Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mastech Digital, Inc. | d550576d8k.htm |

Q2 2013

Industry & MHH Overview

CONFIDENTIAL

Exhibit 99.1 |

Copyright

©2010 Mastech, Inc. All Rights Reserved. mastech.com 2

Safe Harbor...

Certain statements contained in this presentation are forward-looking statements

based on management’s expectations, estimates, projections and assumptions.

Words such as “expects,” “anticipates,” “plans,”

“believes,” “scheduled,” “estimates” and variations of

these words and similar expressions are intended to identify forward-looking

statements, which include but are not limited to projections of revenues,

earnings, and cash flow. These statements are based on information currently

available to the Company and it assumes no obligation to update the forward-looking

statements as circumstances change. These statements are not guarantees of future

performance and involve certain risks and uncertainties, which are difficult to predict.

Therefore, actual future results and trends may differ materially from what is forecast

in forward-looking statements due to a variety of factors, including, without

limitation, the level of market demand for its services, the highly competitive market

for the types of services offered by the company, the impact of competitive factors on

profit margins, market conditions that could cause the Company’s customers to

reduce their spending for its services, and the company’s ability to create,

acquire and build new lines of business, to attract and retain qualified personnel,

reduce costs and conserve cash, and other risks that are described in more detail in

the company’s filings with the Securities and Exchange Commission including its

Form 10-K for the year ended December 31, 2012. |

3

Mastech: A National Staffing Business

e-Business Solutions; Service Oriented Architecture & Web Services

Business Intelligence & Data Warehousing

ERP / CRM Implementation

Surgical Nursing & Physical / Occupational Therapy

700

full-time IT

Consultants in the USA

100

FTE

Healthcare

Professionals

200 Staff Employees (Sales / Recruitment / Support / Management)

70% of Staff India-Based

Service Offerings

Employees/

Consultants

26 years

of Staffing Industry Experience (former iGATE Corporation

subsidiary)

Spun-off from iGATE in October 2008; certified MBE

Trade on NYSE / MKT: “MHH” Only

Public IT Staffing Company with “Centralized “

Business Model

History

National provider of

Information Technology and Specialized

Healthcare

Staffing

Services

100% of Revenues are derived from Staffing Services

Business

Description

Integrity,

Accountability,

Quality,

Dignity

&

Respect

Core Values |

MHH

– Shareholder Performance

MHH 2013 YTD:

•

40% Increase To-Date

•

12 Month Trailing P/E = 9.80

Pittsburgh Business Times, Largest Public Companies Jan 2013

Finance.Yahoo.com

/

MHH

–

June

4,

2013 |

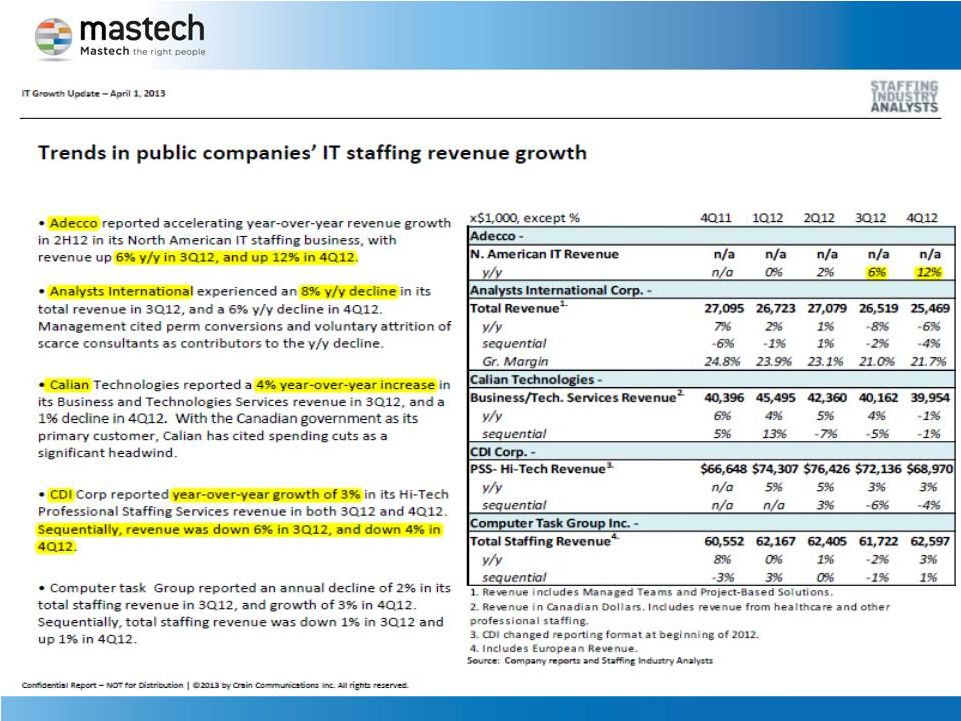

IT Employment

Hits Another All-time High in April! •

215K IT jobs created in the US in the past 12 months; 350K in the past 24 months

•

5.1% Y-O-Y Growth... 3X the Growth rate of the general workforce

•

17

th

consecutive month of growth; former all time high eclipsed in Q1 2012

|

IT Staffing

Industry Forecasted to Grow 8% |

H/C Staffing

Industry Forecasted to Grow 9% |

Bottom

Line....with USA GDP Forecasted @ 2%.... And Q1-2013 at 2.4%....

|

Two IT

Staffing Industry Business Models... •

Geographic

decentralized

control & leadership;

relationship sales

model

•

Gross Margin: 24-30%

•

S, G & A

(expenses)

: 20-25%

•

Operating Margins: 4-8%

Branch

Services

Model

•

Customers

drive Geography; majority of

the organization centralized;

Low Cost

Location

opportunity;

•

Gross Margin: 18-21%

•

S, G & A

(expenses)

: 13-17%

•

Operating Margins: 4-8%

Centralized

Model

“prove it & move it”;

;

Value

Pricing |

Professional

Procurement Services Enter the Fray... VMS

(vendor management system)

•

9 yr penetration–All Buyers: 8%

to 60% •

9

yr

penetration-

Core

Buyers:

42%

to

73%

•

Technology

/ Telecomm Industry: 75%

in use;

21% planned use (96%)

•

All Large Scale (Fortune 1000): 75% or

more in Use and nearly all planned use. |

Bottom

Line... Professional Procurement Processes & Tools have changed The Staffing

Industry... •

Create Transparency & Level the Playing Field...

•

Comparisons become easier

•

Price & Delivery Matters

•

Relationships less important

•

Exert Pressure on Gross Margins

•

Low Cost Players will be advantaged

•

Forces Thinking to Move from Gross Margin to Operating Profit

•

MHH Loves ‘em...and the Branch Guys Don’t...

•

MHH

Operating

Profit

Increase....

Driven

by

Top

Line

Growth

and

Leverage

on the Cost Structure

•

2012 over 2011: 89%; 2011 over 2010: 75%

•

Here to Stay ...

•

Argue Penetration Levels & Timing |

MHH exceeds

market growth rates 2010-2012 Strong Balance Sheet / Access to Capital

Returned $9.2 million to Shareholders in 2012

Q1-2012:

Dutch Auction Tender Offer within Share Buyback Program Limits

Q4-2012:

$2 / Share Special Dividend

Revenue –

19% CAGR

EPS –

89% CAGR

Consultants On Billing –

18% CAGR |

Industry

Trends & Outlook

What Differentiates

Mastech

MHH: A Catalyst for Future Growth

Centralized Business Model; Scalable

Cost Structure; Low-

Cost

Recruitment Engine

Strong Brand Recognition with both

U.S. Citizens and H1

B Visa

Professionals

Established Client-

Base of High-

Volume Consumers of Staffing

Services

Favorable Pricing / Value Proposition

for Clients

Motivated and Capable Management

Team

-

U.S. Job Market Recovery Positive for

Industry

Fundamental Shift Towards Greater

Utilization of Staffing Services

Large Consumers of Staffing Services

Employing VMS / MSP Model

Client Focus more about Consultant

Quality, Speed to Market and Value

Pricing |

Bottom

Line....Macro Growing; Staffing Industry Changes Favor Centralized

Model; MHH Performing |

MHH Goals

(not Guidance) •

Organically Grow Revenues at +1.5X Industry Average. |

MHH Goals

(not Guidance) •

Organically Grow Revenues at +1.5X Industry Average.

•

Maintain Gross Margins @ 19%. |

MHH Goals

(not Guidance) •

Organically Grow Revenues at +1.5X Industry Average.

•

Maintain Gross Margins @ 19%.

•

Drive Operating Expenses to 13-14% of Revenue. |

MHH Goals

(not Guidance) •

Organically Grow Revenues at +1.5X Industry Average.

•

Maintain Gross Margins @ 19%.

•

Drive Operating Expenses to 13-14% of Revenue..

•

Deliver Operating Margins of 6%+ of Revenue. |

MHH Goals

(not Guidance) •

Organically Grow Revenues at +1.5X Industry Average.

•

Maintain Gross Margins @ 19%.

•

Drive Operating Expenses to 13-14% of Revenue.

•

Deliver Operating Margins of +6% of Revenue.

•

Continue to Return Capital to our Shareholders. |

Q2

2013 Industry & MHH Overview

CONFIDENTIAL |

MHH ... 1.5X

industry Growth |

MHH ... 1.5X

industry Growth |

Professional

Procurement Services Enter the Fray... (MSP / VMS)

MSP (managed service provider program) •

5 yr penetration–All Buyers: 34% to 54%

•

5

yr

penetration-

Core

Buyers:

48%

to

58%

•

Technology

/

Telecomm

Industry:

62%

in

use; 7% planned use (69%)

•

All Large Scale (Fortune 1000): 60% in Use an

additional 10-15% planned use. |