Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PNMAC Holdings, Inc. | a13-14341_18k.htm |

Exhibit 99.1

|

|

PennyMac Mortgage Investment Trust June 4, 2013 KBW 2013 Mortgage Finance Conference |

|

|

1 This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein, from past results discussed herein, or illustrative examples provided herein. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: changes in general business, economic, market and employment conditions from those expected; continued declines in residential real estate and disruption in the U.S. housing market; the availability of, and level of competition for, attractive risk-adjusted investment opportunities in residential mortgage loans and mortgage-related assets that satisfy our investment objectives and investment strategies; changes in our investment or operational objectives and strategies, including any new lines of business; the concentration of credit risks to which we are exposed; the availability, terms and deployment of short-term and long-term capital; unanticipated increases in financing and other costs, including a rise in interest rates; the performance, financial condition and liquidity of borrowers; increased rates of delinquency or decreased recovery rates on our investments; increased prepayments of the mortgage and other loans underlying our investments; changes in regulations or the occurrence of other events that impact the business, operation or prospects of government sponsored enterprises; changes in government support of homeownership; changes in governmental regulations, accounting treatment, tax rates and similar matters; and our ability to satisfy complex rules in order to qualify as a REIT for U.S. federal income tax purposes. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation only. Forward-Looking Statements KBW 2013 Mortgage Finance Conference |

|

|

PennyMac Mortgage Investment Trust Is a Unique Mortgage REIT 2 Demonstrated record of EPS and dividend growth, focused on delivering strong returns on equity over the long term Invests in unique residential mortgage strategies with relatively limited leverage Earnings contributions from both distressed investing and correspondent lending Current investments concentrated in distressed whole loans and mortgage servicing rights (MSRs), which are well positioned in an improving economy with gradually rising rates Significant potential for further growth in correspondent lending at attractive returns Pursuing other investment opportunities including MSR acquisitions and prime jumbo acquisition and securitization for future investments Strategies are enabled by our relationship with PennyMac Financial Services, Inc. and its specialized operations and expertise KBW 2013 Mortgage Finance Conference |

|

|

3 Demonstrated track record of increasing EPS and dividends over the long term Raised over $800 million of new equity during this period Earnings Per Share and Dividends Declared KBW 2013 Mortgage Finance Conference 7% 13% 16% 15% 13% 17% 16% 17% 18% Return on Equity(1) (1) Return on average equity. |

|

|

4 Investment activities and correspondent lending are both key contributors to pre-tax earnings KBW 2013 Mortgage Finance Conference Pre-tax Net Income by Operating Segment Correspondent Lending Intersegment Elimination 1Q12 2Q12 3Q12 4Q12 1Q13 Intersegment Elimination $ 14.3 $ 26.0 $ 21.5 $ 24.3 $ 50.3 $ 10.3 $ 12.0 $ 37.4 $ 41.0 $ 8.9 $ - $ - $ - $ - $ (3.3) Correspondent Lending Investment Activities Intersegment & Other $ - $ - $ - $ - $ (3.3) ($ in millions) (1) (1) Primarily corporate absorption of fulfillment fees for transition adjustment related to the amended and restated management agreement effective February 1, 2013. |

|

|

5 Investments Today Are Primarily Distressed Loans With Relatively Low Leverage Mortgage Assets ($ in millions) KBW 2013 Mortgage Finance Conference PMT’s Long-Term Investments (1) Defined as all debt, senior and subordinated, as a multiple of equity at quarter end. 1.3x 1.0x 0.9x 1.3x 1.1x Leverage Ratio(1) |

|

|

6 PMT's Distressed Loans Are Held at Significant Discounts To Property Value (1) KBW 2013 Mortgage Finance Conference Nonperforming loans are valued at 68% of the estimated current value of the underlying properties Expect to realize returns over time through property resolution strategies, including short sales and deeds-in-lieu of foreclosure Performing loans are valued at 69% of the estimated current value of the underlying properties Expect to realize returns over time through interest income and restructure / refinance strategies (in millions) (in millions) |

|

|

7 IPO of PennyMac Financial Services, Inc. Leading non-bank mortgage specialist Broad operational capabilities Loan origination and fulfillment Prime servicing Special servicing Investment management expertise Distressed whole loans MSRs Non-agency securities Legacy-free, specialized and scalable operating platform Key Benefits to PMT $213 million(1) in net proceeds raised New capital will be invested in growing PFSI’s infrastructure and capabilities Expanding and adding operational sites to support correspondent and servicing portfolio growth Facilitates potential co-investment opportunities Synergistic relationship with strong alignment of interests PMT’s efficient capital and PFSI operational capabilities and management expertise drives performance for both companies PFSI sources and manages high-quality investments that drive returns for PMT shareholders Performance-based incentives align interests for strong investment returns KBW 2013 Mortgage Finance Conference (1) Net of the underwriting discount and issuance costs. |

|

|

8 We believe that PMT has in place the proper agreements, controls, and oversight to mitigate potential conflicts in its relationship with PFSI Governance led by our Board of Trustees which includes seven independent members PMT receives services from PFSI’s subsidiaries pursuant to a Management Agreement, Flow Servicing Agreement, Mortgage Banking and Warehouse Services Agreement, and other associated agreements A Board committee comprised solely of independent members undertook a comprehensive review of the agreements last year, engaging independent counsel and a financial advisor Effort resulted in amended agreements effective February 1, 2013; revisions include, but are not limited to: Establishes a four-year term for all services, subject to periodic assessment of fees Provides for exclusivity of correspondent lending fulfillment to PMT Better aligns PCM’s incentives under the Management Agreement with PMT’s performance Provides remuneration to PMT for a percentage of the MSR value on refinanced loans recaptured by PLS Governance of Relationship With PFSI Please see 8-K filed February 7, 2013. The above summary highlights various components of the “revised agreements” and is not intended to be comprehensive or provide guidance as to the relative materiality of any component of such agreements. Investors should read the agreements in their entirety to fully ascertain the full extent of the agreements and their impact on PMT. KBW 2013 Mortgage Finance Conference |

|

|

Current Market Trends and Opportunities for PMT 9 Correspondent competitive landscape Distressed whole loan demand Ongoing improvement in home prices Home prices continue to improve in most regions of the country and housing appears to be on a steady path to recovery Shortage of home inventory and strong investor demand helping to increase prices Rent vs. buy economics favor home ownership, driving purchase demand Improving loan-to-value ratios expected to lead to refinance activity Market becoming more competitive, with lower margins, but are still above historical norms Significant growth potential for PMT by expanding the network of sellers, broadening product offerings and deepening existing relationships Expected growth in correspondent channel’s share as lenders sell more loans servicing released. Market demand remains strong; smaller deals appear more attractive Large legacy deals are declining whereas “mini-bulk” and flow opportunities are becoming more prevalent Changing economics of retaining MSRs, combined with complexities of mortgage servicing are driving smaller institutions to sell MSR Acquisitions Robust supply, with over $5 billion in UPB of loan pools reviewed by PCM in 1Q13 Scarcity of quality investment alternatives is driving greater investor interest in residential real estate as the market recovers Improving real estate values have lowered competing investor yield targets, which is particularly notable in reperforming loan transactions KBW 2013 Mortgage Finance Conference |

|

|

10 Distressed whole loan purchases in 1Q13 reached $366 million in UPB Comprised largely of nonperforming loans Acquisition price to UPB averaged 55% in 1Q13 In April, we committed to enter into forward purchase agreements for a total of $481 million in UPB for two pools of nonperforming mortgage loans with an initial purchase price of $294 million(1) PMT Continues To Be Active in Distressed Whole Loan Acquisitions Distressed Whole Loan Purchases ($ in millions) UPB (1) These pending transactions are subject to the negotiation and execution of definitive documentation, continuing due diligence, and customary closing conditions. There can be no assurance that we will acquire these assets or that the transaction will be completed. (1) KBW 2013 Mortgage Finance Conference |

|

|

11 Valuation gains in PMT’s $2.4 billion(1) distressed loan portfolio totaled $56 million in 1Q13 Performing - $674 million(1) performing loan portfolio had valuation gains of $23 million Nonperforming - $1,680 million(1) nonperforming loan portfolio had valuation gains of $33 million Valuation gains were driven by strong operational performance, improved home price performance and strong investor demand The housing market recovery is appearing in most major metro areas across the country Lower-tier properties have led price gains in most metro areas Distressed loans primarily fall into the low and middle price tiers Metro areas hardest hit by the housing downturn have seen the largest growth Rising values consistent with appreciation in the market for other credit-risk assets Rising Home Values Drove Solid Valuation Gains In Distressed Loans Home Price Change by Tier Within Metro Areas(3) % change Y/Y Net Gain on Mortgage Loans Valuation Changes(2) (1) Unpaid principal balance (2) At fair value (3) Source: Case Shiller Tiered Index Level as of January 2013 KBW 2013 Mortgage Finance Conference Quarter ended ($ in thousands) March 31, 2013 Valuation Changes: Performing Loans 22,984 $ Nonperfoming Loans 32,632 55,616 $ |

|

|

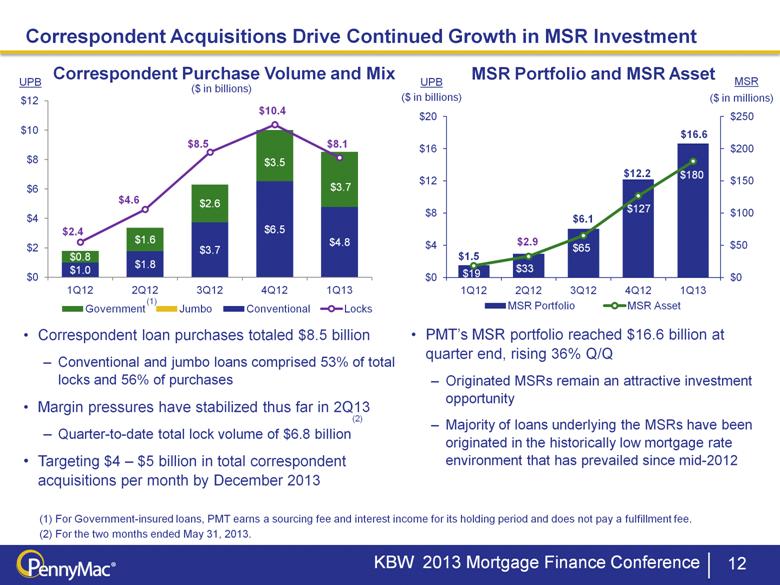

MSR Portfolio and MSR Asset Correspondent Purchase Volume and Mix 12 Correspondent Acquisitions Drive Continued Growth in MSR Investment (1) For Government-insured loans, PMT earns a sourcing fee and interest income for its holding period and does not pay a fulfillment fee. (2) For the two months ended May 31, 2013. (1) ($ in billions) Correspondent loan purchases totaled $8.5 billion Conventional and jumbo loans comprised 53% of total locks and 56% of purchases Margin pressures have stabilized thus far in 2Q13 Quarter-to-date total lock volume of $6.8 billion Targeting $4 – $5 billion in total correspondent acquisitions per month by December 2013 UPB PMT’s MSR portfolio reached $16.6 billion at quarter end, rising 36% Q/Q Originated MSRs remain an attractive investment opportunity Majority of loans underlying the MSRs have been originated in the historically low mortgage rate environment that has prevailed since mid-2012 UPB MSR ($ in billions) ($ in millions) KBW 2013 Mortgage Finance Conference (2) |

|

|

13 Correspondent Lending Economics Are Attractive KBW 2013 Mortgage Finance Conference Low-cost debt financing and short holding periods for inventory produce attractive returns on equity at these margins Other revenues include origination fees from customers and sourcing fees for FHA/VA loans Results in long-term investments in MSR asset (1) Conventional and Jumbo locks only. (2) Fulfillment fees are 45 - 50bps on loan fundings per the Mortgage Banking and Warehouse Services Agreement. (2) (1) ($ in millions) Quarter Ended March 31, 2013 As % of Interest Rate Lock Commitments Revenues: Net gain on mortgage loans acquired for sale 29.3 $ 0.69% Interest income 6.3 0.15 Other income 5.5 0.13 41.1 $ 0.97% Expenses: Loan fulfillment fees 24.9 0.59% Interest 5.6 0.13 Loan servicing & other 1.7 0.04 32.2 0.76% Pre-tax net income 8.9 $ 0.21% |

|

|

Prime Non-Agency Jumbo Securitizations(1) ($ in billions) Private-label jumbo securitization represents a significant long-term growth opportunity Securitization levels are a fraction of pre-crisis levels, but recent activity indicates that the market is recovering As the mortgage market normalizes, we expect private-label securitizations to play a much more significant role in housing finance Policymakers seek to have the private market assume a greater role PMT’s prime jumbo lock volumes are growing Lock volume in 1Q13 totaled $100 million 2Q13 quarter-to-date locks totaled $129 million Targeting 3Q13 for first securitization transaction Deal size of between $250 – $350 million Retain all or part of I/O and subordinate tranches as investments Revenue model is primarily interest income Prime Jumbo Acquisitions and Private Label Securitization Opportunity 14 $230 Jumbo securitizations in the market YTD have surpassed full-year 2012 issuance PMT Prime Jumbo Lock Volume(1) ($ in millions) (1) Source: Inside Mortgage Finance (2) For the two months ended May 31, 2013 KBW 2013 Mortgage Finance Conference (2) (2) |