Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BUCKEYE PARTNERS, L.P. | d549756d8k.htm |

2013 Annual

Meeting of Limited Partners Houston, TX

June 4, 2013

©

Copyright 2013 Buckeye Partners, L.P.

Exhibit 99.1 |

LEGAL

NOTICE/FORWARD-LOOKING STATEMENTS ©

Copyright 2013 Buckeye Partners, L.P.

2

This presentation contains “forward-looking statements” that we believe to be

reasonable as of the date of this presentation. These statements, which include

any statement that does not relate strictly to historical facts, use terms such as “anticipate,” “assume,” “believe,” “estimate,”

“expect,” “forecast,” “intend,” “plan,”

“position,” “predict,” “project,” or “strategy” or the negative connotation or other variations of such

terms or other similar terminology. In particular, statements, express or implied,

regarding future results of operations or ability to generate sales, income or cash

flow, to make acquisitions, or to make distributions to unitholders are forward-looking statements. These forward-looking

statements are based on management’s current plans, expectations, estimates, assumptions

and beliefs concerning future events impacting Buckeye Partners, L.P. (the

“Partnership” or “BPL”) and therefore involve a number of risks and uncertainties, many of which are beyond

management’s control. Although the Partnership believes that its expectations

stated in this presentation are based on reasonable assumptions, actual results may

differ materially from those expressed or implied in the forward-looking statements. The factors listed in the

“Risk Factors” sections of, as well as any other cautionary language in, the

Partnership’s public filings with the Securities and Exchange Commission, provide

examples of risks, uncertainties and events that may cause the Partnership’s actual results to differ materially from the

expectations it describes in its forward-looking statements. Each

forward-looking statement speaks only as of the date of this presentation, and the

Partnership undertakes no obligation to update or revise any forward-looking statement. |

INVESTMENT

HIGHLIGHTS •

Over 125 years of continuous operations, with a 26-year track record as a publicly traded

MLP on the NYSE

•

Market capitalization of $7.0 billion

•

Lower cost of capital realized from elimination of GP IDRs; differentiation from many of our

peers •

Investment grade credit rating with a conservative approach toward financing growth

•

Increased

geographic

and

product

diversity

resulting

from

recent

acquisitions

•

Attractive growth investment opportunities across our domestic and international asset

platform; including crude diversification projects utilizing existing asset

footprint •

Opportunities

for

significant

internal

growth

projects

on

legacy

and

recently

acquired

assets

•

Increased distribution declared for Q1 2013; paid cash distributions each quarter since

formation in 1986

Petroleum storage tanks at our Macungie terminal in Pennsylvania

Aerial view of BORCO’s six offshore jetties with tank farm in the distance

©

Copyright 2013 Buckeye Partners, L.P.

3 |

BUCKEYE’S

STRATEGY 4

Key Component

Guiding Principle

Generate

Exceptional

Financial

Returns to

Unitholders

©

Copyright 2013 Buckeye Partners, L.P.

Our Vision: Buckeye

-

the

logistical

solutions

partner

of

choice

for

the

global

energy

business

Our Mission: To deliver superior returns to our investors through our talented, valued

employees and our core strengths of

•

An unwavering commitment to safety, environmental responsibility, regulatory compliance, and

personal integrity •

Best-in-class customer service and sophisticated commercial operations

•

Operational excellence that provides consistent, reliable performance at the lowest reasonable

cost •

An entrepreneurial approach toward logistical solutions to profitably expand and optimize

Buckeye’s portfolio of global energy assets •

A commitment to consistent execution and the continuous improvement of our operations, projects

and people |

ORGANIZATIONAL

OVERVIEW Three Business Operating Units

Domestic Pipelines & Terminals

International

Pipelines

&

Terminals

•

•

•

Buckeye Services

Natural Gas Storage

Energy Services

•

Development & Logistics

•

(1) LTM

through March 31, 2013. See Appendix for Non-

GAAP Reconciliations

©

Copyright 2013 Buckeye Partners, L.P.

5

72.3%

22.5%

0.9%

2.3%

2.0%

LTM ADJUSTED EBITDA

(1)

~30 million barrels of storage capacity at 2 terminal facilities

in The Bahamas (~25 million) and Puerto Rico (~5 million)

Deep water berthing capability to handle ULCCs and VLCCs

in The Bahamas

Announced expansion of 4.7 million barrels at Bahamian facility nearing

completion, with 1.9 million barrels placed in service 2 half

2012, 1.6

million placed into service during Q1 2013, and 1.2 million barrels expected

to be placed into service during Q3 2013

Markets refined petroleum products in areas served by Domestic

Pipelines & Terminals

Operates and/or maintains third-party pipelines under agreements

with major oil and gas and chemical companies

nd

•

~Over 30 Bcf of working natural gas storage capacity in Northern

California

•

~6,000 miles of pipeline with ~100 delivery locations

•

~100 liquid petroleum product terminals

•

~42 million barrels of liquid petroleum product storage capacity

|

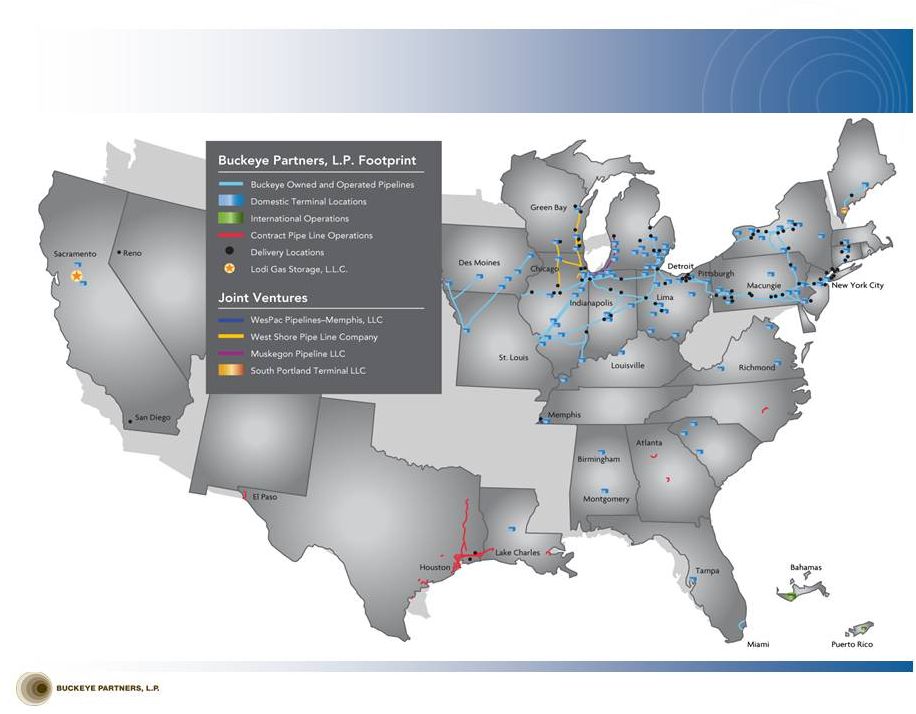

BUCKEYE SYSTEM

MAP ©

Copyright 2013 Buckeye Partners, L.P.

6 |

CRUDE

DIVERSIFICATION ©

Copyright 2013 Buckeye Partners, L.P.

7

•

Albany, NY

•

Multi-year contract signed with Irving Oil in October 2012 to

provide crude oil services, including offloading unit trains,

storage,

and

throughput

•

Albany terminal has two ship docks on the Hudson River, allowing

transport of crude oil directly to Irving’s facility

•

Perth Amboy, NJ

•

Project initiated to add crude by rail capability

•

Outbound transportation options include ship, barge, and pipeline

•

Chicago Complex

•

Diluent

storage

and

transshipments

–

inbound

via

railroad

and

pipeline; outbound via pipeline to Canadian destinations

•

Contract recently signed with major for construction of crude storage

•

Further discussions underway for potential projects, including crude by rail

opportunities

•

Woodhaven, MI

•

Offload Bakken crude from railcars and transport via pipeline to an Ohio

refinery

•

BORCO (Freeport, Bahamas)

•

Multi-year agreement signed in April 2012 to support 1.2 million barrel

expansion of facility

•

Latin America crude

developments

forcing

producers

to

find

large

storage locations with blending capabilities and segregation for

multiple qualities of crude

•

Advanced marine infrastructure and service capabilities provide

competitive advantage over other marine terminals in the region

With the emergence of the Bakken and Utica shale plays, as well as new crude developments in

Latin America, Buckeye is looking at ways to leverage its assets to provide crude oil

logistics solutions to producers and refiners wherever possible.

Crude Blending & Staging

To West

Coast

To Asia

To Gulf

Coast

To Europe

From Latin

America

Source: PFC Energy |

PERTH AMBOY

OVERVIEW BPL purchased facility from Chevron (closed in July 2012)

Located at the southwest end of New York Harbor on the

Arthur Kill

•

Only ~ 6 miles from Buckeye Linden complex

•

Pipeline, water, rail, and truck access

•

Strategically situated on New York Harbor as a NYMEX

delivery point

Approximately 5 MMBbls total storage capacity

•

2.7 MMBbls of active refined product storage

•

1.3 MMBbls of refurbishable refined product storage

•

0.8 MMBbls of heavy oil refurbishable storage

4 docks (1 ship, 3 barge

(1)

) with water draft up to 37'

~250 acre site with significant undeveloped acreage for

expansion potential

Capital investment period supported by multi-year

storage, blending, and throughput commitments from

Chevron

©

Copyright 2013 Buckeye Partners, L.P.

8

Note: Facility

located in Perth

Amboy, NJ.

Green line

indicates

approximate

property

boundaries

(1)

One of the barge docks is currently out of service.

Growth Opportunities

•

Near-term plans to transform existing terminal into a highly

efficient, multi-product storage, blending, and throughput facility

•

Potential for crude, gasoline, distillate, ethanol, asphalt, or 6 oil

service that can be optimized as market needs evolve

•

Pipeline planned for direct interconnect to Buckeye Linden

complex

•

Project initiated to allow handling of Bakken-sourced crude oil via

rail and ship

Improves connectivity and service capabilities for

customers to increase Buckeye system utilization

Provides for security and diversity of product supply for

Buckeye’s customers by connecting waterborne product

supply with end destination markets across the Buckeye

system

Provides customers with storage at New York Harbor, a

highly liquid NYMEX settlement point

•

Facility Overview

•

•

•

•

•

Strategic Rationale

•

•

• |

INTERNATIONAL

INTERNAL GROWTH PROJECTS EXPANSION AND OTHER GROWTH OPPORTUNITIES

©

Copyright 2013 Buckeye Partners, L.P.

9

•

Expanded storage capacity by 3.5 million barrels, with an additional 1.2

million barrels of crude oil storage expected to be in service in the third

quarter of 2013; all 4.7 million barrels are fully leased

•

Constructed ample berthing capacity to allow future expansion without

incremental marine infrastructure spend

•

Designed facility to accommodate multiple product segregations to

enable blending and maximum flexibility for changes in facility

requirements

•

Improved simultaneous operations to move product in and out of the

facility at the same time

•

Provided critical infrastructure redundancy to ensure business

continuity

•

Improved loading and unloading rates to allow for reduced berthing

time

•

Laid ground work for future expansion by optimizing facility

configuration

Other Internal Growth Opportunities

•

•

•

•

•

2014 Panama Canal expansion to allow passage of Suezmax vessels

expected to lead to 20-30% increase in traffic; BORCO location ideal to

service the incremental vessels

•

BORCO

Expansion

Capacity

(1)

–millions

of

barrels

(1)

Graph reflects expected midpoint of capital spend range. Dates represent expected date that

capacity is placed in service. BORCO Capital Investment Since Acquisition (~$340

million): Bluefield

Future

Expansion Area

Yellowfield

Significant land available for further expansion

Additional interest for staging of crude oil resulting from Latin American

production expected to come online over the next decade

•

Provides optionality to multiple end-market destinations

Bunkering

Opportunities

–

Blended

Fuel

Oil

Yabucoa, Puerto Rico facility provides opportunities for jet fuel and crude

storage, as well as fuel oil supply and bunkering

BORCO is a logical geographical location spot for a new “Bunker filling

Yellowfield 2

Bluefield 2

Bluefield 1

Yellowfield 1

station” |

BUCKEYE SERVICES

OVERVIEW ©

Copyright 2013 Buckeye Partners, L.P.

10

Recently reduced costs by right-sizing the infrastructure

for reduced geographic focus

Development & Logistics

Contract operations

Project origination

Asset development

Engineering design

Project management

Energy Services

Buckeye’s Lodi Gas Storage facility is a high performance natural gas storage facility

with over 30 Bcf of working gas capacity in Northern California serving the greater San

Francisco Bay Area

Revenue is generated through firm storage services and hub services The facilities collectively have a maximum injection and withdrawal capability of

approximately 550 million cubic feet per day (MMcf/day) and 750 MMcf/day, respectively

Lodi’s facilities are designed to provide high deliverability natural gas storage service

and have a proven track record of safe and reliable operations Natural

Gas Storage Buckeye Energy Services (“BES”) markets a wide range

of refined petroleum products and other ancillary

products in areas served by Buckeye’s pipelines and

terminals

Strategy for mitigating basis risk included a reduction of

refined product inventories in the Midwest and focusing

on fewer, more strategic locations for transacting

business

Contributed approximately $24.5 million in revenues to

Domestic Pipelines & Terminals during the last twelve

months through March 31,2013, while also providing

valuable insight on demand and pricing support for our

terminalling and storage business

Buckeye

Development & Logistics (“BDL”) operates and/or maintains

third-party pipelines under agreements with major oil and gas and chemical

companies

BDL is also responsible for identifying and completing

potential acquisitions and organic growth projects for

Buckeye

BDL services offered to customers |

FERC ORDER

DEVELOPMENTS Buckeye Pipe Line’s Market-Rate Program

FERC Closes “Show Cause”

Proceeding Regarding Buckeye Pipe Line Company, L.P. (“BPL Co.”)

©

Copyright 2013 Buckeye Partners, L.P.

11

•

In response to protest of an airline shipper in the NYC area, FERC issued a “Show

Cause” order on March 30, 2012, directing BPL Co. to justify continuation of its

innovative rate-setting system and rejecting its routine, system-wide tariff increases.

•

FERC issued an order on February 22, 2013, closing the “Show Cause” proceeding and

ruling that:

•

BPL Co. can continue to charge its current rates undisturbed •

BPL Co. granted full market-based-rate authority, i.e., no longer subject to rate

increase caps, in markets previously found by FERC to be competitive markets, in which

BPL Co. generated $137 million of revenue from interstate transportation service in

2012

•

BPL Co. allowed to file future rates in its remaining markets, in which BPL Co. generated

$126 million of revenue from interstate transportation service in 2012, pursuant to

any of the methodologies permitted by FERC regulations, including in accordance with

the generic FERC index

•

On October 10, 2012, BPL Co. filed its answer to the complaint, and additional filings were

made by the parties in October and November. No third parties have filed to

intervene in the complaint proceeding.

•

On February 22, 2013, FERC issued an order setting the matter for hearing, but such hearing is

on hold pending the outcome of FERC- ordered settlement discussions between the

parties, which are being facilitated by a FERC-appointed settlement judge.

•

In 2012, deliveries of jet fuel to the NYC airports generated approximately $32 million of BPL

Co.’s revenues. The complaint is not directed at BPL Co.’s rates for service

to other destinations, and it has no impact on the pipeline systems and terminals owned by

Buckeye’s other operating subsidiaries. BPL Co.

Increases Tariffs Airlines’

Complaint

•

BPL

Co.

increased

tariffs

effective

May

1

by

approximately

seven

percent

in

those

markets

subject

to

market-based-rate

authority

tariff

increase (excluding

the

NYC

market)

effective

with

the

normal

July

1

index

cycle.

st

st

•

The July 1, 2013 increase in the FERC index, which is a methodology available to BPL Co., has

been set by FERC at 4.6 percent. Treatment

of

NYC

market

rate

still

pending

outcome

of

two

other

filings,

as

discussed

below

(Airlines’

Complaint

and Market-Based Rates Application for New York City Market)

•

Earlier program utilized by BPL Co. now discontinued.

•

On September 20, 2012, four airlines filed a complaint at FERC challenging BPL Co.’s

tariff rates for transporting jet fuel to three NYC airports –

the

same

movements

that

were

the

subject

of

the

March

2012

protest

that

led

to

the

“show

cause”

proceeding.

•

•

BPL

Co.

is

still

evaluating

the

extent

to

which

it

will

increase

tariff

rates

in

the

remaining

markets,

but

does

expect

to

file

for

a |

FERC ORDER

DEVELOPMENTS (Continued) Buckeye Pipe Line’s Market-Rate Program

Market-Based Rates Application for New York City Market

©

Copyright 2013 Buckeye Partners, L.P.

12

On October 15, 2012, BPL Co. filed an application with FERC seeking authority to charge

market-based rates for deliveries of refined petroleum products to the NYC

market. If FERC grants the application, BPL Co. would be permitted prospectively to set its

rates in response to competitive forces, and the airlines’ cost-based

challenges to BPL Co.’s jet fuel delivery rates to the NYC airports would be moot with respect to future rates.

Buckeye believes that the New York City-area market is robust and highly

competitive. The New York Harbor is one of the world’s most active

refined petroleum products markets. Within this market, BPL Co.’s customers have access to numerous existing alternatives, via

pipeline, barge, and truck, to transport refined products. The three airports are

located near other active products pipelines or barge docks and, with reasonable

investment, should be able to access alternative jet fuel supplies efficiently and economically.

On December 14, 2012, four airlines filed a joint protest of BPL Co.’s market-based

rates application, specifically pertaining to jet fuel transportation to three NYC

airports - the same movements that were the subject of the March 2012 protest that led to the “show cause”

proceeding. The protest is not directed at BPL Co.’s market-based rates application

pertaining to movements of any other products or to any other destinations in the

NYC market.

On January 14, 2013, BPL Co. filed its answer to the protest. Additional filings were

also made by the parties in January and February 2013.

On February 22, 2013, FERC issued an order setting the application for hearing, but putting it

on hold pending the outcome of settlement discussions regarding the Airlines’

Complaint.

•

•

•

•

•

• |

BUCKEYE GREEN

INITIATIVES •

Electric Power Efficiency Initiatives:

•

Been recognized for innovative efficient pump procurement process. Received the ITT

Goulds Pumps Award for best-in-class “Heart of the Industry”

•

Use of drag reduction agents reduces electricity use by almost 100 million kilowatt hours

annually thereby eliminating greenhouse gas (GHG) in excess of 120,000 metric tons of

carbon dioxide emissions, equivalent to annual electricity use of approximately

8,350 homes •

Solar energy farms located on three Buckeye properties

•

Fleet Management Benefits: Increased use of fuel efficient vehicles and reduced

number of vehicles in our fleet saving 14,000 gallons of gasoline a month and reducing

carbon dioxide emissions by 1,500 metric tons, equivalent to annual GHG emission from

286 passenger vehicles •

Renewable Fuels Blending: Ethanol blending capabilities added at virtually all truck

rack terminals with ability to provide E-85 at many facilities; bio-diesel

blending also offered at a number of facilities. •

Recycling Program: Recycle office products, such as paper, batteries, bulbs and

commingled products (cans, glass, plastics), in excess of 20,000 pounds annually

©

Copyright 2013 Buckeye Partners, L.P.

13 |

FINANCIAL

PERFORMANCE (1)

©

Copyright 2013 Buckeye Partners, L.P.

14

Adjusted EBITDA ($MM)

(2)

Cash Distributions Declared per Unit

Cash Distribution Coverage

(2)(3)

(1)

LTM through March 31, 2013

(2)

See Appendix for Non-GAAP Reconciliations

(3)

Distributable cash flow divided by cash distributions declared for the respective periods

(4)

Long-term debt less cash and cash equivalents divided by Adjusted EBITDA (adjusted for pro

forma impacts of acquisitions); calculation as per BPL Credit Facility Net LT

Debt/Adjusted EBITDA (4)

1.01x

1.16x

1.03x

0.91x

1.04x

1.15x

0.00x

0.40x

0.80x

1.20x

1.60x

2008

2009

2010

2011

2012

LTM

4.47x

3.62x

3.89x

4.55x

4.74x

3.97x

0.00x

1.50x

3.00x

4.50x

6.00x

2008

2009

2010

2011

2012

LTM

$313.6

$370.2

$382.6

$487.9

$559.5

$603.4

$0

$100

$200

$300

$400

$500

$600

$700

2008

2009

2010

2011

2012

LTM

$3.475

$3.675

$3.875

$4.075

$4.150

$4.163

$0.00

$1.25

$2.50

$3.75

$5.00

2008

2009

2010

2011

2012

LTM |

INVESTMENT

SUMMARY Stability and Growth

•

Proven 26-year track record as a publicly traded partnership through varying economic and

commodity price cycles •

Management

continues

to

drive

operational

excellence

through

its

best

practices

initiative

•

Recent acquisitions provide Buckeye with increased geographic and product diversity, including

access to international logistics opportunities, and provide significant near-term

growth projects •

July 2012 acquisition of marine terminal facility in Perth Amboy, NJ from Chevron furthers

Buckeye’s strategy to create a fully integrated and flexible system that offers

unparalleled connectivity and service capabilities; provides significant near-term

growth opportunities at attractive multiple •

World-class

BORCO

marine

storage

terminal

with

24.9

million

barrels

of

storage

capacity

for

crude

oil

and

liquid

petroleum products in Freeport, Bahamas, with opportunity for significant additional capacity

expansion; serves as important logistics hub for international petroleum product

flows •

Diversified portfolio of assets provides balanced mix of stability and growth and is well

positioned to take advantage of changing

supply

and

demand

fundamentals

for

crude

and

refined

petroleum

products

to

drive

improved

returns

to

unitholders

©

Copyright 2013 Buckeye Partners, L.P.

15 |