Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MRC GLOBAL INC. | d545176d8k.htm |

KeyBanc

Capital Markets May 30, 2013

1

May 30, 2013

Jim Braun

EVP & CFO

MRC Global Inc. //

KeyBanc Capital Markets’

Industrial

Automotive and Transportation Conference

Exhibit 99.1 |

KeyBanc Capital Markets

May 30, 2013

2

2

This presentation contains forward-looking statements within the meaning of

Section 21E of the Securities Exchange Act of 1934, as amended, and Section

27A of the Securities Act, as amended, including, for example, statements about the Company’s business strategy, its industry, its future

profitability, growth in the Company’s various markets, and the Company’s

expectations, beliefs, plans, strategies, objectives, prospects and

assumptions. These forward-looking statements are not guarantees of

future performance. These statements involve known and unknown risks,

uncertainties

and

other

factors

that

may

cause

the

Company’s

actual

results

and

performance

to

be

materially

different

from

any

future

results

or

performance

expressed

or

implied

by

these

forward-looking

statements.

For

a

discussion

of

key

risk

factors,

please

see

the

risk

factors

disclosed

in

the

Company’s annual report on Form 10-K for the year ended December 31, 2012

and the registration statement (including a prospectus and prospectus

supplement)

for

the

offering

to

which

this

communication

relates,

which

are

available

on

the

SEC’s

website

at

www.sec.gov

and

on

the

Company’s

website, www.mrcglobal.com.

Undue reliance should not be placed on the Company’s forward-looking

statements. Although forward-looking statements reflect the Company’s good

faith

beliefs,

reliance

should

not

be

placed

on

forward-looking

statements

because

they

involve

known

and

unknown

risks,

uncertainties

and

other

factors, which may cause our actual results, performance or achievements to differ

materially from anticipated future results, performance or achievements

expressed or implied by such forward-looking statements. The Company undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information, future

events, changed circumstances or otherwise. Statement Regarding Use of

Non-GAAP Measures: The Non-GAAP financial measures contained in this

presentation (EBITDA, Adjusted EBITDA, Adjusted EPS and variations thereof) are not measures of

financial performance calculated in accordance with GAAP and should not be

considered as alternatives to net income (loss) or any other performance

measure derived in accordance with GAAP or as alternatives to cash flows from

operating activities as a measure of our liquidity. They should be viewed

in addition to, and not as a substitute for, analysis of our results reported in

accordance with GAAP, or as alternative measures of liquidity. Management

believes that certain non-GAAP financial measures provide a view to measures

similar to those used in evaluating our compliance with certain financial

covenants under our credit facilities and provide financial statement users

meaningful comparisons between current and prior year period results. They

are also used as a metric to determine certain components of performance-based

compensation. The adjustments and Adjusted EBITDA are based on

currently available information and certain adjustments that we believe are

reasonable and are presented as an aid in understanding our operating

results. They are not necessarily indicative of future results of operations that

may be obtained by the Company. Forward Looking Statements and Non-GAAP

Disclaimer |

KeyBanc Capital Markets

May 30, 2013

3

By the Numbers

Industry Sectors

Product Categories

Business Model

2012 Sales

$5.57 B

Upstream

Line Pipe / OCTG

Locations

400+

Countries

44+

Midstream

Valves

Customers

18,000+

Suppliers

18,000+

Downstream/

Industrial

Fittings / Flanges

SKU’s

175,000+

Employees

4,750+

Company Snapshot

Canada

14%

Europe / Asia Pacific

10%

MRC is the largest global distributor of pipe, valves and fittings (PVF) to the

energy industry MRO

70%

Projects

30%

U.S.

76% |

KeyBanc Capital Markets

May 30, 2013

4

Founded

1921

1989

Acquires

Appalachian

Pipe & Supply

2007

Goldman Sachs

Capital Partners

Strategic

Investment

1977

Founded

2005

Acquires

Midfield

Supply

2007

Merger of

McJunkin

and Red Man

to form

MRC

2009

MRC opens

Houston HQ

2011

MRC

acquires

SPF

2011

MRC

acquires

VSC

2012

MRC

acquires

OneSteel

Piping

Systems

2009

MRC

acquires

Transmark

2010

MRC

acquires

South

Texas

Supply

2010

MRC

acquires

Dresser

Oil Tools

MRC’s 92 Year History // The Road to the Fortune 500

2012

MRC

Global

IPO;

begins

trading

on NYSE

2012

MRC

listed on

Fortune 500

2012

MRC

signs the

industry’s

first global

valve

contract with

Shell

2008

MRC

acquires

LaBarge

2012

MRC

acquires

Chaparral

Supply

2012

MRC

acquires

Production

Specialty

Services

(now #451, up from #493 after IPO

and #10

on the Barron’s 500 of Top Companies) |

KeyBanc Capital Markets

May 30, 2013

5

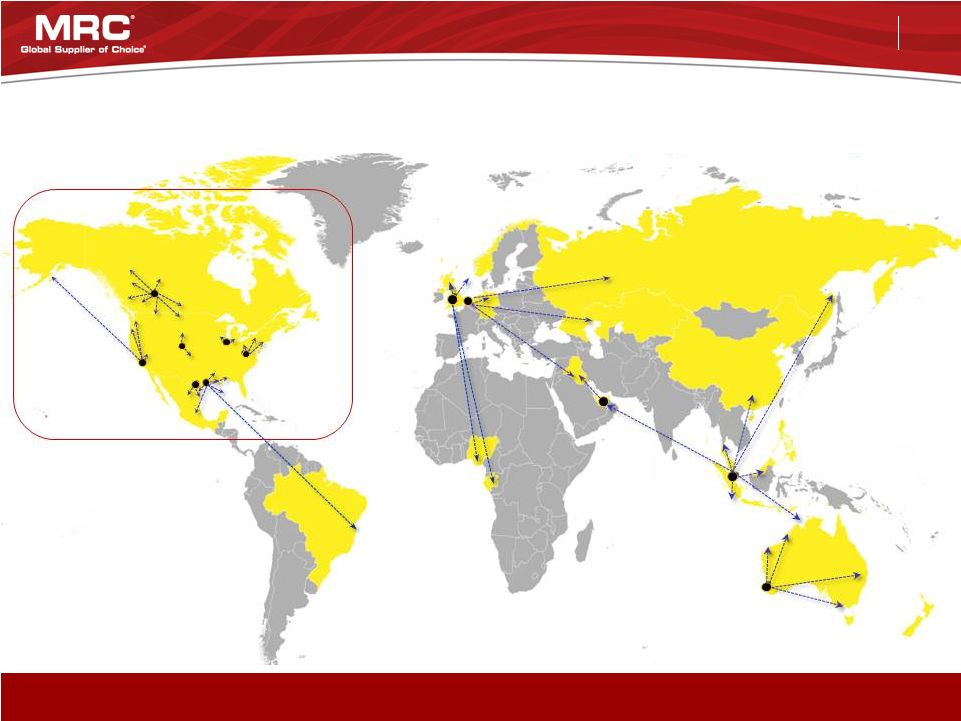

Clear Market Leader Globally and in the Shales

•

~2/3 of sales are under contracts

1

with a 95%

renewal rate since 2000

•

Continue to grow “share”

and “size of wallet”

with

major existing customers while adding new ones

•

North American Shales as much as 5x PVF

intensive as conventional activity

Leading

industrial

distributor

of

PVF

globally

to

the

energy

and

industrials

sectors

Note: As of 31-Dec-2012

1

Including contracts and pricing arrangements.

2

International locations include sales offices and pipe yards at MRC locations.

Ecuador

Equatorial Guinea

Finland

France

Germany

India

Indonesia

Iraq

Italy

Kazakhstan

Kuwait

Malaysia

Mexico

Netherlands

New Zealand

Nigeria

Norway

Pakistan

Peru

Poland

Russia

Saudi Arabia

44+ Countries & 400+ Locations

Angola

Aruba

Australia

Austria

Belgium

Brunei

Cameroon

Canada

China

Colombia

Denmark

Branch operations and significant direct export sales

Singapore

South Africa

South Korea

Spain

Sweden

Thailand

Trinidad

Turkey

United Arab Emirates

United Kingdom

United States

2

North America

International

Branches

190+

50+

Distribution Centers

8 = U.S.

1 = Canada

1 = U.K.

1 = Singapore

1 = Netherlands

1 = Australia

Valve Automation Centers

12

12

Pipe Yards

120

10 |

KeyBanc Capital Markets

May 30, 2013

6

By Geography

Note: Business mix based on fiscal year 2012.

By Product Line

By Industry Sector

MRC Diversification

1 -

Approximately 17% (or $200 M) of total

for valves is valve automation

Industry leading product, end market and geographic diversification

|

KeyBanc Capital Markets

May 30, 2013

7

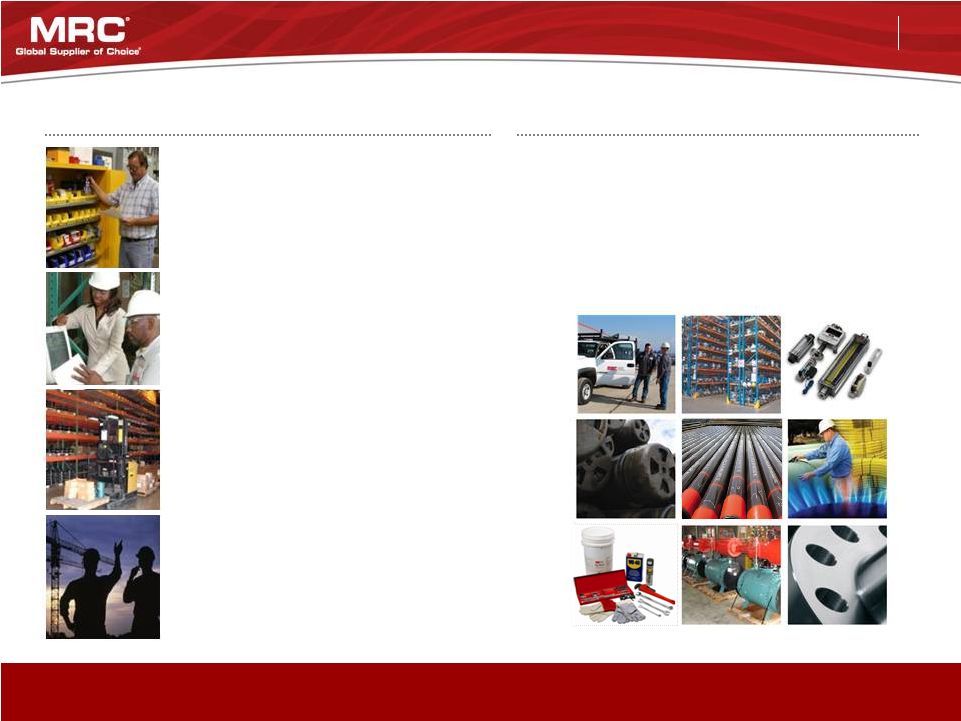

Core Distribution Processes

•

Cost Savings and Efficiencies

•

Order Management and Product

Bundling

•

Quality Assurance

•

Supplier Registration

•

Logistics Management

•

Customer Reporting

Integrated Services

•

Technical Assistance / Product

Recommendation

•

Inventory Consignment / Just-in-

Time Delivery

•

Customized IT Solutions

•

Warehouse Management

Service Offerings

Products

Delivery of Mission Critical Products and Value Added Services

Generating savings and efficiencies for our customers

while enabling them to focus on their core competencies

•

175,000+ unique, mission-critical products

used in high pressure, high stress or

abrasive operating environments

•

Low cost relative to overall cost of

maintenance or project spend so service is

paramount |

KeyBanc Capital Markets

May 30, 2013

8

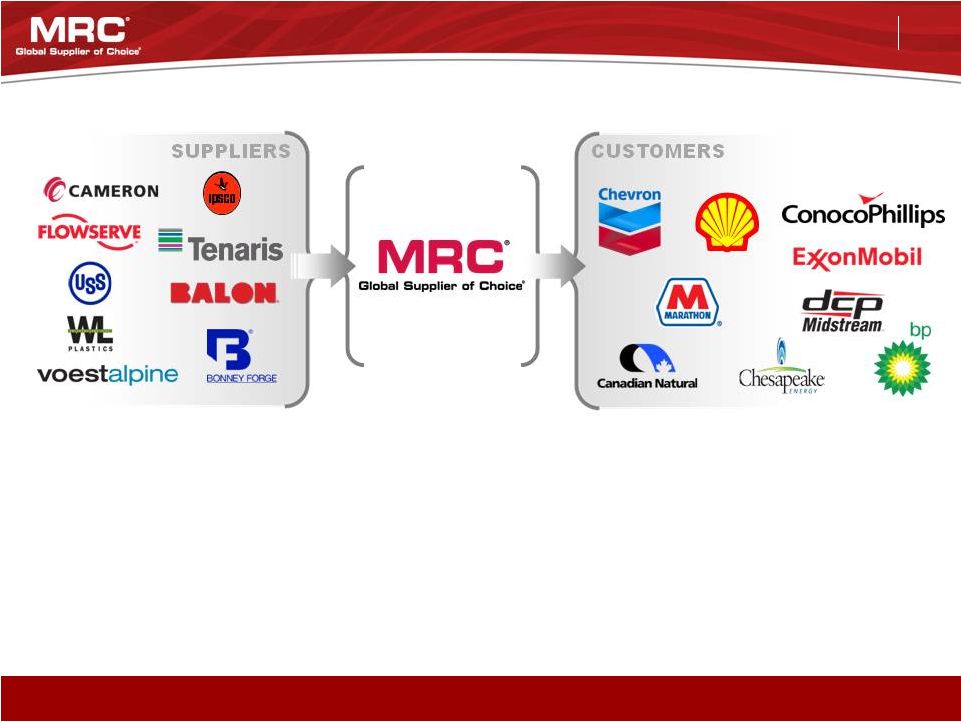

Supplier Benefits

Customer Benefits

MRC plays a critical role in the complex, technical, global energy supply chain

Strong

Long-Term

Relationships

with

“Blue

Chip”

Customers

and

Suppliers

Mutual Benefits

•

Access to over 18,000+

customers

•

Manufacturing and scale

efficiencies

•

Leverage MRC’s technical

sales force

•

Trusted long-term partnerships

•

Financial stability

•

MRC Approved Supplier List /

Quality Program

•

Access to over 18,000+ suppliers

worldwide

•

Efficiencies and inventory

management

•

Access to a broad product offering

(~$1B inventory)

•

Access to global sourcing from 35

countries |

KeyBanc Capital Markets

May 30, 2013

9

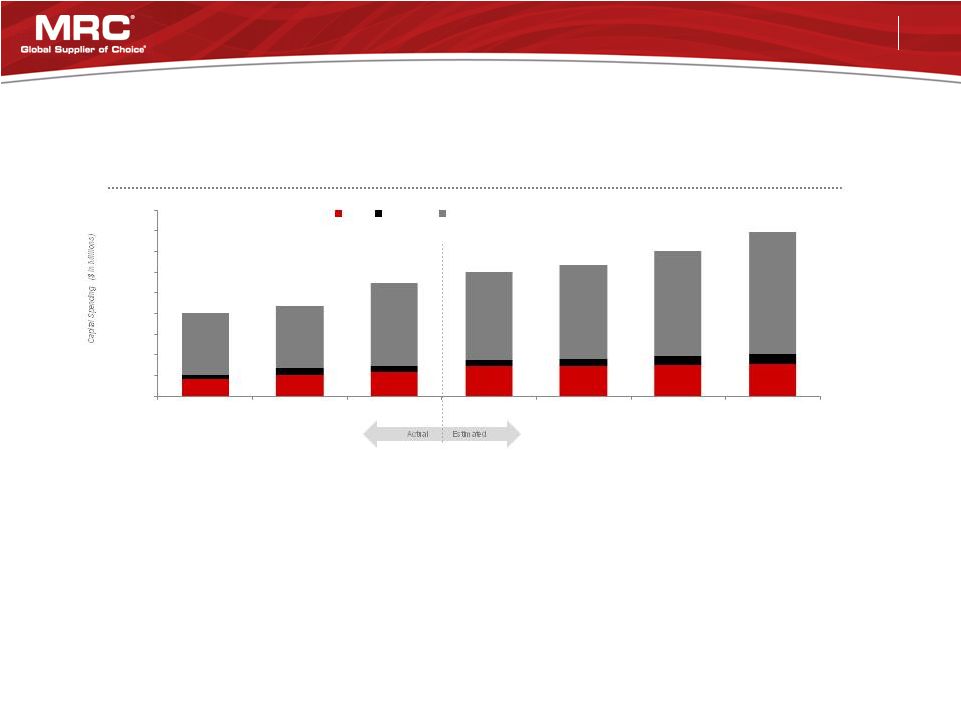

Positive Energy and Industrial Spending Trends

•

Global:

Energy demand continues to grow with sizable MRO/project opportunities given the

age of global energy infrastructure and slowly improving global

economy •

Upstream:

Shales

extremely

active,

shift

to

Oil/NGL

E&P,

Natural

Gas

MRO

production,

Oil

Sands

activity seeing strong growth

•

Midstream:

Shale activity in new unsupported areas; increased pipeline integrity regulation

plus aging pipeline infrastructure accelerating MRO rates; gas utilities

continue to outsource PVF procurement •

Downstream:

MRO and infrastructure projects accelerating; strong growth in chemical/industrial

with low natural gas prices and steady PMI; rebound in refinery utilization

/ margins Multi-Year Exploration & Production Spending Forecast

Source: Barclays Global 2013 E&P Spending Outlook Dec 2012

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

2009A

2010A

2011A

2012E

2013E

2014E

2015E

US

Canada

Outside North America |

KeyBanc Capital Markets

May 30, 2013

10

(US$ in millions)

1

Reflects reported revenues for the year of acquisition

MRC has completed and successfully acquired $3 billion of revenues since 2007

M&A Driven Growth: Track Record of Success

Date

Acquisition

Rationale

Region

Revenue

1

Apr-07

Midway Tristate

Appalachian

/ Rockies PVF

U.S.

$150

Oct-07

Jul

-08

Red Man

Midfield

(49%)

Transformational

Merger

100% Ownership

of Canadian

Subsidiary

U.S.

Canada

1,982

Oct-08

LaBarge

Midstream

U.S.

233

Oct-09

Transmark

International

MRO Platform

Europe and Asia

346

May-10

South Texas Supply

Eagle Ford

South Texas

9

Aug

-10

Dresser

Oil Tools Supply

Bakken

North Dakota

13

Jun

-11

SPF

Australia / SE Asia Projects

Australia

91

Jul

-11

VSC

Valve Automation

U.S.

13

Mar-12

On

eSteel

Piping Systems

Australia PVF MRO

Australia

174

Jun

-12

Chaparral Supply

Mississippian Lime MRO

Oklahoma / Kansas

71

Dec-12

Production Specialty Services

Permian Basin / Eagle Ford

U.S.

127

Total

$3,209 |

KeyBanc Capital Markets

May 30, 2013

11

Today

10 –

15 Years Ago

Next 1 to 5 Years

Changing PVF Energy Distribution Landscape

Consolidating energy industry benefits global players

Procurement

•

PVF purchasing handled

locally

•

Facility-by-facility basis

•

Separate contracts

by product class:

•

Pipe

•

Valves

•

Fittings

•

Flanges

•

Supplies

Centralized

Procurement

•

Purchasing more

consolidated

•

Contracts by end

segment:

•

Upstream

•

Midstream

•

Downstream

•

Contracts cover PVF

•

Customers align with

suppliers with size/scale

Global

Procurement

•

Global upstream /

midstream /

downstream PVF

contracts

Decentralized |

KeyBanc Capital Markets

May 30, 2013

12

MRC & Shell // Global Valve Contract for MRO and Projects

Industry’s first valve and combined North American PFF contract

Shell has one of the top 5 global CAPEX budgets

Deepwater

GOM

NA Tight Gas

& Liquids

Brazil

Offshore

BC-10

West

Africa

Future

Middle

East

RDC

FLNG

/ LNG

Oceania

Sakhalin

Shell

Offshore

Coal Bed

Methane

Cracker Unit

Pittsburgh, PA

Tar Sands

Kashagan

Ph1

Alaska

Offshore

LNG /

GTL

North America

Includes PFF

Salym

Development

LNG

China

Tight Gas |

KeyBanc Capital Markets

May 30, 2013

13

•

Global

Energy Demand Favorable:

Continued

general economic recovery, commodity price

environment, global supply constraints and

increased energy consumption

•

Shale

Activity

Unprecedented:

Shale

gas,

as

a

percentage

of

total

natural

gas

production,

has

rapidly

increased

from

less

than

2%

of

total

U.S.

natural

gas

production

in

2001

to

30%

in

2011

and

is

projected

to

increase

to

49%

by

2035

•

Accelerating

MRO:

Increased

utilization

of

processing

facilities

and

decreasing

quality

of

energy

feedstocks

accelerating

PVF

replacement

rates

•

Recovering

Project

Outlook:

Infrastructure

and

E&P

projects

rebounding

with

economic

growth

and

need

for

capacity

expansions

Large,

Fragmented

Market

with

Significant

Growth

Opportunities

•

One-Stop

Solution:

Leverage

extensive

product

offering

and

be

“one-stop”

PVF

solution

•

Cross-Selling:

Introduce

existing

customers

to

complete

PVF

product

portfolio

•

Projects:

Further

penetrate

existing

customer’s

project

activity

•

Investments:

Add

incremental

branches,

DCs

and

sales

people

•

International:

Expand

further

globally with existing customers

•

Adjacencies:

Add

new

products

to

existing

PVF

“bundle”

or

target

new

complimentary

end

markets

•

Core

Competency:

Proven

ability

to

identify,

execute

and

integrate

strategic

and

tuck-in

acquisitions

•

Highly

Fragmented:

Opportunities

to

extend

product

offering,

end

markets

and/or

geographic

coverage

MRC is in an excellent position to continue to exceed industry growth

Long-term

Targets:

Revenue

Growth:

10-12%

|

Adjusted

EBITDA

Margin:

10+%

|

Leverage:

2.0

–

3.0x

Note: All targets are long term.

Global E&P Spending Growth –

Positive Secular Trends

(Target 6 –

7% Annually)

Organic Growth –

Leverage Scale

(Target: 8 –

9% Annually)

Acquisitions –

Accretive Expansion

(Target: 2 –

3% Annually) |

KeyBanc Capital

Markets May 30, 2013

14

Financial Overview |

KeyBanc Capital Markets

May 30, 2013

15

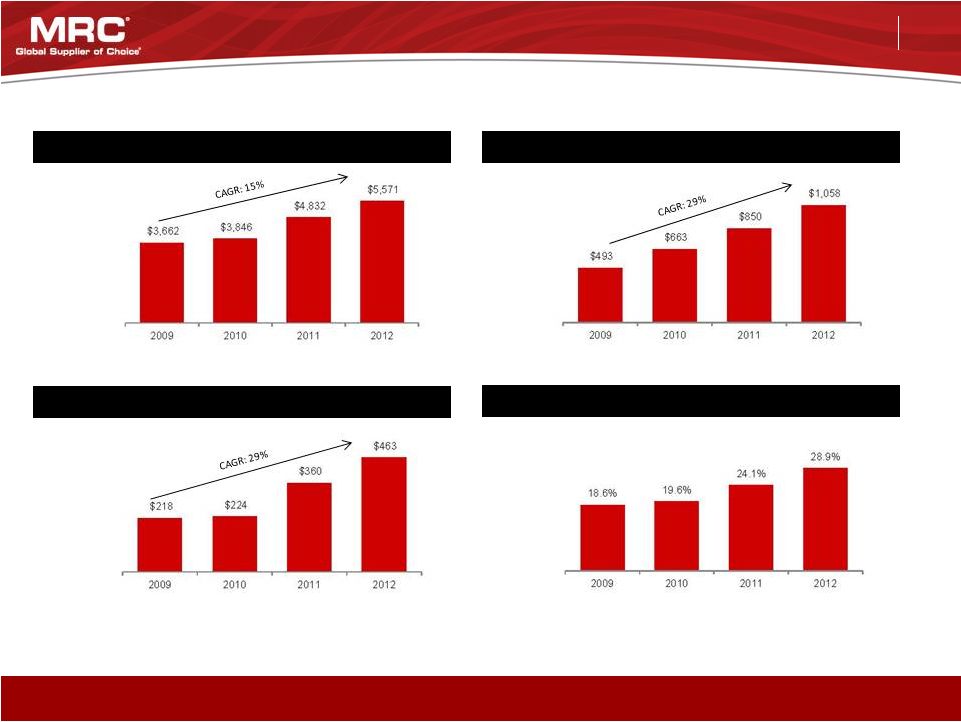

Strong Growth and Margin Drive Attractive Returns

Sales

Adjusted Gross Profit and % Margin

Adjusted EBITDA and % Margin

Adjusted EBITDA RONA

Y-o-Y Growth

5%

26%

15%

(US$ in millions)

Y-o-Y Growth

34%

28%

24%

Y-o-Y Growth

3%

61%

29%

6.0%

5.8%

7.5%

8.3%

13.5%

17.2%

17.6%

19.0%

Strong growth and continued improving profitability

1

Source: Company management; Company Filings

1

Adjusted

EBITDA

RONA

calculation

=

Adjusted

EBITDA

/

(EOY

Inventory

+

EOY

LIFO

reserve

+

EOY

Receivables

+

EOY

PP&E

–

Payables). |

KeyBanc Capital Markets

May 30, 2013

16

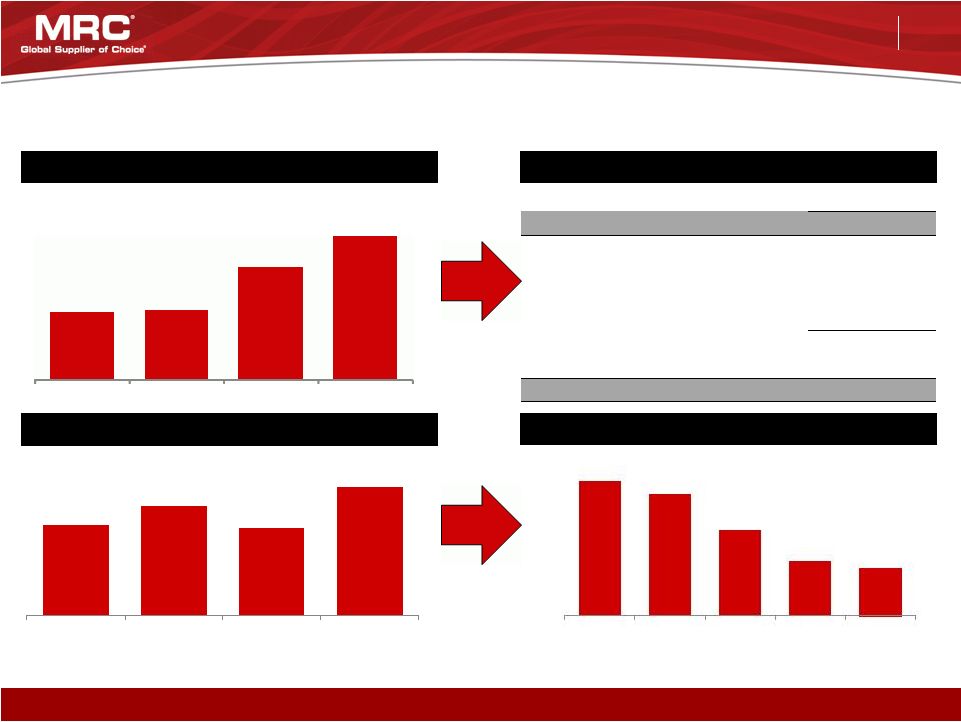

Significant Cash Flow for Deleveraging and Growth Investments

Capital Structure

Cumulative FCF

Net Leverage

(US$ in millions)

1

Strong cash flows allow for continued deleveraging

($ in millions)

March 31, 2013

Cash and Cash Equivalents

$ 27

Total Debt (including current portion):

Term Loan B due 2019, net of discount

641

Global ABL Facility due 2017

426

Other

6

Total Debt

$ 1,073

Total Equity

1,231

Total Capitalization

$ 2,304

$495

$597

$479

$695

2009

2010

2011

2012

1

6.4 x

5.8 x

4.1 x

2.6 x

2.3 x

2009

2010

2011

2012

Since 2008, Free Cash Flow defined as cash from operations, less fixed asset purchases (net of

disposals). $202

$210

$342

$437

2009

2010

2011

2012

5.5%

5.5%

7.8%

7.1%

Mar

-

13

Adjusted

EBITDA

–

Capex

and

%

Margin |

KeyBanc Capital Markets

May 30, 2013

17

Sales

Margins

Net Income

Q1 2013 Financial Summary

(In millions except per share data)

Q1

2012

2013

OCTG

$221

$126

All Other

1,162

1,179

2%

Total

$1,383

$1,305

Adjusted Gross Profit

Adjusted EBITDA

Net Income

EPS

$ 260

$ 262

Q1 2012

Q1 2013

18.8%

20.1%

$ 115

$ 104

Q1 2012

Q1 2013

8.3 %

8.0%

$ 38

$ 46

Q1 2012

Q1 2013

$ 0.44

$ 0.45

Q1 2012

Q1 2013

•

Total revenue was impacted by strategic OCTG

reduction

•

Acquisition related revenue offset slowdown in

customer spending

•

Year-on-year adjusted gross profit margin expansion of

~130 bps due to emphasis on higher margin products

•

Adjusted EBITDA margins reflected lower sales

•

Net Income improvement driven by $18 million interest

expense savings

•

EPS reflects additional shares outstanding in 2013 |

KeyBanc Capital Markets

May 30, 2013

18

Appendix |

KeyBanc Capital Markets

May 30, 2013

19

March 31

December 31

($ in millions)

2013

2012

2012

2011

2010

2009

Net income (loss)

$ 46.2

$ 37.5

$118.0

$ 29.0

$(51.8)

$(339.8)

Income taxes

25.0

21.1

63.7

26.8

(23.4)

(15.0)

Interest expense

15.3

33.7

112.5

136.8

139.6

116.5

Write off of debt issuance costs

-

1.7

1.7

9.5

-

-

Depreciation and amortization

5.4

4.1

18.6

17.0

16.6

14.5

Amortization of intangibles

13.2

12.3

49.5

50.7

53.9

46.6

Amortization of purchase price

accounting

-

-

-

-

-

15.7

Change in fair value of derivative

instruments

(0.6)

(2.1)

(2.2)

(7.0)

4.9

(8.9)

Closed locations

-

-

-

-

(0.7)

1.4

Share based compensation

1.9

1.8

8.5

8.4

3.7

7.8

Franchise taxes

-

-

-

0.4

0.7

1.4

Loss (gain) on early extinguishment of

debt

-

-

114.0

-

-

(1.3)

Goodwill and intangibles impairment

-

-

-

-

-

386.1

Inventory write-down

-

-

-

-

0.4

46.5

IT system conversion costs

-

-

-

-

-

2.4

M&A transaction & integration expenses

-

-

-

0.5

1.4

17.5

Pension settlement

-

-

4.4

-

-

-

Legal and consulting expenses

-

-

(1.2)

9.9

4.2

1.9

Joint venture termination

-

-

-

1.7

-

-

Provision for uncollectible accounts

-

-

-

0.4

(2.0)

1.0

Severance and related costs

-

-

-

1.1

3.2

4.4

MRC Transmark pre-Acquisition

contribution

-

-

-

-

-

38.5

LIFO

(3.1)

6.9

(24.1)

73.7

74.6

(115.6)

Other expenses

0.6

(1.8)

(0.2)

1.6

(1.1)

(3.1)

Adjusted EBITDA

$ 103.9

$ 115.2

$ 463.2

$ 360.5

$ 224.2

$ 218.5

EBITDA Adjustments |

KeyBanc Capital Markets

May 30, 2013

20

December 31

($ in millions)

EBITDA

$

463.2

$

360.5

$

224.2

$

218.5

AR

$

823.2

$

791.3

$

596.4

$

506.2

Inventory at AC

1,121.2

1,074.2

866.8

898.5

Fixed Assets

122.5

107.4

104.7

111.5

(-) AP

(438.4)

(479.6)

(426.6)

(338.5)

PSS Adjustment

(28.0)

—

—

—

Total Adjusted Net Assets

$

1,600.5

$

1,493.3

$

1,141.3

$

1,177.7

Inventory at LIFO

970.2

899.1

765.4

871.6

(+) LIFO reserve

151.0

175.1

101.4

26.9

Total Inventory

$

1,121.2

$

1,074.2

$

866.8

$

898.5

RONA

28.9

%

24.1

%

19.6

%

18.6

%

2011

2010

2009

2012

December 31

($ in millions)

Stockholders' Equity

$

1,185.9

$

720.8

$

689.8

$

743.9

Long term debt

1,256.6

1,526.7

1,360.2

1,452.6

Deferred taxes

334.5

357.2

373.7

377.9

Other liabilities

147.7

143.3

140.8

170.2

Intangible assets

(1,359.7)

(1,333.1)

(1,366.5)

(1,425.7)

LIFO reserve

151.0

175.1

101.4

26.9

Other assets

(50.4)

(50.6)

(101.9)

(111.9)

Cash

(37.1)

(46.1)

(56.2)

(56.2)

PSS Adjustment

(28.0)

—

—

—

Total Adjusted Net Assets

$

1,600.5

$

1,493.3

$

1,141.3

$

1,177.7

Net income (loss)

$

118.0

$

29.0

$(51.8)

$(339.8)

Stockholders' equity

1,185.9

720.8

689.8

743.9

Net income / stockholders'equity

10.0

%

4.0

%

(7.5)%

(45.7)%

2012

2011

2010

2009

Adjusted EBITDA RONA

Calculation

Total Adjusted Net Assets

GAAP Reconciliation |

KeyBanc Capital Markets

May 30, 2013

21

March 31

December 31

($ in millions)

2013

2012

2012

2011

2010

2009

Gross Profit

$ 246.6

$ 236.6

$ 1,013.7

$ 708.2

$ 518.1

$ 548.0

Depreciation and amortization

5.4

4.1

18.6

17.0

16.6

14.5

Amortization of intangibles

13.2

12.3

49.5

50.7

53.9

46.6

(Decrease) increase in LIFO reserve

(3.1)

6.9

(24.1)

73.7

74.6

(115.6)

Adjusted Gross Profit

$ 262.1

$ 259.9

$ 1,057.7

$ 849.6

$ 663.2

$ 493.5

December 31

($ in millions)

2012

2011

2010

2009

Cash from operations

$ 240.1

$(102.9)

$ 112.7

$ 505.5

Fixed asset purchases

(26.2)

(18.1)

(14.3)

(16.7)

Disposal of fixed assets

2.3

3.1

3.1

6.5

Free cash flow

$216.2

$(117.9)

$ 101.5

$ 495.3

Cummulative free cash flow

$ 695.1

$ 478.9

$ 596.8

$ 495.3

Adjusted Gross Profit GAAP Reconciliation

Free Cash Flow Calculation |