Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEALED AIR CORP/DE | d541813d8k.htm |

| EX-99.1 - EX-99.1 - SEALED AIR CORP/DE | d541813dex991.htm |

SEALED AIR CORPORATION

Goldman Sachs Basic Materials Conference

May 22, 2013

Carol

P.

Lowe

–

Senior

Vice

President

&

Chief

Financial

Officer

Ryan

Flanagan

–

President

–

Protective

Packaging

Division

Exhibit 99.2 |

Safe

Harbor and Regulation G Statement •

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

can

be

identified

by

such

words

as

“anticipates,”

“believes,”

“plan,”

“assumes,”

“could,”

“estimates,”

“expects,”

“intends,”

“may,”

“plans to,”

“will”

and similar expressions.

Examples of these forward-looking statements include 2013 financial

expectations and assumptions associated with

our

restructuring

programs,

availability

and

pricing

of

raw

materials,

success

of

our

growth

programs,

economic conditions, and the success of pricing actions. These statements reflect

our beliefs and expectations as to future events and trends affecting our

business, our consolidated financial position and our results of operations.

A variety of factors may cause actual results to differ materially from these

expectations, including general domestic and international economic and

political conditions affecting packaging utilization; changes in our raw

material and energy costs; credit ratings; competitive conditions and contract

terms; currency translation and devaluation effects, including Venezuela;

the success of our financial growth, profitability and manufacturing

strategies and our cost reduction and productivity efforts; the effects of animal

and food-related health issues; pandemics; environmental matters;

regulatory actions and legal matters; and the successful integration of

Diversey. For

more

extensive

information,

see

“Risk

Factors”

and

“Cautionary

Notice

Regarding

Forward-

Looking Statements,”

which appear in our most recent Annual Report on Form 10-K, as filed with the

Securities and Exchange Commission, and as revised and updated by our

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

While we may elect to update these forward-looking statements at some point in the future,

we specifically disclaim any obligation to do so, whether as a result of new

information, future events, or otherwise.

•

Our management uses non-U.S. GAAP financial measures to evaluate the

Company’s performance, which exclude items we consider unusual or

special items. We believe the use of such financial measures and

information may be useful to investors. We believe that the use of non-U.S.

GAAP measures helps investors to gain

a

better

understanding

of

core

operating

results

and

future

prospects,

consistent

with

how

management

measures and forecasts the Company's performance, especially when comparing such

results to previous periods or forecasts. For important information on our

use of non-U.S. GAAP financial measures and information, including

reconciliations of such non-U.S. GAAP financial measures and information to

comparable U.S. GAAP measures and information, please refer to the

financial tables and information provided in our most recent earnings release. 1

|

Premium global provider with #1 or #2 position in our principal

applications

•

Food and Beverage (F&B)

–

Food Packaging and Food Solutions businesses, along with Diversey food and

beverage hygiene solutions business •

Institutional and Laundry (I&L)

–

Building services, food service, health care, hospitality and retail markets

•

Protective Packaging

–

Protective Packaging and Specialty Materials (formerly part of Other)

•

Medical Applications and New Ventures (Other category)

•

Geographic Reporting structure

–

North America

–

Europe

–

Latin America

–

AMAT (Asia, Middle East, Africa and Turkey)

–

Japan and Australia/New Zealand

2

49% F&B

28% I&L

21% Protective

2% Other

Diversified Revenue

Geographical

Reach

39% N. Am

33% Europe

11% L. Am

10% AMAT

7%

Japan/ANZ

24% Developing

regions

(1)

$7.6B

(1)

Developing Regions are Africa, Asia (excluding Japan and South Korea), Central and

Eastern Europe, and Latin America |

3

Food & Beverage: Value Creation In Operations and Downstream

Note: All classifications include the related equipment sales.

Sales Mix by End Sector:

Sales Mix by Geography:

40%

28%

14%

6%

12%

North America

Europe

Latin America

AMAT

Japan/ANZ

41%

15%

10%

15%

19%

Fresh Meat

Smoked &

Processed

Dairy

Microwavable

Meals

Cleaning &

Hygiene |

4

Institutional & Laundry: Reducing the “Total Cost to Clean”

Facility

Management &

BSC

Retailers

Hospitality

Food Service

Healthcare

*BSC=Building Service Contractors

Sales Mix by End Sector:

Sales Mix by Geography:

25%

45%

9%

18%

3%

North America

Europe

Latin America

AMAT

Japan/ANZ

11%

13%

11%

12%

9%

10%

34%

BSC*

Food Service

Retail

Lodging

Healthcare

Other

Distributors |

5

Protective Packaging: Focused on Sustainable & Efficient Delivery

*General Use=Bubblewrap, PakNatural loose fill, Jiffy mailers; Pack Sys=NewAir IB,

PriorityPak, Fill-Air, FilTeck, PackTiger, FasFil EZ, RapidFill Sales Mix

by Geography: Sales Mix by End Sector:

57%

24%

5%

8%

6%

North America

Europe

Latin America

AMAT

Japan/ANZ

38%

35%

17%

10%

Cushioning

General Use*

Shrink

Pack Systems* |

2013:

Focus on Quality of Earnings Improving

Profitability

6

Pricing Discipline

Deliver cost synergies and manage cost structure

Prioritizing

Resources

Repayment of debt

Dividends

R&D productivity

Aligning

Management

Goals

Productivity:

Support expenses measured in

relation to profitability

Achieving Plan:

Adjusted EBITDA

Cash Flow:

Reduced investment in working capital |

Q1

2013 Highlights 7

Please see Sealed Air’s May 1, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures.

Reported U.S. GAAP Measures: Q1-13 Operating Profit: $130M; Q1-12

Operating Profit: $ 83M Food and Beverage

Institutional & Laundry

Protective Packaging

Excluding SARs expense:

Q1 2013 Adjusted EBITDA $245M, 13.2% of Sales

Q1 2012 Adjusted EBITDA $240M, 13.0% of Sales

•

+1.9% Organic Growth

•

Growth Drivers:

Developing Regions,

Brazilian Beef Production,

Equipment

•

Challenges:

North

American and European

Protein Supply

Constraints, price-cost

spread

•

+1.2% Organic Growth

•

Growth Drivers:

Developing Regions,

Food Service

•

Challenges:

Southern

Europe, SARs expense,

machine sales,

distribution in mature

markets

•

-0.8% Organic Growth

•

Growth

Drivers:

E-

commerce/retail

•

Challenges:

Global

economic weakness,

customer mix,

price/cost spread |

Outlook for Full Year 2013

Management’s full year outlook includes:

–

Net Sales approximately $7.7 billion to $7.9 billion

–

Adjusted EBITDA approximately $1.01 billion to $1.03 billion

–

Earnings Per Share approximately $1.10 to $1.20 per share

–

Revised Free Cash Flow approximately $275 million to $325 million

•

Includes estimated cash costs of $65 million for earnings quality improvement

program and $70 million for the 2011-2014 Integration and Optimization

Program and anticipated higher SARs payments

•

Includes 2013 estimated capital expenditures of $160 million

•

2012 Free Cash Flow was $280 million and was net of $81 million of Integration and

Optimization cash payments and $125 million of capital expenditures

8

Please see Sealed Air’s May 1, 2013 earnings press release for important

information about the use of non-U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures. Adjusted

EPS guidance excludes the impact of special items. It also excludes the payment of the W. R. Grace settlement, as the exact timing

of the settlement is unknown. Final payment of the W. R. Grace settlement is

expected to be accretive to adjusted EPS by approximately $0.13 annually

following the payment date under the assumption of using a substantial portion of cash on hand for the payment and ceasing

to accrue interest on the settlement amount. Additionally, guidance excludes

any non-operating gains or losses that may be recognized in 2013 due to

currency fluctuations in Venezuela. |

Protective

Packaging – Value Proposition

•

Minimize total cost of

packaging

•

Improved labor productivity

•

Reduced storage space

requirements

•

Reduced freight costs

9

•

Retail presentation

•

Highest clarity, high-gloss

•

Clean, tight package

appearance

•

Ease of use

•

Custom printing

•

Cushioning, Blocking & Bracing,

Void Fill, Surface Protection,

Containment

•

Minimize impact of shock,

vibration, and abrasion

•

Reduced damage during

distribution

•

High performance

with less material

•

Market leader in

biodegradable and

compostable

packaging products

•

High recycled

content

•

Recycling programs

Maximum

Value

Product

Protection

Customer

Appeal

Operational

Efficiency

Sustainability |

•

Systematically shifting from product and geography to application and market

segment focus

•

Product lines and market / sales organization aligned with this shift

•

Instapak, Specialty

Foams, and Korrvu

product lines

•

Design driven solutions

which leverage SAC

support capabilities

•

Direct/Distribution/Fabric

ator sales model –

customer visibility is good

•

Instapak equipment and

service are key

competitive advantages

•

Products offer medium to

high levels of protection

Cushioning

Packaging

Systems

•

New Air Inflatable Bubble,

Fill Air Inflatable bags,

PackTiger Paper systems,

PriorityPak and Rapid Fill

systems

•

Based on a system &

consumable value sell

•

Sold through distribution,

but SAC has high visibility

through system support

•

Growth has been double

digits

•

Products offer low to

medium levels of

protection

Shrink Packaging

•

Cryovac and Opti shrink

films, and Shanklin

wrapping equipment

•

Based on a system &

consumable value sell

•

Sold through

distribution, but SAC

has good visibility

through technical sales

support

•

Products offer

unitization and display,

with light surface

protection

General Use

Cushioning Sales Force

General Use/PSS Sales Force

Shrink Sales Force

Protective Packaging –

Solution (Application) Segments

10

•

BubbleWrap, PE Foam,

Mailers and Loosefill

product lines

•

Primarily sold through

distribution

•

No systems or support

•

Ease of use and

affordability are key

considerations

•

Products offer low to

medium levels of

protection |

Protective

Packaging: Distribution Channels 11 |

SEALED AIR CORPORATION

Goldman Sachs Basic Industrials Conference

May 22, 2013

Q&A

Q&A

Q&A

Please see Sealed Air’s May 1, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures. All

results are on a continuing operations basis. 12 |

SEALED AIR CORPORATION

Goldman Sachs Basic Industrials Conference

May 22, 2013

Appendix

Appendix

Appendix

Please see Sealed Air’s May 1, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures. All

results are on a continuing operations basis. 13 |

Positive volume growth

across all Divisions

Offset by unfavorable

Foreign Exchange –

particularly in Latin America

14

Q1 Net Sales Bridge

($ in millions)

+19

+3

-14

1,853

1,845

Q1 2012

Volume

Price-Mix

Foreign

Exchange

Q1 2013 |

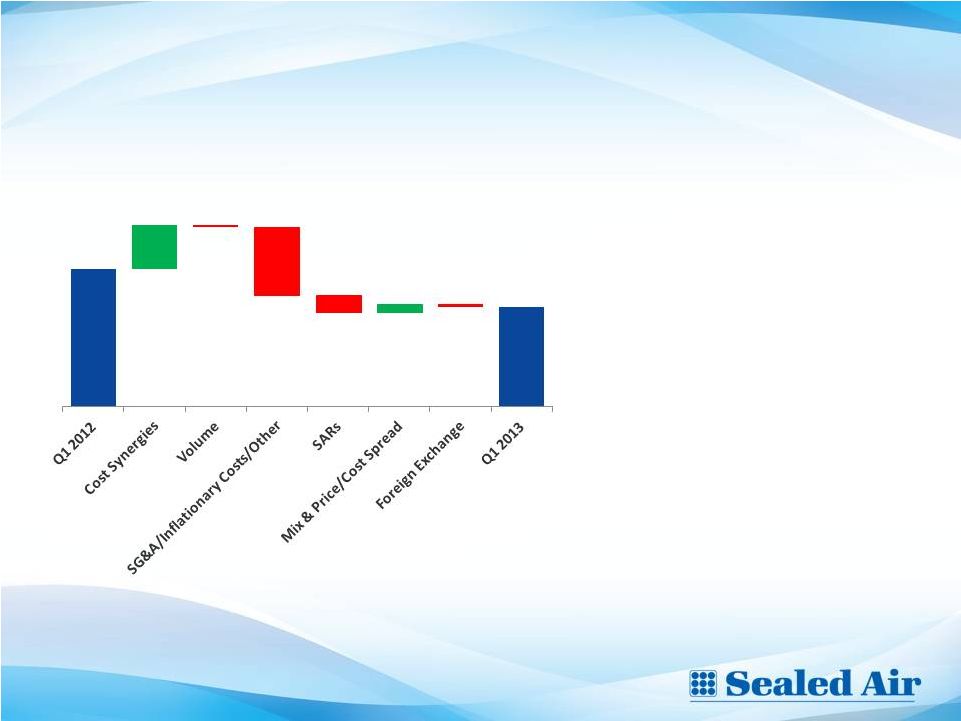

Q1

2013 Adjusted EBITDA Bridge 15

($ millions)

Please see Sealed Air’s May 1, 2013 earnings press release for important

information about the use of non-U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures.

•

Strong cost synergies

•

Offset by inflationary

expense growth and SARs

expense

•

Excluding the impact of

SARs expense, Q1 2013

EBITDA grew $5 million over

prior year

228

227

+29

+7

-17

-7

-6

-5

-2 |

Q1

2013 Adjusted EBITDA Bridge – F&B

16

($ millions)

Please see Sealed Air’s May 1, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures.

•

Strong cost synergies

•

Positive volume growth

•

Unfavorable SARs and

Price/Cost Spread

+13

+6

-8

-2

-3

-1

131

126 |

Q1

2013 Adjusted EBITDA Bridge – I&L

17

($ millions)

Please see Sealed Air’s May 1, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures.

•

Strong cost synergies

•

Unfavorable impact of

SG&A/Inflationary Cost

Increases

•

Unfavorable impact of

SARs expense

36

+11

-1

-17

-4

+2

-1

26 |

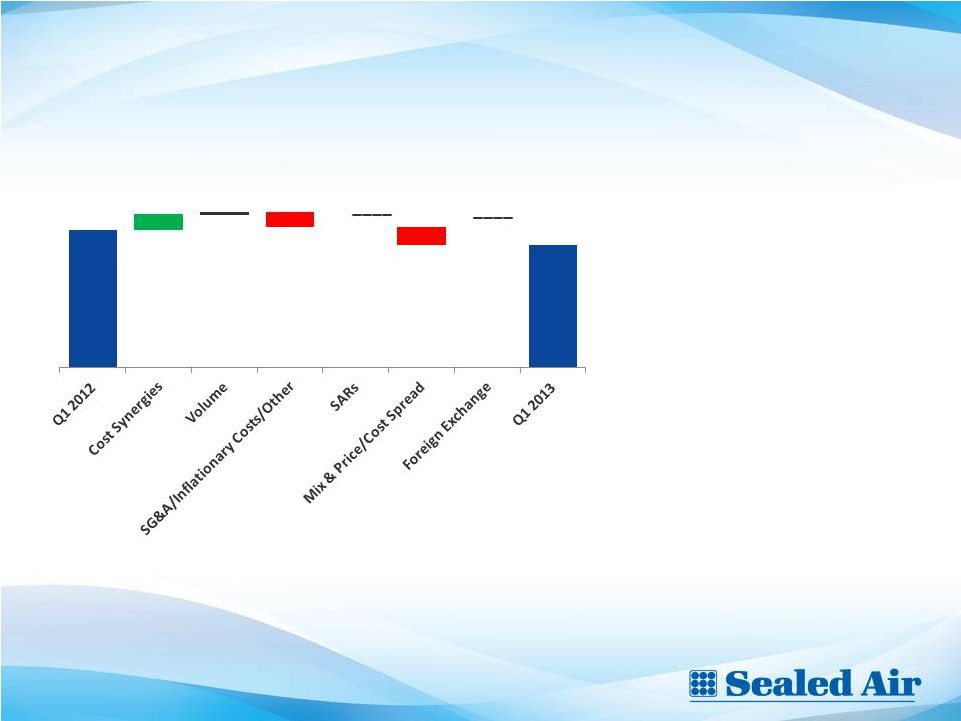

Q1

2013 Adjusted EBITDA Bridge – Protective Packaging

18

($ millions)

Please see Sealed Air’s May 1, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures.

•

Strong cost synergies

•

Unfavorable Price/Cost

Spread

61

+4

0

-3

0

-4

0

58 |

19

Q1 Refinancing Provides Maturity Extension at Attractive Rates

= Senior Secured Credit Facilities (term loans) = $1.626B

= Short Term Borrowings

= Bonds (associated interest rate) =

$2.925B Debt Maturity Schedule

($ millions)

12.0%

8.125%

8.375%

6.875%

*Reflects estimated cash liability at December 31, 2013. Exact timing of the

settlement is unknown. 6.5%

Net Total Leverage Ratio Covenant*

(fiscal

year

ending

December

31

st

)

2013

2014

2015

2016+

5.25

4.50

3.75

3.25

Weighted average interest rate

Is approx. 6.2%

5.25%

8

120

330

408

760

150

750

425

750

425

450

926

77

2013

2014

2015

2016

2017

2018

2019

2020

2021

2023

2033

= W. R. Grace Settlement

* |

Regional Sales Performance

First Quarter 2013

Latin

America

Reported: +5.4%

Organic: +11.9%

North

America

Reported: +0.2%

Organic: +0.2%

20

Please see Sealed Air’s May 1, 2013 earnings press release for important

information about the use of non- U.S. GAAP financial measurers,

including applicable reconciliations to U.S. GAAP financial measures.

Japan/ANZ

Reported: -2.3%

Organic: -0.6%

Europe

Reported: -2.1%

Organic: -2.4%

AMAT

Reported: +7.1%

Organic: +8.0% |