Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. | d552732d8k.htm |

| EX-99.2 - EX-99.2 - ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. | d552732dex992.htm |

| EX-10.1 - EX-10.1 - ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. | d552732dex101.htm |

Allscripts

Investor Presentation

June 2013

Exhibit 99.1 |

A

Connected Community

of

Health

|

1

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Forward-Looking

Statements This presentation contains forward-looking statements within the

meaning of the federal securities laws. Statements regarding future events or

developments, our future performance, as well as management’s expectations, beliefs,

intentions, plans, estimates or projections relating to the future are

forward-looking statements with the meaning of these laws. These forward-looking statements are subject to a number of risks and

uncertainties, some of which are outlined below. As a result, no assurances can be given

that any of the events anticipated by the forward- looking statements will

transpire or occur, or if any of them do so, what impact they will have on our results of operations or financial condition.

Such risks, uncertainties and other factors include, among other things: the possibility

that our current initiatives focused on product delivery, client experience,

streamlining our cost structure, and financial performance may not be successful, which could result in declining demand for

our products and services, including attrition among our existing customer base; the

impact of the realignment of our sales and services organization; potential

difficulties or delays in achieving platform and product integration and the connection and movement of data among

hospitals, physicians, patients and others; the risk that we will not achieve the

strategic benefits of the merger (the “Eclipsys Merger”) with Eclipsys

Corporation (Eclipsys), or other companies that we have purchased or that the Allscripts products will not be integrated successfully

with these other companies products; competition within the industries in which we

operate, including the risk that existing clients will switch to products of

competitors; failure to maintain interoperability certification pursuant to the Health Information Technology for Economic and

Clinical Health Act (HITECH), with resulting increases in development and other costs for

us and possibly putting us at a competitive disadvantage in the marketplace; the

volume and timing of systems sales and installations, the length of sales cycles and the installation

process and the possibility that our products will not achieve or sustain market

acceptance; the timing, cost and success or failure of new product and service

introductions, development and product upgrade releases; any costs or customer losses we may incur relating to the

standardization of our small office electronic health record and practice management

systems that could adversely affect our results of operations; competitive

pressures including product offerings, pricing and promotional activities; our ability to establish and maintain strategic

relationships; errors or similar problems in our software products or other product

quality issues; the outcome of any legal proceeding that has been or may be

instituted against us and others; compliance obligations under new and existing laws, regulations and industry initiatives,

including new regulations relating to HIPAA/HITECH, increasing enforcement activity in

respect of anti-bribery, fraud and abuse, privacy, and similar laws, and future

changes in laws or regulations in the healthcare industry, including possible regulation of our software by the U.S.

Food and Drug Administration; the possibility of product-related liabilities; our

ability to attract and retain qualified personnel; the continued implementation and

ongoing acceptance of the electronic record provisions of the American Recovery and Reinvestment Act of 2009, as well

as elements of the Patient Protection and Affordable Care Act (aka health reform) which

pertain to healthcare IT adoption, including uncertainly related to changes in

reimbursement methodology and the shift to pay-for-outcomes; maintaining our intellectual property rights

and litigation involving intellectual property rights; legislative, regulatory and

economic developments; risks related to third-party suppliers and our ability

to obtain, use or successfully integrate third-party licensed technology; and breach of data security by third parties and

unauthorized access to patient health information by third parties resulting in

enforcement actions, fines and other litigation. See our Annual Report on Form

10-K/10K-A for 2012 and other public filings with the Securities and Exchange Commission (the “SEC”) for a further discussion

of these and other risks and uncertainties applicable to our business. The statements

herein speak only as of their date and we undertake no duty to update any

forward-looking statement whether as a result of new information, future events or changes in expectations.

|

2

Explanation of Non-GAAP Financial Measures

Non-GAAP revenue consists of GAAP revenue as reported and adds back the provision for

revenue deferral as well as acquisition-related deferred revenue adjustment

booked for GAAP purposes. Non-GAAP net income consists of GAAP net income as

reported, excludes acquisition-related amortization, stock-based compensation expense and

non-recurring expenses and transaction-related costs, and adds back the provision

for revenue deferral as well as acquisition-related deferred revenue

adjustments, in each case net of any related tax effects. Non-GAAP net income also includes a tax rate alignment adjustment.

Adjusted EBITDA is a non-GAAP measure and consists of GAAP net income (loss) as

reported and adjusts for: the provision for revenue deferral; provision/(benefit)

for income taxes; net interest expense and interest income and other income/(expense); stock-based compensation expense;

depreciation and amortization; deferred revenue adjustment; non-recurring and

transaction-related costs; and non-cash asset impairment charges. A

Connected Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Allscripts reports its

financial results in accordance with generally accepted accounting principles, or GAAP. To supplement this information,

Allscripts presents in this release non-GAAP revenue, and net income, including

non-GAAP net income on a per share basis, and Adjusted EBITDA, which are

non-GAAP financial measures under Section 101 of Regulation G under the Securities Exchange Act of 1934, as amended. |

3

An Open, Connected Community

of Health

™

Our Vision

We provide clinical, financial,

connectivity and information

SOLUTIONS and related professional

services to physicians, health systems,

hospitals and post-acute organizations.

We deliver insights that healthcare

providers require to generate world-class

outcomes and transform healthcare by

improving the quality and efficiency of

patient care.

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

4

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Who We Are and What We Do

1

Total research and development costs before software capitalization.

OUR Solutions

•

Electronic Health

Record Technology

•

Revenue Cycle

Management

•

Professional Services

•

Clinical & Financial

Transaction

Management

•

Hosting

•

Connectivity

•

Population Health

Management

•

IT Outsourcing

OUR CLIENTS

•

180,000 Physicians

•

50,000 Physician

Practices

•

1,500 Hospitals

•

10,000 Post-acute

Facilities

•

27,000 Individual

Post-acute Providers

OUR COMPANY

•

~$1.45BB 2012

Revenue

•

~7,100 Employees

•

Grow 2013 R&D

1

double-digits

•

Breadth and depth

of solutions across

the continuum of

care |

5

Investment Highlights

MARKET LEADER

Diverse, industry-leading client base

Brand name recognition

OPEN systems

COMPLETE PRODUCT

PORTFOLIO

Depth and breadth

Maximizes opportunities to expand market and wallet share

Significant investment in technology platform and mobile platforms

DYNAMIC GROWTH

MARKET

Clinical innovation & regulatory requirements drive incremental client demand

Replacement opportunity with fragmented, legacy vendors

Connectivity, care coordination, analytics solutions for population health

management

Select global opportunities

OPERATING LEVERAGE

Scalable platform for sales growth

$40-50MM SG&A cost savings in 2014

Making key investments today

SOUND FINANCIAL

MODEL

~$2.7BB revenue backlog (March 31, 2013)

~74% recurring revenue (March 31, 2013)

~$223MM 2012 operating cash flow

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

6

MARKET

DIFFERENTIATION

GROWTH

Agenda

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

7

A Large, Dynamic Market

U.S. Acute/Ambulatory EHR Opportunity ~$43BB

Source: McKinsey & Company

$45

$40

$35

$30

$25

$20

$15

$10

$5

$0

Ambulatory

Stand-Alone

Opportunity

Acute

Stand-Alone

Opportunity

Integrated/Complete

Solution Across Hospitals

and Physician Practices

$16B

$10B

$17B

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

8

Meaningful Use

ICD-10

HIPAA

Population

Health

Management

•

~$20BB

federal

program

to

drive

“meaningful”

adoption

of

electronic

health

records

–

Technology and regulatory bar increases over time

–

Yields opportunity for market share gains and competitor replacement/additions

•

Overhaul of healthcare coding system for procedures, diagnosis and billing

•

Opportunities to upgrade revenue cycle management systems

•

Professional and related services opportunity

•

Shift away from volume to value

•

Requires infrastructure above and beyond the electronic health record

•

Connect, analyze and coordinate care across a community

•

Patient and consumer engagement

•

The PHM technology market could grow to exceed $60BB by 2025¹

•

Recent updates to HIPAA Rules drive additional HIPAA compliance requirements

•

Technology platform enables and facilitates sharing of information

–

Critical criteria for success in next generation technology systems

1

Source: Equity research reports

Industry Demand Drivers

Allscripts well positioned to capitalize on evolving market

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

9

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Unsustainable Trend

Requiring Change 9

VOLUME

VALUE

Source: HFMA “Value in Healthcare: Current State & Future Directions, June

2011 •

Fragmented providers

and payments

•

No uniform quality

•

Fees for volume

•

Demand increasing

•

Collaboration,

connectivity

•

Clinical, financial

data, analysis

•

Optimize outcomes

•

Accountable care |

10

Unsustainable Trend Requiring Change…Will Drive Future

Growth

Opportunities

“Above”

the

EHR

Care

Coordination

Population

Health

Patient

Engagement

Enterprise

Analytics

Software

Development Kit

Health Info

Exchange

Physician EHRs

Hospital EHRs

Alternate Site EHRs

Government Entities

Patient-centered Platform

Single health record

Allscripts provides connectivity, analytics and services across the community, regardless of

underlying system –

a key differentiator for the future

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

11

MARKET

GROWTH

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. DIFFERENTIATION

|

12

Leading Footprint Across the Market

1 of 3

MDs

1 of 3

Hospitals

10,000

Post-acute

Care Providers

Used By:

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

13

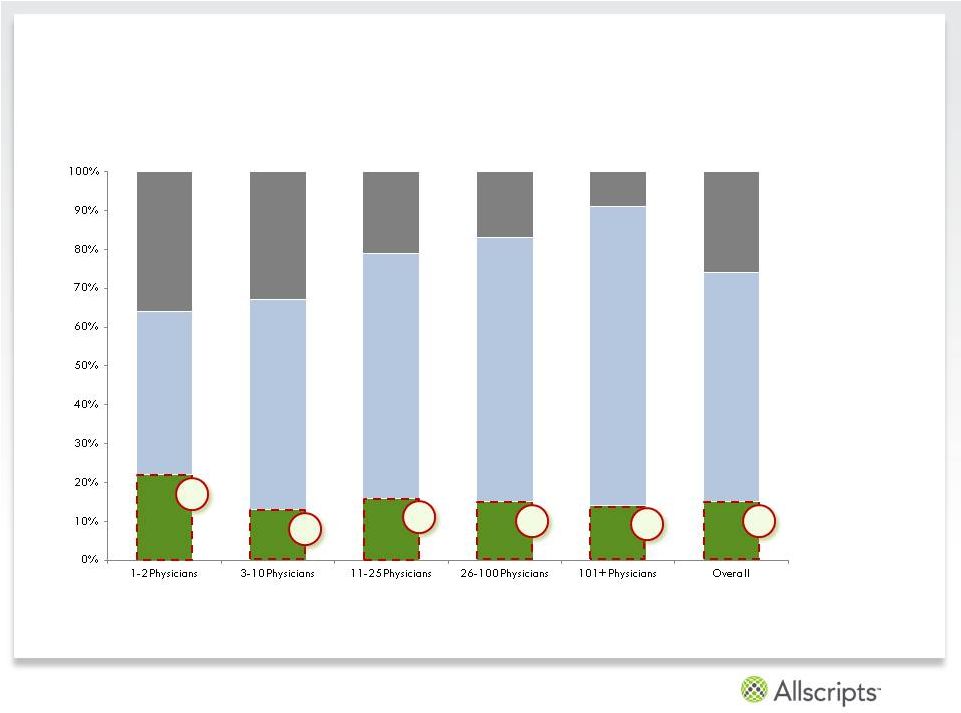

Leading Market Share in Ambulatory

2012 Share by Practice Size

Source: Capsite, 2012 US Ambulatory EHR & PM Study, August 2012

Allscripts Market

Position

#1

#1

#1

#2

#2

#2

22%

13%

16%

15%

14%

15%

42%

54%

63%

68%

77%

59%

36%

33%

21%

17%

9%

26%

Top 15 Vendors

(ex Allscripts)

Rest of Market

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

14

Source: Analysis of HIMSS Analytics, CDR, 2011-2012.

1. For illustrative purposes, two acute vendors with ~22% and ~9% of the hospital IT

market. Total 2012 Market Share

Potential

replacement

opportunity

31%

Positioned for Growth in Acute

1

Allscripts

4.0%

Other

65.0

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

15

A Connected

Community

of

Health

|

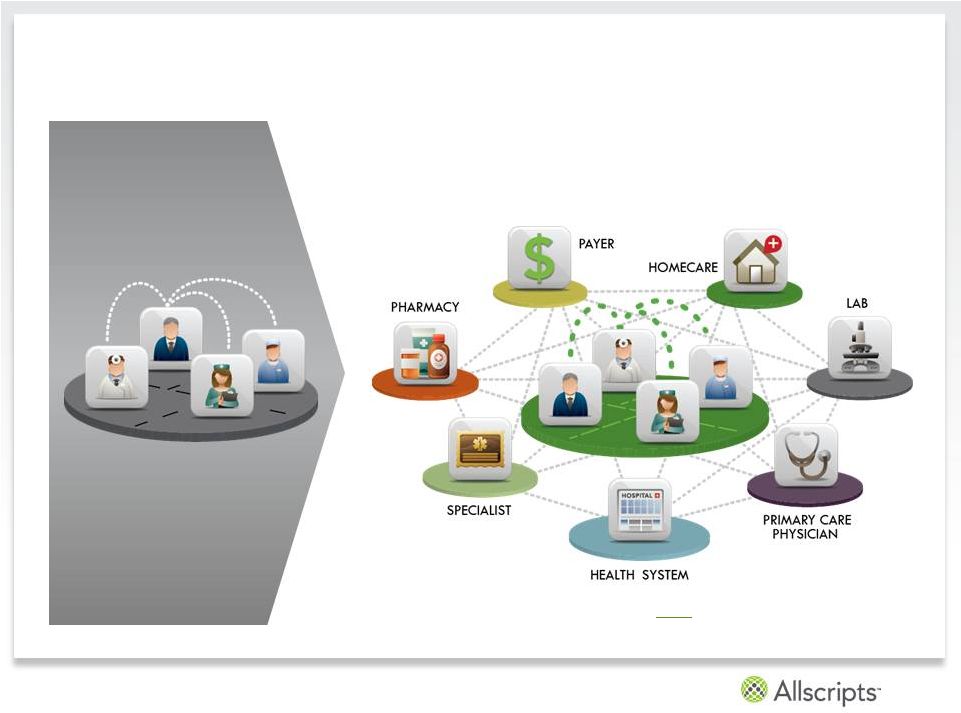

Copyright © 2013 Allscripts Healthcare Solutions, Inc. To Succeed in Value Based

Care: Interoperability, Open Platform

Traditional World

(Monolithic/Closed

Mainframe)

New World

(Modern/Open Platform)

Connect Inside

Connect Inside and

Outside |

16

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Our Solutions: OPEN + Depth

& Breadth |

17

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Complete Core Solution

Set Homecare

Care Management

Electronic Health Records

Practice Management

Payerpath

Clinical and Financial Management

Care Management

Emergency Department

•

Enterprise EHR and Practice Management

•

Professional EHR and Practice Management

•

Pathway Solutions

•

Sunrise Clinical Manager

•

Sunrise Financial Manager

•

Sunrise Ambulatory

•

Allscripts Care Management

•

Provides business, clinical and scheduling

functionality for multiple lines of business –

home, health, hospital & private duty

•

Referral Management allows home health

agencies, hospice agencies, and post-acute

facilities to track all patient referrals

Physician

Hospital & Health System

At Home/Alternate Site

Deploy as software, SaaS & hosted solutions |

18

A Connected

Community

of

Health

|

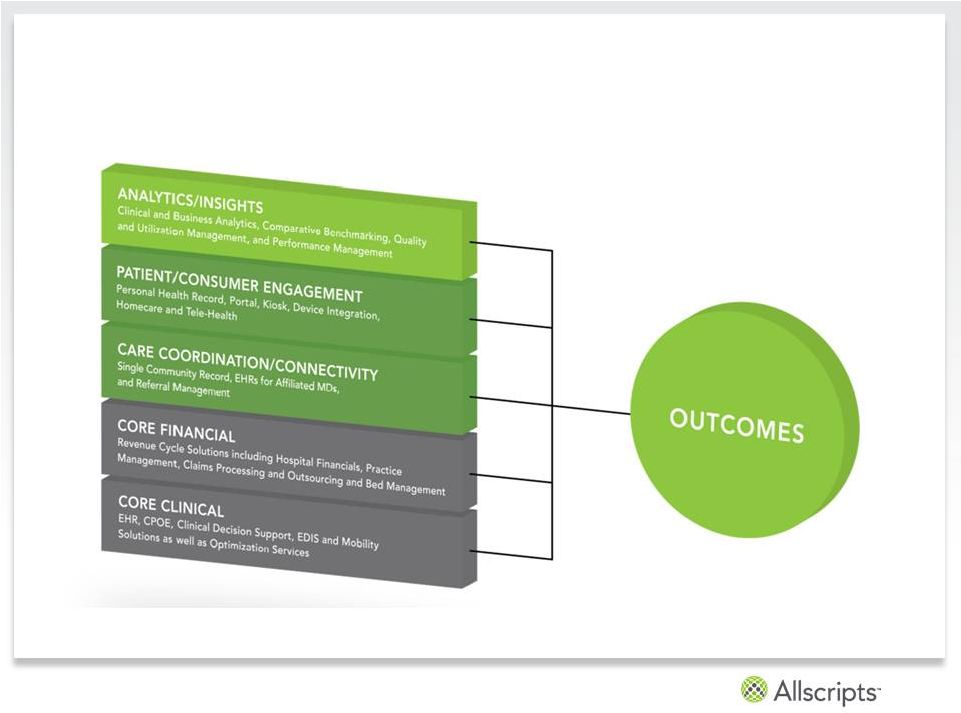

Copyright © 2013 Allscripts Healthcare Solutions, Inc. SOLUTIONS for the

“Virtual Layer” Beyond the EHR:

Patient Engagement, Connectivity, Analytics and Care

Coordination

Physician

Hospital & Health System

At Home/Alternate Site

Health

Information

Exchange:

dbMotion

Patient Engagement: Follow My

Health™ Clinical Analytics

& Financial Analytics: CQS; dB Motion; EPSi Care Coordination Applications:

e.g. Care Director, Care Management Technology platform a source of

competitive advantage for the future |

19

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. •

Stage

1:

EHR/Application

•

Stage

2:

Connection

•

Stage

3:

Information

•

Stage

4:

Analytics

and

Insights

•

Stage

5:

Outcomes

LEVEL OF

IMPACT

(Quality,

Cost of Care)

TIME

Well-positioned for Next Generation of Healthcare

•

Significant drivers post Meaningful Use: Accountable Care Organization functionality,

care coordination and predictive analytics (i.e. Population Health

Management) •

Interoperability, connectivity, clinical decision support to drive better outcomes

Today |

20

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Allscripts Leadership

Stabilized and experienced team comprised of HCIT and technology

veterans

Name

Title

Years

Relevant

Experience

Experience

Paul Black

CEO and President

25+

Cerner, IBM

Rick Poulton

Chief Financial Officer

25+

AAR, United Airlines, Arthur Andersen

Cliff Meltzer

EVP, Solutions Development

30+

CA Technologies, Apple, Cisco, IBM

Steve Shute

EVP, Sales & Services

18

IBM

Joe Carey

Client Experience Officer

23

Enterprise Systems, HBOC

Brian Farley

SVP, General Counsel

20+

Motorola, Level 3, Rythyms NetConnections

Dennis Olis

SVP, Operations

25+

Motorola

Deborah Snow

SVP, Culture & Talent

18

Cisco, Bank of America

Diane Bradley

Chief Quality and Outcomes Officer

16

Motorola, University Health System |

21

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. MARKET

DIFFERENTIATION

GROWTH |

22

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Strategic Imperatives for

2013 Client Commitments

Position for Growth

Enhance Financial Consistency

Operational Effectiveness

•

Deliver timely, high-quality upgrades, ensuring client

success with upcoming regulatory compliance requirements

•

Invest in improving client satisfaction

•

“Centers of Excellence”

R&D/support strategy

•

$500MM R&D and M&A commitment in 2013

•

Acquired leading connectivity provider dbMotion and

patient engagement platform “Follow My Health”

•

Delivered integrated acute revenue cycle management

solution

•

Increase deployment of hosted and mobile solutions

•

Launched Population Health Management applications

including “Care Director”

•

Package offerings

•

Longer term client commitments

•

Increased subscription/SaaS revenue

•

Expand share of wallet through incremental IT budget

•

Site consolidation plan

•

Rationalize small physician office offering

•

Streamline reporting structures and management layers

•

Discipline in procurement and sourcing

•

Invest $45-$50MM in 2013 to drive in excess of $50MM

in annualized savings beginning in 2014 |

23

A Connected

Community

of

Health

|

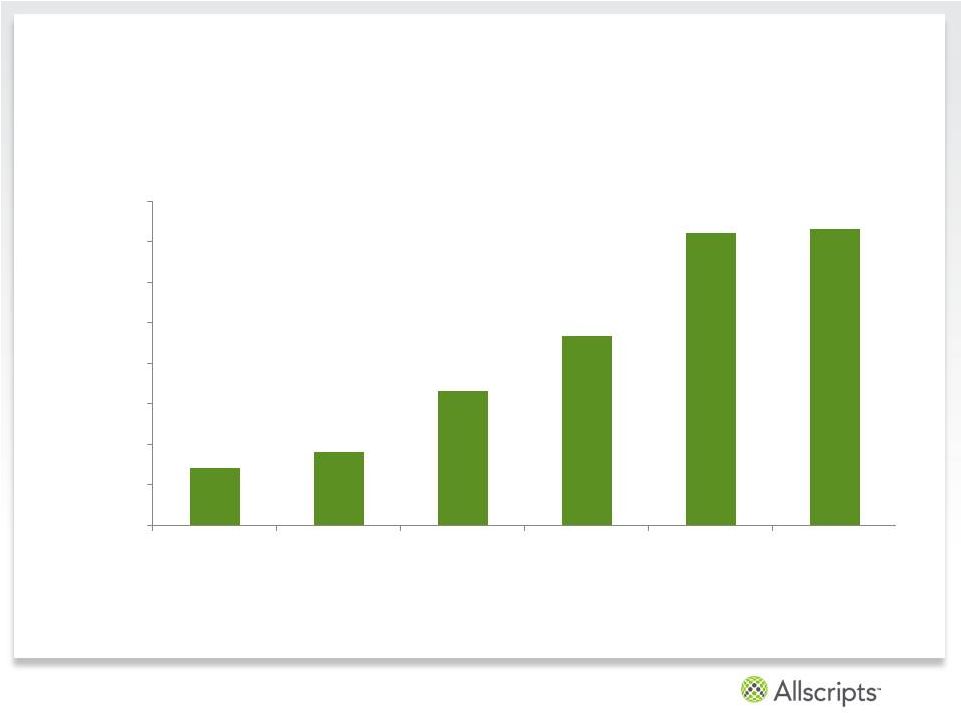

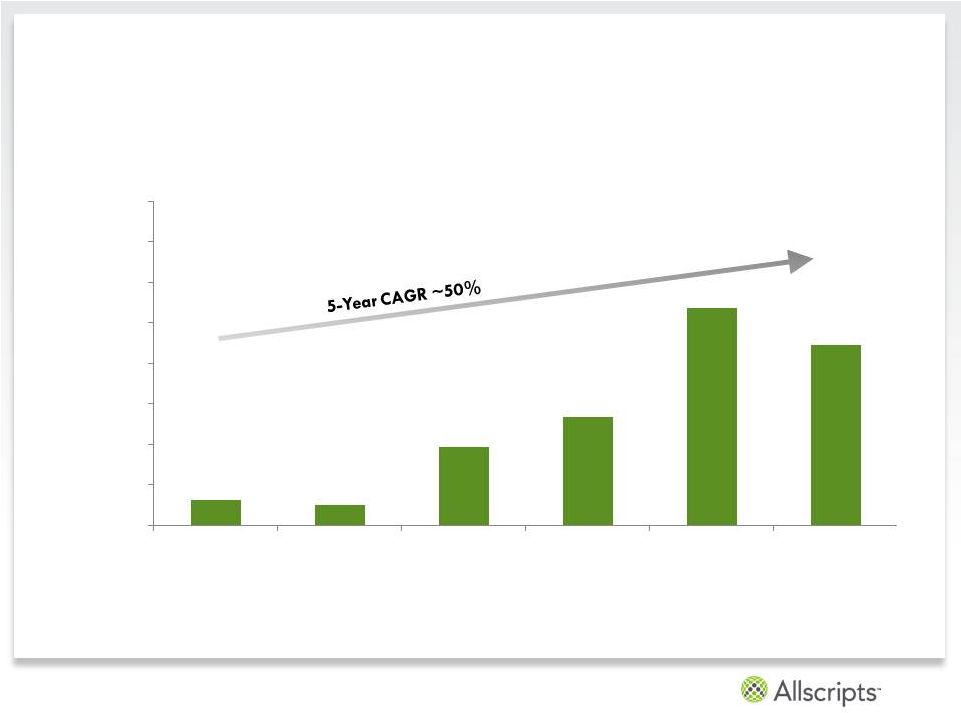

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Growth: Long-Term

Focus ¹

Annual revenue for Allscripts illustrated above is based on a GAAP presentation and is

calenderized based on reported quarterly results. Please note Allscripts changed its fiscal year-end

to

May between the period of September 2008 and May 2010. Revenue includes the impact

of acquisitions and divestitures, including revenue from Eclipsys beginning in 3Q 2010.

ALLSCRIPTS REVENUE

1

2007 -

2012

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

2007

2008

2009

2010

2011

2012

$934MM

$1.444BB

$1.446BB

$282MM

$364MM

$661MM |

24

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Strong Cash Flow

Generation ¹

Annual

cash

flow

from

operations

for

Allscripts

illustrated

above

is

calenderized

based

on

annual

results.

Please

note

Allscripts

changed

its

fiscal

year-end

to

May

between

the

period of September 2008 and May 2010. Cash flows from operations also include the

impact of acquisitions and divestitures CASH

FLOW

FROM

OPERATIONS

1

2007

-

2012

$0

$50

$100

$150

$200

$250

$300

$350

$400

2007

2008

2009

2010

2011

2012

$134MM

$269MM

$223MM

$31MM

$24MM

$97MM |

25

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. 1Q’13 Results

($MM except per share)

Q1’13

Q4’12

Q1’12

Y/Y % change

Bookings

$177.7

$180.7

$194.6

(8.7%)

Non–GAAP Revenue

$348.0

$368.0

$365.5

(4.8%)

Adj. EBITDA

margin

$49.8

(2)

14%

$53.6

15%

$58.3

16.0%

(14.6%)

(1.7%)

Non-GAAP EPS

$0.09

(2)

$0.16

$0.12

(25%)

Please see the Non-GAAP reconciliation and related footnotes in the appendix to this

presentation Adjusted EBITDA and non-GAAP EPS for the three months ended March

31, 2013 include a pre-tax gain of approximately $8.0 million.investor.allscripts.com

1

1

1

1.

2.

Source: Company filings and publications.

|

26

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. Recent Results and

Corporate Update •

Q1: signed a new Sunrise community agreement (Resolute Health) and large client

renewal (Phoenix Children’s Hospital)

•

Investing in clients /solutions

•

Focused on meeting commitments

•

Results not indicative of long-term potential

•

Increased Q1 2013 gross R&D expenditures 19% year-over-year

•

Recent acquisitions (March 2013) position Allscripts for future growth

•

dbMotion

•

Follow My Health

•

Non-GAAP revenue and non-GAAP operating income for the second quarter of

2013 are expected to be materially consistent with the first quarter of 2013

Source: Company filings and publications. investor.allscripts.com |

27

Key Balance Sheet Metrics

($MM)

2010

2011

2012

Q1’13

Cash and Cash Equivalents

$129.4

$157.8

$104.0

$92.3

Accounts Receivable

317.2

362.8

337.0

351.8

Total Assets

2,418.6

2,503.6

2,384.5

2,622.8

Accounts Payable

46.6

41.2

45.9

73.0

Accrued Liabilities

125.1

121.5

137.2

140.7

Total Deferred Revenue

228.6

288.9

290.7

327.9

Debt

490.5

368.1

442.0

544.3

Total Liabilities

1,034.8

1,026.9

1,100.1

1,288.5

Stockholders’

Equity

1,383.8

1,476.7

1,284.3

1,334.3

Source: Company filings

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. |

28

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc. In Summary….

|

29

Non-GAAP Reconciliations: Revenue and earnings first

quarter 2013 and 2012 and fourth quarter 2012

Source: Company filings

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc.

3/31/13

12/31/12

3/31/12

Total revenue, as reported

$347.1

$350.9

$364.7

Provision for revenue deferral (a)

0.0

16.8

0.0

Acquisition-related deferred revenue adjustment

0.9

0.3

0.8

Total non-GAAP revenue

$348.0

$368.0

$365.5

Net income/(loss), as reported

($11.6)

($24.3)

$5.8

Provision for revenue deferral

0.0

17.3

0.0

Acquisition-related deferred revenue adjustment

0.7

0.3

0.5

Acquisition-related amortization

12.4

15.9

10.4

Stock-based compensation expense

6.1

13.0

4.9

Non-recurring expenses and transaction-related costs

16.0

12.5

1.9

Tax rate alignment

(7.4)

(6.7)

0.0

Non-GAAP net income

$16.2

$28.1

$23.5

Tax Rate

23%

-3%

37%

Weighted

shares

outstanding

-

diluted

173.7

173.5

192.9

Earnings

per

share

-

diluted,

as

reported

($0.07)

($0.14)

$0.03

Non-GAAP

earnings

per

share

-

diluted

$0.09

$0.16

$0.12

Three Months

Ended

Allscripts Healthcare Solutions, Inc.

Condensed Non-GAAP Financial Information

(In millions, except per-share amounts)

(Unaudited)

(a)

Provision

for

revenue

deferral

for

the

three

months

and

year

ended

December

31,

2012

reflects

a

non-recurring

revenue

deferral related to clients who have long-aged accounts receivable

balances. Three Months

Ended

Three Months

Ended |

30

Non-GAAP Reconciliations: Adjusted EBITDA first quarter

2013 and 2012 and fourth quarter 2012

Source: Company filings

A Connected

Community

of

Health

|

Copyright © 2013 Allscripts Healthcare Solutions, Inc.

3/31/13

12/31/12

3/31/12

Total revenue, as reported

$347.1

$350.9

$364.7

Provision for revenue deferral (a)

0.0

16.8

0.0

Acquisition related deferred revenue adjustment

0.9

0.3

0.8

Total non-GAAP revenue

$348.0

$368.0

$365.5

Net income/(loss), as reported

($11.6)

($24.3)

$5.8

Tax provision/(benefit)

(13.2)

(5.8)

3.7

Interest expense (income) and other (income) expense (b)

3.2

2.2

2.0

Stock-based compensation expense

8.0

12.7

7.7

Depreciation and amortization

40.8

39.6

35.2

Acquisition-related deferred revenue adjustments

0.9

0.3

0.8

Provision for revenue deferral

0.0

16.8

0.0

Acquisition-related amortization

1.2

0.0

0.0

Non-recurring expenses and transaction-related costs (c)

20.4

12.2

3.0

Non-GAAP adjusted EBITDA

$49.8

$53.6

$58.3

Non-GAAP adjusted EBITDA margin

14%

15%

16%

Three Months

Ended

Allscripts Healthcare Solutions, Inc.

Non-GAAP Financial Information -

Adjusted EBITDA

(In millions)

Three Months

Ended

Three Months

Ended

(Unaudited)

(a) Provision for revenue deferral for the three months and year ended

December 31, 2012 reflects a non-recurring revenue

deferral related to clients who have long-aged accounts receivable

balances. (b) Interest expense (income) and other (income) expense has been

adjusted from the amounts presented in the statements of

operations in order to remove the amortization of deferred debt

issuance costs from interest expense since such amortization is

also included in depreciation and amortization. Additionally, the

amount presented for the three months ended March 31, 2013

excludes gains on investments totaling $8.0 million.

(c) Non-recurring expenses relate to certain severance,

legal, consulting, and other charges incurred in connection with

activities that are considered one-time. Depreciation expense

totaling $0.4 million has been excluded from non-recurring

expenses for the three months ended March 31, 2013 since this amount is

also included in depreciation and amortization. |

Allscripts

Investor Presentation

June 2013 |