Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED MAY 23, 2013 - DOVER Corp | ex99_1.htm |

| 8-K - DOVER CORP. FORM 8-K - DOVER Corp | form8k.htm |

Exhibit 99.2

Spin Off of Knowles Corporation

Conference Call

Conference Call

May 23, 2013 - 7:30am CT

Forward Looking Statements

We want to remind everyone that our comments may contain forward-looking

statements relating to, among other things, the planned separation of certain of our

communication technologies businesses, the potential benefits and timing thereof,

and the prospects and expected financial results of Dover and such separated

businesses after the planned transaction. Such forward-looking statements are

subject to inherent risks and uncertainties that could cause actual results to differ

materially from current expectations, and the forward-looking statements in this

presentation, including, but not limited to, unanticipated developments that delay

or negatively impact the planned transaction; changes in market conditions;

disruption to operations as a result of the planned transaction; the ability of the

businesses to operate independently; and the ability to retain key personnel. We

refer you to our filings with the Securities and Exchange Commission, such as our

reports on Form 10-K, Form 10-Q and Form 8-K, for a discussion of risks and

uncertainties that could cause our results to differ from those anticipated in any

forward-looking statements. We undertake no obligation to update any forward-

looking statement, except as required by applicable law.

statements relating to, among other things, the planned separation of certain of our

communication technologies businesses, the potential benefits and timing thereof,

and the prospects and expected financial results of Dover and such separated

businesses after the planned transaction. Such forward-looking statements are

subject to inherent risks and uncertainties that could cause actual results to differ

materially from current expectations, and the forward-looking statements in this

presentation, including, but not limited to, unanticipated developments that delay

or negatively impact the planned transaction; changes in market conditions;

disruption to operations as a result of the planned transaction; the ability of the

businesses to operate independently; and the ability to retain key personnel. We

refer you to our filings with the Securities and Exchange Commission, such as our

reports on Form 10-K, Form 10-Q and Form 8-K, for a discussion of risks and

uncertainties that could cause our results to differ from those anticipated in any

forward-looking statements. We undertake no obligation to update any forward-

looking statement, except as required by applicable law.

2

An Independent Global Communications Technology Leader

§ Dover plans to spin off certain Communication Technologies businesses to

shareholders

shareholders

• Transaction expected to be tax free to Dover and U.S. shareholders

§ New company, Knowles Corporation (“Knowles”), will have:

• Industry leading position in acoustic components and communication infrastructure

components

components

• Leading brands, technology and market presence

• High growth rate, solid profitability, strong cash flow and appropriate capital structure

§ Enables Knowles to pursue a focused and aggressive growth strategy

§ Dover remains a strong company, well positioned to focus on its key growth

spaces: Energy, Fluids, Refrigeration & Food Equipment, and Printing &

Identification

spaces: Energy, Fluids, Refrigeration & Food Equipment, and Printing &

Identification

3

Significant Opportunity for Shareholder Value Creation

Knowles’ Evolution - An Industry Leading Enterprise

§ We have built an industry leading enterprise in terms of brand recognition,

technology leadership and market presence

technology leadership and market presence

4

$1.4B

All-in CAGR: 15%; Organic CAGR: 9%

Major Milestones:

§ 2005: Knowles Electronics acquired

§ 2009: 1 billionth MEMs mic sold

§ 2011: Sound Solutions acquired

§ 2012: 3 billionth MEMs mic sold

§ 2012: Speakerbox product launched

§ 2013: 5 billionth MEMs mic sold *

Forecast

MEMs Growth: Significantly higher

* Projected for 2013

2009 2010 2011 2012 2013

Knowles’ Evolution - Strong Earnings Growth

§ Pro-forma EBITDA growth has been strong and margins are in the mid-20s

5

$350M

All-in CAGR: 19%

Notes: EBITDA reflects 100% of DCT segment’s corporate costs and adjustments for non-recurring

expenses such as restructuring, but does not consider any estimate for public company costs

expenses such as restructuring, but does not consider any estimate for public company costs

Forecast

2011

2012

2013

2010

2009

Knowles’ Unique Business Model

6

|

Consistent

with Dover

|

Unique to

Knowles |

|

|

Strong market tailwinds

|

ü

|

|

|

Strong financial performance

|

ü

|

|

|

Brand strength

|

ü

|

|

|

Innovation leadership

|

ü

|

|

|

Customer intimacy

|

ü

|

|

|

Dynamic R&D

|

|

ü

|

|

Faster product cycles

|

|

ü

|

|

Customer & investor profile

|

|

ü

|

|

High volume manufacturing

|

|

ü

|

We Believe Knowles is Best Positioned to Grow as a Standalone Company

§ The Knowles business model has evolved as its end-markets have developed

and grown

and grown

Knowles Profile

§ 2013 Pro-forma Revenue Forecast: ≈$1.3B

§ Pro-forma EBITDA margin profile: mid-20s

§ Key markets:

• Consumer electronics, hearing health

• Communications infrastructure

§ Key products:

• Acoustic components

• Communication infrastructure components

§ Appropriate capitalization: consistent

with investment grade metrics

with investment grade metrics

§ Significant industry momentum

• Fast growing smart phone segment

• Rising content per phone

• Several new product releases on horizon

§ Strong team in place, led by Jeffrey Niew,

current CEO of DCT

current CEO of DCT

7

Knowles

Key brands:

Notes: EBITDA reflects 100% of DCT segment’s corporate costs and adjustments for non-recurring

expenses such as restructuring, but does not consider any estimate for public company costs

expenses such as restructuring, but does not consider any estimate for public company costs

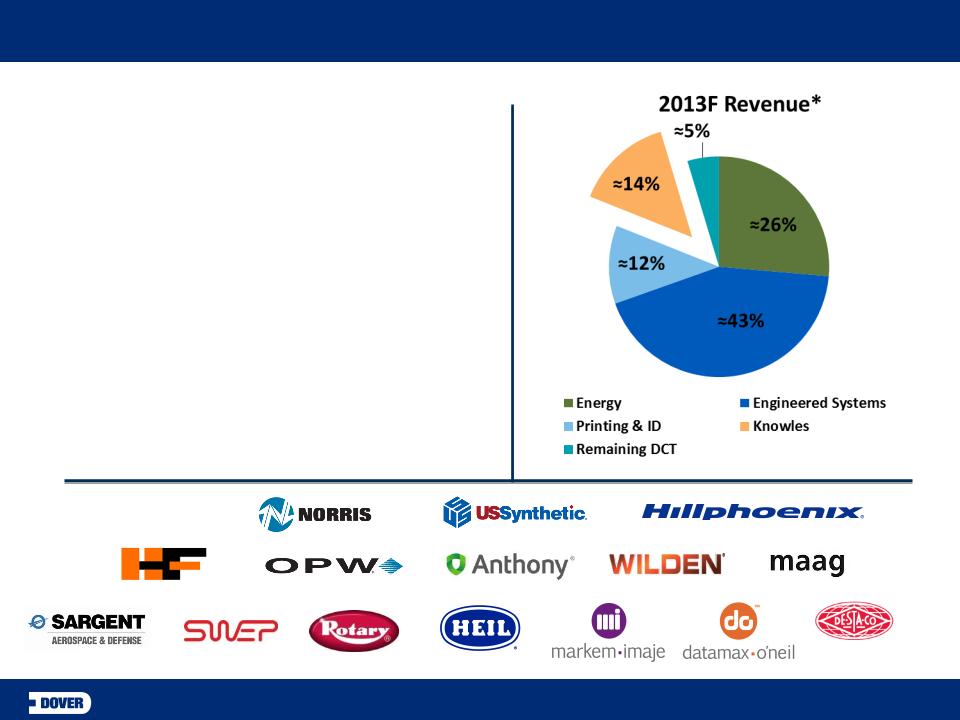

Dover Profile

8

§ 2013 Pro-forma Revenue Forecast:

$7.4B - $7.6B, after spin off of Knowles

$7.4B - $7.6B, after spin off of Knowles

§ Strong profitability and cash flow

§ Key markets:

• Refrigeration & food equipment, and industrial

• Drilling, production and downstream energy

• Fast moving consumer goods

§ Strong tailwinds:

• Increased global demand for energy

• Increased customer focus on energy efficiency

and sustainability

and sustainability

• Growing consumerism in developing economies

• Consumer product safety

Dover

Key brands:

* Total Dover,

before spin

before spin

Roadmap to Completion

§ Distribution of 100% of the stock of a new, independent, publicly

traded company to be named Knowles Corporation

traded company to be named Knowles Corporation

• Anticipated to be tax free to Dover and U.S. shareholders

• Expected one-time costs associated with transaction of $60 - $70 million

§ Transaction expected to close early next year, subject to, among

others:

others:

• Favorable IRS ruling

• Effectiveness of Form-10 registration statement to be filed with SEC

• Final approval by Dover Board of Directors

9

Spin Off will Benefit Both Knowles and Dover

§ Transaction will allow Knowles to pursue a more aggressive growth

strategy

strategy

• Invest to expand technology and manufacturing leadership

• Commitment to innovation

§ Dover continues to be focused on its key industrial end-markets

• Energy, Engineered Systems and Product Identification receive focused growth investment

§ Dover continues balanced capital allocation policy

• Internal growth, acquisitions, dividend growth and share repurchases

§ Benefits to shareholders

• Unlocks Knowles’ growth potential

• Simplifies Dover’s business profile

10

Clear Focus on Distinct Growth Strategies and Business Models Will Allow

Each Company to Create Significant Value for Shareholders

Each Company to Create Significant Value for Shareholders