Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - NEWBRIDGE BANCORP | v347222_8k.htm |

| EX-99.1 - PRESS RELEASE - NEWBRIDGE BANCORP | v347222_ex99-1.htm |

NASDAQ: NBBC www.newbridgebank.com ACQUISITION OF SECURITY SAVINGS BANK June 13, 2013

FORWARD - LOOKING STATEMENTS This presentation contains forward-looking statements relating to the financial condition, results of operations and business of NewBridge Bancorp and its subsidiary NewBridge Bank . These forward looking statements involve risks and uncertainties and are based on the beliefs and assumptions of the management of NBBC Bancorp, and the information available to management at the time that this presentation was prepared . Factors that could cause actual results to differ materially from those contemplated by such forward-looking statements include, among others, the following : (i) general economic or business conditions, either nationally or regionally, may be less favorable than expected, resulting in, among other things, a deterioration in credit quality and/or a reduced demand for credit or other services ; (ii) changes in the interest rate environment may reduce net margins and/or the volumes and values of loans made or held as well as the value of other financial assets held ; (iii) competitive pressures among depository and other financial institutions may increase significantly ; (iv) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which NBBC Bancorp is engaged ; (v) local, state or federal taxing authorities may take tax positions that are adverse to NBBC Bancorp ; (vi) adverse changes may occur in the securities markets ; (viii) competitors of NBBC Bancorp may have greater financial resources and develop products that enable them to compete more successfully than NBBC Bancorp ; (viii) costs or difficulties related to the integration of Security Savings Bank SSB, may be greater than expected ; (ix) expected cost savings associated with our acquisition of Security Savings Bank, SSB may not be fully realized within the expected time frame ; and (x) deposit attrition, customer loss or revenue loss following our acquisition of Security Savings Bank may be greater than expected . Additional factors affecting NBBC Bancorp and NewBridge Bank are discussed in NBBC Bancorp’s filings with the Securities and Exchange Commission (the “SEC”, Annual Report on Form 10 -K, its Quarterly Reports on Form 10 -Q and its Current Reports on Form 8 -K . Please refer to the Securities and Exchange Commission's website at www . sec . gov to review such documents . NewBridge Bancorp does not undertake a duty to update any forward-looking statements made in this presentation 2

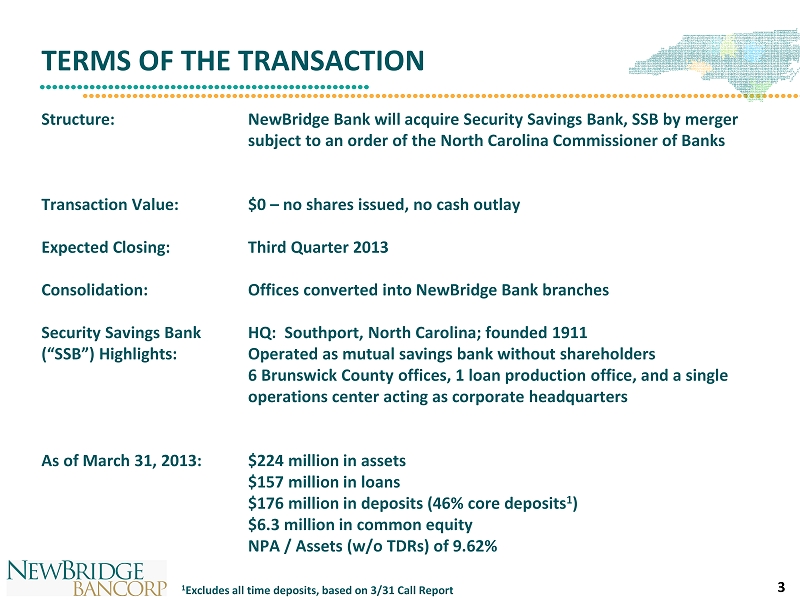

TERMS OF THE TRANSACTION Structure: Transaction Value: Expected Closing: Consolidation: Security Savings Bank (“SSB”) Highlights: As of March 31, 2013: NewBridge Bank will acquire Security Savings Bank, SSB by merger subject to an order of the North Carolina Commissioner of Banks $0 – no shares issued, no cash outlay Third Quarter 2013 Offices converted into NewBridge Bank branches HQ: Southport, North Carolina; founded 1911 Operated as mutual savings bank without shareholders 6 Brunswick County offices, 1 loan production office, and a single operations center acting as corporate headquarters $224 million in assets $157 million in loans $176 million in deposits (46% core deposits 1 ) $6.3 million in common equity NPA / Assets (w/o TDRs) of 9.62% 3 1 Excludes all time deposits, based on 3/31 Call Report

STRATEGIC RATIONALE • Metro Wilmington is a growing and dynamic economic market • Build - out of coastal franchise - leverages existing NBBC leadership and infrastructure in the region • Coastal expansion consistent with NBBC’s strategic growth plan • Cultural similarity and community - based bank operating • Gaining critical mass – approaching $2.0 billion in assets • Significant EPS accretion and favorable TBV payback period • Revenue synergies likely through NBBC’s wealth management and mortgage banking businesses • Manageable asset quality – NBBC experienced in asset quality resolution • Establishes NBBC as an active acquirer in the Carolinas • Strategic deployment of capital raised at the end of 2012 is a sign of strength to investors • Addition of key SSB personnel complements NBBC’s existing sales leadership in its E astern C arolina franchise • Positions NBBC as the #1 community bank in the Wilmington MSA Attractive Markets Strong Financial Impact Well - Positioned Franchise 4

FRANCHISE FOOTPRINT NBBC Locations SSB Locations Wilmington, NC MSA June '12 Total Market # of Deposits Share Rank Institution State Branches ($M) (%) 1 BB&T Corp. NC 22 $1,612 27.4 % 2 Wells Fargo & Co. CA 10 896 15.3 3 First Citizens BancShares Inc. NC 14 683 11.6 4 Bank of America Corp. NC 10 456 7.8 Pro Forma Institution 9 338 5.8 5 PNC Financial Services Group Inc. PA 10 328 5.6 6 Live Oak Bancshares Inc. NC 1 263 4.5 7 First Bancorp NC 9 256 4.4 8 SunTrust Banks Inc. GA 6 238 4.1 9 SCBT Financial Corp. SC 7 237 4.0 10 Security Savings Bank SSB NC 6 199 3.4 11 Toronto-Dominion Bank - 5 159 2.7 12 Crescent Financial Bancshares Inc. NC 6 146 2.5 13 NewBridge Bancorp NC 3 139 2.4 14 First Community Bancshares Inc. VA 7 119 2.0 15 North State Bancorp NC 1 63 1.1 Market Total 124 $5,875 100.0 % Source: SNL Financial 5 ($ Dollars in Thousands) Branch List Address City County 6/30/12 Deposits ($000) 5074 Main St Shallotte Brunswick $53,478 10231 Beach Dr SW Calabash Brunswick 44,201 101 N Howe St Southport Brunswick 43,051 840 Sunset Blvd Sunset Beach Brunswick 19,139 4815 E Oak Island Dr Oak Island Brunswick 15,556 3020 George II Hwy Boiling Springs Brunswick 7,497 5201 Southport Supply Rd (LPO) Southport Brunswick - 300 N Howe St. (HQ-OPS) Southport Brunswick - Total: $182,922

METRO WILMINGTON MARKET HIGHLIGHTS • Industrial and research based economy – Port of Wilmington – economic impact of nearly $300 million – Military Ocean Terminal Sunny Point - largest military terminal in the world – GE Energy - Wilmington – University of NC - Wilmington – Robust small business economy • Strong tourism industry – Cape Fear region of Southeast NC – miles of ocean coastline and pristine beaches – Notable film and television production in the region • Accolades – #32 in the nation on Forbes 2010 - “Best Places for Business and Careers” – “One of the Best Towns” , “The Next Big Thing” , Outside Magazine - 2011 • Population – Total population of 373,464 • Projected population growth – Increase of 8.6% from 2012 - 2017 • Regional income levels – Current household income of $43,499 – Per capita income of $25,444 – More than 14% of all households have income > $100,000 • Projected income growth – Increase of 18.2% from 2012 - 2017 in household income – Increase of 11.5% from 2012 - 2017 for per capital income Overview Demographic Highlights Source: SNL Financial, Wilmington Chamber of Commerce 6

PRO FORMA BUSINESS MIX – 1Q 2013 • Favorable impact to lending portfolio – Addition of $156 million in loans in a low - growth environment – Provides yield improvement • Well - positioned deposit portfolio – Ability to run off higher costing CDs and replace with core - based funding – Strong levels of transaction accounts based on relationship banking C&D 6.7% 1 - 4 Fam 27.8% HELOC 17.1% OwnOcc CRE 20.6% Other CRE 14.7% Multifam 1.8% C&I 8.0% Consr & Other 3.3% Non Int. Bearing 14.5% NOW Accts 6.3% MMDA & Sav 50.7% Retail Time 15.6% Jumbo Time 12.8% Loans Deposits 7 Source : SNL Financial

DUE DILIGENCE & ESTIMATED FAIR VALUE MARKS • A robust balance sheet analysis to evaluate credit exposure – Reviewed $70.7 million (45%) of the total loan portfolio, including $55 million (75%) of the commercial loan portfolio – Reviewed all TDRs and substandard or worse credits in excess of $100,000 – Reviewed all OREO properties in excess of $100,000 • Fair value marks based on impairment (actual dollars) and NBBC’s model for ALLL – Loan portfolio mark down of $6.9 million or 4.4% of SSB loans • Credit mark down of $11.3 million or 7.2% of SSB loans • Yield mark up of $4.4 million or 2.8% of SSB loans – Reverse of $5.7 million existing allowance or 3.7% of SSB loans – OREO mark down of $4.3 million or 45% of credit - related OREO balances – Other fair value marks totaling a mark down of $5.4 million • Credit losses already identified and incurred – Since 2008 peak loan balance, charge offs totaled $42.6 million or 11.9% of peak loans – With addition of acquisition credit mark and historical OREO losses, total credit mark down of $64.8 million 8

FINANCIAL IMPACT OF TRANSACTION • Attractive Pro Forma Balance Sheet – Total assets of $1.9 billion – Total loans of $1.3 billion – Total deposits of $1.5 billion • Strong Pro Forma Capital Ratios – TCE/TA ~7.2% – Leverage ratio ~ 8.5% – Tier 1 RBC ratio ~10.8% – Total RBC ratio ~12.1% • Financial Returns – Earnings accretion >10% per annum once fully integrated – Tangible book value payback period less than 1 year – Significant cost saves available – approximately 50% – Acquisition related costs of $1.8 million – Total intangibles of approximately $900 thousand – primarily CDI 9 Note: Pro forma capital ratios are for the holding company level

TRANSACTION SUMMARY • Coastal expansion at a minimal cost - no shares issued or cash outlaid • Favorable earnings accretion through cost saving initiatives and synergies with existing NBBC business lines • Continued building of core deposit base and increasing market share – #2 in Brunswick County and #5 in the Wilmington MSA • Coastal market supports NBBC’s operating model – Business & private banking, wealth management, and mortgage banking • SSB sales team adds depth to the coastal franchise • Identified problem loans along with conservative credit marks makes asset quality manageable 10

INVESTOR CONTACTS • Pressley A. Ridgill, Chief Executive Officer pressley.ridgill@newbridgebank.com 336.369.0903 • Ramsey K. Hamadi, Chief Financial Officer ramsey.hamadi@newbridgebank.com 336.369.0975 • David P. Barksdale, Chief Strategy Officer david.barksdale@newbridgebank.com 336.369.0939 11