Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TENET HEALTHCARE CORP | d558574d8k.htm |

| EX-99.3 - EX-99.3 - TENET HEALTHCARE CORP | d558574dex993.htm |

| EX-99.1 - EX-99.1 - TENET HEALTHCARE CORP | d558574dex991.htm |

Acquisition of

Vanguard Health Systems

A New Company for a New Healthcare Environment

June 24, 2013

Exhibit 99.2 |

Disclosures / Forward-Looking Statements

1

Our presentation includes certain financial measures such as Adjusted EBITDA, which

are not calculated in accordance with generally accepted accounting

principles (GAAP). Reconciliation between non-GAAP measures and related GAAP

measures can be found at the end of this presentation.

Non-GAAP Information

Certain statements in our presentation are “forward-looking statements” under Section

27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements are based on current expectations. However, actual results may

differ materially from expectations due to the risks, uncertainties and other factors that affect our business and

Vanguard Health Systems' (“Vanguard”) business. These factors include, among others, the

occurrence of any event, change or other circumstances that could give rise to the termination

of the merger agreement; the failure to satisfy conditions to completion of the merger,

including receipt of regulatory approvals; changes in the business or operating prospects of Vanguard; changes in

health care and other laws and regulations; economic conditions; adverse litigation or regulatory

developments; competition; our success in implementing our business development plans and

integrating newly acquired assets; our ability to hire and retain health care professionals;

our ability to meet our capital needs, including our ability to manage our indebtedness; and our ability to

grow our Conifer Health Solutions business segment (“Conifer”). We and Vanguard provide

additional information about these and other factors in the reports filed with the Securities

and Exchange Commission, including, but not limited to, those described in “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our and

Vanguard’s annual reports on Form 10-K for the year ended December 31, 2012 and June 30,

2012, respectively. We disclaim any obligation to update any forward-looking statement in

this presentation, whether as a result of changes in underlying factors, new information,

future events or otherwise. |

Acquisition Highlights

•

Tenet

acquiring

Vanguard

for

$21

cash

per

share,

or

an

aggregate

of

$4.3

billion

(a)

•

Unanimously approved by both Boards of Directors

•

Accretive to Tenet’s earnings in year one

•

$100-200

million

in

annual

synergies

expected

–

revenue

cycle

management

efficiency

and

improvement,

overhead

reduction,

and

supply

chain

management

and

other

operating improvement

•

Ed Kangas, Non-Executive Chairman of Tenet, to continue as Non-Executive

Chairman; Charlie Martin, Vanguard CEO, to join Tenet board

•

Trevor Fetter to continue as President and CEO; Keith Pitts, Vice Chairman of

Vanguard, to join Tenet as Vice Chairman

•

Tenet intends to complete existing share repurchase program in 2013

•

Leverage ratio projected to return to 4.75x-5.0x by year end 2014

•

Expected to close by year end 2013

2

(a)

Includes $2.5 billion in Vanguard debt |

3

Well-Positioned for the New Healthcare

Environment

•

79 hospitals and 157 outpatient centers

•

Applies proven cost management, quality improvement, care integration and

network development strategies across a broader platform

•

Enhances portfolio management opportunities

Increased

Scale

•

Expands

market

leader

position

–

#1

or

#2

position

in

19

important

markets

•

Adds geographic diversification with expansion into additional states

•

Adds

important

markets

in

Texas

–

San

Antonio

and

South

Texas

Enhanced

Geographic

Breadth

•

Physician alignment, recruitment and employment strategies applied across

broader network

•

Leverages Vanguard’s health plan experience developing successful clinical

integration and ACO models

Broader

Physician

Platform

•

Leverages Conifer Health Solutions across broader portfolio

•

Adding

Vanguard

health

plan

expertise

expands

Conifer

value-based

care

and

population health management capabilities

Integrated

Service

Offering

•

Combines two organizations with similar values, priorities and demonstrated

cultures of ethics and compliance

•

Tenet’s proven management capabilities augmented by Vanguard turnaround

expertise and experience in health plan operations

Complementary

Management

Teams |

4

Successful track record

of generating growth by

acquisition and strategic

Vanguard

Tenet

Hard-wired culture

of ethics and

compliance

High quality clinical

operations

Industry-leading

quality and safety

programs

Complementary Operational Strengths and

Shared Values

Successful track record of

generating organic growth

Systematic approach to cost

management (Performance

Excellence Program)

Excellent centralized managed

care contracting and outpatient

development strategies

Highly technology-enabled

and scalable revenue

cycle operation

Innovative approaches to

cost management

Expertise in health plan

operations and innovative

payment models

Experienced in not-for-profit

partnerships and turn-

around management

partnerships |

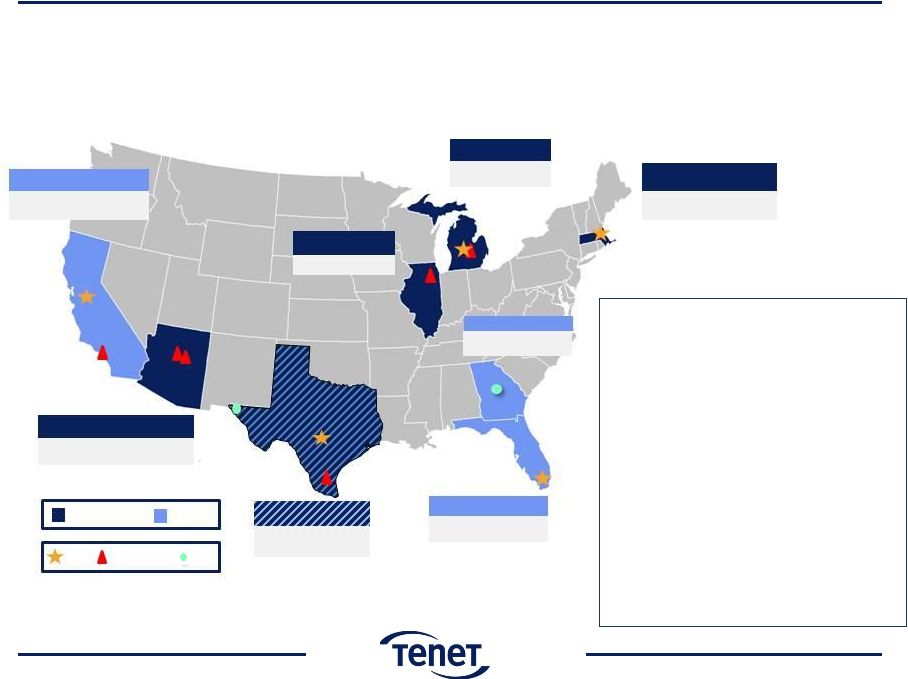

Established Positions in Key Markets

Greater Breadth Provides Opportunities for Revenue Growth

(a)

Excludes 2 Connecticut hospitals currently under LOI

5 |

6

•

Complements established Tenet positions in El Paso,

Houston, Nacogdoches and Dallas

•

Both new markets demonstrate underlying population

growth

•

Vanguard showing strong organic growth in its own

operations/market share

•

San Antonio

•

#2 system in Texas' 3rd largest market

•

Opportunities for additional growth

•

Harlingen / Brownsville

•

Opportunities for further earnings improvement in

strong market

•

Pro forma revenue doubles from $1.5B to $3.0B

•

Vanguard’s health plan and ACE pilot program provide

platform for innovative contracting models

•

Positioned for significant upside from ACA

Current Tenet market

Current Vanguard market

Adds Important New Markets in Texas

(b)

Includes 3 freestanding OP facilities recently acquired by Tenet

(a)

Includes 2 Vanguard hospitals under development

San Antonio

7 Hospitals

(a)

13 OP Centers

(b)

Houston

3 Hospitals

15 OP Centers

El Paso

3 Hospitals

8 OP Centers

Nacogdoches

1 Hospital

2 OP Centers

Harlingen/

Brownsville

2 Hospitals

1 OP Center

Dallas

3 Hospitals

8 OP Centers |

Medicare and Medicaid Covered Lives

(Projected Growth: 2013-2017)

San Antonio

Chicago

Massachusetts

Nacogdoches

South Texas

Detroit

Philly Children’s Market

Spalding

San Ramon

San Luis Obispo

Saint Louis

Rock Hill

Philadelphia

Downtown

Houston

Palm Beach County

Orange County

NW Houston

North Central CA

Phoenix

Miami

Memphis

Hilton

Head

Hickory

El Paso County

East Cooper

Dallas

Coachella Valley

Central Carolina

Birmingham

Atlanta

U.S. Average

Connecticut

U.S. Average

(a)

Projections assume all Tenet’s states implement Medicaid expansion; does not

include Texas expansion for Vanguard Source: MPACT 5.0, PRISM 4.1, McKinsey

Health Reform Team. Projected

Expansion

of

Insurance

Coverage

with

Healthcare

Reform

(a)

Vanguard

Tenet

7

Geographic Presence Creates Substantial

Benefit from Affordable Care Act

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

55%

60%

65%

70%

75%

80% |

Source:Vanguard

and Tenet

company financials.

(a) For Vanguard, acute care only.

(b) Represents markets with less than 5% of revenue

8

Greater Geographic Diversification Balances Revenue Sources

Texas

17%

California

24%

Florida

19%

Other

(b)

13%

Texas

21%

California

15%

Florida

12%

Michigan

13%

Illinois

5%

Massachusetts

5%

Other

(b)

23%

Pennsylvania

6%

Georgia

7%

Pennsylvania

9%

Other

Markets

(n=10)

41%

Markets

with #1 or #2

Share (n=14)

59%

Other

Markets

(n=11)

30%

Markets

with #1 or

#2 Share

(n=19)

70%

S. Carolina

6%

Missouri

5%

Established Positions in Key Markets

% of Revenues

by State

(CY 2012)

% of Revenues

from #1 or 2

Market Share

(CY 2012)

Tenet

Standalone

Tenet

Post-Acquisition

(a) |

9

(a) Vanguard revenue payor mix is based on Q3YTD actual payor mix

(b) Managed care includes Managed Medicare and Managed Medicaid

Source: Vanguard and Tenet company financial projections.

Broader Service Offering and Well-Balanced Payor Mix

Revenue Breakdown

Inpatient

Outpatient

Services

and other

Health plans

Post-

Acquisition

Tenet

Standalone

Managed

care

(b)

Medicare

Medicaid

Other

Post-

Acquisition

Tenet

Standalone

Revenues By Service, CY 2013

Revenues By Payor

(a)

, CY 2013

10%

31%

59%

56%

32%

8%

4%

11%

22%

59%

8%

10%

24%

58%

8% |

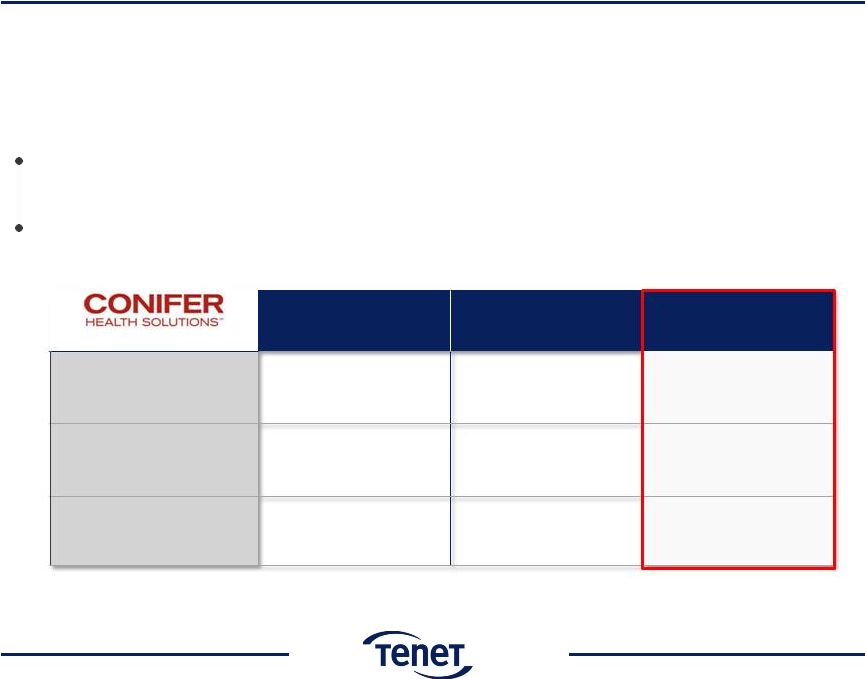

28%

increase

in

Conifer

revenues

(incremental

$250

million

added

by

Vanguard

annually)

10

(a)

2013 est. pro-forma for integration of Catholic Health Initiatives

Builds Conifer’s Position in Fast-Growing

Healthcare Business Services Industry

Conifer

Current

(a)

Conifer Post-

Acquisition

% Increase

Net Client Revenue

Processed Annually

$21B

$26B

24%

Patient Accounts

Processed Annually

10M

12M

20%

Revenues

$890M

$1,140M

28%

Health plans operations augment Conifer’s value-based care

capabilities |

11

Source:

Company website, Company financials, Vanguard management presentation

(a) Excludes member lives lost from Phoenix Health Plan, with exception of

Maricopa (b) To be launched in 2014

Creates Greater Scale and New Opportunities

•

Vanguard health plan skills

and capabilities diversify

Tenet’s service offerings

•

Assists in successful

development of clinical

integration and ACO

models

•

Capabilities can be

leveraged in managing next

generation payment models

and population health

Enhanced Health Plan Expertise

Vanguard

Tenet

ACO

Health Plan

Michigan

~18,000 lives

Texas

~24,000 lives

~18,000 lives

Florida

~13,000 lives

Georgia

~9,000 lives

(b)

Massachusetts

~32,000 lives

Illinois

~52,200 lives

California

Arizona

~101,000 lives

(a)

CIO |

12

Tenet

Vanguard

(a)

($M)

($M)

Both Management Teams Bring Strong Growth

Track Records to Combination

396

525

598

636

714

955

1,036

1,126

1,203

5.0%

7.0%

9.0%

11.0%

13.0%

15.0%

$250

$500

$750

$1,000

$1,250

2004

2005

2006

2007

2008

2009

2010

2011

2012

Adjusted EBITDA

Adjusted EBITDA Margin

174

245

255

245

264

299

323

420

573

5.0%

7.0%

9.0%

11.0%

13.0%

$0

$100

$200

$300

$400

$500

$600

2004

2005

2006

2007

2008

2009

2010

2011

2012

EBITDA

EBITDA Margin

(a)

Source: Vanguard Management.

Figures shown on fiscal year basis.

Vanguard EBITDA does not reflect the effect of stock based compensation.

|

Synergies are Significant and Achievable

Clearly Identified Through Cost Savings, Benefits of Scale and

Operating Opportunities

13

•

Revenue Cycle

Management Efficiency

and Improvement

Synergy Area

Estimated

Timing

•

Supply Chain Management

and Other Operational

Improvement

•

Overhead Reduction

12-24 months

6-18 months

12-24 months

50% Projected to be Achieved Within the First Year Post-Closing

Projected

Synergies

$100 -

200

million |

Analysis Shows Clear Synergy Opportunities

14

Source: Vanguard financials, Tenet financials

Total operating

expense per

adj. discharge

($, acuity-

adjusted)

Cost metric

$6,923

$7,950

-13%

Tenet

comparable

facilities

(FY2012)

Example

Vanguard

market

(Q3 FY2013

YTD)

Opportunities exist

within Vanguard’s acute

care portfolio to capture

synergies through cost

optimization

A large Vanguard

market shows

potential for cost

reduction in operating

expenses when

compared to a set of

Tenet comparable

facilities |

•

Modest multiple compared to historical industry transactions

•

NPV

of

expected

synergies

of

approximately

$1.4

billion

•

Committed financing in place from Bank of America Merrill Lynch

•

Tenet to refinance Vanguard debt at attractive rates

•

Pro forma debt/EBITDA leverage ratios to decrease within first year

after closing

•

Projected at 4.75x-5.0x by year-end 2014

•

Longer term post-acquisition leverage target of 4.25x-4.75x

•

Tenet’s existing share repurchase program to continue

uninterrupted

•

Existing NOLs of approximately $1.5 billion to be utilized across the

earnings of the combined organization

15

Tenet Retains Significant Financial Flexibility |

Next

Steps and Road to Completion •

Definitive

agreement

–

no

Tenet

shareholder

vote;

voting

commitments received from Vanguard controlling shareholders

•

Regulatory approvals expected

•

Hart-Scott-Rodino

•

State and local approvals as required

•

Tenet intends to complete existing share repurchase program in

2013

•

Integration team assembled and ready to be deployed immediately

upon closing

•

Closing expected by year end 2013

16 |

17

Transaction Enhances Shareholder Value

Substantial

Synergies

Increases

Scale

Broader

Service

Offering

Shareholder

Value

Expanded

Partnership

Opportunities

Maintains

Financial

Flexibility

Strong and

Complementary

Management

Teams

Enhances

Geographic

Breadth

Upside

from

Affordable

Care Act |

Reconciliation of EBITDA

Adjusted EBITDA, a non-GAAP term, is defined by the Company as net income (loss)

attributable to Tenet Healthcare Corporation common shareholders before (1)

the

cumulative

effect

of

changes

in

accounting

principle,

net

of

tax;

(2)

net

loss

(income)

attributable

to

noncontrolling

interests;

(3)

preferred

stock

dividends;

(4)

income (loss) from discontinued operations, net of tax; (5) income tax benefit

(expense); (6) investment earnings (loss); (7) gain (loss) from early extinguishment of

debt; (8) net gain (loss) on sales of investments; (9) interest expense; (10)

litigation and investigation benefit (costs), net of insurance recoveries; (11) hurricane

insurance recoveries, net of costs; (12) impairment and restructuring charges, and

acquisition-related costs; and (13) depreciation and amortization. The Company’s

Adjusted EBITDA may not be comparable to EBITDA reported by other companies.

The Company provides this information as a supplement to GAAP information to assist

itself and investors in understanding the impact of various items on its financial

statements, some of which are recurring or involve cash payments. The Company

uses this information in its analysis of the performance of its business excluding

items

that

it

does

not

consider

as

relevant

in

the

performance

of

its

hospitals

in

continuing

operations.

In

addition,

from

time

to

time

we

use

this

measure

to

define

certain performance targets under our compensation programs. Adjusted EBITDA is not

a measure of liquidity, but is a measure of operating performance that

management uses in its business as an alternative to net income (loss) attributable

to Tenet Healthcare Corporation common shareholders. Because Adjusted EBITDA

excludes many items that are included in our financial statements, it does not provide a complete measure of our operating performance. Accordingly,

investors are encouraged to use GAAP measures when evaluating the Company’s

financial performance. The reconciliation of net income (loss) attributable to Tenet

Healthcare Corporation common shareholders, the most comparable GAAP term, to

Adjusted EBITDA, is set forth below. 18

For a presentation of Vanguard’s reconciliation of Adjusted EBITDA to

financial measures calculated in accordance with GAAP, see Exhibits 99.1 and 99.2 to

Vanguard’s

Reports

on

Form

8-K

filed

with

the

SEC

on

August

23,

2012,

August

25,

2011,

August

26,

2010,

September

1,

2009,

September

22,

2008,

September

18,

2007, September 19, 2006, September 12, 2005 and August 9, 2004.

|

|