Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Del Frisco's Restaurant Group, Inc. | d565097dex11.htm |

| EX-23.1 - EX-23.1 - Del Frisco's Restaurant Group, Inc. | d565097dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 16, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DEL FRISCO’S RESTAURANT GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5812 | 20-8453116 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

930 S. Kimball Ave., Suite 100

Southlake, TX 76092

(817) 601-3421

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark S. Mednansky

Chief Executive Officer

Del Frisco’s Restaurant Group, Inc.

930 S. Kimball Ave., Suite 100

Southlake, TX 76092

(817) 601-3421

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jeffrey A. Chapman Peter W. Wardle Gibson, Dunn & Crutcher LLP 2100 McKinney Ave., Suite 1100 Dallas, TX 75201 tel: (214) 698-3100 fax: (214) 571-2900 |

Colin J. Diamond White & Case LLP 1155 Avenue of the Americas New York, NY 10036 tel: (212) 819-8200 fax: (212) 354-8113 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Common Stock, par value $0.001 per share |

5,750,000 | $21.84 | $125,580,000 | $17,130 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 750,000 shares that the underwriters have the option to purchase. See “Underwriting.” |

| (2) | Estimated solely for the purpose of calculating the registration fee under Rule 457(c) of the Securities Act of 1933, as amended, based on the average of the high and low prices of a share of common stock on the Nasdaq Global Select Market on July 10, 2013, which was $21.84. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated July 16, 2013

Del Frisco’s Restaurant Group, Inc.

5,000,000 Shares

Common Stock

The selling stockholder identified in this prospectus is offering 5,000,000 shares of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholder.

Our common stock is listed on the Nasdaq Global Select Market under the symbol “DFRG.” We are an “emerging growth company” under applicable Securities and Exchange Commission rules and are therefore subject to reduced public company reporting requirements. On July 15, 2013, the last reported sales price of a share of our common stock on the Nasdaq Global Select Market was $22.59.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholder |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

The selling stockholder identified in this prospectus has granted the underwriters an option to purchase up to 750,000 additional shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholder.

The underwriters expect to deliver the shares of common stock to purchasers on , 2013.

| Deutsche Bank Securities | Piper Jaffray | Wells Fargo Securities |

| Cowen and Company | Raymond James |

The date of this prospectus is , 2013.

Table of Contents

Table of Contents

Market and Industry Data and Forecasts

Industry, market and demographic data appearing throughout this prospectus, including information relating to our relative position in the restaurant industry, the projected growth of sales in the U.S. restaurant industry, projected changes in food expenditures and projected changes in the U.S. population, are derived principally from publicly available information, industry publications, U.S. government data, data made available by market research firms, our own data and similar sources, which we believe to be reasonable. None of the independent industry publications used in this prospectus was prepared on our or our affiliates’ behalf. Information in this prospectus concerning the average check at our restaurants is calculated on a per entrée basis and excludes tax and tip.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that may be important to you. You should carefully read this prospectus in its entirety before making an investment decision. In particular, you should read the section entitled “Risk Factors” and the consolidated and combined financial statements and notes related to those statements included elsewhere in this prospectus.

As used in this prospectus, unless the context otherwise indicates, the references to “DFRG,” “Del Frisco’s Restaurant Group,” “our company,” “the Company,” “us,” “we” and “our” refer to Del Frisco’s Restaurant Group, Inc. and its consolidated subsidiaries. Unless otherwise indicated or the context otherwise requires, financial and operating data in this prospectus reflects the consolidated business and operations of Del Frisco’s Restaurant Group, Inc. and its wholly-owned subsidiaries.

Our Company

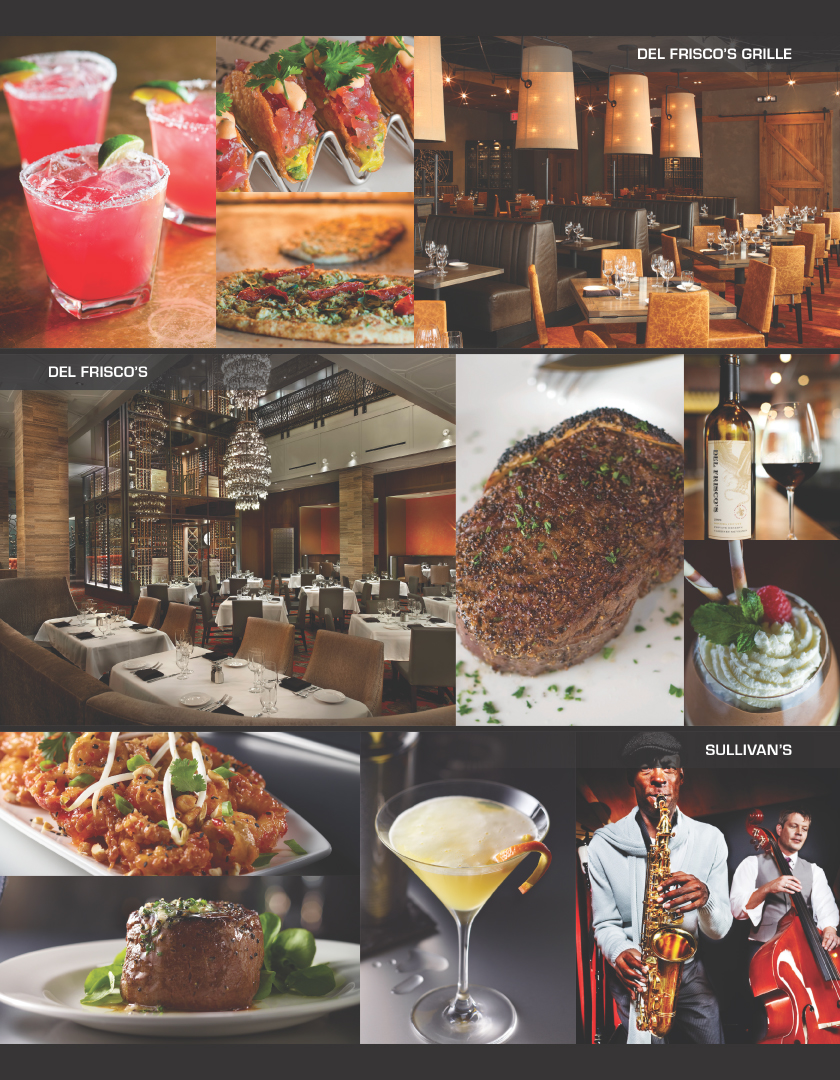

We develop, own and operate three contemporary, high-end, complementary restaurants: Del Frisco’s Double Eagle Steak House, or Del Frisco’s, Sullivan’s Steakhouse, or Sullivan’s, and Del Frisco’s Grille, or the Grille. We are a leader in the full-service steakhouse industry based on average unit volume, or AUV, EBITDA margin and comparable restaurant sales growth. We currently operate 36 restaurants in 19 states. Each of our three restaurant concepts offers steaks as well as other menu selections, such as chops and fresh seafood. Our Grille concept is designed to appeal to both business as well as upscale casual diners and features relatively less expensive entrées, such as flatbread pizzas, sandwiches and salads. These menu selections are complemented by an extensive, award-winning wine list. Del Frisco’s, Sullivan’s and the Grille are positioned within the fine dining segment and are designed to appeal to both business and local dining customers. Our Del Frisco’s restaurants are sited in urban locations to target customers seeking a “destination dining” experience while our Sullivan’s and Grille restaurants are intended to appeal to a broader demographic, allowing them to be located either in urban areas or in close proximity to affluent residential neighborhoods. We believe our success reflects consistent execution across all aspects of the dining experience, from the formulation of proprietary recipes to the procurement and presentation of high quality menu items and delivery of a positive customer experience.

We generated revenues of $232.4 million for the fiscal year ended December 25, 2012, representing 17.0% total revenue growth and 4.2% comparable restaurant sales growth over 2011. We recorded net income of $13.8 million and adjusted EBITDA of $43.0 million for 2012, representing 53.3% net income growth and 18.1% adjusted EBITDA growth over 2011. Our 2012 operating income and adjusted EBITDA margins were 10.7% and 18.5%, respectively. We generated revenues of $120.2 million for the 24 weeks ended June 11, 2013, representing 15.9% total revenue growth and 1.0% comparable restaurant sales growth over the 24 weeks ended June 12, 2012. We recorded net income of $8.0 million and adjusted EBITDA of $20.0 million for the 24 weeks ended June 11, 2013, representing a 7.1% and 2.7% decrease in net income and adjusted EBITDA, respectively, as compared to the 24 weeks ended June 12, 2012. Our operating income and adjusted EBITDA margins for the 24 weeks ended June 11, 2013 were 9.9% and 16.6%, respectively. For a reconciliation of adjusted EBITDA and adjusted EBITDA margin and a discussion of why we consider them useful, see “—Summary Historical Consolidated Financial and Operating Data.”

1

Table of Contents

Del Frisco’s Double Eagle Steak House

We believe Del Frisco’s is one of the premier steakhouse concepts in the United States. The Del Frisco’s brand is defined by its menu, which includes USDA Prime grade, wet-aged steaks hand-cut at the time of order and a range of other high-quality offerings, including prime lamb, fresh seafood, and signature side dishes and desserts. It is also distinguished by its “swarming service,” whereby customers are served simultaneously by multiple servers. Each restaurant has a sommelier to guide diners through an extensive, award-winning wine list and our bartenders specialize in hand-shaken martinis and crafted cocktails. Del Frisco’s restaurants target customers seeking a full-service, fine dining steakhouse experience. We believe the décor and ambiance, with both contemporary and classic designs, enhance our customers’ experience and differentiate Del Frisco’s from other upscale steakhouse concepts. We currently operate ten Del Frisco’s steakhouses in eight states. These restaurants range in size from 11,000 to 24,000 square feet with seating capacity for at least 300 people. Annual AUVs per Del Frisco’s restaurant were $13.8 million for the fiscal year ended December 25, 2012. During the same period, the average check at Del Frisco’s was $104.

Sullivan’s Steakhouse

Sullivan’s was created in the mid-1990’s as a complementary concept to Del Frisco’s. The Sullivan’s brand is defined by a fine dining experience at a more accessible price point, along with a vibrant atmosphere created by an open kitchen, live music and a bar area designed to be a center for social gathering and entertainment. Each Sullivan’s features fine hand-selected aged steaks, fresh seafood and a broad list of custom cocktails, along with an extensive selection of award-winning wines. We currently operate 19 Sullivan’s steakhouses in 15 states. These restaurants range in size from 7,000 to 11,000 feet with seating capacity for at least 250 people. Annual AUVs per current Sullivan’s restaurant were $4.4 million for the fiscal year ended December 25, 2012. During the same period, the average check at Sullivan’s was $59.

Del Frisco’s Grille

We developed the Grille, our newest concept, to take advantage of the positioning of the Del Frisco’s brand and to provide greater potential for expansion due to its smaller size, lower build out cost and more diverse menu. The Grille is an upscale casual concept with a menu designed to appeal more broadly to both business and casual diners that features a variety of Del Frisco’s prime aged steaks, top selling signature menu items and a broad selection of the same quality wines. The Grille also offers an assortment of relatively less expensive entrées, such as flatbread pizzas, sandwiches and salads, all prepared with the same signature flavors, high quality ingredients and presentation associated with the Del Frisco’s brand. We believe the ambiance of the concept appeals to a wide range of customers seeking a less formal atmosphere for their dining occasions. We currently operate seven Grilles in five states and the District of Columbia. Additional Grille openings are planned over the next year and we anticipate they will, like existing Grille locations, range in size from 6,500 to 8,500 square feet with seating capacity for at least 200 people. We are targeting annual AUVs per Grille restaurant of between $4.5 million and $6.0 million with an average check of between $45 and $55.

Our Business Strengths

We believe the following are key strengths of our business and serve to differentiate us from our competitors:

Multiple Top Performing Concepts with an Expanding National Platform. We are one of the nation’s leading fine dining restaurant operators. We currently have 36 restaurants in

2

Table of Contents

29 cities in 19 states in a wide variety of geographic and demographic markets. Our current locations that were operating throughout the fiscal year ended December 25, 2012 had AUVs of $7.5 million per location across all concepts, $13.8 million at our Del Frisco’s locations ($10.9 million excluding our New York location) and $4.4 million at our Sullivan’s locations. Further, we believe we appeal to landlords with desirable locations by offering three complementary concepts adaptable to a variety of areas and venues. In 2011, we expanded our national platform by opening a Del Frisco’s in Boston, Massachusetts and our first two Grille restaurants in New York City and Dallas, Texas. In 2012, we opened Grilles in Phoenix, Arizona, Washington D.C. and Atlanta, Georgia, and a Del Frisco’s in Chicago, Illinois. In 2013, we have to date opened Grilles in Houston, Texas and Santa Monica, California and expect to open three to four additional Grilles by the end of the year.

Operating Model Driving Higher Margins. Our AUVs and high average check per person, combined with our operating efficiencies, enable us to achieve industry-leading operating margins based on 2012 public company data for U.S. based full-service dining restaurants that generate a majority of their revenues from restaurant operations and excluding companies with a majority of franchised operations. We believe that our success is driven by our consistent execution across all aspects of the dining experience, from the formulation of proprietary recipes to the procurement and presentation of high quality menu items and our focus on providing a positive customer experience. Our entrepreneurial culture and bonus incentives empower and motivate the general manager at each restaurant to act as the owner of his or her restaurant. These general managers meet weekly as a group with senior management to share best practices. Chefs and kitchen staff at each restaurant are responsible for maintaining and ordering their own food inventory, thereby increasing efficiency and reducing waste and the need for additional headcount at the corporate level. We believe we achieve significant cost, quality and availability advantages through centralized sourcing from our primary suppliers of beef, wine and other products. In fiscal 2012, our revenues were comprised 66% of food and 34% of alcohol. We had operating income and restaurant-level EBITDA margins of 10.7% and 24.3% in fiscal 2012 and 9.9% and 23.2% for the 24 weeks ended June 11, 2013, respectively.

Fine Dining Concepts with Complementary Market Positions. Del Frisco’s, Sullivan’s and the Grille are fine dining concepts that share a focus on high quality food, individualized interior design and attentive service. The concepts were designed to coexist with one another, each maintaining its own identity and price point. Average checks at Del Frisco’s and Sullivan’s were $104 and $59, respectively, for the fiscal year ended December 25, 2012, and the targeted average check at the Grille is between $45 and $55. Currently, we operate multiple concepts in close proximity to each other in six of our markets. We believe our complementary positioning will continue to allow us to develop our concepts in a single metropolitan area without competing for customers. We have secured prominent locations for our restaurants and a number of unique sites not typically used for steakhouse locations, including a historic bank building, a redeveloped wharf, a landmark theater building and a former retail space in Rockefeller Center. We believe the locations of our restaurants distinguish us from our competitors, add to the strength of our brands and help drive our AUVs. Furthermore, we believe many landlords and developers seek out our concepts to be restaurant anchors for their developments as our concepts are complementary to upscale national retailers with similar target demographics.

Focus on Innovation. We have developed and created three full-service restaurant concepts. As we have grown our concepts, we have evolved each to incorporate proprietary recipes with bold and flavorful seasonings that reflect our heritage in the Southern United States, extensive wine lists, prominent bar scenes and our “swarming service.” We have

3

Table of Contents

positioned the Del Frisco’s brand as a contemporary alternative to the traditional fine dining steakhouse dining concept. We developed Sullivan’s in the mid-1990’s, featuring lower price points and live music to attract a broader clientele. The Grille, introduced in 2011, leverages and broadens Del Frisco’s appeal in a less formal and smaller format. The Grille has been recognized in the industry as an innovative and exciting new concept, including being honored with Nation’s Restaurant News’ 2012 Hot Concepts Award. We remain committed to evolving our existing concepts to remain relevant to a range of customers.

High Quality Menu Offerings with a Focus on Social Experience and Customer Service. We believe our concepts provide our customers with a true fine dining steakhouse and upscale grille experience by combining high quality food, atmosphere and service. We offer high quality cuisine across all menu items, with an emphasis on aged beef, fresh seafood and locally sourced ingredients. These offerings are complemented by an extensive, award-winning wine list and a broad cocktail selection. The dining experience is enhanced by our commitment to providing a social atmosphere and décor that includes carefully-selected artwork, private dining rooms and separate bar areas. To further enhance our customers’ dining experience we have a staff of highly-trained employees who undergo an extensive training program and are evaluated regularly by management. These employees provide our “swarming service,” which creates frequent interactions with our customers.

Experienced Executive and Restaurant Management Teams. Our executive team has extensive experience with an average of over 20 years in the restaurant industry, including significant tenure with our company as well as other high-end restaurant concepts. Our restaurant-level managers are also very experienced, with average tenure at Del Frisco’s and Sullivan’s of ten and four years, respectively, and additional experience at other fine dining establishments. Our management team, which includes senior management, regional managers and general managers, meets on a weekly basis to review financial and operating results as well as receive feedback from both senior management and their peers to collaborate on best practices. We believe this management process fosters a commitment to operational excellence focused on producing a positive customer experience and strong financial performance.

Our Growth Strategy

We believe there are significant opportunities to grow our business, strengthen our competitive position and enhance our concepts through the continued implementation of the following strategies:

Pursue Disciplined New Unit Expansion. We believe our concepts have significant room to grow. We have an established growth pipeline and a disciplined strategy for opening new restaurants. Our growth strategy includes entering new markets and expanding our presence in existing markets. We believe our concepts’ market positioning, broad range of average checks and menu offerings, coupled with the flexibility of our restaurant models across a range of trade areas and square footage layouts will allow us to expand each of our three concepts into a greater number of locations. We have successfully opened new restaurants in a number of diverse markets. We target a cash-on-cash return beginning in the third operating year of at least 25% for new restaurants across all of our concepts. We believe there are opportunities to open four to six restaurants annually, generally composed of one Del Frisco’s and three to five Sullivan’s and/or Grilles, with new openings of our Grille concept likely serving as the primary driver of new unit growth in the near term. In 2012, we opened Grilles in Phoenix, Arizona, Washington D.C. and Atlanta, Georgia, and a Del Frisco’s in Chicago, Illinois. In 2013, we have to

4

Table of Contents

date opened Grilles in Houston, Texas and Santa Monica, California and expect to open three to four additional Grilles by the end of the year. Beyond domestic new unit growth, although we have no current intention to do so, we believe our concepts have the potential for expansion in select international markets through franchising, licensing, Company-owned restaurants or a combination of the foregoing. While we do not have a specific global expansion strategy and we have no current intention to expand into international markets, we believe there is a long-term opportunity for our concepts beyond the U.S. market.

Grow Our Existing Restaurant Sales. Our concepts achieve strong sales and customer count growth. We have increased comparable restaurant sales in twelve out of the last thirteen quarters, including fourteen consecutive quarterly increases for our Del Frisco’s concept. We believe there are opportunities to continue to increase our sales and average check through maintaining our focus on tableside up-selling and salesmanship by our servers and by strategically adjusting menu prices and enhancing our concepts’ brand awareness through increased marketing efforts. In addition, we are adding seating to select locations, which we believe will increase sales at these restaurants.

Further Grow Our Private Dining Business. We believe we are well-positioned to grow our private dining business due to our commitment to our customers’ dining experience, our unique locations and our plans to invest in improving our private dining facilities at select locations. All of our restaurants can serve large and small groups for private dining events, including corporate events, sales meetings, presentations, charity events and private parties. We are focused on growing our private dining business as it typically has a higher average check per customer and higher overall margins than regular dining room business. Private dining, excluding the Grille, represented approximately 15.3% of our total sales in the fiscal year ended December 25, 2012 as compared to 14.1% in the fiscal year ended December 27, 2011. We intend to drive growth by enhancing our private dining capacity and increasing awareness of our private dining services. To help drive this growth, we are creating additional private dining space at select locations by expanding or reconfiguring existing space. In addition, each location currently dedicates a staff member to increasing its private dining business. At the beginning of 2011, we hired a corporate-wide private dining executive who meets weekly with each restaurant’s private dining coordinator regarding upcoming events and sales initiatives, and during 2012, we hired a national private dining sales coordinator who coordinates private dining for national accounts for all restaurant locations.

Our Equity Sponsor

Lone Star Fund V (U.S.), L.P., which we refer to in this prospectus, along with its affiliates and associates (excluding us and other companies that it or they own as a result of their investment activities), as Lone Star Fund, is a leading U.S. private equity firm. Since 1995, the principals of Lone Star Fund have organized private equity funds totaling approximately $38.5 billion to invest globally in corporate secured and unsecured debt instruments, real estate-related assets and select corporate acquisitions. Lone Star Fund has affiliate offices in Dallas, New York, London, Tokyo, Dublin, Brussels, Luxembourg, Frankfurt, France, Montreal and Bermuda. Immediately prior to this offering, Lone Star Fund owned 13,094,667 shares, or 55.0%, of our outstanding common stock, and it will own 8,094,667 shares, or 34.0%, of our outstanding common stock immediately following the consummation of this offering, assuming the underwriters do not exercise their option to purchase additional shares of common stock.

5

Table of Contents

Conflicts of Interest

Certain conflicts of interest may arise in connection with this offering. Specifically, Lone Star Fund, an affiliate of our controlling stockholder, beneficially owns a majority of our outstanding common stock, which makes us a “controlled company” within the meaning of the NASDAQ corporate governance rules. While Lone Star Fund will no longer beneficially own a majority of our outstanding common stock following the completion of this offering, it will beneficially own approximately 8,094,667 shares, or 34.0%, of our outstanding common stock immediately following the completion of this offering, assuming no exercise of the underwriters’ option to purchase additional shares of common stock, and therefore will continue to have sufficient voting power to significantly affect the outcome of all matters submitted to our stockholders, including a merger, consolidation or other business combination. In addition, the interests of Lone Star Fund and its principals, members, directors, managers, partners, stockholders, officers, employees and other representatives, some of whom serve as our directors, may not always coincide with our interests as a company or the interests of our other stockholders. Neither Lone Star Fund nor these individuals have any duty to refrain from engaging in business that conflicts with ours or to communicate business opportunities to us. As a result, Lone Star Fund may from time to time acquire and hold interests in businesses that compete directly or indirectly with us or pursue acquisition opportunities that may be complementary to our business resulting in those acquisition opportunities not being available to us. See “Risk Factors—Risks Related to this Offering.” We also guarantee five leases for affiliates of Lone Star Fund that are not controlled or managed by our company. At June 11, 2013, the maximum potential amount of future lease payments we could be required to make as a result of the guarantees was $1.8 million. In July 2012, we entered into a transition services agreement with affiliates of Lone Star Fund pursuant to which we are provided certain insurance management, legal and benefits administration services. See “Certain Relationships and Related Party Transactions—Relationships with Lone Star Fund and its Affiliates—Termination of Asset Advisory Agreement.” Finally, we expect that Mr. Mark S. Mednansky, our Chief Executive Officer, and Mr. Thomas J. Pennison, Jr., our Chief Financial Officer, will be paid transaction bonuses of approximately $ and $ , respectively, (or $ and $ , respectively, if the underwriters fully exercise their option to purchase additional shares), by our parent company in connection with this offering, as discussed in greater detail under “Executive Compensation—Payments in Connection with Our Initial Public Offering and this Offering—Transaction Bonuses.”

Corporate Information

Our corporate headquarters is located at 930 S. Kimball Avenue, Suite 100, Southlake, TX 76092, and our telephone number is (817) 601-3421. Our website address is www.dfrg.com, and we also host www.delfriscos.com, www.sullivanssteakhouse.com and www.delfriscosgrille.com. Information contained on our websites or connected thereto does not constitute a part of this prospectus or the registration statement of which it forms a part. DEL FRISCO’S®, SULLIVAN’S®, DEL FRISCO’S GRILLE™ and DEL FRISCO’S RESTAURANT GROUP™, and other trademarks or service marks of ours appearing in this prospectus are the property of Del Frisco’s Restaurant Group, Inc. Other trademarks and service marks appearing in this prospectus are the property of their respective holders.

Summary Risk Factors

An investment in our common stock involves various risks. You should consider carefully the risks discussed below and under “Risk Factors” before purchasing our common stock. If any

6

Table of Contents

of these risks actually occur, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our shares of common stock would likely decline and you may lose all or part of your investment. The following is a summary of some of the principal risks we face:

| • | Changes in general economic conditions, including economic uncertainty, have adversely impacted our business and results of operations and may continue to do so. |

| • | If our restaurants are not able to compete successfully with other restaurants, our business and results of operations may be adversely affected. |

| • | Our future growth depends on our ability to open new restaurants and operate them profitably, and if we are unable to successfully execute this strategy, our results of operations could be adversely affected. |

| • | If we are unable to increase our sales or improve our margins at existing restaurants, our profitability and overall results of operations may be adversely affected. |

| • | The failure to continue to successfully develop our Grille concept may have a material adverse effect on our financial condition and results of operations. |

| • | Our growth, including the continued development of the Grille, may strain our infrastructure and resources, which could delay the opening of new restaurants and adversely affect our ability to manage our existing restaurants. |

| • | Our New York Del Frisco’s location represents a significant portion of our revenues, and any significant downturn in its business or disruption in the operation of this location could harm our business, financial condition and results of operations. |

| • | Negative customer experiences or negative publicity surrounding our restaurants or other restaurants could adversely affect sales in one or more of our restaurants and make our brands less valuable. |

| • | Negative publicity relating to the consumption of beef, including in connection with food-borne illness, could result in reduced consumer demand for our menu offerings, which could reduce sales. |

7

Table of Contents

The Offering

| Common stock offered by the selling stockholder |

5,000,000 shares, or 5,750,000 shares if the underwriters fully exercise their option to purchase additional shares |

| Common stock to be outstanding immediately after this offering |

23,794,667 shares |

| Option to purchase additional shares of common stock |

The selling stockholder has granted the underwriters an option for a period of 30 days to purchase up to 750,000 additional shares of common stock. |

| Use of proceeds |

The selling stockholder will receive all net proceeds from the sale of the shares of common stock to be sold in this offering, and we will not receive any of these proceeds. See “Use of Proceeds,” “Principal and Selling Stockholders” and “Underwriting.” |

| NASDAQ symbol |

“DFRG” |

| Risk factors |

Investment in our common stock involves substantial risks. You should read this prospectus carefully, including the section entitled “Risk Factors” and the consolidated financial statements and the related notes to those statements included elsewhere in this prospectus before investing in our common stock. |

Unless otherwise indicated, this prospectus:

| • | is based upon 23,794,667 shares of common stock outstanding as of July 15, 2013; |

| • | assumes the underwriters do not exercise their option to purchase up to an additional 750,000 shares from the selling stockholder; |

| • | assumes no exercise of options to purchase 851,500 shares of our common stock outstanding as of July 15, 2013, with a weighted average exercise price of $13.37; and |

| • | assumes no issuances of additional options to purchase shares of our common stock or other equity-based awards under our stock incentive plan. |

8

Table of Contents

Summary Historical Consolidated Financial and Operating Data

The following table sets forth, for the periods and dates indicated, our summary historical consolidated financial and operating data. We have derived the summary income statement data for the fiscal years ended December 28, 2010, December 27, 2011 and December 25, 2012 from our audited consolidated financial statements appearing elsewhere in this prospectus. We have derived the summary income statement data for each of the 24 weeks ended June 12, 2012 and June 11, 2013 and the summary balance sheet data as of June 11, 2013 from our unaudited interim consolidated financial statements appearing elsewhere in this prospectus. In the opinion of management, these unaudited interim consolidated financial statements include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of our financial position and operating results for these periods. Results from interim periods are not necessarily indicative of results that may be expected for the entire year and historical results are not indicative of the results to be expected in the future. The summary financial data presented below represent portions of our financial statements and are not complete. You should read this information in conjunction with “Use of Proceeds,” “Capitalization,” “Selected Consolidated and Combined Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes to those statements included elsewhere in this prospectus.

| Fiscal Year Ended(1) | 24 Weeks Ended | |||||||||||||||||||

| December 28, 2010 |

December 27, 2011 |

December 25, 2012 |

June 12, 2012 |

June 11, 2013 |

||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Revenues |

$ | 162,855 | $ | 198,625 | $ | 232,435 | $ | 103,678 | $ | 120,162 | ||||||||||

| Costs and expenses: |

||||||||||||||||||||

| Costs of sales |

49,481 | 60,743 | 71,093 | 31,963 | 36,533 | |||||||||||||||

| Restaurant operating expenses |

71,917 | 86,311 | 100,143 | 43,778 | 53,454 | |||||||||||||||

| Marketing and advertising costs |

2,744 | 4,246 | 4,682 | 2,006 | 2,256 | |||||||||||||||

| Pre-opening costs |

798 | 3,018 | 4,058 | 902 | 919 | |||||||||||||||

| General and administrative |

7,512 | 10,640 | 13,449 | 5,400 | 7,938 | |||||||||||||||

| Management and accounting fees paid to related party |

3,345 | 3,399 | 1,252 | 1,196 | — | |||||||||||||||

| Asset advisory agreement termination fee |

— | — | 3,000 | — | — | |||||||||||||||

| Secondary public offering costs |

— | — | — | — | 412 | |||||||||||||||

| Public offering transaction bonuses |

— | — | 1,462 | — | 1,805 | |||||||||||||||

| Depreciation and amortization |

6,459 | 6,998 | 8,675 | 3,570 | 5,006 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

20,599 | 23,270 | 24,621 | 14,863 | 11,839 | |||||||||||||||

| Other income (expense), net: |

||||||||||||||||||||

| Interest expense-affiliates |

(1,775 | ) | — | — | — | — | ||||||||||||||

| Interest expense-other |

(9,906 | ) | (6,355 | ) | (2,920 | ) | (2,228 | ) | (48 | ) | ||||||||||

| Write-off of debt issuance costs |

— | (2,501 | ) | (1,649 | ) | — | — | |||||||||||||

| Other, net |

(249 | ) | (114 | ) | 113 | 65 | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from continuing operations before income taxes |

8,669 | 14,300 | 20,165 | 12,700 | 11,791 | |||||||||||||||

| Income tax expense (benefit) |

(88 | ) | 4,653 | 5,592 | 4,172 | 3,791 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from continuing operations |

$ | 8,757 | $ | 9,647 | $ | 14,573 | $ | 8,528 | $ | 8,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Discontinued operations, net of income tax benefit |

(27 | ) | (674 | ) | (819 | ) | 84 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 8,730 | $ | 8,973 | $ | 13,754 | $ | 8,612 | $ | 8,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

9

Table of Contents

| Fiscal Year Ended(1) | 24 Weeks Ended | |||||||||||||||||||

| December 28, 2010 |

December 27, 2011 |

December 25, 2012 |

June 12, 2012 |

June 11, 2013 |

||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Basic net income (loss) per common share(2): |

||||||||||||||||||||

| Continuing operations |

$ | 0.49 | $ | 0.54 | $ | 0.71 | $ | 0.47 | $ | 0.34 | ||||||||||

| Discontinued operations |

(0.00 | ) | (0.04 | ) | (0.04 | ) | 0.01 | 0.00 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic net income per share |

$ | 0.49 | $ | 0.50 | $ | 0.67 | $ | 0.48 | $ | 0.34 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted net income (loss) per common share(2): |

||||||||||||||||||||

| Continuing operations |

$ | 0.49 | $ | 0.54 | $ | 0.71 | $ | 0.47 | $ | 0.34 | ||||||||||

| Discontinued operations |

(0.00 | ) | (0.04 | ) | (0.04 | ) | 0.01 | 0.00 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted net income per share |

$ | 0.49 | $ | 0.50 | $ | 0.67 | $ | 0.48 | $ | 0.34 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares used in computing net income per common share(2): |

||||||||||||||||||||

| Basic |

17,994,667 | 17,994,667 | 20,432,579 | 17,994,667 | 23,794,667 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

17,994,667 | 17,994,667 | 20,432,579 | 17,994,667 | 23,794,869 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| December 28, 2010 |

December 27, 2011 |

December 25, 2012 |

June 11, 2013 |

|||||||||||||

| (in thousands) | ||||||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||

| Cash and cash equivalents |

$ | 4,157 | $ | 14,119 | $ | 10,763 | $ | 14,443 | ||||||||

| Working capital (deficit)(3) |

(232 | ) | 2,940 | (755 | ) | 8,038 | ||||||||||

| Total assets |

217,725 | 234,274 | 258,385 | 266,244 | ||||||||||||

| Total debt |

78,922 | 70,000 | — | — | ||||||||||||

| Total stockholders’ equity |

87,155 | 95,872 | 177,901 | 188,146 | ||||||||||||

| Fiscal Year Ended(1) | 24 Weeks Ended | |||||||||||||||||||

| December 28, 2010 |

December 27, 2011 |

December 25, 2012 |

June 12, 2012 |

June 11, 2013 |

||||||||||||||||

| (in thousands, except restaurant and percentage amounts) | ||||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Net cash provided by operating activities |

$ | 11,999 | $ | 28,503 | $ | 30,968 | $ | 12,691 | $ | 12,151 | ||||||||||

| Net cash used in investing activities |

(1,210 | ) | (7,151 | ) | (32,173 | ) | (12,545 | ) | (10,250 | ) | ||||||||||

| Net cash provided by (used in) financing activities |

(19,889 | ) | (11,390 | ) | (2,151 | ) | (8,500 | ) | 1,779 | |||||||||||

| Capital Expenditures |

5,550 | 20,063 | 33,635 | 12,429 | 10,230 | |||||||||||||||

| Adjusted EBITDA(4) |

29,926 | 36,415 | 43,005 | 20,531 | 19,981 | |||||||||||||||

| Adjusted EBITDA Margin(5) |

18.4 | % | 18.3 | % | 18.5 | % | 19.8 | % | 16.6 | % | ||||||||||

| Restaurant-level EBITDA(4) |

38,713 | 47,325 | 56,454 | 25,931 | 27,919 | |||||||||||||||

| Restaurant-level EBITDA Margin(6) |

23.8 | % | 23.8 | % | 24.3 | % | 25.0 | % | 23.2 | % | ||||||||||

| Operating Data: |

||||||||||||||||||||

| Total Restaurants (at end of period) |

27 | 30 | 34 | 32 | 35 | |||||||||||||||

| Total comparable restaurants (at end of period)(7) |

26 | 26 | 28 | 28 | 29 | |||||||||||||||

| Average sales per comparable restaurant |

$ | 6,237 | $ | 6,802 | $ | 7,457 | $ | 3,451 | $ | 3,479 | ||||||||||

| Percentage change in comparable restaurant sales(7) |

4.4 | % | 11.2 | % | 4.2 | % | 5.4 | % | 1.0 | % | ||||||||||

| (1) | We utilize a 52- or 53-week accounting period which ends on the last Tuesday of December. The fiscal years ended December 28, 2010, December 27, 2011 and December 25, 2012 each had 52 weeks. |

| (2) | Basic and diluted income per share is computed by dividing net income for each period by the shares of common stock issued following our conversion from a limited liability company to a corporation immediately prior to our initial public offering. Such shares are assumed to be outstanding for all periods presented. |

10

Table of Contents

| (3) | Defined as total current assets minus total current liabilities. |

| (4) | Adjusted EBITDA and restaurant-level EBITDA are metrics used by management to measure operating performance. Adjusted EBITDA represents net income before interest, taxes, and depreciation and amortization, plus the sum of certain non-operating expenses, including pre-opening costs, management fees and expenses, asset advisory agreement termination fees, public offering transaction bonuses and secondary public offering costs. Restaurant-level EBITDA represents net income before interest, taxes and depreciation and amortization, plus the sum of certain non-operating expenses, including pre-opening costs, management fees and expenses, asset advisory agreement termination fees, public offering transaction bonuses, secondary public offering costs and general and administrative expenses. |

The following table presents a reconciliation of adjusted EBITDA and restaurant-level EBITDA to net income:

| Fiscal Year Ended(1) | 24 Weeks Ended | |||||||||||||||||||

| December 28, 2010 |

December 27, 2011 |

December 25, 2012 |

June 12, 2012 |

June 11, 2013 |

||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Income from continuing operations |

$ | 8,757 | $ | 9,647 | $ | 14,573 | $ | 8,528 | $ | 8,000 | ||||||||||

| Income tax expense (benefit) |

(88 | ) | 4,653 | 5,592 | 4,172 | 3,791 | ||||||||||||||

| Interest income |

(75 | ) | (16 | ) | (9 | ) | (6 | ) | — | |||||||||||

| Interest expense-other |

9,906 | 6,355 | 2,920 | 2,228 | 48 | |||||||||||||||

| Interest expense-affiliate |

1,775 | — | — | — | — | |||||||||||||||

| Write-off of debt issuance costs |

— | 2,501 | 1,649 | — | — | |||||||||||||||

| Depreciation and amortization |

6,459 | 6,998 | 8,675 | 3,570 | 5,006 | |||||||||||||||

| Pre-opening costs |

798 | 3,018 | 4,058 | 902 | 919 | |||||||||||||||

| Lease guarantee payments and other |

324 | 130 | (167 | ) | (59 | ) | — | |||||||||||||

| Management fees and expenses(a) |

2,070 | 3,129 | 1,252 | 1,196 | — | |||||||||||||||

| Asset advisory agreement termination fee |

— | — | 3,000 | — | — | |||||||||||||||

| Public offering transaction bonuses |

— | — | 1,462 | — | 1,805 | |||||||||||||||

| Secondary public offering costs |

— | — | — | — | 412 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 29,926 | $ | 36,415 | $ | 43,005 | $ | 20,531 | $ | 19,981 | ||||||||||

| General and administrative |

7,512 | 10,640 | 13,449 | 5,400 | 7,938 | |||||||||||||||

| Related party shared services fees |

1,275 | 270 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Restaurant-level EBITDA |

$ | 38,713 | $ | 47,325 | $ | 56,454 | $ | 25,931 | $ | 27,919 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Includes asset management fees and expenses paid to an affiliate of Lone Star Fund pursuant to our previously existing asset advisory agreement, but excludes amounts paid to another affiliate of Lone Star Fund for accounting, administrative and management services under our previously existing shared services agreement, which is referred to as the related party shared services fee. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Financial Definitions—Management and Accounting Fees Paid to Related Party” and “Certain Relationships and Related Party Transactions—Relationships with Lone Star Fund and its Affiliates—Termination of Asset Advisory Agreement.” |

We present adjusted EBITDA and restaurant-level EBITDA as supplemental performance measures because we believe they facilitate a comparative assessment of our operating performance relative to our performance based on our results under generally accepted accounting principles in the United States, or GAAP, while isolating the effects of some items that vary from period to period without any correlation to core operating performance. Specifically, adjusted EBITDA allows for an assessment of our operating performance without the effect of non-cash depreciation and amortization expenses or our ability to service or incur indebtedness. Restaurant-level EBITDA allows for further assessment of our operating performance by eliminating the effect of general and administrative expenses incurred at the corporate level. These measures also function as a benchmark to evaluate our operating performance or compare our performance to that of our competitors because companies within our industry exhibit significant variations with respect to capital structures and cost of capital (which affect interest expense and tax rates) and differences in book depreciation of facilities and equipment (which affect relative depreciation expense), including significant differences in the depreciable lives of similar assets among various companies.

This prospectus also includes information concerning adjusted EBITDA margin, which is defined as the ratio of adjusted EBITDA to revenues, and restaurant-level EBITDA margin, which is defined as the ratio of restaurant-level

11

Table of Contents

EBITDA to revenues. We present adjusted EBITDA margin and restaurant-level EBITDA margin because they are used by management as a performance measurement to judge the level of adjusted EBITDA and restaurant-level EBITDA, respectively, generated from revenues. We believe their inclusion is appropriate to provide additional information to investors and other external users of our financial statements.

Adjusted EBITDA, restaurant-level EBITDA, adjusted EBITDA margin and restaurant-level EBITDA margin are not measurements of our financial performance under GAAP and should not be considered in isolation or as an alternative to net income, net cash provided by operating, investing or financing activities or any other financial statement data presented as indicators of financial performance or liquidity, each as presented in accordance with GAAP. We understand that although adjusted EBITDA is frequently used by securities analysts, lenders and others in their evaluation of companies, it and restaurant-level EBITDA have limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of our results as reported under GAAP, as adjusted EBITDA and restaurant-level EBITDA do not reflect:

| • | discretionary cash available to us to invest in the growth of our business; |

| • | changes in, or cash requirements for, our working capital needs; |

| • | our capital expenditures or future requirements for capital expenditures; |

| • | the interest expense, or the cash requirements necessary to service interest or principal payments, associated with our indebtedness; or |

| • | depreciation and amortization, which are non-cash charges, although the assets being depreciated and amortized will likely have to be replaced in the future, and adjusted EBITDA does not reflect any cash requirements for such replacements. |

| (5) | Adjusted EBITDA margin is the ratio of adjusted EBITDA to revenues. |

| (6) | Restaurant-level EBITDA margin is the ratio of restaurant-level EBITDA to revenues. |

| (7) | We consider a restaurant to be comparable in the first full fiscal period following the eighteenth month of operations. Changes in comparable restaurant sales reflect changes in sales for the comparable group of restaurants over a specified period of time. |

12

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this prospectus before purchasing our common stock. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the trading price of our common stock could decline and you may lose some or all of your investment.

Risks Related to Our Business

Changes in general economic conditions, including economic uncertainty, have adversely impacted our business and results of operations and may continue to do so.

Purchases at our restaurants are discretionary for consumers and we are therefore susceptible to economic slowdowns. We believe that consumers generally are more willing to make discretionary purchases, including high-end restaurant meals, during favorable economic conditions. The recent economic uncertainty, continuing disruptions in the overall economy, including high unemployment and financial market volatility and unpredictability, and the related reduction in consumer confidence negatively affected customer traffic and sales throughout our industry, including our segment. In addition, we believe that uncertainty over U.S. budgetary and fiscal policy that ultimately led to higher personal income tax rates may have adversely impacted sales in the early part of 2013 and, together with adverse weather affects, created challenges for us to achieve an increase in comparable restaurant sales in the first quarter of 2013. If the economy experiences a new downturn or there are continued uncertainties regarding U.S. budgetary and fiscal policies, our customers, including our business clientele, may further reduce their level of discretionary spending, impacting the frequency with which they choose to dine out or the amount they spend on meals while dining out. We believe the majority of our weekday revenues in our Del Frisco’s and Sullivan’s concepts are derived from business customers using expense accounts and our business therefore may be affected by reduced expense account or other business-related dining by our business clientele. If business clientele were to dine less frequently at our restaurants, our business and results of operations would be adversely affected as a result of a reduction in customer traffic or average revenues per customer.

There is also a risk that if the current uncertain economic conditions persist for an extended period of time or worsen, consumers might make long-lasting changes to their discretionary spending behavior, including dining out less frequently. The ability of the U.S. economy to handle this uncertainty is likely to be affected by many national and international factors that are beyond our control, including current economic trends in Europe. These factors, including national, regional and local politics and economic conditions, disposable consumer income and consumer confidence, also affect discretionary consumer spending. Continued uncertainty in or a worsening of the economy, generally or in a number of our markets, and our customers’ reactions to these trends could adversely affect our business and cause us to, among other things, reduce the number and frequency of new restaurant openings, close restaurants and delay our re-modeling of existing locations.

If our restaurants are not able to compete successfully with other restaurants, our business and results of operations may be adversely affected.

Our industry is intensely competitive with respect to price, quality of service, restaurant location, ambiance of facilities and type and quality of food. A substantial number of national

13

Table of Contents

and regional restaurant chains and independently owned restaurants compete with us for customers, restaurant locations and qualified management and other restaurant staff. The principal competitors for our Del Frisco’s and Sullivan’s concepts are other upscale steakhouse chains such as Fleming’s Prime Steakhouse and Wine Bar, The Capital Grille, Smith & Wollensky, The Palm, Ruth’s Chris Steak House and Morton’s The Steakhouse. The principal competitors for our Grille concept also include other upscale chains such as Hillstone and Seasons 52. Our concepts also compete with additional restaurants in the broader upscale dining segment. Some of our competitors have greater financial and other resources, have been in business longer, have greater name recognition and are better established in the markets where our restaurants are located or where we may expand. Our inability to compete successfully with other restaurants may harm our ability to maintain acceptable levels of revenue growth, limit or otherwise inhibit our ability to grow one or more of our concepts, or force us to close one or more of our restaurants. We may also need to evolve our concepts in order to compete with popular new restaurant formats or concepts that emerge from time to time, and we cannot provide any assurance that we will be successful in doing so or that any changes we make to any of our concepts in response will be successful or not adversely affect our profitability. In addition, with improving product offerings at fast casual restaurants and quick-service restaurants combined with the effects of uncertain economic conditions and other factors, consumers may choose less expensive alternatives, which could also negatively affect customer traffic at our restaurants. Any unanticipated slowdown in demand at any of our restaurants due to industry competition may adversely affect our business and results of operations.

Our future growth depends in part on our ability to open new restaurants and operate them profitably, and if we are unable to successfully execute this strategy, our results of operations could be adversely affected.

Our financial success depends in part on management’s ability to execute our growth strategy. One key element of our growth strategy is opening new restaurants. We believe there are opportunities to open four to six new restaurants annually, generally composed of one Del Frisco’s and three to five Sullivan’s and/or Grilles, with new openings of our Grille concept likely serving as the primary driver of new unit growth in the near term. In 2012 we opened Grilles in Phoenix, Arizona, Washington D.C. and Atlanta, Georgia, and one Del Frisco’s in Chicago, Illinois. In 2013, we have to date opened Grilles in Houston, Texas and Santa Monica, California and expect to open three to four additional Grilles by the end of the year. For the opening of a new restaurant, we measure our cash investment costs net of landlord contributions and equipment financing, but including pre-opening costs. We target average cash investment costs of $7.0 million to $9.0 million for a new Del Frisco’s and $3.0 million to $4.5 million for a new Sullivan’s or Grille.

Our ability to open new restaurants and operate them profitably is dependent upon a number of factors, many of which are beyond our control, including:

| • | finding quality site locations, competing effectively to obtain quality site locations and reaching acceptable agreements to lease or purchase sites; |

| • | complying with applicable zoning, land use and environmental regulations and obtaining, for an acceptable cost, required permits and approvals; |

| • | having adequate capital for construction and opening costs and efficiently managing the time and resources committed to building and opening each new restaurant; |

| • | timely hiring and training and retaining the skilled management and other employees necessary to meet staffing needs; |

14

Table of Contents

| • | successfully promoting our new locations and competing in their markets; |

| • | acquiring food and other supplies for new restaurants from local suppliers; and |

| • | addressing unanticipated problems or risks that may arise during the development or opening of a new restaurant or entering a new market. |

A new restaurant typically experiences a “ramp-up” period of approximately 18 months before it achieves our targeted level of performance. This is due to the costs associated with opening a new restaurant, as well as higher operating costs caused by start-up and other temporary inefficiencies associated with opening new restaurants. For example, there are a number of factors which may impact the amount of time and money we commit to the construction and development of new restaurants, including landlord delays, shortages of skilled labor, labor disputes, shortages of materials, delays in obtaining necessary permits, local government regulations and weather interference. Once the restaurant is open, how quickly it achieves a desired level of profitability is impacted by many factors, including the level of market familiarity and acceptance when we enter new markets, as well as the availability of experienced staff and the time required to negotiate reasonable prices for food and other supplies from local suppliers. Our business and profitability may be adversely affected if the “ramp-up” period for a new restaurant lasts longer than we expect.

If we are unable to increase our sales or improve our margins at existing restaurants, our profitability and overall results of operations may be adversely affected.

Another key aspect of our growth strategy is increasing comparable restaurant sales and improving restaurant-level margins. Improving comparable restaurant sales and restaurant-level margins depends in part on whether we achieve revenue growth through increases in the average check and further expand our private dining business at each restaurant. We believe there are opportunities to increase the average check at our restaurants through, for example, selective introduction of higher priced items and increases in menu pricing. We also believe that expanding and enhancing our private dining capacity will also increase our restaurant sales, as our private dining business typically has a higher average check and higher overall margins than regular dining room business. However, these strategies may prove unsuccessful, especially in times of economic hardship, as customers may not order or enjoy higher priced items and discretionary spending on private dining events may decrease. Select price increases have not historically adversely impacted customer traffic; however, we expect that there is a price level at which point customer traffic would be adversely affected. It is also possible that these changes could cause our sales volume to decrease. If we are not able to increase our sales at existing restaurants for any reason, our profitability and results of operations could be adversely affected.

The failure to continue to successfully develop our Grille concept could have a material adverse effect on our financial condition and results of operations.

We launched our new concept, the Grille, in the third quarter of 2011 with the opening of our New York City location. We opened a second location in Dallas, Texas in the fourth quarter of 2011, locations in Phoenix, Arizona, Washington D.C. and Atlanta, Georgia in 2012 and locations in Houston, Texas and Santa Monica, California thus far in 2013. We believe that new openings of the Grille are likely to serve as the primary driver of new unit growth in the near term. Our ability to continue to succeed with this new concept will require significant capital expenditures and management attention and is subject to certain risks in addition to those of opening a new restaurant under one of our existing concepts, including customer acceptance of and competition to that concept. If the “ramp-up” period for our Grille restaurants and for our

15

Table of Contents

development of concepts in general does not meet our expectations, our operating results may be adversely affected. In addition, we are targeting restaurant-level EBITDA margins of between 20% and 25% for the Grille. However, because we face new challenges at the Grille, such as predicting demand for new menu selections that are not offered at our other concepts, we cannot provide any assurance that our operating margins will achieve these levels. As a result, we may need to adjust our pricing and menu offering strategies. We may not be successful enough to recoup our investments in the concept. There can be no assurance that we will be able to successfully develop and grow the Grille or any other new concept to a point where it will become profitable or generate positive cash flow or that it will prove to be a platform for future expansion. We may not be able to attract enough customers to meet targeted levels of performance at new restaurants because potential customers may be unfamiliar with our concepts or the atmosphere or menu might not appeal to them. The Grille may even operate at a loss, which could have a material adverse effect on our overall operating results. In addition, opening a new restaurant concept such as a Grille in an existing market could reduce the revenue of our existing restaurants in that market. If we cannot successfully execute our growth strategies for the Grille, or if customer traffic generated by the Grille results in a decline in customer traffic at one of our other restaurants in the same market, our business and results of operations may be adversely affected.

Our growth, including the continued development of the Grille, may strain our infrastructure and resources, which could delay the opening of new restaurants and adversely affect our ability to manage our existing restaurants.

We plan to continue our current pace of new restaurant growth, including the continued development and promotion of the Grille. We believe there are opportunities to open four to six restaurants annually, generally composed of one Del Frisco’s and three to five Sullivan’s and/or Grilles, with new openings of our Grille concept likely serving as the primary driver of new unit growth in the near term. We typically target an average cash investment of approximately $7.0 million to $9.0 million per restaurant for a Del Frisco’s restaurant and $3.0 million to $4.5 million for a Sullivan’s or a Grille, in each case net of landlord contributions and equipment financing and including pre-opening costs. In addition to new openings, we also may “refresh” a number of our Del Frisco’s and Sullivan’s locations to, among other things, add additional seating, further grow our private dining business and add patio seating. During 2012, we completed refreshes, with varying scopes of work, of five Del Frisco’s and six Sullivan’s at an average cost of $0.3 million per location. Thereafter, we expect to complete one to two refreshes each year at an approximate cost of $0.5 million per location. This growth and these investments will increase our operating complexity and place increased demands on our management as well as our human resources, purchasing and site management teams. While we have committed significant resources to expanding our current restaurant management systems, financial and management controls and information systems in connection with our recent growth, if this infrastructure is insufficient to support this expansion, our ability to open new restaurants, including the continued development and promotion of the Grille, and to manage our existing restaurants, including the expansion of our private dining business, would be adversely affected. If we fail to continue to improve our infrastructure or if our improved infrastructure fails, we may be unable to implement our growth strategy or maintain current levels of operating performance in our existing restaurants.

Our New York Del Frisco’s location represents a significant portion of our revenues, and any significant downturn in its business or disruption in the operation of this location could harm our business, financial condition and results of operations.

Our New York Del Frisco’s location represented approximately 21%, 18% and 16% of our revenues in 2010, 2011 and 2012, respectively. Accordingly, we are susceptible to any

16

Table of Contents

fluctuations in the business at our New York Del Frisco’s location, whether as a result of adverse economic conditions, negative publicity, changes in customer preferences or for other reasons. In addition, any natural disaster, prolonged inclement weather, act of terrorism or national emergency, accident, system failure or other unforeseen event in or around New York City could result in a temporary or permanent closing of this location, could influence potential customers to avoid this geographic region or this location in particular or otherwise lead to a decrease in revenues. Any significant interruption in the operation of this location or other reduction in sales could adversely affect our business and results of operations.

Negative customer experiences or negative publicity surrounding our restaurants or other restaurants could adversely affect sales in one or more of our restaurants and make our brands less valuable.

The quality of our food and our restaurant facilities are two of our competitive strengths. Therefore, adverse publicity, whether or not accurate, relating to food quality, public health concerns, illness, safety, injury or government or industry findings concerning our restaurants, restaurants operated by other foodservice providers or others across the food industry supply chain could affect us more than it would other restaurants that compete primarily on price or other factors. A restaurant in Louisville, Kentucky has the right to use, and uses, a specific registration of the Del Frisco’s name pursuant to a concurrent use agreement and we licensed the use of the Del Frisco’s name to one restaurant in Orlando, Florida through June 1, 2013, as described in greater detail in “Business—Intellectual Property.” We do not own or control the Louisville restaurant, and we did not own or control the Orlando restaurant, but any adverse publicity relating to those operations could negatively affect us. In addition, although we would not be legally liable for any such failure, because the Louisville and Orlando restaurants operate or operated under one of our brand names, we may be subject to litigation as a result of either restaurant’s failure to comply with food quality, preparation or other applicable rules and regulations. If customers perceive or experience a reduction in our food quality, service or ambiance or in any way believe we have failed to deliver a consistently positive experience, the value and popularity of one or more of our concepts could suffer. Any shifts in consumer preferences away from the kinds of food we offer, particularly beef, whether because of dietary or other health concerns or otherwise, would make our restaurants less appealing and could reduce customer traffic and/or impose practical limits on pricing.

Negative publicity relating to the consumption of beef, including in connection with food-borne illness, could result in reduced consumer demand for our menu offerings, which could reduce sales.

Instances of food-borne illness, including Bovine Spongiform Encephalopathy, which is also known as BSE or mad cow disease, aphthous fever, which is also known as hoof and mouth disease, as well as hepatitis A, lysteria, salmonella and e-coli, whether or not found the United States or traced directly to one of our suppliers or our restaurants, could reduce demand for our menu offerings. Any negative publicity relating to these and other health-related matters, such as the confirmation of a case of mad cow disease in a dairy cow in California in April 2012, may affect consumers’ perceptions of our restaurants and the food that we offer, reduce customer visits to our restaurants and negatively impact demand for our menu offerings. Adverse publicity relating to any of these matters, beef in general or other similar concerns could adversely affect our business and results of operations.

Increases in the prices of, and/or reductions in the availability of commodities, primarily beef, could adversely affect our business and results of operations.

Our profitability depends in part on our ability to anticipate and react to changes in commodity costs, which have a substantial effect on our total costs. For example, we purchase

17

Table of Contents

large quantities of beef, particularly USDA prime beef and premium choice beef. Our beef costs represented approximately 32%, 33% and 34% of our food and beverage costs during 2010, 2011 and 2012, respectively, and we currently do not purchase beef pursuant to any long-term contractual arrangements with fixed pricing or use futures contracts or other financial risk management strategies to reduce our exposure to potential price fluctuations. The market for USDA prime beef and premium choice beef is particularly volatile and is subject to extreme price fluctuations due to seasonal shifts, climate conditions, the price of feed, industry demand, energy demand and other factors. For example, during 2011 and 2012, beef costs were impacted by (i) the summer drought in Texas and Oklahoma, (ii) the price of corn, (iii) the entrance of major supermarkets into the USDA choice beef market and (iv) new free trade agreements increasing exports. Although we currently do not engage in futures contracts or other financial risk management strategies with respect to potential price fluctuations, from time to time, we may opportunistically enter into fixed price beef supply contracts or contracts for other food products or consider other risk management strategies with regard to our meat and other food costs to minimize the impact of potential price fluctuations. This practice could help stabilize our food costs during times of fluctuating prices, although there can be no assurances that this will occur. However, because our restaurants feature USDA prime beef and premium choice beef, we generally expect to purchase these types of beef even if we have not entered into any such arrangements and the price increased significantly. The prices of other commodities can affect our costs as well, including corn and other grains, which are ingredients we use regularly and are also used as cattle feed and therefore affect the price of beef. Energy prices can also affect our bottom line, as increased energy prices may cause increased transportation costs for beef and other supplies, as well as increased costs for the utilities required to run each restaurant. Historically we have passed increased commodity and other costs on to our customers by increasing the prices of our menu items. While we believe these price increases did not historically affect our customer traffic, there can be no assurance additional price increases would not affect future customer traffic. If prices increase in the future and we are unable to anticipate or mitigate these increases, or if there are shortages for USDA Prime beef and premium choice beef, our business and results of operations would be adversely affected.

We depend upon frequent deliveries of food and other supplies, in most cases from a limited number of suppliers, which subjects us to the possible risks of shortages, interruptions and price fluctuations.

Our ability to maintain consistent quality throughout our restaurants depends in part upon our ability to acquire fresh products, including USDA prime beef and premium choice beef, fresh seafood, quality produce and related items from reliable sources in accordance with our specifications. In addition, we rely on one or a limited number of suppliers for certain ingredients. For example, U.S. Foodservice supplies all of the beef for our restaurants and has done so since June of 2009. This contract expires in June 2015 and can be terminated by either party for any reason upon 90 days advanced notice. This dependence on one or a limited number of suppliers, as well as the limited number of alternative suppliers of USDA prime beef and premium choice beef and quality seafood, subjects us to the possible risks of shortages, interruptions and price fluctuations in beef and seafood. If any of our suppliers is unable to obtain financing necessary to operate its business or its business is otherwise adversely affected, does not perform adequately or otherwise fails to distribute products or supplies to our restaurants, or terminates or refuses to renew any contract with us, particularly with respect to one of the suppliers on which we rely heavily for specific ingredients, we may be unable to find an alternative supplier in a short period of time or if we can, it may not be on acceptable terms. Our inability to replace our suppliers in a short period of time on acceptable terms could increase our costs or cause shortages at our restaurants that may cause us to remove certain items from a menu, increase the price of certain offerings or temporarily close a restaurant, which could adversely affect our business and results of operations.

18

Table of Contents

We depend on the services of key executives, and our business and growth strategy could be materially harmed if we were to lose these and executives and were unable to replace them with executives of equal experience and capabilities.