Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d546717d8k.htm |

| EX-99.2 - EX-99.2 - ENCORE CAPITAL GROUP INC | d546717dex992.htm |

ENCORE CAPITAL GROUP, INC.

CABOT CREDIT MANAGEMENT

DISCUSSION MATERIAL

May 30, 2013

Exhibit 99.1 |

PROPRIETARY

2

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words “will,”

“may,” “believe,” “projects,” “expects,”

“anticipates” or the negation thereof, or similar expressions, constitute

“forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995 (the “Reform Act”). These statements may include,

but are not limited to, statements regarding our future operating results and growth. For

all “forward-looking statements,” the Company claims the protection of the safe

harbor for forward-looking statements contained in the Reform Act. Such forward-

looking statements involve risks, uncertainties and other factors which may cause actual

results, performance or achievements of the Company and its subsidiaries to be

materially different from any future results, performance or achievements expressed or

implied by such forward-looking statements. These risks, uncertainties and other factors

are discussed in the reports filed by the Company with the Securities and Exchange

Commission, including the most recent reports on Forms 10-K, 10-Q and 8-K, each as it

may be amended from time to time. The Company disclaims any intent or obligation to

update these forward-looking statements. |

PROPRIETARY

3

ENCORE HAS BEEN EXPLORING THE U.K. NON-PERFORMING LOAN

MARKET FOR SEVERAL YEARS

U.K. is a large

market

Favorable

operational

conditions

Opportunity to

leverage Encore's

capabilities

•

Second largest debt

purchase market

•

~£9 to £10B (face-

value) of debt

purchased in 2012

•

Significant backlog

of debt expected to

be marketed in next

2-3 years

•

Transparent regulatory

environment

•

Attractive portfolio

returns

•

Deploy Encore's

superior analytical

capabilities

•

Leverage Encore's

efficient operating

platform, including

the India call-center |

PROPRIETARY

WE WAITED UNTIL WE FOUND AN OPPORTUNITY THAT FIT OUR

CRITERIA

Growth

potential

•

Cabot

specializes in the growing semi-performing debt

segment, which has very favorable repayment characteristics

Market leader

•

Cabot is the leading player in the U.K. debt purchase market

•

Cabot purchased

~£130M

of charged off debt in 2012

Leverages

Encore's

capabilities

•

Cabot can further benefit from Encore's strength in analytics

•

Opportunity to leverage our India operations for U.K collections

Strong

management

team

•

Cabot has an experienced and skilled management

team that can continue to grow its U.K. operations

Available for

the right price

•

Partnership with J.C. Flowers enables Encore to purchase a

controlling interest in Cabot at a reasonable price

4 |

PROPRIETARY

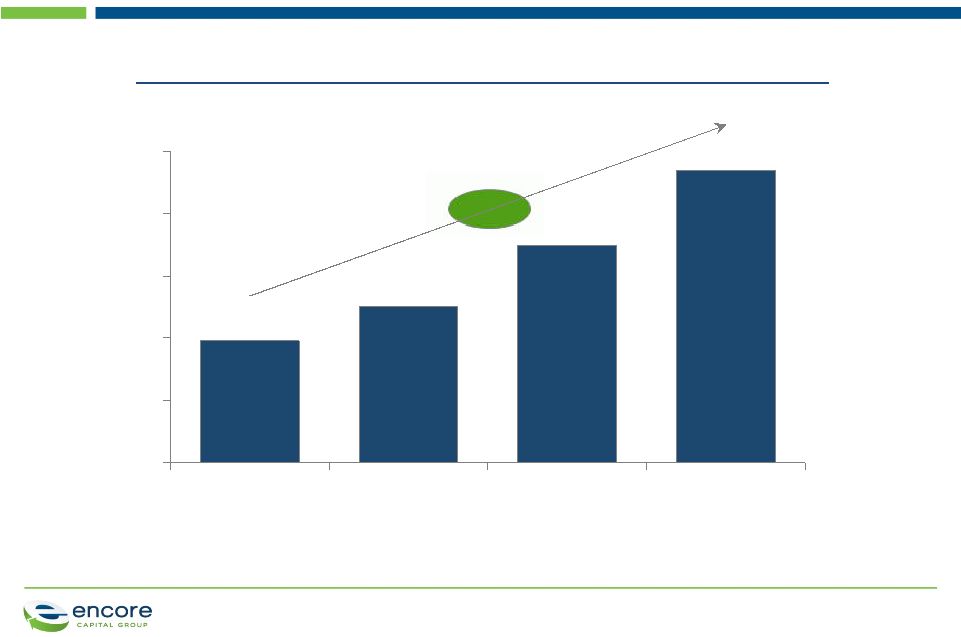

5

9.4

7.0

5.0

3.9

0

2

4

6

8

10

£B

2010

+34%

2012

2011

2009

THE U.K. DEBT PURCHASE MARKET HAS GROWN SUBSTANTIALLY

Face-value of debt sold in the U.K. (2009-12) |

PROPRIETARY

6

Market leader in U.K. debt management

•

Over 14 years of collections growth

•

Operations in Great Britain and Ireland

Specializes in higher balance, “semi-

performing”

(i.e., paying) accounts

•

Favorable repayment characteristics

Key statistics as of March 31, 2013:

•

£7.7B face-value of debt acquired for £706M

•

ERC = £934M

•

3.6M customer accounts

•

2012 collections = £161M

•

2012

capital

deployment

=

£130M

1

Cabot was the leading purchaser

of debt in the U.K. in 2012

CABOT IS THE LEADING PURCHASER OF DEBT IN THE U.K.

1. £31M funded by Anacap

42

91

0

50

100

150

£M

Arrow

Lowell

Cabot

130

1

For FY 2012 |

PROPRIETARY

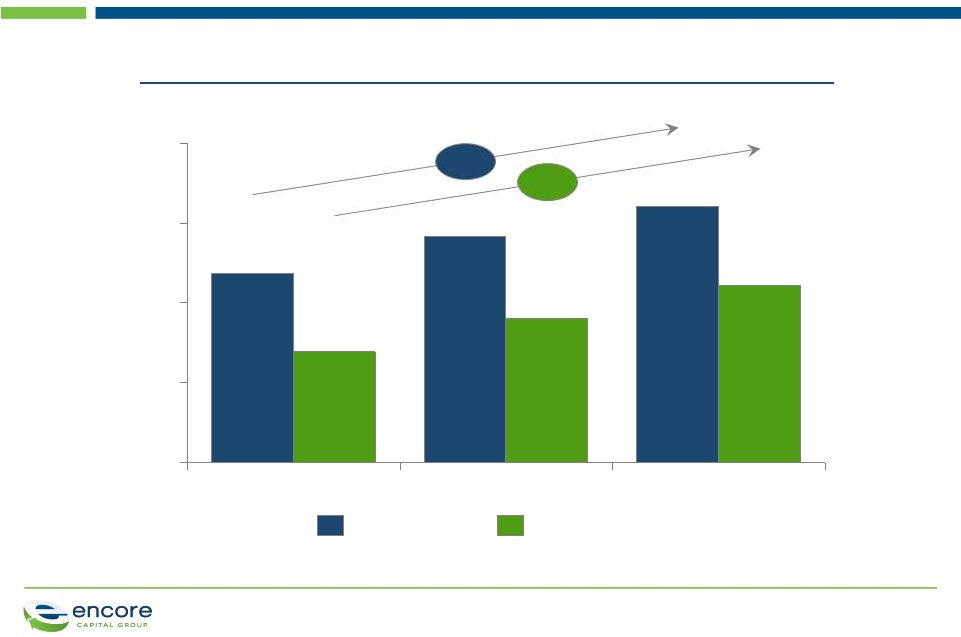

7

CABOT HAS DELIVERED STRONG COLLECTIONS AND ADJUSTED

EBITDA GROWTH

161

142

119

111

90

69

0

50

100

150

200

27%

17%

2012

2011

£M

2010

Total Collections

1.Adjusted EBITDA is defined as net cash flow from operating activities adjusted to

exclude the effects of working capital adjustments, integration costs, loan portfolio acquisitions and non-cash

retranslation adjustments.

Total

Collections

and

Adjusted

EBITDA

1

(2010-12)

Adjusted

EBITDA

1 |

PROPRIETARY

8

Management

CABOT WILL BE OWNED JOINTLY BY ENCORE, J.C. FLOWERS AND

CABOT MANAGEMENT

Deal structure

Details

•

Encore will have the largest

ownership interest in Cabot

•

Encore will control the board

•

Cabot will be consolidated in

Encore's financial statements

•

This transaction is expected to

generate attractive returns

•

Encore will have the right to

acquire the remaining

ownership

interest

between 4 and 6 years

after the closing |

PROPRIETARY

9

Encore's

investment of

£127.6M

PECs

(£96.7M)

Security type purchased

What it gives Encore

Class A Equity

Shares

(£8.4M)

12% cumulative annual

preferred return

No voting rights

42.8% economic interest in

incremental returns above

the 12% preferred return

Bridge Preferred

Equity Certificates

(PECs)

(£22.5M)

Allows potential

repatriation of £22.5M in

the first year to the extent

permitted by existing bond

covenants

PROPRIETARY

9

THE INVESTMENT STRUCTURE PROVIDES OPTIMAL RETURN

AND ENABLES CONSOLIDATION

|

PROPRIETARY

10

ENCORE PROVIDES CABOT WITH SEVERAL SYNERGY

OPPORTUNITIES

Leverage

Encore's

analytics

•

Deploy Encore's superior analytical

capabilities to the Cabot platform

•

Focus on improving account

segmentation and specialized

collection strategies

Leverage

Encore's

operations

and know-

how

•

Enhance collections by leveraging

Encore's efficient operations,

including our operations in India

•

Leverage Encore's experience in

secondary and tertiary debt to

pursue new investments in the U.K.

•

Leverage Encore’s favorable

financing to fund growth

Invest in

different

segments |

PROPRIETARY

11

Growing market

•

Encore can deploy capital in a growing market

Profitable market

•

Portfolio IRRs are strong and favorable

Timeline

•

Deal expected to close in Q3 of 2013

Encore EPS

•

Supports Encore's 15% long-term EPS growth

1

1. Calculation of EPS excludes one-time transaction and integration costs,

which are not available at this time, and non-cash interest associated with the Company’s 2012 convertible debt offering

PROPRIETARY

11

ENCORE'S ACQUISITION OF CABOT WILL PROVIDE A VEHICLE TO

CONTINUE ITS STRONG EARNINGS GROWTH

|