | 4,502 | 4,376 | 2.9 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

16

Non-GAAP Financial Measures

Free Cash Flow

“Free cash flow” meets the definition of a non-GAAP financial measure. NV Energy, Inc. defines free cash flow as net cash from operating activities less additions to utility plant (excluding AFUDC-equity). Since free cash flow is not a measure of liquidity calculated in accordance with GAAP, it should be considered in addition to, but not as a substitute for, the GAAP measure net cash from operating activities.

NV Energy, Inc. considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated from operations after capital expenditures that may be available for increasing its common stock dividend payout ratio, strengthening its capital structure, and considering new investment opportunities.

NV Energy, Inc.’s definition of free cash flow is limited, in that it does not represent residual cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations. The table below provides a reconciliation between GAAP net cash from operating activities and non-GAAP free cash flow (dollars in thousands).

| Six Months Ended June 30, | ||||||||||||

| 2013 | 2012 | Change from Prior Year |

||||||||||

| Net Cash from Operating Activities |

$ | 228,143 | $ | 292,663 | (22.0 | )% | ||||||

| Less Additions to Utility Plant (Excluding AFUDC-Equity) |

(191,673 | ) | (261,559 | ) | (26.7 | )% | ||||||

|

|

|

|

|

|||||||||

| Free Cash Flow |

$ | 36,470 | $ | 31,104 | 17.3 | % | ||||||

|

|

|

|

|

|||||||||

Gross Margin

NV Energy, Inc. presents gross margin in order to aid the reader in determining how profitable the utilities’ electric and gas businesses are at the most fundamental level. Gross margin, which is a “non-GAAP financial measure” as defined in accordance with SEC rules, provides a measure of income available to support the other operating expenses of the business and is utilized by management in its analysis of its business.

NV Energy, Inc. believes presenting gross margin allows the reader to assess the impact of the utilities’ regulatory treatment and their overall regulatory environment on a consistent basis. Gross margin, as a percentage of revenue, is primarily impacted by the fluctuations in regulated utility electric and natural gas supply costs versus the fixed rates collected from utility customers. While these fluctuating costs impact gross margin as a percentage of revenue, they only impact gross margin amounts if the costs cannot be passed through to utility customers. Gross margin, which NV Energy, Inc. calculates as operating revenues less energy and energy efficiency program costs, provides a measure of income available to support the other operating expenses of the utilities. Gross margin changes are based primarily on the utilities’ general base rate adjustments (which are required to be filed by statute every three years). These non-GAAP measures should not be considered as substitutes for the GAAP measures. Reconciliations between GAAP operating income and gross margin are provided in the table below.

17

NV Energy, Inc.

Consolidated Gross Margin

(dollars in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||

| 2013 | 2012 | Change from Prior Year |

2013 | 2012 | Change from Prior Year |

|||||||||||||||||||

| Operating Revenues: |

$ | 731,638 | $ | 740,698 | (1.2 | )% | $ | 1,315,860 | $ | 1,352,118 | (2.7 | )% | ||||||||||||

| Energy Costs: |

||||||||||||||||||||||||

| Fuel for power generation |

188,979 | 112,585 | 67.9 | % | 336,227 | 229,620 | 46.4 | % | ||||||||||||||||

| Purchased power |

170,861 | 164,092 | 4.1 | % | 292,171 | 281,208 | 3.9 | % | ||||||||||||||||

| Gas purchased for resale |

17,274 | 9,492 | 82.0 | % | 54,894 | 41,109 | 33.5 | % | ||||||||||||||||

| Deferred energy |

(86,687 | ) | 10,490 | N/A | (165,752 | ) | (1,249 | ) | N/A | |||||||||||||||

| Energy efficiency program costs |

12,599 | 24,600 | (48.8 | )% | 22,444 | 44,025 | (49.0 | )% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Costs |

$ | 303,026 | $ | 321,259 | (5.7 | )% | $ | 539,984 | $ | 594,713 | (9.2 | )% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Gross Margin |

$ | 428,612 | $ | 419,439 | 2.2 | % | $ | 775,876 | $ | 757,405 | 2.4 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Merger related costs |

13,552 | — | 13,552 | — | ||||||||||||||||||||

| Other operating expenses |

106,798 | 103,371 | 211,470 | 206,972 | ||||||||||||||||||||

| Maintenance |

24,046 | 24,650 | 48,952 | 57,176 | ||||||||||||||||||||

| Depreciation and amortization |

98,884 | 96,316 | 194,886 | 187,178 | ||||||||||||||||||||

| Taxes other than income |

15,846 | 14,266 | 32,322 | 28,775 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Operating Income |

$ | 169,486 | $ | 180,836 | (6.3 | )% | $ | 274,694 | $ | 277,304 | (0.9 | )% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

18