Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Jefferies Financial Group Inc. | d573558d8k.htm |

Leucadia National Corporation

2013 Annual Meeting

July 25, 2013

Exhibit 99.1 |

Note on

Forward Looking Statements This

document

contains

“forward

looking

statements”

within

the

meaning

of

the

safe

harbor

provisions

of

Section

27A

of

the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward looking statements include statements about our future and

statements that are not historical facts. These forward looking statements are usually preceded by the words

“should,”

“expect,”

“intend,”

“may,”

“will,”

or similar expressions. Forward looking statements may contain expectations

regarding revenues, earnings, operations, and other results, and may include

statements of future performance, plans, and objectives. Forward looking

statements also include statements pertaining to our strategies for future development of our business and products.

Forward looking statements represent only our belief regarding future events, many

of which by their nature are inherently uncertain. It is possible that the

actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking

statements. Information regarding important factors, including our Risk Factors,

that could cause actual results to differ, perhaps materially, from those in

our forward looking statements is contained in reports we file with the SEC. You should read and

interpret

any

forward

looking

statement

together

with

reports

we

file

with

the

SEC.

i |

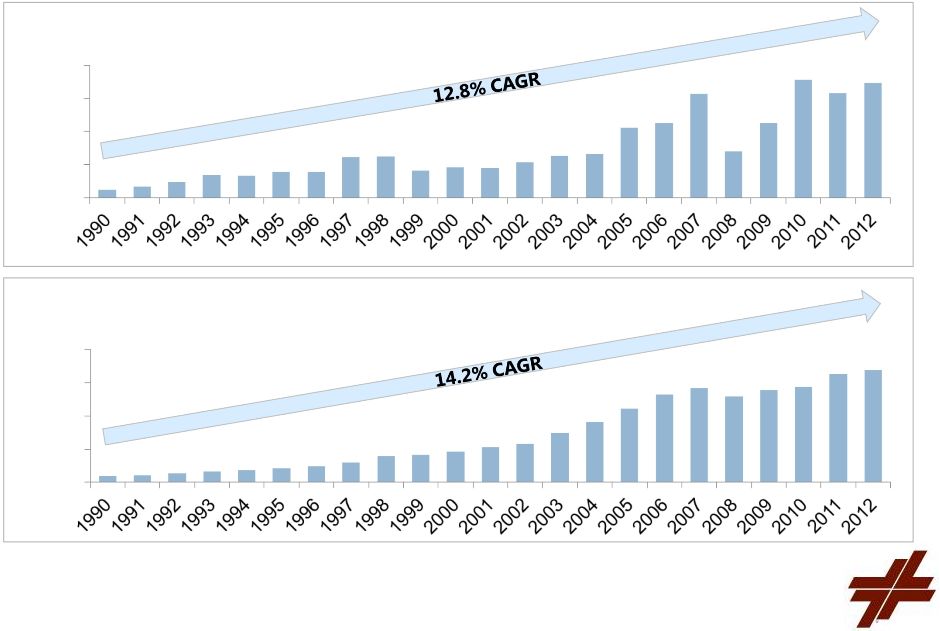

Book

Value per Share Growth Since 1990 Note: Book value per share figures are

split-adjusted. (1) Reduction in book value per share reflects special

1999 dividend payments totaling $811.9 million, or $4.53 per share. 1

Leucadia –

Book Value per Share Growth Since 1990

Jefferies –

Book Value per Share Growth Since 1990

(1)

$1.97

$6.16

$7.26

$16.95

$28.53

$27.67

$32.00

$24.00

$16.00

$8.00

$0.00

$0.91

$2.07

$4.64

$11.07

$14.43

$16.90

$20.00

$15.00

$10.00

$5.00

$0.00 |

Overview

Our Businesses:

Liquidity:

National Beef

(Beef Processing)

2012

Berkadia

(Mortgage Servicing)

2009

Garcadia

(Auto Retail)

2006

Jefferies

(Investment Banking)

2013

Conwed

(Plastics)

1985

Idaho Timber

(Wood Products)

2005

Premier

Entertainment

(Gaming)

2006

Cash & Investments

$2.8 billion

Deferred Tax Asset

$1.8 billion

Linkem

(Telecommunications)

2011

Real Estate /

HomeFed

Note: Figures reflect book value as of 03/31/13.

2 |

Liquidity Events –

Last Twelve Months

Leucadia has generated over $2 billion of proceeds in the last

twelve months

Fortescue Metals note redemption and stock sale (July

and October 2012): $868 million

Inmet Mining merger consideration (March 2013): $732 million,

including $340 million of First Quantum stock

Mueller stock sale (September 2012): $427 million

Keen Energy sale (October 2012): $128 million plus $40 million

note

TeleBarbados sale (September 2012): $28 million

3 |

Long-Term Strategy –

Compelling Value in Sectors We

Understand

Financial Services

Jefferies

Berkadia

Asset Management

Auto Retail –

Garcadia

Agribusiness –

National Beef

Project Development

Gasification

Oregon Liquefied Natural Gas

Energy, Metals and Mining, Consumer, Industrial, Media,

Telecom

4 |

5 |

6

National Beef harvests ~3.7M fed cattle per year representing ~14.5% market share

3 processing plants strategically located in Liberal and Dodge City, KS and Brawley, CA

Compete with Tyson, Cargill, JBS and numerous small beef packers

Export beef and beef by-products to more than 20 countries

Beef processing is a spread margin business, but National Beef is intensely focused on

value-added production to drive superior performance versus its commodity-focused

competitors

National

Beef

operates

3

further

processing

plants

converting

beef

and

pork

into

fresh,

consumer-ready products

Strategically located in PA, GA and KS

National Beef’s tannery is among the largest in the world

Convert

raw

cattle

hides

to

wet

blue

leather

for

use

in

finished

leather

production

for

automotive, shoes, fashion, etc.

www.kansascitysteaks.com

Premium direct to consumer beef and other center-of-the-plate entrees

National Carriers refrigerated and livestock transportation and logistics business

Services National Beef along with numerous 3rd party shippers

Overview |

U.S. beef cowherd has been in downward trend for a generation, however

due to improvements in genetics and production practices, overall beef

supply has actually increased

The U.S. has historically been a net importer of beef. Due to increasing

international demand for U.S. beef and a decline of lean beef imports, the

U.S. is now a net exporter of beef. This has had a positive impact on industry

margins

U.S. Net Beef Trade –

Imports Minus

Exports (Million lbs)

(1)

U.S. Commercial Beef Production vs. Beef

Cow Inventory

(1)

Industry Trends

(1)

Source: USDA.

7

28

27

26

25

24

23

22

21

20

46

44

42

40

38

36

34

32

30

28

3,500

3,000

2,500

2,000

1,500

1,000

500

0

(500)

(1,000) |

The cutout ratio is a good proxy for industry profitability…and demonstrates

the variability of beef processing margins

KS

Steer

Comprehensive

Beef

Cutout

Ratio

August

2002

–

June

2013

(1)

Industry Trends (Cont’d)

Avg.

1.60

(1)

Cutout ratio is calculated as the USDA National Comprehensive Boxed Beef Cutout

divided by the USDA Kansas Weekly Weighted Average Steer Price.

8

2.00

1.95

1.90

1.85

1.80

1.75

1.70

1.60

1.65

1.55

1.50

1.45

1.40

1.35

1.30

1.25

Aug-02

Aug-03

Aug-04

Aug-05

Aug-06

Aug-07

Aug-08

Aug-09

Aug-10

Aug-11

Aug-12 |

Financial Performance

The beef processing industry is cyclical and working capital intensive.

However, it has significant barriers to entry and offers attractive prospects for

free cash flow generation over the cycle

Given cattle supply constraints, strategies designed to drive margin

expansion are more important to long-term profit growth versus those focused

on increasing revenue

(1)

Prior to being acquired by Leucadia in December 2011, National Beef’s fiscal

year ended in August. In addition, 2012 amounts are not comparable to prior

periods as they reflect the application of acquisition accounting for National Beef, principally resulting in greater

depreciation and amortization expenses during 2012.

(2)

Profit from operations is a non-GAAP measure. Profit from operations equals

pre-tax income, plus depreciation and amortization expenses and

excluding interest expense / (income), net. See page 29 in the appendix for a reconciliation to GAAP amounts.

FYE August,

FYE

Dec.,

FYE August,

FYE

Dec.,

9

Profit from Operations ($ Millions)

(1, 2)

Revenue ($ Billions)

(1)

$8

$6

$4

$2

$0

$5.8

$5.4

$5.8

$6.8

$7.5

2008

2009

2010

2011

2012

$400

$300

$200

$100

$0

2008

2009

2010

2011

2012

$196.9

$212.7

$313.3

$324.5

$154.5 |

Recent

Developments Global protein demand is expected to continue current growth

trend; growth of middle class in developing countries points to increasing

demand for beef Recent regulatory change in cattle age requirement by Japan

has resulted in industry-wide increase in export volume to Japan

Acquired remaining minority interest in Kansas City Steaks, increasing

ownership from 75% to 100%

Retrofit of hide tanning facility expected to be completed in December 2013,

at which point National Beef will have the largest tannery, anticipated to be

the most efficient in the United States

Widespread

drought

conditions

have

contributed

to

a

delay

in

the

reversal

of

the downward trend in U.S beef cow numbers. Fewer cows ultimately result in

lower supplies of fed cattle and that has reduced industry-wide beef packing

margins and National Beef’s profitability

10 |

11 |

Acquired by Leucadia in a 50/50 joint venture with Berkshire Hathaway from the

Capmark bankruptcy estate

3rd

largest

servicer

of

commercial

real

estate

loans

in

the

U.S.

Berkadia

collects

payments,

manages

tax,

insurance

and

maintenance

escrow

reserves

on behalf of, and reports and remits funds to, the owners of 30,500 loans.

Berkadia

bears

the

risk

of

loss

on

less

than

1%

of

its

servicing

portfolio

5th

largest

multifamily

loan

originator

(12th

largest

commercial

real

estate

loan

originator overall) in the U.S. Berkadia originates loans on behalf of third

party investors, primarily Government Sponsored Enterprises (GSEs), HUD,

conduits and life insurance companies

Able to direct the investment of, and retain the investment earnings on, a

significant portion of the escrow cash balances associated with the servicing

portfolio

Leucadia’s original investment was $217 million. As of July 15, 2013,

cumulative cash distributions to Leucadia have been $191 million, with

substantial value going

forward Overview

12 |

Despite the ongoing run-off of the historical servicing base, Berkadia has been

able to grow in originations, revenues, margins, servicing portfolio and,

most importantly, cash flow

Low-cost high quality master and primary servicer, driven in part by

company-

owned operations in India

2012 production volume of $9.5 billion was up 81% over 2011 while the

overall market was up 30%

In December 2012, Berkadia acquired Hendricks & Partners to add

investment sales capabilities and deepen borrower relationships in multifamily

space

Impending real estate loan maturities in industry should drive significant future

loan originations

$840 billion of the $1.5 trillion commercial real estate loans outstanding

(excluding banks) mature over the next 5 years

Multifamily loan maturities increase every year through 2017

Overview (Cont’d)

13 |

Financial Performance

(1)

Cash Earnings is a non-GAAP measure. Cash Earnings equals pre-tax income

plus depreciation and amortization of mortgage servicing rights

(MSR’s), intangible assets, the increase in balance sheet loan loss reserves, less gains

attributable to origination of MSR’s. See page 30 in the appendix for a

reconciliation to GAAP amounts. 14

Loan Originations ($ Billions)

Pre-Tax Margin (% of Revenue)

Pre-Tax Income ($ Millions)

Cash Earnings

($ Millions)

(1) |

Servicing

Portfolio

–

Unpaid

Principal

Balance

($

Billions)

(1)

Portfolio Growth

(1)

Shown net of Special Servicing.

15

220.3

185.8

155.7

127.0

114.2

6.6

14.6

53.3

121.7

4.8

9.9

16.8

21.7

$220.3

$197.2

$180.2

$197.1

$257.6

$0

$50

$100

$150

$200

$250

$300

2009

2010

2011

2012

Jul-13

Purchased

Servicer's Servicer

Originations

More than 50% of the servicing portfolio has been added since acquisition

As of July 2013, the U.S. servicing portfolio is the largest it has been in its

history |

Opportunities

Benefit from a rise in interest rates, especially short term interest rates

Fill-in

national

footprint

by

hiring

experienced

mortgage

bankers

and

investment

sales

advisors in new markets and diversify across all product types

Better capitalize on our combined mortgage banking and investments sales team by

continuing to build and improve tools that better serve our customers

(including additional differentiating products, capital sources, and process

improvements) Both servicing and origination markets are fragmented and

consolidating Increased efficiency

Risks

Reduced Fannie Mae, HUD and Freddie Mac presence in the multifamily lending markets

due to changes in government policy or regulation may impact margins

Banking counterparty risks

Credit

quality

deterioration

–

credit

performance

has

been

excellent

as

losses

and

delinquency have been very low and are lower than industry averages

Not being able to enter into additional Servicer’s Servicers transactions on

favorable economic terms

Sustaining current growth rates

Opportunities & Risks

16 |

Garcadia

17 |

Number of Dealerships by Manufacturer

(52% Domestic, 48% Foreign)

15th Largest U.S. Dealership Group

21 dealerships

1,800 employees

Current group will sell 50,000 units annually

Garcadia Overview

Units Sold by Current Platform

18 |

Auto

Market Overview U.S. New Vehicle Sales (Thousands)

(1)

(1)

Source: WardsAuto.

19

Pent up demand

Average age of vehicle on road –

10.8 years

Consumer financing available at pre-recession levels

Aggressive loan to value

Prime and near prime approval levels on the rise

Number of licensed drivers on the rise

Used vehicle valuations remain strong

Key Market Trends |

$700 billion in annual sales

17,900 dealerships nationwide

Top 10 groups represent only 8% of market

Aging dealer body without succession plans

Many “old school”

processes exist in auto dealerships

Must embrace new technology to stay ahead

Auto Retail Industry

20

Technology Changing Business

Many Acquisition Opportunities

Large and Fragmented Market |

Build geographic clusters in medium to large markets

Target medium to high volume stores

Focus on profitable, but underperforming dealerships

Solve succession issues

Hire the best people

Maintain flat organization

Execute on key operational initiatives

Data-

and results-driven culture

Manage to $1,000 net income per vehicle retailed

Garcadia Model

21

Operations

Acquisition Strategy |

Company Performance ($ Millions)

Garcadia Joint Venture

JV Partner: Ken Garff Automotive Group

85 years in the industry

Acts as the dealer principal

Provides operating management

(1)

Represent

combined

amounts

for

all

Garcadia

dealership

holdings,

not

just

Leucadia’s

share.

(2)

Represents

Leucadia’s

share

of

cash

distributions

and

rent

paid

by

Garcadia

for

land

owned

by

Leucadia.

22

FYE December 31,

2010

2011

2012

Total Units Sold

20,832

25,483

35,394

# of Dealerships

14

17

18

Garcadia Revenue

(1)

639.5

$

789.4

$

1,100.8

$

% Growth

NA

23.4%

39.4%

Garcadia Pre-Tax Income

(1)

14.1

$

22.3

$

37.4

$

% Margin

2.2%

2.8%

3.4%

Garcadia Distributions

(2)

13.8

$

16.0

$

30.4

$

|

23 |

Jefferies Group

Full-Service Capital Markets Platform:

expertise and depth across

equities, fixed income, commodities and investment banking

Client-Focused:

providing investor and issuer clients with the highest

quality advice and execution

Global Footprint:

sales & trading and investment banking presence

across the United States, Europe and Asia

Strong, Stable Foundation:

robust long-term capital base,

comparatively low leverage and free from dependence upon

government support

Positioned to Seize Market Share:

having broadened our product

offering and hired additional key talent during the downturn, Jefferies is

growing rapidly

24 |

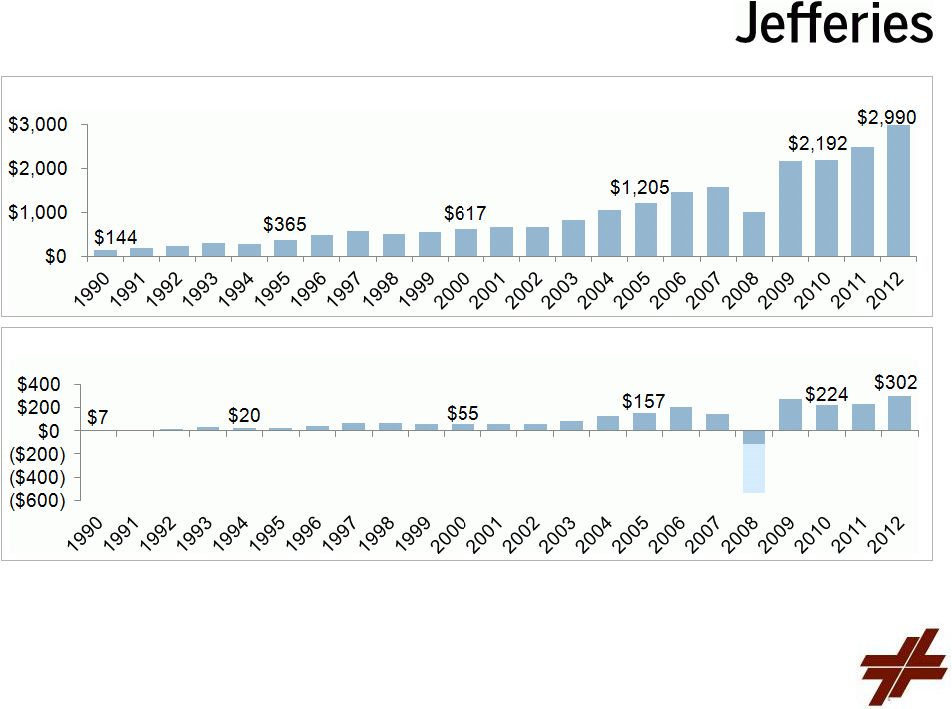

Net

Income Net Revenues

Jefferies Revenues & Net Income –

Since 1990

($ Millions)

(1)

(2)

25

(2)

(1)

(3)

(1)

The selected financial information for the year ended November 30, 2011

are non-GAAP financial measures. See page 31 in the appendix for

a reconciliation to GAAP amounts.

(2)

The selected financial information for the year ended November 30, 2012

are non-GAAP financial measures. See page 31 in the appendix for

a reconciliation to GAAP amounts.

(3)

Includes post-tax losses of $427 million related to the

modification of the terms of Jefferies’ employee stock awards in Q4 2008, such that

previously granted awards were written off and current year employee

stock compensation awards were expensed in the year in which service

was provided. |

A

Full Service

Investment

Bank

Derivatives

Cash

Equities

Electronic

Trading

Prime

Brokerage /

Securities

Finance

ETFs

Convertibles

Wealth

Management

MBS / ABS

Emerging

Markets

Investment

Grade

Rates /

Repos

Leveraged

Credit

Municipals

Base Metals

Listed

Futures

Precious

Metals

Foreign

Exchange

Metals &

Mining

Industrials

Healthcare

Financials

TMT

Real

Estate,

Gaming &

Lodging

Energy

Consumer

Equity

Capital

Markets

Leveraged

Finance

M&A

Financial

Sponsors

Equities

Fixed Income

Jefferies Bache

Investment Banking

Public

Finance

Restructu-

ring

Research

ETFs

Research

Research

26 |

Recent

Developments Jefferies continues to win market share and deliver consistent

profitability Investment Banking revenues underline the quality and

durability of

Jefferies’

platform

Solid growth in Equities revenues

Durable Fixed Income, Commodities and Currencies platforms

Continued emphasis on earnings growth through increased employee

productivity

Jefferies’

full-service capabilities and momentum outside the U.S. present a

significant growth opportunity

27 |

Appendix

28 |

National Beef –

GAAP Reconciliation

Note: Prior to being acquired by Leucadia in December 2011, National Beef’s

fiscal year ended in August. In addition, 2012 amounts are not comparable to

prior periods as they reflect the application of acquisition accounting for National Beef, principally resulting in greater

depreciation and amortization expenses during 2012.

($ Millions)

29

FYE August,

FYE Dec.,

2008

2009

2010

2011

2012

Pre-Tax Income (GAAP)

127.0

$

145.1

$

249.0

$

261.6

$

59.0

$

Interest Expense / (Income), net

33.5

23.2

14.7

11.7

12.4

Depreciation & Amortization

36.4

44.4

49.6

51.2

83.1

Profit from Operations (Non-GAAP)

196.9

$

212.7

$

313.3

$

324.5

$

154.5

$ |

Berkadia –

GAAP Reconciliation

($ Millions)

30

FYE December 31,

Three Months Ended,

2010

2011

2012

03/31/12

03/31/13

Pre-Tax Income (GAAP)

31.0

$

34.6

$

103.8

$

26.0

$

37.8

$

Amortization, Impairment and Depreciation

88.1

107.5

112.7

23.7

25.7

Gains Attributable to Origination of MSR's

(42.4)

(45.2)

(93.1)

(11.5)

(22.2)

Loan Loss Reserves and Guarantee Liabilities, net of cash losses

3.1

3.2

18.8

0.4

3.1

Unrealized (Gains) / Losses; and all other, net

(9.1)

7.0

(7.7)

(6.7)

(6.1)

Cash Earnings (Non-GAAP)

70.7

$

107.1

$

134.5

$

31.9

$

38.3

$ |

Jefferies –

GAAP Reconciliation

($ Millions)

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

31

FYE November 30,

2011

2012

GAAP

Adjustments

Adjusted

GAAP

Adjustments

Adjusted

Net Revenues

2,548.8

$

72.7

$

2,476.1

$

2,998.8

$

8.4

$

2,990.4

$

Compensation and Benefits

1,482.6

11.8

1,470.8

1,770.8

24.7

1,746.1

Noncompensation Expenses

643.3

7.8

635.4

693.3

14.5

678.8

Total Non-interest Expenses

2,125.9

19.6

2,106.2

2,464.1

39.2

2,424.9

Earnings Before Income Taxes

419.3

53.1

366.3

491.8

(30.8)

522.6

Income Tax Expense (Benefit)

133.0

0.2

132.7

168.6

(11.4)

180.1

Net Earnings

286.4

52.8

233.5

323.1

(19.4)

342.5

Net Earnings to Common Shareholders

284.6

$

52.8

$

231.8

$

282.4

$

(19.4)

$

301.8

$

(1)

In accordance with debt extinguishment accounting under ASC 405 and

470, Jefferies recorded a gain on debt extinguishment of $20.2 million, relating to trading

activities in its own long term debt. The 2011 year also includes a

bargain purchase gain of $52.5 million resulting from the acquisition of the Bache entities from

Prudential recorded in 2011.

(2)

In connection with the acquisition of the Bache entities, compensation

expense was recognized for 2011 related to 1) severance costs for certain employees of the

acquired Bache entities that were terminated subsequent to the

acquisition, 2) the amortization of stock awards granted to former Bache employees as replacement

awards for previous Prudential stock awards that were forfeited in the

acquisition and 3) bonus costs for employees as a result of the completion of the acquisition.

(3)

Includes the amortization of intangible assets of $0.7 million

recognized during 2011 in connection with the acquisition of the Bache entities as well as expenses

(primarily professional fees) totaling $7.1 million related to the

acquisition and/or integration of the Bache entities within Jefferies.

(4)

A total domestic marginal tax rate of 41.7% was applied. The bargain

purchase gain of $52.5 million on the acquisition of Bache is not a taxable item.

(5)

Includes a gain on debt extinguishment of $9.9 million in accordance

with debt extinguishment accounting relating to trading activities in Jefferies own long term

debt and a bargain purchase gain of $3.4 million resulting from the

acquisition of Hoare Govett, partially offset by additional interest expense of $4.8 million from

subsequent amortization of debt discounts upon reissuance of Jefferies

own long-term debt. (6)

Includes compensation expense related to the amortization

of retention and stock replacement awards granted in connection with the acquisition of the Bache entities

and Hoare Govett and bonus costs for employees as a result of the

completion of the Hoare Govett acquisition. (7) Reflects an impairment charge of

$2.9 million on indefinite-lived intangible assets and amortization of intangible assets recognized in connection with the

acquisitions of Hoare Govett and the Bache entities, donations to

Hurricane Sandy relief of $4.1 million and transaction costs (primarily professional fees) associated

with the merger with Leucadia National Corporation of $4.7 million.

(8)

Reflects the tax benefit on the additional interest expense, Hoare

Govett and Bache related expense items, Hurricane Sandy relief donations and transaction costs

associated with the merger with Leucadia at a domestic and foreign

marginal tax rate of 42.3% and 24.7%, respectively. |

Leucadia National Corporation

2013 Annual Meeting

July 25, 2013 |