Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACI WORLDWIDE, INC. | d544839d8k.htm |

May

2013 ACI Worldwide Investor Conferences

May & June, 2013

Exhibit 99.1 |

May

2013 Private Securities Litigation Reform Act of 1995

Safe Harbor for Forward-Looking Statements

This presentation contains forward-looking statements based on

current expectations that involve a number of risks and uncertainties.

The forward-looking statements are made pursuant to safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. A

discussion of these forward-looking statements and risk factors that

may affect them is set forth at the end of this presentation. The

Company assumes no obligation to update any forward-looking

statement in this presentation, except as required by law.

1 |

May

2013 About ACI Worldwide

24 of the top 25 and

67 of the top 100

global banks are

customers

60-Month Backlog

~$3.1BN

We are rated in the

#1 or #2 position by

industry analysts in

nearly all categories

We control 6% of the

market spend

1/3 of all SWIFT

transactions

65% of all fed wires

ACI software enables

$13 trillion in

payments each day

Revenue

2013

$895

-

$915MM

EBITDA

2013

$266

-

$276MM

Founded in 1975, ACI is a leading provider of electronic payments

and transaction banking software solutions for financial

institutions, retailers, processors and billers worldwide

Leadership

•

Global payments company with a diversified, blue-chip

customer base, >96% retention rates, and >70% annual

recurring revenue

•

High quality products, ~20% of revenue invested in R&D,

and substantial switching costs drive recurring revenue

with strong renewal rates and significant competitive

barriers

•

Provide mission critical software meeting increased

regulatory demands

•

Market leader focused on increasing scale and improving

competitive positioning within attractive markets

•

Low ongoing capital expenditures with a solid balance

sheet and significant liquidity

1

Financial metrics represent 2013 guidance range

2

1

1

Op. Inc. 2013

$170 -

$180MM

1 |

May

2013 Global Distribution and Customer Base

Note: Figures include Online Resources

3

AMERICAS

1,950+ customers

EMEA

500+ customers

ASIA/PACIFIC

150+ customers

~ 2,600 customers in over 80 countries rely on ACI solutions

~ 4,200 employees in 36 countries

Customers: ~ 180

processors globally

Customers: ~ 290

retailers globally

Customers: 600+

US billers

Headquarters

Regional Offices

Distributors |

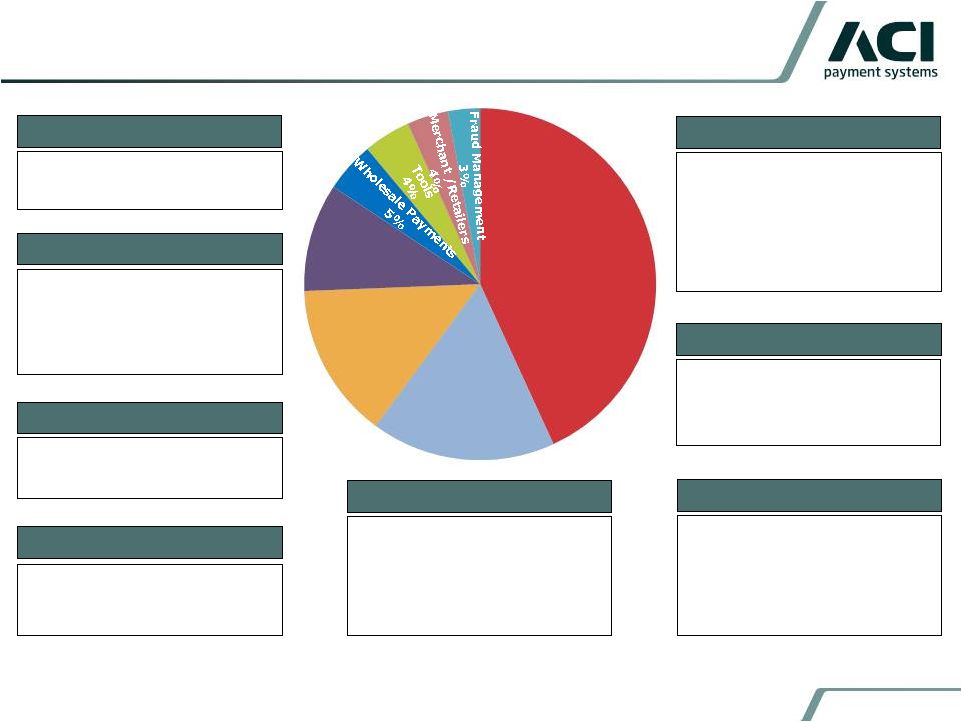

4

ACI is a Leading Provider of Electronic Payments and Transaction

Banking Solutions

Retail Payments

43%

Online Banking

14%

Community

Banking

10%

•

U.S. and Int’l corporate online

banking and cash management

•

U.S. and Int’l branch systems

•

Trade finance

•

Mobile banking

•

In-house or hosted solution

•

Sold to large FIs globally

Online Banking

•

U.S. business and consumer

online banking

•

U.S. branch system

•

Mobile banking

•

Hosted solutions

•

Sold to community FIs and credit

unions

Community Banking

•

U.S. and Int’l merchant retail

payments engines

•

In-store integration

•

PCI compliance

•

Loyalty / stored value

•

Serves Retailers of all sizes

Merchant Retail

•

Analytics

•

Payments Infrastructure

•

Testing tools

Tools

•

Wholesale payments engines

•

Transaction banking

•

Serves FIs globally

Wholesale Payments

•

Payments transaction fraud

•

Enterprise financial crimes

•

Case management

Fraud Management

Retail Payments

•

Retail payments engines

•

Card and account management

•

Authentication, authorization,

acquiring, clearing and settlement

•

Single message format

•

Mobile payments

•

Sold to FIs and processors of all

sizes globally

•

Bank Bill Pay (consolidator model)

•

Biller Direct (Biller Direct model)

•

Virtual Collections

•

Serves FIs, Billers, & Issuers

•

Hosted solutions

Bill Pay / Collections

ACI Product Family as % of 2012 Pro Forma Revenue

Bill Pay / Collections

17%

Note: Figures represent Pro Forma GAAP Revenue for Online Resources

May 2013 |

Universal Payments

Platform (UPP) Strategy 5

Retail

Wholesale

Online

Fraud

Bill Pay

Universal Payments Platform (UPP)

Service Management and Orchestration

Today

Orchestrated

integration:

Past

Customers burdened

with integration

issues:

Retail

Wholesale

Online

Fraud

Bill Pay

FI Core Systems

Reference Architecture

FI Core Systems

Reference Architecture

•

Massive customization

needs

•

High cost of

maintenance

•

Slow time to market

•

Difficult to achieve

differentiation

•

Simplified

•

Lower cost

•

Faster time to market

•

Increased differentiation

May 2013 |

May

2013 6

Our Customers are Top Global Banks, Processors and

Retailers

Customers are Top Global Banks, Processors, Billers, and Retailers |

7

Large & Growing Worldwide Payment Opportunity

Source: IDC Financial Insights 2011, ACI Internal Analysis

8,949

9,864

10,881

11,914

12,989

14,184

5.8%

10.6%

10.5%

10.2%

7.7%

7.2%

796

5,625

556

604

381

987

844

6,259

619

644

429

1,068

898

6,965

688

691

483

1,155

957

7,695

760

744

510

1,247

1,005

8,456

834

796

562

1,335

1,057

9,307

916

854

619

1,430

Retail Banking

Payments

Merchant Retailer

Payments

5YR CAGR (2011-16)=

9.6%

Wholesale Banking

Payments

2011 ESTIMATED SHARE

SERVICEABLE SOFTWARE

INDUSTRY SPEND IN 2016 = $14.2B

Tools and

Infrastructure

Online Banking and

Cash Management

Fraud Management

($ in millions)

BPO (e.g..

processors)

IT SERVICES

SOFTWARE

FundTech

Bottomline

NICE (Actimize)

BAE (Norkom & Detica)

Clear2Pay

Dovetail

FIS

16%

38%

46%

OTHER

(Homegrown &

Regional)

IBM

ACI

–

2011

Estimated Share of 8%

FAIR ISAAC (FICO)

INTUIT (Digital

Insight)

SAS

Note: ACI market share pro forma for S1 acquisition

Source: IDC Financial Insights, June 2011; Company reports and ACI analysis

May 2013 |

•

Shift from paper to electronic

•

Compounding regulatory

requirements

•

Revenue and profitability pressures

•

Complexity from globalization

FIs looking to transform their businesses by:

•

Driving down unit costs

•

Launching new products quicker

•

Reducing risks

•

Improving customer satisfaction and loyalty

•

Vendor Consolidation

8

Favorable Industry and Customer Trends

Customer

Trends

Industry

Dynamics

•

Total addressable market growing 9.6% CAGR ~$10bn in 2012

•

50% of addressable market is in-sourced (homegrown) applications

•

Global transaction volume growth expected to be 9% CAGR through 2020

Market

Sizing

•

Increasing fraud costs

•

Convergence of payments; real-time

•

Legacy systems increasingly difficult to

update

May 2013 |

9

Strategy to Drive Superior Performance

Continued focus on Control, Profitability and Growth

•

Continue to increase recurring revenue base while maintaining

industry leading retention rates

•

Expand customer relationships by cross-selling (on average

customers use less than 3 ACI products)

•

Lead payments transformation with Universal Payments Platform

delivering technology-enabled efficiencies

•

Expand geographically

Growth

Drivers

•

Expand margins through operating leverage and process-driven

operating philosophy

•

Realize cost synergies derived from recent acquisitions

Continuous

Improvements to

Drive Margin Expansion

•

Buy, build or partner to fill-in product gaps or expand customer base

•

Recent acquisitions have added product, scale and market breadth

Disciplined Acquisition/

Investment Strategy

May 2013 |

Financial

Overview May 2013 |

May

2013 11

Financial

Summary

(2008

–

2013E)

17% CAGR

Note: Dollars are in Millions. Total Revenue, Adjusted EBITDA and Operating Income are presented

on a non-GAAP basis adding back deferred revenue haircuts and other one-time

expenses. 2013 estimates assume the midpoint of company guidance.

39% CAGR

52% CAGR

$28

$37

$65

$30

$63

$67

$24

$54

2008

2009

2010

2011

2012

LTM

3/31/2013

Operating Free Cash Flow

IBM Alliance Prepayment

$418

$406

$418

$465

$689

$905

2008

2009

2010

2011

2012

2013E

Operating Free Cash Flow

Non-GAAP Operating Income & Margin

Adjusted EBITDA & Margin

Non-GAAP Revenue

$22

$42

$54

$73

$128

$175

5%

10%

13%

16%

19%

19%

2008

2009

2010

2011

2012

2013E

Operating Income

Operating Margin %

$52

$73

$88

$113

$191

$271

12%

18%

21%

24%

28%

30%

2008

2009

2010

2011

2012

2013E

Adjusted EBITDA

% Margin |

May

2013 12

Large & Growing Backlog Provides Revenue and Earnings Visibility

Note: Dollars are in Millions, data as of 3/31/2013

•

Backlog from monthly recurring revenues and scheduled project go-lives drives

80%+ of GAAP revenue, leading to very high visibility on an annual basis

•

Recurring revenues (maintenance, license, and hosting fees) comprise majority

of 60-month backlog

•

Backlog assumes continued >96% retention and excludes growth in users and

incidental capacity

Monthly

Recurring,

82%

Non

-

Recurring,

18%

Committed,

48%

Renewal,

52%

12-Month

Backlog

-

$743MM

60-Month

Backlog

-

$3.1BN |

13

Low Attrition & Fixed Term Licenses Produce Recurring Revenue Model

60 Month Backlog

Sales Bookings

Note: Dollars are in Millions. Revenue presented on a GAAP basis; Pro Forma includes Online

Resources for full 12 months.

•

>70% recurring revenue (includes

maintenance, license and hosting fees)

•

80% of annual revenue comes from

backlog

•

95% of our contracts are transaction

based

•

5-year fixed term licenses

–

Legacy S1 contracts are generally perpetual license

fees and 3-year fixed term for hosting

–

Legacy ORCC contracts are generally transaction-

based and recurring

•

Renewal rates across ACI products >96%

•

New Account / New Product Sales –

revenue generally split evenly among

license, maintenance and service

$323

$293

$315

$330

$501

$136

$132

$210

$226

$265

$460

$425

$525

$556

$766

2008

2009

2010

2011

2012

ACI Sales, Net of Term Extensions

ACI Term Extensions

$2,396

$660

$1,407

$1,517

$1,566

$1,617

$2,416

$3,056

2008

2009

2010

2011

2012

3/31/2013

ACI 60-Month Backlog

ORCC 60-Month Backlog

13

May 2013 |

May

2013 14

Diversified Revenue Base by Geography & Type

LTM 3/31/2013 Revenue by Region

LTM 3/31/2013 Revenue by Type

•

Diversified global company with

customers spanning more than 80

countries

•

Approximately 80% of business

denominated in U.S. dollars

•

EMEA is comprised of ~30% UK-

derived revenue, 20% Middle

East/Africa and 50% Europe

(inclusive of 32 countries)

•

Online Resources business is

100% U.S. focused and 95%

hosting with the remainder split

between maintenance / services

•

Higher margin revenues

(maintenance, license and hosting

fees) comprise >80% of revenue

Note: Revenue percentages based on GAAP and includes Online Resources for full 12 months.

Americas

63%

EMEA

26%

Asia/ Pacific

11%

Licenses

25%

Maintenance

25%

Services

16%

Hosting

34% |

May

2013 15

Diversified Customer Base with Significant Cross Sales Opportunity

•

Historically, no ACI

customer has accounted for

more than 4% of total

revenue

•

In FY 2012, the largest

customer represented 3.3%

of total pro forma revenue,

utilizing 8 different products

(includes a combination of

legacy ACI, S1 and ORCC)

•

Average customers uses <3

products, representing large

cross selling opportunity

ACI Pro Forma FY 2012 Revenue by Customer

Customer

% of Total

Customer #1

3.3%

Customer #2

1.7%

Customer #3

1.7%

Customer #4

1.4%

Customer #5

1.1%

Customer #6

1.1%

Customer #7

0.9%

Customer #8

0.9%

Customer #9

0.9%

Customer #10

0.9%

Customer #11

0.9%

Customer #12

0.9%

Customer #13

0.8%

Customer #14

0.7%

Customer #15

0.7%

Customer #16

0.7%

Customer #17

0.7%

Customer #18

0.7%

Customer #19

0.7%

Customer #20

0.7%

Top 20

21.4%

All Others

78.6%

Total ACI Pro Forma 2012 Revenue

100.0%

No single customer represents more than 4% of pro forma 2012 revenue

|

May

2013 >70% Annual Recurring Revenue and Growing

Recurring revenue has increased in dollar amount and as a percent of revenue

Virtually

all

components

of

revenue

are

seasonally

stronger

in

the

back

half

•

Revenue have averaged 44% in 1H and 56% in 2H

•

Sales bookings higher in Q4 given customer’s “budget flush”

•

Project “Go Lives”

often occur in Q4

•

Recurring annual license payments mostly occur in Q4

•

~40% -

50% of incidental capacity revenues historically occur in Q4

•

Implementation accounting causes quarter-quarter variability

•

Services for implementation projects are expensed as incurred, while revenue is often deferred

until “Go-Live” events, which causes this revenue to be very high

margin 16

(50,000)

50,000

100,000

150,000

200,000

250,000

Q108

Q208

Q308

Q408

Q109

Q209

Q309

Q409

Q110

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

Q312

Q412

Q113

Ongoing services,

implementations,

increased capacity

sales and other

Recurring revenue:

(hosting,

maintenance and

license fees (paid

monthly, quarterly

or annually)

- |

May

2013 17

2013 Outlook

Guidance

•

Represents 9

2/3

months of financial results of ORCC

•

Includes 7.5 months of annual cost synergies of $12 million to be realized in 2013

•

Excludes impact of one-time transaction and integration expenses expected to be

approximately $14 million

•

Excludes impact of deferred revenue haircut of approximately $6 million

•

Guidance assumes estimates for non-cash purchase accounting adjustments, intangible

valuations and deferred revenue haircut

First Half 2013 Revenue Outlook

•

Expected to be in a range of 41%-42% of full year revenue guidance

Current

Non-GAAP

Guidance

ORCC

Guidance

$'s in millions

Range

Impact*

Range

Revenue

$765 - $785

$128 - $132

$895 - $915

Operating Income

$150 - $160

$19 - $21

$170 - $180

Adjusted EBITDA

$230 - $240

$35 - $37

$266 - $276

* ORCC results are for the period March 11, 2013 through December 31, 2013 and

exclude the impact of deferred revenue haircut and one-time expenses

|

May

2013 Questions? |

May

2013 Non-GAAP Financial Measures

To supplement our financial results presented on a GAAP basis, we use the non-GAAP measure

indicated in the tables, which exclude certain business combination accounting entries

and expenses related to the acquisitions of ORCC and S1, as well as other significant

non-cash expenses such as depreciation, amortization

and

share-based

compensation,

that

we

believe

are

helpful

in

understanding

our

past

financial

performance and our future results. The presentation of these non-GAAP financial

measures should be considered in addition to our GAAP results and are not intended to

be considered in isolation or as a substitute for the financial information prepared

and presented in accordance with GAAP. Management generally compensates for limitations

in the use of non-GAAP financial measures by relying on comparable GAAP financial

measures and providing investors with a reconciliation of non-GAAP financial measures only in

addition to and in conjunction with results presented in accordance with GAAP. We believe that

these non- GAAP financial measures reflect an additional way of viewing aspects of

our operations that, when viewed with our GAAP results, provide a more complete

understanding of factors and trends affecting our business. Certain non-GAAP

measures include: 19

•

Non-GAAP

revenue:

revenue

plus

deferred

revenue

that

would

have

been

recognized

in

the

normal

course

of business by S1 and ORCC if not for GAAP purchase accounting requirements.

Non-GAAP revenue should

be

considered

in

addition

to,

rather

than

as

a

substitute

for,

revenue.

•

Non-GAAP operating income: operating income (loss) plus deferred revenue that would have

been recognized in the normal course of business by S1 and ORCC if not for GAAP

purchase accounting requirements and one-time expense related to the acquisitions

of ORCC and S1. Non-GAAP operating income should be considered in addition

to, rather than as a substitute for, operating income. •

Adjusted EBITDA: net income (loss) plus income tax expense, net interest income (expense), net

other income (expense), depreciation, amortization and non-cash compensation, as

well as deferred revenue that

would

have

been

recognized

in

the

normal

course

of

business

by

S1

and

ORCC

if

not

for

GAAP

purchase accounting requirements and one-time expense related to the acquisitions of ORCC

and S1. Adjusted

EBITDA

should

be

considered

in

addition

to,

rather

than

as

a

substitute

for,

operating

income. |

May

2013 Non-GAAP Financial Measures

20

Non-GAAP Revenue (millions)

2012

2011

2010

2009

2008

Revenue

$ 667

$ 465

$ 418

$ 406

$ 418

Plus:

Deferred revenue fair value adjustment

22

-

-

-

-

Non-GAAP Revenue

$ 689

$ 465

$ 418

$ 406

$ 418

Non-GAAP Operating Income (millions)

2012

2011

2010

2009

2008

Operating income

$ 74

$ 66

$ 54

$ 42

$ 22

Plus:

Deferred revenue fair value adjustment

22

-

-

-

-

Employee related actions

15

-

-

-

-

Facility closure costs

5

-

-

-

-

IT exit costs

3

-

-

-

-

Other one-time S1 related expenses

9

7

-

-

-

Non-GAAP Operating Income

$ 128

$ 73

$ 54

$ 42

$ 22

For the Years ended December 31,

For the Years ended December 31, |

May

2013 21

Non-GAAP Financial Measures

Adjusted EBITDA (millions)

2012

2011

2010

2009

2008

Net income

$ 49

$ 46

$ 27

$ 20

$ 11

Plus:

Income tax expense

16

18

22

13

17

Net interest expense

10

1

1

2

2

Net other expense (income)

-

1

3

7

(8)

Depreciation expense

13

8

7

6

6

Amortization expense

38

21

20

17

16

Non-cash compensation expense

15

11

8

8

8

Adjusted EBIDTA

141

106

88

73

52

Deferred revenue fair value adjustment

22

-

-

-

-

Employee related actions

11

-

-

-

-

Facility closure costs

5

-

-

-

-

IT exit costs

3

-

-

-

-

Other one-time S1 related expenses

9

7

-

-

-

Adjusted EBIDTA excluding one-time transaction expenses

$ 191

$ 113

$ 88

$ 73

$ 52

For the Years ended December 31, |

May

2013 Non-GAAP Financial Measures

ACI is also presenting operating free cash flow, which is defined as net cash provided by

operating activities, plus net after-tax payments associated with

employee-related actions and facility closures, net after-tax payments

associated with acquisition related transaction costs, net after-tax payments associated

with IBM IT outsourcing transition and termination, and less capital expenditures.

Operating free cash flow is considered a non-GAAP financial measure as defined by

SEC Regulation G. We utilize this non-GAAP financial measure, and believe it is

useful to investors, as an indicator of cash flow available for debt repayment and other

investing activities, such as capital investments and acquisitions. We utilize

operating free cash flow as a further indicator of operating performance and for

planning investing activities. Operating free cash flow should be considered in addition to,

rather than as a substitute for, net cash provided by operating activities. A limitation

of operating free cash flow is that it does not represent the total increase or

decrease in the cash balance for the period. This measure also does not exclude

mandatory debt service obligations and, therefore, does not represent the residual cash flow

available for discretionary expenditures. We believe that operating free cash flow is useful

to investors to provide disclosures of our operating results on the same basis as that

used by our management. 22

Reconciliation

of

Operating

Free

Cash

Flow

(millions)

2012

2011

2010

2009

2008

Net

cash

provided

(used)

by

operating

activities

$ (9)

$ 84

$ 81

$ 44

$ 78

Net after-tax payments associated with employee-related actions

6

-

-

3

4

Net after-tax payments associated with lease terminations

3

-

-

-

1

Net after-tax payments associated with S1 related transaction costs

9

3

-

-

-

Net

after-tax

payments

associated

with

cash

settlement

of

S1

options

10

-

-

-

-

Net

after-tax

payments

associated

with

IBM

IT

Outsourcing

Transition

1

1

1

-

-

Plus

IBM

Alliance

liability

repayment

21

-

-

-

-

Less

capital

expenditures

(17)

(19)

(13)

(10)

(12)

Less

Alliance

technical

enablement

expenditures

-

(2)

(6)

(7)

(6)

Operating Free Cash Flow

$ 24

$ 67

$ 63

$ 30

$ 65

For the Years ended December 31, |

May

2013 Non-GAAP Financial Measures

ACI also includes backlog estimates, which include all software license fees, maintenance fees

and services specified in executed contracts, as well as revenues from assumed contract

renewals to the extent that we believe

recognition

of

the

related

revenue

will

occur

within

the

corresponding

backlog

period.

We

have

historically included assumed renewals in backlog estimates based upon automatic renewal

provisions in the executed contract and our historic experience with customer renewal

rates. Backlog is considered a non-GAAP financial measure as defined by SEC

Regulation G. Our 60-month backlog estimate represents expected revenues from

existing customers using the following key assumptions: 23

•

Maintenance fees are assumed to exist for the duration of the license term for those contracts

in which the committed maintenance term is less than the committed license term.

•

License and facilities management arrangements are assumed to renew at the end of their

committed term at a rate consistent with our historical experiences.

•

Non-recurring

license

arrangements

are

assumed

to

renew

as

recurring

revenue

streams.

•

Foreign currency exchange rates are assumed to remain constant over the 60-month backlog

period for those contracts stated in currencies other than the U.S. dollar.

•

Our pricing policies and practices are assumed to remain constant over the 60-month

backlog period. |

May

2013 Non-GAAP Financial Measures

Estimates

of

future

financial

results

are

inherently

unreliable.

Our

backlog

estimates

require

substantial

judgment and are based on a number of assumptions as described above. These assumptions may

turn out to be inaccurate or wrong, including for reasons outside of management’s

control. For example, our customers may attempt to renegotiate or terminate their

contracts for a number of reasons, including mergers, changes in their financial

condition, or general changes in economic conditions in the customer’s industry or

geographic location, or we may experience delays in the development or delivery of products or

services specified in customer contracts which may cause the actual renewal rates and amounts

to differ from historical experiences. Changes in foreign currency exchange rates

may also impact the amount of revenue actually recognized in future periods.

Accordingly, there can be no assurance that contracts included in backlog estimates

will actually generate the specified revenues or that the actual revenues will be

generated within the corresponding 60-month period. Backlog should be considered in

addition to, rather than as a substitute for, reported revenue and deferred

revenue.

24 |

May

2013 Forward-Looking Statements

25

This presentation contains forward-looking statements based on current expectations that

involve a number of risks and uncertainties. Generally, forward-looking statements

do not relate strictly to historical

or

current

facts

and

may

include

words

or

phrases

such

as

“believes,”

“

will,”

“expects,”

“anticipates,”

“intends,”

and words and phrases of similar impact. The forward-looking statements are

made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements in this presentation include, but are not limited

to, statements regarding: •

Expectations that we will generate $19.5 million in annual cost synergies, of which $12

million will be realized in 2013, and that additional cost synergies will be realized

from facilities and data center consolidation.

•

Expectations regarding 2013 financial guidance related to revenue, operating income and

adjusted EBITDA.

•

Expectations of future growth by increasing our recurring revenue base, cross-selling more

products, expanding

geographically,

utilizing

our

Universal

Payment

Platform,

leveraging

Online

Resources’

base of

biller

connections,

and

capitalizing

on

industry

and

customer

trends

•

Expectations that our margins will increase through operating leverage and cost savings

synergies from recent acquisitions |

May

2013 Forward-Looking Statements

26

All of the foregoing forward-looking statements are expressly qualified by the risk

factors discussed in our filings with the Securities and Exchange Commission. Such

factors include but are not limited to, increased competition, the performance of our

strategic product, BASE24-eps, demand for our products, restrictions and other financial

covenants in our credit facility, consolidations and failures in the financial services

industry, customer reluctance to switch to a new vendor, the accuracy of

management’s backlog estimates, the maturity of certain products, our strategy to

migrate customers to our next generation products, ratable or deferred recognition of certain

revenue associated with customer migrations and the maturity of certain of our products,

failure to obtain renewals of customer contracts or to obtain such renewals on

favorable terms, delay or cancellation of customer projects or inaccurate project

completion estimates, volatility and disruption of the capital and credit markets and

adverse changes in the global economy, our existing levels of debt, impairment of our goodwill or intangible

assets, litigation, future acquisitions, strategic partnerships and investments, risks related

to the expected benefits to be achieved in the transaction with Online Resources, the

complexity of our products and services and the risk that they may contain hidden

defects or be subjected to security breaches or viruses, compliance of our products

with applicable legislation, governmental regulations and industry standards, our compliance with

privacy regulations, the protection of our intellectual property in intellectual property

litigation, the cyclical nature of our revenue and earnings and the accuracy of

forecasts due to the concentration of revenue generating activity during the final weeks

of each quarter, business interruptions or failure of our information technology and

communication systems, our offshore software development activities, risks from operating internationally,

including fluctuations in currency exchange rates, exposure to unknown tax liabilities, and

volatility in our stock price. For a detailed discussion of these risk factors,

parties that are relying on the forward-looking statements should review our

filings with the Securities and Exchange Commission, including our most recently filed Annual

Report on Form 10-K, Registration Statement on Form S-4, and subsequent reports on

Forms 10-Q and 8-K. |

May

2013 ACI’s software underpins electronic payments throughout

retail and wholesale banking, and commerce all the time,

without fail.

www.aciworldwide.com |