Attached files

| file | filename |

|---|---|

| 8-K - OLD LINE BANCSHARES, INC. FORM 8-K - OLD LINE BANCSHARES INC | oldline8k.htm |

Exhibit 99.1

James W. Cornelsen

President & CEO

Mark A. Semanie

Executive Vice President, COO & CFO

NASDAQ: OLBK

2nd Annual DC Field Trip

Sponsored By Sandler O’Neill

June 11, 2013

OLBK - 6/2013

OLD LINE BANCSHARES, INC | 2

This presentation includes forward-looking statements, including statements about future

results. These statements are subject to uncertainties and risks, including but not limited to our

ability to integrate acquisitions; the strength of the U.S. economy and the local economies where

we conduct operations; harsh weather conditions; fluctuations in inflation, interest rates, or

monetary policies; changes in the stock market and other capital and real estate markets;

legislative or regulatory changes; customer acceptance of third-party products and services;

increased competition and its effect on pricing; technological changes; security breaches and

computer viruses that may affect our computer systems; changes in consumer spending and

savings habits; our growth and profitability; changes in accounting; and our ability to manage the

risks involved in the foregoing. These factors, as well as additional factors, can be found in our

Annual Report on Form 10-K for the fiscal year ended December 31, 2012 along with our other

filings with the SEC, which are available at the SEC’s internet site (http://www.sec.gov). Actual

results may differ materially from projections and could be affected by a variety of factors,

including factors beyond our control. Forward-looking statements in this presentation speak only

as of the date of these materials, and we assume no obligation to update forward-looking

statements or the reasons why actual results could differ. In addition, this presentation includes

certain non-GAAP financial measures.

results. These statements are subject to uncertainties and risks, including but not limited to our

ability to integrate acquisitions; the strength of the U.S. economy and the local economies where

we conduct operations; harsh weather conditions; fluctuations in inflation, interest rates, or

monetary policies; changes in the stock market and other capital and real estate markets;

legislative or regulatory changes; customer acceptance of third-party products and services;

increased competition and its effect on pricing; technological changes; security breaches and

computer viruses that may affect our computer systems; changes in consumer spending and

savings habits; our growth and profitability; changes in accounting; and our ability to manage the

risks involved in the foregoing. These factors, as well as additional factors, can be found in our

Annual Report on Form 10-K for the fiscal year ended December 31, 2012 along with our other

filings with the SEC, which are available at the SEC’s internet site (http://www.sec.gov). Actual

results may differ materially from projections and could be affected by a variety of factors,

including factors beyond our control. Forward-looking statements in this presentation speak only

as of the date of these materials, and we assume no obligation to update forward-looking

statements or the reasons why actual results could differ. In addition, this presentation includes

certain non-GAAP financial measures.

Forward-Looking Statement

OLBK - 6/2013

OLD LINE BANCSHARES, INC | 3

OLBK Corporate Overview

§ 5th largest MD-headquartered independent banking company

traded on a major exchange with $1.2 billion total assets, $124.3M

market capitalization, 23 branch locations*

traded on a major exchange with $1.2 billion total assets, $124.3M

market capitalization, 23 branch locations*

§ Primary market area is suburban Maryland - (Washington, D.C.

suburbs and Southern Maryland). Also targets customers

throughout the greater Washington, D.C. metropolitan area

suburbs and Southern Maryland). Also targets customers

throughout the greater Washington, D.C. metropolitan area

§ We operate in the best strategic, natural submarkets within

footprint with population growth rates & per capita income above

national averages - bedroom communities for both Washington

and Baltimore

footprint with population growth rates & per capita income above

national averages - bedroom communities for both Washington

and Baltimore

§ We operate Loan Production Offices in seven locations

§ We have been an acquirer (2 completed) and will continue to seek

logical acquisitions

logical acquisitions

§ 29.84% Insider/Stakeholder and Board ownership; 18.33%

institutional & .82% mutual fund ownership*

institutional & .82% mutual fund ownership*

*Source: SNL Financial, Inc. as of 05/20/2013

OLBK - 6/2013

OLD LINE BANCSHARES, INC | 4

Vision

Grow Old Line Bancshares’ position

as the community bank of choice and

the employer of choice

across our Maryland-based footprint.

as the community bank of choice and

the employer of choice

across our Maryland-based footprint.

OLBK - 6/2013

OLD LINE BANCSHARES, INC | 5

Presentation Agenda

1. Market Analysis

2. Financial Performance Highlights

3. Key Strategic Goals

4. Compelling Investment Considerations

OLD LINE BANCSHARES, INC | 6

OLBK - 6/2013

95

70

PENNSYLVANIA

495

95

66

83

MD

2

495

695

Old Line Bank branch (23)

ANNE

ARUNDEL

PRINCE

GEORGE’S

ST.

MARY’S

CHARLES

Old Line Bank Branch Map

OLD LINE BANCSHARES, INC | 7

OLBK - 6/2013

|

|

As of March 31, 2013

|

|

||||

|

|

Old Line

|

WSB

|

Combined

|

|||

|

|

Deposits

|

Branches

|

Deposits

|

Branches

|

Deposits

|

Branches

|

|

County

|

($mm)

|

(#)

|

($mm)

|

(#)

|

($mm)

|

(#)

|

|

Prince George’s

|

346

|

7

|

79

|

1

|

425

|

8

|

|

Charles

|

226

|

4

|

69

|

1

|

295

|

5

|

|

Saint Mary’s

|

116

|

3

|

-

|

-

|

116

|

3

|

|

Anne Arundel

|

32

|

2

|

75

|

3

|

107

|

5

|

|

Calvert

|

28

|

2

|

-

|

-

|

28

|

2

|

|

Total

|

748

|

18

|

223

|

5

|

971

|

23

|

Logical In-Market Consolidation

95

70

PENNSYLVANIA

495

95

66

83

MD

2

495

695

Old Line Bank

Source: Internal Data

OLD LINE BANCSHARES, INC | 8

OLBK - 6/2013

Selected OLBK Market Highlights

§ Household income for entire franchise is $78,182 vs. $50,157 for the U.S.

§ Projected HH income growth rate (2012-2017) is 13.37% across franchise.

§ Projected 5-year population growth rate (2012-2017) in overall market = 3.86%.

§ OLBK deposit market rank/share by county (2012):

Maryland Rank Share # Branches

Prince George’s #6 5.43% 8

Charles #3 16.00% 5

Saint Mary’s #4 8.41% 3

Anne Arundel #13 1.15% 5

Calvert #8 2.69% 2

Source: SNL Financial, Inc.

OLD LINE BANCSHARES, INC | 9

OLBK - 6/2013

|

|

2008

|

2009

|

2010

|

2011

|

2012

|

|

Total Assets (000)

|

$317,731

|

$357,219

|

$401,910

|

$811,042

|

$861,856

|

|

Total Loans, net (000)

|

$231,054

|

$265,009

|

$299,606

|

$539,298

|

$595,145

|

|

Total Deposits (000)

|

$231,431

|

$286,348

|

$340,527

|

$690,768

|

$735,458

|

|

Return on Average Assets

|

0.64%

|

0.62%

|

0.36%

|

0.77%

|

0.90%

|

|

Return on Average Equity

|

5.03%

|

5.35%

|

3.87%

|

9.03%

|

10.52%

|

|

Total Equity/Total Assets

|

13.31%

|

10.25%

|

9.37%

|

8.45%

|

8.75%

|

|

Tangible Equity/Tangible Assets

|

13.31%

|

10.25%

|

9.37%

|

7.87%

|

8.29%

|

|

Total Risk-Based Capital Ratio

|

17.40%

|

13.70%

|

12.40%

|

11.26%

|

11.40%

|

|

Net Interest Margin

|

3.78%

|

3.75%

|

3.83%

|

4.59%

|

4.63%

|

|

Efficiency Ratio

|

69.87%

|

69.19%

|

71.72%

|

64.27%

|

60.51%

|

|

Nonperforming Assets/Assets(1)

|

.27%

|

.60%

|

1.12%

|

1.87%

|

1.26%

|

Old Line Bancshares, Inc.

(1)Nonperforming assets (NPAs) include non-accrual loans, 90 days past due and still accruing loans, accruing

troubled debt restructurings, and net other real estate and other assets owned.

troubled debt restructurings, and net other real estate and other assets owned.

Year-End Highlights

Source: SNL

Financial, Inc.

Financial, Inc.

OLD LINE BANCSHARES, INC | 10

OLBK - 6/2013

Loan Composition

Deposit Composition

Loans and Deposits

(As of 03/31/13)

Source: FFIEC Call Report

OLD LINE BANCSHARES, INC | 11

OLBK - 6/2013

Credit Composition & Quality

Loan Portfolio Composition (As of 03/31/13)

|

|

Balance

|

Percent

|

|

Residential Mortgages

|

|

|

|

Construction

|

13,154

|

2.14

|

|

Permanent

|

102,809

|

16.69

|

|

|

|

|

|

Total Mortgage Loans

|

115,963

|

18.83

|

|

|

|

|

|

Commercial Loans

|

|

|

|

Owner Occupied R/E

|

158,995

|

25.82

|

|

Non-Owner Occupied R/E

|

182,943

|

29.70

|

|

Farmland

|

1,380

|

0.22

|

|

Construction and Land Development

|

45,110

|

7.32

|

|

Business Loans and Lines

|

81,395

|

13.22

|

|

|

|

|

|

Total Commercial Loans

|

469,823

|

76.28

|

|

|

|

|

|

Consumer Loans

|

|

|

|

Home Equity Lines

|

19,232

|

3.12

|

|

Personal Lines

|

70

|

0.01

|

|

Installment

|

9,180

|

1.49

|

|

Credit Cards

|

1,635

|

0.27

|

|

|

|

|

|

Total Consumer Loans

|

30,117

|

4.89

|

|

|

|

|

|

Total Loans

|

615,903

|

100.00

|

Dollars in thousands. Source: FFIEC Call Report

OLD LINE BANCSHARES, INC | 12

OLBK - 6/2013

Credit Composition & Quality

Dollars in thousands. (1)Non-performing assets include loans 90+ days past due, non-accruals and OREO.

|

|

2Q2011

|

3Q2011

|

4Q2011

|

1Q2012

|

2Q2012

|

3Q2012

|

4Q2012

|

1Q2013

|

Percent of

Total NPAs |

|

Residential Mortgages

|

|

|

|

|

|

|

|

|

|

|

Construction

|

-

|

-

|

-

|

242

|

242

|

242

|

242

|

242

|

2.96

|

|

Permanent

|

2,814

|

4,072

|

1,945

|

1,298

|

1,499

|

2,838

|

3,261

|

3,214

|

39.30

|

|

Total Mortgage Loans

|

2,814

|

4,072

|

1,945

|

1,540

|

1,741

|

3,080

|

3,503

|

3,456

|

42.26

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Loans

|

|

|

|

|

|

|

|

|

|

|

Owner Occupied R/E

|

225

|

225

|

1,091

|

2,267

|

2,262

|

2,257

|

771

|

341

|

4.17

|

|

Non-owner Occupied R/E

|

1,050

|

946

|

75

|

427

|

427

|

427

|

426

|

500

|

6.11

|

|

Construction and Land

Development |

1,840

|

1,490

|

2,628

|

2,151

|

2,883

|

1,394

|

300

|

300

|

3.67

|

|

Business Loans and

Lines

|

636

|

78

|

90

|

261

|

259

|

1,153

|

910

|

855

|

10.45

|

|

Total Commercial Loans

|

3,751

|

2,739

|

3,884

|

5,106

|

5,831

|

5,231

|

2,407

|

1,996

|

24.40

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Loans

|

-

|

-

|

34

|

-

|

1

|

2

|

6

|

0

|

.00

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Real Estate Owned

|

3,949

|

4,126

|

4,005

|

3,919

|

3,491

|

3,231

|

3,720

|

2,727

|

33.34

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Nonperforming

Assets (1) |

10,514

|

10,937

|

9,868

|

10,565

|

11,064

|

11,544

|

9,636

|

8,179

|

100.00

|

|

|

|

|

|

|

|

|

|

|

|

|

NPAs/Total Assets (1)

|

1.38

|

1.39

|

1.22

|

1.32

|

1.31

|

1.35

|

1.13

|

1.03

|

|

Source: FFIEC Call Reports

OLD LINE BANCSHARES, INC | 13

OLBK - 6/2013

Historically, OLBK’s asset quality has been strong.

Credit Composition & Quality

|

|

2008

|

2009

|

2010

|

2011

|

2012

|

|

NPAs & 90+ days Past

Due/Assets

|

.27

|

.60

|

1.12

|

1.87

|

1.26

|

|

|

|

|

|

|

|

|

Nonperforming Loans/Loans

(1) |

.37

|

.80

|

1.11

|

2.06

|

1.19

|

|

|

|

|

|

|

|

|

Reserves/Gross Loans

|

.85

|

.93

|

.82

|

.69

|

.66

|

|

|

|

|

|

|

|

|

Reserves/Nonperforming

Loans |

233.14

|

116.20

|

73.56

|

33.51

|

55.82

|

|

|

|

|

|

|

|

|

Net Charge-offs/Average

Loans |

.01

|

.16

|

.38

|

.11

|

.23

|

Source: SNL Financial, Inc.

(1)Non-performing loans include loans 90+ days past due, non-accruals and accruing troubled debt restructurings.

OLD LINE BANCSHARES, INC | 14

OLBK - 6/2013

Dollars in thousands.

Quarterly Financial Trends

|

|

2Q11

|

3Q11

|

4Q11

|

1Q12

|

2Q12

|

3Q12

|

4Q12

|

1Q13 |

|

Net Interest Income

|

7,471

|

8,345

|

7,700

|

7,762

|

8,464

|

8,537

|

8,402

|

7,847

|

|

Provision for Credit Losses

|

50

|

800

|

800

|

375

|

375

|

375

|

400

|

200

|

|

Non-interest Income

|

747

|

676

|

657

|

667

|

710

|

633

|

642

|

717

|

|

Non-interest Income - Non-

Recurring |

-

|

222

|

-

|

-

|

-

|

-

|

7

|

(86)

|

|

Non-interest Expense

|

5,788

|

6,030

|

5,410

|

5,689

|

6,029

|

6,081

|

6,191

|

6,839

|

|

Non-interest Expense - Non-

Recurring |

377

|

78

|

29

|

29

|

29

|

49

|

1,064

|

240

|

|

Net Income (Loss) before Taxes

|

1,773

|

2,407

|

2,143

|

2,580

|

2,995

|

2,920

|

1,691

|

1,795

|

|

Applicable Income Taxes

|

656

|

737

|

198

|

844

|

983

|

912

|

(19)

|

522

|

|

Net Income (Loss)

|

1,117

|

1,670

|

1,945

|

1,736

|

2,012

|

2,008

|

1,709

|

1,273

|

|

Net Income (Loss) Available to

Common Stockholders |

1,183

|

1,707

|

1,967

|

1,756

|

2,029

|

2,028

|

1,717

|

1,286

|

|

EPS - Net Income (Loss)

Available to Common Stockholders |

.17

|

.25

|

.29

|

.26

|

.29

|

.29

|

.25

|

.19

|

|

Net Interest Margin

|

4.63

|

5.04

|

4.46

|

4.46

|

4.79

|

4.72

|

4.55

|

4.28

|

|

Efficiency Ratio (GAAP)

|

66.71

|

63.95

|

59.98

|

63.00

|

63.70

|

58.26

|

57.28

|

70.92

|

|

Non-interest Income/Operating

Revenue (GAAP) |

9.24

|

7.43

|

7.84

|

7.91

|

7.74

|

6.90

|

7.10

|

8.37

|

|

Return on Average Assets

|

.60

|

.87

|

.97

|

.86

|

.97

|

.93

|

.79

|

.59

|

|

Return on Average Equity

|

6.97

|

10.78

|

11.55

|

10.64

|

12.02

|

11.71

|

9.77

|

7.05

|

Source: SNL Financial, Inc.

OLD LINE BANCSHARES, INC | 15

OLBK - 6/2013

Financial Results & Trends

Average Balance Sheet Growth

Dollars in thousands.

Source: SNL Financial, Inc.

4Q12

OLD LINE BANCSHARES, INC | 16

OLBK - 6/2013

Revenue Composition

Revenue Breakdown

1Q13 Non-interest Income Detail (1)

Dollars in thousands. (1)Non-interest income y-t-d excludes investment securities gains

Source: SNL Financial, Inc.

OLD LINE BANCSHARES, INC | 17

OLBK - 6/2013

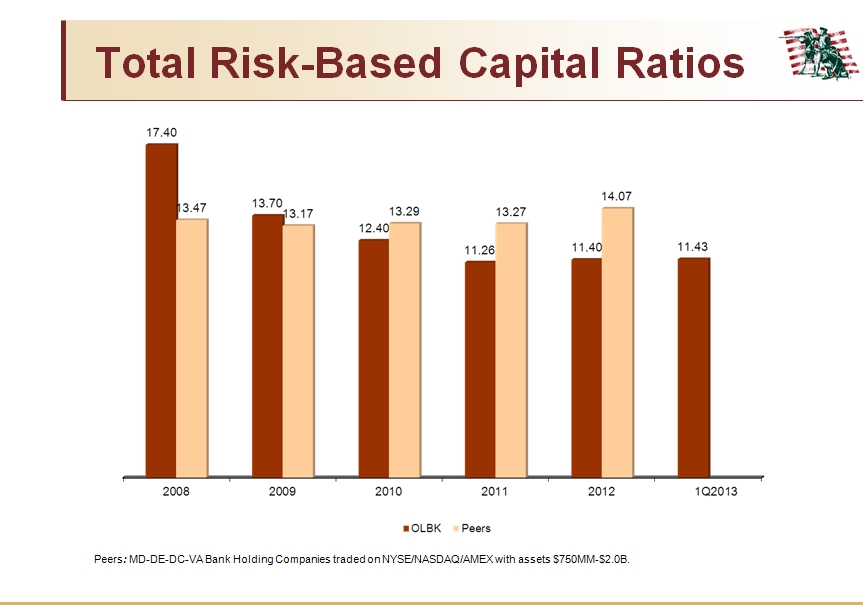

Capital Adequacy

Minimum total risk-based capital ratio to be well capitalized - 10%

Source: SNL Financial, Inc.

OLD LINE BANCSHARES, INC | 18

OLBK - 6/2013

Key Strategic Goals

Profitability

§ Target Net Interest Margin - NIM > 4.25%

§ Maintain bank efficiency ratios <60%

§ Reduce Non-Performing Assets - NPAs <1%

§ DDA balances to exceed 25% of Total Deposits

§ Grow loan portfolio in excess of 15% annually

OLD LINE BANCSHARES, INC | 19

OLBK - 6/2013

Key Strategic Goals

§ Commitment to invest in infrastructure to maintain state-

of-the art status of existing systems; add quality talent to

support growth

of-the art status of existing systems; add quality talent to

support growth

§ Dominate all sub-markets within our footprint

§ Acquire smaller community banks in-market

§ Expand reach into new contiguous natural markets

§ Grow sources of non-interest income

Growth

OLD LINE BANCSHARES, INC | 20

OLBK - 6/2013

95

70

PENNSYLVANIA

495

95

66

83

MD

2

495

695

Old Line Bank branch (23)

ANNE

ARUNDEL

PRINCE

GEORGE’S

ST.

MARY’S

CHARLES

Old Line Bank Branch Map

OLD LINE BANCSHARES, INC | 21

OLBK - 6/2013

§ Track record of consistent financial performance

§ Depth of senior management talent and across entire employee base

§ Strong underlying capital position with good access to capital markets

§ Strong track record of consistent asset quality

§ Solid net interest margin compares favorably to peers

§ Skilled bank acquirers

§ Dominant independent and locally headquartered

financial services company within our footprint

financial services company within our footprint

§ Acquirer and employer of choice within footprint; Now

moving towards dominant suburban MD position

surrounding D.C.

moving towards dominant suburban MD position

surrounding D.C.

What Makes OLBK Unique?

OLBK - 6/2013

OLD LINE BANCSHARES, INC | 22

WSB Merger - Strategic Rationale

§ In-market acquisition consistent with Old Line’s long-term growth strategy:

§ Significant operating synergies

§ Built on successful acquisition of Maryland Bankcorp in 2011

§ Expands product line by adding a successful mortgage origination and sale unit

§ Created a $1.2 billion Maryland-based bank with a continuing focus on the greater

Washington, D.C. metropolitan area, Anne Arundel County and southern Maryland:

§ Old Line expanded to 23 branches and deposits of over $970 million

§ Of banks based in Maryland, Old Line is the 5th largest in assets and 3rd largest

in full service branches

§ Old Line has the highest board/insider ownership (29.84%) of any publicly-

traded Maryland bank with assets over $1.2 billion

OLBK - 6/2013

OLD LINE BANCSHARES, INC | 23

WSB Merger - Financial Rationale

§ 7% EPS accretion in Year 1 excluding merger related costs, with

higher levels in later years.

§ Restructured WSB FHLB borrowings of $26 million at 4.40%;

and another $42 million at 1.84%

§ Opportunity to reduce WSB legacy deposit costs

§ Significant in-market cost savings

§ Return to pre-closing tangible book within one year

§ Payback on tangible book dilution from transaction in ~3.5 years

§ Pricing compares favorably to recent local and regional transactions

OLD LINE BANCSHARES, INC | 24

OLBK - 6/2013

Compelling Investment Considerations

§ We deliver a proven track record of results

§ Our deep management talent could lead a much larger company

§ We are the emerging leader in in-market consolidations

§ We are focused on creating sustainable competitive

advantages

advantages

§ Our current valuation is attractive considering our rapid

ramp-up of EPS over a short timeframe

ramp-up of EPS over a short timeframe

§ Our customer base is stable with good population growth

trends and above average demographics in the affluent retail

and small middle-market segments

trends and above average demographics in the affluent retail

and small middle-market segments

§ Our demand deposit growth focus is outperforming our peer

group

group

OLD LINE BANCSHARES, INC | 25

OLBK - 6/2013

ADDENDUM

OLD LINE BANCSHARES, INC | 26

OLBK - 6/2013

Significant WSB Merger Assumptions

§ Gross credit and OREO mark-down of $18 million

§ Real estate mark-up of $7.7 million

§ Mark on FHLB borrowings ($26 million at 4.40% and $42 million at 1.84%) of

$4.6 million

§ CDI of 1.96% on non-CD accounts amortized over 8 years (SL)

§ Combined Old Line and WSB merger related expenses of $3.2 million after

tax

§ Cost savings of 35% of WSB’s annualized non-interest expense (projections

assume 20% of cost savings not realized in year one)

* Information is based upon original due diligence. Valuation of acquired

balance sheet is in process.

OLD LINE BANCSHARES, INC | 27

OLBK - 6/2013

Publicly traded Bank

Holding Companies in MD,

DC, VA, DE

with total

Holding Companies in MD,

DC, VA, DE

with total

assets between $750MM-$2.0B

Peer Group Definition

OLD LINE BANCSHARES, INC | 28

OLBK - 6/2013

Peers: MD-DE-DC-VA Bank Holding Companies traded on NYSE/NASDAQ/AMEX with assets $750MM-$2.0B. Data as of 12/31/2012

Source: SNL Financial, Inc.

OLBK Peer Group

OLD LINE BANCSHARES, INC | 29

OLBK - 6/2013

Talent, depth, unique skills…

James W. Cornelsen, 58, is the President and Chief Executive Officer of Old Line Bancshares, Inc. and Old Line Bank. He joined Old Line

Bank and its Board of Directors in 1994 and has been a member of the Board of Directors of Old Line Bancshares, Inc. since its incorporation

in April 2003. He has over 30 years of commercial banking experience. Prior to joining OLBK, Mr. Cornelsen was a Senior Vice President at

Sequoia National Bank and Vice President of Commercial Lending at Citizens Bank of Maryland.

Bank and its Board of Directors in 1994 and has been a member of the Board of Directors of Old Line Bancshares, Inc. since its incorporation

in April 2003. He has over 30 years of commercial banking experience. Prior to joining OLBK, Mr. Cornelsen was a Senior Vice President at

Sequoia National Bank and Vice President of Commercial Lending at Citizens Bank of Maryland.

Mark A. Semanie, 50, joined Old Line Bank in January 2013. He is an Executive Vice President and Chief Operating Officer and Acting Chief

Financial Officer and assists in the planning and strategic growth of Old Line Bank. Mr. Semanie is a CPA and prior to joining Old Line Bank

he was the Senior Vice President and Chief Financial Officer of Carrollton Bancorp and prior to that tenure he served as Executive Vice

President and Chief Financial Officer at Bay National Bank. He has over 25 years of accounting and financial services experience.

Financial Officer and assists in the planning and strategic growth of Old Line Bank. Mr. Semanie is a CPA and prior to joining Old Line Bank

he was the Senior Vice President and Chief Financial Officer of Carrollton Bancorp and prior to that tenure he served as Executive Vice

President and Chief Financial Officer at Bay National Bank. He has over 25 years of accounting and financial services experience.

Joseph E. Burnett, 67, joined Old Line Bank as a Senior Vice President and Chief Lending Officer in August 2001 and was promoted to

Executive Vice President in May 2006. He is also an Executive Vice President of Old Line Bancshares, Inc. He has over 45 years of banking

experience in the Washington, D.C. metropolitan area specializing in commercial transactions. Prior to joining Old Line Bank, Mr. Burnett was

a Senior Vice President in Commercial Lending at Farmers Bank for two years (1999-2001) and at Suburban Bank for twelve years (1987-

1999).

Executive Vice President in May 2006. He is also an Executive Vice President of Old Line Bancshares, Inc. He has over 45 years of banking

experience in the Washington, D.C. metropolitan area specializing in commercial transactions. Prior to joining Old Line Bank, Mr. Burnett was

a Senior Vice President in Commercial Lending at Farmers Bank for two years (1999-2001) and at Suburban Bank for twelve years (1987-

1999).

Sandi F. Burnett, 55, Executive Vice President and Chief Credit Officer of Old Line Bank, joined Old Line Bank in 2005 as Senior Vice

President and the team leader for the College Park, MD loan production office. Prior to joining Old Line Bank, she was employed by BB&T, a

major southeastern regional bank, most recently as a City Executive, Senior Vice President. In this capacity, she was responsible for

supervising the overall team management, portfolio quality and growth within suburban Maryland, principally Prince George’s County. Prior to

this position, she was employed by Commerce Bank, a local bank that merged into BB&T in 1999. She started with Commerce Bank in

1994. Ms. Burnett is a career banker with over 30 years of commercial banking experience.

President and the team leader for the College Park, MD loan production office. Prior to joining Old Line Bank, she was employed by BB&T, a

major southeastern regional bank, most recently as a City Executive, Senior Vice President. In this capacity, she was responsible for

supervising the overall team management, portfolio quality and growth within suburban Maryland, principally Prince George’s County. Prior to

this position, she was employed by Commerce Bank, a local bank that merged into BB&T in 1999. She started with Commerce Bank in

1994. Ms. Burnett is a career banker with over 30 years of commercial banking experience.

Kevin P. Huffman, 52, joined Old Line Bank in May 2013 as Executive Vice President. Prior to joining Old Line Bank, Mr. Huffman served as

President and Director of The Washington Savings Bank from January 2004 until merger with Old Line Bank. He also served as Chief

Operating Officer of The Washington Savings Bank since May 2003 and Director of WSB since its formation in January 2008. He joined The

Washington Savings Bank in November 2001; prior to which he served in multiple capacities for Pen Mar Bancshares, Patapsco Valley

Bancshares, Inc. and Commercial and Farmers Bank.

President and Director of The Washington Savings Bank from January 2004 until merger with Old Line Bank. He also served as Chief

Operating Officer of The Washington Savings Bank since May 2003 and Director of WSB since its formation in January 2008. He joined The

Washington Savings Bank in November 2001; prior to which he served in multiple capacities for Pen Mar Bancshares, Patapsco Valley

Bancshares, Inc. and Commercial and Farmers Bank.

OLBK Senior Management Team

OLD LINE BANCSHARES, INC | 30

OLBK - 6/2013

Selected Financial Data

|

|

2008

|

2009

|

2010

|

2011

|

2012

|

1Q2013

|

|

Performance Ratios:

|

|

|

|

|

|

|

|

Return on average assets

|

.64

|

.62

|

.36

|

.77

|

.90

|

.59

|

|

Return on average common equity

|

5.03

|

4.36

|

4.14

|

9.37

|

10.52

|

7.05

|

|

Yield on average interest-earning

assets |

6.10

|

5.54

|

5.22

|

5.46

|

5.12

|

4.78

|

|

Rate on average interest-bearing

liabilities |

2.95

|

2.15

|

1.64

|

1.08

|

.89

|

.66

|

|

Net interest spread

|

3.15

|

3.39

|

3.58

|

4.38

|

4.23

|

4.12

|

|

Net interest margin

|

3.78

|

3.75

|

3.83

|

4.59

|

4.63

|

4.28

|

|

Efficiency ratio-GAAP

|

69.87

|

69.19

|

71.72

|

64.27

|

60.51

|

70.92

|

|

|

|

|

|

|

|

|

|

Capital Ratios:

|

|

|

|

|

|

|

|

Tier 1 leverage

|

14.00

|

10.00

|

9.20

|

7.78

|

7.94

|

8.14

|

|

Total risk-based capital

|

17.40

|

13.70

|

12.40

|

11.26

|

11.40

|

11.43

|

|

Tier 1 risk-based capital

|

16.60

|

12.80

|

11.60

|

10.61

|

10.77

|

10.79

|

|

Total equity to total assets

|

13.31

|

10.25

|

9.37

|

8.45

|

8.75

|

8.66

|

|

|

|

|

|

|

|

|

|

Credit Quality Ratios:

|

|

|

|

|

|

|

|

Allowance for loan losses to loans

|

.85

|

.93

|

.82

|

.69

|

.66

|

.66

|

|

Nonperforming loans to total loans

(1) |

.37

|

.80

|

1.11

|

2.06

|

1.19

|

1.08

|

|

Nonperforming assets to total assets

|

.27

|

.60

|

1.12

|

1.87

|

1.26

|

1.03

|

|

Net charge-offs to average loans

|

.01

|

.16

|

.38

|

.11

|

.23

|

.07

|

Source: SNL Financial, Inc.

(1)Non-performing loans include loans 90+ days past due, non-accruals and accruing troubled debt restructurings.

OLD LINE BANCSHARES, INC | 31

OLBK - 6/2013

ROAA/ROAE

ROAA

ROAE

|

Peers: MD-DE-DC-VA Bank Holding Companies traded on NYSE/NASDAQ/AMEX with assets $750MM-/$2B.

|

2008 2009 2010 2011 2012 1Q2013

2008 2009 2010 2011 2012 1Q2013

Source: SNL Financial, Inc.

OLD LINE BANCSHARES, INC | 32

OLBK - 6/2013

Source: SNL Financial, Inc.

OLD LINE BANCSHARES, INC | 33

OLBK - 6/2013

Peers: MD-DE-DC-VA Bank Holding Companies traded on NYSE/NASDAQ/AMEX with assets $750MM-$2.0B.

Source: SNL Financial, Inc.

OLD LINE BANCSHARES, INC | 34

OLBK - 6/2013

Net Interest Margin

|

Peers: MD-DE-DC-VA Bank Holding Companies traded on NYSE/NASDAQ/AMEX with assets $750MM-$2.0B.

|

Source: SNL Financial, Inc.

OLD LINE BANCSHARES, INC | 35

OLBK - 6/2013

Efficiency Ratio

(GAAP)

Peers: MD-DE-DC-VA Bank Holding Companies traded on NYSE/NASDAQ/AMEX with assets $750MM-$2.0B.

Note: Presented on a GAAP basis

Source: SNL Financial, Inc.

OLD LINE BANCSHARES, INC | 36

OLBK - 6/2013

Peers: MD-DE-DC-VA Bank Holding Companies traded on NYSE/NASDAQ/AMEX with assets $750MM - $2.0B.

Source: SNL Financial, Inc.