Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MID AMERICA APARTMENT COMMUNITIES INC. | d548937d8k.htm |

| EX-99.1 - EX-99.1 - MID AMERICA APARTMENT COMMUNITIES INC. | d548937dex991.htm |

A

transformative combination creating the pre-eminent Sunbelt Multifamily REIT

June 2013

Exhibit 99.2 |

Two

highly complementary multifamily REIT platforms coming together to establish

the pre-eminent Sunbelt multifamily REIT 100% all stock combination of

Mid-America Apartment Communities (NYSE: MAA) with Colonial Properties

Trust (NYSE: CLP) Fixed exchange ratio of 0.36x MAA shares for each CLP

share Pro forma ownership of approximately 56.2% MAA / 43.8% CLP

Transaction

consideration

Expected

close

Q3 2013

Corporate

name and

headquarters

MAA to retain its corporate name and ticker symbol (NYSE: MAA)

Memphis, TN

Management

& Board

Eric Bolton, Chairman & CEO

Al Campbell, EVP & CFO

Tom Grimes, EVP & COO

Ongoing support from CLP management in integration efforts

New MAA board will be composed of 12 directors, including 7 directors from MAA

board and 5 directors from CLP board

Gross G&A

synergies

Expected $25 million annual run rate

Dividend

MAA will maintain its quarterly dividend at an annual rate of $2.78 per

share Positioned to drive superior long-term investment returns to

capital 1 |

Strategic rationale and transaction benefits

Higher efficiency in on-site product and service procurement in addition to

back-office and system platforms

Ability to further scale local and regional management operations

Cost elimination from duplicative public company costs and platform

Enhanced

margins and

synergy

opportunities

Leading Sunbelt footprint to drive superior deal flow and opportunistic new growth

opportunities

Superior cost of capital benefits over full cycle to enhance accretive capital

deployment opportunities

Platform

scale

drives

operating

cost

advantages

and

enhances

the

ability

to

attract

top

talent

Strengthened platform through integration of best practices of both

companies Enhanced

competitive

advantage

Enhanced

portfolio

strength

Second largest multifamily REIT by number of units

Improved diversification across high-growth region and markets

Enhanced ability to increase pro-active and opportunistic capital

re-cycling “Full cycle”

capital deployment and performance strategy strengthened

Improved investment grade metrics and limited near-term debt maturities

Larger scale enhances capital market opportunities

Long-term cost of capital benefits

Enhanced

balance sheet

Shared vision for success; enhanced platform to execute

2 |

Combination of complementary portfolios to create market-leading platform

1

As of 5/31/13

2

Includes all multifamily properties, including operating, lease up, joint venture

communities 3

Multifamily assets weighted by 3/31/13 NOI

4

Represents multifamily portfolio occupancy as of 3/31/13

Formation date

Mid-America Apartments

Colonial Properties

New MAA

Equity market cap

($bn)

Age

3

Occupancy

January 1994

September 1993

Q3 2013

$3.0

$2.1

$5.1

168

117

285

15.4 yrs

14.5 yrs

15.0 yrs

96%

96%

96%

Total market cap

($bn)

1

$4.7

$3.9

$8.6

Units

49,591

35,181

84,772

Revenue / unit

$994

$966

$982

Communities

3

1

2

2

4 |

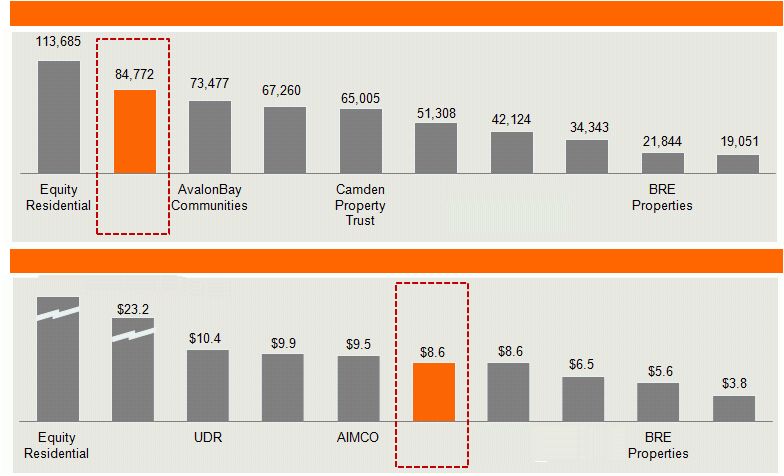

Second largest multifamily REIT by units with a market cap of over $8.6bn

Units

1

Total market capitalization ($bn)

2

Source: Company 1Q’13 Financial Supplements

1

As of 3/31/2013

2

As of 5/31/13

4

$33.8

New MAA

AIMCO

UDR

Essex

Property

Trust

Post

Properties

Home

Properties

AvalonBay

Communities

Essex

Property

Trust

New MAA

Home

Properties

Post

Properties

Camden

Property

Trust |

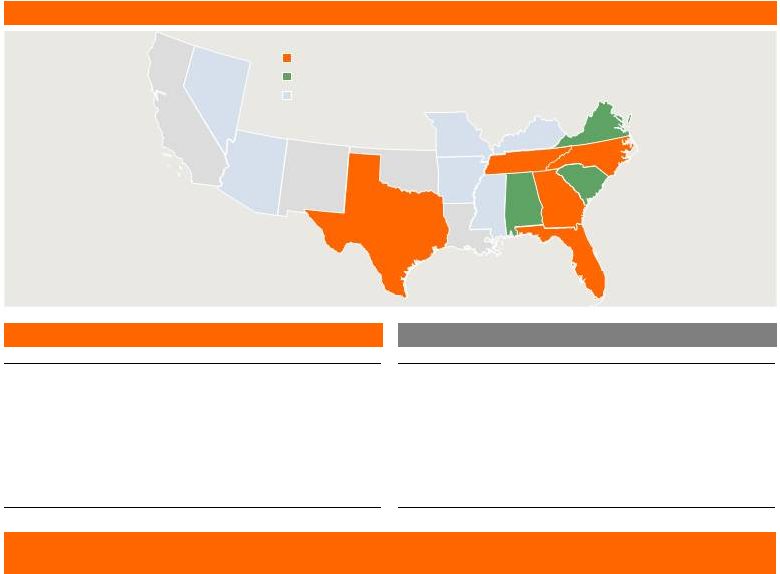

Portfolio

distribution

by

total

units

Note: Other large markets includes 3 additional MSAs; Other secondary markets

includes 29 additional MSAs 1

Breakdown based on number of total multifamily 1Q’13 NOI, including operating,

lease-up and joint venture communities (at share) Continued commitment to a

portfolio strategy focused on high-growth markets across the Sunbelt region, allocated

across both large and secondary markets, to capture superior risk-adjusted

performance over full market cycles Distribution

by

secondary

markets

(38%

of

total)

Distribution by large markets (62% of total)

Alabama

Arizona

Arkansas

California

Florida

Georgia

Kentucky

Louisiana

Nevada

New Mexico

North Carolina

Oklahoma

South

Carolina

Tennessee

Texas

Virginia

Mississippi

2,000–5,000 units

Greater than 5,000 units

Less than 2,000 units

Missouri

Note: Includes all multifamily properties, including operating, lease up, joint

venture communities Enhanced diversification across high-growth Sunbelt

region Large markets

% of total Q1'13 NOI

1

Dallas / Fort Worth

11.7%

2

Atlanta

6.9%

3

Austin

6.4%

4

Raleigh

6.3%

5

Charlotte

5.8%

6

Nashville

4.9%

7

Jacksonville

4.6%

8

Tampa

4.0%

9

Orlando

3.9%

10

Houston

3.4%

Secondary markets

% of total Q1'13 NOI

1

Memphis

3.2%

2

Charleston

3.0%

3

Savannah

2.9%

4

Birmingham

2.4%

5

Richmond

2.2%

6

Jackson

2.0%

7

Greenville

1.6%

8

Columbus

1.6%

9

San Antonio

1.6%

10

Little Rock

1.5%

5

1

1

1 |

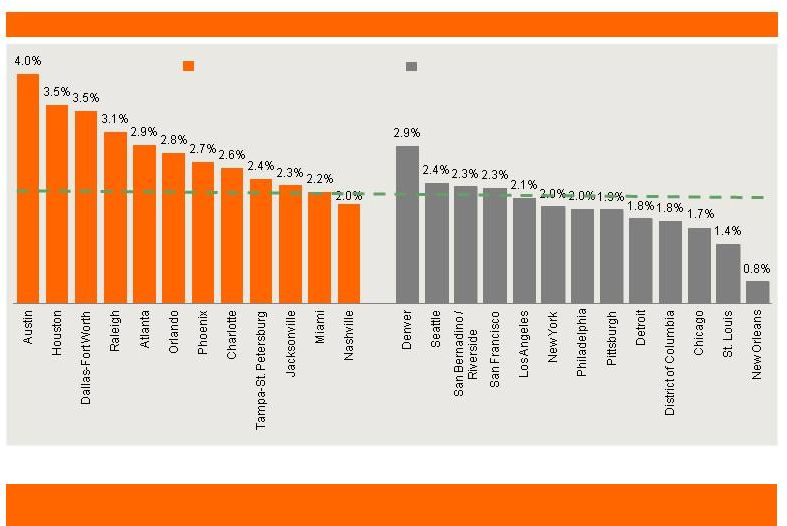

Significant presence in large, high growth markets

Source: Moody’s

Note: Highlighted markets represent 58.7% of New MAA’s multifamily portfolio

(weighted by units) U.S. average: 2.2%

Large markets with meaningful presence

MAA’s combined new, large markets are on a weighted average basis projected to

show 3.0% job growth over the next 5 years vs. U.S. average of 2.2%

Major non-MAA markets

6

5-year projected employment growth CAGR (%) |

MAA’s two-tier market strategy has delivered stable, long-term

outperformance over the “full cycle”

MAA has generated higher average growth combined with lower volatility than

peers MAA

average: 2.8%

Peer

average: 2.6%

Source: Third party research

Note: Multifamily peers include BRE, CLP, CPT, ESS, HME, PPS, UDR

2009

trough: (5.1%)

2009

trough: (1.8%)

7

Same store NOI growth |

New

MAA will have an enhanced large market focus across the Sunbelt region Top 10

markets by NOI 1Q’13 unit count by market

% of 1Q’13 same store NOI by market

1

2

3

4

5

6

7

8

9

10

MAA

DFW

Jacksonville

Nashville

Houston

Atlanta

Memphis

Austin

Tampa

Raleigh

Columbus

CLP

DFW

Charlotte

Raleigh

Austin

Atlanta

Orlando

Charleston

Savannah

Birmingham

Tampa

New MAA

DFW

Atlanta

Austin

Raleigh

Charlotte

Nashville

Jacksonville

Tampa

Orlando

Houston

49,591

35,181

84,772

Source: REIS

Markets with 5-year projected employment growth above national average

8

25,846

24,646

50,492

23,745

10,535

34,280 |

Synergy and value creation potential through integration

Significant overlap in asset footprint creates potential for

margin improvement

Significant overlap in technology to drive and track

performance, leading to minimal business disruption

Opportunity to improve cost structure by leveraging a

combined business platform across a significantly larger

asset portfolio

Estimated total run-rate annual synergies of $25mm

Potential for additional synergies include improved debt

costs and opportunities for scale efficiencies

Strengthened platform through integration of best

practices of both companies

Market

Station

-

Kansas

City,

MO

Colonial

Grand

at

Double

Creek

-

Austin,

TX

9 |

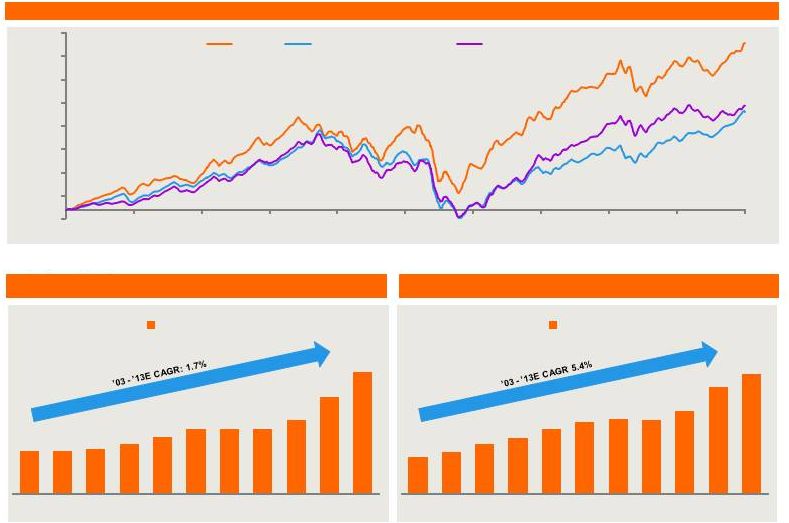

2

Q1 2013 dividend / share annualized

3

Excludes the write-off of original issuance costs for preferred shares

redeemed 4

Mid point of 2013E FFO / share guidance

MAA management’s proven record of disciplined capital deployment and

performance 359%

224%

211%

Note: Multifamily peers include AIV, AVB, BRE, CLP, CPT, EQR, ESS, HME, PPS,

UDR 1

20 day simple moving average

4

2

3

3

10

(20.0)%

30.0%

80.0%

130.0%

180.0%

230.0%

280.0%

330.0%

380.0%

05/30/03

05/29/04

05/29/05

05/30/06

05/30/07

05/30/08

05/30/09

05/30/10

05/31/11

05/30/12

05/31/13

MAA

MSCIUS REIT Index

Multifamily peers

Total

return

performance

10

years

1

$2.34 $2.34

$2.35

$2.38

$2.42

$2.46 $2.46 $2.46

$2.51

$2.64

$2.78

2003

2005

2007

2009

2011

2013E

Dividend / share

$2.87

$3.00

$3.20

$3.33

$3.55

$3.73

$3.79

$3.77

$3.98

$4.57

$4.87

2003

2005

2007

2009

2011

2013E

FFO / share

MAA dividend growth 10 years

MAA FFO growth 10 years

2004

2006

2008

2010

2012

2004

2006

2008

2010

2012

–

–

– |

New

MAA will maintain a disciplined approach to development Expected stabilized

NOI yields between 6% and 8% Cost to

Cost to

Expected cost

Expected

MSA

Total units

date

complete

Total

Per unit ($000)

stabilization

MAA

River's Walk

Charleston

270

21.9

11.5

33.4

124

4Q14

1225 South Church Phase II

Charlotte

210

$26.3

$1.2

$27.5

$131

1Q14

Subtotal: MAA

774

$56.3

$45.0

$101.3

$131

CLP

CR at South End

Charlotte

353

31.7

27.6

59.3

168

4Q14

CG at Ayrsley (Phase II)

Charlotte

81

$5.4

$3.7

$9.1

$113

4Q13

CG at Randal Lakes

Orlando

462

24.2

32.8

57.0

123

1Q15

CG at Lake Mary (Phase III)

Orlando

132

2.4

13.7

16.1

122

3Q14

Subtotal: CLP

1,028

$63.7

$77.8

$141.5

$138

Total

1,802

$120.0

$122.8

$242.8

$135

220 Riverside

Jacksonville

294

8.1

32.3

40.4

137

4Q15

11

Active multifamily development pipeline ($mm, except per unit costs)

|

New

MAA will continue to recycle capital into high quality properties in growth markets

Allure at Brookwood

Colonial Grand at Windemere

Legends at Lowe’s Farm

Colonial Reserve at Las Colinas

MAA purchase: Sept. 2011

MSA: Dallas, TX

Acquisition price: $47mm

Total units: 456

Year built: 2008

Occupancy: 95%

MAA purchased: July 2012

MSA: Atlanta, GA

Acquisition price: $64mm

Total units: 349

Year built: 2008

Occupancy: 94%

CLP purchase: March 2013

MSA: Orlando, FL

Acquisition price: $43mm

Total units: 280

Year built: 2009

Occupancy: 95%

CLP purchase: Nov. 2012

MSA: Dallas, TX

Acquisition price: $43mm

Total units: 306

Year built: 2006

Occupancy: 91%

12 |

Total unencumbered assets to book value

Debt

/

LTM

EBITDA

Debt / gross assets

Debt / market capitalization

Secured debt / gross assets

LTM

fixed

charge

coverage

ratio

MAA

57.4%

6.5x

44.9%

36.2%

29.8%

4.3x

CLP

69.7%

7.7x

44.2%

45.6%

17.6%

2.5x

New MAA

63.7%

6.7x

44.5%

40.5%

23.6%

3.4x

Debt maturity profile ($mm)

Note: As of 3/31/13

2

Excludes pro rata share of unconsolidated joint venture debt

Strong investment grade balance sheet and manageable debt maturity profile

3%

14%

15%

8%

47%

%

maturing

13%

Credit metrics

Note: As of 3/31/13

1

Includes pro rata share of unconsolidated joint venture debt

2

New MAA EBITDA includes $25mm of synergies pro forma for the transaction

$511

$285

13

1

2

2

2 |

Strong investment grade balance sheet -

capital structure profile

New MAA capital structure

Debt / market capitalization: 40.5%

Note: As of 3/31/13. Includes pro rata share of unconsolidated joint venture

debt Floating vs. fixed rate debt

Unsecured vs. secured debt

% of unencumbered assets

14 |

Source: Company filings, SNL Financial

1

EBITDA includes $25mm of synergies pro forma for the transaction

Investment grade balance sheet metrics

Debt / gross assets

Debt / LTM EBITDA

Secured debt / gross assets

LTM fixed charge coverage ratio

15 |

| Strategy and long-term outlook

Optimize cash flow growth through “full-cycle”

Support growing and secure dividend

Deliver superior long-term risk-adjusted returns

Focus on high-growth Sunbelt markets

Prudent capital deployment practices

Proactive capital recycling program

Build competitive advantages in local markets

Limited and disciplined approach to development

Develop New MAA brand value

16 |

Certain matters in this presentation may constitute forward-looking statements

within the meaning of Section 27-A of the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

and

Exchange

Act

of

1934.

Such

statements

include,

but are not limited to, statements made about anticipated economic and market

conditions, expectations for future demographics, the impact of competition,

general changes in the apartment industry, expectations for acquisition and

joint venture performance, ability to pay dividends and the ability to obtain financing at reasonable rates. Actual

results

and

the

timing

of

certain

events

could

differ

materially

from

those

projected

in

or

contemplated

by

the

forward-looking statements due to a number of factors, including a downturn in

general economic conditions or the capital markets, competitive factors

including overbuilding or other supply/demand imbalances in some or all of our

markets, changes in interest rates and other items that are difficult to control

such as the impact of legislation, as well as the other general risks

inherent in the apartment and real estate businesses. Reference is hereby made to

the filings of Mid-America Apartment Communities, Inc., with the Securities and

Exchange Commission, including quarterly reports on Form 10-Q, reports

on Form 8-K, and its annual report on Form 10-K, particularly including the

risk factors contained in the latter filing.

Eric Bolton, MAA

CEO

901-248-4127

eric.bolton@maac.com

Al Campbell, MAA

CFO

901-248-4169

al.campbell@maac.com

Leslie Wolfgang, MAA

Investor Relations

901-248-4126

leslie.wolfgang@maac.com

Jennifer Patrick, MAA

Investor Relations

901-435-5371

jennifer.patrick@maac.com

http://ir.maac.com

Tom Lowder, CLP

CEO

205-250-8700

tlowder@colonialprop.com

Jerry Brewer, CLP

Executive Vice President

800-645-3917

jbrewer@colonialprop.com

17 |

| Additional Information about the Proposed Transaction and Where to Find

It In connection with the proposed transaction, MAA expects to file with the SEC a registration

statement on Form S-4 that will include a joint proxy statement of MAA and Colonial

Properties Trust that also constitutes a prospectus of MAA. MAA and Colonial Properties

Trust also plan to file other relevant documents with the SEC regarding the proposed

transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy

statement/prospectus (if and when it becomes available) and other relevant documents filed by

MAA and Colonial Properties Trust with the SEC at the SEC’s website at www.sec.gov.

Copies of the documents filed by MAA with the SEC will be available free of charge on MAA’s website

at www.maac.com or by contacting MAA Investor Relations at 901-682-6600. Copies of the

documents filed by Colonial Properties Trust with the SEC will be available free of charge on

Colonial Properties Trust’s website at www.colonialprop.com or by contacting Colonial

Properties Trust Investor Relations at 205-250-8700.

MAA and Colonial Properties Trust and their respective directors and executive officers and other

members of management and employees may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. You can find information about MAA’s

executive officers and directors in MAA’s definitive proxy statement filed with the SEC on March 22,

2013. You can find information about Colonial Properties Trust’s executive officers and

directors in Colonial Properties Trust’s definitive proxy statement filed with the SEC on

March 13, 2013. Additional information regarding the interests of such potential

participants will be included in the joint proxy statement/prospectus and other relevant documents

filed with the SEC if and when they become available. You may obtain free copies of these

documents from MAA or Colonial Properties Trust using the sources indicated above. This document shall

not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. No offering

of securities shall be made except by means of a prospectus meeting the requirements of Section

10 of the U.S. Securities Act of 1933, as amended. |