Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - FORLINK SOFTWARE CORP INC | v344442_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - FORLINK SOFTWARE CORP INC | v344442_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - FORLINK SOFTWARE CORP INC | v344442_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - FORLINK SOFTWARE CORP INC | v344442_ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - FORLINK SOFTWARE CORP INC | Financial_Report.xls |

U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

| x | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31, 2013

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from ________ to ________.

Commission File Number 000-18731

Forlink Software Corporation, Inc.

(Exact name of small business issuer as specified in its charter)

| Nevada | 98-0398666 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. employer identification number) |

| Shenzhou Mansion 9F, ZhongGuanCun South Street, No. 31, | |

| Haidian District, Beijing, China 100081 | |

| (Address of principal executive offices and zip code) | |

| 01186-10 6811 8866 | |

| (Registrant’s telephone number, including area code) | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer ¨ | |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company x | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

As of May 14, 2013, we had 4,651,173 shares of common stock issued and outstanding.

FORLINK SOFTWARE CORPORATION, INC.

FORM 10-Q

INDEX

| Page Number | ||

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | ii | |

| PART I. FINANCIAL INFORMATION | 1 | |

| Item 1. | Financial Statements (unaudited) | 1 |

| Consolidated Balance Sheets as of March 31, 2013 and December 31, 2012 | 2 | |

| Consolidated Statements of Operations | 3 | |

| Consolidated Statements of Cash Flows | 4 | |

| Notes to the Consolidated Financial Statements | 5 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 19 |

| Item 4. | Controls and Procedures | 27 |

| PART II. OTHER INFORMATION | 28 | |

| Item 6. | Exhibits | 28 |

| SIGNATURES | 29 | |

| i |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limited to growth and strategies, future operating and financial results, financial expectations and current business indicators, are based upon current information and expectations and are subject to change based on factors beyond the control of the Company. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “will,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update this forward-looking information. Nonetheless, the Company reserves the right to make such updates from time to time by press release, periodic report or other method of public disclosure without the need for specific reference to this Quarterly Report on Form 10-Q (“Form 10-Q”). No such update shall be deemed to indicate that other statements not addressed by such update remain correct or create an obligation to provide any other updates.

| ii |

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

The information required by Item 1 begins on the next page.

| 1 |

Forlink Software Corporation, Inc.

Consolidated Balance Sheets

(Expressed in US Dollars)

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 4,746,979 | $ | 103,578 | ||||

| Accounts receivable | 134,424 | 132,892 | ||||||

| Other receivables, deposits and prepayments (Note 3) | 721,178 | 672,475 | ||||||

| Inventories (Note 4) | 1,903,303 | 1,554,868 | ||||||

| Deferred taxes assets | 124,586 | 134,119 | ||||||

| Total current assets | 7,630,470 | 2,597,933 | ||||||

| Property, plant and equipment (Note 6) | 205,977 | 225,757 | ||||||

| Long term investments (Note 7) | 1,367,668 | 1,363,623 | ||||||

| Total assets | $ | 9,204,115 | $ | 4,187,313 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Short term borrowings | $ | 319,035 | $ | 318,193 | ||||

| Accounts payable | 65,930 | 16,629 | ||||||

| Amounts due to related party (Note 5) | 263,006 | 383,486 | ||||||

| Customer deposits | 5,600,903 | 2,631,583 | ||||||

| Other payables and accrued expenses (Note 8) | 749,360 | 864,052 | ||||||

| Other tax payable | 105,267 | - | ||||||

| Total current liabilities | $ | 7,103,501 | $ | 4,213,943 | ||||

| Shareholders’ equity | ||||||||

| Common stock, par value $0.001 per share; | ||||||||

| 200,000,000 and 200,000,000 shares authorized; | ||||||||

| 4,966,173 shares issued and 4,651,173 shares outstanding at March 31, 2013 and December 31, 2012 |

$ | 99,322 | $ | 99,322 | ||||

| Treasury stock | (163,800 | ) | (163,800 | ) | ||||

| Additional paid-in capital | 10,040,675 | 10,040,675 | ||||||

| Accumulated losses | (9,318,381 | ) | (11,437,544 | ) | ||||

| Accumulated other comprehensive income | 1,442,798 | 1,434,717 | ||||||

| Non-controlling interest | - | - | ||||||

| Total shareholders’ equity | $ | 2,100,614 | $ | (26,630 | ) | |||

| Total liabilities and shareholders’ equity | $ | 9,204,115 | $ | 4,187,313 | ||||

See accompanying notes to unaudited consolidated condensed financial statements.

| 2 |

Forlink Software Corporation, Inc.

Consolidated Statements of Operations

(unaudited)

(Expressed in US Dollars)

| Three Months ended | ||||||||

| March 31, | ||||||||

| 2013 | 2012 | |||||||

| Net sales | $ | 1,367,276 | $ | 214,633 | ||||

| Cost of sales | (349,160 | ) | (232,533 | ) | ||||

| Gross profit | 1,018,116 | (17,900 | ) | |||||

| Selling expenses | (271,043 | ) | (184,819 | ) | ||||

| Research and development expenses | (222,724 | ) | (246,732 | ) | ||||

| General and administrative expenses | (287,404 | ) | (313,553 | ) | ||||

| Bad debt recovery | 1,793,935 | - | ||||||

| Total operating expenses | 1,012,764 | (745,104 | ) | |||||

| Operating profit/(loss) | $ | 2,030,880 | $ | (763,004 | ) | |||

| Gain from cost method investee (Note 14) | 79,963 | - | ||||||

| Interest income | 1,266 | 933 | ||||||

| Interest expenses | (7,831 | ) | (6,355 | ) | ||||

| Other income, net | 24,759 | - | ||||||

| Profit / (Loss) before tax | $ | 2,129,037 | $ | (768,426 | ) | |||

| Income tax | (9,874 | ) | - | |||||

| Non-controlling interest | - | - | ||||||

| Net profit/(loss) | $ | 2,119,163 | $ | (768,426 | ) | |||

| Profit/(loss) per share | 0.46 | (0.17 | ) | |||||

| Weighted average common shares outstanding -basic and diluted | 4,651,173 | 4,651,173 | ||||||

See accompanying notes to unaudited consolidated condensed financial statements.

| 3 |

Forlink Software Corporation, Inc.

Consolidated Statements of Cash Flows

Increase in Cash and Cash Equivalents

(unaudited)

(Expressed in US Dollars)

| Three Months Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Cash flows from operating activities | ||||||||

| Net profit/(loss) | $ | 2,119,163 | $ | (768,426 | ) | |||

| Adjustments to reconcile net profit/(loss) to | ||||||||

| net cash provided by/(used in) operating activities | - | - | ||||||

| Non-controlling interest | - | - | ||||||

| (Gain)/loss from write-off of property, plant and equipment | - | - | ||||||

| Depreciation of property, plant and equipment | 23,218 | 27,932 | ||||||

| Income from equity method investee | - | - | ||||||

| Gain from cost method investee | (79,963 | ) | - | |||||

| Effect of deferred taxes | 9,874 | (84 | ) | |||||

| Change in: | ||||||||

| Accounts receivables | (718 | ) | (109,188 | ) | ||||

| Other receivables, deposits and prepayments | (44,583 | ) | 149,887 | |||||

| Inventories | (338,911 | ) | (249,881 | ) | ||||

| Accounts payable | 49,199 | 4,748 | ||||||

| Amounts due to related party | (122,829 | ) | 66,870 | |||||

| Customer deposits | 2,953,200 | 104,312 | ||||||

| Other payables and accrued expenses | (119,985 | ) | (142,868 | ) | ||||

| Income tax payable | - | - | ||||||

| Other taxes payable | 105,267 | - | ||||||

| Net cash provided by/(used in) operating activities | 4,552,932 | (916,698 | ) | |||||

| Cash flows from investing activities | ||||||||

| Purchase of long term investment | - | (364,657 | ) | |||||

| Acquisition of property, plant and equipment | (6,292 | ) | (203,884 | ) | ||||

| Buy-out of non-controlling interest | - | (5,781 | ) | |||||

| Proceeds from disposal of long term investment | - | - | ||||||

| Dividend from investee | 79,963 | - | ||||||

| Loan to another company | - | - | ||||||

| Net cash used in investing activities | 73,671 | (574,322 | ) | |||||

| Cash flows from financing activities | ||||||||

| Proceeds from short term borrowings | - | - | ||||||

| (Repayments to)/advances from shareholders | - | - | ||||||

| Proceeds from issuances of common stock under Plan 2002 | - | - | ||||||

| Net cash provided by financing activities | - | - | ||||||

| Effect of exchange rate changes | 16,798 | 13,266 | ||||||

| Net increase/(decrease) in cash and cash equivalents | 4,643,401 | (1,477,754 | ) | |||||

| Cash and cash equivalents at beginning of period | 103,578 | 1,692,449 | ||||||

| Cash and cash equivalents at end of period | $ | 4,746,979 | $ | 214,695 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Income tax paid | $ | - | $ | - | ||||

| Interest paid | $ | 7,831 | $ | 6,355 | ||||

See accompanying notes to unaudited consolidated condensed financial statements.

| 4 |

NOTE 1 - ORGANIZATION AND DESCRIPTION OF BUSINESS

Forlink Software Corporation, Inc. (the "Company" or the "Registrant" or "Forlink"), is a Nevada corporation which was originally incorporated on January 7, 1986 as "Why Not?, Inc. " under the laws of the State of Utah and subsequently reorganized under the laws of Nevada on December 30, 1993. From 1996 until 1999, the Company continued as an unfunded venture in search of a suitable business acquisition or business combination.

On November 3, 1999, we entered into a Plan of Reorganization with Beijing Forlink Software Technology Co., Ltd., (hereinafter "BFSTC"), a limited liability company organized under the laws of the PRC, under the terms of which BFSTC gained control of the Company. Pursuant to the Plan of Reorganization, we acquired 100% of the registered and fully paid-up capital of BFSTC in exchange for 20,000,000 shares of the Company's authorized, but unissued, common stock. BFSTC is engaged in the provision of computer software consultancy and engineering services and the development and sale of computer software in the PRC. As a part of its computer consultancy and engineering services, BFSTC is also engaged in the sale of computer hardware. In June 2001, BFSTC changed its name to Forlink Technologies Co. Ltd. (“FTCL”). FTCL is our major operating subsidiary in China.

On June 18, 2003, Forlink Technologies (Hong Kong) Limited (“FTHK”) was incorporated in Hong Kong Special Administrative Region as a limited liability company. In December 2003, FTHK became a wholly owned subsidiary of Forlink. FTHK is an investment holding company. Because of the favorable business environment in Hong Kong, we can simplify and speed up investment transactions through this subsidiary. Through FTHK, on December 18, 2003, we invested $760,870 in All China Logistics Online Co., Ltd. ("All China Logistics"), a privately held PRC company and a leading provider of logistic services in China, in exchange for a 17.8% equity interest. Through this investment, we have become the second largest shareholder of All China Logistics and its sole software solution provider. FTHK is also responsible for directly importing from overseas companies certain hardware needed for product integration, which allows us to improve our hardware pass-through profit margin.

On June 14, 2004, Forlink Technologies (Chengdu) Limited ("FTCD") was established as a limited liability company in Chengdu, PRC and subsequently became a wholly owned subsidiary of FTHK in September 2004. FTCD is in the business of providing software outsourcing services and software development. The registered capital of FTCD is $5,000,000 and the fully paid up capital was $750,000 as of December 31, 2005. In April 2006, FTHK further invested $130,000 in FTCD. FTCD commenced operations in late 2005. The registered capital of FTCD was reduced to $200,000 in December 2007.

In compliance with China’s foreign investment restrictions on telecom value-added services and other laws and regulations, we conduct our telecom value-added services and application integration services for government organizations in China via Beijing Forlink Hua Xin Technology Co. Ltd. ("BFHX"). BFHX was established in the PRC on September 19, 2003 as a limited liability company. The registered capital of BFHX is $120,733 (RMB 1,000,000) and was fully paid up as of March 31, 2005. Mr. Yi He and Mr. Wei Li have been entrusted as nominee owners of BFHX to hold 70% and 30%, respectively, of the fully paid up capital of BFHX on behalf of Forlink as the primary beneficiary. BFHX is considered a Variable Interest Entity ("VIE"), and because we are the primary beneficiary, our consolidated financial statements include BFHX. Upon the request of the Company, Mr. Yi He and Mr. Wei Li are required to transfer their ownership in BFHX to us or our designee at any time for the amount of the fully paid registered capital of BFHX. Mr. Yi He is the Chief Executive Officer, a director and a major stockholder of the Company. Mr. Wei Li is the administration manager of FTCL.

On October 12, 2006, we invested $31,969 (RMB 250,000) in Wuxi Stainless Steel Exchange Co., Ltd. (“Wuxi Exchange”), a PRC limited liability company, for a 12.5% equity interest. In addition, we agreed to deploy a proprietary, integrated software solution, estimated at RMB 1,000,000, to support Wuxi Exchange’s operations. The software was deployed in February 2007. On January 14, 2007, the Company entered into an agreement with a major shareholder of Wuxi Exchange pursuant to which the Company transferred 2.5% of the Company’s interest in Wuxi Exchange to this major shareholder for a cash payment of RMB 500,000. On February 2, 2012, Wuxi Exchange increased its registered capital to RMB 50,000,000, and since we invested additional funds into Wuxi Exchange, the ratio of our holding was still as a 10% equity interest.

| 5 |

On January 25, 2007, our board of directors and the majority holders of the Company’s common stock jointly approved an amendment to our Articles of Incorporation by written consent, to increase the number of authorized shares of common stock from 100,000,000 to 200,000,000. The Certificate of Amendment to our Articles of Incorporation to effect the increase of the number of our authorized common shares was filed with Nevada’s Secretary of State on April 4, 2007.

On July 12, 2007, we invested through FTGX, $1,063,830 (RMB 8,000,000) in Nanning Bulk Commodities Exchange Corporation Limited (“NNBCE”), a privately held PRC company, for an 80% equity interest. NNBCE became a subsidiary of FTGX. NNBCE, established on April 29, 2007, commenced operations on March 28, 2008, and provides logistical e-commerce service. On February 2, 2012 , FTHX paid $203,884 (RMB 1,285,960) to purchase all the equity interests of NNBCE.

On December 24, 2007, our board of directors and the majority holders of the Company’s common stock jointly approved an amendment to our Articles of Incorporation by written consent, to effect a 1-for-20 reverse stock split. The Certificate of Amendment to our Articles of Incorporation to effect the reverse split was filed with Nevada’s Secretary of State on February 21, 2008.

On February 8, 2010, the Company transferred all its ownership interests in FTCL to BFHX for the amount of FTCL’s 100% fully paid capital.

On October 8, 2010, the Company invested $151,213 (RMB 1,000,000), through BFHX, in Shanghai Shipping Freight Exchange Co., LTD (“SSFE”), a PRC limited liability company, established on October 8, 2010, for a 5% equity interest. SSFE began to commence its operations on March 25, 2011.

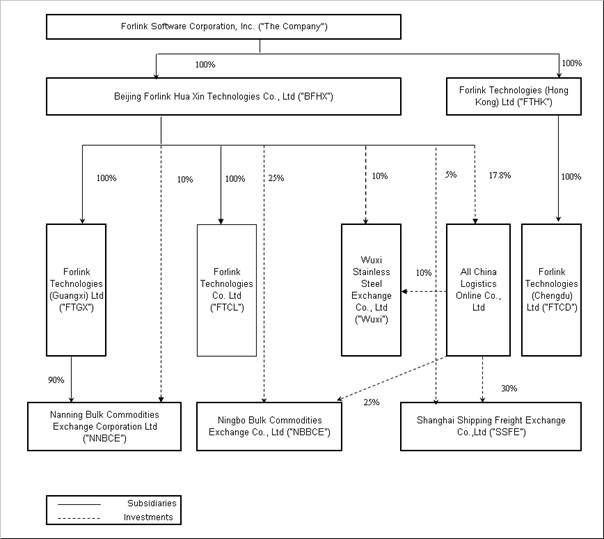

Forlink, its subsidiaries and VIE (hereinafter collectively referred to as the “Company”), are all operating companies. Set forth below is a diagram illustrating the Company’s corporate structure as of March 31, 2013:

| 6 |

| 7 |

NOTE 2 - BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting and Principles of Consolidation

The consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America that include the financial statements of Forlink and its subsidiaries and VIE, namely, FTCL, FTHK, BFHX, FTCD, FTGX, and NNBCE. All inter-entity transactions and balances have been eliminated.

Non-controlling interests at the balance sheet date, being the portion of the net assets of subsidiaries attributable to equity interests that are not owned by Forlink, whether directly or indirectly through subsidiaries, are presented in the consolidated balance sheet separately from liabilities and the shareholders’ equity. Non-controlling interests in the results of the Company for the years are also separately presented in the income statement.

Use of Estimates

The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Foreign Currency Translation and Transactions

The functional currency of Forlink is the US Dollar (“US$”) and the financial records are maintained and the financial statements prepared in US$. The functional currency of FTHK is the HK Dollar (“HK$”) and its financial records are maintained, and its financial statements prepared, in HK$. The functional currency of FTCL, BFHX, FTCD, FTGX, and NNBCE is the Renminbi (“RMB”) and their financial records are maintained, and their financial statements are prepared, in RMB.

Foreign currency transactions during the period are translated into each company’s denominated currency at the exchange rates on the transaction dates. Gain and loss resulting from foreign currency transactions are included in the consolidated statement of operations. Assets and liabilities denominated in foreign currencies at the balance sheet date are translated into each company’s denominated currency at the year-end exchange rates. All exchange differences are dealt with in the consolidated statements of operations.

The financial statements of the Company’s operations based outside of the United States have been translated into US$ under the guidance of the FASB Accounting Standards Codification (ASC) Topic 830 “Foreign Currency Matters”. Management has determined that the functional currency for each of the Company’s foreign operations is its applicable local currency. When translating functional currency financial statements into US$, year-end exchange rates are applied to the consolidated balance sheets, while average period rates are applied to consolidated statements of operations. Translation gains and losses are recorded in a translation reserve as a component of shareholders’ equity.

The value of the RMB is subject to changes in China’s central government policies and to international economic and political developments affecting supply and demand in the China Foreign Exchange Trading System market. Since 1994, the conversion of RMB into foreign currencies, including US$, has been based on rates set by the People’s Bank of China, which are set daily based on the previous day’s inter-bank foreign exchange market rates and current exchange rates on the world financial markets. Since 1994, the official exchange rate generally has been stable. In July 2005, the Chinese government announced that it would no longer peg its currency exclusively to US$, but would switch to a managed floating exchange rate based on market supply and demand with reference to a basket of currencies which would likely increase the volatility of RMB as compared to US$. The exchange rate of RMB to US$ changed from RMB8.28 to RMB8.11 in late July 2005.

| 8 |

The exchange rates used as of March 31, 2013 and December 31, 2012 are US$1:HK$7.76:RMB6.27, and US$1:HK$7.75:RMB6.29, respectively. The weighted average rates ruling for the periods ended March 31, 2013 and March 31, 2012 are US$1:HK$7.76:RMB6.28, and US$1:HK$7.79:RMB6.31, respectively.

Foreign Currency Risk

The RMB is not a freely convertible currency. The State Administration for Foreign Exchange, under the authority of the People’s Bank of China, controls the conversion of RMB into foreign currencies. The value of the RMB is subject to changes in central government policies and to international economic and political developments affecting supply and demand in the China Foreign Exchange Trading System market.

The PRC subsidiaries conduct their business substantially in the PRC, and their financial performance and position are measured in terms of RMB. Any devaluation of the RMB against the US$ would consequently have an adverse effect on the financial performance and asset values of the Company when measured in terms of US$. The PRC subsidiaries’ products are primarily procured, sold and delivered in the PRC for RMB. Thus, their revenues and profits are predominantly denominated in RMB. Should the RMB devalue against US$, such devaluation could have a material adverse effect on the Company’s profits and the foreign currency equivalent of such profits repatriated by the PRC entities to the Company.

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand and all highly liquid investments with an original maturity of three months or less.

Allowance for Doubtful Accounts

We record an allowance for doubtful accounts based on specifically identified amounts that the Company believes to be uncollectible. We have a limited number of customers with individually large amounts due at any given balance sheet date. Any unanticipated change in one of those customers’ credit worthiness or other matters affecting the collectability of amounts due from such customers could have a material effect on the results of operations in the period in which such changes or events occur. After all attempts to collect a receivable have failed, the receivable is written off against the allowance.

Inventories

Inventories are stated at the lower of cost or market. For inventory used in system integration services, cost is calculated using the specific identification method. For the sale of computer hardware, cost is calculated using first-in, first-out method. Cost includes all costs of purchase, cost of conversion and other costs incurred in bringing the inventories to their present location and condition. Market value is determined by reference to the sales proceeds of items sold in the ordinary course of business after the balance sheet date or to management estimates based on prevailing market conditions.

Property, Plant, Equipment and Depreciation

Property, plant and equipment are stated at cost. Depreciation is computed using the straight-line method to allocate the cost of depreciable assets over the estimated useful lives of the assets as follows:

| Estimated useful life (in years) | ||||

| Building | 20 | |||

| Computer equipment | 3 | |||

| Office equipment | 5 | |||

| Motor vehicle | 10 | |||

| 9 |

Major improvements of property, plant and equipment are capitalized, while expenditures for repair and maintenance and minor renewals and betterments are charged directly to the statements of operations as incurred. When assets are disposed of, the related cost and accumulated depreciation thereon are removed from the accounts and any resulting gain or loss is included in the statement of operations.

Computer Software Development Costs

Software development costs are expensed as incurred until technological feasibility in the form of a working model has been established. Deferred software development costs will be amortized over the estimated economic life of the software once the product is available for general release to customers. For the current software products, the Company determined that technological feasibility was reached at the point in time it was available for general distribution. Therefore, no costs were capitalized.

Long term investments

The Company’s long term investments consist of (1) equity investments which are accounted for in accordance with the equity method and (2) cost investments which are accounted for under the cost method. Under the equity method, each such investment is reported at cost plus the Company’s proportionate share of the income or loss or other changes in shareholders’ equity of each such investee since its acquisition. The consolidated results of operations include such proportionate share of income or loss. See Note 7.

Fair Values of Financial Instruments

The carrying amounts of financial instruments (cash and cash equivalents, investments, accounts receivable and accounts payable) approximate their fair values as of March 31, 2013 and December 31, 2012 because of the relatively short-term maturity of these instruments.

Revenue Recognition

The Company generally provides services under multiple element arrangements, which include software license fees, hardware and software sales, and the provision of system integration services including consulting, implementation, and software maintenance. The Company evaluates revenue recognition on a contract-by-contract basis as the terms of each arrangement vary. The evaluation of the contractual arrangements often requires judgments and estimates that affect the timing of revenue recognized in the statements of operations. Specifically, the Company may be required to make judgments about:

| · | whether the fees associated with our products and services are fixed or determinable; | |

| · | whether collection of our fees is reasonably assured; | |

| · | whether professional services are essential to the functionality of the related software product; | |

| · | whether we have the ability to make reasonably dependable estimates in the application of the percentage-of-completion method; and | |

| · | whether we have verifiable objective evidence of fair value for our products and services. |

The Company recognizes revenues in accordance with the provisions of ASC 985, “Software Revenue Recognition.” ASC 985 requires among other matters, that there be a signed contract evidencing an arrangement exists, delivery has occurred, the fee is fixed or determinable, and collectability is probable.

| 10 |

Software license revenue is recognized over the accounting periods contained in the terms of the relevant agreements, commencing upon the delivery of the software provided that (1) there is evidence of an arrangement, (2) the fee is fixed or determinable, and (3) collection of the fee is considered probable.

Revenue from non-software, multiple-element arrangements is recognized in accordance with ASC 605-25, “Revenue Arrangements with Multiple Deliverables”. Under ASC 605-25, the Company recognizes revenue from the multiple-deliverables that have value to the customer on a stand-alone basis. Deliverables in an arrangement that do not meet the separation criteria in ASC 605-25 are treated as one unit of accounting for purposes of revenue recognition.

In the case of maintenance revenues, vendor-specific objective evidence, or VSOE, of fair value is based on substantive renewal prices, and the revenues are recognized ratably over the maintenance period.

In the case of consulting and implementation services revenues, where VSOE is based on prices from stand-alone sale transactions, the revenues are recognized as services that are performed pursuant to ASC 985-605-25.

For hardware transactions where software is incidental, the Company does not apply separate accounting guidance to the hardware and software elements. The Company applies the provisions of ASC 985-605-15. Per ASC 985-605-15, if the software is considered not essential to the functionality of the hardware, then the hardware is not considered “software related” and is excluded from the scope of ASC 985-605-15. Such sale of computer hardware is recognized as revenue on the transfer of risks and rewards of ownership, which generally coincides with the time when the goods are delivered to customers and title has passed.

Remote hosting services, where VSOE is based upon consistent pricing charged to customers based on volumes and performance requirements on a stand-alone basis and substantive renewal terms, are recognized ratably over the contract term as the services are performed. The remote hosting arrangements generally require the Company to perform one-time set-up activities and include a one-time set-up fee. This one-time set-up fee is generally paid by the customer at the time of contract execution. The Company has determined that these set-up activities do not constitute a separate unit of accounting, and accordingly, the related set-up fees are recognized protractedly over the term of the contract.

The Company is considering the applicability of ASC 985-605-55, “Application of AICPA Statement of SOP 97-2 to Arrangements That Include the Right to Use Software Stored on Another Entity’s Hardware,” to the hosting services arrangements on a contract-by-contract basis. If the Company determines that the customer does not have the contractual right to take possession of the Company’s software at any time during the hosting period without significant penalty, ASC 985-605 would not apply to these contracts in accordance with ASC 985-605-55.

Stock Based Compensation

Effective January 1, 2006, we adopted “Statement of Financial Accounting Standards ASC 718, Share-Based Payment” using the modified prospective application transition method. Before we adopted ASC 718, we accounted for share-based compensation in accordance with “Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees.”

ASC 718 requires the Company to record the cost of stock options and other equity-based compensation in its income statement based upon the estimated fair value of those rewards. The Company elected to use the modified prospective method for adoption, which requires compensation expense to be recorded for all unvested stock options and other equity-based compensation beginning in the first quarter of adoption. Accordingly, prior periods have not been restated to reflect stock based compensation. On January 1, 2006, the Company adopted ASC 718 using the modified prospective method, and the adoption of this standard did not have a material impact on the Company’s consolidated financial statements because most of the Company’s outstanding stock options were vested as of December 31, 2005 and the unvested portion of the stock options was considered immaterial.

| 11 |

ASC 718 also requires the Company to estimate forfeitures in calculating the expense relating to share-based compensation as opposed to recognizing forfeitures as an expense reduction as they incur. The adjustment to apply estimated forfeitures to previously share-based compensation was considered immaterial by the Company and as such was not classified as a cumulative effect of a change in accounting principle. As of January 1, 2006, the Company had no unrecognized compensation cost remaining associated with existing stock option grants. Also, the Company made no modifications to outstanding stock option grants prior to the adoption of ASC 718, and there were no changes in valuation methodologies or assumptions compared to those used by the Company prior to January 1, 2006.

In November 2005, the FASB issued FSP No. 123(R)-3, “Transition Election Related to Accounting for the Tax Effects of Share-Based Payment Awards.” The Company adopted the alternative transition method provided in the FSP for calculating the tax effects of share-based compensation pursuant to ASC 718 in the fourth quarter of fiscal 2006. The alternative transition method includes simplified methods to establish the beginning balance of the Additional Paid-in Capital (“APIC”) pool related to the tax effects of employee share-based compensation, and to determine the subsequent impact on the APIC pool and Consolidated Statements of Cash Flows of the tax effects of employee share-based compensation awards that are outstanding upon adoption of ASC 718. The adoption did not have a material impact on the Company’s results of operations and financial position.

In February 2006, the FASB issued FASB ASC 718-10-35, “Classification of Options and Similar Instruments Issued as Employee Compensation That Allow for Cash Settlement upon the Occurrence of a Contingent Event.” This position amended ASC 718 to incorporate that a cash settlement feature that can be exercised only upon the occurrence of a contingent event that is outside the employee’s control does not meet certain conditions in ASC 718 until it becomes probable that the event will occur. The guidance in this FASB Staff Position was required to be applied upon initial adoption of ASC 718. The Company does not have any option grants that allow for cash settlement.

The Company did not adopt any new share-based compensation plans in 2013. Stock options issued under the Company’s 2002 Stock Plan were exercised for the purchase of 200,000 shares during the year 2008.

Advertising costs

All advertising costs incurred in the promotion of the Company’s products and services are expensed as incurred. Advertising expenses were insignificant for the three months ended March 31, 2013 and 2012.

Income Taxes

The Company accounts for income taxes in accordance with ASC 740 “Accounting for Income Taxes.” Under ASC 740, deferred tax liabilities or assets at the end of each period are determined using the tax rate expected to be in effect when taxes are actually paid or recovered. Valuation allowances are established when it is more likely than not that some or all of the deferred tax assets not be realized.

In July, 2006, the FASB ASC 740-10-25, “Accounting for Uncertainty in Income Taxes-an interpretation of FASB Statement No. 109.” This Interpretation provides guidance for recognizing and measuring uncertain tax positions, as defined in ASC 740, “Accounting for Income Taxes.” ASC 740-10-25 prescribes a threshold condition that a tax position must meet for any of the benefit of the uncertain tax position to be recognized in the financial statements. Guidance is also provided regarding derecognition, classification and disclosure of these uncertain tax positions.

Earnings Per Common Share

The Company computes net earnings per share in accordance with ASC 260, “Earnings per Share” and SEC Staff Accounting Bulletin No. 98 (“SAB 98”). Under the provisions of ASC 260 and SAB 98, basic net earnings per share is computed by dividing the net earnings available to common shareholders for the period by the weighted average number of shares of common stock outstanding during the period. The calculation of diluted net earnings per share gives effect to common stock equivalents, however, potential common stock in the diluted EPS computation are excluded in net loss periods, as their effect is anti-dilutive.

| 12 |

Recent Issued Accounting Guidance

In May 2011, the FASB issued ASU 2011-04 to provide a consistent definition of fair value (“FV”) and ensure that the FV measurement and disclosure requirements are similar between accounting principles generally accepted in the United States of America (“US GAAP”) and IFRS. ASU 2011-04 changes certain FV measurement principles and enhances the disclosure requirements particularly for Level 3 FV measurements. The adoption of ASU 2011-04 did not have any significant impact on the Company’s financial statements.

In July 2012, the FASB issued an authoritative pronouncement related to testing indefinite-lived intangible assets, other than goodwill, for impairment. Under the guidance, an entity testing an indefinite-lived intangible asset for impairment has the option of performing a qualitative assessment before calculating the fair value of the asset. If the entity determines, on the basis of qualitative factors, that the fair value of the indefinite-lived intangible asset is not more likely than not (i.e., a likelihood of more than 50 percent) impaired, the entity would not need to calculate the fair value of the asset. The guidance does not revise the requirement to test indefinite-lived intangible assets annually for impairment. In addition, the guidance does not amend the requirement to test these assets for impairment between annual tests if there is a change in events or circumstances; however, it does revise the examples of events and circumstances that an entity should consider in interim periods. The guidance was effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012. Early adoption is permitted. The adoption of this guidance did not have a significant effect on our consolidated financial statements.

In February, 2013, the FASB issued ASU 2013-02 that addresses the reporting of reclassifications out of accumulated other comprehensive income. This ASU clarifies FASB Codification Topic 220, Comprehensive Income, and requires an entity to report the effect of significant reclassifications out of accumulated other comprehensive income on the net income line items affected if the amount is required under US GAAP to be reclassified in its entirety to net income in the same reporting period. Amounts not required to be reclassified in their entirety to net income must be cross-referenced to other disclosures that provide additional detail about those amounts. These amendments are effective for reporting periods beginning after December 15, 2013. Because the only significant amounts in the Company’s accumulated other comprehensive income relate to foreign exchange translations, the Company does not expect significant impact by this standard in the foreseeable future.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a significant impact on the Company’s consolidated financial statements upon adoption.

NOTE 3 - OTHER RECEIVABLES, DEPOSITS AND PREPAYMENTS

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Other receivables | $ | 342,001 | $ | 282,942 | ||||

| Deposits | 378,167 | 267,481 | ||||||

| Prepayments | 1,010 | 122,053 | ||||||

| $ | 721,178 | $ | 672,476 | |||||

| 13 |

Other receivables include deposits for operating leases and advances to employee for traveling outlays.

NOTE 4 - INVENTORIES

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Computer hardware and software | $ | 218,862 | $ | 56,415 | ||||

| Work-in-progress | 1,684,441 | 1,498,453 | ||||||

| $ | 1,903,303 | $ | 1,554,868 | |||||

All the inventories were purchased for identified system integration contracts.

Work-in-progress includes payroll and other operating expenses associated with various contracts in progress.

NOTE 5 – RELATED PARTY TRANSACTIONS

The Company, from time to time, received from or made repayments to major stockholders who are also management of the Company. The amounts due from/to stockholders do not bear any interest and do not have clearly defined terms of repayment.

As of March 31, 2013, the amounts due to Mr. Yi He, who is a shareholder and CEO of the Company were $89,531 as compared with $146,663 on December 31, 2012; the amounts due to Mr. Wei Li, who is a shareholder and the administration manager of FTCL, were $146,436 as compared with $146,183 on December 31, 2012; the amounts due to Mr. Hongkeung Lam, who is a shareholder and CFO of the Company were $0 as compared with $63,639 on December 31, 2012. The amounts due to the stockholders above do not bear any interest and do not have clearly defined terms of repayment. The change of total amounts balance to Mr. Wei Li was caused totally by exchange rate fluctuation. The changes of total amounts balance to Mr. Yi He and Mr. Hongkeung Lam were caused by both repayment and exchange rate fluctuation.

NOTE 6 - PROPERTY, PLANT AND EQUIPMENT, NET

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Building | $ | 180,137 | $ | 180,137 | ||||

| Computer and office equipment | 1,110,641 | 1,107,203 | ||||||

| Motor vehicles | 149,657 | 149,657 | ||||||

| 1,440,435 | 1,436,997 | |||||||

| Less: Accumulated depreciation | (1,234,458 | ) | (1,211,240 | ) | ||||

| $ | 205,977 | 225,757 | ||||||

| 14 |

The building is located in Chengdu, PRC and was purchased on behalf of the Company by Mr. Yi He, one of the shareholders, directors and officers of the Company. By a shareholders’ resolution passed on March 8, 1999, it was ratified that the title to the building belonged to the Company. In 2005, the title to the building was transferred to Forlink Technologies (Chengdu) Limited.

NOTE 7 - LONG TERM INVESTMENTS

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Equity investments | $ | - | $ | - | ||||

| Cost investments | 1,367,668 | 1,363,623 | ||||||

| $ | 1,367,668 | 1,363,623 | ||||||

In December 2003, the Company invested $760,870 in a privately held PRC company, All China Logistics Online Co., Ltd., for a 17.8% equity interest. The Company has recorded the investment at cost because it does not have the ability to exercise significant influence over the investee.

On October 12, 2006, the Company entered into a definitive agreement to acquire 12.5% of registered capital in Wuxi Stainless Steel Exchange Co., Ltd. (“Wuxi”), a private held PRC company. In exchange for the 12.5% registered capital, the Company was to deploy a proprietary, integrated software solution (“software”), estimated at RMB 1,000,000, by reference to the similar products sold to third parties in 2006, to support Wuxi’s operations, plus RMB 250,000 cash payment to Wuxi. In 2006, the Company contributed cash of $31,969 (RMB 250,000), the software been deployed to Wuxi in December 2006. The Company recorded the investment at cost because it does not have the ability to exercise significant influence over Wuxi. On January 14, 2007, the Company entered into a Share Transfer Agreement with a major shareholder of Wuxi to transfer 2.5% interest in Wuxi held by the Company to the major shareholder for a cash payment of RMB 500,000. After this transfer, the Company continues to hold a 10% equity interest in Wuxi. On February 2, 2012, Wuxi Exchange increased its registered capital to RMB 50,000,000. We invested an additional $364,657 (RMB 2,300,000) into Wuxi Exchange, however, the ratio of our holding remained a 10% equity interest.

On September 17, 2007, the Company invested $99,734 in a privately held PRC Company, Ningbo Bulk Commodities Exchange Corporation Limited (“NBBCE”), for a 25% equity interest. The Company’s investment was made through BFHX. The Company recorded the investment at cost as the Company does not have the ability to exercise significant influence over NBBCE because NBBCE’s strategic and business decisions are dominated by another major shareholder. NBBCE terminated its operations as of December 31, 2011. The value of the investment was $0 at the end of March 31, 2013..

On October 8, 2010, the Company invested $151,213 (RMB 1,000,000), through BFHX, in Shanghai Shipping Freight Exchange Co., LTD (“SSFE”), a PRC limited liability company, established on October 8, 2010, for a 5% equity interest. The Company has recorded the investment at cost because it does not have the ability to exercise significant influence over the investee.

NOTE 8 - OTHER PAYABLES AND ACCRUED EXPENSES

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Other payables | $ | 545,773 | $ | 672,086 | ||||

| Accrued salaries & wages | 203,587 | 191,966 | ||||||

| $ | 749,360 | $ | 864,052 | |||||

| 15 |

Other payables includes rental payable and utilities payable.

NOTE 9 - INCOME TAX

According to the relevant PRC tax rules and regulations, FTCL, which is recognized as a New Technology Enterprise operating within a New and High Technology Development Zone, is entitled to an Enterprise Income Tax (“EIT”) rate of 15%.

Pursuant to approval documents dated September 23, 1999 and August 2, 2000 issued by the Beijing Tax Bureau and State Tax Bureau respectively, FTCL was fully exempted from EIT for fiscal years 1999, 2000, 2001 and 2002. FTCL received a 50% EIT reduction at the rate of 7.5% for fiscal years 2003, 2004 and 2005. As of December 31, 2010, FTCL was entitled to an EIT rate of 15%.

Pursuant to an approval document dated January 19, 2004 issued by the State Tax Bureau, BFHX was fully exempted from EIT for fiscal years 2004, 2005 and 2006. As of December 31, 2010, BFHX was entitled to an EIT rate of 25%.

Hong Kong profits tax is calculated at 16.5% on the estimated assessable profits of FTHK for the period. The EIT rate for FTCD, FTGX and NNBCE is 25%. No provision for EIT and Hong Kong profits tax were made for FTCL, FTCD, FTGX, NNBCE and FTHK as they have not gained taxable income for the periods.

On January 1, 2007, the Company adopted FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes-an interpretation of FASB Statement No. 109 (“FIN 48”). This Interpretation provides guidance for recognizing and measuring uncertain tax positions, as defined in ASC 740, Accounting for Income Taxes. FIN 48 prescribes a threshold condition that a tax position must meet for any of the benefits of the uncertain tax position to be recognized in the financial statements. Guidance is also provided regarding derecognition, classification and disclosure of these uncertain tax positions. The Company classified all interest and penalties related to tax uncertainties as income tax expense. The Company’s liability for income taxes includes the liability for unrecognized tax benefits, interest and penalties which relate to tax years still subject to review by taxing authorities. Audit periods remain open for review until the statute of limitations has passed. The completion of review or the expiration of the statute of limitations for a given audit period could result in an adjustment to our liability for income taxes. Any such adjustment could be material to the Company’s results of operations for any given quarterly or annual period based, in part, upon the results of operations for the given period. As of September 30, 2010, the Company does not have any liability for uncertain tax positions. The adoption of FIN 48 did not have a material impact on the Company’s results operations, financial position or liquidity.

On March 16, 2007, the 5th Plenary Session of the 10th National People's Congress passed the Corporate Income Tax Law of the PRC ("the New Corporate Income Tax Law"), which took effect on January 1, 2008. Beginning on that date, the EIT rate is expected to gradually increase to the standard rate of 25% over a five-year transition period. However, the New Corporate Income Tax Law does not specify how the existing preferential tax rate will gradually increase to the standard rate of 25%. Also, under the New Corporate Income Tax Law, certain high technology enterprises will continue to be entitled to a reduced tax rate of 15%. However, the implementation rules regarding the preferential tax policies (e.g. the details on how the taxpayer can qualify as a high-tech enterprise under the New Corporate Income Tax Law) have yet to be made public. Consequently, the Company is not able to make an estimate of the expected financial effect of the New Corporate Income Tax Law on its deferred tax assets and liabilities. The enactment of the New Corporate Income Tax Law did not have any financial effect on the provision for income tax for the year ended March 31, 2013 and on the amounts accrued in the balance sheet in respect of current tax payable.

| 16 |

NOTE 10 - OTHER TAXES RECOVERABLE/(PAYABLE)

Other taxes payable comprise mainly of the Valued-Added Tax (“VAT”) and Business Tax (“BT”). The Company is subject to output VAT levied at the rate of 17% of its operating revenue. The input VAT paid on purchases of materials and other direct inputs can be used to offset the output VAT levied on operating revenue to determine the net VAT payable or recoverable. BT is charged at a rate of 5% on the revenue from other services.

As part of the PRC government’s policy of encouraging software development in the PRC, companies that fulfill certain criteria set by the relevant authorities, and which develop their own software products and have the software products registered with the relevant authorities in the PRC, are entitled to a refund of VAT equivalent to the excess over 3% of revenue paid in the month when output VAT exceeds input VAT (excluding export sales). The excess portion of the VAT is refundable and is recorded by the Company on an accrual basis. The VAT rebate included in other income was $22,853 and $0 for the three months ended March 31, 2013 and 2012, respectively.

NOTE 11– COMPREHENSIVE INCOME/(LOSS)

The components of comprehensive income/(loss) were as follows:

| Three Months Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Net profit/(loss) | $ | 2,119,163 | $ | (768,426 | ) | |||

| Foreign currency translation adjustment | 8,081 | 15,151 | ||||||

| Comprehensive income/(loss) | $ | 2,127,244 | $ | (753,275 | ) | |||

NOTE 12 - CONCENTRATION OF CUSTOMERS

During the year, the following customers accounted for more than 10% of total sales:

| Three Months Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Net sales derived from: | ||||||||

| Customer A | 653,225 | * | ||||||

| Customer B | 364,640 | * | ||||||

| Customer C | 181,940 | * | ||||||

| Customer D | * | * | ||||||

| Customer E | * | 34,695 | ||||||

| % of total net sales from: | ||||||||

| Customer A | 48 | % | * | |||||

| Customer B | 27 | % | * | |||||

| Customer C | 13 | % | * | |||||

| Customer D | * | * | ||||||

| Customer E | * | 16 | % | |||||

| Account receivable from: | ||||||||

| Customer A | 51,046 | 125,296 | ||||||

| Customer B | 17,866 | * | ||||||

| Customer C | 15,952 | * | ||||||

| Customer D | * | * | ||||||

| Customer E | * | * | ||||||

| % of total accounts receivable from: | ||||||||

| Customer A | 38 | % | 40 | % | ||||

| Customer B | 13 | % | * | |||||

| Customer C | 12 | % | * | |||||

| Customer D | * | * | ||||||

| Customer E | * | * | ||||||

* Less than 10%

| 17 |

NOTE 13 – SUBSEQUENT EVENTS

On April 26, 2013, Forlink Technologies (BeiHai) Limited ("FTBH") was established as a limited liability company in BeiHai, PRC and subsequently became a wholly owned subsidiary of FTCL in April 2013. FTBH is in the business of providing software outsourcing services and software development. The registered capital of FTBH is $3,215,021 (RMB20,000,000) and the fully paid up capital was $3,215,021(RMB20,000,000) as of April 30, 2013. FTBH did not commence operations as of May 13, 2013.

NOTE-14- GAIN FROM COST METHOD INVESTEE

FTHX received a cash dividend of $79,963 from All China Logistics on January 2013.

| 18 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Statements contained herein that are not historical facts are forward-looking statements as that term is defined by the Private Securities Litigation Reform Act of 1995. Although we believe that the expectations reflected in such forward looking statements are reasonable, the forward looking statements are subject to risks and uncertainties that could cause actual results to differ from those projected. We caution investors that any forward looking statements made by us are not guarantees of future performance and that actual results may differ materially from those in the forward-looking statements. Such risks and uncertainties include, without limitation: well-established competitors who have substantially greater financial resources and longer operating histories, regulatory delays or denials, ability to compete as a company in a highly competitive market, and access to sources of capital.

The following discussion and analysis should be read in conjunction with our financial statements and notes thereto included elsewhere in this Form 10-Q. Except for the historical information contained herein, the discussion in this Form 10-Q contains certain forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. The cautionary statements made in this Form 10-Q should be read as being applicable to all related forward looking statements wherever they appear in this Form 10-Q. The Company's actual results could differ materially from those discussed here. We undertake no obligation to update publicly any forward-looking statements for any reason even if new information becomes available or other events occur in the future.

Overview

We are a provider of software solutions and information technology services in China (the “PRC” or “China”). We focus on providing Enterprise Application Integration (EAI) solutions for large companies in the telecom, finance, and logistics industries. In May 2004, we launched For-online, which delivers enterprise applications and services over the Internet to small and medium-sized enterprises (SMEs) in China. Since its launch, For-Online has become an important channel for delivering and distributing our products and services to more customers. In August 2007, we launched our integrated e-business application platform For-Online 4.0, and based on this platform, we also released new versions of For-eMarket 3.0 in September 2007, ForCRM in October 2007 and ForOA in October 2007. We released For-eMarketPlace 3.1 in August 2008. We released For-EAI 5.0 and For-Online 5.0 in June 2009. We released For-eTrade V1.0 and For-WMS V2.0 in January 2011 and SMS Gateway Management Platform V2.0 in November 2011.

Revenues

Our business includes Forlink’s “For-series” brand software system sales such as ForOSS, ForRMS, For-Mail and their copyright licensing, and “For-series” related system integration, which consists of hardware sales and other related services rendered to customers. The following table shows our revenue breakdown by business line:

| Three Months Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Sales of For-series software | $ | 1,320,121 | $ | 214,633 | ||||

| as a percentage of net sales | 97 | % | 100 | % | ||||

| For-series related system integration | $ | 47,155 | $ | 0 | ||||

| as a percentage of net sales | 3 | % | 0 | % | ||||

As indicated in the foregoing table, sales of For-series software increased by approximately 537% to $1,320,121 in the first quarter of 2013 from $214,633 in the comparable quarter of 2012. For-series related system integration as a percentage of net sales increased from $0 or 0% in the comparable quarter of 2012 to $47,155 or 3% in the first quarter of 2013. The gross margins for the three months ended March 31, 2013 and 2012 were 74% and (8%), respectively.

| 19 |

Generally, we offer our products and services to our customers on a total-solutions basis. Most of the contracts we undertake for our customers include revenue from hardware and software sales and professional services.

Sources of Revenue

Hardware Revenue: Revenues from sales of products are mainly derived from sales of hardware. All hardware is purchased from third-party vendors and included in customer contracts. Normally, the hardware that we procure is in connection with total-solutions basis system integration contracts.

Service Revenue: Service revenue consists of revenue for the professional services we provide to our customers for network planning, design and systems integration, software development, modification and installation, and related training services.

Software License Revenue: We generate revenue in the form of fees received from customers to whom we issue licenses for the use of our software products over an agreed period of time.

Cost of Revenue

Our cost of revenue includes hardware costs, software-related costs and compensation and travel expenses for the professionals involved in the relevant projects. Hardware costs consist primarily of third party hardware costs. We recognize hardware costs in full upon delivery of the hardware to our customers. Software-related costs consist primarily of packaging and written manual expenses for our proprietary software products and software license fees paid to third-party software providers for the right to sublicense their products to our customers as part of our solutions offerings. The costs associated with designing and modifying our proprietary software are classified as research and development expenses as such costs are incurred.

Operating Expenses

Operating expenses are comprised of selling expenses, research and development expenses and general and administrative expenses.

Selling expenses include compensation expenses for employees in our sales and marketing departments, third party advertising expenses, as well as sales commissions and sales agency fees.

Research and development expenses relate to the development of new software and the modification of existing software. We expense such costs as they are incurred.

General and administrative expenses include salaries and wages in the management section, office expenses, and travel expenses.

Taxes

According to the relevant PRC tax rules and regulations, FTCL is recognized as a New Technology Enterprise operating within a New and High Technology Development Zone, and as such is entitled to an Enterprise Income Tax (“EIT”) rate of 15%.

Pursuant to approval documents dated September 23, 1999 and August 2, 2000 issued by the Beijing Tax Bureau and the State Tax Bureau respectively, FTCL received a full exemption from EIT for fiscal years 1999 through 2002, and a 50% EIT reduction at the rate of 7.5% for fiscal years 2003 through 2005. As of March 31, 2013, FTCL was entitled to an EIT rate of 15%.

| 20 |

Pursuant to an approval document dated January 19, 2004 issued by the State Tax Bureau, BFHX received full exemption from EIT for fiscal years 2004 through 2006. As of March 31, 2013, BFHX was entitled to an EIT rate of 25%.

Hong Kong profits tax is calculated at 16.5% on the estimated assessable profits of FTHK for the period. The EIT rates for FTCD and NNBCE range from 9% to 33%.

Revenue from the sale of hardware procured in China together with the related system integration is subject to a 17% value added tax (“VAT”). However, companies that develop their own software and have the software registered are generally entitled to a VAT refund. If the net amount of the VAT payable exceeds 3% of software sales, the excess portion of the VAT is refundable upon our application to the tax authority. This policy is effective until 2013. Changes in Chinese tax laws may adversely affect our future operations.

Foreign Exchange

Our functional currency is the U.S. Dollar (“US$”), and our financial records are maintained and financial statements prepared in US$. The functional currency of FTHK is the Hong Kong Dollar (“HK$”) and the financial records are maintained and the financial statements prepared in HK$. The functional currency of Slait, FTCL, BFHX and FTCD is the Renminbi (“RMB”) and their financial records are maintained and the financial statements are prepared in RMB.

Foreign currency transactions during this reporting period are translated into each company’s denominated currency at the exchange rates ruling at the transaction dates. Gains and losses resulting from foreign currency transactions are included in the consolidated statement of operations. Assets and liabilities denominated in foreign currencies at the balance sheet date are translated into each company’s denominated currency at the applicable period-end exchange rates. All exchange differences are dealt with in the consolidated statements of operations.

The financial statements of our operations based outside of the United States have been translated into US$ under the guidance of the Foreign Currency Matters Topic of the FASB Accounting Standards Codification. We have determined that the functional currency for each of the Company’s foreign operations is its applicable local currency. When translating functional currency financial statements into US$, period-end exchange rates are applied to the consolidated balance sheets, while average period rates are applied to consolidated statements of operations. Translation gains and losses are recorded in translation reserve as a component of shareholders’ equity.

Exchange rates among US$, HK$ and RMB had minimal fluctuations during the periods presented. The applicable rates as of March 31, 2013 are US$1: HK$7.762: RMB6.629.The weighted average rates applicable for the three months ended March 31, 2013 are US$1: HK$7.759: RMB6.277.

| March 31, 2013 | ||||

| Applicable Rates | $1 US = 7.762 HK | 1 US = 6.269 RMB | ||

| Weighted Average Rates | $1 US = 7.759 HK | 1 US = 6.277 RMB | ||

Critical Accounting Policies and Estimates

We prepare our consolidated financial statements in accordance with generally accepted accounting principles in the United States of America. The preparation of those financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. On an on-going basis, we evaluate our estimates and judgments, including those related to revenues and cost of revenues under customer contracts, bad debts, income taxes, investment in affiliate, long-lived assets and goodwill. We base our estimates and judgments on historical experience and on various other factors that we believe are reasonable. Actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies affect the more significant judgments and estimates used in the preparation of our consolidated financial statements.

| 21 |

Revenue Recognition

We generally provide services under multiple element arrangements, which include software license fees, hardware and software sales, providing system integration services, including consulting, implementation, and software maintenance. We evaluate revenue recognition on a contract-by-contract basis as the terms of each arrangement vary. The evaluation of the contractual arrangements often requires judgments and estimates that affect the timing of revenue recognized in the statements of operations. Specifically, we may be required to make judgments about:

| · | whether the fees associated with our products and services are fixed or determinable; |

| · | whether collection of our fees is reasonably assured; |

| · | whether professional services are essential to the functionality of the related software product; |

| · | whether we have the ability to make reasonably dependable estimates in the application of the percentage-of-completion method; and |

| · | whether we have verifiable objective evidence of fair value for our products and services. |

We recognize revenues in accordance with the provisions of ASC 985, “Software Revenue Recognition.” ASC 985 requires among other matters, that there be a signed contract evidencing an arrangement exists, delivery has occurred, the fee is fixed or determinable, and collectability is probable.

Software license revenue is recognized over the accounting periods contained in the terms of the relevant agreements, commencing upon the delivery of the software provided that (1) there is evidence of an arrangement, (2) the fee is fixed or determinable, and (3) collection of the fee is considered probable.

Revenue from non-software, multiple-element arrangements is recognized in accordance with ASC 605-25, “Revenue Arrangements with Multiple Deliverables”. Under ASC 605-25, the Company recognizes revenue from the multiple-deliverables that have value to the customer on a stand-alone basis. Deliverables in an arrangement that do not meet the separation criteria in ASC 605-25 are treated as one unit of accounting for purposes of revenue recognition.

In the case of maintenance revenues, vendor-specific objective evidence, or VSOE, of fair value is based on substantive renewal prices, and the revenues are recognized ratably over the maintenance period.

In the case of consulting and implementation services revenues, where VSOE is based on prices from stand-alone sale transactions, the revenues are recognized as services that are performed pursuant to ASC 985-605-25.

For hardware transactions where software is incidental, the Company does not apply separate accounting guidance to the hardware and software elements. The Company applies the provisions of ASC 985-605-15. Per ASC 985-605-15, if the software is considered not essential to the functionality of the hardware, then the hardware is not considered “software related” and is excluded from the scope of ASC 985-605-15. Such sale of computer hardware is recognized as revenue on the transfer of risks and rewards of ownership, which generally coincides with the time when the goods are delivered to customers and title has passed.

Remote hosting services, where VSOE is based upon consistent pricing charged to customers based on volumes and performance requirements on a stand-alone basis and substantive renewal terms, are recognized ratably over the contract term as the services are performed. The remote hosting arrangements generally require the Company to perform one-time set-up activities and include a one-time set-up fee. This one-time set-up fee is generally paid by the customer at the time of contract execution. The Company has determined that these set-up activities do not constitute a separate unit of accounting, and accordingly, the related set-up fees are recognized protractedly over the term of the contract.

| 22 |

The Company is considering the applicability of ASC 985-605-55, “Application of AICPA Statement of SOP 97-2 to Arrangements That Include the Right to Use Software Stored on Another Entity’s Hardware,” to the hosting services arrangements on a contract-by-contract basis. If the Company determines that the customer does not have the contractual right to take possession of the Company’s software at any time during the hosting period without significant penalty, ASC 985-605 would not apply to these contracts in accordance with ASC 985-605-55.

Income Taxes

The Company accounts for income taxes in accordance with ASC 740 “Accounting for Income Taxes.” Under ASC 740, deferred tax liabilities or assets at the end of each period are determined using the tax rate expected to be in effect when taxes are actually paid or recovered. Valuation allowances are established when it is more likely than not that some or all of the deferred tax assets not be realized.

In July, 2006, the FASB ASC 740-10-25, “Accounting for Uncertainty in Income Taxes-an interpretation of FASB Statement No. 109.” This Interpretation provides guidance for recognizing and measuring uncertain tax positions, as defined in ASC 740, “Accounting for Income Taxes.” ASC 740-10-25 prescribes a threshold condition that a tax position must meet for any of the benefit of the uncertain tax position to be recognized in the financial statements. Guidance is also provided regarding derecognition, classification and disclosure of these uncertain tax positions.

Allowance for Doubtful Accounts

We record an allowance for doubtful accounts based on specifically identified amounts that the Company believes to be uncollectible. We have a limited number of customers with individually large amounts due at any given balance sheet date. Any unanticipated change in one of those customers’ credit worthiness or other matters affecting the collectability of amounts due from such customers could have a material effect on the results of operations in the period in which such changes or events occur. After all attempts to collect a receivable have failed, the receivable is written off against the allowance.

Recent Issued Accounting Guidance

In July 2012, the FASB issued an authoritative pronouncement related to testing indefinite-lived intangible assets, other than goodwill, for impairment. Under the guidance, an entity testing an indefinite-lived intangible asset for impairment has the option of performing a qualitative assessment before calculating the fair value of the asset. If the entity determines, on the basis of qualitative factors, that the fair value of the indefinite-lived intangible asset is not more likely than not (i.e., a likelihood of more than 50 percent) impaired, the entity would not need to calculate the fair value of the asset. The guidance does not revise the requirement to test indefinite-lived intangible assets annually for impairment. In addition, the guidance does not amend the requirement to test these assets for impairment between annual tests if there is a change in events or circumstances; however, it does revise the examples of events and circumstances that an entity should consider in interim periods. The guidance was effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012. Early adoption is permitted. The adoption of this guidance did not have a significant effect on our consolidated financial statements.

In February, 2013, the FASB issued ASU 2013-02 that addresses the reporting of reclassifications out of accumulated other comprehensive income. This ASU clarifies FASB Codification Topic 220, Comprehensive Income, and requires an entity to report the effect of significant reclassifications out of accumulated other comprehensive income on the net income line items affected if the amount is required under US GAAP to be reclassified in its entirety to net income in the same reporting period. Amounts not required to be reclassified in their entirety to net income must be cross-referenced to other disclosures that provide additional detail about those amounts. These amendments are effective for reporting periods beginning after December 15, 2013. Because the only significant amounts in the Company’s accumulated other comprehensive income relate to foreign exchange translations, the Company does not expect significant impact by this standard in the foreseeable future.

| 23 |

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a significant impact on the Company’s consolidated financial statements upon adoption.

Consolidated Results of Operations for the Three Months Ended March 31, 2013 and 2012.

The following table sets forth the results of our operations for the periods indicated:

| Three Months Ended | Three Months Ended | |||||||

| March 31, 2013 | March 31, 2012 | |||||||

| Net Sales | $ | 1,367,276 | $ | 214,633 | ||||

| Cost of Sales | (349,160 | ) | (232,533 | ) | ||||

| Gross Profit | 1,018,116 | (17,900 | ) | |||||

| Selling Expenses | (271,043 | ) | (184,819 | ) | ||||

| Research and Development Expenses | (222,724 | ) | (246,732 | ) | ||||

| General and Administrative Expenses | (287,404 | ) | (313,553 | ) | ||||

| Bad debt recovery | 1,793,935 | - | ||||||

| Operating Profit (Loss) | 2,030,880 | (763,004 | ) | |||||

| Other Income | 24,759 | - | ||||||

| Net Profit (Loss) | $ | 2,119,163 | $ | (768,426 | ) | |||

| Gain/Loss Per Share | 0.46 | (0.17 | ) | |||||

| Basic Weighted Average Shares Outstanding | 4,651,173 | 4,651,173 | ||||||

| Diluted Weighted Average Shares Outstanding | 4,651,173 | 4,651,173 | ||||||

Net Sales

For the three-month period ended March 31, 2013, our revenue was $1,367,276, an increase of approximately 537% from our revenue of $214,633 for the comparable period in 2012. The Company recognizes net sales based on certain revenue recognition criteria set forth in accordance with the accounting principles generally accepted in the United States. The significant increase in net sales was attributable to such criteria being met for certain service contracts from one of the Company’s major customers during the quarter, which added approximately $615,415 to net sales.

Cost of Sales

Our cost of sales was $349,160 for the three-month period ended March 31, 2013, which was an increase of approximately 50% from our cost of sales of $232,533 for the comparable period in 2012. The increase is associated with the significant increase in Net Sales.

Gross Profit

For the three-month period ended March 31, 2013, gross profit was $1,018,116, representing an increase of 5788% against ($17,900) for the comparable period in 2012. This increase was primarily attributable to the significant increase in both software sales and hardware sales for the quarter.

| 24 |

Operating Expenses

Total operating expenses were ($1,012,764) for the three-month period ended March 31, 2013, as compared to $745,104 for the comparable period in 2012, representing a decrease of 236%. The overall decrease in operating expenses is mainly attributable to the bad debt recovery of $1,793,935 for the three-month period ended March 31, 2013. On February 28, 2013, the Company received $1,793,935 (RMB 11,261,250) from one of its past major customers for a former debt (free of interest and penalties) that was written off as bad debt in 2011, which reduced the Company’s operating expenses. The past customer’s accounts receivable balance had been written off as bad debt in 2011 after the Company evaluated such balance for collectability and determined it was uncollectible for three consecutive years.

Selling expenses were $271,043 for the three-month period ended March 31, 2013, representing an increase of 32% against $184,819 for the comparable period in 2012. This increase was primarily due to increased compensation expense for the increased number of employees in our sales department.

Research and development expenses were $222,724 for the three-month period ended March 31, 2013, compared with $246,732 for the same period in 2012. The decrease was primarily attributable to a decrease in the number of new research projects in the first quarter of 2013, offset by an increase in expenses associated with ongoing research and development projects.

General and administrative expenses were $287,404 for the three-month period ended March 31, 2013, as compared to $313,553 for the same period in 2012, a decrease of 8%. The decrease was primarily due to a decrease in the acquisition of office supplies in the first quarter of 2013.

Operating Profit (Loss)