Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT [TO COME] - Swisher Hygiene Inc. | swsh_8k.htm |

EXHIBIT 99.1

1

SWISHER HYGIENE

Annual Shareholders’ Meeting

June 5, 2013

2

FORWARD LOOKING INFORMATION

This presentation includes financial forecasts, projections and other forward-

looking statements regarding Swisher Hygiene Inc., its business and prospects.

This forward-looking information is based on management assumptions and

expectations which, while considered reasonable by Swisher Hygiene and its

management as of the date of this presentation, are subject to risks, uncertainties,

and other factors that may cause actual results and performance to materially

differ from results or performance expressed or implied by the forward-looking

statements. A description of these factors can be found in our Annual Report on

Form 10-K for the year ended December 31, 2012, filed with the Securities and

Exchange Commission ("SEC") on May 1, 2013, and in our other filings with the

SEC, which are available at www.sec.gov. Swisher Hygiene undertakes no

obligation to publicly update the forward-looking statements presented, except as

required by law.

looking statements regarding Swisher Hygiene Inc., its business and prospects.

This forward-looking information is based on management assumptions and

expectations which, while considered reasonable by Swisher Hygiene and its

management as of the date of this presentation, are subject to risks, uncertainties,

and other factors that may cause actual results and performance to materially

differ from results or performance expressed or implied by the forward-looking

statements. A description of these factors can be found in our Annual Report on

Form 10-K for the year ended December 31, 2012, filed with the Securities and

Exchange Commission ("SEC") on May 1, 2013, and in our other filings with the

SEC, which are available at www.sec.gov. Swisher Hygiene undertakes no

obligation to publicly update the forward-looking statements presented, except as

required by law.

3

» Tom Byrne . . . . . . . . .. . . President and Chief Executive Officer

» Tom Aucamp . . . . . . . . .EVP and Secretary

» Bill Nanovsky . . . . . . . SVP and Chief Financial Officer

» Tom LaMartina . . . . . . SVP, Sales and Service

» Blake Thompson .. . . SVP, Manufacturing and Supply Chain

» Amy Simpson . . . .. . . . VP, Investor Relations

SWISHER MANAGEMENT ATTENDEES

4

2012 IN REVIEW

5

RESTATEMENT AND COMPLIANCE

Restatement had Significant Effect on 2012 Results

» Major investment of management time

» Significant accounting, legal and consulting costs, which

continued until we became a current filer in May 2013

and regained NASDAQ compliance with the holding of

this meeting

continued until we became a current filer in May 2013

and regained NASDAQ compliance with the holding of

this meeting

» Lost revenue and accounting costs offset benefits from

expense reductions

expense reductions

» Delayed implementation of some elements of four point

plan

plan

6

BUT WE DID NOT SIT STILL

Laid the Foundation for 2013 and Future Initiatives

» Key additions to management team

» Implementation of operation and financial initiatives

» Handheld route technology

» Consolidation of multiple databases

» Integration of tuck-in acquisitions

» Shift to internal manufacturing

» Initial expense reductions

» Sale of waste operations

» Ended the year with strong balance sheet

7

BUSINESS MODEL

8

SWISHER AT-A-GLANCE

Key Differentiators to Build Around

» Leading provider of essential hygiene and sanitizing

solutions

solutions

» National chemical service footprint

» 50,000 customers and 800 distributors

» Strategic manufacturing plant locations

» $230 million of 2012 revenue

» Leverageable route network

9

CORE SOLUTIONS

We Deliver Clean

CHEMICAL

»General Cleaning

»Warewashing

»Laundry

»Specialty

HYGIENE

»Restroom Care

»Hand Hygiene

»Paper Products

»Air Care

FACILITY SERVICES

»Water Filtration

»Drainline Treatment

»Bar Towels and Aprons

»Floor Mats and Mops

10

BUSINESS MODEL

Leveraging Account Relationship and Delivery Options

11

» Products that are critical to our

customers

customers

» $35 billion market opportunity

» Scalable structure with significant

leverage from incremental revenue

leverage from incremental revenue

» Recurring revenue

» Key differentiators in place to generate

ongoing organic growth and profitability

ongoing organic growth and profitability

BUSINESS MODEL AND POSITION

Secured Strong Position in Core Chemical Market

Source: Kline Consulting, Textile Rental

Services Association and various other industry

publications and public competitor filings.

Services Association and various other industry

publications and public competitor filings.

North America Market

12

OPERATIONAL PLAN

13

» Enhance customer service and satisfaction

» Strengthen the team

» Simplify and standardize the business model

» Operational simplification

» Supply chain rationalization

» Financial process improvement

» Brand and product enhancement

» Balanced sales strategy

FOUR POINT PLAN

Keys to Maximizing Customer Satisfaction, Growth and Profitability

14

IMPACT OF THE PLAN

2012 Initiatives Provided Basis for Continued Progress

» Sustainable organic revenue growth

» $10 million of 2013 annualized expense savings, starting primarily

in 2nd half of the year

in 2nd half of the year

» $5 million annualized expense savings starting in 1st half 2014

Brand

Consolidation

Internal

Manufacturing

Manufacturing

Acquisition

Integration

Database

Consolidation

Handheld

Deployment

15

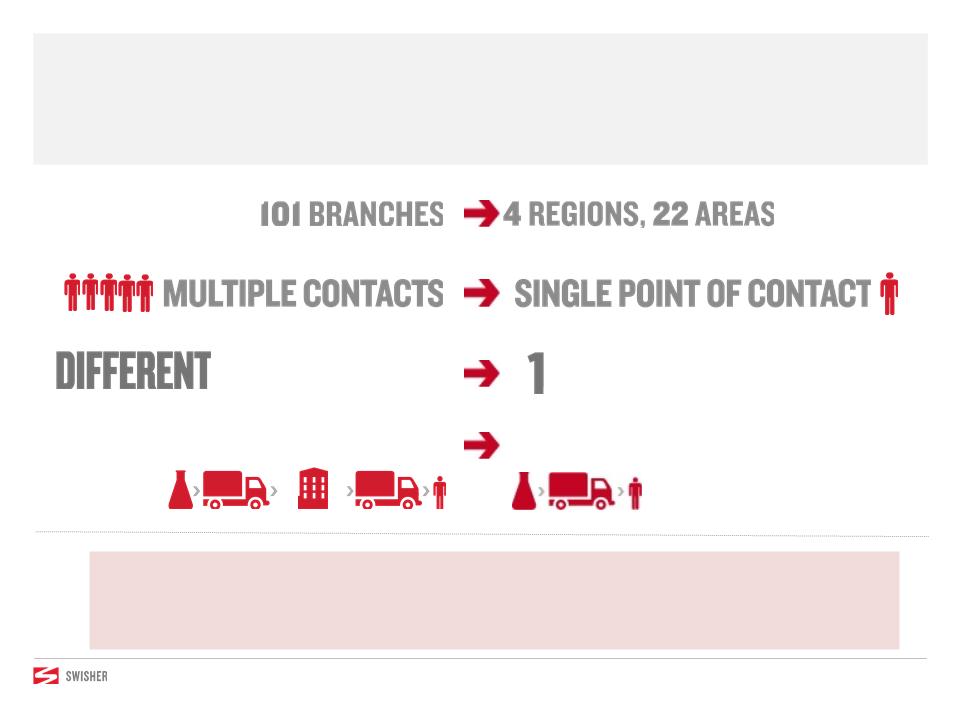

OPERATIONAL SIMPLIFICATION

Consolidating Service and Support Infrastructure

PREVIOUS DELIVERY METHOD

Swisher Plant to Branches to Customer

Swisher Plant to Branches to Customer

NEW & SIMPLE

Delivery Method

OPERATING MODELS

OPERATING

MODEL

» 35% reduction in square footage in 2013 and 2014

» SG&A reduction in Q3 2013 through Q1 2014

16

» 20-30% reduction in

miles driven

miles driven

» 10-20% increase in

revenue per service

employee

revenue per service

employee

» Improved inventory

control

control

» Route expense

reduction in Q3’13

through Q2’14

reduction in Q3’13

through Q2’14

SUPPLY CHAIN RATIONALIZATION

Route Consolidations Reduce Costs and Increase Customer Contact

Before

After

17

SUPPLY CHAIN RATIONALIZATION

Plant Consolidations Reduce Multiple Costs

» Improves speed and flexibility

» 20-30% reduction in plant

inventories

inventories

» 70% current plant capacity

available

available

» Cost of Sales reduction in Q3’13

through Q1’14

through Q1’14

Transition from 8 to 5 plants

Transition from 50+ to 2 brands

18

BRAND & PRODUCT ENHANCEMENT

Elevating our Brand and Product Offering

» Increases awareness

» Strengthens price flexibility

» Reduces costs through brand consolidation

» Streamlines product offering

Brand Enhancement

Product Innovation

Sales Support

19

BALANCED SALES STRATEGY

Finding the Best Mix of Upsells, Field Sales and Multi-unit Sales

Focus All products & services to key market segments

Target Distributor relationships, corporate sourced

agreements and large independents

Focus All products & services to key market segments

Target Corporate relationships within all GPO’s and

multi-unit chains

Account

Manager

Focus All products and service offering

Target Current Swisher customer

Focus Hygiene and facility service offering

Target Current Swisher customer

Hygiene

Specialist

Field

Sales

Corporate

Accounts

20

Upselling a Wide Range of Needed Products and Services

BALANCED SALES STRATEGY

Food Safety Treatment

Water Filtration

Aprons & Chef Wear

Floor Care

Restroom Sanitation

Bathroom Cleaners

Floor Mats & Mops

Dish Machine Products

Pot & Pan Detergents

Warewash Equipment

Specialty Products

Drainline Treatment

All-Purpose Cleaners

Carpet Care Products

Paper Products

Hand Hygiene

On-Premise Laundry

Food Safety Labeling

Food Safety

Odor Control & Misting

Degreasers

Deep Cleaning

21

GPOs and Distributors to Accelerate New Account Sales

BALANCED SALES STRATEGY

$ MILLIONS

FOODSERVICE

HEALTHCARE

HOSPITALITY

RETAIL

Penetration of Current Relationships

Opportunities Cross Multiple Verticals

Current Revenue

Potential Revenue

22

LOOKING AHEAD

23

2013 STRATEGY AND TACTICS

Focus on Chemicals and Hygiene

» Focus on core chemical and hygiene operations

» Continue to aggressively implement four point plan

» Increase sales through combination of customer upsell and

balanced mix of new sales

balanced mix of new sales

» Reduce expenses through standardization, simplification and cost

eliminations

eliminations

» Partner with leading providers to offer additional critical

services

services

» Measured expansion into other chemical segments

24

IMPACT OF PLAN ON FUTURE RESULTS

Recap of Current Targets

» Sequential revenue growth beginning in 2013

» Reduction in both investigation and review-related

expenses and other professional fees in 2nd quarter of

2013

expenses and other professional fees in 2nd quarter of

2013

» Significant expense reductions beginning in 3rd quarter

of 2013

of 2013

» Positive operating cash flow beginning in 3rd quarter of

2013

2013

25

CONCLUSION

The Opportunity is Bigger Today Than Originally Envisioned

» Large industry with attractive business characteristics

and demand still exists for an alternative chemical

provider

and demand still exists for an alternative chemical

provider

» Focus will be on leveraging unique position within the

hygiene and chemical portion of our $35 billion market

hygiene and chemical portion of our $35 billion market

» Team is executing on four point game plan to enhance

service, increase revenue and decrease expenses

service, increase revenue and decrease expenses

» Investors will begin to see the results of our efforts in the

coming months

coming months

26

CONTACT INFORMATION:

SWISHER INVESTOR SERVICES

(704) 602-7116

INVESTORRELATIONS@SWSH.COM

SWISHER INVESTOR SERVICES

(704) 602-7116

INVESTORRELATIONS@SWSH.COM