Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bausch Health Companies Inc. | d546634d8k.htm |

Exhibit 99.1

Valeant Pharmaceuticals International, Inc.

Presentation to Lenders May 30, 2013

Forward-Looking Statements

Forward-Looking Statements

Certain statements made in this presentation may constitute forward-looking statements, including, but not limited to, statements regarding anticipated financings, regulatory filings and transaction closings, preliminary results and guidance with respect to expected revenues, non-GAAP financial measures, organic growth, integration-related activities and benefits, synergies, and launches, and assumptions with respect to guidance of Valeant Pharmaceuticals International, Inc. (the “Company”). Forward looking statements may be identified by the use of the words “anticipates,” “expects,” “intends,” “plans,” “could,” “should,” “would,” “may,” “will,” “believes,”

“estimates,” “potential,“or “continue” and variations or similar expressions. These statements are based upon the current expectations and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include, but are not limited to, risks and uncertainties discussed in the company’s most recent annual or quarterly report filed with the Securities and Exchange Commission (“SEC”) and other risks and uncertainties detailed from time to time in the Company’s filings with the SEC and the Canadian Securities Administrators (“CSA”), which factors are incorporated herein by reference. Readers are cautioned not to place undue reliance on any of these forward-looking statements. The Company undertakes no obligation to update any of these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect actual outcomes.

Non-GAAP Information

To supplement the financial measures prepared in accordance with generally accepted accounting principles (GAAP), the Company uses non-GAAP financial measures that exclude certain items. Management uses non-GAAP financial measures internally for strategic decision making, forecasting future results and evaluating current performance. By disclosing non-GAAP financial measures, management intends to provide investors with a meaningful, consistent comparison of the Company’s core operating results and trends for the periods presented. Non-GAAP financial measures are not prepared in accordance with GAAP; therefore, the information is not necessarily comparable to other companies and should be considered as a supplement to, not a substitute for, or superior to, thecorresponding measures calculated in accordance with GAAP. The Company has provided preliminary results and guidance with respect to cash earnings per share, adjusted cash flows from operations and organic product growth rates, which are non-GAAP financial measures. The Company has not provided a reconciliation of these preliminary and forward-looking non-GAAP financial measures due to the difficulty in forecasting and quantifying the exact amount of the items excluded from the non-GAAP financial measures that will be included in the comparable GAAP financial measures. Reconciliations of historical non-GAAP financials can be found at www.valeant.com.

Transaction Overview

Valeant Pharmaceuticals International, Inc. (“Valeant” or the “Company”) announced that it has entered into a definitive agreement to acquire Bausch + Lomb (“B&L” or the “Target”) for a purchase price of $8.7 billion

Valeant plans to issue $1.5—2.0 billion in common equity to partially finance the acquisition

Pro forma LTM 03/31/13 Consolidated Adjusted EBITDA is expected to be $3.9 billion

Pro forma for the transaction, Net Senior Secured Leverage is expected to be 2.1x and Net Total Leverage will be 4.6x (assuming equity is raised at the midpoint of range, or $1.75 billion)

The combination is expected to yield cost synergies at an annual run rate of at least $800 million by the end of fiscal year 2014

This acquisition represents a significant milestone for the Company as we continue to diversify our product mix and grow our size and scale

The combination adds the fourth-largest eye health provider to Valeant’s diverse businesses, providing scale and further diversification to drive future growth and free cash flow generation

In addition to its surgical and consumer vision products, B&L adds an ophthalmic pharmaceuticals business, which will complement Valeant’s existing ophthalmic portfolio

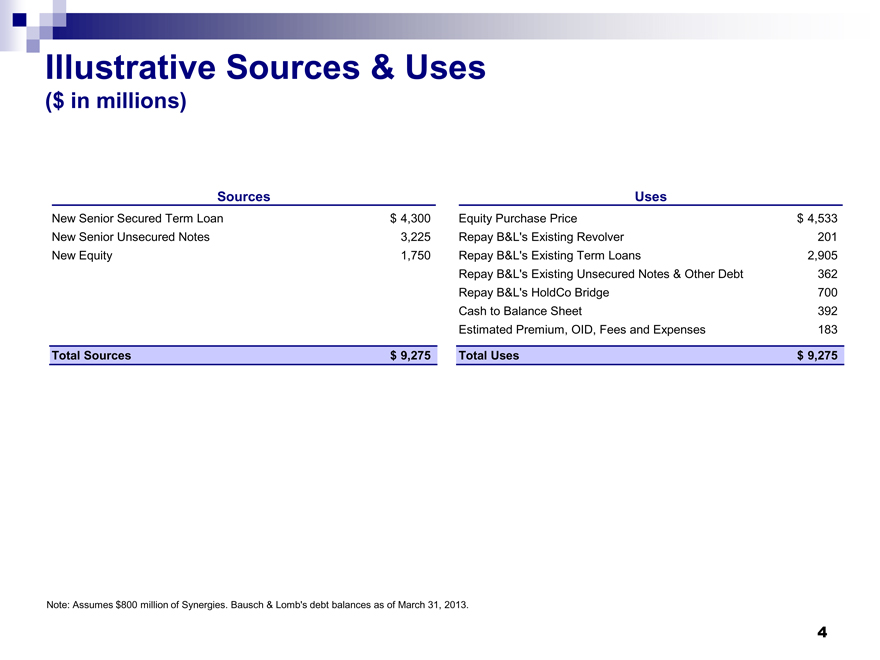

Illustrative Sources & Uses

($ in millions)

Sources

New Senior Secured Term Loan

New Senior Unsecured Notes

New Equity

$ 4,300

3,225

1,750

Uses

Equity Purchase Price

Repay B&L’s Existing Revolver

Repay B&L’s Existing Term Loans

Repay B&L’s Existing Unsecured Notes & Other Debt

Repay B&L’s HoldCo Bridge

$ 4,533

201

2,905

362

700

392

183

Estimated Premium, OID, Fees and Expenses

Cash to Balance Sheet

Total Uses

$ 9,275

$ 9,275

Total Sources

Note: Assumes $800 million of Synergies. Bausch & Lomb’s debt balances as of March 31, 2013.

| 4 |

|

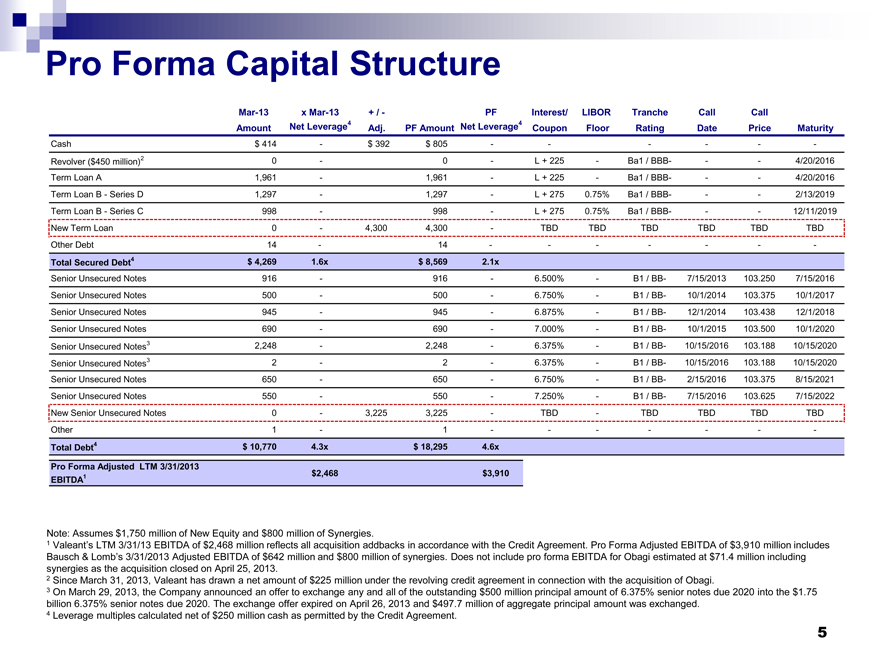

Pro Forma Capital Structure

Mar-13 x Mar-13 + /—PF Interest/ LIBOR Tranche Call Call Net Leverage4 Net Leverage4

Amount Adj. PF Amount Coupon Floor Rating Date Price Maturity

Cash $ 414 —$ 392 $ 805 — — —Revolver ($450 million)2 0 —0 —L + 225—Ba1 / BBB——4/20/2016 Term Loan A 1,961 —1,961 —L + 225—Ba1 / BBB——4/20/2016 Term Loan B—Series D 1,297 —1,297 —L + 275 0.75% Ba1 / BBB——2/13/2019 Term Loan B—Series C 998 —998 —L + 275 0.75% Ba1 / BBB——12/11/2019 New Term Loan 0 —4,300 4,300 —TBD TBD TBD TBD TBD TBD Other Debt 14—14 — — — -

Total Secured Debt4 $ 4,269 1.6x $ 8,569 2.1x

Senior Unsecured Notes 916 —916 —6.500%—B1 / BB- 7/15/2013 103.250 7/15/2016 Senior Unsecured Notes 500 —500 —6.750%—B1 / BB- 10/1/2014 103.375 10/1/2017 Senior Unsecured Notes 945 —945 —6.875%—B1 / BB- 12/1/2014 103.438 12/1/2018 Senior Unsecured Notes 690 —690 —7.000%—B1 / BB- 10/1/2015 103.500 10/1/2020 Senior Unsecured Notes3 2,248 —2,248 —6.375%—B1 / BB- 10/15/2016 103.188 10/15/2020 Senior Unsecured Notes3 2 —2 —6.375%—B1 / BB- 10/15/2016 103.188 10/15/2020 Senior Unsecured Notes 650 —650 —6.750%—B1 / BB- 2/15/2016 103.375 8/15/2021 Senior Unsecured Notes 550 —550 —7.250%—B1 / BB- 7/15/2016 103.625 7/15/2022 New Senior Unsecured Notes 0 —3,225 3,225 —TBD—TBD TBD TBD TBD Other 1 —1 — — — -

Total Debt4 $ 10,770 4.3x $ 18,295 4.6x Pro Forma Adjusted LTM 3/31/2013

1 $2,468 $3,910 EBITDA

Note: Assumes $1,750 million of New Equity and $800 million of Synergies.

1 Valeant’s LTM 3/31/13 EBITDA of $2,468 million reflects all acquisition addbacks in accordance with the Credit Agreement. Pro Forma Adjusted EBITDA of $3,910 million includes

Bausch & Lomb’s 3/31/2013 Adjusted EBITDA of $642 million and $800 million of synergies. Does not include pro forma EBITDA for Obagi estimated at $71.4 million including synergies as the acquisition closed on April 25, 2013.

2 Since March 31, 2013, Valeant has drawn a net amount of $225 million under the revolving credit agreement in connection with the acquisition of Obagi.

3 On March 29, 2013, the Company announced an offer to exchange any and all of the outstanding $500 million principal amount of 6.375% senior notes due 2020 into the $1.75 billion 6.375% senior notes due 2020. The exchange offer expired on April 26, 2013 and $497.7 million of aggregate principal amount was exchanged.

4 Leverage multiples calculated net of $250 million cash as permitted by the Credit Agreement.

5

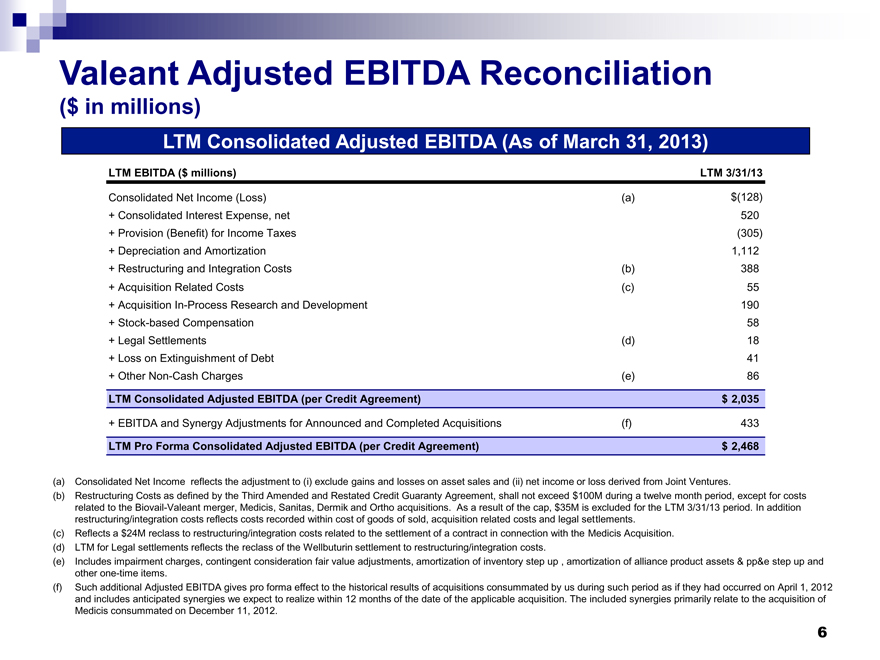

Valeant Adjusted EBITDA Reconciliation

($ in millions)

LTM Consolidated Adjusted EBITDA (As of March 31, 2013)

LTM EBITDA ($ millions) LTM 3/31/13

Consolidated Net Income (Loss) (a) $(128)

+ Consolidated Interest Expense, net 520

+ Provision (Benefit) for Income Taxes (305)

+ Depreciation and Amortization 1,112

+ Restructuring and Integration Costs (b) 388

+ Acquisition Related Costs (c) 55

+ Acquisition In-Process Research and Development 190

+ Stock-based Compensation 58

+ Legal Settlements (d) 18

+ Loss on Extinguishment of Debt 41

+ Other Non-Cash Charges (e) 86

LTM Consolidated Adjusted EBITDA (per Credit Agreement) $ 2,035

+ EBITDA and Synergy Adjustments for Announced and Completed Acquisitions (f) 433

LTM Pro Forma Consolidated Adjusted EBITDA (per Credit Agreement) $ 2,468

(a) Consolidated Net Income reflects the adjustment to (i) exclude gains and losses on asset sales and (ii) net income or loss derived from Joint Ventures.

(b) Restructuring Costs as defined by the Third Amended and Restated Credit Guaranty Agreement, shall not exceed $100M during a twelve month period, except for costs related to the Biovail-Valeant merger, Medicis, Sanitas, Dermik and Ortho acquisitions. As a result of the cap, $35M is excluded for the LTM 3/31/13 period. In addition restructuring/integration costs reflects costs recorded within cost of goods of sold, acquisition related costs and legal settlements.

(c) Reflects a $24M reclass to restructuring/integration costs related to the settlement of a contract in connection with the Medicis Acquisition. (d) LTM for Legal settlements reflects the reclass of the Wellbuturin settlement to restructuring/integration costs.

(e) Includes impairment charges, contingent consideration fair value adjustments, amortization of inventory step up , amortization of alliance product assets & pp&e step up and other one-time items.

(f) Such additional Adjusted EBITDA gives pro forma effect to the historical results of acquisitions consummated by us during such period as if they had occurred on April 1, 2012 and includes anticipated synergies we expect to realize within 12 months of the date of the applicable acquisition. The included synergies primarily relate to the acquisition of Medicis consummated on December 11, 2012.

| 6 |

|

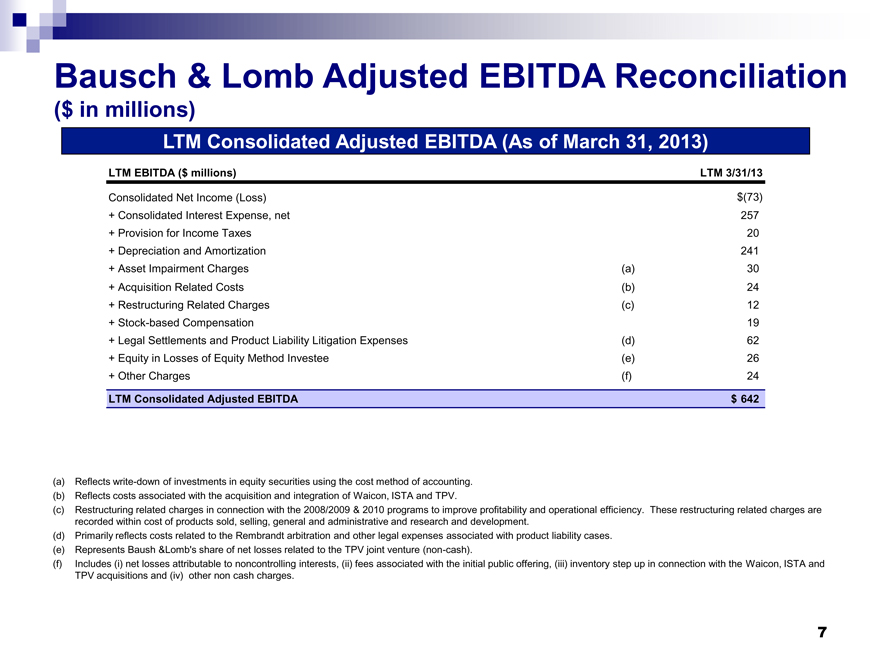

Bausch & Lomb Adjusted EBITDA Reconciliation

($ in millions)

LTM Consolidated Adjusted EBITDA (As of March 31, 2013)

LTM EBITDA ($ millions) LTM 3/31/13

Consolidated Net Income (Loss) $(73)

+ Consolidated Interest Expense, net 257

+ Provision for Income Taxes 20

+ Depreciation and Amortization 241

+ Asset Impairment Charges (a) 30

+ Acquisition Related Costs (b) 24

+ Restructuring Related Charges (c) 12

+ Stock-based Compensation 19

+ Legal Settlements and Product Liability Litigation Expenses (d) 62

+ Equity in Losses of Equity Method Investee (e) 26

+ Other Charges (f) 24

LTM Consolidated Adjusted EBITDA $ 642

Reflects write-down of investments in equity securities using the cost method of accounting.

Reflects costs associated with the acquisition and integration of Waicon, ISTA and TPV.

Restructuring related charges in connection with the 2008/2009 & 2010 programs to improve profitability and operational efficiency. These restructuring related charges are recorded within cost of products sold, selling, general and administrative and research and development.

Primarily reflects costs related to the Rembrandt arbitration and other legal expenses associated with product liability cases.

Represents Baush &Lomb’s share of net losses related to the TPV joint venture (non-cash).

Includes (i) net losses attributable to noncontrolling interests, (ii) fees associated with the initial public offering, (iii) inventory step up in connection with the Waicon, ISTA and TPV acquisitions and (iv) other non cash charges.

| 7 |

|