Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMEDISYS INC | d546131d8k.htm |

| EX-99.2 - EX-99.2 - AMEDISYS INC | d546131dex992.htm |

Investor

Presentation Leading Home Health & Hospice

May 2013

clinical

quality

innovative

care models

better

communities

Exhibit 99.1 |

Forward-looking Statements

This presentation may include forward-looking statements as defined by the Private

Securities Litigation Reform Act of 1995. These forward-looking statements are based

upon current expectations and assumptions about our business that are subject to a

variety of risks and uncertainties that could cause actual results to differ materially

from those described in this presentation. You should not rely on forward-looking

statements as a prediction of future events.

materially from those discussed in any forward-looking statements are described in

reports and registration statements we file with the SEC, including our Annual Report on

Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K, copies of which are available on the Amedisys internet website

http://www.amedisys.com

at (800) 467-2662.

We disclaim any obligation to update any forward-looking statements or any changes in

events, conditions or circumstances upon which any forward-looking statement may be

based except as required by law.

2

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we have

posted additional important

information such as press releases,

profiles concerning our business and

clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-critical

information regarding the Company in

advance of or in lieu of distributing a

press release or a filing with the SEC

disclosing the same information.

or by contacting the Amedisys Investor Relations department

Additional

information

regarding

factors

that

could

cause actual

results

to

differ |

Company

Overview 1

3

•

Founded in 1982, publicly listed 1994

•

524 care centers in 38 states

•

15,100 employees

•

Projected revenue in 2013 of approximately $1.3

billion

•

Largest provider of skilled home health services

•

4

th

largest hospice business

1

For the quarter ended March 31, 2013 |

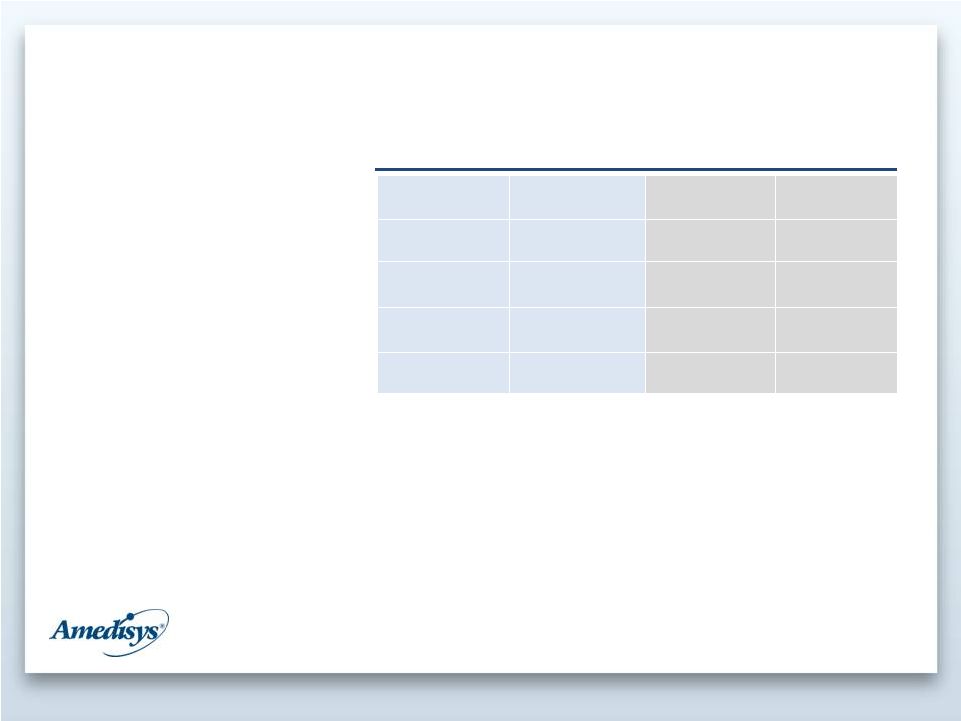

Business

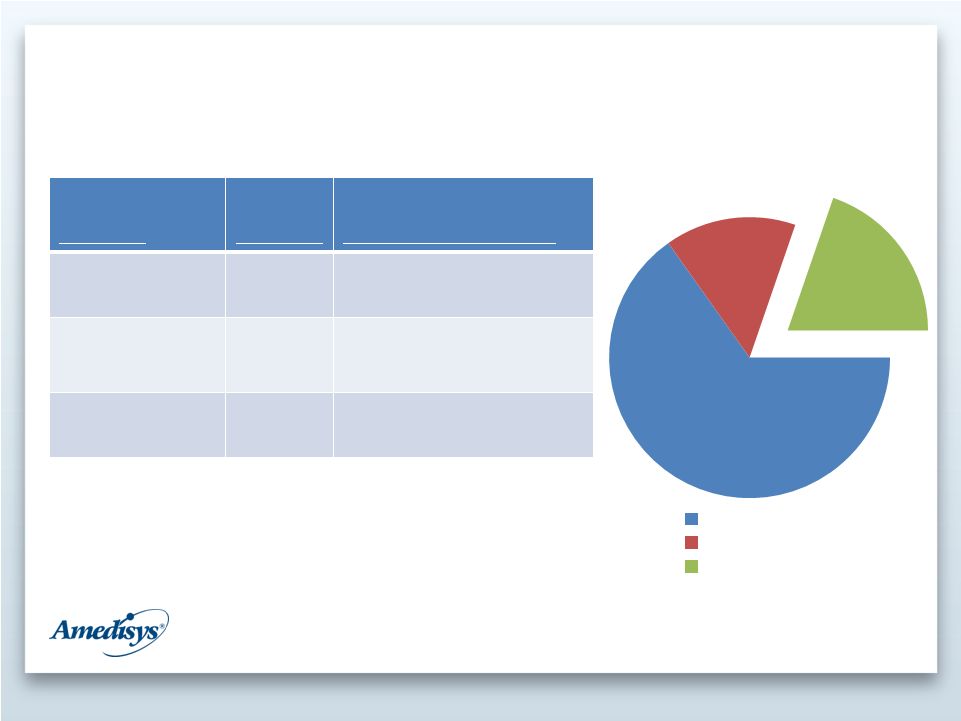

Segments 4

Business

Segment

% of

Revenue

Reimbursement Type

HH -

Medicare

65%

Paid episodically (over a 60-

day episode of care)

HH –

Non-Medicare

15%

Majority paid per visit;

remainder paid episodically

Hospice

20%

Mainly Medicare; paid at a

daily rate

1

Revenue mix based on 1Q13 revenue

65%

15%

20%

Revenue Mix

¹

HH -

Medicare

Hospice

HH -

Non-Medicare |

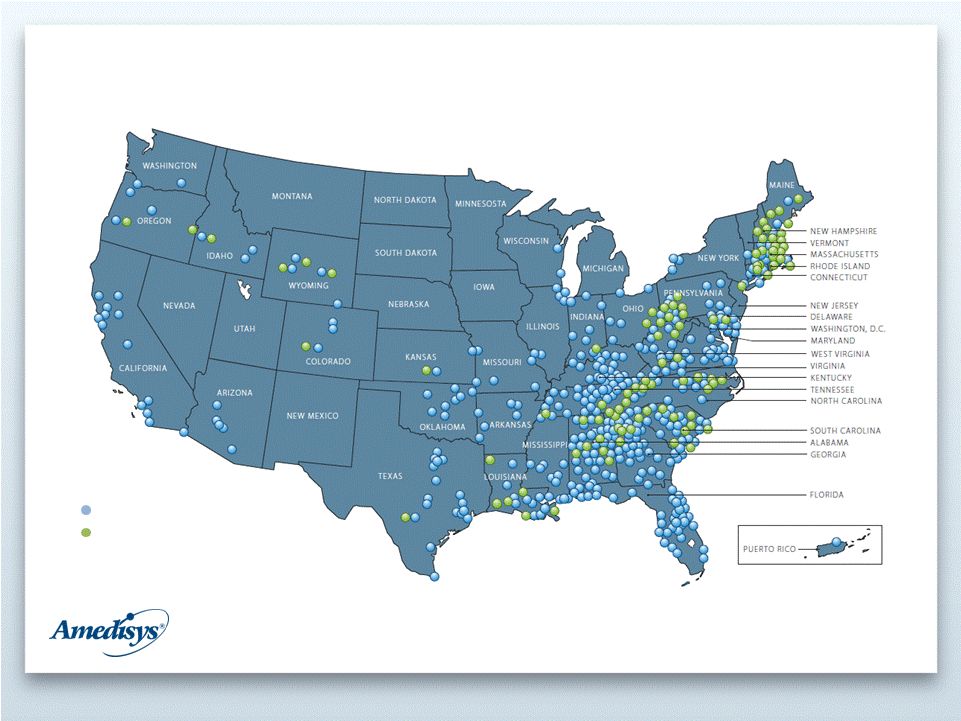

Care Center

Locations 1

5

Home Health Care Centers (427)

Hospice Care Centers (97)

1

As of March 31, 2013 |

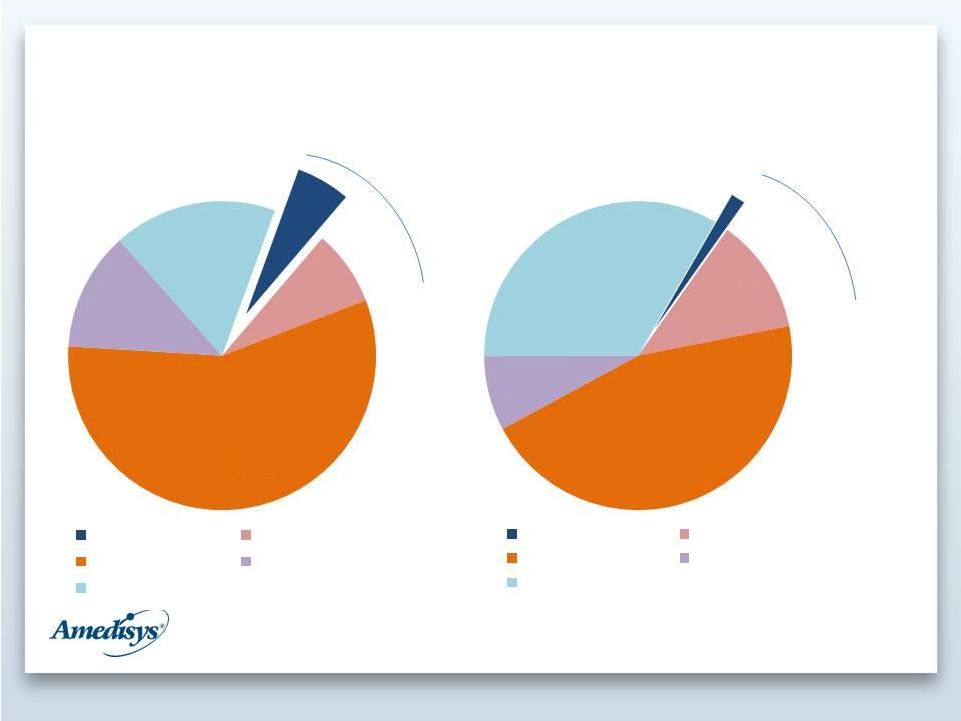

Estimated

Market

Share

–

Medicare

Revenue

6

13.6%

13.6%

5.7%

7.9%

56.8%

12.5%

17.1%

Home Health

Amedisys

Public Peers

For Profit

Hospital-based

Non-Profit

1.5%

12.1%

45.2%

7.8%

33.4%

Hospice

Amedisys

Public Peers

For Profit

Hospital-based

Non-Profit |

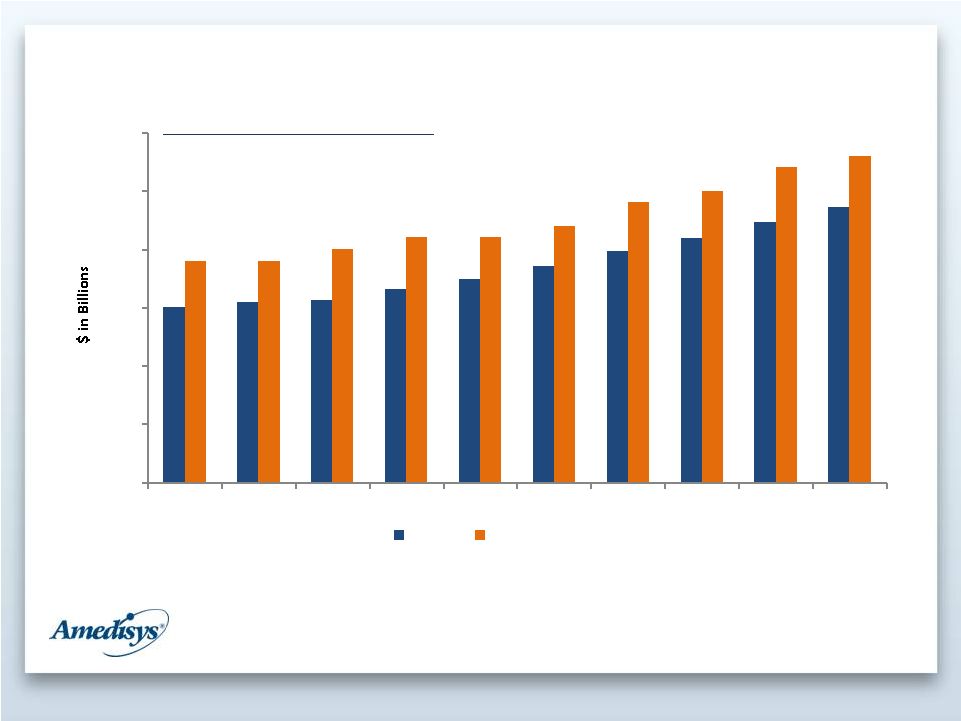

7

Home Health/Hospice Medicare Spend

Home Health Source: CBO March 2013 Baseline report (10 year CAGR)

Hospice

Source:

2011

actual

hospice

spending

with

growth

rate

based

on

“Other

Services”

section

of

CBO

March

2013

Baseline

report

(10

year

CAGR)

Population growth estimates provided by Tetrad; CAGR is for 2012-2017 (5 years)

Compound Annual Growth Rates (CAGR)

Home Health Expenditures = 4.4%

Hospice Expenditures = 5.2%

65+ Population = 3.6%

75+ Population = 2.6%

15

15

16

17

17

19

20

21

22

24

19

19

20

21

21

22

24

25

27

28

$-

$5

$10

$15

$20

$25

$30

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Hospice

Home Health |

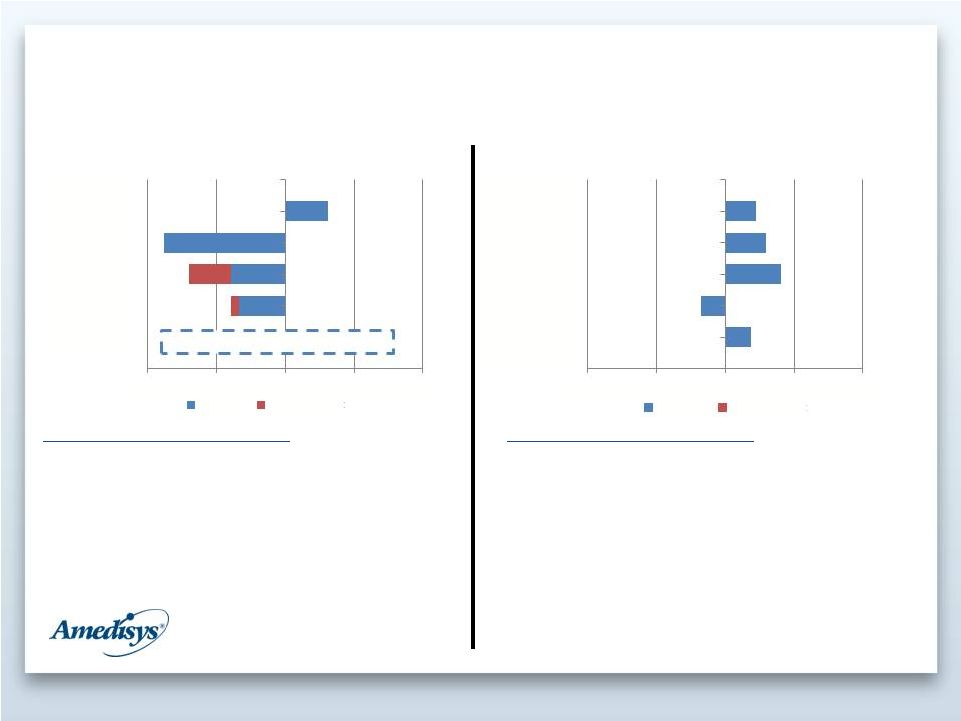

Medicare

Reimbursement 8

Reimbursement

Considerations

Reimbursement

Considerations

-

-

-

-2.0%

-2.4%

-5.2%

1.9%

-2.3%

-4.2%

-6.0%

-3.0%

0.0%

3.0%

6.0%

2013

2012

2011

2010

Home Health

Industry

AMED Specific

-1.1%

Industry

AMED Specific

1.1%

2.4%

1.8%

1.4%

-6.0%

-3.0%

0.0%

3.0%

6.0%

2013

2012

2011

2010

Hospice

Expected in July

•

2014 rebasing

•

Sustainable growth rate legislation

(Doc Fix)

•

Co-payment proposals

•

2014 proposed rule

•

Hospice rebasing (U-shaped

reimbursement)

•

Nursing home reimbursement

2014

-

Proposed

2014

-

Proposed |

Favorable Long

Term Trends •

Compelling demographics

•

Patient preference

•

Low cost of care delivery

•

Increased payor and hospital focus

9

Inpatient

Hospital

LTAC

IRF

SNF

Hospice

Home

Health

Average Cost of Stay

$11,700

$38,664

$17,398

$11,728

$11,321

$5,257

Average Length of Stay

5 days

26 days

13 days

27 days

86 days

120 days

Average Per Diem Cost

$2,388

$1,470

$1,338

$431

$132

$44

Source: MedPAC March 2013 report; hospital information is for inpatient facilities only and is

estimated based on patient discharges |

Traditional Home

Health and Hospice 10

Current

Business

Dynamics

Issues

•

Fee for service based

•

High volume / low margins

•

“Retail”

relationships

•

Patients with multiple

conditions

•

Limited physician

coordination

•

Poor coordination /

communication

•

Misaligned incentives

•

Minimal data interchange

•

Regulatory limitations on

services |

Future

Trends 11

Home

Health

Coordinated Care

Management

Patient

Home

Hospice

Post-Acute

Facilities

Payors

Physicians

Hospitals

•

Aligned incentives

•

Data exchange

•

Communications

•

Care Protocol

•

Outcome focused

•

Value driven

Informal

Care Givers |

Care Management

Initiatives •

Patient care management

•

Shared service care centers

•

Bundled payment initiatives

•

Next generation operating system

•

Other

–

ACO partnerships

–

Enterprise-level relationships

–

Palliative care and medical home

12 |

Patient Care

Management 13

•

“Right Care. Right Time. Right Place.”

•

Centralized support

–

Local clinical decisions

–

Exception reporting

•

Recertification review

–

Attainment of patient goals

–

Physician orders or medication changes

–

Hospitalization during episode

•

Utilization focus

–

Reduce care plan variability

–

Patient outcome driven |

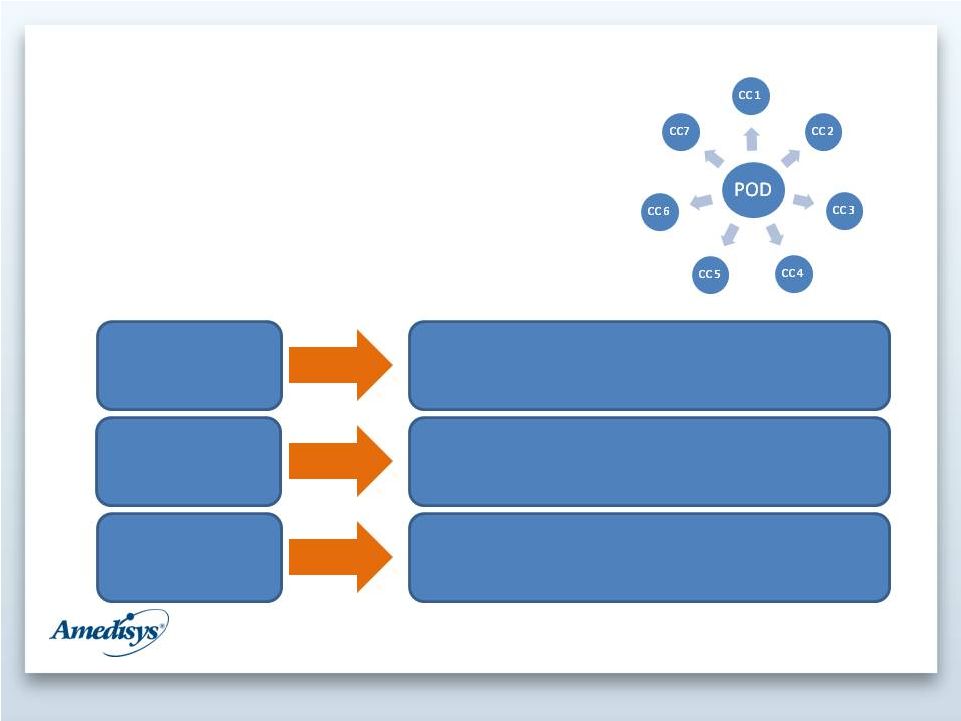

Shared Service

Model •

~ 475 care centers organized into 70 “pods”

–

Completed by the end of 2013

–

~850 ADC; $20M in revenue per “pod”

14

Quality Care

Operational

Efficiency

Leadership

•

Centralized functions (on-call, intake, scheduling)

•

Scheduling efficiency

•

Specialty clinician productivity

•

Clinical resource support

•

Consistency in care delivery/training

•

POD leadership supporting all care centers

•

Improved leadership turnover coverage |

Bundles

•

CMS Bundled Payment for Care Initiative (BPCI) program

–

Amedisys focused on Model 3 (post-acute)

–

CMS to set target price for relevant services during bundle

–

Awardees share savings and “at risk”

for costs greater than target

•

Amedisys in awardee process in 5 regions

–

Currently in Phase I --

a no-risk reporting and ramp-up period

–

Phase II (at risk), expected to begin October 1, 2013

–

Developing partnerships with hospitals/other partners to manage

•

Also focused on ACOs and Model 2 bundles

15 |

AMS3 Operating

System •

4Q13 Development complete / implementation begins

•

Migrating to .Net platform

Existing platform sun setting

•

Benefits of proprietary system

–

Low incremental spend

–

Ongoing flexibility and customization

•

Enhancements over existing system

–

Greater clinician productivity

–

Superior clinical management engine

–

Care center efficiencies

–

Interoperability

–

Billing efficiencies

–

Expect $10-$15M in net annual savings after fully rolled out

16 |

Capital

Expenditures 17

PeopleSoft

IT Security

AMS3 Development

28.4

36.4

64.0

44.4

48.3

48.0

2.4%

2.4%

4.0%

3.0%

3.2%

3.7%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

0.0

25.0

50.0

75.0

100.0

125.0

2008

2009

2010

2011

2012

2013 |

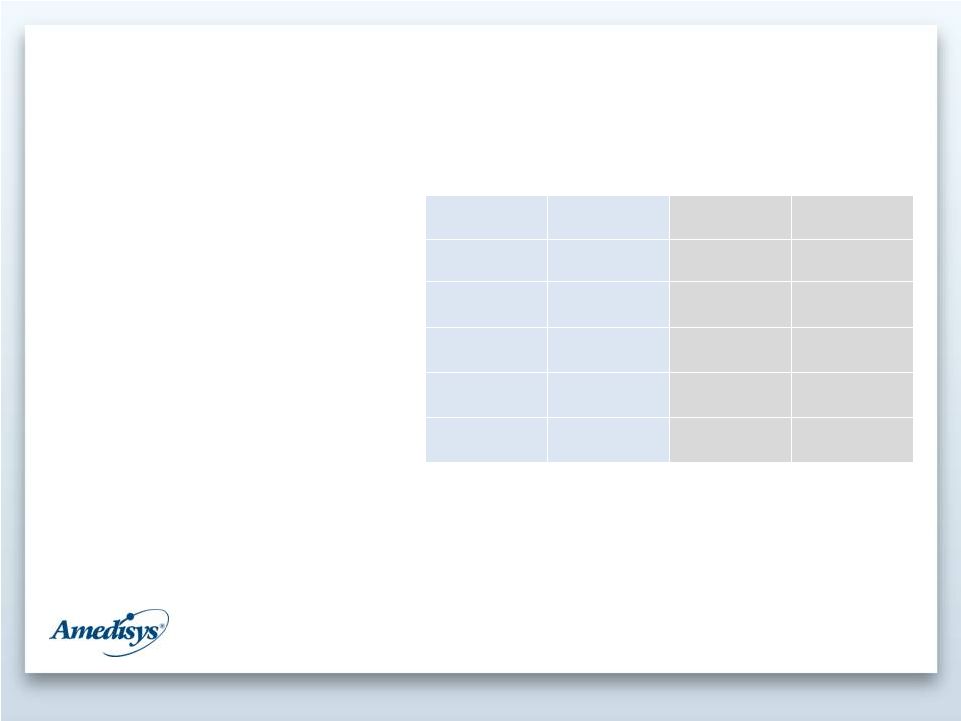

Summary

Financial Results 18

(Continuing operations only. $ in millions, except per share

data)

2011

(1)

2012

(1)

1Q12

(2)

1Q13

(2)

Adjusted Net Revenue

$ 1,464

$ 1,488

$ 371

$ 339

Gross Margin %

46.7%

43.5%

43.8%

43.2%

Adjusted EBITDA

$ 157

$ 103

$ 27

$ 17

Adjusted EBITDA Margin

10.7%

6.9%

7.3%

5.1%

Adjusted EPS

$2.29

$1.08

$0.29

$0.13

1.

The financial results for the years 2012 and 2011 are adjusted for certain items incurred in

2012 and 2011 and should be considered non-GAAP financial measures. A

reconciliation of these non-GAAP financial measures is included as Exhibit 99.2 to our

Form 8-K filed with the Securities and Exchange Commission on March 12, 2013.

2.

The financial results for the three-month period ended March 31, 2013 and March 31, 2012

are adjusted for the legal fees associated with investigations of $1.2 million and $2.2

million, respectively, and should be considered a non-GAAP financial measure. A reconciliation of this non-GAAP financial measure is included as Exhibit 99.2 to our

Form 8-K filed with the Securities and Exchange Commission on April 30, 2013 |

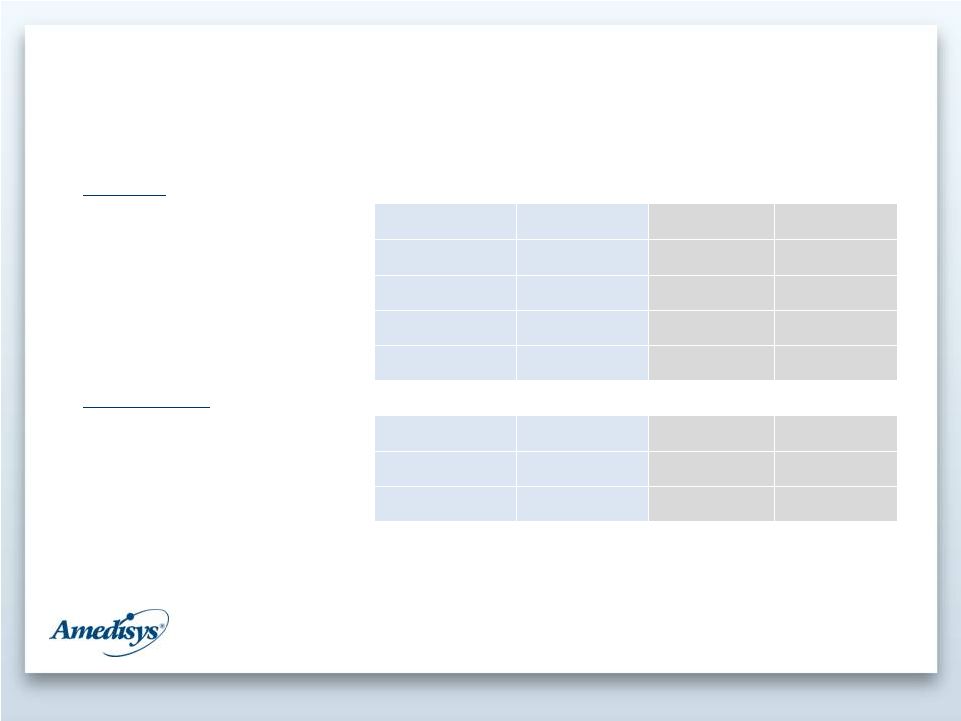

Home Health

Segment 19

($ in millions, continuing operations)

2011

(1)

2012

(1)

1Q12

(2)

1Q13

(2)

Medicare Revenue

$ 1,038

$ 953

$ 242

$ 221

Non-Medicare Revenue

$213

$245

$59

$51

Total Revenue

$ 1,251

$ 1,198

$ 301

$ 272

Gross Margin %

46.9%

42.3%

42.9%

42.3%

Contribution

$220

$124

$32

$26

Contribution %

17.6%

10.4%

10.5%

9.4%

1.

Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2012 as filed with the Securities and Exchange Commission on March 12, 2013. 2.

Results as reported in our Quarterly Report on Form 10-Q for the quarter ended March 31,

2013 as filed with the Securities and Exchange Commission on April 30, 2013 |

20

Home Health Operating Statistics

2011

(1)

2012

(1)

1Q12

(2)

1Q13

(2)

Medicare

Admissions

202,603

200,590

51,153

52,122

Same store admissions growth

(5)%

0%

(2)%

2%

Recertification rate

44.4%

42.2%

43.5%

37.7%

Revenue per episode

$3,027

$2,874

$2,882

$2,782

Visits per episode

18.7

18.7

18.6

17.4

Non-Medicare

Admissions

73,880

93,016

23,192

22,423

Visits

1,754,255

2,074,446

504,398

436,035

Revenue / Visit

$121.30

$118.30

$116.97

$117.42

1.

Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2012 as filed with the Securities and Exchange Commission on March 12, 2013.

2.

Results as reported in our Quarterly Report on Form 10-Q for the quarter ended March 31,

2013 as filed with the Securities and Exchange Commission on April 30, 2013. |

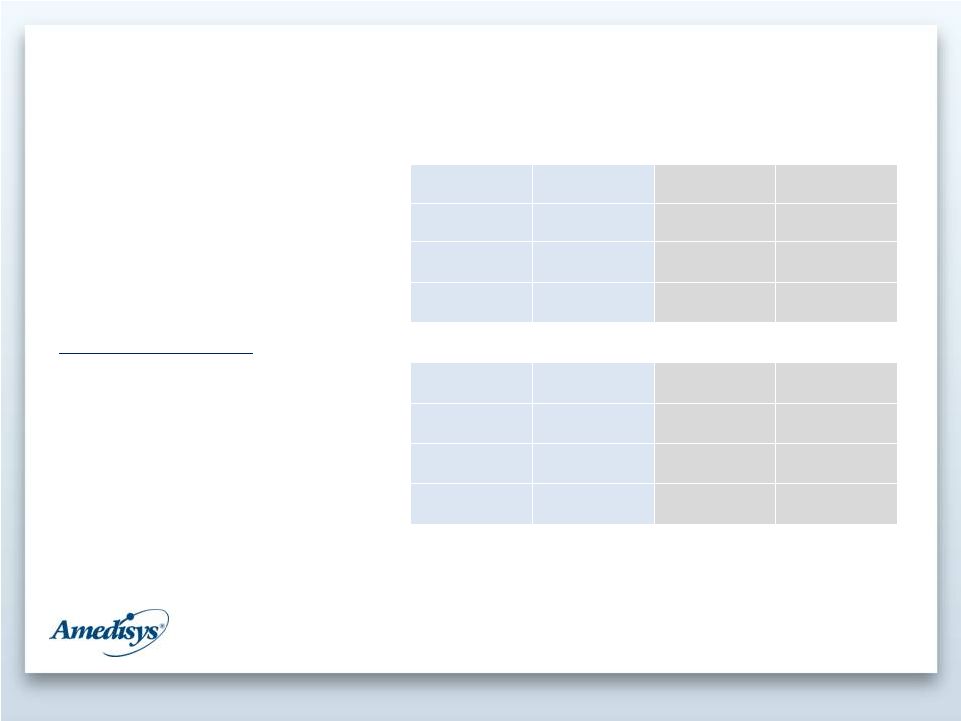

Hospice

Segment 21

($ in millions, continuing operations)

2011

(1)

2012

(1)

1Q12

(2)

1Q13

(2)

Total Revenue

$ 218

$ 290

$ 69

$ 67

Gross Margin %

46.5%

48.3%

47.4%

47.1%

Contribution

$49

$62

$15

$12

Contribution %

22.6%

21.4%

21.9%

17.5%

Operating Statistics

Total admissions

15,889

19,161

4,902

4,992

Same store revenue growth

19%

13%

17%

(5)%

Average daily census (ADC)

4,197

5,427

5,190

5,091

Average length of stay (ALOS)

88

99

91

103

1.

Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2012 as filed with the Securities and Exchange Commission on March 12, 2013 2.

Results as reported in our Quarterly Report on Form 10-Q for the quarter ended March 31,

2013 as filed with the Securities and Exchange Commission on April 30, 2013. |

22

Summary Balance Sheet

Assets

Dec. 31, 2012

Mar. 31, 2013

Cash

$ 15

$ 7

Accounts Receivable, Net

169

145

Property and Equipment

157

156

Goodwill

210

210

Other

180

194

Total Assets

$ 731

$ 712

Liabilities and Equity

Debt

$ 103

$ 79

Other Liabilities

174

171

Equity

454

462

Total Liabilities and Equity

$ 731

$ 712

Leverage Ratio

1.10x

0.95x

Days Sales Outstanding

42

37

($ in millions) |

23

Liquidity

1

1.

Unused revolver of $143 million

2.

1Q13

scheduled

debt

repayment

includes

$20M

principal

payment

of

senior

notes

due

in

March

2013,

at

end

of

quarter

$20M

in

senior

notes

remain

outstanding

and

are

due

in

March

2014

3.

Other cash flows include refinancing costs associated with credit agreement signed on October

26, 2012, retirement of long-term debt and acquisitions. ($ in millions)

2012A

1Q13A

2013F

Cash Flow From Operations

$ 69

$32

$ 94-99

Capital Expenditures

48

10

45-50

Scheduled

debt

repayments

2

29

24

36

Cash Flow, Net

(8)

(2)

8-18

Beginning Cash

48

$15

Other

3

(25)

(6)

End Cash

$ 15

$7 |

1Q13 Announced

Initiatives •

Exiting 50 low-performing care centers

–

~15 will be consolidated with other care centers

–

~35 will be divested

–

~$10M annualized run rate EBITDA improvement

•

Corporate cost savings

–

~$5M annualized run rate EBITDA improvement

•

Patient care management

–

Consistency in care

–

Improved utilization and outcomes

24 |

25

Guidance

¹

Calendar Year 2013

²

Net revenue:

$1.28 -

$1.32 billion

EPS:

$0.45 -

$0.55

Diluted shares:

31.5 million

1.

Guidance based on continuing operations excluding the effects of any one-time costs

associated with our announced market exit activity or corporate expense initiatives.

2.

Provided as of the date of our form 8-K filed with the Securities and Exchange Commission

on April 30, 2013. |

Investment

Rationale •

Favorable demographic trends

•

Positive attributes of home based care

•

IT infrastructure/scalability

•

Clinical quality and innovation

•

Strong liquidity and capital position

•

Market share capture opportunities

26

Efficient Core

Business

Care Mgmt

Solutions |

Contact

Information Tom Dolan

SVP Finance and Treasurer

Amedisys, Inc.

5959 S. Sherwood Forest Boulevard

Baton Rouge, LA 70816

Office: 225.299.3391

Fax: 225.298.6435

tom.dolan@amedisys.com

27 |