Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Artisan Partners Asset Management Inc. | a2q13form8-k.htm |

| EX-99.1 - PRESS RELEASE OF ARTISAN PARTNERS ASSET MANAGEMENT INC. DATED 7/24/13 - Artisan Partners Asset Management Inc. | artisan2q13earningsrelease.htm |

B U S I N E S S U P D A T E A N D S E C O N D Q U A R T E R 2 0 1 3 E A R N I N G S P R E S E N T A T I O N Artisan Partners Asset Management

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 1 BUSINESS UPDATE & QUARTERLY RESULTS DISCUSSION Eric R. Colson is President and Chief Executive Officer of Artisan Partners. Prior to joining the firm in January 2005, Mr. Colson was an executive vice president of Callan Associates, Inc. where he managed the institutional consulting group, providing business and investment advice to asset management firms. Prior to managing the institutional consulting group, he managed Callan's global manager research. Mr. Colson holds a BA in Economics from the University of California-Irvine. Mr. Colson is a Chartered Financial Analyst. • 20 years of industry experience • 8 years at Artisan Partners Charles (C.J.) Daley, Jr. is a Managing Director and Chief Financial Officer of Artisan Partners. Prior to joining the firm in July 2010, Mr. Daley was senior executive vice president, chief financial officer and treasurer of the global asset management firm Legg Mason, Inc. Mr. Daley holds a BS in Accounting from the University of Maryland. He is an inactive Certified Public Accountant. • 25 years of industry experience • 2 years at Artisan Partners

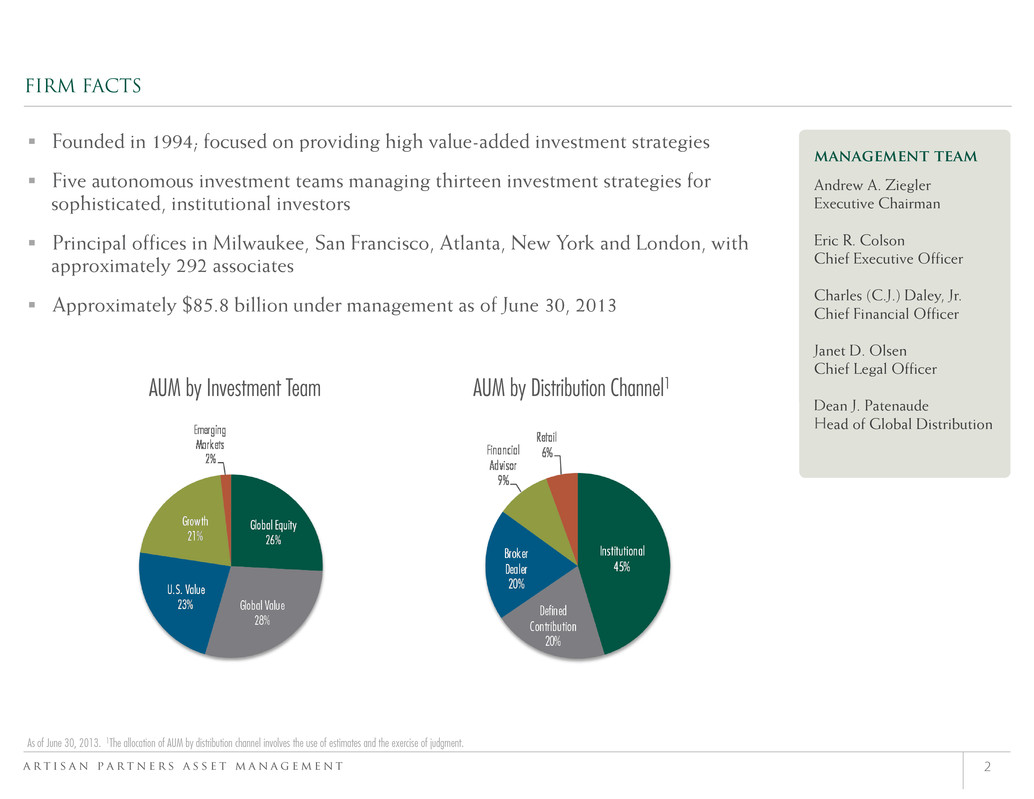

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 2 FIRM FACTS management team Andrew A. Ziegler Executive Chairman Eric R. Colson Chief Executive Officer Charles (C.J.) Daley, Jr. Chief Financial Officer Janet D. Olsen Chief Legal Officer Dean J. Patenaude Head of Global Distribution Founded in 1994; focused on providing high value-added investment strategies Five autonomous investment teams managing thirteen investment strategies for sophisticated, institutional investors Principal offices in Milwaukee, San Francisco, Atlanta, New York and London, with approximately 292 associates Approximately $85.8 billion under management as of June 30, 2013 AUM by Distribution Channel1 As of June 30, 2013. 1The allocation of AUM by distribution channel involves the use of estimates and the exercise of judgment. AUM by Investment Team

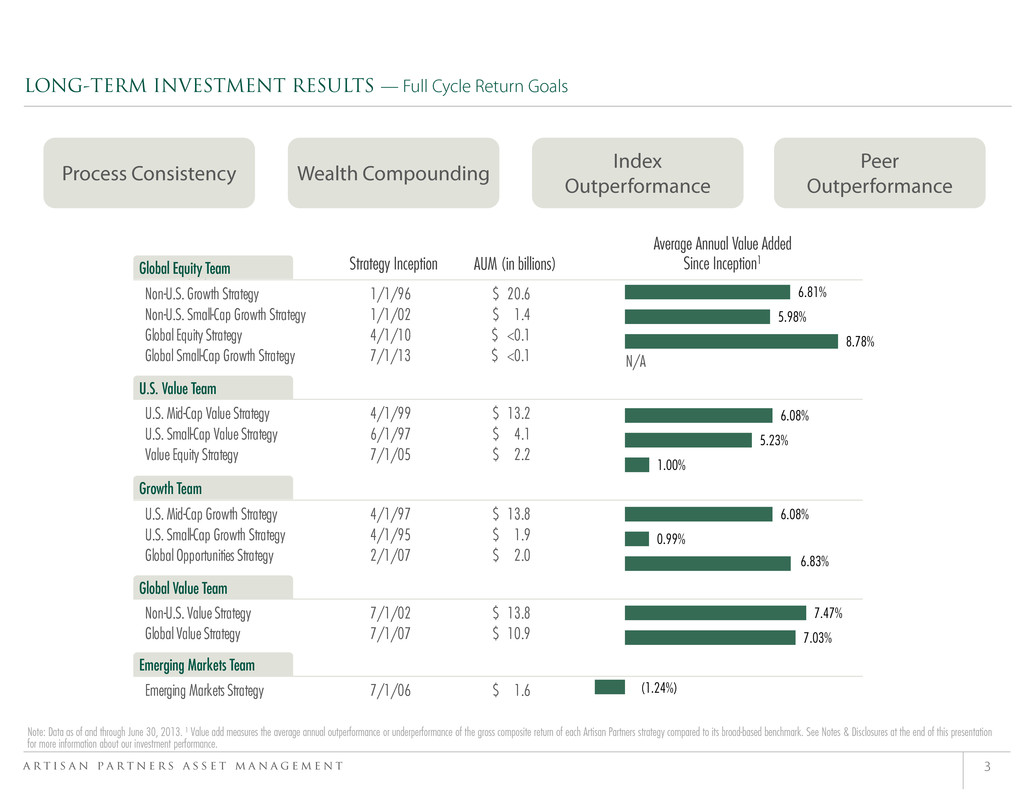

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 3 Global Equity Team Non-U.S. Growth Strategy 1/1/96 20.6$ Non-U.S. Small-Cap Growth Strategy 1/1/02 1.4$ Global Equity Strategy 4/1/10 $ <0.1 Global Small-Cap Growth Strategy 7/1/13 $ <0.1 U.S. Value Team U.S. Mid-Cap Value Strategy 4/1/99 13.2$ U.S. Small-Cap Value Strategy 6/1/97 4.1$ Value Equity Strategy 7/1/05 2.2$ Growth Team U.S. Mid-Cap Growth Strategy 4/1/97 13.8$ U.S. Small-Cap Growth Strategy 4/1/95 1.9$ Global Opportunities Strategy 2/1/07 2.0$ Global Value Team Non-U.S. Value Strategy 7/1/02 13.8$ Global Value Strategy 7/1/07 10.9$ Emerging Markets Team Emerging Markets Strategy 7/1/06 1.6$ LONG-TERM INVESTMENT RESULTS — Full Cycle Return Goals Note: Data as of and through June 30, 2013. ¹ Value add measures the average annual outperformance or underperformance of the gross composite return of each Artisan Partners strategy compared to its broad-based benchmark. See Notes & Disclosures at the end of this presentation for more information about our investment performance. Process Consistency Wealth Compounding Index Outperformance Peer Outperformance U.S. Value Team Global Equity Team Growth Team Global Value Team Emerging Markets Team (1.24%) 7.03% 7.47% 6.83% 0.99% 6.08% 1.00% 5.23% 6.08% 8.78% 5.98% 6.81% Average Annual Value Added Since Inception1AUM (in billions)Strategy Inception N/A

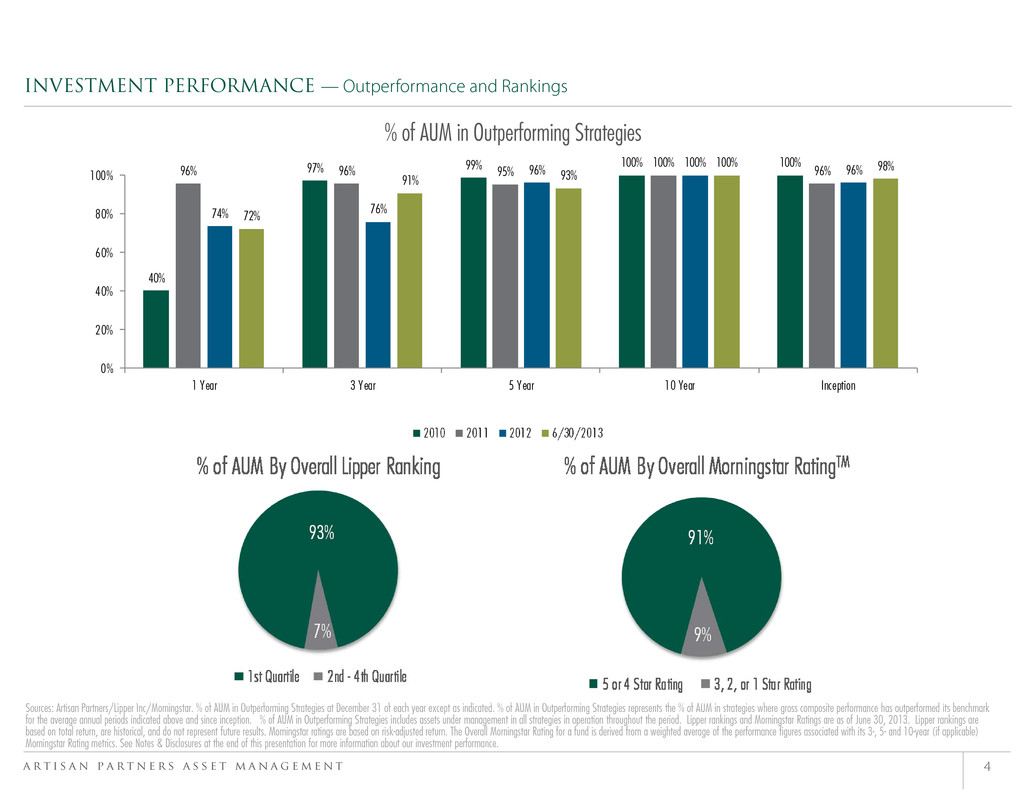

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 4 INVESTMENT PERFORMANCE — Outperformance and Rankings Sources: Artisan Partners/Lipper Inc/Morningstar. % of AUM in Outperforming Strategies at December 31 of each year except as indicated. % of AUM in Outperforming Strategies represents the % of AUM in strategies where gross composite performance has outperformed its benchmark for the average annual periods indicated above and since inception. % of AUM in Outperforming Strategies includes assets under management in all strategies in operation throughout the period. Lipper rankings and Morningstar Ratings are as of June 30, 2013. Lipper rankings are based on total return, are historical, and do not represent future results. Morningstar ratings are based on risk-adjusted return. The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar Rating metrics. See Notes & Disclosures at the end of this presentation for more information about our investment performance. % of AUM in Outperforming Strategies 40% 97% 99% 100% 100%96% 96% 95% 100% 96% 74% 76% 96% 100% 96% 72% 91% 93% 100% 98% 0% 20% 40% 60% 80% 100% 1 Year 3 Year 5 Year 10 Year Inception 2010 2011 2012 6/30/2013

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 5 ASSET DIVERSIFICATION AUM by Distribution Channel1 As of June 30, 2013. 1The allocation of AUM by distribution channel involves the use of estimates and the exercise of judgment. AUM by Client DomicileAUM by Vehicle AUM by Investment Team

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 6 BUSINESS PHILOSOPHY & APPROACH Growth-Oriented Culture Active Strategies Autonomous Franchises Proven Results Designed for Investment Talent to Thrive Managed by Business Professionals Structured to Align Interests Based on Actively Identifying Talent Committed to Maintaining an Entrepreneurial Spirit Focused on Long-Term Demand Globally Since its founding, Artisan has built its business based upon a consistent philosophy and business model. Talent Driven Business Model High Value Added Investment Firm

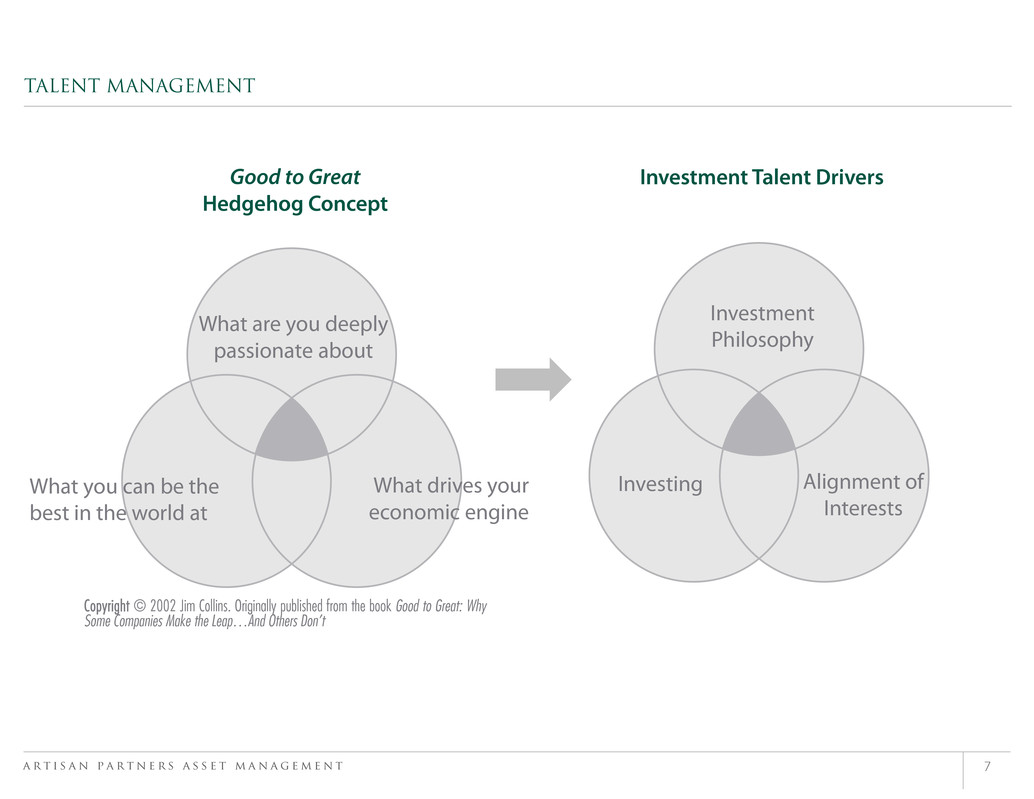

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 7 TALENT MANAGEMENT Good to Great Hedgehog Concept Investment Talent Drivers What are you deeply passionate about What drives your economic engine What you can be the best in the world at Investment Philosophy Investing Alignment of Interests Copyright © 2002 Jim Collins. Originally published from the book Good to Great: Why Some Companies Make the Leap…And Others Don’t

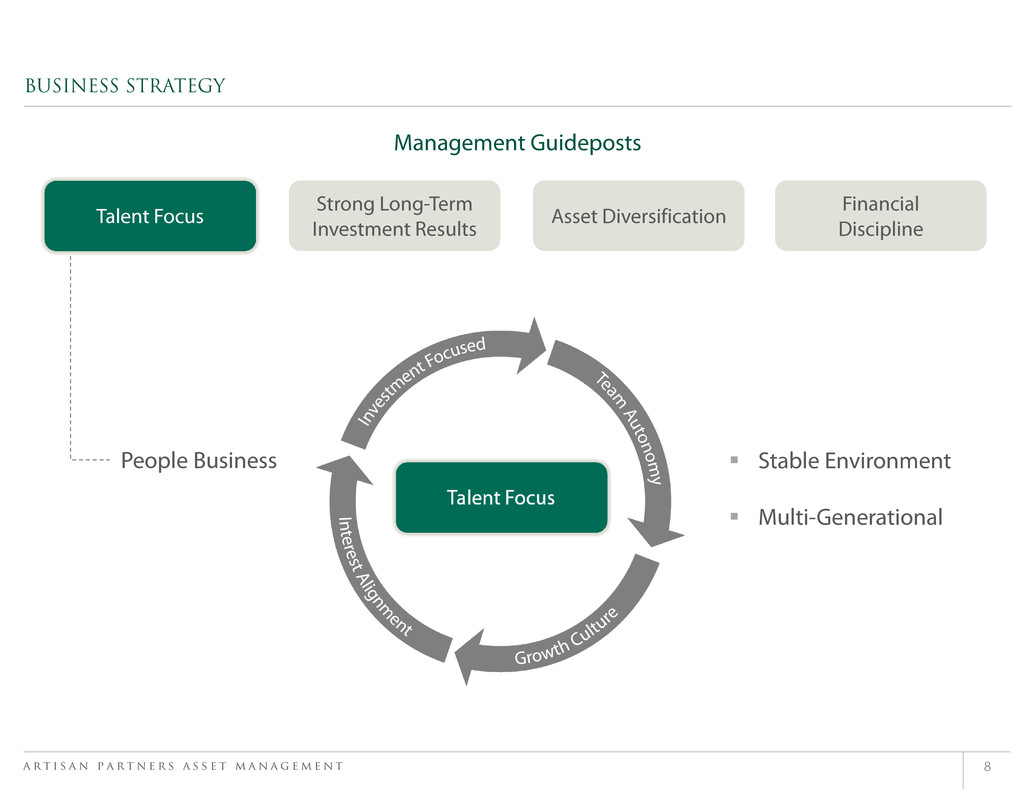

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 8 Talent Focus BUSINESS STRATEGY Management Guideposts Strong Long-Term Investment Results Asset Diversification Financial Discipline Stable Environment Multi-Generational People Business Talent Focus

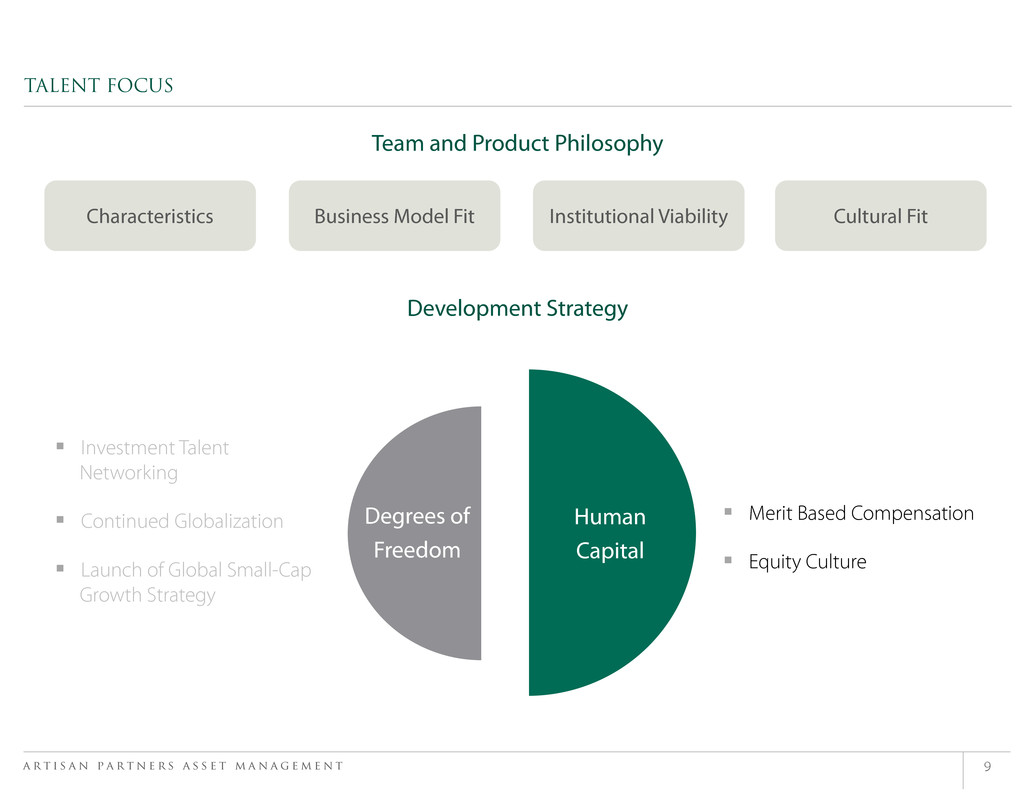

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 9 TALENT FOCUS Characteristics Business Model Fit Institutional Viability Cultural Fit Team and Product Philosophy Merit Based Compensation Equity Culture Investment Talent Networking Continued Globalization Launch of Global Small-Cap Growth Strategy Degrees of Freedom Human Capital Development Strategy

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 10 EQUITY GRANTS Equity Grant Philosophy Long-term interest alignment Talent acquisition and retention Merit-based award driven by consistent value creation Equity as a percentage of an employee’s total compensation highly variable year-over-year 2013 Equity Grant Overview 2.25% of outstanding common and preferred shares Reflects reinvestment in talent, our private to public transition and business growth Weighted to value creation

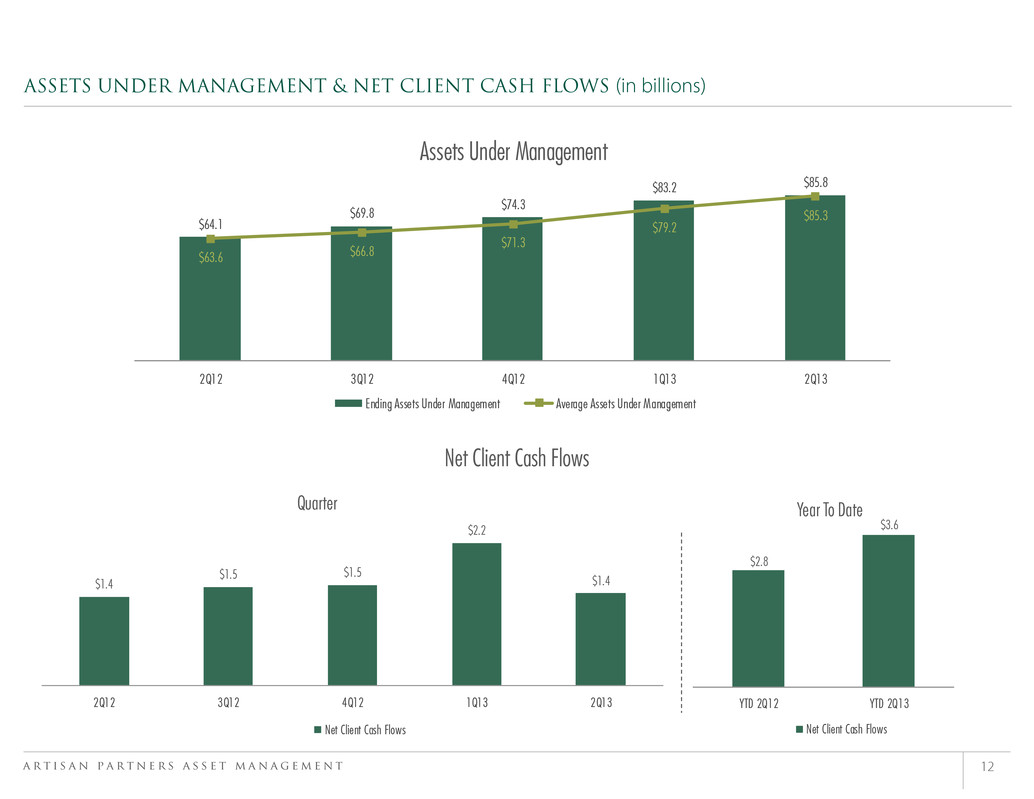

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 11 AUM increased 3% to $85.8 billion, the highest quarter-end level in the firm’s history Average AUM increased 8% to $85.3 billion Net flows of $1.4 billion resulting in 6.8% annualized organic growth Revenues increased 9% to $162.0 million Operating margin of 29.8% Net income per basic and diluted share of $0.38 Adjusted operating margin of 44.6% Adjusted net income per adjusted share of $0.64 Declared on July 17 a dividend of $0.43 per share of Class A common stock, payable August 26 to Class A shareholders of record as of August 12 Issued on July 17 restricted shares of Class A common stock to employees in an amount equal to 2.25% of outstanding common and preferred stock Assets Under Management Net Client Cash Flows Operating Results Capital Management SUMMARY OF SECOND QUARTER 2013 RESULTS

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 12 ASSETS UNDER MANAGEMENT & NET CLIENT CASH FLOWS (in billions) Net Client Cash Flows $64.1 $69.8 $74.3 $83.2 $85.8 $63.6 $66.8 $71.3 $79.2 $85.3 2Q12 3Q12 4Q12 1Q13 2Q13 Assets Under Management Ending Assets Under Management Average Assets Under Management $1.4 $1.5 $1.5 $2.2 $1.4 2Q12 3Q12 4Q12 1Q13 2Q13 Quarter Net Client Cash Flows $2.8 $3.6 YTD 2Q12 YTD 2Q13 Year To Date Net Client Cash Flows

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 13 $1.0 $1.0 $0.6 $1.6 $1.0 $0.4 $0.5 $0.9 $0.6 $0.4 2Q12 3Q12 4Q12 1Q13 2Q13 Quarter U.S. Non-U.S. 9% 10% 11% 11% 11% $5.7 $6.7 $7.9 $9.2 $9.8 2Q12 3Q12 4Q12 1Q13 2Q13 Non-U.S. Client AUM Non-U.S. Cl ient AUM as a % of Fi rmwide AUM Non-U.S. Cl ient AUM GLOBAL DISTRIBUTION (in billions) U.S. vs. Non-U.S. Client Net Flows $2.3 $2.6 $0.5 $1.0 YTD 2Q12 YTD 2Q13 Year To Date U.S. Non-U.S.

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 14 FINANCIAL RESULTS — Financial Highlights Average Total AUM (in billions) Revenues (in millions) Quarter Year To Date $63.6 $79.2 $85.3 2Q12 1Q13 2Q13 $63.3 $82.3 YTD 2Q12 YTD 2Q13 $120.8 $148.2 $162.0 2Q12 1Q13 2Q13 $240.5 $310.2 YTD 2Q12 YTD 2Q13

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 15 1Q13 2Q132Q12 41.6% 37.0% 44.6% 2Q12 1Q13 2Q13 FINANCIAL RESULTS — Financial Highlights Adjusted Operating Margin1 Adjusted Net Income (in millions) & Adjusted Net Income per Share1 Quarter Year To Date 40.6% 41.0% YTD 2Q12 YTD 2Q13 1 Operating Margin (GAAP) for the quarters ended June 30, 2012, March 31, 2013, and June 30, 2013 was 34.3%, (284.3)%, and 29.8%, respectively, and for the six months ended June 30, 2012 and June 30, 2013 was 19.1% and (120.2%), respectively. Net Income attributable to APAM for the quarters ended March 31, 2013 and June 30, 2013 was $3.0M and $5.7M, respectively, and for the six months ended June 30, 2013 was $8.7M. Net Income per basic and diluted share for the quarters ended March 31, 2013 and June 30, 2013 was $0.19 and $0.38, respectively, and for the six months ended June 30, 2013 was $0.57. See page 19 for a reconciliation of GAAP to Non-GAAP (“Adjusted”) Measures $30.8 $33.2 $0.47 $44.5 $0.64 $59.3 $77.7 $1.11 YTD 2Q12 YTD 2Q13 Adjusted Net Income per Adjusted ShareAdjusted Net Income Adjusted Net Income per Adjusted ShareAdjusted Net Income

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 16 The decrease in total compensation and benefits in the June 2013 quarter was driven by compensation charges in the March 2013 quarter related to the reorganization of the Company’s capital structure from a private to a public company. Salary & Incentives includes incentive compensation, which increased in the June 2013 quarter due to higher revenues. The March 2013 quarter includes previously disclosed severance payment to a former portfolio manager. The pre-IPO retention award amortization for investment teams, which is included in each of the quarters presented, ends the December 2013 quarter. Seasonal benefits costs decreased in the second quarter due in part to the first quarter funding of 50% of the Company's annual contribution to employee health savings accounts and 401(k) matching. We expect that equity grants to employees, including the recently made 2013 grant, will increase the compensation ratio by approximately 200 – 350 basis points over the next few years assuming annual stock price growth of approximately 10% and future annual equity grants (consisting of 50% restricted stock and 50% stock options and vesting pro rata over five years) of approximately 2% of our outstanding common and preferred stock. The stock price assumption is solely for purposes of estimating our future compensation ratio, and our actual equity grants may be sized and structured differently than assumed for these purposes. FINANCIAL RESULTS — Compensation & Benefits (in millions) June 2013 % of Rev. March 2013 % of Rev. June 2012 % of Rev. Salary & Incentives 63.1$ 39.0% 58.0$ 39.1% 49.3$ 40.8% Benefits & Payroll taxes 2.6 1.6% 3.1 2.1% 2.0 1.7% Equity Based Compensation Expense - 0.0% - 0.0% - 0.0% Subtotal Compensation and Benefits 65.7 40.6% 61.1 41.2% 51.3 42.5% Pre-offering related compensation 23.9 14.8% 476.2 321.3% 8.9 7.4% Severance & cash retention award 2.2 1.4% 9.3 6.3% 1.6 1.3% Seasonal benefits 1.3 0.8% 2.3 1.6% 0.7 0.6% Total Compensation and Benefits 93.1$ 57.5% 548.9$ 370.4% 62.5$ 51.7%

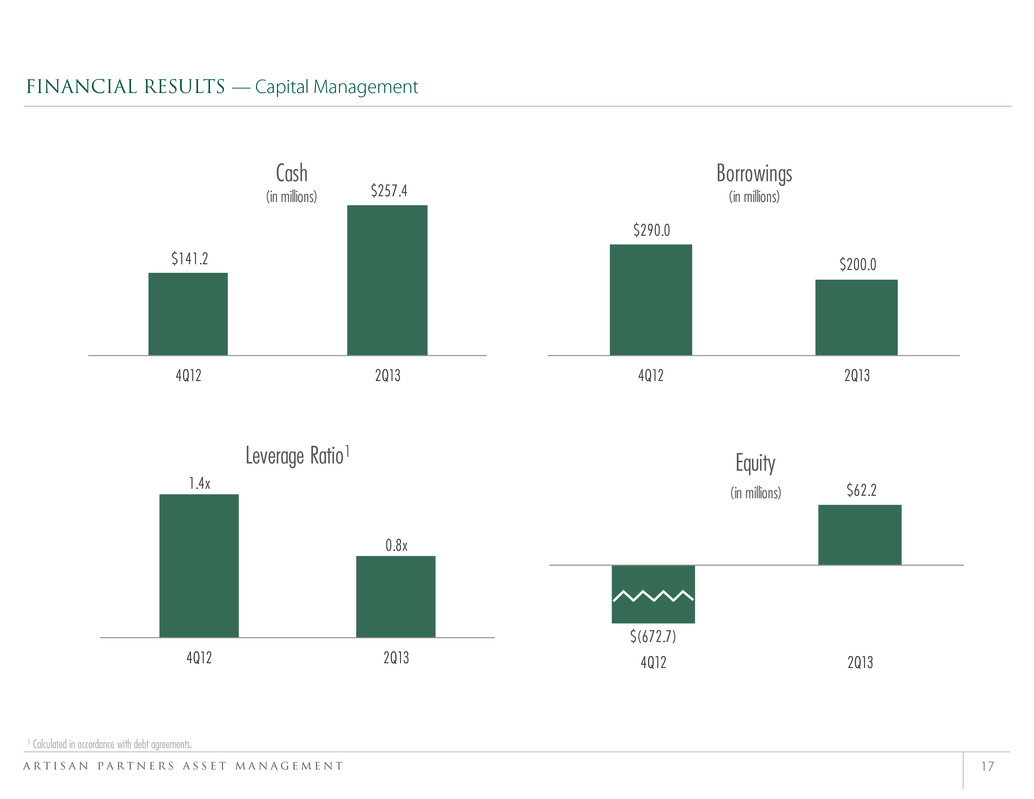

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 17 FINANCIAL RESULTS — Capital Management ¹ Calculated in accordance with debt agreements. $141.2 $257.4 4Q12 2Q13 Cash (in millions) $290.0 $200.0 4Q12 2Q13 Borrowings (in millions) 1.4x 0.8x 4Q12 2Q13 Leverage Ratio1 $(672.7) $62.2 4Q12 2Q13 Equity (in millions)

APPENDIX

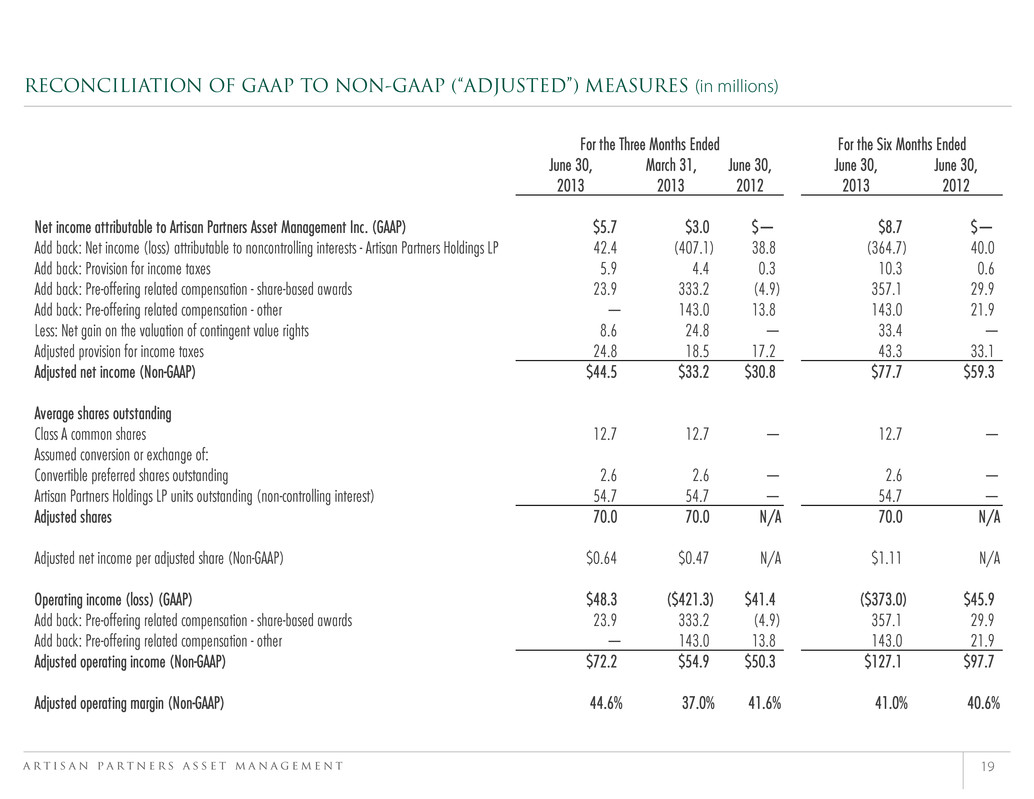

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 19 RECONCILIATION OF GAAP TO NON-GAAP (“ADJUSTED”) MEASURES (in millions) June 30, March 31, June 30, June 30, June 30, 2013 2013 2012 2013 2012 Net income attributable to Artisan Partners Asset Management Inc. (GAAP) $5.7 $3.0 $— $8.7 $— Add back: Net income (loss) attributable to noncontrolling interests - Artisan Partners Holdings LP 42.4 (407.1) 38.8 (364.7) 40.0 Add back: Provision for income taxes 5.9 4.4 0.3 10.3 0.6 Add back: Pre-offering related compensation - share-based awards 23.9 333.2 (4.9) 357.1 29.9 Add back: Pre-offering related compensation - other — 143.0 13.8 143.0 21.9 Less: Net gain on the valuation of contingent value rights 8.6 24.8 — 33.4 — Adjusted provision for income taxes 24.8 18.5 17.2 43.3 33.1 Adjusted net income (Non-GAAP) $44.5 $33.2 $30.8 $77.7 $59.3 Average shares outstanding Class A common shares 12.7 12.7 — 12.7 — Assumed conversion or exchange of: Convertible preferred shares outstanding 2.6 2.6 — 2.6 — Artisan Partners Holdings LP units outstanding (non-controlling interest) 54.7 54.7 — 54.7 — Adjusted shares 70.0 70.0 N/A 70.0 N/A Adjusted net income per adjusted share (Non-GAAP) $0.64 $0.47 N/A $1.11 N/A Operating income (loss) (GAAP) $48.3 ($421.3) $41.4 ($373.0) $45.9 Add back: Pre-offering related compensation - share-based awards 23.9 333.2 (4.9) 357.1 29.9 Add back: Pre-offering related compensation - other — 143.0 13.8 143.0 21.9 Adjusted operating income (Non-GAAP) $72.2 $54.9 $50.3 $127.1 $97.7 Adjusted operating margin (Non-GAAP) 44.6% 37.0% 41.6% 41.0% 40.6% For the Three Months Ended For the Six Months Ended

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 20 LONG-TERM INVESTMENT RESULTS Source: Artisan Partners/MSCI/Russell. Average Annual Total Returns (Gross) represents gross of fees performance for the Artisan Composites. Value add measures the average annual outperformance or underperformance of the gross composite return of each Artisan Partners strategy compared to its broad-based benchmark. See Notes & Disclosures at the end of this presentation for more information about our investment performance. Artisan Global Small-Cap Growth strategy launched on July 1, 2013. Average Annual Value-Added As of June 30, 2013 1 Yr 3 Yr 5 Yr 7 Yr 10 Yr Inception Since Inception (bp) Global Equity Team Artisan Non-U.S. Growth (Inception: 1-Jan-96) 22.49% 16.21% 3.42% 5.44% 10.60% 11.24% 681 MSCI EAFE Index 18.62% 10.03% -0.63% 1.37% 7.66% 4.43% Artisan Non-U.S. Small-Cap Growth (Inception: 1-Jan-02) 32.88% 18.47% 7.08% 8.96% 16.13% 16.02% 598 MSCI EAFE Small Cap Index 20.88% 11.87% 2.48% 2.03% 10.37% 10.04% Artisan Global Equity (Inception 1-Apr-10) 34.12% 21.88% --- --- --- 15.79% 878 MSCI All Country World Index 16.57% 12.35% --- --- --- 7.01% U.S. Value Team Artisan U.S. Mid-Cap Value (Inception: 1-Apr-99) 28.29% 20.34% 11.18% 10.13% 13.91% 14.65% 608 Russell Midcap ® Index 25.41% 19.51% 8.27% 6.91% 10.64% 8.57% Artisan U.S. Small-Cap Value (Inception: 1-Jun-97) 16.72% 13.47% 8.44% 7.48% 11.75% 12.66% 523 Russell 2000 ® Index 24.21% 18.65% 8.77% 5.81% 9.52% 7.43% Artisan Value Equity (Inception: 1-Jul-05) 19.82% 17.58% 7.45% 6.89% --- 7.25% 100 Russell 1000 ® Index 21.24% 18.61% 7.11% 5.84% --- 6.24% Growth Team Artisan U.S. Mid-Cap Growth (Inception: 1-Apr-97) 21.61% 22.44% 11.75% 10.77% 12.36% 15.93% 608 Russell Midcap ® Index 25.41% 19.51% 8.27% 6.91% 10.64% 9.85% Artisan U.S. Small-Cap Growth (Inception: 1-Apr-95) 23.65% 24.36% 13.30% 7.73% 10.78% 9.95% 99 Russell 2000 ® Index 24.21% 18.65% 8.77% 5.81% 9.52% 8.95% Artisan Global Opportunities (Inception: 1-Feb-07) 21.69% 21.70% 10.10% --- --- 8.41% 683 MSCI All Country World Index 16.57% 12.35% 2.30% --- --- 1.59% Global Value Team Artisan Non-U.S. Value (Inception: 1-Jul-02) 28.34% 17.51% 10.36% 8.24% 14.38% 13.77% 747 MSCI EAFE Index 18.62% 10.03% -0.63% 1.37% 7.66% 6.30% Artisan Global Value (Inception: 1-Jul-07) 28.31% 20.56% 12.31% --- --- 7.31% 703 MSCI All Country World Index 16.57% 12.35% 2.30% --- --- 0.28% Emerging Markets Team Artisan Emerging Markets (Inception: 1-Jul-06) -0.05% -1.18% -3.40% 4.57% --- 4.57% -124 MSCI Emerging Markets Index 2.87% 3.38% -0.43% 5.81% --- 5.81% Average Annual Total Returns (Gross)

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 21 NOTES & DISCLOSURES Forward-Looking Statements Certain information in this presentation, and other written or oral statements made by or on behalf of Artisan Partners, are “forward-looking statements” within the meaning of the federal securities laws. Statements regarding future events and developments and the company’s future performance, as well as management’s current expectations, beliefs, plans, estimates or projections relating to the future, are forward-looking statements within the meaning of these laws. These forward-looking statements are only predictions based on current expectations and projections about future events. These forward-looking statements are subject to a number of risks and uncertainties, and there are important factors that could cause actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. Among the important factors that could cause actual results, level of activity, performance or achievements to differ materially from those indicated by such forward-looking statements are: fluctuations in quarterly and annual results, incurrence of net losses, adverse effects of management focusing on implementation of a growth strategy, failure to develop and maintain the Artisan Partners brand and other factors disclosed in the company’s filings with the Securities and Exchange Commission, including those factors listed under the caption entitled “Risk Factors” in the company’s registration statement on Form S-1 (File No. 333-184686). The company undertakes no obligation to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this presentation. Investment Performance We measure the results of our “composites”, which represent the aggregate performance of all discretionary client accounts, including mutual funds, invested in the same strategy except those accounts with respect to which we believe client-imposed socially based restrictions may have a material impact on portfolio construction and those accounts managed in a currency other than U.S. dollars (the results of these accounts, which represented approximately 8% of our assets under management at June 30, 2013, are maintained in separate composites, which are not presented in these materials). Results for any investment strategy described herein, and for different investment products within a strategy, are affected by numerous factors, including different material market or economic conditions; different investment management fee rates, brokerage commissions and other expenses; and the reinvestment of dividends or other earnings. The returns for any strategy may be positive or negative, and past performance does not guarantee future results. In these materials, we present “Value-Added”, which is the amount in basis points by which the average annual gross composite return of each of our strategies has outperformed or underperformed the market index most commonly used by our clients to compare the performance of the relevant strategy. The market indices used to compute the value added for each of our strategies are as follows: Non-U.S. Growth Strategy—MSCI EAFE® Index; Non-U.S. Small-Cap Growth Strategy—MSCI EAFE® Small Cap Index; Global Equity Strategy—MSCI ACWI® Index; U.S. Mid-Cap Value Strategy—Russell Midcap® Index; U.S. Small-Cap Value Strategy—Russell 2000® Index; Value Equity Strategy—Russell 1000® Index; U.S. Mid-Cap Growth Strategy— Russell Midcap® Index; U.S. Small-Cap Strategy—Russell 2000® Index; Global Opportunities Strategy—MSCI ACWI® Index; Non-U.S. Value Strategy—MSCI EAFE® Index; Global Value Strategy— MSCI ACWI® Index; Emerging Markets Strategy—MSCI Emerging Markets IndexSM. In this document, we present information based on Morningstar, Inc., or Morningstar, ratings for series of Artisan Partners Funds, Inc. (“Artisan Funds”). The Morningstar ratings refer to the ratings by Morningstar of the share class of the respective series of Artisan Funds with the earliest inception date and are based on a 5-star scale. Morningstar data © 2012 Morningstar, Inc.; all rights reserved. Morningstar data contained herein (1) is proprietary to Morningstar and/or its content providers, (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ which is based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance, including the effects of sales charges, loads, and redemption fees, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star.

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 22 NOTES & DISCLOSURES Ratings are based on risk-adjusted returns and are historical and do not represent future results. The Overall Morningstar RatingTM for a fund is derived from a weighted average of the performance figures associated with its three-year, five-year, and ten-year (if applicable) Morningstar Ratings metrics. The Artisan Funds, the ratings of which form the basis for the information reflected in the table on page 7, and the categories in which they are rated are: Artisan International Fund—Foreign Large Blend Funds Category; Artisan International Small Cap Fund—Foreign Small/Mid Growth Funds Category; Artisan Global Equity Fund—World Stock; Artisan Small Cap Value Fund—Small Value Funds Category; Artisan Mid Cap Value Fund—Mid- Cap Value Funds Category; Artisan Value Equity Fund—Large Value Funds Category; Artisan Mid Cap Fund—Mid-Cap Growth Funds Category; Artisan Global Opportunities Fund—World Stock; Artisan Small Cap Fund—Small Growth Funds Category; Artisan International Value Fund—Foreign Small/Mid Funds Category; Artisan Global Value Fund—World Stock; Artisan Emerging Markets Fund— Diversified Emerging Markets Funds Category. Morningstar ratings are initially given on a fund’s three year track record and change monthly. We also present information based on Lipper rankings for series of Artisan Funds. Lipper rankings are based on total return, are historical and do not represent future results. The number of funds in a category may include multiple share classes of the same fund, which may have a material impact on a fund’s ranking within a category. Lipper, a Thomson Reuters company, is the owner of all trademarks and copyrights relating to Lipper rankings. Financial Information Throughout these materials, we present historical information about our assets under management and our average assets under management for certain periods. We use our information management systems to track our assets under management and we believe the information in these materials regarding our assets under management is accurate in all material respects. We also present information regarding the amount of our assets under management sourced through particular distribution channels. The allocation of assets under management sourced through particular distribution channels involves estimates and the exercise of judgment. We have presented the information on our assets under management sourced by distribution channel in the way in which we prepare and use that information in the management of our business. Data sourced by distribution channel on our assets under management are not subject to our internal controls over financial reporting. Rounding Any discrepancies included in these materials between totals and the sums of the amounts listed are due to rounding. Trademark Notice The MSCI EAFE® Index, the MSCI EAFE® Growth Index, the MSCI EAFE® Small Cap Index, the MSCI EAFE® Value Index, the MSCI ACWI® Index and the MSCI Emerging Markets IndexSM are trademarks of MSCI Inc. MSCI Inc. is the owner of all copyrights relating to these indices and is the source of the performance statistics of these indices that are referred to in these materials. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com) The Russell 2000® Index, the Russell 2000® Value Index, the Russell Midcap® Index, the Russell Midcap® Value Index, the Russell 1000® Index, the Russell 1000® Value Index, the Russell Midcap® Growth Index, the Russell 1000® Growth Index and the Russell 2000® Growth Index are trademarks of Russell Investment Group. Russell Investment Group is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a presentation of Artisan Partners. Russell Investment Group is not responsible for the formatting or configuration of this material or for any inaccuracy in Artisan Partners' presentation thereof. None of the information in these materials constitutes either an offer or a solicitation to buy or sell any fund securities, nor is any such information a recommendation for any fund security or investment service. Copyright 2013 Artisan Partners. All rights reserved. This presentation may not be reproduced in whole or in part without Artisan Partners’ permission.