Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ENTERPRISE GROUP INC | d570806d8k.htm |

Forward Looking Statement

EXHIBIT 99

3 |

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Income from Continuing

Operations/Net Income reported in accordance with accounting principles

generally accepted in the United States (GAAP). Operating Earnings

is a non- GAAP financial measure that differs from Net Income because

it excludes gains or losses associated with Nuclear Decommissioning

Trust (NDT), Mark-to-Market (MTM) accounting, and other material

one-time items. PSEG presents Operating Earnings because

management believes that it is appropriate for investors to consider

results excluding these items in addition to the results reported in

accordance with GAAP. PSEG believes that the non-GAAP financial

measure of Operating Earnings provides a consistent and comparable

measure of performance of its businesses to help shareholders understand

performance trends. This information is not

intended to be viewed as an alternative to GAAP

information. The last slide in this presentation includes a list

of items excluded

from Income from Continuing Operations/Net Income to reconcile to Operating

Earnings, with a reference to that slide included on each of the

slides where the

non-GAAP information appears.

4 |

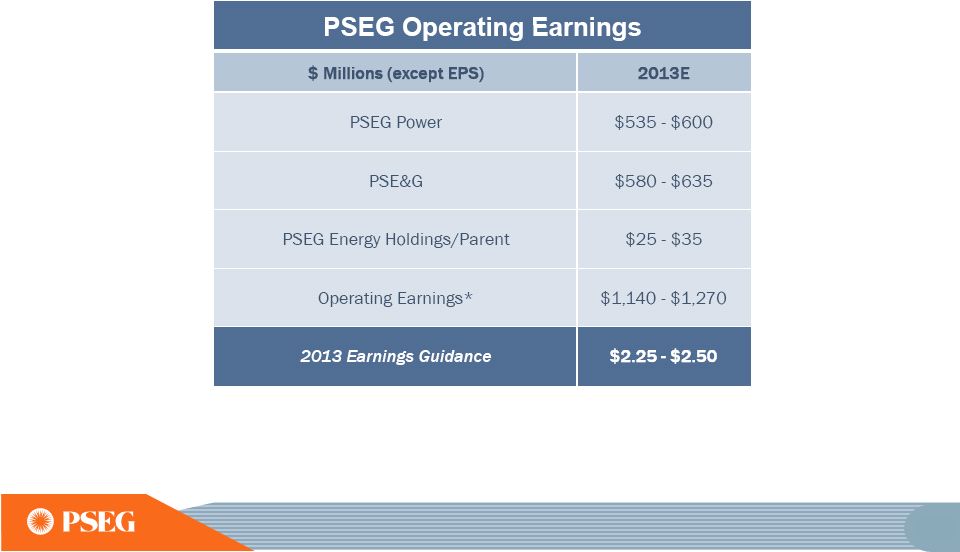

2013 Operating Earnings Guidance

$2.74

$2.44

$2.25 -

$2.50 E

2011 Operating Earnings*

2012 Operating Earnings*

2013 Guidance

* SEE PAGE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING

OPERATIONS/NET INCOME TO RECONCILE TO OPERATING

EARNINGS. E = ESTIMATE.

9 |

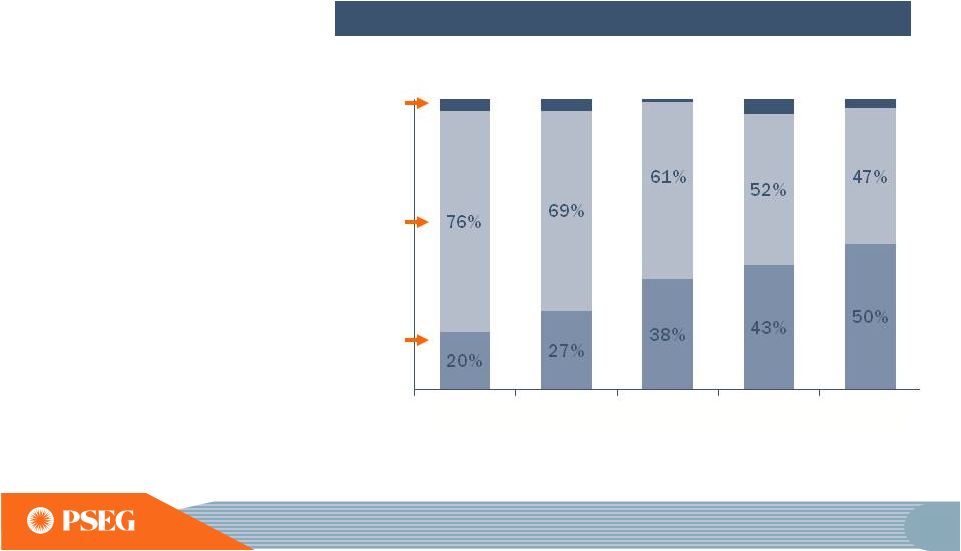

2013 Operating Earnings

*

*SEE PAGE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING OPERATIONS/NET

INCOME TO RECONCILE TO OPERATING EARNINGS; ALL PERIODS REFLECT TEXAS IN

DISCONTINUED OPERATIONS. E=ESTIMATE. Investment in the

regulated business

has changed the

earnings mix

Our 2009-2013

investment focus has

brought us to a 50/50

mix for 2013

PSE&G’s 2013-2017

Energy Strong Program

and ongoing transmission

investments will support

continued growth in

PSE&G’s earnings

Percent of Operating Earnings Contribution by Subsidiary

PSE&G

Power

Other

$2.74

$2.44

$2.25 -$2.50E

$3.09

$3.12

10

2009

2010

2011

2012

2013E |

54 local NJ towns and 5 counties

support

•

54 municipalities and five counties (Bergen, Hudson, Mercer,

Passaic and Somerset) have approved resolutions in support

of Energy Strong, PSE&G’s infrastructure proposal to improve

and fortify its electric and gas distribution systems

•

The Energy Strong proposal is currently being evaluated by

the NJ Board of Public Utilities

16 |

Providing

solutions

for

New Jersey’s

energy and

economic

development

goals

($ Millions)

Approval

Date

Forecast

Amount*

Spending

Thru 2012

Remaining

Spending

Renewables

Solar Loan I & II

April 2008/

November

2009

$243

$209

34

Solar 4 All

July 2009

456

437

19

Energy Efficiency

Carbon Abatement

December

2008

45

45

-

Energy Efficiency

Economic Stimulus

July 2009

161

156

5

Demand Response

July 2009

35

27

8

Energy Efficiency

Economic Stimulus

Extension

July 2011

95

14

81

Distribution

NJ Capital Infrastructure

Program 1 (CIP 1)

April 2009

702

702

-

NJ Capital Infrastructure

Program 2 (CIP 2)

July 2011

273

253

20

Total

$2,010

$1,843

$167

* THIS FORECAST DOES NOT REFLECT THE IMPACT OF A RECENTLY APPROVED

AGREEMENT FOR SL3 AND S4AE. DATA AS OF MARCH 31, 2013.

33 |

PSE&G’s capital program will continue to be

focused on delivering energy solutions to meet New Jersey’s

public policy

PSE&G’s Capital Expenditures

35

0

500

1,000

1,500

2,000

2,500

2009

2010

2011

2012

2013E

2014E

2015E

2016E

2017E

Transmission Hardening

Proposed Filings*

Approved Solar/Energy Efficiency

Transmission

Gas Distribution

Electric Distribution

* PROPOSED FILINGS INCLUDE EE4A, SL3, S4AE, AND ENERGY STRONG (ES). DATA

AS OF MARCH 31, 2013. E = ESTIMATE |

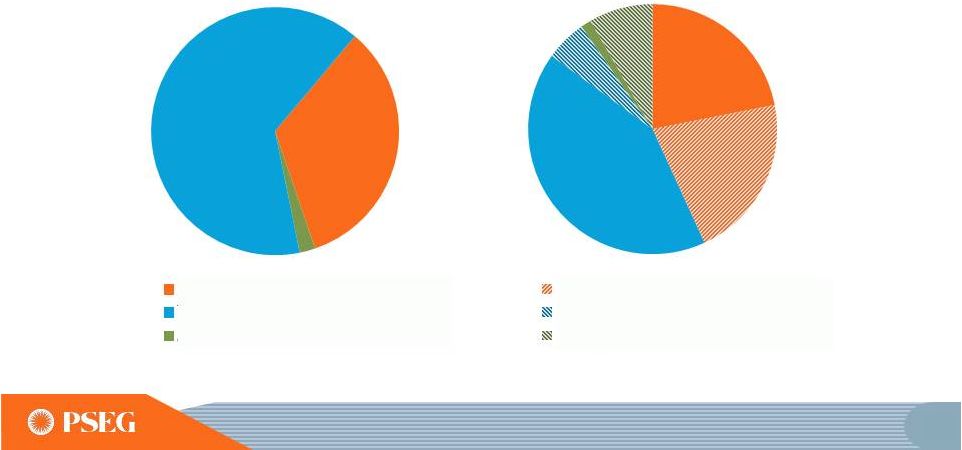

2013-2017 proposed investment plan

would grow our current capital plan by up to 50%

2013-2017E Capital Expenditures

* Distribution ES and Transmission Hardening extend 10 years

*

*

DATA AS OF MARCH 31, 2013. E = ESTIMATE

36

34%

2%

64%

Distribution

Distribution ES Filing

Transmission

Transmission Hardening

Approved Solar/Energy Efficiency

Solar/Energy Efficiency Filings

22%

21%

42%

6%

1%

8%

Existing Plan

$6.9 Billion

Existing Plan and Proposed Filings

$10.6 Billion |

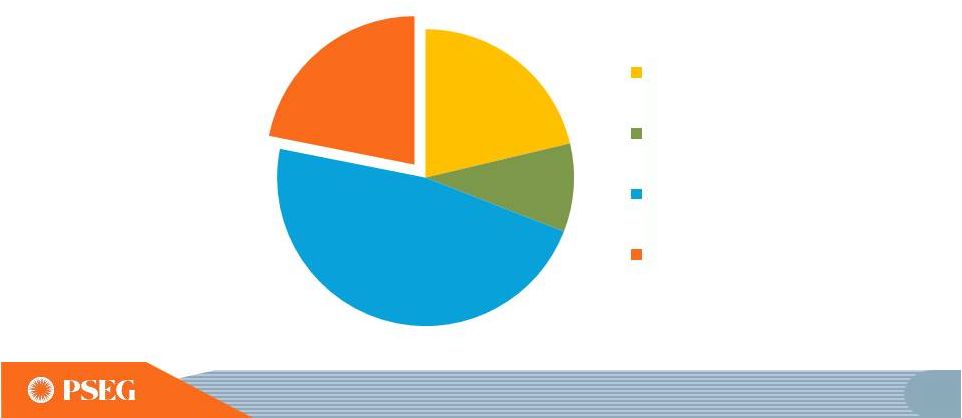

PSE&G’s proposed investments would be

recovered through contemporaneous recovery mechanisms

DATA AS OF MARCH 31, 2013. E = ESTIMATE

37

2013

-

2017E Capital Spending by Recovery Method

Energy Strong Filing (ES)

Solar/Energy Efficiency

Clauses

FERC Formula Rates

Distribution Base Rates

21%

10%

47%

22%

$10.6 Billion

Contemporaneous Recovery Mechanisms

Traditional Recovery Mechanisms |

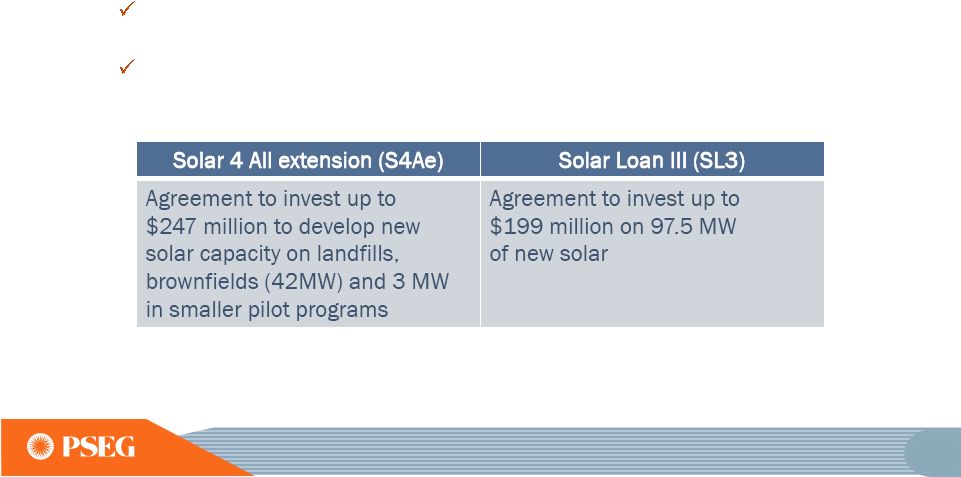

PSE&G is continuing to provide solutions

to assist New Jersey in achieving its EMP goals

The NJBPU approved the Solar Agreement reached with BPU Staff

and certain other parties on May 29

The agreement provides for investment of $446 million over a

3-year period, and a return on equity of 10%

Solar Agreement Approved

46 |

PSE&G’s 2013 operating earnings

is benefiting from transmission growth and

cost containment initiatives

E = ESTIMATE

*SEE SLIDE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING OPERATIONS/NET

INCOME TO RECONCILE TO OPERATING EARNINGS.

48

$528

2012

2013 Guidance

PSE&G Operating Earnings*

($ Millions)

$580 -

$635E |

Maintaining 2013 operating earnings guidance

E = ESTIMATE

*SEE SLIDE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING

OPERATIONS/NET INCOME TO RECONCILE TO OPERATING EARNINGS.

90 |

PSEG Summary

•

Maintaining

2013

operating

earnings

guidance

of

$2.25

-

$2.50

per share, with earnings mix shifting to ~50% regulated

•

Double digit operating earnings growth at PSE&G starting in 2013,

and continuing through 2015 driven by transmission investments

and approved programs

•

Power’s continued focus on operational excellence, market expertise

and financial strength reduces risk in low price environment

•

Strong Balance Sheet and Cash Flow support full capital program

without the need for equity

•

Long history of returning cash to the shareholder through the

common dividend, with opportunity for further growth

103 |

New Jersey Board of Public Utilities (BPU)

•

The Board of Public Utilities consists of five commissioners

appointed by the Governor. These appointees are confirmed by the

NJ Senate for six-year, staggered terms. The Governor appoints one

of the five to serve as Commission President.

Currently, the commissioners are:

•

Robert M. Hanna, Commission President

•

Jeanne M. Fox

•

Joseph L. Fiordaliso

•

Mary-Anna Holden

•

Dianne Solomon

•

Stefanie Brand, Director of the N.J. Division of Rate Counsel

110 |

Items Excluded from Income from Continuing

Operations/Net Income to Reconcile to Operating Earnings

Three Months Ended

March 31,

2013

2012

2012

2011

2010

2009

2008

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

9

$

5

$

52

$

50

$

46

$

9

$

(71)

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

(105)

52

(10)

107

(1)

(11)

14

Lease Transaction Activity (Energy Holdings)

-

4

36

(173)

-

29

(490)

Storm O&M (PSEG Power)

(17)

-

(39)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

-

-

(72)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

-

-

34

-

-

(13)

Total Pro-forma adjustments

(113)

$

61

$

39

$

18

$

(27)

$

27

$

(560)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

507

507

508

Per Share Impact (Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.02

$

0.01

$

0.10

$

0.10

$

0.09

$

0.02

$

(0.14)

$

Gain (Loss) on MTM (PSEG Power)

(0.21)

0.10

(0.02)

0.21

-

(0.02)

0.03

Lease Transaction Activity (Energy Holdings)

-

0.01

0.07

(0.34)

-

0.05

(0.96)

Storm O&M (PSEG Power)

(0.03)

-

(0.08)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

-

-

(0.14)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

-

-

0.06

-

-

(0.03)

Total Pro-forma adjustments

(0.22)

$

0.12

$

0.07

$

0.03

$

(0.05)

$

0.05

$

(1.10)

$

For the Year Ended

December 31,

(Unaudited)

Pro-forma Adjustments, net of tax

A

PLEASE SEE PAGE 3 FOR AN EXPLANATION OF PSEG’S USE OF OPERATING

EARNINGS AS A NON-GAAP FINANCIAL MEASURE AND HOW IT DIFFERS FROM

INCOME FROM CONTINUING OPERATIONS/NET INCOME. |