Attached files

| file | filename |

|---|---|

| EX-3.1 - EX-3.1 - OCI Partners LP | d548532dex31.htm |

| EX-3.2 - EX-3.2 - OCI Partners LP | d548532dex32.htm |

| EX-10.2 - EX-10.2 - OCI Partners LP | d548532dex102.htm |

| EX-23.5 - EX-23.5 - OCI Partners LP | d548532dex235.htm |

| EX-23.1 - EX-23.1 - OCI Partners LP | d548532dex231.htm |

| EX-21.1 - EX-21.1 - OCI Partners LP | d548532dex211.htm |

| EX-23.6 - EX-23.6 - OCI Partners LP | d548532dex236.htm |

| EX-23.4 - EX-23.4 - OCI Partners LP | d548532dex234.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 14, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

OCI Partners LP

(Exact name of registrant as specified in its charter)

| Delaware | 2800 | 90-0936556 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| Mailing Address: | Physical Address: | |||||

| P.O. Box 1647 Nederland, Texas 77627 |

5470 N. Twin City Highway Nederland, Texas 77627 |

|||||

| (409) 723-1900 | ||||||

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Frank Bakker

President and Chief Executive Officer

| Mailing Address: | Physical Address: | |||||

| P.O. Box 1647 Nederland, Texas 77627 |

5470 N. Twin City Highway Nederland, Texas 77627 |

|||||

| (409) 723-1900 | ||||||

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

| Brett E. Braden Divakar Gupta Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

G. Michael O’Leary Stephanie C. Beauvais Andrews Kurth LLP 600 Travis, Suite 4200 Houston, Texas 77002 (713) 220-4200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Common units representing limited partner interests |

$480,000,000 | $65,472 | ||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) of the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated June 14, 2013

PROSPECTUS

Common Units

Representing Limited Partner Interests

OCI Partners LP

This is the initial public offering of common units representing limited partner interests of OCI Partners LP. We are offering common units in this offering.

Prior to this offering, there has been no public market for our common units. We currently expect the initial public offering price will be between $ and $ per common unit. We intend to apply to list our common units on the New York Stock Exchange under the symbol “OCIP.”

We qualify as an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933 and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. Furthermore, as long as we remain an emerging growth company, we will qualify for certain limited exceptions from investor protection laws such as the Sarbanes-Oxley Act of 2002 and the Investor Protection and Securities Reform Act of 2010. Please read “Prospectus Summary—Our Emerging Growth Company Status.”

Investing in our common units involves a high degree of risk. Before purchasing any of our common units, you should carefully read the discussion of material risks of investing in our common units in “Risk Factors” beginning on page 21. These risks include the following:

| • | We may not have sufficient cash available for distribution to pay any quarterly distribution on our common units. |

| • | The amount of our quarterly cash distributions, if any, will vary significantly both quarterly and annually and will be directly dependent on the performance of our business. Unlike most publicly traded partnerships, we will not have a minimum quarterly distribution or employ structures intended to maintain or increase quarterly cash distributions over time. |

| • | For each of the year ended December 31, 2012 and the twelve months ended March 31, 2013, on a pro forma basis, we would not have generated sufficient cash available for distribution to have paid the per unit quarterly distribution that we project that we will be able to pay for the twelve months ending June 30, 2014. |

| • | We have a limited operating history. As a result, you may have difficulty evaluating our ability to pay quarterly cash distributions to our unitholders or our ability to be successful in implementing our business strategy. |

| • | Our gross profit is vulnerable to fluctuations in the prices at which we sell methanol and ammonia and the cost of natural gas, our primary feedstock. |

| • | Our facility faces operating hazards and interruptions, including unscheduled maintenance or downtime. We could face significant reductions in revenues and increases in expenses to the extent these hazards or interruptions cause a material decline in production and are not fully covered by our existing insurance coverage. |

| • | Our general partner and its affiliates, including our sponsor, have conflicts of interest with us and limited duties to us and our unitholders, and they may favor their own interests to our detriment and that of our unitholders. |

| • | Our tax treatment depends on our status as a partnership for U.S. federal income tax purposes. If the IRS were to treat us as a corporation for U.S. federal income tax purposes, which would subject us to additional amounts of entity-level taxation, then our cash available for distribution to our unitholders would be substantially reduced. |

| • | Our unitholders’ share of our income will be taxable to them for U.S. federal income tax purposes even if they do not receive any cash distributions from us. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Common Unit |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to OCI Partners LP |

$ | $ | ||||||

| (1) | Excludes an aggregate structuring fee equal to % of the gross proceeds from this offering payable to Merrill Lynch, Pierce, Fenner & Smith Incorporated. Please read “Underwriting.” |

We have granted the underwriters an option to purchase up to an additional common units from us at the initial public offering price, less the underwriting discount, within 30 days from the date of this prospectus.

The underwriters expect to deliver the common units to purchasers on or about , 2013 through the book-entry facilities of the Depository Trust Company.

| BofA Merrill Lynch | Barclays | Citigroup |

The date of this prospectus is , 2013.

Table of Contents

Table of Contents

| Page |

||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| Summary Historical and Pro Forma Financial and Operating Data |

18 | |||

| 21 | ||||

| 21 | ||||

| 40 | ||||

| 45 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| OUR CASH DISTRIBUTION POLICY AND RESTRICTIONS ON DISTRIBUTIONS |

54 | |||

| 54 | ||||

| 56 | ||||

| 58 | ||||

| 61 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| SELECTED HISTORICAL AND PRO FORMA FINANCIAL AND OPERATING DATA |

67 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

70 | |||

| 70 | ||||

| 71 | ||||

| 72 | ||||

| 73 | ||||

| 73 | ||||

| 75 | ||||

| 80 | ||||

| 82 | ||||

| 84 | ||||

| 85 | ||||

| 85 | ||||

| 87 | ||||

| 87 | ||||

i

Table of Contents

| Page |

||||

| 88 | ||||

| 88 | ||||

| 89 | ||||

| 93 | ||||

| 98 | ||||

| 102 | ||||

| 102 | ||||

| 103 | ||||

| 105 | ||||

| 106 | ||||

| 107 | ||||

| 110 | ||||

| 111 | ||||

| 112 | ||||

| 113 | ||||

| 114 | ||||

| 114 | ||||

| 115 | ||||

| 119 | ||||

| 120 | ||||

| 120 | ||||

| 120 | ||||

| 120 | ||||

| 121 | ||||

| 121 | ||||

| 121 | ||||

| 122 | ||||

| 122 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 126 | ||||

| 128 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

129 | |||

| 131 | ||||

| 131 | ||||

| 131 | ||||

| 133 | ||||

| 134 | ||||

| Procedures for Review, Approval and Ratification of Related Person Transactions |

134 | |||

| 135 | ||||

| 135 | ||||

| 140 | ||||

| 144 | ||||

| 144 | ||||

| 144 | ||||

| 144 | ||||

| 145 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

ii

Table of Contents

| Page |

||||

| 146 | ||||

| 148 | ||||

| 149 | ||||

| 149 | ||||

| Merger, Consolidation, Conversion, Sale or other Disposition of Assets |

151 | |||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| 153 | ||||

| 154 | ||||

| 154 | ||||

| 154 | ||||

| 155 | ||||

| 155 | ||||

| 155 | ||||

| 156 | ||||

| 156 | ||||

| 157 | ||||

| 157 | ||||

| 157 | ||||

| 158 | ||||

| 158 | ||||

| 159 | ||||

| 159 | ||||

| 159 | ||||

| 160 | ||||

| 161 | ||||

| 162 | ||||

| 163 | ||||

| 163 | ||||

| 169 | ||||

| 171 | ||||

| 173 | ||||

| 174 | ||||

| 175 | ||||

| 178 | ||||

| 178 | ||||

| 180 | ||||

| 182 | ||||

| 182 | ||||

| 183 | ||||

| 183 | ||||

| 183 | ||||

| 184 | ||||

| 185 | ||||

| 185 | ||||

| 185 | ||||

| 185 | ||||

| 185 | ||||

| 188 | ||||

| 188 | ||||

| 188 | ||||

| 189 | ||||

iii

Table of Contents

| Page |

||||

| F-1 | ||||

| APPENDIX A: FORM OF FIRST AMENDED AND RESTATED AGREEMENT OF LIMITED PARTNERSHIP OF OCI PARTNERS LP |

A-1 | |||

| B-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be delivered to you. We have not, and the underwriters have not, authorized any other person to provide you with additional, different or inconsistent information from that contained in this prospectus and any free writing prospectus. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should not assume that the information contained in this prospectus or in any free writing prospectus is accurate as of any date other than the date on the front cover of this prospectus or the date of such free writing prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering, or possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common units and the distribution of this prospectus outside of the United States.

iv

Table of Contents

Industry and Market Data

When we make statements in this prospectus about our position in the methanol industry, the ammonia industry, any sector of those industries or about our market share, we are making those statements based on our belief as to their accuracy. This belief is based on data regarding the methanol industry and the ammonia industry, including trends in such markets and our position and the position of our competitors within those industries, derived from a variety of sources, including independent industry publications, government publications and other published independent sources, information obtained from customers, distributors, suppliers, trade and business organizations and publicly available information (including the reports and other information our competitors file with the U.S. Securities and Exchange Commission (“SEC”), which we did not participate in preparing and as to which we make no representation), as well as our good faith estimates, which have been derived from management’s knowledge and experience in the areas in which our business operates. Estimates of market size and relative positions in a market are difficult to develop and inherently uncertain. Accordingly, investors should not place undue weight on the industry and market share data presented in this prospectus.

In this prospectus, we rely on and refer to information regarding the methanol industry and the ammonia industry and future methanol and ammonia production and consumption from Jim Jordan and Associates, LP (“Jim Jordan”), with respect to the methanol industry, and Blue, Johnson & Associates, Inc. (“Blue Johnson”), with respect to the ammonia industry. Neither Jim Jordan nor Blue Johnson is affiliated with us. Each of Jim Jordan and Blue Johnson has consented to being named in this prospectus.

We do not have any knowledge that the market and industry data and forecasts provided to us from third party sources are inaccurate in any material respect. However, we have been advised that certain information provided to us from third party sources is derived from estimates or subjective judgments, and while such third party sources have assured us that they have taken reasonable care in the compilation of such information and believe it to be accurate and correct, data compilation is subject to limited audit and validation procedures. We believe that, notwithstanding such qualification by such third party sources, the market and industry data provided in this prospectus is accurate in all material respects.

Our estimates, in particular as they relate to market share and our general expectations, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors.”

v

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. You should carefully read the entire prospectus, including “Risk Factors” and the historical and unaudited pro forma condensed financial statements and related notes included elsewhere in this prospectus, before making a decision to invest in our common units. Unless otherwise indicated, the information in this prospectus assumes (1) an initial public offering price of $ per common unit (the midpoint of the price range set forth on the cover page of this prospectus) and (2) that the underwriters do not exercise their option to purchase additional common units, and, accordingly, that the common units that could be purchased by the underwriters pursuant to such option will instead be issued to OCI USA Inc. at the expiration of the option period.

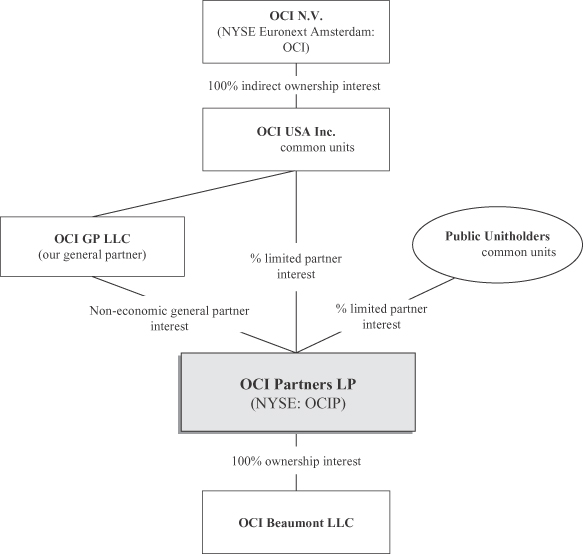

Unless the context otherwise requires, references in this prospectus to “our partnership,” “we,” “our,” “us” and similar terms, when used in a historical context, refer to the business and operations of OCI Beaumont LLC, a Texas limited liability company (“OCIB”) that OCI USA Inc. will contribute to OCI Partners LP in connection with this offering. When used in the present tense or future tense, those terms and “OCI Partners LP” refer to OCI Partners LP, a Delaware limited partnership, and its subsidiaries, including OCIB. References to “our general partner” refer to OCI GP LLC, a Delaware limited liability company and a wholly owned subsidiary of OCI USA Inc. References to “OCI” refer to OCI N.V., a Dutch public limited liability company, and its consolidated subsidiaries other than us, our subsidiaries and our general partner. References to “OCI USA” refer to OCI USA Inc., a Delaware corporation, which is an indirect wholly owned subsidiary of OCI. References to “OCI Fertilizer” refer to OCI Fertilizer International B.V., a Dutch private limited liability company, which is an indirect wholly owned subsidiary of OCI. The transactions being entered into in connection with this offering that are described beginning on page 9 of this prospectus are referred to herein as the “Transactions.” You should also read the “Glossary of Selected Terms” contained in Appendix B for definitions of some of the terms we use to describe our business and industry and other terms used in this prospectus.

OCI Partners LP

We are a Delaware limited partnership formed in February 2013 to own and operate a recently upgraded, integrated methanol and ammonia production facility that is strategically located on the Texas Gulf Coast near Beaumont. We are currently the largest merchant methanol producer in the United States with an annual methanol production capacity of approximately 730,000 metric tons and an annual ammonia production capacity of approximately 265,000 metric tons, and we are in the early stages of a debottlenecking project that will increase our annual methanol production capacity by 25% to approximately 912,500 metric tons and our annual ammonia production capacity by 15% to approximately 305,000 metric tons. Given our advantageous access and connectivity to customers and attractively priced natural gas feedstock supplies, we believe that we are one of the lowest-cost producers of methanol and ammonia in our markets and intend to capitalize on our competitive position to maximize our cash flow. We believe that the prospects for our methanol and ammonia business will remain positive for the foreseeable future because of growing U.S. and global demand for methanol and ammonia, our continued access to attractively priced natural gas feedstock, the United States’ current position as a net importer of both methanol and ammonia and our competitive position in our markets.

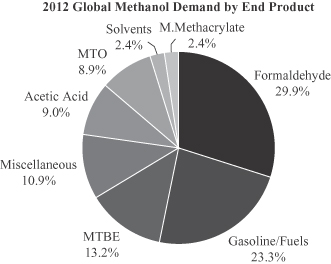

Both methanol and ammonia are global commodities that are essential building blocks for numerous end-use products. Methanol is a liquid petrochemical that is used in a variety of industrial and energy-related applications. Methanol is used in industrial applications to produce adhesives used in manufacturing wood products, such as plywood, particle board and laminates, resins to treat paper and plastic products, paint and varnish removers, solvents for the textile industry and polyester fibers for clothing and carpeting. Methanol is also used outside of the United States as a direct fuel for automobile engines, as a fuel blended with gasoline and

1

Table of Contents

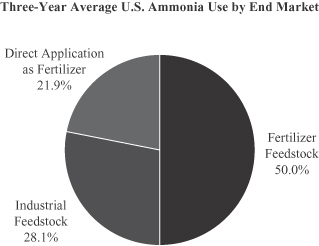

as an octane booster in reformulated gasoline. In the United States, ammonia is primarily used as a feedstock to produce nitrogen fertilizers, such as urea and ammonium sulfate, and is also directly applied to soil as a fertilizer. In addition, ammonia is widely used in industrial applications, particularly in the Texas Gulf Coast market, including in the production of plastics, synthetic fibers, resins and numerous other chemical compounds.

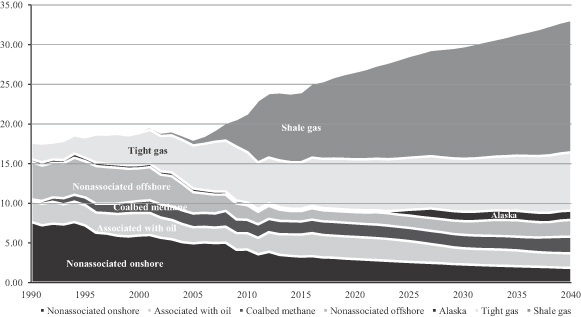

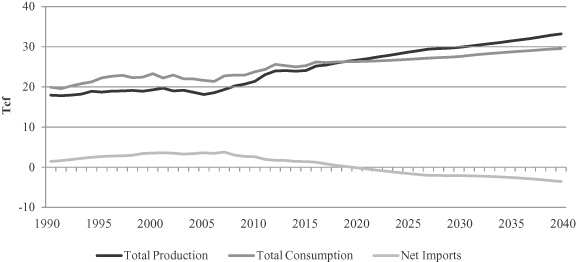

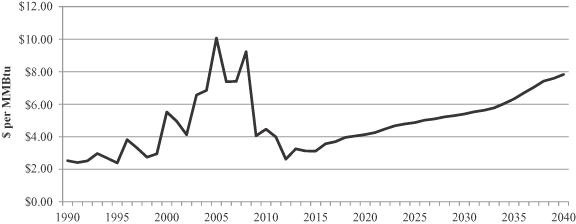

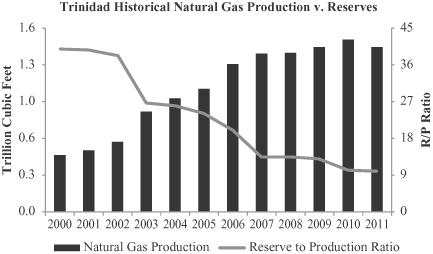

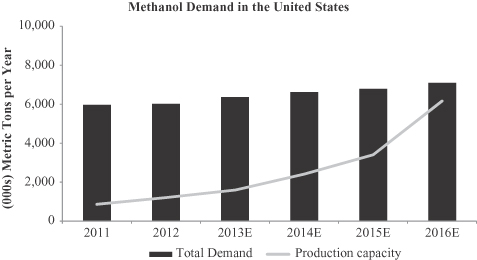

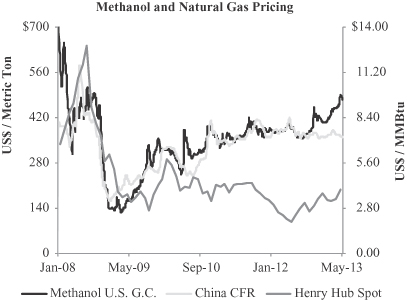

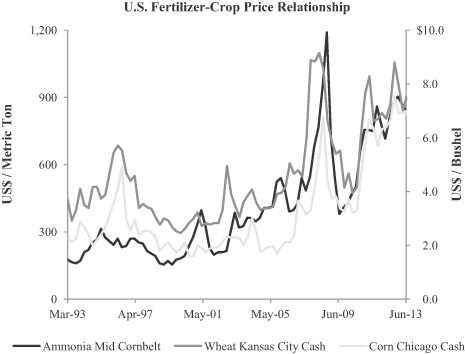

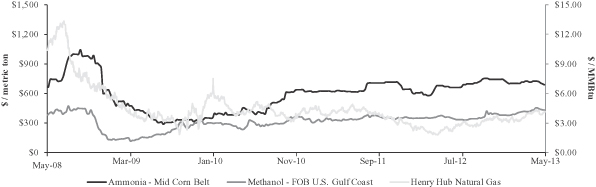

Natural gas, methanol and ammonia commodity market dynamics have contributed favorably to our profitability in four ways. First, increased natural gas production from shale formations in the United States has increased domestic supplies of natural gas, resulting in a relatively low natural gas price environment. Second, robust and increasing domestic and global demand for both methanol and ammonia has led to historically high prices for those commodities. Third, domestic methanol and ammonia production capacity is currently constrained, as the higher domestic natural gas price environment during the period from 1998 through 2007 prompted U.S. producers to shut down or relocate U.S. production facilities, which has resulted in significantly more domestic demand for methanol and ammonia than can be satisfied with domestic production and substantial reliance on foreign imports to meet domestic demand for methanol and ammonia. Consequently, approximately 82% of U.S. methanol demand and approximately 39% of U.S. ammonia demand during 2012 was met by imports according to Jim Jordan and Blue Johnson, respectively. Fourth, we and other domestic methanol and ammonia producers have been able to satisfy a growing portion of domestic demand as foreign natural gas-based producers, particularly in Trinidad, are experiencing declining methanol and ammonia production due to decreased natural gas production and declining natural gas reserves. The favorable pricing environment for our products driven by robust demand, together with attractive natural gas feedstock prices, has enabled us to realize significant profit margins since our facility began operating at full capacity in the fourth quarter of 2012.

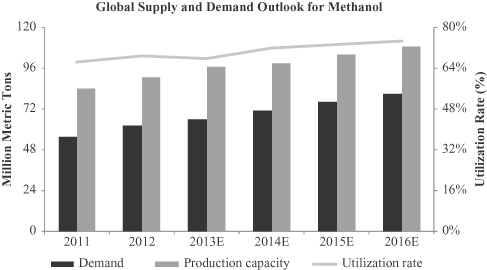

We expect the current commodity market dynamics for our products and natural gas feedstock to continue for the foreseeable future. In addition, according to Jim Jordan, annual U.S. demand for methanol is forecasted to increase from approximately 6.0 million metric tons in 2012 to approximately 7.1 million metric tons by 2016, representing a compound annual growth rate of approximately 4.2%, while annual domestic production of methanol is expected to increase from approximately 1.1 million metric tons to approximately 5.1 million metric tons over this same period. Moreover, according to Blue Johnson, annual U.S. demand for ammonia is forecasted to increase from approximately 16.5 million metric tons in 2012 to approximately 17.5 million metric tons in 2016, representing a compound annual growth rate of approximately 1.5%, while annual domestic production of ammonia is expected to increase from approximately 10.1 million metric tons to approximately 11.7 million metric tons over this same period, which is expected to result in an annual production deficit of approximately 5.8 million metric tons in 2016. In addition, recent increases in domestic natural gas production levels from shale formations have resulted in a significant increase in the supply of natural gas, leading to a lower natural gas price environment in the United States compared to other regions. We expect this trend of relatively low natural gas prices in the United States to continue for the foreseeable future as a result of ongoing investment in the development of shale formations and related midstream infrastructure.

We acquired our facility (which had been idled by the previous owners since 2004) in May 2011, commenced an upgrade that was completed in July 2012 and began operating our facility at full capacity in the fourth quarter of 2012. Our newly renovated facility began ammonia production in December 2011 and began methanol production in July 2012 (with no significant methanol production until August 2012), with revenues first generated from ammonia sales in the first quarter of 2012 and from methanol sales in the third quarter of 2012. For the three months ended March 31, 2013, our net income and EBITDA, on a pro forma basis, were approximately $56.5 million and $65.2 million, respectively. Subject to certain assumptions, we expect our net income and EBITDA to be approximately $167.3 million and $201.8 million, respectively, for the twelve months ending June 30, 2014. For a reconciliation of EBITDA to net income and the assumptions used in our forecast of our net income and EBITDA for the twelve months ending June 30, 2014, please read “Selected Historical and Pro Forma Financial and Operating Data” and “Our Cash Distribution Policy and Restrictions on Distribution—Unaudited Forecasted Cash Available for Distribution.”

2

Table of Contents

Attractively Priced Natural Gas for Methanol and Ammonia Production. Given our ready access to abundant domestic natural gas supplies and our relatively low natural gas feedstock costs compared to our overseas competitors, including Trinidadian producers, we believe that we are one of the lowest-cost producers of methanol and ammonia in our markets. For the three months ended March 31, 2013, natural gas feedstock represented approximately 59.1% of our total cost of goods sold (or approximately 85.0% of our variable cost of goods sold). The emergence of a U.S. “shale gas advantage” has led to an increase in the domestic production of natural gas, resulting in attractive domestic natural gas feedstock prices. In addition, continued robust demand for methanol and ammonia globally has resulted in a favorable pricing environment for our products. Since our facility began operating at full capacity in the fourth quarter of 2012, we have been able to compete effectively with higher-cost foreign producers and realize significant profit margins.

Favorable Market Fundamentals with Growing Demand for Our Products. Due to growing demand and constrained domestic production capacity for our products, we expect the fundamentals for the production and sale of methanol and ammonia in the United States to remain favorable for the foreseeable future.

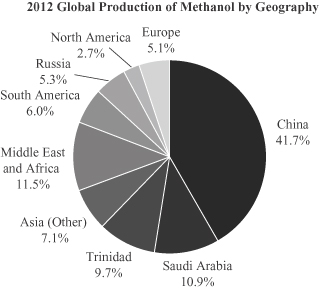

| • | According to Jim Jordan, annual global demand for methanol is forecasted to increase from 62.6 million metric tons in 2012 to 81.2 million metric tons in 2016, representing a compound annual growth rate of approximately 6.7%. Annual U.S. demand for methanol is forecasted to increase from 6.0 million metric tons to 7.1 million metric tons over this same period, representing a compound annual growth rate of approximately 4.2%. Over this same period, the United States is expected to remain a net importer of methanol, as Jim Jordan forecasts that annual domestic methanol production will increase to only 5.1 million metric tons by the end of 2016. We expect prices for methanol to remain favorable for the foreseeable future as global prices for methanol are highly correlated to the prices set by higher-cost, coal-based methanol producers in China. |

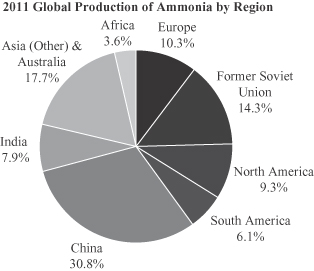

| • | According to Blue Johnson, annual global demand for ammonia is forecasted to increase from 166.0 million metric tons in 2012 to 182.0 million metric tons in 2016, representing a compound annual growth rate of approximately 2.3%. Annual U.S. demand for ammonia is forecasted to increase from 16.5 million metric tons to 17.5 million metric tons over this same period, representing a compound annual growth rate of approximately 1.5%. Over this same period, the United States is expected to remain a net importer of ammonia, as Blue Johnson forecasts that imports will comprise approximately 6.4 million metric tons of U.S. consumption in 2016. In addition, Blue Johnson forecasts that ammonia prices in the United States will remain elevated for the foreseeable future as a result of growing agricultural demand and continued strong industrial demand, particularly in the Texas Gulf Coast region. |

As a result of growing demand and constrained production capacity in the United States, we expect that domestic producers of methanol and ammonia will continue to displace a portion of imported supplies for the foreseeable future because of the higher feedstock and transportation costs associated with foreign supplies.

Strategic Location on the Texas Gulf Coast with Access to Port and Pipeline Facilities. We are strategically located on the Texas Gulf Coast, which provides us advantageous access and connectivity to our existing and prospective customers and attractively priced natural gas feedstock supplies. Our facility is connected to established infrastructure and transportation facilities, including pipeline connections to adjacent customers and port access with dedicated methanol and ammonia export barge docks. We also have the flexibility to add rail and truck loading facilities to improve delivery options for our customers. We have connections to one major interstate and three major intrastate natural gas pipelines that provide us access to significantly more natural gas supply than our facility requires and flexibility in sourcing our natural gas

3

Table of Contents

feedstock. Our facility is located in close proximity to many of our major customers, which allows us to deliver our products to those customers at competitive prices and realize greater margins than overseas suppliers that are subject to significant costs associated with transporting product to our markets. In addition, we have direct pipeline connections to certain of our methanol and ammonia customers, which provides us a competitive advantage in supplying their methanol and ammonia requirements.

Recently Upgraded Production Facility that Operates Efficiently and Maximizes Returns. We completed an upgrade on the methanol and ammonia production units at our facility in 2012. From January 1, 2013 through May 31, 2013, our methanol production unit and our ammonia production unit each operated at over a 95% utilization rate relative to its nameplate capacity. As a means of further optimizing our production efficiencies, we are in the early stages of a debottlenecking project on our production facility that is expected to be completed in the second half of 2014 and increase our annual methanol production capacity by approximately 25% and our annual ammonia production capacity by approximately 15%. For information on our debottlenecking project, please read “—Our Debottlenecking Project.”

Advantageous Relationship with Our Sponsor, OCI. We expect to benefit from OCI’s commercial, operational and technical expertise. OCI is a global nitrogen-based fertilizer producer and engineering and construction contractor based in the Netherlands, with projects and investments across Europe, the United States, South America, the Middle East, North Africa and Central Asia. We expect to benefit from OCI’s expertise in strategic development, as OCI’s management team has successfully executed over $25 billion in acquisitions, divestments and greenfield projects in 15 countries in the past eight years. In June 2013, we entered into a procurement and construction contract with Orascom E&C, Inc., an indirect wholly owned construction subsidiary of OCI, for our debottlenecking project. OCI Construction Group’s technical expertise and experience with large-scale infrastructure and industrial projects were critical to the recent upgrade of our facility that was completed in 2012 and will be essential to the cost-effective implementation of our debottlenecking project.

Experienced Management and Operational Team. We are managed by an experienced and dedicated team of executives with a long history in the chemical industry. Our senior operational team has an average of 30 years of experience in the chemical industry and significant experience operating facilities such as ours. In fact, a majority of our operating management team ran our facility for many years under prior ownership. Our management team was responsible for developing and executing the recent upgrade of our facility and will be integral in the execution of our debottlenecking project and any future expansion projects.

Distribute 100% of Our Cash Available for Distribution each Quarter. Upon the completion of this offering, the board of directors of our general partner will adopt a policy to distribute 100% of the cash available for distribution that we generate each quarter to unitholders of record on a pro rata basis. We do not intend to maintain excess distribution coverage or retain funds in order to maintain stable quarterly distributions or fund future distributions. Unlike many publicly traded partnerships, our general partner will have a non-economic general partner interest and will have no incentive distribution rights. Therefore, all of our cash distributions will be made to our unitholders, in contrast to other publicly traded partnerships, some of which distribute up to 50% of their quarterly cash distributions in excess of specified levels to their general partner. Our structure is designed to maximize distributions to our unitholders and to align OCI’s interests with those of our other unitholders. We expect our distribution yield to be % (calculated by dividing our forecasted distribution for the twelve months ending June 30, 2014 of $ per common unit by $ (the midpoint of the price range set forth on the cover page of this prospectus)). Please read “Our Cash Distribution Policy and Restrictions on Distributions—Unaudited Forecasted Cash Available for Distribution.”

4

Table of Contents

Pursue Organic Growth Opportunities and Strategic Acquisitions. We will continue to evaluate methods of expanding our production capabilities and product offerings. We are in the early stages of a debottlenecking project that is designed to increase our annual methanol production capacity by approximately 182,500 metric tons, or approximately 25%, and increase our annual ammonia production capacity by approximately 40,000 metric tons, or approximately 15%. As part of the debottlenecking project, we additionally plan to complete a maintenance turnaround as well as various other upgrades to our facility. We expect that the debottlenecking project will be completed in the second half of 2014 and currently estimate the total cost of the project will be approximately $150 million (including costs associated with a maintenance turnaround and various other upgrades). We intend to fund a portion of the costs of our debottlenecking project and other budgeted capital projects incurred after the completion of this offering with a portion of the net proceeds from this offering. Please read “—Our Debottlenecking Project.”

We also intend to pursue strategic acquisitions that offer attractive synergies and maximize distributions to our unitholders, such as increasing our logistical capabilities by purchasing infrastructure at the industrial park in which our production facility is located. In addition, we intend to evaluate and pursue acquisition and development opportunities that will enhance our operating platform and increase our cash available for distribution.

Maintain High Utilization Rates. From January 1, 2013 through May 31, 2013, we operated at over a 95% utilization rate relative to the nameplate capacity of our methanol and ammonia production units, and we intend to maintain consistent and reliable operations at our facility, which are critical to our financial performance and results of operations. Efficient production of methanol and ammonia requires reliable and stable operations at our facility due to the high costs associated with planned and unplanned downtime. In addition, strict production schedules are essential in order to maximize utilization and productivity and to ensure a competitive cost position. We intend to continue implementing our rigorous maintenance program, which is executed by a skilled, experienced and well-trained workforce, at regular intervals. To continue to maintain our high utilization rates and minimize downtime at our facility, we plan to perform maintenance capital projects that require downtime during scheduled turnarounds. We believe that our diligent adherence to proactive maintenance programs and the experience of our workforce will minimize unplanned downtime and maintain our facility’s longevity and high utilization rates.

Continue Commitment to Health, Safety and the Environment. We are committed to maintaining a culture that makes health, safety and the environment a high priority. We have made significant investments in safety analysis and reporting technology and have established a track record of safe operations, with a total case incident rate (the average number of work-related injuries incurred by 100 workers during a one-year period) for both our employees and contractors of 0.13 for 2012 and 0.0 from January 1, 2013 through May 31, 2013. We also view personnel training as essential for accident prevention and successful operation of our facility and intend to continue our efforts in these areas. In addition, we are participating in Occupational Safety and Health Act (“OSHA”) Voluntary Protection Programs to become an OSHA Star site. We believe that our commitment to health, safety and the environment is critical to the success of our business.

Maintain a Conservative and Flexible Capital Structure. We are committed to maintaining a conservative capital structure with prudent leverage that affords us the financial flexibility to execute our business strategy. As of March 31, 2013, on a pro forma basis, after giving effect to the Transactions (including this offering), we would have had approximately $235.0 million of total indebtedness (excluding unamortized debt discount of $2.4 million) and approximately $ million of cash and cash equivalents, resulting in net leverage of $ million (or approximately $235.0 million of total indebtedness (excluding unamortized debt discount of $2.4 million) and approximately $ million of cash and cash equivalents, resulting in net leverage of $ million, if the underwriters exercise their option to purchase additional common units in full). We will retain a portion of net proceeds from this offering to pre-fund growth capital expenditures,

5

Table of Contents

including the anticipated remaining costs of our debottlenecking project (including a maintenance turnaround and various other upgrades).

OCI is a global nitrogen-based fertilizer producer and engineering and construction contractor based in the Netherlands, with projects and investments across Europe, the United States, South America, the Middle East, North Africa and Central Asia. The OCI Fertilizer Group owns and operates nitrogen fertilizer plants in the Netherlands, the United States, Egypt and Algeria and has an international distribution platform spanning from the Americas to Asia. The OCI Fertilizer Group ranks among the world’s largest nitrogen fertilizer producers by production capacity with annual production capacity of nearly 7.0 million metric tons.

The OCI Fertilizer Group’s latest greenfield project, the Iowa Fertilizer Company located near the Mississippi River in Wever, Iowa, is a $1.8 billion plant that is the first world scale natural gas-based fertilizer plant to be built in the United States in nearly 25 years. The plant is being constructed by Orascom E&C, Inc., an indirect wholly owned subsidiary of OCI, and is expected to produce approximately 2.0 million metric tons of nitrogen fertilizer annually following completion of construction in late 2015. In connection with financing the project, Iowa Fertilizer Company issued approximately $1.2 billion of tax-exempt bonds, representing one of the largest non-investment grade transactions ever sold in the U.S. tax-exempt bond market.

The OCI Construction Group provides international engineering and construction services primarily on infrastructure, industrial and high-end commercial projects in the United States, Europe, the Middle East, North Africa and Central Asia for public and private clients. According to the Engineering News Record, the OCI Construction Group consistently ranks among the world’s top global contractors.

OCI employs more than 75,000 people in 35 countries and is listed on the NYSE Euronext in Amsterdam under the symbol “OCI.” OCI’s market capitalization, as reported by Bloomberg, was approximately $5.9 billion as of June 6, 2013.

Our integrated methanol and ammonia production facility is located on a 28-acre site south of Beaumont, Texas on the Neches River. We acquired our facility (which had been idled by the previous owners since 2004) in May 2011, commenced an upgrade that was completed in July 2012 and began operating our facility at full capacity in the fourth quarter of 2012. Our newly renovated facility began ammonia production in December 2011 and began methanol production in July 2012 (with no significant methanol production until August 2012), with revenues first generated from ammonia sales in the first quarter of 2012 and from methanol sales in the third quarter of 2012.

The following table sets forth our facility’s production capacity and storage capacity:

| Product |

Current Production Capacity | Production during the Three Months Ended March 31, 2013 |

Expected Production

Capacity after Completion of Debottlenecking Project |

Product Storage Capacity (Metric Tons) |

||||||||||||||||||||

| Metric Tons/Day |

Metric Tons/Year(1) |

Metric Tons |

Metric Tons/Day |

Metric Tons/Year(1) |

||||||||||||||||||||

| Methanol |

2,000 | 730,000 | 175,523 | 2,500 | 912,500 | 42,000 (2 tanks) | ||||||||||||||||||

| Ammonia |

726 | 264,990 | 64,491 | 835 | 304,739 | 18,000 (1 tank) | ||||||||||||||||||

| (1) | Assumes facility operates 365 days per year. |

6

Table of Contents

As a means of further optimizing our production efficiencies, we are in the early stages of a debottlenecking project on our production facility, including a maintenance turnaround and environmental upgrades, which we collectively refer to as our “debottlenecking project.” This project is expected to increase our annual methanol production capacity by approximately 182,500 metric tons, or approximately 25%, and increase our annual ammonia production capacity by approximately 40,000 metric tons, or approximately 15%. We expect the debottlenecking project to be completed in the second half of 2014 and currently estimate the total cost of the project to be approximately $150 million (including costs associated with a maintenance turnaround and environmental upgrades). We expect to shut down our facility for approximately 30 to 40 days in the second half of 2014 in order to complete our debottlenecking project. As of May 31, 2013, OCIB had incurred approximately $2.6 million in expenditures related to our debottlenecking project, including costs associated with engineering fees and down payments on equipment, and will fund any costs incurred through the completion of this offering. We intend to fund a portion of the costs of our debottlenecking project and other budgeted capital projects incurred after the completion of this offering with a portion of the net proceeds from this offering. Please read “Business—Our Growth Projects—Our Debottlenecking Project.”

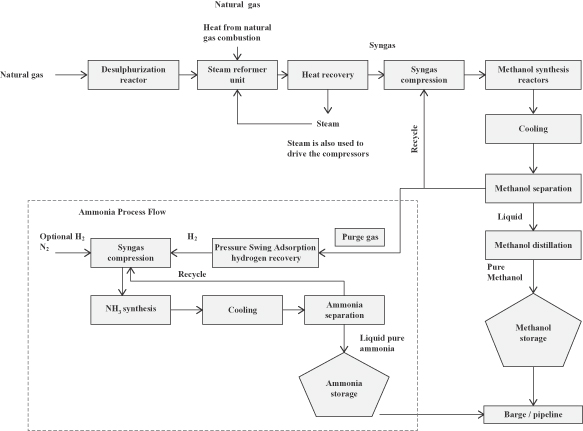

The primary feedstock that we use to produce methanol and ammonia is natural gas. Operating at full capacity, our methanol and ammonia production units together require approximately 84,000 MMBtu per day of natural gas. For the three months ended March 31, 2013, natural gas feedstock costs represented approximately 59.1% of our total cost of goods sold (or approximately 85.0% of our variable cost of goods sold). Accordingly, our profitability depends in large part on the price of our natural gas feedstock.

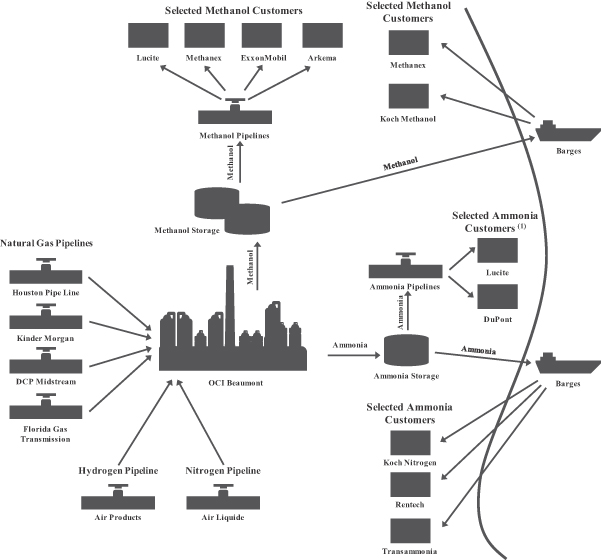

We have connections to one major interstate and three major intrastate natural gas pipelines that provide us flexibility in sourcing our natural gas supplies. We currently source natural gas from a subsidiary of DCP Midstream Partners, LP (“DCP Midstream”) and a subsidiary of Kinder Morgan Energy Partners, L.P. (“Kinder Morgan”). In addition, we have recently connected our facility to a natural gas pipeline owned by Florida Gas Transmission Company, LLC (“Florida Gas Transmission”) and a natural gas pipeline owned by Houston Pipe Line Company LP (“Houston Pipe Line Company”). We believe that we have ready access to an abundant supply of natural gas for the foreseeable future due to our location and connectivity to major natural gas pipelines.

We generate our revenues from the sale of methanol and ammonia manufactured at our facility. We sell our products, primarily under contract, to industrial users and commercial traders for further processing or distribution. In addition, we derive a portion of our revenues from uncontracted sales of methanol and ammonia. We are party to methanol sales contracts with a subsidiary of Methanex Corporation (“Methanex”), a subsidiary of Koch Industries, Inc. (“Koch”), a subsidiary of Exxon Mobil Corporation (“ExxonMobil”), Arkema Inc. (“Arkema”) and a subsidiary of Lucite International, Inc. (“Lucite”). Consistent with industry practice, these contracts set our pricing terms to reflect a specified discount to a published monthly benchmark methanol price (Jim Jordan or Southern Chemical), and our methanol is sold on a free on board (“FOB”) basis when delivered by barge. Currently, we deliver approximately 55% of our methanol sales by barge and approximately 45% of our methanol sales by pipeline.

We generally sell ammonia under monthly contracts with a subsidiary of Transammonia, Inc. (“Transammonia”), a subsidiary of Koch and a subsidiary of Rentech Nitrogen Partners, L.P. (“Rentech”). Consistent with industry practice, these contracts set our pricing terms to reflect a specified discount to a

7

Table of Contents

published monthly benchmark ammonia price (CFR Tampa). Although we have ammonia pipeline connections with certain of our customers, currently all of our ammonia is sold on an FOB basis and is transported by barge.

Our Emerging Growth Company Status

As a company with less than $1.0 billion in revenue during its last fiscal year, we qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). As an emerging growth company, we may, for up to five years, take advantage of specified exemptions from reporting and other regulatory requirements that are otherwise applicable generally to public companies. These exemptions include:

| • | the presentation of only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| • | exemption from the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting; |

| • | exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| • | exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and |

| • | reduced disclosure about executive compensation arrangements. |

We may take advantage of these provisions until we are no longer an emerging growth company, which will occur on the earliest of (i) the last day of the fiscal year following the fifth anniversary of this offering, (ii) the last day of the fiscal year in which we have more than $1.0 billion in annual revenue, (iii) the date on which we issue more than $1.0 billion of non-convertible debt over a three-year period and (iv) the date on which we are deemed to be a “large accelerated filer,” as defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We have elected to take advantage of all of the applicable JOBS Act provisions, except that we will elect to opt out of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards (this election is irrevocable). Accordingly, the information that we provide you may be different than what you may receive from other public companies in which you hold equity interests.

An investment in our common units involves risks associated with our business, our partnership structure and the tax characteristics of our common units. You should carefully consider the risks described in “Risk Factors” and the other information in this prospectus before investing in our common units. Please also read “Forward-Looking Statements.”

8

Table of Contents

OCI Partners LP was formed on February 7, 2013 by OCI USA to own, operate and grow our methanol and ammonia business. In connection with this offering, OCI USA, an indirect wholly owned subsidiary of OCI, will contribute all of its ownership interest in OCIB to OCI Partners LP. In this prospectus, we refer to the following transactions that have taken place or will take place in connection with this offering, collectively, as the “Transactions.”

The following transactions have already occurred prior to this offering:

| • | On May 21, 2013, OCIB entered into a $360.0 million senior secured term loan credit facility with a group of lenders and Bank of America, N.A., as administrative agent. The term loan facility is comprised of two term loans in the amounts of $125.0 million (the “Term B-1 Loan”) and $235.0 million (the “Term B-2 Loan”), respectively; |

| • | OCIB used all $125.0 million of proceeds under the Term B-1 Loan to repay outstanding borrowings under its previous third-party credit facility; |

| • | OCIB used approximately $230.0 million of the proceeds from the Term B-2 Loan to finance a distribution to OCI USA and approximately $2.8 million of the proceeds from the Term B-2 Loan to pay for bank fees, accrued interest and legal fees associated with the term loan facility. The remaining proceeds from the Term B-2 Loan of approximately $2.2 million were recorded to cash; and |

| • | OCIB transferred an office lease to OCI USA. |

Additionally, at or prior to the completion of this offering, the following transactions will occur:

| • | OCIB will enter into a new $235.0 million senior secured term loan credit facility (the “Term Loan B”) with a syndicate of institutional lenders and investors, which Bank of America, N.A. will serve as administrative agent, to repay borrowings under the Term B-2 Loan; |

| • | OCIB will transfer all of its employees to OCI GP LLC; |

| • | OCIB will distribute to OCI USA all of OCIB’s cash, restricted cash and accounts receivable; |

| • | OCI USA will contribute the member interests it owns in OCIB to OCI Partners LP in exchange for common units; |

| • | OCI Partners LP will (i) pay offering expenses, estimated at approximately $ million, excluding the underwriting discount, (ii) pay a structuring fee of approximately $ million to Merrill Lynch, Pierce, Fenner & Smith Incorporated for the evaluation, analysis and structuring of OCI Partners LP in connection with this offering and (iii) make a capital contribution to OCIB of the remaining net proceeds from this offering, estimated to be approximately $ million (based on an assumed initial public offering price of $ per common unit, the midpoint of the price range set forth on the cover page of this prospectus); |

| • | OCIB will use the capital contribution from OCI Partners LP of the net proceeds from this offering referred to in the immediately preceding bullet as described in “Use of Proceeds;” |

9

Table of Contents

| • | OCIB will enter into a new $40.0 million, seven-year intercompany revolving credit facility with OCI Fertilizer as the lender; |

| • | OCI Partners LP’s partnership agreement and the limited liability company agreement of OCI GP LLC will be amended and restated to the extent necessary to reflect the transactions in the contribution agreement; and |

| • | OCI Partners LP will redeem the limited partner interest issued to OCI USA in connection with OCI Partners LP’s formation and will retire such limited partner interest in exchange for a payment of $1,000 to OCI USA. |

The number of common units to be issued to OCI USA includes common units that will be issued at the expiration of the underwriters’ option to purchase additional common units, assuming that the underwriters do not exercise the option. Any exercise of the underwriters’ option to purchase additional common units would reduce the common units shown as issued to OCI USA by the number to be purchased by the underwriters in connection with such exercise. If and to the extent the underwriters exercise their option to purchase additional common units, the number of common units purchased by the underwriters pursuant to any exercise will be sold to the public, and any remaining common units not purchased by the underwriters pursuant to any exercise of the option will be issued to OCI USA at the expiration of the option period for no additional consideration. We will use any net proceeds from the exercise of the underwriters’ option to purchase additional common units from us for general partnership purposes.

10

Table of Contents

Organizational Structure After the Transactions

After giving effect to the Transactions described above and assuming the underwriters’ option to purchase additional common units from us is not exercised, our common units will be held as follows:

| Public common units |

% | |||

| OCI common units |

% | |||

|

|

|

|||

| Total |

100 | % | ||

|

|

|

The following simplified diagram depicts our organizational structure after giving effect to the Transactions described above.

11

Table of Contents

We are managed and operated by the board of directors and executive officers of OCI GP LLC, our general partner. OCI USA, an indirect wholly owned subsidiary of OCI, is the sole member of our general partner and has the right to appoint the entire board of directors of our general partner, including the independent directors appointed in accordance with the listing standards of the New York Stock Exchange (“NYSE”). Unlike shareholders in a publicly traded corporation, our unitholders will not be entitled to elect our general partner or the board of directors of our general partner. For more information about the directors and executive officers of our general partner, please read “Management.”

Principal Executive Offices and Internet Address

Our principal executive offices are located at 5470 N. Twin City Highway, Nederland, Texas 77627, our mailing address is P.O. Box 1647, Nederland, Texas 77627 and our telephone number is (409) 723-1900. Our website is located at www. .com. We expect to make our periodic reports and other information filed with or furnished to the SEC available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

Summary of Conflicts of Interest and Duties

Under our partnership agreement, our general partner has a duty to manage us in a manner it believes is in the best interests of our partnership. However, because our general partner is an indirect, wholly owned subsidiary of OCI, the officers and directors of our general partner and the officers and directors of OCI have a duty to manage the business of our general partner in a manner that is in the best interests of OCI. As a result of these relationships, conflicts of interest may arise in the future between us and our unitholders, on the one hand, and our general partner and its affiliates, including OCI, on the other hand. For a more detailed description of the conflicts of interest and duties of our general partner, please read “Risk Factors—Risks Inherent in an Investment in Us” and “Conflicts of Interest and Duties.”

Delaware law provides that Delaware limited partnerships may, in their partnership agreements, expand, restrict or eliminate the fiduciary duties owed by the general partner to limited partners and the partnership. Our partnership agreement contains various provisions replacing the fiduciary duties that would otherwise be owed by our general partner with contractual standards governing the duties of the general partner and contractual methods of resolving conflicts of interest. The effect of these provisions is to restrict the remedies available to unitholders for actions that might otherwise constitute breaches of our general partner’s fiduciary duties. Our partnership agreement also provides that affiliates of our general partner, including OCI, are not restricted from competing with us, and neither our general partner nor its affiliates have any obligation to present business opportunities to us. By purchasing a common unit, the purchaser agrees to be bound by the terms of our partnership agreement, and pursuant to the terms of our partnership agreement each holder of common units consents to various actions and potential conflicts of interest contemplated in our partnership agreement that might otherwise be considered a breach of fiduciary or other duties under Delaware law. Please read “Conflicts of Interest and Duties—Duties of the General Partner” for a description of the fiduciary duties imposed on our general partner by Delaware law, the replacement of those duties with contractual standards under our partnership agreement and certain legal rights and remedies available to holders of our common units. For a description of our other relationships with our affiliates, please read “Certain Relationships and Related Party Transactions.”

12

Table of Contents

| Issuer |

OCI Partners LP, a Delaware limited partnership. |

| Common Units Offered to the Public |

common units. |

| common units if the underwriters exercise their option to purchase additional common units from us in full. |

| Common Units Outstanding after this Offering |

common units. If the underwriters do not exercise their option to purchase additional common units, in whole or in part, we will issue additional common units to OCI USA at the expiration of the option period for no additional consideration. If and to the extent the underwriters exercise their option to purchase additional common units, the number of common units purchased by the underwriters pursuant to such exercise will be sold to the public, and any remaining common units not purchased by the underwriters pursuant to such exercise of the option will be issued to OCI USA at the expiration of the option period for no additional consideration. Accordingly, the exercise of the underwriters’ option will not affect the total number of common units outstanding. |

| In addition, our general partner will own a non-economic general partner interest in us which will not entitle it to receive distributions. |

| Use of Proceeds |

We estimate that the net proceeds to us from this offering, after deducting the estimated underwriting discount, structuring fees and the estimated offering expenses payable by us, will be approximately $ million (based on an assumed initial public offering price of $ per common unit, the midpoint of the price range set forth on the cover page of this prospectus). We intend to use the net proceeds from this offering as follows: |

| • | approximately $125.0 million to repay in full and terminate the Term B-1 Loan; |

| • | approximately $170.5 million to repay in full and terminate all of OCIB’s intercompany debt with OCI Fertilizer; |

| • | to pay a portion of the costs of our debottlenecking project and other budgeted capital projects incurred after the completion of this offering; and |

| • | the remainder, if any, for general partnership purposes, including working capital. |

| If the underwriters exercise their option to purchase up to additional common units in full, the additional net proceeds would be approximately $ million, assuming an initial public offering price per common unit of $ (the midpoint of the price range set forth on the cover page of this prospectus). We will use the net |

13

Table of Contents

| proceeds from any exercise of the underwriters’ option to purchase additional common units for general partnership purposes. |

| Affiliates of each of Merrill Lynch, Pierce, Fenner & Smith Incorporated, Barclays Capital Inc. and Citigroup Global Markets Inc. are lenders under the Term B-1 Loan and, accordingly, may receive a portion of the distributions made to OCIB in connection with this offering. Please read “Underwriting—Other Relationships.” |

| Cash Distributions |

Within 45 days after the end of each quarter, beginning with the first full quarter following the closing date of this offering, we expect to make distributions, as determined by the board of directors of our general partner, to unitholders of record on the applicable record date. |

| Upon the completion of this offering, the board of directors of our general partner will adopt a policy to distribute 100% of the cash available for distribution that we generate each quarter. If we have cash available for distribution, our first distribution will take place following the first full quarter after the completion of this offering and will include cash available for distribution with respect to the period beginning on the closing date of this offering and ending on the last day of the first full quarter ending after the completion of this offering. Cash available for distribution for each quarter will be determined by the board of directors of our general partner following the end of such quarter. We expect that cash available for distribution for each quarter will generally equal the cash we generate during the quarter, less cash needed for maintenance capital expenditures, debt service and other contractual obligations and reserves for future operating or capital needs that the board of directors of our general partner deems necessary or appropriate. We do not intend to maintain excess distribution coverage for the purpose of maintaining stability or growth in our quarterly distribution or otherwise to reserve cash for distributions, nor do we intend to incur debt to pay quarterly distributions. Other than the expansion capital expenditures we intend to fund with the net proceeds from this offering, we expect to finance substantially all of our growth externally, either with commercial bank borrowings or by debt issuances or additional issuances of equity. |

| Because our policy will be to distribute 100% of the cash available for distribution that we generate each quarter, without reserving cash for future distributions or borrowing to pay distributions during periods of low cash flow from operations, our unitholders will have direct exposure to fluctuations in the amount of cash generated by our business. We expect that the amount of our quarterly distributions, if any, will vary based on our cash flow during such quarter. As a result, our cash distributions, if any, will not be stable and will vary from quarter to quarter as a direct result of, among other things, variations in our operating performance and cash flows caused by fluctuations in the prices of our natural gas supply and the demand for and prices of |

14

Table of Contents

| methanol and ammonia. Such variations in the amount of our quarterly distributions may be significant. Unlike most publicly traded partnerships, we will not have a minimum quarterly distribution or employ structures intended to maintain or increase quarterly cash distributions over time. We may change our distribution policy at any time. Our partnership agreement does not require us to pay cash distributions on a quarterly or other basis. |

| Subject to certain assumptions and assuming the board of directors of our general partner declares distributions in accordance with our cash distribution policy, we expect that our cash available for distribution for the twelve months ending June 30, 2014 will be approximately $ million, or $ per common unit. Please read “Our Cash Distribution Policy and Restrictions on Distributions—Unaudited Forecasted Cash Available for Distribution.” Unanticipated events may occur that could materially adversely affect the actual results we achieve during the forecast period. Consequently, our actual results of operations, cash flows, need for reserves and financial condition during the forecast period may vary from the forecast, and such variations may be material. Prospective investors are cautioned not to place undue reliance on our forecast and should make their own independent assessment of our future results of operations, cash flows and financial condition. In addition, the board of directors of our general partner may be required to or elect to eliminate our distributions at any time during periods of reduced prices or demand for our products, among other reasons. Please read “Risk Factors.” |

| For a calculation of our ability to make distributions to unitholders based on our pro forma results of operations for the year ended December 31, 2012 and the twelve months ended March 31, 2013, please read “Our Cash Distribution Policy and Restrictions on Distributions—Unaudited Pro Forma Cash Available for Distribution.” Our pro forma cash available for distribution generated during the year ended December 31, 2012 and the twelve months ended March 31, 2013 would have been $67.0 million and $129.0 million, respectively. However, the pro forma cash available for distribution information for the year ended December 31, 2012 and the twelve months ended March 31, 2013 that we include in this prospectus do not necessarily reflect the actual cash that would have been available for distribution with respect to those periods. |

| Incentive Distribution Rights |

None. |

| Subordinated Units |

None. |

| Issuance of Additional Units |

Our partnership agreement authorizes us to issue an unlimited number of additional units and rights to buy units for the consideration and on the terms and conditions determined by the board of directors of our general partner without the approval of our unitholders. Please read |

15

Table of Contents

| “The Partnership Agreement—Issuance of Additional Securities” and “Common Units Eligible for Future Sale.” |

| Limited Voting Rights |

Our general partner manages us and our operations. Unlike the holders of common stock in a corporation, you will have only limited voting rights on matters affecting our business. You will have no right to elect our general partner or our general partner’s directors on an annual or other continuing basis. Our general partner may be removed by a vote of the holders of at least 66 2/3% of our outstanding common units, including any common units held by our general partner and its affiliates (including OCI USA), voting together as a single class. Upon the closing of this offering, our general partner and its affiliates will own an aggregate of approximately % of our outstanding common units (or approximately % if the underwriters exercise their option to purchase additional common units in full). Please read “The Partnership Agreement—Voting Rights.” |

| Limited Call Right |

If at any time our general partner and its affiliates own more than 90% of the common units, our general partner will have the right, which it may assign to any of its affiliates or to us, but not the obligation, to acquire all, but not less than all, of the common units held by public unitholders at a price not less than their then-current market price, as calculated pursuant to the terms of our partnership agreement. If our general partner and its affiliates reduce their ownership percentage to below 70% of the outstanding units, then concurrently with such reduction, the ownership threshold to exercise the limited call right will be permanently reduced to 80%. There is no restriction in our partnership agreement that prevents our general partner from causing us to issue additional common units and exercising its limited call right. Please read “The Partnership Agreement—Limited Call Right.” |

| Estimated Ratio of Taxable Income to Distributions |

We estimate that if you own the common units you purchase in this offering from the date of the completion of this offering through the record date for distributions for the period ending December 31, 2015 you will be allocated, on a cumulative basis, an amount of U.S. federal taxable income for that period that will be approximately % of the cash distributed to you with respect to that period. Because of the nature of our business and the expected variability of our quarterly distributions, the ratio of our taxable income to distributions may vary significantly from one year to another. Please read “Material U.S. Federal Income Tax Consequences—Tax Consequences of Common Unit Ownership—Ratio of Taxable Income to Distributions.” |

| Material U.S. Federal Income Tax Consequences |

For a discussion of material U.S. federal income tax consequences that may be relevant to prospective unitholders, please read “Material U.S. Federal Income Tax Consequences.” |

16

Table of Contents

| Exchange Listing |

We intend to apply to list our common units on the NYSE under the symbol “OCIP.” |

| Risk Factors |

Please read “Risk Factors” for a discussion of factors that you should carefully consider before deciding to invest in our common units. |

Depending on market conditions at the time of pricing of this offering and other considerations, we may sell fewer or more common units than the number set forth on the cover page of this prospectus.

17

Table of Contents

Summary Historical and Pro Forma Financial and Operating Data

The summary historical financial information presented below under the caption “Statements of Operations Data” and “Cash Flows Data” for the years ended December 31, 2012 and 2011 and the summary historical financial information presented below under the caption “Balance Sheets Data” as of December 31, 2012 and 2011 have been derived from OCIB’s audited financial statements included elsewhere in this prospectus, which financial statements have been audited by KPMG LLP, an independent registered public accounting firm (“KPMG”).

The summary historical financial information presented below under the caption “Statements of Operations Data” and “Cash Flows Data” for the three months ended March 31, 2013 and 2012 and the summary financial data presented below under the caption “Balance Sheets Data” as of March 31, 2013 have been derived from OCIB’s unaudited financial statements included in this prospectus which, in the opinion of management, include all adjustments, consisting of only normal, recurring adjustments, necessary for the fair presentation of the results for the unaudited interim periods.

The summary unaudited pro forma condensed statements of operations data presented for the year ended December 31, 2012 and the three months ended March 31, 2013 assumes that the Transactions occurred as of January 1, 2012, and the unaudited pro forma condensed balance sheet data as of March 31, 2013 assumes that the Transactions occurred as of March 31, 2013. The summary unaudited pro forma condensed financial information is derived from our unaudited pro forma condensed financial statements included elsewhere in this prospectus. The pro forma condensed financial data is not comparable to our historical financial data. A more complete explanation of the pro forma condensed financial data can be found in our unaudited pro forma condensed financial statements and accompanying notes included elsewhere in this prospectus. Neither the pro forma condensed statements of operations data nor the pro forma condensed balance sheet data include estimates of the incremental costs of operating as a publicly traded limited partnership.

18

Table of Contents

For a detailed discussion of the summary historical financial information and operating data contained in the following table, please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The following table should also be read in conjunction with “Use of Proceeds” and our audited and unaudited historical financial statements and our unaudited pro forma condensed financial statements included elsewhere in this prospectus. Among other things, the historical and unaudited pro forma condensed financial statements include more detailed information regarding the basis of presentation for the information in the following table.

| Historical | Pro Forma | |||||||||||||||||||||||

| (Dollars and metric tons in thousands) | Year ended December 31, |

Three months ended |

Year ended |

Three |

||||||||||||||||||||

| 2011 |

2012 |

2012 |

2013 |

2012 |

2013 |

|||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||||||

| Revenues(1) |

$ | — | $ | 224,629 | $ | 26,492 | $ | 112,161 | $ | 224,629 | $ | 112,161 | ||||||||||||

| Cost of goods sold |

— | 124,483 | 19,907 | 43,167 | 124,483 | 43,167 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross Profit |

— | 100,146 | 6,585 | 68,994 | 100,146 | 68,994 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Expenses: |

||||||||||||||||||||||||

| Depreciation expense |

— | 11,355 | 966 | 5,512 | 11,355 | 5,512 | ||||||||||||||||||

| Selling, general and administrative |

236 | 14,980 | 3,479 | 8,098 | 15,000 | 3,750 | ||||||||||||||||||

| Income (loss) from operations before interest expense, other income and income tax expense |

(236 | ) | 73,811 | 2,140 | 55,384 | 73,791 | 59,732 | |||||||||||||||||

| Interest expense |

— | 5,718 | — | 2,259 | 11,002 | 2,750 | ||||||||||||||||||

| Interest expense – related party |

— | 6,469 | — | 4,411 | 200 | 50 | ||||||||||||||||||

| Other income |

523 | 202 | 159 | 9 | 202 | 9 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income tax expense |

287 | 61,826 | 2,299 | 48,723 | 62,791 | 56,941 | ||||||||||||||||||

| Income tax expense |

— | 1,048 | 47 | 474 | 1,048 | 474 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income |

$ | 287 | $ | 60,778 | $ | 2,252 | $ | 48,249 | $ | 61,743 | $ | 56,467 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income per common unit (basic and diluted) |

||||||||||||||||||||||||

| Common units outstanding (basic and diluted) |

||||||||||||||||||||||||

| Cash Flows Data: |

||||||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||||||

| Operating activities |

$ | (5,252 | ) | $ | 74,657 | $ | (4,842 | ) | $ | (15,824 | ) | |||||||||||||

| Investing activities |

(130,214 | ) | (193,965 | ) | (83,752 | ) | (6,481 | ) | ||||||||||||||||

| Financing activities |