Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - NeuBase Therapeutics, Inc. | ohr-8k_053013.htm |

Exhibit 99.1

Marcum MicroCap Conference May 30, 2013

2 Safe Harbor Statement This presentation contains forward - looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. These forward looking statements are made only as the date thereof, and Ohr undertakes no obligation to update or revise the forward looking statement whether as a result of new information, future events or otherwise. Our actual results may differ materially and adversely from those expressed in any forward - looking statements as a result of various factors and uncertainties, including the future success of our scientific studies, our ability to successfully develop products, rapid technological change in our markets, changes in demand for our future products, legislative, regulatory and competitive developments, the financial resources available to us, and general economic conditions. For example, there can be no assurance that Ohr will be able to sustain operations for expected periods. Shareholders and prospective investors are cautioned that no assurance of the efficacy of pharmaceutical products can be claimed or assured until final testing; and no assurance or warranty can be made that the FDA will approve final testing or marketing of any pharmaceutical product. Ohr's most recent Annual Report and subsequent Quarterly Reports discuss some of the important risk factors that may affect our business, results of operations and financial condition. We disclaim any intent to revise or update publicly any forward - looking statements for any reason.

3 Company Overview • Founded in late 2008, publicly traded OTCQB: OHRP • Experienced management team headquartered in New York, NY • Executed on strategy to acquire two late stage clinical programs in 2009 that address large unmet medical needs: wet - AMD & cancer cachexia – Wealth of preclinical and clinical data – Clear competitive path forward – Risk mitigation • Strong intellectual property protection • Tight expense controls • Unknown story with several upcoming catalysts

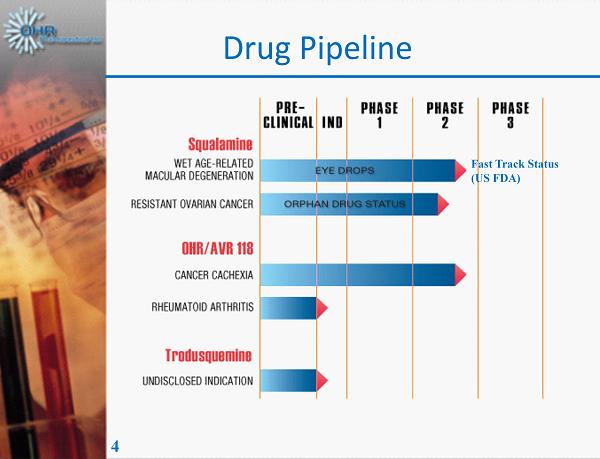

4 Drug Pipeline Fast Track Status (US FDA)

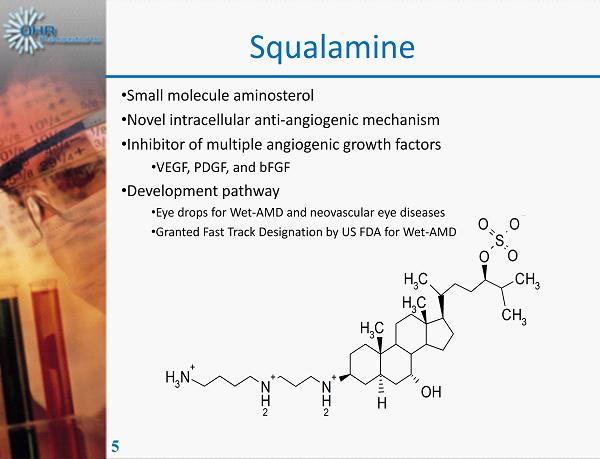

5 Squalamine • Small molecule aminosterol • Novel intracellular anti - angiogenic mechanism • Inhibitor of multiple angiogenic growth factors • VEGF, PDGF, and bFGF • Development pathway • Eye drops for Wet - AMD and neovascular eye diseases • Granted Fast Track Designation by US FDA for Wet - AMD N H 2 + N H 2 + NH 3 + CH 3 H CH 3 CH 3 CH 3 CH 3 O OH S O OO

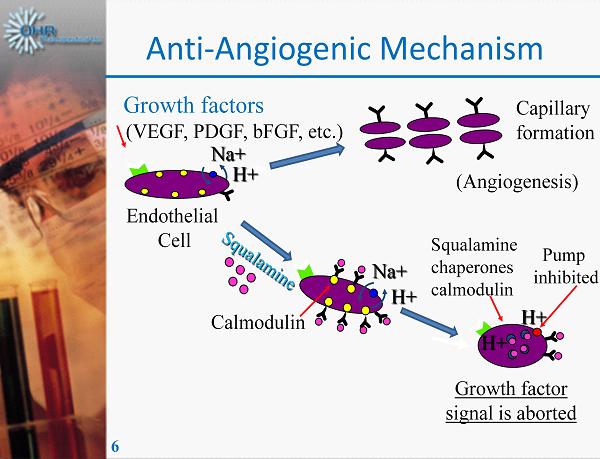

6 Anti - Angiogenic Mechanism Growth factors (VEGF, PDGF, bFGF, etc.) Endothelial Cell H+ Na+ Calmodulin H+ Na+ H+ H+ H+ Growth factor signal is aborted Pump inhibited Squalamine chaperones calmodulin Capillary formation (Angiogenesis)

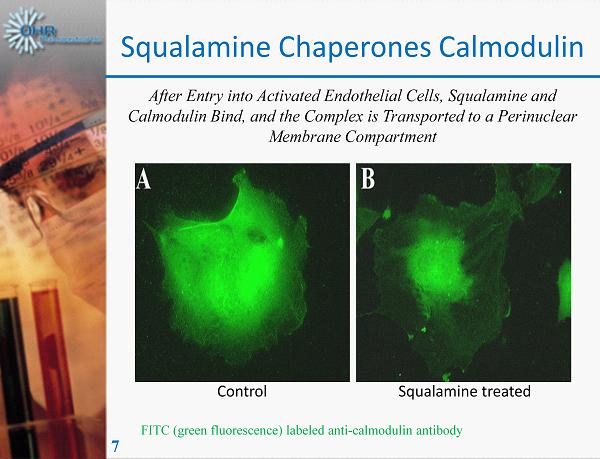

7 Squalamine Chaperones Calmodulin Control Squalamine treated After Entry into Activated Endothelial Cells, Squalamine and Calmodulin Bind, and the Complex is Transported to a Perinuclear Membrane Compartment FITC (green fluorescence) labeled anti - calmodulin antibody

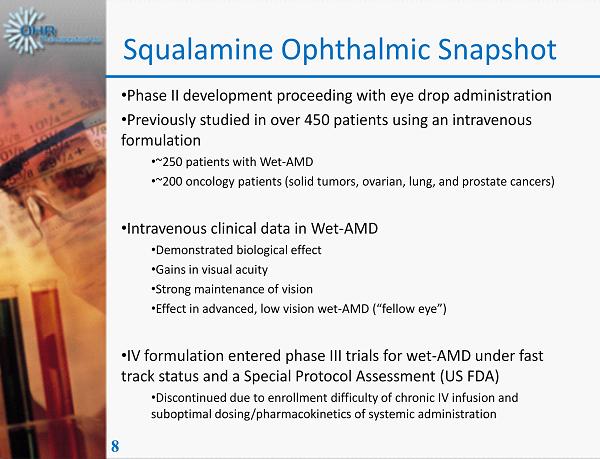

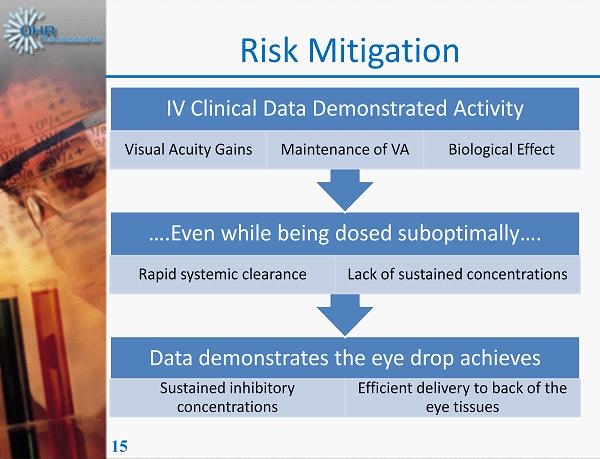

8 Squalamine Ophthalmic Snapshot • Phase II development proceeding with eye drop administration • Previously studied in over 450 patients using an intravenous formulation • ~250 patients with Wet - AMD • ~200 oncology patients (solid tumors, ovarian, lung, and prostate cancers) • Intravenous clinical data in Wet - AMD • Demonstrated biological effect • Gains in visual acuity • Strong maintenance of vision • Effect in advanced, low vision wet - AMD (“fellow eye”) • IV formulation entered phase III trials for wet - AMD under fast track status and a Special Protocol Assessment (US FDA) • Discontinued due to enrollment difficulty of chronic IV infusion and suboptimal dosing/pharmacokinetics of systemic administration

9 IV Drawbacks • Suboptimal dosing - Pharmacokinetic analysis confirms that prior IV dosing was suboptimal especially when going from a weekly to monthly “maintenance” dosing period • Patient compliance - 40 minute weekly infusion very burdensome on elderly patient population • Commercial challenges - ophthalmologist offices not equipped to give large scale prolonged infusions • Infusion site reactions - Due to rapid infusion rates

10 Eye Drop Solves IV Drawbacks – In vivo studies confirm tissue concentrations well in excess of the antiangiogenic level and can consistently stay above threshold levels – Eye drop can be self administered – Topical treatment does not require ophthalmologist infrastructure build out to accommodate large scale IV infusions – In vivo studies indicate negligible systemic uptake and topical dosing is orders of magnitude lower than previous IV MTD

11 Squalamine Eye Drop Formulation • Proprietary reformulation using FDA approved excipients • In - vivo studies in Dutch belted rabbits – 28 day ocular tolerance and toxicity • Demonstrated safety and tolerability to ocular tissues • No macroscopic or histopathology changes – Biodistribution study - single dose • Peak concentrations 8x the threshold level to inhibit choroidal neovascularization – Biodistribution study - QD & BID up to 14 days • Results presented at ARVO & Macula Society - 2012 – 6 month BID ocular tolerance and toxicity • No adverse findings

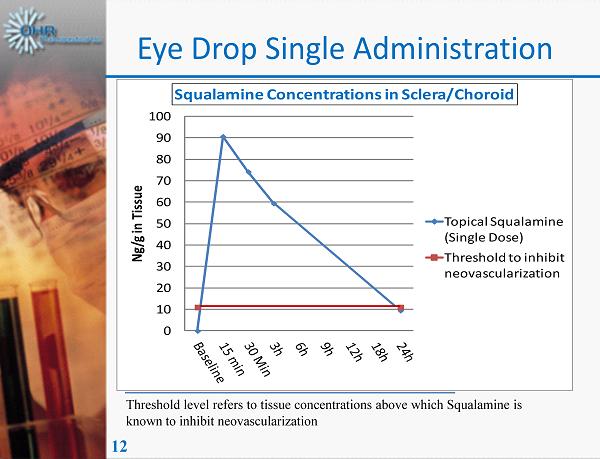

12 Eye Drop Single Administration 0 10 20 30 40 50 60 70 80 90 100 Ng/g in Tissue Squalamine Concentrations in Sclera/Choroid Topical Squalamine (Single Dose) Threshold to inhibit neovascularization Threshold level refers to tissue concentrations above which Squalamine is known to inhibit neovascularization

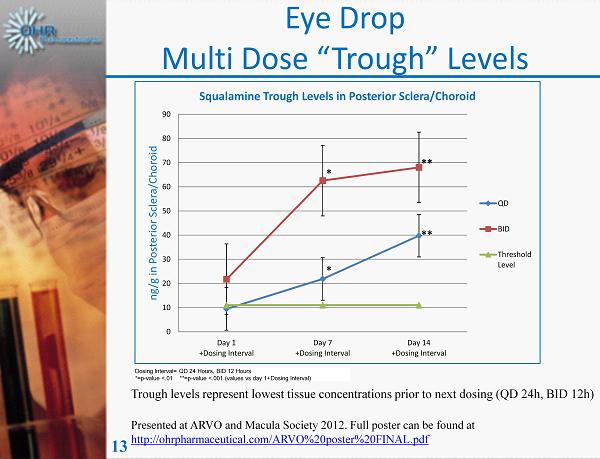

13 Eye Drop Multi Dose “Trough” Levels 0 10 20 30 40 50 60 70 80 90 Day 1 +Dosing Interval Day 7 +Dosing Interval Day 14 +Dosing Interval ng/g in Posterior Sclera/Choroid Squalamine Trough Levels in Posterior Sclera/Choroid QD BID Threshold Level * ** ** * Dosing Interval= QD 24 Hours, BID 12 Hours *=p - value <.01 **=p - value <.001 (values vs day 1+Dosing Interval) Trough levels represent lowest tissue concentrations prior to next dosing (QD 24h, BID 12h) Presented at ARVO and Macula Society 2012. Full poster can be found at http://ohrpharmaceutical.com/ARVO%20poster%20FINAL.pdf

14 Biodistribution Studies Conclusions • Studies Demonstrated: – Rapid uptake to the posterior sclera/choroid ocular tissues with slow tissue clearance – Sustained Squalamine concentrations well above threshold anti - angiogenic levels, which persist throughout the period in between doses – Safety to ocular tissues with no signs of ocular adverse clinical findings – Negligible systemic uptake which minimizes the potential for systemic adverse events

15 Risk Mitigation Data demonstrates the eye drop achieves Sustained inhibitory concentrations Efficient delivery to back of the eye tissues ….Even while being dosed suboptimally …. Rapid systemic clearance Lack of sustained concentrations IV Clinical Data Demonstrated Activity Visual Acuity Gains Maintenance of VA Biological Effect

16 Competitive Advantages Potential advantages over intravitreal injections (“IVT”) for Wet - AMD • Superior delivery method • Current approved therapies are delivered via intravitreal injection directly into the eye every month or two. • Inhibition of Multiple Angiogenic Growth Factors • Clinical evidence has shown that inhibiting VEGF and PDGF provides improvement over Lucentis VA gain response rates. • Activity in advanced AMD cases • Many Wet - AMD patients have a more advanced, low vision wet AMD eye (“fellow eye”). Squalamine clinical data has shown significant VA improvement in these fellow eyes using the IV formulation. • Safety profile • Squalamine had minimal systemic or ocular drug - related adverse events when tested using the IV formulation at much higher doses. • Cost effective manufacture

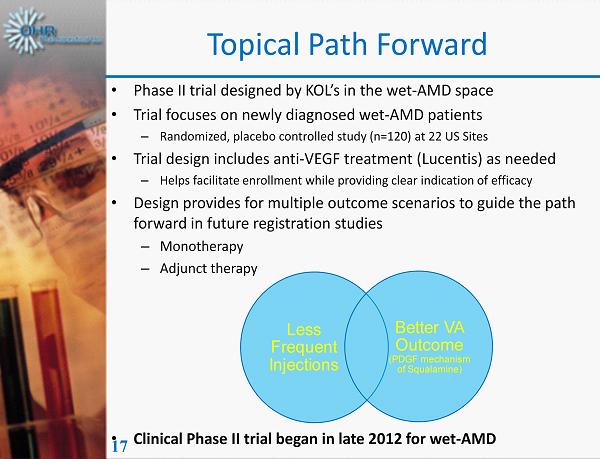

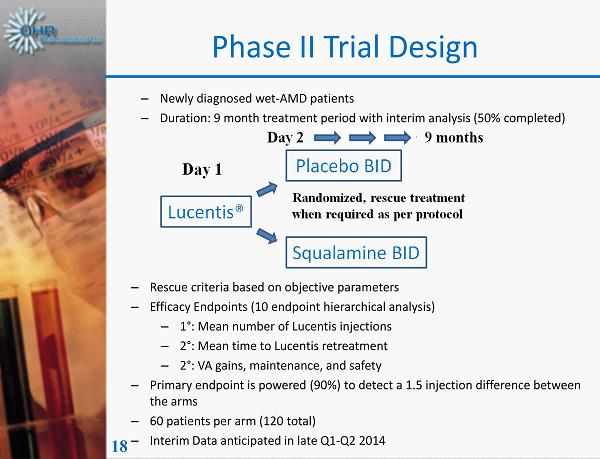

17 Topical Path Forward • Phase II trial designed by KOL’s in the wet - AMD space • Trial focuses on newly diagnosed wet - AMD patients – Randomized, placebo controlled study (n=120) at 22 US Sites • Trial design includes anti - VEGF treatment (Lucentis) as needed – Helps facilitate enrollment while providing clear indication of efficacy • Design provides for multiple outcome scenarios to guide the path forward in future registration studies – Monotherapy – Adjunct therapy • Clinical Phase II trial began in late 2012 for wet - AMD Less Frequent Injections Better VA Outcome (PDGF mechanism of Squalamine )

18 Phase II Trial Design – Rescue criteria based on objective parameters – Efficacy Endpoints (10 endpoint hierarchical analysis) – 1 Σ : Mean number of Lucentis injections – 2 Σ : Mean time to Lucentis retreatment – 2 Σ : VA gains, maintenance, and safety – Primary endpoint is powered (90%) to detect a 1.5 injection difference between the arms – 60 patients per arm (120 total) – Interim Data anticipated in late Q1 - Q2 2014 – Newly diagnosed wet - AMD patients – Duration: 9 month treatment period with interim analysis (50% completed)

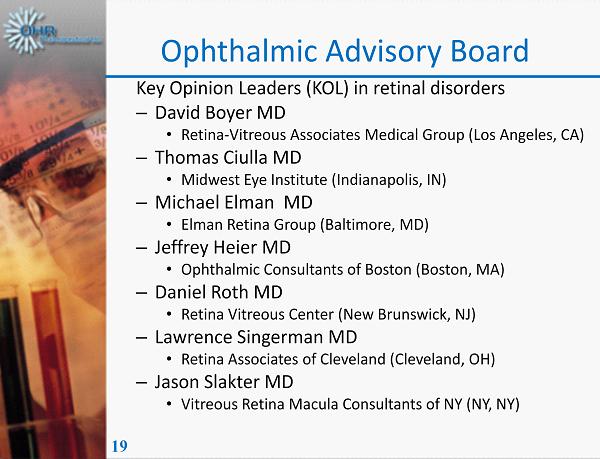

19 Ophthalmic Advisory Board Key Opinion Leaders (KOL) in retinal disorders – David Boyer MD • Retina - Vitreous Associates Medical Group (Los Angeles, CA ) – Thomas Ciulla MD • Midwest Eye Institute (Indianapolis, IN) – Michael Elman MD • Elman Retina Group (Baltimore, MD) – Jeffrey Heier MD • Ophthalmic Consultants of Boston (Boston, MA) – Daniel Roth MD • Retina Vitreous Center (New Brunswick, NJ) – Lawrence Singerman MD • Retina Associates of Cleveland (Cleveland, OH ) – Jason Slakter MD • Vitreous Retina Macula Consultants of NY (NY, NY)

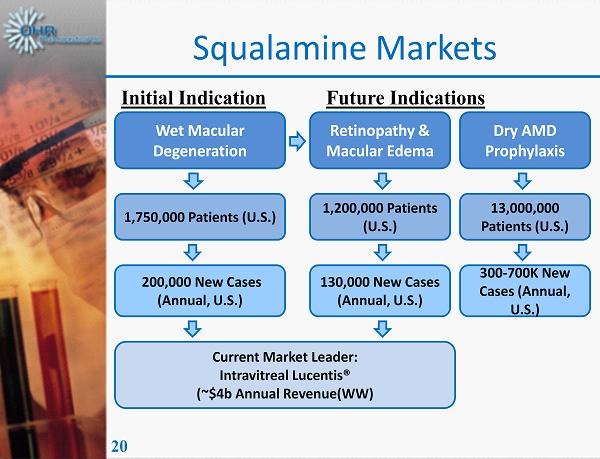

20 Squalamine Markets Wet Macular Degeneration Retinopathy & Macular Edema Dry AMD Prophylaxis 1,750,000 Patients (U.S.) 1,200,000 Patients (U.S.) 13,000,000 Patients (U.S.) 200,000 New Cases (Annual, U.S.) 130,000 New Cases (Annual, U.S.) 300 - 700K New Cases (Annual, U.S.) Initial Indication Future Indications Current Market Leader: Intravitreal Lucentis ® (~$4b Annual Revenue(WW)

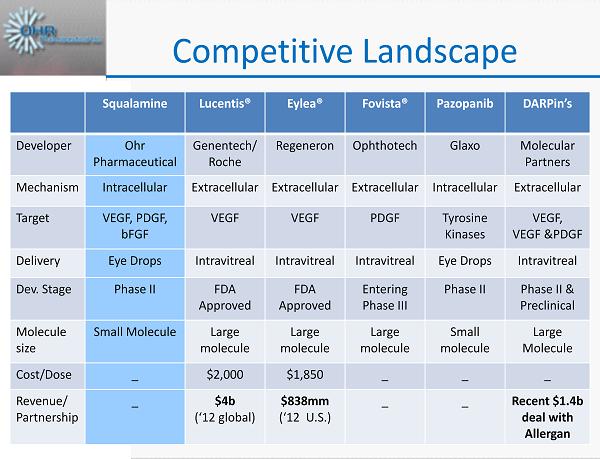

21 Competitive Landscape Squalamine Lucentis® Eylea ® Fovista ® Pazopanib DARPin’s Developer Ohr Pharmaceutical Genentech/ Roche Regeneron Ophthotech Glaxo Molecular Partners Mechanism Intracellular Extracellular Extracellular Extracellular Intracellular Extracellular Target VEGF, PDGF, bFGF VEGF VEGF PDGF Tyrosine Kinases VEGF, VEGF &PDGF Delivery Eye Drops Intravitreal Intravitreal Intravitreal Eye Drops Intravitreal Dev. Stage Phase II FDA Approved FDA Approved Entering Phase III Phase II Phase II & Preclinical Molecule size Small Molecule Large molecule Large molecule Large molecule Small molecule Large Molecule Cost/Dose _ $2,000 $1,850 _ _ _ Revenue/ Partnership _ $4b (‘ 12 global) $838mm (‘ 12 U.S.) _ _ Recent $1.4b deal with Allergan

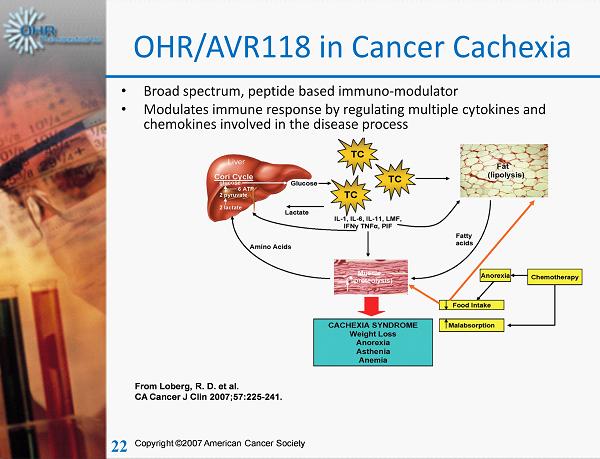

22 OHR/AVR118 in Cancer Cachexia • Broad spectrum, peptide based immuno - modulator • Modulates immune response by regulating multiple cytokines and chemokines involved in the disease process

23 Cancer Cachexia Indication • Wasting disorder often seen in late stage cancer patients characterized by anorexia, loss of muscle mass, fatigue, weakness, and poor quality of life • Cachexia is exacerbated by the cellular stress of chemotherapy and radiation • Research has shown that the etiology of cancer cachexia is likely attributable to a cascade of pro - inflammatory cytokine release (cytokine storm ) • 20 - 30% of cancer patients will succumb to cachexia

24 Phase IIa Clinical Data • 18 Patients, various tumor types, primarily stage IV (84%) • Results Demonstrated – Stabilization of weight, lean body mass, and body fat – Appetite increased (p=.001) – Total PG - SGA scores improved significantly (p =.025) – Enhanced quality of life • Results seen even though 8/18 patients took concomitant chemotherapy or radiation • 11/18 patients continued therapy after completion of the protocol for up to 153 days • OHR/AVR118 was well tolerated with no serious side effects reported • Detailed data expected to be presented at annual cachexia conference in Q4 2013

25 Analyst Coverage • Brean Capital – Jonathan Aschoff - Senior Analyst – Buy Rating: $7 PT • Burrill & Co – Elemer Piros - Senior Analyst – Market Outperform Rating: $3 PT

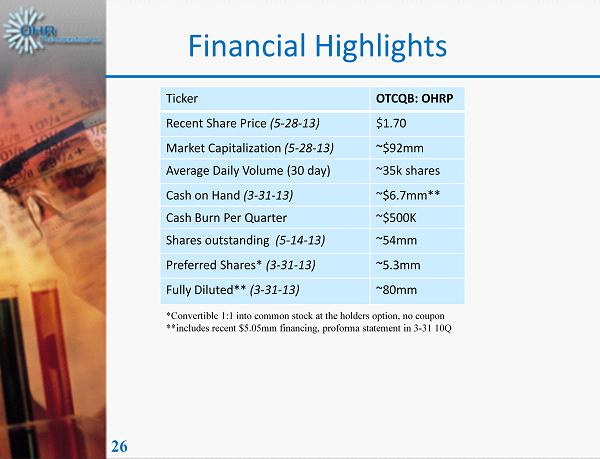

26 Financial Highlights Ticker OTCQB: OHRP Recent Share Price (5 - 28 - 13) $1.70 Market Capitalization (5 - 28 - 13) ~$92mm Average Daily Volume (30 day) ~35k shares Cash on Hand (3 - 31 - 13) ~$6.7mm** Cash Burn Per Quarter ~$500K Shares outstanding (5 - 14 - 13) ~54mm Preferred Shares* (3 - 31 - 13) ~5.3mm Fully Diluted** (3 - 31 - 13) ~80mm *Convertible 1:1 into common stock at the holders option, no coupon **includes recent $5.05mm financing, proforma statement in 3 - 31 10Q

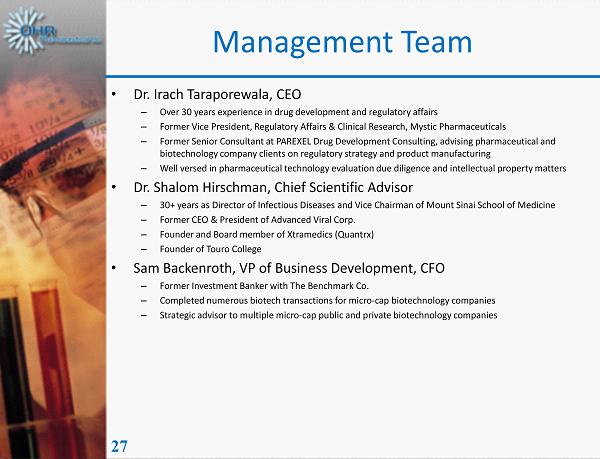

27 Management Team • Dr. Irach Taraporewala, CEO – Over 30 years experience in drug development and regulatory affairs – Former Vice President, Regulatory Affairs & Clinical Research, Mystic Pharmaceuticals – Former Senior Consultant at PAREXEL Drug Development Consulting, advising pharmaceutical and biotechnology company clients on regulatory strategy and product manufacturing – Well versed in pharmaceutical technology evaluation due diligence and intellectual property matters • Dr. Shalom Hirschman, Chief Scientific Advisor – 30+ years as Director of Infectious Diseases and Vice Chairman of Mount Sinai School of Medicine – Former CEO & President of Advanced Viral Corp. – Founder and Board member of Xtramedics (Quantrx) – Founder of Touro College • Sam Backenroth, VP of Business Development, CFO – Former Investment Banker with The Benchmark Co. – Completed numerous biotech transactions for micro - cap biotechnology companies – Strategic advisor to multiple micro - cap public and private biotechnology companies

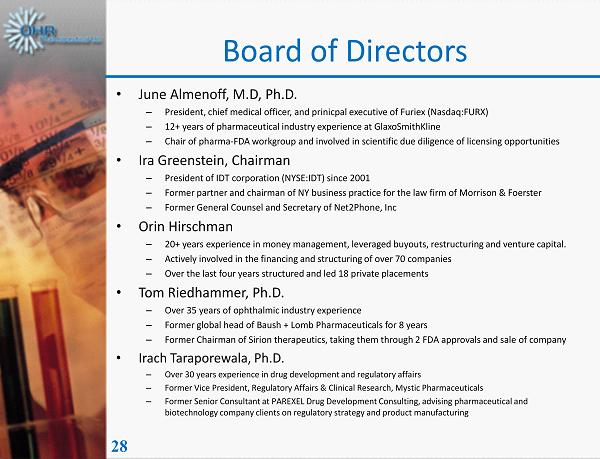

28 Board of Directors • June Almenoff, M.D, Ph.D. – President, chief medical officer, and prinicpal executive of Furiex (Nasdaq:FURX) – 12+ years of pharmaceutical industry experience at GlaxoSmithKline – Chair of pharma - FDA workgroup and involved in scientific due diligence of licensing opportunities • Ira Greenstein, Chairman – President of IDT corporation (NYSE:IDT) since 2001 – Former partner and chairman of NY business practice for the law firm of Morrison & Foerster – Former General Counsel and Secretary of Net2Phone, Inc • Orin Hirschman – 20+ years experience in money management, leveraged buyouts, restructuring and venture capital. – Actively involved in the financing and structuring of over 70 companies – Over the last four years structured and led 18 private placements • Tom Riedhammer, Ph.D. – Over 35 years of ophthalmic industry experience – Former global head of Baush + Lomb Pharmaceuticals for 8 years – Former Chairman of Sirion therapeutics, taking them through 2 FDA approvals and sale of company • Irach Taraporewala, Ph.D. – Over 30 years experience in drug development and regulatory affairs – Former Vice President, Regulatory Affairs & Clinical Research, Mystic Pharmaceuticals – Former Senior Consultant at PAREXEL Drug Development Consulting, advising pharmaceutical and biotechnology company clients on regulatory strategy and product manufacturing

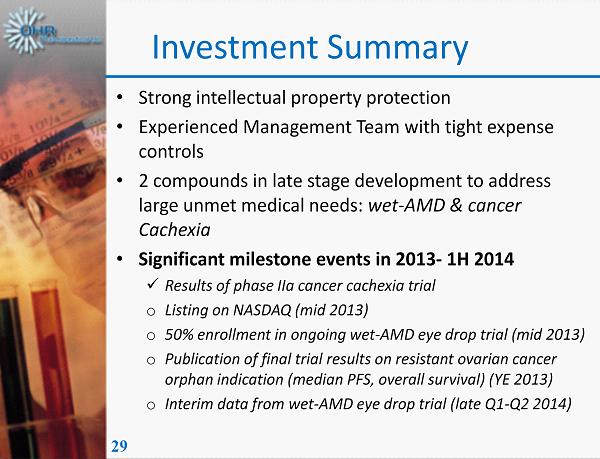

29 Investment Summary • Strong intellectual property protection • Experienced Management Team with tight expense controls • 2 compounds in late stage development to address large unmet medical needs: wet - AMD & cancer Cachexia • Significant milestone events in 2013 - 1H 2014 x Results of phase IIa cancer cachexia trial o Listing on NASDAQ (mid 2013) o 50% enrollment in ongoing wet - AMD eye drop trial (mid 2013) o Publication of final trial results on resistant ovarian cancer orphan indication (median PFS, overall survival) (YE 2013) o Interim data from wet - AMD eye drop trial (late Q1 - Q2 2014)