Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AGILYSYS INC | form8-kxagysq4fy13earnings.htm |

| EX-99.1 - AGYS Q4 FY13 PRESS RELEASE - AGILYSYS INC | exh991agys4qfy2013pressrel.htm |

TECHNOLOGY | INNOVATION | SOLUTIONS Agilysys, Inc. (Nasdaq: AGYS) Fiscal 2013 Fourth Quarter and Full Year Results June 12, 2013

TECHNOLOGY | INNOVATION | SOLUTIONS Forward-looking statements & non-GAAP financial information Forward-Looking Language This presentation and other publicly available documents, including the documents incorporated herein and therein by reference, contain, and our officers and representatives may from time to time make, "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. These statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions, or beliefs and are subject to a number of factors, assumptions, and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include the risk factors set forth in Item 1A of our Annual Report for the fiscal year ended March 31, 2012 copies are available from the SEC or the Agilysys website. We undertake no obligation to update any such factor or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events, or otherwise. Use of Non-GAAP Financial Information To supplement the unaudited condensed consolidated financial statements presented in accordance with U.S. GAAP in this press release, certain non-GAAP financial measures as defined by the SEC rules are used. These non-GAAP financial measures include adjusted operating income (loss) from continuing operations, adjusted net income (loss), adjusted net income (loss) per share and adjusted cash flow from operations. Management believes that such information can enhance investors' understanding of the company's ongoing operations. See the accompanying tables below for reconciliations of adjusted operating income (loss) and adjusted net income (loss), and adjusted cash flow from operations, to the comparable GAAP measures. NOTE: Results presented herein are unaudited. 2

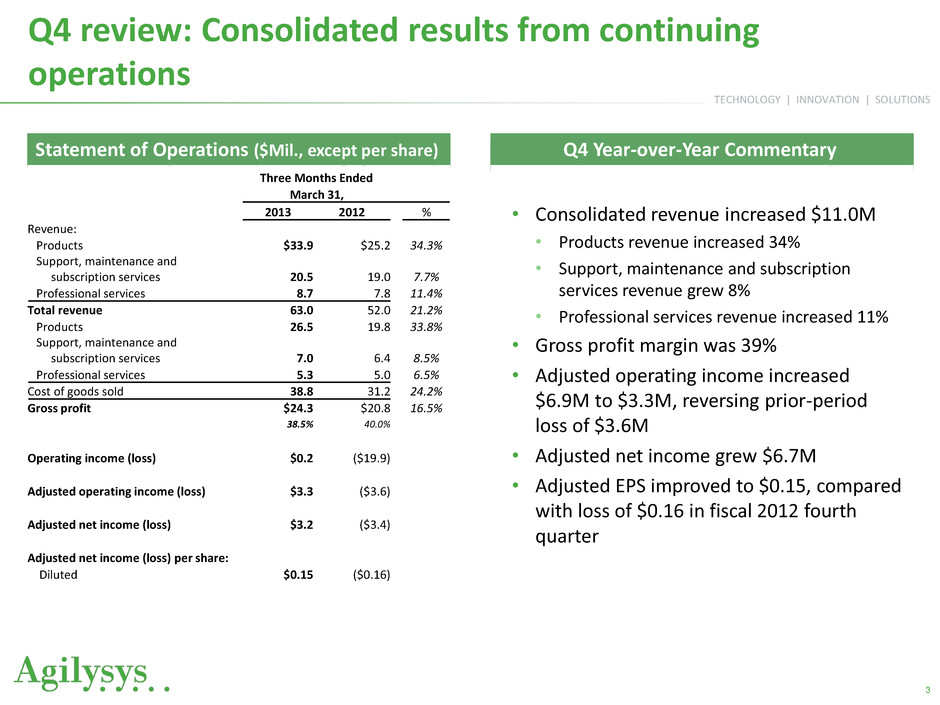

TECHNOLOGY | INNOVATION | SOLUTIONS Q4 review: Consolidated results from continuing operations 3 Q4 Year-over-Year Commentary Statement of Operations ($Mil., except per share) • Consolidated revenue increased $11.0M • Products revenue increased 34% • Support, maintenance and subscription services revenue grew 8% • Professional services revenue increased 11% • Gross profit margin was 39% • Adjusted operating income increased $6.9M to $3.3M, reversing prior-period loss of $3.6M • Adjusted net income grew $6.7M • Adjusted EPS improved to $0.15, compared with loss of $0.16 in fiscal 2012 fourth quarter Three Months Ended March 31, 2013 2012 % Revenue: Products $33.9 $25.2 34.3% Support, maintenance and subscription services 20.5 19.0 7.7% Professional services 8.7 7.8 11.4% Total revenue 63.0 52.0 21.2% Products 26.5 19.8 33.8% Support, maintenance and subscription services 7.0 6.4 8.5% Professional services 5.3 5.0 6.5% Cost of goods sold 38.8 31.2 24.2% Gross profit $24.3 $20.8 16.5% 38.5% 40.0% Operating income (loss) $0.2 ($19.9) Adjusted operating income (loss) $3.3 ($3.6) Adjusted net income (loss) $3.2 ($3.4) Adjusted net income (loss) per share: Diluted $0.15 ($0.16)

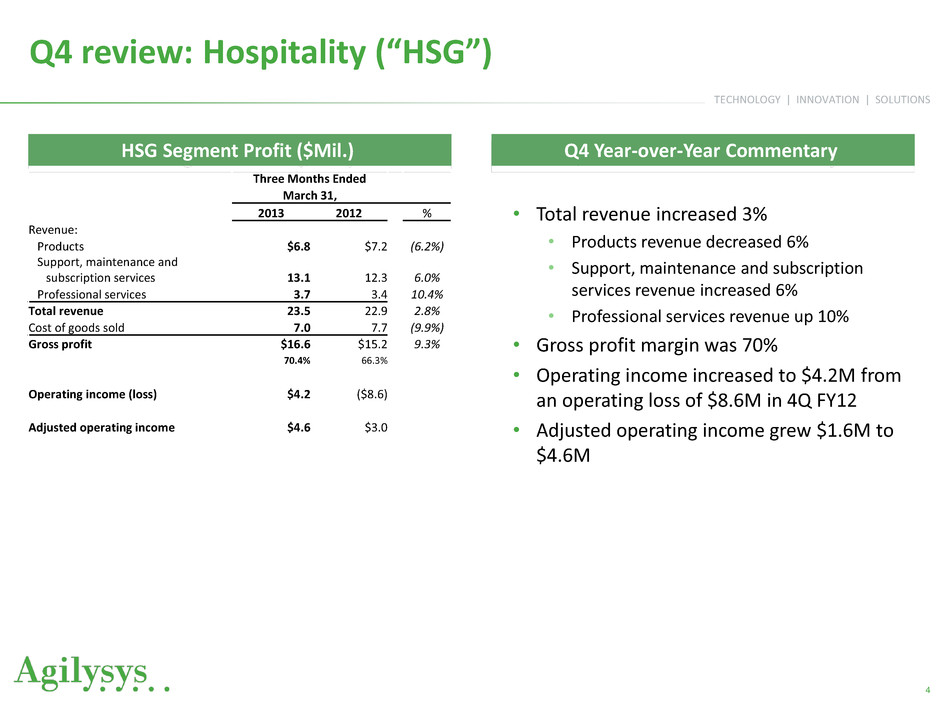

TECHNOLOGY | INNOVATION | SOLUTIONS Q4 review: Hospitality (“HSG”) • Total revenue increased 3% • Products revenue decreased 6% • Support, maintenance and subscription services revenue increased 6% • Professional services revenue up 10% • Gross profit margin was 70% • Operating income increased to $4.2M from an operating loss of $8.6M in 4Q FY12 • Adjusted operating income grew $1.6M to $4.6M 4 HSG Segment Profit ($Mil.) Q4 Year-over-Year Commentary Three Months Ended March 31, 2013 2012 % Revenue: Products $6.8 $7.2 (6.2%) Support, maintenance and subscription services 13.1 12.3 6.0% Professional services 3.7 3.4 10.4% Total revenue 23.5 22.9 2.8% Cost of goods sold 7.0 7.7 (9.9%) Gross profit $16.6 $15.2 9.3% 70.4% 66.3% Operating income (loss) $4.2 ($8.6) Adjusted operating income $4.6 $3.0

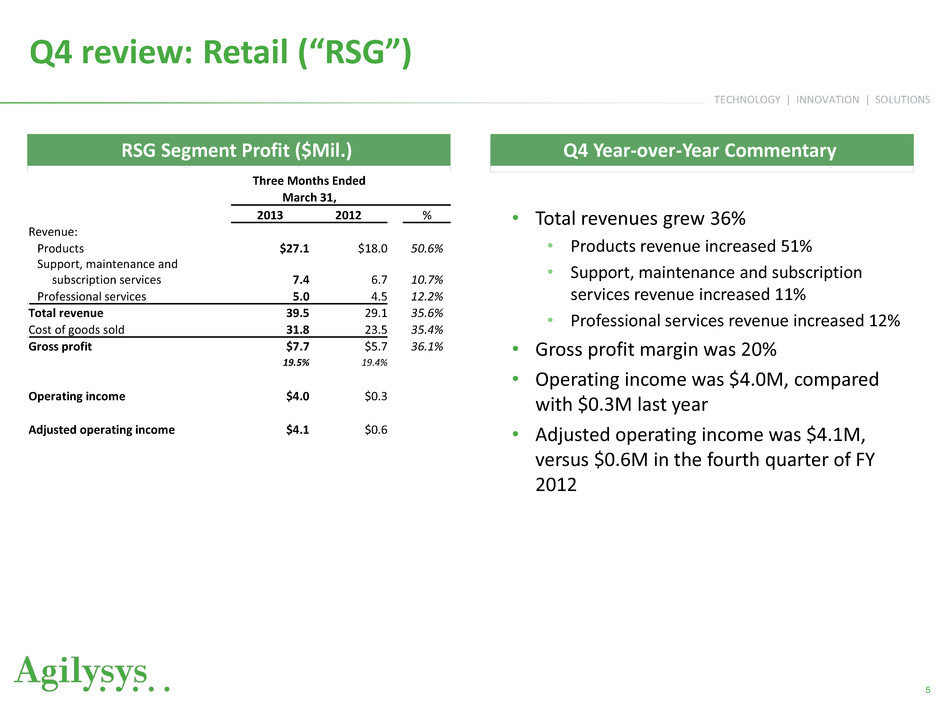

TECHNOLOGY | INNOVATION | SOLUTIONS Q4 review: Retail (“RSG”) • Total revenues grew 36% • Products revenue increased 51% • Support, maintenance and subscription services revenue increased 11% • Professional services revenue increased 12% • Gross profit margin was 20% • Operating income was $4.0M, compared with $0.3M last year • Adjusted operating income was $4.1M, versus $0.6M in the fourth quarter of FY 2012 5 RSG Segment Profit ($Mil.) Q4 Year-over-Year Commentary Three Months Ended March 31, 2013 2012 % Revenue: Products $27.1 $18.0 50.6% Support, maintenance and subscription services 7.4 6.7 10.7% Professional services 5.0 4.5 12.2% Total revenue 39.5 29.1 35.6% Cost of goods sold 31.8 23.5 35.4% Gross profit $7.7 $5.7 36.1% 19.5% 19.4% Operating income $4.0 $0.3 Adjusted operating income $4.1 $0.6

TECHNOLOGY | INNOVATION | SOLUTIONS Q4 review: Corporate and consolidated adjusted operating expenses Excluding stock-based compensation: • Product development expenses increased $1.4M, or 21%; • Sales and marketing expenses declined 21% to $5.6M; and, • General and administrative expenses decreased $2.4M, or 27%. 6 Q4 Year-over-Year Commentary Three Months Ended March 31, 2013 2012 Total revenue $0.0 $0.0 Cost of goods sold 0.0 0.0 Gross profit $0.0 $0.0 Operating loss ($8.0) ($11.6) Adjusted operating loss ($5.4) ($7.2) Three Months Ended March 31, 2013 2012 Consolidated operating expenses as reported: Product development $8.4 $6.9 Sales and marketing 5.6 7.1 General and administrative 7.0 9.4 Depreciation 0.7 1.4 Total $21.7 $24.9 Share-based compensation: Product development $0.2 $0.1 Sales and marketing - - General and administrative 0.5 0.4 Total $0.7 $0.5 Adjusted operating expense: Product development $8.2 $6.8 Sales and marketing 5.6 7.1 General and administrative 6.5 9.0 Depreciation 0.7 1.4 Total $21.0 $24.4 Consolidated adjusted operating expenses ($Mil.) Corporate continuing operations ($Mil.)

TECHNOLOGY | INNOVATION | SOLUTIONS Fiscal 2013 full year review: summary cash flow performance and key balance sheet metrics • Cash and liquid investments on hand of approximately $83M at March 31, 2013 • Fully valued federal net operating losses of approximately $169M • Fiscal 2013 full year uses of cash included: • $6.3M in BEP/SERP payments • $6.9M in cash expenses related to restructuring activities • $4.3M in investments in capitalized software development • Generated adjusted cash flow from operations of $3M in fiscal 2013 7

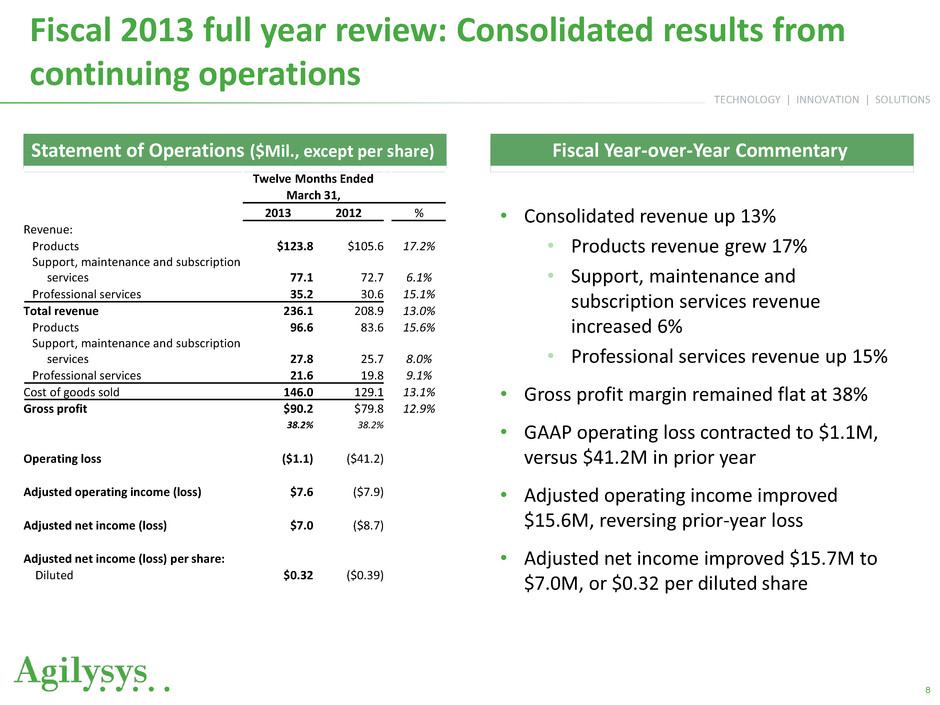

TECHNOLOGY | INNOVATION | SOLUTIONS Fiscal 2013 full year review: Consolidated results from continuing operations • Consolidated revenue up 13% • Products revenue grew 17% • Support, maintenance and subscription services revenue increased 6% • Professional services revenue up 15% • Gross profit margin remained flat at 38% • GAAP operating loss contracted to $1.1M, versus $41.2M in prior year • Adjusted operating income improved $15.6M, reversing prior-year loss • Adjusted net income improved $15.7M to $7.0M, or $0.32 per diluted share 8 Statement of Operations ($Mil., except per share) Fiscal Year-over-Year Commentary Twelve Months Ended March 31, 2013 2012 % Revenue: Products $123.8 $105.6 17.2% Support, maintenance and subscription services 77.1 72.7 6.1% Professional services 35.2 30.6 15.1% Total revenue 236.1 208.9 13.0% Products 96.6 83.6 15.6% Support, maintenance and subscription services 27.8 25.7 8.0% Professional services 21.6 19.8 9.1% Cost of goods sold 146.0 129.1 13.1% Gross profit $90.2 $79.8 12.9% 38.2% 38.2% Operating loss ($1.1) ($41.2) Adjusted operating income (loss) $7.6 ($7.9) Adjusted net income (loss) $7.0 ($8.7) Adjusted net income (loss) per share: Diluted $0.32 ($0.39)

TECHNOLOGY | INNOVATION | SOLUTIONS Agilysys, Inc. (Nasdaq: AGYS) Fiscal 2013 Fourth Quarter and Full Year Results Questions & Answers June 12, 2013

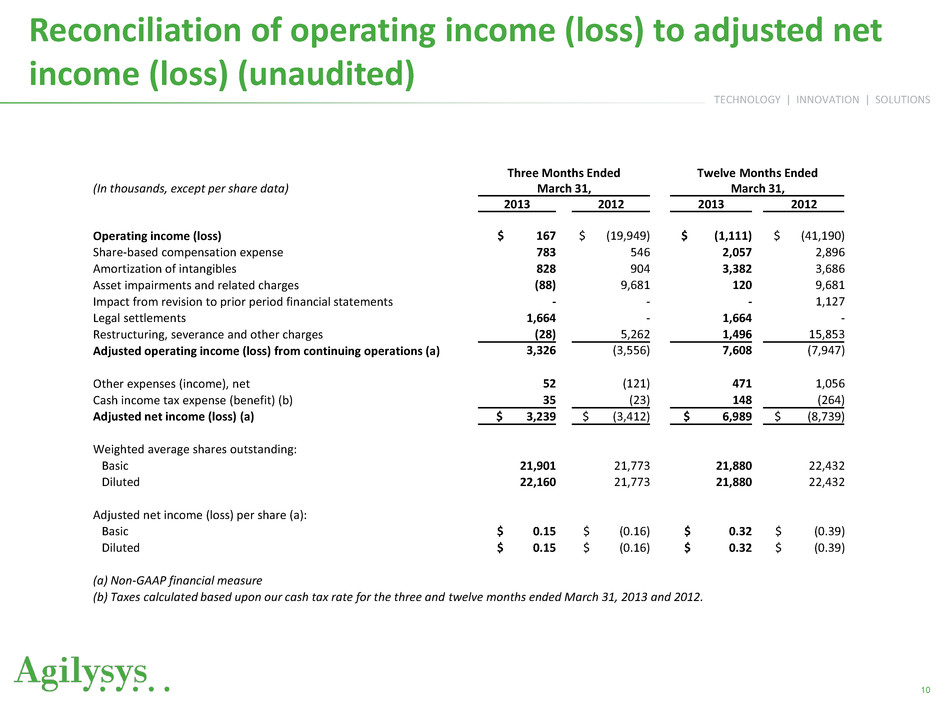

TECHNOLOGY | INNOVATION | SOLUTIONS Reconciliation of operating income (loss) to adjusted net income (loss) (unaudited) 10 (In thousands, except per share data) Three Months Ended Twelve Months Ended March 31, March 31, 2013 2012 2013 2012 Operating income (loss) $ 167 $ (19,949) $ (1,111) $ (41,190) Share-based compensation expense 783 546 2,057 2,896 Amortization of intangibles 828 904 3,382 3,686 Asset impairments and related charges (88) 9,681 120 9,681 Impact from revision to prior period financial statements - - - 1,127 Legal settlements 1,664 - 1,664 - Restructuring, severance and other charges (28) 5,262 1,496 15,853 Adjusted operating income (loss) from continuing operations (a) 3,326 (3,556) 7,608 (7,947) Other expenses (income), net 52 (121) 471 1,056 Cash income tax expense (benefit) (b) 35 (23) 148 (264) Adjusted net income (loss) (a) $ 3,239 $ (3,412) $ 6,989 $ (8,739) Weighted average shares outstanding: Basic 21,901 21,773 21,880 22,432 Diluted 22,160 21,773 21,880 22,432 Adjusted net income (loss) per share (a): Basic $ 0.15 $ (0.16) $ 0.32 $ (0.39) Diluted $ 0.15 $ (0.16) $ 0.32 $ (0.39) (a) Non-GAAP financial measure (b) Taxes calculated based upon our cash tax rate for the three and twelve months ended March 31, 2013 and 2012.

TECHNOLOGY | INNOVATION | SOLUTIONS Reconciliation of operating cash flows from continuing operations to adjusted cash flow from continuing operations (unaudited) 11 Twelve Months Ended (In thousands) March 31, 2013 2012 Operating activities: Net cash (used in) provided by continuing operations $ (10,705) $ 5,301 Non-recurring cash items: Restructuring, severance and other payments 6,924 5,896 BEP/SERP payments 6,271 5,017 Adjusted cash provided by continuing operations $ 2,490 $ 16,214