Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Gold Merger Sub, LLC | d567928d8k.htm |

Lender

Presentation July 16, 2013

Exhibit 99.1 |

Safe

Harbor/Non-GAAP

Financial

Disclosures

2

Forward-Looking Statements

Non-GAAP Financial Measures

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are based on Pinnacle’s and

Ameristar’s current expectations and are subject to uncertainty and changes in

circumstances. These forward-looking statements include, among others, statements regarding the expected

synergies and benefits of a potential combination of Pinnacle and Ameristar, including the expected

accretive effect of the merger on Pinnacle’s financial results and profile (e.g., free cash flow

and Consolidated Adjusted EBITDA); the anticipated benefits of geographic diversity that would result

from the merger and the expected results of Ameristar’s gaming properties; expectations

about future business plans, use of proceeds from financing, prospective performance and

opportunities; required regulatory approvals; the expected timing of the completion of the transaction;

and the anticipated financing of the transaction. These forward-looking statements may be

identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential,” “should”,

“will” or similar words intended to identify information that is not historical in

nature. The inclusion of such statements should not be regarded as a representation that such plans, estimates or

expectations will be achieved. There is no assurance that the potential transaction will be

consummated, and there are a number of risks and uncertainties that could cause actual results to

differ materially from the forward-looking statements made herein. These risks and

uncertainties include (a) the timing to consummate a potential transaction between Pinnacle and Ameristar

may be delayed based on circumstances beyond Pinnacle’s control, including the ability of

Pinnacle to reach a resolution with the Federal Trade Commission (“Commission”); (b) the ability and

timing to complete the dispositions proposed as part of the effort to reach a resolution with the

Commission; (c) the ability and timing to obtain required regulatory approvals and satisfy or waive

other closing conditions; (d) the possibility that the merger does not close when expected or at all;

or that the companies may be required to modify aspects of the merger to achieve regulatory

approval; (e) Pinnacle’s ability to realize the synergies contemplated by a potential

transaction; (f) Pinnacle’s ability to promptly and effectively integrate the business of Pinnacle and Ameristar;

(g) uncertainties in the global economy and credit markets and its potential impact on Pinnacle’s

ability to finance the transaction; (h) the outcome of any legal proceedings that may be instituted

in connection with the transaction; (i) the ability to retain certain key employees of Ameristar; (j)

that there may be a material adverse change affecting Pinnacle or Ameristar, or the respective

businesses of Pinnacle or Ameristar may suffer as a result of uncertainty surrounding the transaction;

(k) Pinnacle’s ability to obtain financing on the terms expected, or at all; and (l) the risk

factors disclosed in Pinnacle’s most recent Annual Report on Form 10-K, which Pinnacle filed

with the Securities and Exchange Commission on March 1, 2013 and the risk factors disclosed in

Ameristar’s most recent Annual Report on Form 10-K, which Ameristar filed with the Securities

and Exchange Commission on February 28, 2013, and in all reports on Forms 10-K, 10-Q and 8-K

filed with the Securities and Exchange Commission by Pinnacle and Ameristar subsequent to the filing

of their respective Form 10-Ks for the year ended December 31, 2012. Forward-looking

statements reflect Pinnacle’s and Ameristar’s management’s analysis as of the date of

this release. Pinnacle and Ameristar do not undertake to revise these statements to reflect subsequent

developments, except as required under the federal securities laws. Readers are cautioned not to place

undue reliance on any of these forward-looking statements. As used in this presentation, Consolidated Adjusted EBITDA, Consolidated Adjusted EBITDA margin, and

Discretionary Cash Flow are non-GAAP measurements. Pinnacle defines Consolidated Adjusted

EBITDA as earnings before interest income and expense, income taxes, depreciation, amortization, pre-opening and development expenses, non-cash share-based compensation, asset

impairment costs, write-downs, reserves, recoveries, corporate-level litigation settlement

costs, gain (loss) on sale of certain assets, loss on early extinguishment of debt, gain (loss) on sale of

equity security investments, minority interest and discontinued operations. Pinnacle defines

Consolidated Adjusted EBITDA margin as Consolidated Adjusted EBITDA divided by revenues.

Pinnacle defines Discretionary Cash Flow as Consolidated Adjusted EBITDA less maintenance capital expenditures, cash paid for income taxes and cash paid for interest expense.

Ameristar defines Adjusted EBITDA as earnings before interest, taxes, depreciation, amortization,

other non-operating income and expenses, stock-based compensation, deferred

compensation plan expense, non-operational professional fees and river flooding expenses and

reimbursements. As shown

below, the Combined Adjusted EBITDA is shown on a combined basis of Pinnacle’s Consolidated Adjusted EBITDA and Ameristar’s Adjusted EBITDA for the period ended March 31,

2013, taking into account synergies Pinnacle expects to achieve. This presentation is for

informational purposes only and shall not constitute an offer to sell nor the solicitation of an offer to buy any securities of Pinnacle or any other issuer. |

Today’s

Speakers Anthony Sanfilippo

Pinnacle Entertainment

Chief Executive Officer

Carlos Ruisanchez

Pinnacle Entertainment

President & Chief Financial Officer

3 |

4

•

On December 21, 2012, Pinnacle announced the acquisition of Ameristar Casinos, Inc.

•

Upon consummation of the transaction, Pinnacle Entertainment is expected to be a

multi-jurisdictional gaming company with 18 properties and a presence in 13 gaming

geographies •

For the TTM period ended 3/31/2013, Pinnacle generated Consolidated Adjusted EBITDA of

$285M Pro Forma for the acquisition, Pinnacle’s TTM at 3/31/13 Consolidated

Adjusted EBITDA would have been $683M

•

Pinnacle intends to raise:

$1,000M, 5-year Revolver

$1,600M, 7-year Term Loan B

Up to $800M of new Senior Unsecured Notes

•

Pinnacle intends to use the proceeds to fund the aggregate cash consideration for its pending

acquisition of Ameristar, refinance its existing credit facilities, pay related

transaction fees and expenses, redeem its existing 8.625% senior notes due 2017 and

provide working capital and funds for general corporate purposes after the

acquisition Ameristar Transaction Overview

1.

For

a

reconciliation

of

these

non-GAAP

financial

measures,

please

see

the

Appendix

at

the

end

of

this

presentation.

Pro

forma

Consolidated

Adjusted

EBITDA

represents

the

sum

of

each

company’s

reported

TTM

at

3/31/13

Consolidated

Adj.

EBITDA

plus

$40M

of

synergies

and

$10.5M

Baton

Rouge

annualization

increment

adjustment.

Pro

forma

Consolidated

Adjusted

EBITDA

does

not

reflect

the

removal

of

Adjusted

EBITDA

from

Lumiere

Place

Casino

and

Hotels.

In

the

TTM

period

ended

3/31/13,

the

net

revenues

and

Adjusted

EBITDA

for

Pinnacle’s

St.

Louis

segment

were

$389.4M

and

$98M,

respectively.

In

the

TTM

period

ended

3/31/13,

Lumiere

Place

Casino

and

Hotels

generated

net

revenues

and

Adjusted

EBITDA

of

$190.7M

and

$34.3M,

respectively,

comprising

49%

and

35%

of

the

St.

Louis

segment

results,

respectively.

1 |

$26.50 in

cash per ASCA share $2.8B total consideration, including assumed debt

7.7x 2012 Consolidated Adjusted EBITDA

Committed debt financing

FTC consent order & remaining state regulatory approvals

3Q13, subject to customary closing conditions and remaining

required regulatory approvals

Ameristar Acquisition Overview

5

Per Share

Consideration

Enterprise Value

Ameristar Valuation

Sources of Financing

Approval Process

Expected Closing |

Pro Forma

Company Profile 6

+

=

Pro Forma

% Growth

3

TTM 3/31/13

Net Revenues

1

$1,217

$1,178

$2,457

101.9%

TTM 3/31/13

Adj. EBITDA

2

$285

$348

$683

140.2%

TTM 3/31/13

Adj. EBITDA Margin

2

23.4%

29.6%

27.8%

440 bps

# of Properties

9

9

18

100.0%

# of Hotel Rooms

2,489

2,414

4,903

97.0%

# of Slots

10,821

12,610

23,431

116.5%

# of Tables

378

317

695

83.9%

# of Employees

8,479

7,115

15,594

83.9%

Source: Company Reports and SEC Filings

2.

For

a

reconciliation

of

these

non-GAAP

financial

measures,

please

see

the

Appendix

at

the

end

of

this

presentation.

Pro

forma

Consolidated

Adjusted

EBITDA

represents

the

sum

of

each company’s reported

TTM at 3/31/13 Consolidated Adj. EBITDA plus $40M of synergies and $10.5M Baton Rouge

annualization increment adjustment. 3.

Represents

percent

growth

from

Pinnacle

stand-alone

operations.

Note:

Historic

and

Proforma

statistics

and

financial

data

do

not

give

effect

to

the

anticipated

regulatory

divestitures

of

Lumiere

Place

Casino

and

Hotels

and

Ameristar’s

Lake

Charles

development project. In the

TTM period ended 3/31/13, the net revenues and Adjusted EBITDA for Pinnacle’s St. Louis

segment were $389.4M and $98M, respectively. In the TTM period ended 3/31/13, Lumiere

Place

Casino

and

Hotels

generated

net

revenues

and

Adjusted

EBITDA

of

$190.7M

and

$34.3M,

respectively,

comprising

49%

and

35%

of

the

St.

Louis

segment

results,

respectively.

1.

Pro

forma

combined

company

net

revenue

adjusted

for

$62M

Baton

Rouge

annualization

increment.

($M)

|

Enhanced

Footprint in Attractive Markets 7

•

A leading gaming company in the U.S.

•

PF Net Revenues of $2.5B (TTM at 1Q13)

•

PF Consolidated Adj. EBITDA of $683M (TTM at 1Q13)

Ameristar

Pinnacle Entertainment

•

18 properties in 13 distinct geographies

•

4,903 rooms

•

23,431 slot machines

•

695 table games

East Chicago

St. Charles

Council

Bluffs

Kansas City

Blackhawk

Lake Charles

Vicksburg

Note:

Historic

and

Proforma

statistics

and

financial

data

do

not

give

effect

to

the

anticipated

regulatory

divestitures

of

Lumiere

Place

Casino

and

Hotels

and

Ameristar’s

Lake

Charles

development

project |

8

Complementary Properties |

9

With Strong Brands |

10

In Attractive Gaming Markets |

11

Well Maintained, No Deferred Maintenance |

Transaction,

FTC, & Regulatory Process Update 12

FTC

Process

Update

State Gaming

Regulators

•

The FTC filed an administrative complaint seeking to block the transaction due to concerns

regarding unfair competition in St. Louis, MO and Lake Charles, LA

•

An agreement in principle was reached with the FTC Bureau of Competition Staff regarding

proposed divestiture remedies to gain clearance to close the transaction. Remedies

include: •

Received Nevada, Iowa, Mississippi and Indiana regulatory approval

•

Louisiana

and

Missouri

regulatory

approvals

are

expected

in

July 2013

Transaction

Process

•

Transaction received ASCA shareholder approval

•

Received requisite consents on Ameristar’s 7.5% Senior Notes due 2021 in April

2013 •

Meaningful progress on integration planning and synergies

A sale of Lumière Place Casino & Hotel and the Four Seasons Hotel & Spa St.

Louis A sale of the Ameristar Lake Charles development project

•

Detailed terms and conditions of the proposed divestiture remedies are currently being

negotiated,

with

a

Consent

Order

finalizing

the

process

expected

to

be

approved

by

the

FTC

in early August 2013 |

Regulatory

Asset Divestiture Update 13

•

Net divestiture proceeds from Lake Charles will be

used to repay debt and reduce leverage, post close

•

Upon completion, the divestiture of the Lake Charles

project eliminates meaningful future growth cap ex

commitments, which is expected to enhance free

cash flow generation and hasten debt repayment and

leverage reduction

•

Ameristar has previously disclosed that through

3/31/13, it had invested total capital of $144.5M in

the Lake Charles project, and that it expects capital

spending of $84.0 million related to Lake Charles

design and construction costs in 2Q13.

•

Net divestiture proceeds from Lumiere Place Casino

and Hotels will be used to repay debt and reduce

leverage, post close

•

In the TTM period ended 3/31/13, the net revenues

and Adjusted EBITDA for Pinnacle’s St. Louis segment

were $389.4M and $98M, respectively. In the TTM

period ended 3/31/13, Lumiere Place Casino and

Hotels generated net revenues and Adjusted EBITDA

of $190.7M and $34.3M, respectively, comprising

49% and 35% of the St. Louis segment results,

respectively.

Lumière Place Casino and Hotels

Ameristar Casino Resort Spa Lake Charles |

14

Key Credit Considerations |

15

Our combination with Ameristar is transformative and brings together two

complementary asset portfolios

Our geographic, financial and operational diversification will be significantly enhanced

We expect to have a much larger cash flow base, with increased scale and distribution

We expect to generate at least $40M of annual synergies

We expect the combined company will generate significant discretionary cash flow

Pro forma discretionary cash flow is expected to increase from $121M to $315M

Merger synergies and tax asset utilization is expected to enhance our cash flow

generation Post-completion of Lake Charles divestiture, growth capital spending is

limited to the $209M River Downs project and $20M New Orleans hotel expansion

We

expect

to

use

our

enhanced

cash

flow

generation

to

repay

debt

and

reduce

leverage

to

the

targeted range of 3.5x-4.0x

Anticipated regulatory divestitures improve the combined Company’s credit profile

Upon completion, we expect to use net divestiture proceeds to repay debt and reduce

leverage Lake Charles divestiture eliminates significant future growth cap ex

commitments; remaining growth cap ex commitments are serviceable with discretionary

cash flow We expect divestitures to further enhance diversification and reduce pro

forma concentrations in St. Louis and Lake Charles (the combined Company’s two

largest gaming geographies) Key Transaction and Credit Highlights

1. For a detailed calculation of Pinnacle Stand Alone and Proforma Combined Company

Discretionary Cash Flow, please see the Appendix at the end of this presentation.

1 |

Sources &

Uses 16

Sources ($M)

Uses ($M)

Sources ($M)

Amount

Uses ($M)

Amount

Debt summary

Equity purchase price @ $26.50 per share

$959

$1,000M revolver

$387

Term loan B

1,600

Pinnacle Debt

Secured debt

$1,987

Revolver repayment

-

Term loan B repayment

319

Assumed existing Pinnacle bonds

$675

Refinance existing Pinnacle bonds

446

Assumed existing Ameristar bonds

1,040

Assumed bonds

675

New senior unsecured notes

800

Total Pinnacle debt

$1,440

Unsecured debt

$2,515

Ameristar Debt

Total debt

$4,502

Revolver repayment

-

Term Loan A repayment

190

Term Loan B repayment

685

Assumed 2021 notes

1,040

Existing other debt

0

Total Ameristar debt

$1,915

Estimated transaction fees

$187

Total sources

$4,502

Total uses

$4,502

Note:

Based

on

funded

debt

at

close;

refinanced

debt

balances

are

as

of

3/31/13.

Not

pro

forma

for

the

regulatory

divestiture

of

Lumière

Place

Casino

and

Hotels

and

the Ameristar

Lake

Charles

development

project |

1.

For a reconciliation of non-GAAP financial measures, please see the Appendix . Pro

forma Consolidated Adjusted EBITDA represents the sum of each company’s reported TTM at 3/31/13 Consolidated Adj.

EBITDA plus $40M of synergies and $10.5M Baton Rouge annualization increment adjustment. Pro

forma Consolidated Adjusted EBITDA does not reflect the removal of Adjusted EBITDA from Lumiere Place

Casino and Hotels. In the TTM period ended 3/31/13, the net revenues and Adjusted EBITDA for

Pinnacle’s St. Louis segment were $389.4M and $98M, respectively. In the TTM period ended 3/31/13, Lumiere

Place Casino and Hotels generated net revenues and Adjusted EBITDA of $190.7M and $34.3M,

respectively, comprising 49% and 35% of the St. Louis segment results, respectively.

2.

Excludes synergies in calculations for pro forma Pinnacle

Capitalization ($M)

Divestiture Proceeds

Merger

Pro forma

($M)

Pinnacle

Ameristar

Combined

Adjustment

Combined (1)

Cash

$99

$125

$224

-

$224

-

Revolver

-

-

-

-

-

Term loan A

-

190

190

(190)

-

Term loan B

319

685

1,004

(1,004)

-

-

New revolver

-

-

-

387

387

New term loan B

-

-

-

1,600

1,600

Sr. secured debt

319

875

1,194

793

1,987

PNK -

8.625% Senior notes due 2017

446

-

446

(446)

-

PNK -

8.75% Senior subordinated notes due 2020

350

-

350

-

350

PNK -

7.75% Senior subordinated notes due 2022

325

-

325

-

325

ASCA -

7.5% Senior unsecured notes due 2021

-

1,040

1,040

-

1,040

Other debt

-

0

0

(0)

-

New senior unsecured notes

-

-

-

800

800

Total debt

$1,440

$1,915

$3,355

$1,147

$4,502

TTM 3/31/13 Consolidated Adj. and PF EBITDA

1

$285

$348

$633

$50

$683

TTM 3/31/13 Reported and PF Interest expense

117

116

233

34

267

At closing -

03/31/13

Interest coverage(2)

2.4x

3.0x

2.7x

2.4x

Sr. sec. debt / TTM Adj. EBITDA

1.1x

2.5x

1.9x

2.9x

Sr. sec. net debt / TTM Adj. EBITDA

0.8x

2.2x

1.5x

2.6x

Total debt / TTM Adj. EBITDA

5.1x

5.5x

5.3x

6.6x

Total net debt / TTM Adj. EBITDA

4.7x

5.1x

4.9x

6.3x

Sr. Secured Debt:

Net divestiture

proceeds will be used

to repay

Term Loan B

PF total leverage,

sr. secured

leverage, and

interest coverage

ratios will benefit

from debt pay

down with asset

sales proceeds.

Pro Forma Capitalization

17 |

Attractive

Debt Maturity Profile 18

•

Pro forma, the Company will have no near term maturities and significant room to

generate cash flow and repay or refinance existing debt

Note: Based on funded debt, not adjusted for net proceeds from anticipated regulatory

divestitures of Lumière Place Casino and Hotels and Ameristar’s Lake Charles development project.

New $800M senior unsecured note is assumed to mature in ten years; actual term of note may

differ. Revolver

TLB

PNK notes

ASCA notes

New senior unsecured notes

$2,200

$2,000

$1,800

$1,600

$1,400

$1,200

$800

$600

$400

$0

'13

'14

'15

'16

'17

'18

'19

'20

'21

'22+

$200

$1,000

$1,950

$1,040

$1,125

$387

$1,600

$350

$800

$325

Pro forma Debt Maturity Profile ($M)

$1,000 |

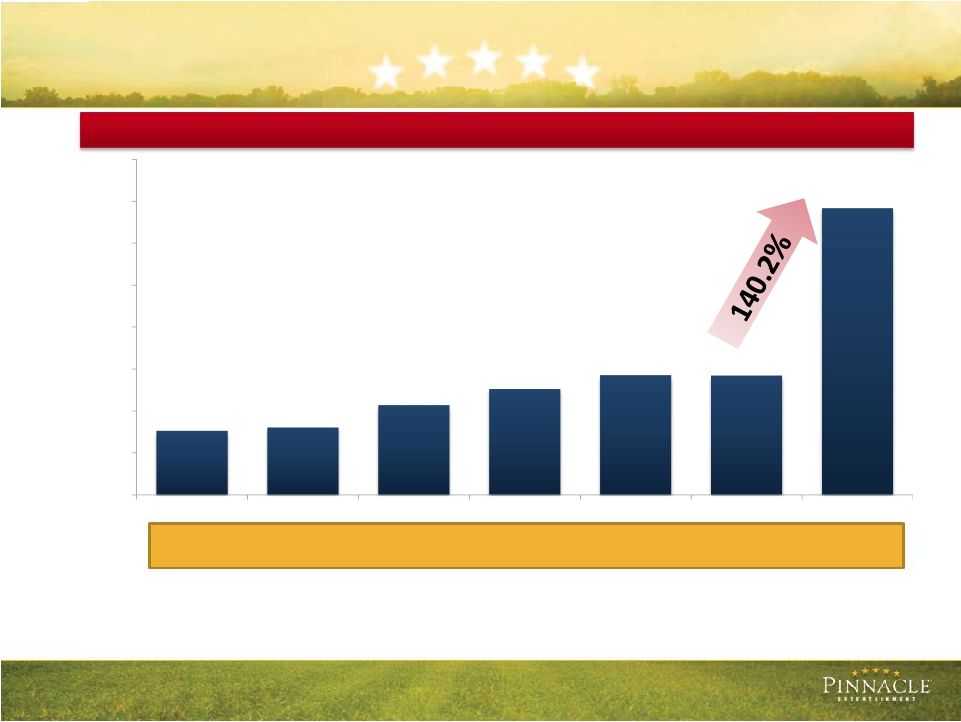

Demonstrated

History of Growth 19

Pinnacle Historical Consolidated Adj. EBITDA and Combined Pro forma Consolidated Adj. EBITDA

($M) # of assets:

# of gaming positions(2):

$683.3

$284.5

$285.2

$252.2

$213.6

$160.2

$152.8

$800.0

$700.0

$600.0

$500.0

$400.0

$300.0

$200.0

$100.0

$0.0

2008

2009

2010

2011

2012

TTM 3/31/13 (1)

Pro Forma (1)

8

8

8

7

9

9

18

28,296

13,467

13,467

11,688

12,700

12,141

14,090

1.

For a reconciliation of these non-GAAP financial measures, please see the Appendix at the

end of this presentation. Pro forma Consolidated Adjusted EBITDA represents the sum of each company’s reported TTM at

3/31/13 Consolidated Adj. EBITDA plus $40M of synergies and $10.5M Baton Rouge annualization

increment adjustment. Pro forma Consolidated Adjusted EBITDA does not reflect the removal of Adjusted EBITDA from

Lumiere Place Casino and Hotels. In the TTM period ended 3/31/13, the net revenues and

Adjusted EBITDA for Pinnacle’s St. Louis segment were $389.4M and $98M, respectively. In the TTM period ended 3/31/13,

Lumiere Place Casino and Hotels generated net revenues and Adjusted EBITDA of $190.7M and

$34.3M, respectively, comprising 49% and 35% of the St. Louis segment results, respectively. Growth rate represents

percent growth of pro forma from Pinnacle stand-alone operations. 2. Represents the sum of table games multiplied by seven positions

plus total slot positions |

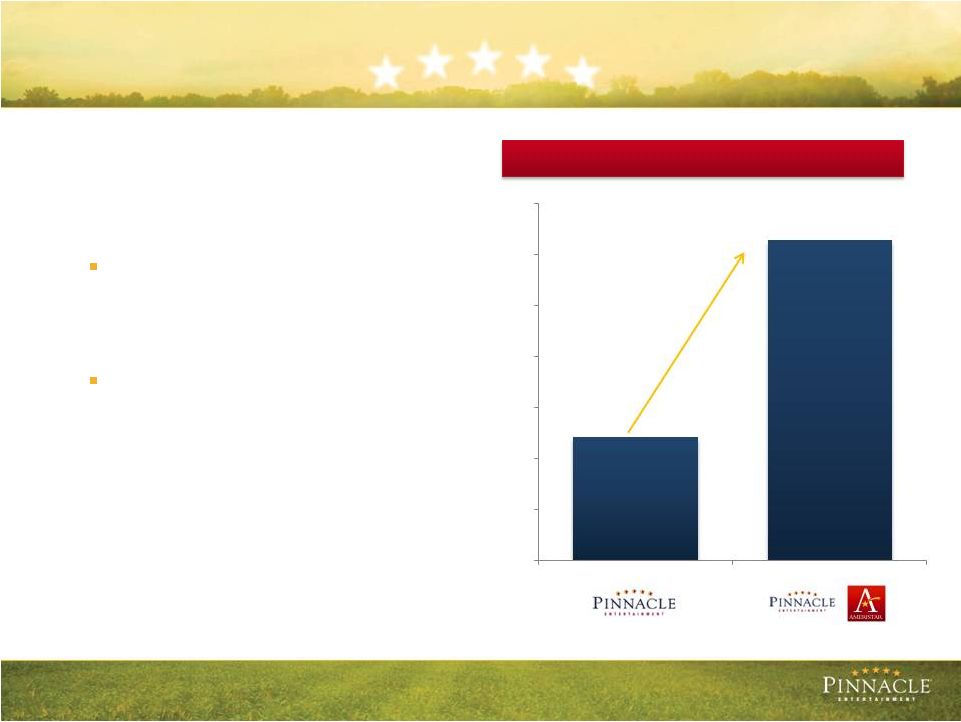

Attractive

Margin Opportunity 20

•

Combined platform margins to benefit from efficiencies of scale and synergies

•

Additional margin opportunities from leveraging best practices from both companies and

applying them across the combined enterprise

Combination With Ameristar Is Significantly Accretive To Pinnacle’s Consolidated Adj.

EBITDA Margins 1.

For

a

reconciliation

of

these

non-GAAP

financial

measures,

please

see

the

Appendix

at

the

end

of

this

presentation.

Pro

forma

Consolidated

Adjusted

EBITDA

represents

the

sum

of

each

company’s

reported

TTM at 3/31/13

Consolidated

Adj.

EBITDA

plus

$40M

of

synergies

and

$10.5M

Baton

Rouge

annualization

increment

adjustment.

Pro

forma

Consolidated

Adjusted

EBITDA

does

not

reflect

the

removal

of

Adjusted EBITDA from Lumiere Place Casino and

Hotels.

In

the

TTM

period

ended

3/31/13,

the

net

revenues

and

Adjusted

EBITDA

for

Pinnacle’s

St.

Louis

segment

were

$389.4M

and

$98M,

respectively.

In

the

TTM

period ended 3/31/13, Lumiere Place Casino and Hotels generated

net

revenues

and

Adjusted

EBITDA

of

$190.7M

and

$34.3M,

respectively,

comprising

49%

and

35%

of

the

St.

Louis

segment

results,

respectively. Growth

rate

represents

basis

point

increase

of

pro

forma

margin

from

Pinnacle stand-

alone operations.

17.0%

20.2%

22.1%

23.8%

23.4%

27.8%

5%

10%

15%

20%

25%

30%

35%

2009

2010

2011

2012

TTM 3/31/13 (1)

Pro Forma (1) |

Diversified

Revenue Platform 21

•

Significantly de-risks the portfolio by more than doubling gaming geographies to 13

•

Balanced portfolio decreases pro forma revenue reliance on two largest gaming

geographies by more than 20 percentage points

•

St. Louis and Lake Charles divestitures are expected to further reduce pro forma

concentrations

Pinnacle

3/31/13

TTM

Net

Revenue

Diversification

¹

Pro Forma

3/31/13

TTM

Net

Revenue

Diversification

¹

St. Louis, MO,

32.4%

Lake Charles, LA,

31.4%

Belterra, IN,

12.7%

New Orleans,

LA, 10.0%

Baton Rouge,

LA, 7.0%

Bossier City, LA,

6.6%

St. Louis, MO,

26.8%

Lake Charles,

LA, 15.4%

Belterra, IN,

6.3%

New Orleans,

LA, 4.9%

Baton Rouge,

LA, 6.0%

Kansas City,

MO, 8.5%

Council Bluffs,

6.7%

Vicksburg, MS,

4.8%

Denver, CO,

6.5%

Greater

Chicago, 8.5%

Jackpot, NV,

2.3%

Bossier City,

LA, 3.2%

1.

Net revenue is derived from Pinnacle and Ameristar’s respective 10-Qs for the three

months ended March 31, 2013 and 2012 and 10-Ks for the twelve months ended December 31, 2012. Net revenue diversification

calculations are based upon reported segment net revenue data for Pinnacle in the

stand-alone case and for Pinnacle and Ameristar in the pro forma case

Note: Historic and pro forma financial data does not give effect to the anticipated

regulatory divestiture of Lumiere Place Casino and Hotels, net revenue Data excludes Pinnacle’s Racetrack segment, and pro forma net revenue

includes a $62M Baton Rouge annualization increment adjustment.

|

Enhanced

Scale 22

Net Revenue ($M)

EBITDA ($M)

Source: Company documents and filings

1. Figures are based on TTM at 3/31/13. For a reconciliation of non-GAAP financial

measures, please see the Appendix at the end of this presentation. 2. Pro forma

adjustments: BYD for the Peninsula acquisition; PENN for the Harrah’s St. Louis acquisition; CHDN for the Riverwalk Casino acquisition.

3. 3/31/13 TTM pro forma Revenue includes $62M Baton Rogue annualization increment

adjustment 4. For

a

reconciliation

of

these

non-GAAP

financial

measures,

please

see

the

Appendix

at

the

end

of

this

presentation.

Pro

forma

Consolidated

Adjusted

EBITDA

represents

the

sum

of

each

company’s

reported

TTM

at

3/31/13

Consolidated

Adj.

EBITDA

plus

$40M

of

synergies

and

$10.5M

Baton

Rouge

annualization

increment

adjustment.

Pro

forma

Consolidated

Adjusted

EBITDA

does

not

reflect

the

removal

of

Adjusted

EBITDA

from

Lumiere

Place

Casino and Hotels. In the TTM period ended 3/31/13, the net revenues and Adjusted EBITDA for

Pinnacle’s St. Louis segment were $389.4M and $98M, respectively. In the TTM period ended 3/31/13, Lumiere Place Casino and

Hotels

generated

net

revenues

and

Adjusted

EBITDA

of

$190.7M

and

$34.3M,

respectively,

comprising

49%

and

35%

of

the

St.

Louis

segment

results,

respectively.

Growth

rate

represents

percent

increase

of

pro

forma

from

Pinnacle stand-alone operations.

1

1

102% growth

140% growth |

Significant

Discretionary Cash Flow Accretion 23

•

Transaction increases discretionary

cash flow generation to fund debt

repayment and leverage reduction

Combination is expected to add

more than $190M in annual

discretionary cash flow

Total annual pro forma

discretionary cash flow is

expected to increase to

approximately $315M

1. For a detailed calculation of Pinnacle Stand-alone and pro forma Combined Company

Discretionary Cash Flow, please see the Appendix at the end of this presentation.

160%

growth

+$194M

$314.7

$121.2

$350

$300

$250

$200

$150

$100

$50

$-

PNK TTM 3/31/13 (Stand-alone)

Pro Forma TTM 3/31/13

Discretionary

Cash

Flow

Generation¹

($M) |

Enhanced Free

Cash Flow Generation 24

Pinnacle’s credit profile will improve from:

(1) repayment of Term Loan B with regulatory asset sale proceeds, and

(2) utilization of enhanced cash flow stream to repay debt and reduce leverage

1.

River Downs budget of $209M excludes capitalized interest, original acquisition cost of $45M

and state gaming license fees of $50M •

Elimination of Lake Charles growth cap ex reduces burden on the combined

company’s pro forma TTM at 3/31/13 discretionary cash flow of $315M

•

Post asset divestitures, the Company’s growth cap ex commitments will be limited to

only two growth projects:

River Downs, $209M total spend ($7.5M incurred through

3/31/13)¹ New Orleans hotel growth cap ex spend of

$20M •

Merger synergies and lower cost of capital should benefit pro forma cash flow

generation

•

NOLs and other tax assets are expected to reduce Federal cash taxes, enhance cash

flow generation, and hasten balance sheet deleveraging |

25

•

Pinnacle expects to generate at least $40M of annual synergies

Clearly Identified Synergies

Corporate departments:

$40M of annual synergies

Public

Company

Costs

Named

Executive

Officers

Marketing

IT

HR

Accounting/

Tax

Planning and

Analysis

Strategic

Sourcing

Internal Audit

Legal/

Compliance

Government

and Public

Affairs

Design and

Construction

Corporate

Operations

Support

Administration

Property/

Regional

Operations

Board

of Directors

(outside) |

Substantial

Additional Cash Flow From Tax Attributes 26

•

Pinnacle currently has meaningful tax assets that will be utilized to offset taxable

income for a multi-year period

Pinnacle’s current base Federal NOL is approximately $271M

Federal NOL is expected to increase by approximately $241M upon completion

of Atlantic City land disposition

Ameristar has taxable income reductions related to goodwill amortization for its

Kansas City and East Chicago properties

Potential

additional

NOL

creation

from

required

regulatory

asset

divestitures in

St. Louis and Lake Charles |

Other Recent

Developments 27

Land Sales

Activity

In the process of selling 20 acres of land in Atlantic City

Transaction

is

expected

to

close

by

the

end

of

3Q13

for

approximately

$30.6M

of

net

proceeds

AC

land

sale

is

expected

to

crystalize

an

additional

Federal

NOL

of

approximately

$241M

Marketing excess land in Reno, NV and committed to selling Ameristar’s land in

Springfield, MA

Development

Activity

Focused

on

hotel

cap

ex

spend

for

River

City

property

–

which

is

on

time

and

on

budget

1,600 space parking deck opened in November 2012

Event Center opened in June 2013

200-room hotel expected to open in September 2013

Construction of new $20M New Orleans hotel began in 1Q13; expected completion in

late- 2Q14

ACDL has completed two $30M capital raises since December 2012, neither of which

Pinnacle participated in; Phase 1 resort expected to open in late July 2013

|

28

Financial Overview |

29

1Q Net Revenue

1Q Net Revenue

1Q Cons. Adj. EBITDA

¹

1Q Cons. Adj. EBITDA

¹

Cons. Adj. EBITDA Margin

¹

Cons. Adj. EBITDA Margin

¹

1Q Net Revenue

1Q Net Revenue

1Q Cons. Adj. EBITDA

¹

1Q Cons. Adj. EBITDA

¹

Cons. Adj. EBITDA Margin

¹

Cons. Adj. EBITDA Margin

¹

1Q13 Results

Source: Company documents and filings

1. For a reconciliation of non-GAAP financial measures, please see the Appendix at the end

of this presentation. Note: Historic financial data does not give effect to the

anticipated divestitures of Lumiere Place Casino and Hotels and Ameristar’s Lake Charles development project |

Summary

Operating Performance 30

Total

Revenues

1

($M)

Total

Revenues

1

($M)

Consolidated

Adjusted

EBITDA

2

($M)

Consolidated

Adjusted

EBITDA

2

($M)

Capital

Expenditures

3

($M)

Capital

Expenditures

3

($M)

15.6%

17.0%

20.2%

22.1%

23.8%

23.4%

27.8%

PNK

Pro Forma

PNK

Pro Forma

PNK

Pro Forma

$979

$949

$1,059

$1,141

$1,197

$1,217

$2,457

2008

2009

2010

2011

2012

TTM 3/31/13

PF TTM

3/31/13

$153

$161

$214

$252

$285

$285

$683

2008

2009

2010

2011

2012

TTM 3/31/13

PF TTM

3/31/13

$306

$226

$158

$154

$300

$273

$424

2008

2009

2010

2011

2012

TTM 3/31/13

PF TTM

3/31/13

Source: Company Reports and SEC Filings

1.

Pro forma combined company net revenue adjusted for $62M Baton Rouge annualization increment

adjustment.

2.

For a reconciliation of non-GAAP financial measures, please see the Appendix at the end of

this presentation. Pro forma Consolidated Adjusted EBITDA represents the sum of each company’s reported TTM at 3/31/13 Consolidated Adj. EBITDA

plus $40M of synergies and $10.5M Baton Rouge annualization increment adjustment. Pro forma

Consolidated Adjusted EBITDA does not reflect the removal of Adjusted EBITDA from Lumiere Place Casino and Hotels. In the TTM period ended

3/31/13, the net revenues and Adjusted EBITDA for Pinnacle’s St. Louis segment were

$389.4M and $98M, respectively. In the TTM period ended 3/31/13, Lumiere Place Casino and Hotels generated net revenues and Adjusted EBITDA of

$190.7M and $34.3M, respectively, comprising 49% and 35% of the St. Louis segment results,

respectively.

3.

Represents reported total capital expenditures. Pro forma represents the sum of Pinnacle

and Ameristar total reported capital expenditures. |

Historical

& Pro Forma Covenant Levels 31

Total Leverage Ratio

Total Leverage Ratio

Senior Secured Leverage Ratio

Senior Secured Leverage Ratio

Interest Coverage Ratio¹

Interest Coverage Ratio¹

1. Excludes synergies in calculation for pro forma Pinnacle

Note: Historic and Pro forma leverage and coverage statistics do not give effect to

proceeds from the anticipated divestiture of Lumiere Place Casino and Hotels or Ameristar’s Lake Charles development project.

Divestiture Proceeds

Divestiture Proceeds

Net asset sales

proceeds will be

used to repay debt

and reduce PF

leverage

Specifically, net

asset sales

proceeds will be

used to repay

Term Loan B,

thereby reducing

PF total and sr.

secured leverage.

PF interest

coverage will

benefit from debt

pay down with

net asset sales

proceeds |

Key

Conclusions 32

Transformative

Transaction with

Increased Scale

and Diversity

Seamless

Integration and

Meaningful

Synergies

Proven

Management Team

Implementing Best

Practices

Strong Cash Flow

Profile Drives

Debt Repayment

and Leverage

Reduction

Long-Term Value

Creation

Opportunities |

33

Syndication Update |

Summary

Indicative Terms and Conditions 34

Summary indicative terms and conditions

Borrower

Pinnacle

Entertainment,

Inc.

(the

“Company”

or

the

“Borrower”)

Facility

Facility

Size

Maturity

Revolver

Term Loan

$1,000 million

$1,600 million

5 years

7 years

Expected ratings

Corporate:

B1/BB-

Facility:

Ba1/BB+

Security

Perfected first priority security interest in substantially all of tangible and intangible

assets (including capital stock) of the Borrower and Guarantors, subject to certain

exceptions Amortization

TLB: 1% per annum in equal quarterly installments, with remainder at maturity

Call premium

101 soft call for twelve months

Financial

covenants

Financial covenants will apply to RC only (TLB is covenant-lite):

•

Maximum Consolidated Senior Secured Debt Ratio

•

Maximum Consolidated Total Leverage Ratio

•

Minimum Consolidated Interest Coverage Ratio

Mandatory

prepayments

•

100% of the net cash proceeds of any sale, issuance or incurrence of indebtedness by the

Borrower (other than permitted indebtedness)

•

100% of the net cash proceeds of any sale or other disposition (including insurance proceeds

and condemnation awards) by the Borrower or any of its restricted subsidiaries of any

assets subject to customary exceptions and reinvestment rights •

50% of excess cash flow

Use of proceeds

Fund the aggregate cash consideration for the acquisition of Ameristar Casinos, Inc., repay

existing indebtedness subject to certain exceptions, refinance its existing credit

facilities, pay related transaction fees and expenses, redeem its existing 8.625% senior notes

due 2017 and provide working capital and funds for general corporate purposes after the

acquisition |

Transaction

timetable 35

Week of

Term Loan B

July 15

•

Lender meeting (July 16

)

July 29th

•

Commitments due from lenders (July 29

)

•

Allocate term loan

August

•

Close transaction

Denotes bank holiday

Financing key date

th

th

th

July 2013

August 2013

S

M

T

W

T

F

S

S

M

T

W

T

F

S

1

2

3

4

5

6

1

2

3

7

8

9

10

11

12

13

4

5

6

7

8

9

10

14

15

16

17

18

19

20

11

12

13

14

15

16

17

21

22

23

24

25

26

27

18

19

20

21

22

23

24

28

29

30

31

25

26

27

28

29

30

31 |

36

Appendix |

Gaming Portfolio

Overview 37

Source: Per company SEC filings as of 3/31/13

Note:

Historic

and

pro

forma

statistics

and

financial

data

do

not

give

effect

to

the

anticipated

divestitures

of

Lumiere

Place

Casino

and

Hotels

and

Ameristar’s

Lake

Charles

development

project.

River

City

and

Lumiere Place Casino and Hotels financial data is presented in the St. Louis segment report

format. In the trailing twelve month period ended March 31, 2013, Lumiere Place Casino and Hotels generated Net

Revenues and Adjusted EBITDA of $190.7M and $34.3M, respectively, comprising 49% and 35% of the

St. Louis segment results, respectively. State

Location

Property

Market

Slots

Tables

No. of

gaming

positions

Rooms

LTM

Revenue ($M)

LTM

EBITDA ($M)

% Margin

Belterra

Belterra, IN

1,416

53

1,734

608

$152.9

$30.4

19.9%

Ameristar Casino Hotel

(East Chicago)

East Chicago, IN

1,970

36

2,186

288

206.8

37.0

17.9%

Boomtown Casino

(New Orleans)

New Orleans, LA

1,288

39

1,522

0

120.1

37.3

31.1%

L'Auberge Casino

(Resort Lake Charles)

Lake Charles, LA

1,616

75

2,066

205

377.3

112.7

29.9%

L'Auberge Casino

(Baton Rouge)

Baton Rouge, LA

1,480

56

1,816

187

84.6

10.0

11.8%

Boomtown Casino and Hotel

(Bossier City)

Bossier City, LA

999

25

1,149

494

79.4

17.8

22.4%

Lumière Place Casino & hotels

St. Louis, MO

2,004

68

2,412

494

River City Casino

St. Louis, MO

2,018

62

2,390

0

Ameristar Casino Resort Spa

(St. Charles)

St. Charles, MO

2,620

72

3,052

397

266.4

93.8

35.2%

Ameristar Casino Hotel

(Kansas City)

Kansas City, MO

2,590

72

3,022

184

207.4

73.5

35.4%

Iowa

Ameristar Casino Hotel

(Council Bluffs)

Council Bluffs, IA

1,590

23

1,728

444

164.3

67.7

41.2%

Mississippi

Ameristar Casino Hotel

(Vicksburg)

Vicksburg, MS

1,570

41

1,816

149

117.7

53.5

45.4%

Colorado

Ameristar Casino Hotel

(Black Hawk)

Black Hawk, CO

1,490

47

1,772

536

159.2

57.7

36.2%

Nevada

The Jackpot Properties

Jackpot, NV

780

26

936

416

56.3

16.2

28.8%

Ohio

River Downs

Cincinnati, OH

11.8

(1.3)

NM

98.0

389.4

25.2%

Indiana

Louisiana

Missouri

Kansas City

Vicksburg

East Chicago

Black Hawk |

38

Boomtown New

Orleans

Bossier City

Lumière Place

Atlantic City

Property¹

Pinnacle Entertainment, Inc.

(Public Co. / Debt Issuer)

Pinnacle

Stockholders

L'Auberge Lake

Charles Casino

Resort

River Downs

Racetrack

Hotel Lumière

L'Auberge

Baton Rouge

Casino Magic,

LLC

River City

Belterra Casino

Resort

Cactus Pete’s

Inc.

Ameristar

Casino

Council

Bluffs, Inc.

Ameristar

Casino

Kansas City,

Inc.

Ameristar

East Chicago

Holdings, LLC

Ameristar

Casinos

Financing

Corp.

Ameristar

Casino St.

Louis, Inc.

Ameristar

Casino East

Chicago, LLC

Ameristar

Casino Lake

Charles, LLC

Ameristar

Casino

Vicksburg,

Inc.

Ameristar

Casino St.

Charles, Inc.

Ameristar

Casino Black

Hawk, Inc.

Ameristar

Lake Charles

Holdings, LLC

Ameristar

Casino Las

Vegas, Inc.

PNK (SAM) LLC²

PNK

Development 7

/ HPT

Stockholders

Borrower Entity

Non-Borrower Entity

100% Owner

Interests in

Vietnam

Venture and

Other Assets

PNK

Development 11

Pinnacle Unrestricted Subsidiaries

Interest in

Retama Park

Racetrack

1.

Pinnacle’s Atlantic City Property is held in unrestricted subsidies under the Credit

Agreement 2.

Management company that manages Retama Park Racetrack

$1,000M Revolver

$1,600M Term Loan B

Existing ASCA 7.5% Senior Unsecured Notes due 2021

Existing PNK 8.75% Senior Subordinated Notes due 2020

Existing PNK 7.75% Senior Subordinated Notes due 2022

Pinnacle Assets

Restricted Subsidiaries

Pro forma Organizational Structure

Ameristar

Casino

Springfield,

LLC. |

Pinnacle

Consolidated Adjusted EBITDA Reconciliation 39

PINNACLE ENTERTAINMENT: RECONCILIATION OF INCOME (LOSS) FROM CONTINUING OPERATIONS TO

CONSOLIDATED ADJUSTED EBITDA Trailing 12-month

period ended

(Dollars in Thousands)

June 30, 2012

September 30, 2012

December 31, 2012

March 31, 2013

March 31, 2013

Income (Loss) From Continuing Operations

12,943

6,757

(42,013)

(85,346)

(107,659)

Income Tax Expense (Benefit)

2,150

1,962

974

611

5,697

Interest Expense, Net of Interest Income and Capitalized Interest

22,485

22,960

26,324

28,670

100,439

Loss on Equity Method Investment

1,244

1,367

26,574

92,181

121,366

Depreciation and Amortization

26,201

27,562

35,685

28,002

117,450

Write-downs, Reserves and Recoveries, net

788

103

10,919

314

12,124

Non-Cash Share Based Compensation

3,155

1,859

1,728

1,914

8,656

Pre-opening and Development Costs

4,212

11,546

3,117

7,561

26,436

Consolidated Adjusted EBITDA

73,178

74,116

63,308

73,907

284,509

Income (Loss) From Continuing Operations Margin

4.3%

2.2%

-13.9%

-27.3%

-8.8%

Consolidated Adjusted EBITDA Margin

24.5%

24.4%

21.0%

23.6%

23.4%

Source: Pinnacle Entertainment SEC Filings

For the three months ended, |

Ameristar

Adjusted EBITDA Reconciliation 40

AMERISTAR CASINOS: RECONCILIATION OF GAAP NET INCOME TO ADJUSTED EBITDA

Trailing 12-month

period ended

(Dollars in Thousands)

June 30, 2012

September 30, 2012

December 31, 2012

March 31, 2013

March 31, 2013

GAAP Net Income

17,622

16,131

1,215

17,978

52,946

Income Tax Provision

12,480

11,612

1,898

11,441

37,431

Interest Expense, Net of Capitalized Interest

28,821

29,652

29,383

28,634

116,490

Interest Income

(12)

(7)

(5)

(3)

(27)

Other

112

-

-

-

112

Net Loss (gain) on disposition of assets

550

(28)

208

(9)

721

Impairment of Fixed Assets

-

-

9,563

23

9,586

Depreciation and Amortization

26,999

27,036

25,761

25,147

104,943

Stock Based Compensation

3,650

3,738

5,505

3,752

16,645

Non-operational Professional Fees & Merger related Costs

-

-

6,669

2,175

8,844

Non-Capitalizable Lake Charles Development Costs

-

-

193

512

705

Deferred Compensation Plan Expense

124

-

-

-

124

Net River Flooding (reimbursements) expenses

(189)

-

-

-

(189)

Adjusted EBITDA

90,157

88,134

80,390

89,650

348,331

Net Income Margin

5.9%

5.4%

0.4%

6.1%

4.5%

Adjusted EBITDA Margin

30.4%

29.6%

27.8%

30.4%

29.6%

Source: Ameristar Casinos SEC Filings

For the three months ended, |

Pro forma

Consolidated Adjusted EBITDA Reconciliation 41

PRO FORMA COMBINED COMPANY CONSOLIDATED ADJUSTED EBITDA WITH SYNERGIES AND BATON ROUGE

ANNUALIZATION TTM at 3/31/2013

Pro forma Combined Company

(Dollars in Thousands)

Consolidated Adj. EBITDA

Pinnacle Entertainment TTM at 3/31/13 Consolidated Adj. EBITDA (a)

284,509

Ameristar Casinos TTM at 3/31/13 Consolidated Adj. EBITDA (a)

348,331

Plus: Expected Merger Synergies (b)

40,000

Plus: Baton Rouge Adjusted EBITDA Annualization Increment (c)

10,486

Combined Company Pro forma Consolidated Adjusted EBITDA

683,326

Source: Pinnacle Entertainment and Ameristar Casinos SEC Filings and Company Estimates.

(a)

Represents company reported Consolidated Adjusted EBITDA for the trailing twelve month period ended

March 31, 2013. Pinnacle's Consolidated Adjusted EBITDA is not adjusted for Lumiere

Place Casino and Hotels. In the trailing twelve month period ended March 31, 2013, the net

revenues and Adjusted EBITDA for Pinnacle's St. Louis segment were $389.4 million and $98

million, respectively. In the trailing twelve month period ended March 31, 2013, the net revenues and Adjusted

EBITDA for Lumiere Place Casino and Hotels was $190.7 million and $34.3 million, respectively,

comprising 49% and 35% of the St. Louis segment results, respectively.

(b)

Estimated $40 million of annual synergies expected to be generated by the combination of Pinnacle

Entertainment and Ameristar Casinos, as estimated by Pinnacle Entertainment management.

(c)

Represents the adjustment required to annualize the partial year Adjusted EBITDA operating

performance of Pinnacle Entertainment's new L'Auberge Baton Rouge property. This

calaculation is based upon the property's 2013 first quarter Adjusted EBITDA of $5.1 million

times four, minus trailing twelve months through March 31, 2013 reported Adjusted EBITDA of

$10 million. |

Pro forma

Discretionary Cash Flow Calculation 42

PINNACLE ENTERTAINMENT STAND ALONE DISCRETIONARY CASH FLOW CALCULATION

TTM at 3/31/2013

Pinnacle Entertainment

(Dollars in Thousands)

Discretionary Cash Flow

Consolidated Adjusted EBITDA at 3/31/13 (a)

284,509

Less: Interest Expense, before Capitalized Interest (b)

(116,700)

Less: Cash Paid for Income Taxes (c)

(3,546)

Less: Maintenance Capital Expensitures (d)

(43,100)

Combined Company Pro forma Discretionary Cash Flow

121,163

Source: Pinnacle Entertainment SEC Filings.

(a)

Represents Pinnacle Entertainment's reported Consolidated Adjusted EBITDA for the trailing twelve

month period ended March 31, 2013. In the trailing twelve month period ended March 31, 2013,

the net revenues and Adjusted EBITDA for Lumiere Place Casino and Hotels was $190.7 million

and $34.3 million, respectively, comprising 49% and 35% of the St. Louis segment results,

respectively. (b)

Based upon the combined company's expected pro forma capital structure. The profma capital structure

is not adjusted for proceeds from regulatory asset divestitures in St. Louis and Lake

Charles.

(c)

Estimated combined company cash taxes relate principally to state level income taxes. Federal cash

taxes are expected to be limited by the combined company's substantial Federal NOL carry

forwards.

(d)

Represents Pinnacle Entertainment's TTM at 3/31/13 total capital capital expenditures, minus capital

spending on growth projects (River Downs and L'Auberge Baton Rouge). |

Pro forma

Discretionary Cash Flow Calculation 43

COMBINED COMPANY PRO FORMA DISCRETIONARY CASH FLOW CALCULATION

TTM at 3/31/2013

Pro forma Combined Company

(Dollars in Thousands)

Discretionary Cash Flow

Combined Company Pro forma Consolidated Adjusted EBITDA at 3/31/13 (a)

683,326

Less: Pro forma Cash Interest Expense (b)

(267,385)

Less: Pro forma Combined Company Cash Taxes (c)

(4,800)

Less: Pro forma Maintenance Capital Expenditures (d)

(96,400)

Combined Company Pro forma Discretionary Cash Flow

314,741

Source: Pinnacle Entertainment and Ameristar Casinos SEC Filings.

(a)

Represents the sum of each company's reported Consolidated Adjusted EBITDA for the

trailing twelve month period ended March 31, 2013, plus $40 million of

expected synergies, $10.5 million Baton Rouge Adjusted EBITDA annualization

increment. Pinnacle's Consolidated Adjusted EBITDA is not adjusted for

Lumiere Place Casino and Hotels. In the trailing twelve month period ended

March 31, 2013, the net revenues and Adjusted EBITDA for Lumiere Place Casino and Hotels was

$190.7 million and $34.3 million, respectively, comprising 49% and 35% of St.

Louis segment results, resoectively. (b)

Based upon the combined company's expected pro forma capital structure. The

profma capital structure is not adjusted for proceeds from regulatory asset

divestitures in St. Louis and Lake Charles. (c)

Estimated combined company cash taxes relate principally to state level income

taxes. Federal cash taxes are expected to be limited by the combined

company's substantial Federal NOL carry forwards. (d)

Represents the sum of Pinnacle Entertainment and Ameristar Casinos TTM at 3/31/13

total capital capital expenditures, minus capital spending on growth

projects (Lake Charles, River Downs and L'Auberge Baton Rouge). Ameristar Casinos total capital

expenditures are further adjusted for one-time, non-recurring expenditures

related to the Vicksburg site stabilization project of

$5.1

million

and

a

$9.3

million

charge

related

to

St.

Charles

hotel

construction

litigation |