Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2013

o TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE EXCHANGE ACT

For the transition period from _____________ to _____________

CHINA LIAONING DINGXU ECOLOGICAL AGRICULTURE DEVELOPMENT, INC.

(Exact name of small business issuer as specified in its charter)

Commission File No. 333-170480

|

Nevada

|

80-0638212

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

Room 2119 Mingyong Building, No. 60 Xian Road.

Shahekou District, Dalian, China 116021

(Address of Principal Executive Offices)

0086-13909840703

(Issuer’s telephone number)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO þ

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 46,450,000 Shares of Common Stock, as of March 31, 2013 and May 17, 2013.

| PART I - FINANCIAL INFORMATION | |||||

| Item 1. | 4 | ||||

| Item 2. | 20 | ||||

| Item 3. | 34 | ||||

| Item 4. | 34 | ||||

| PART II - OTHER INFORMATION | |||||

| Item 1. | 36 | ||||

| Item 1A. |

36

|

||||

| Item 2. | 36 | ||||

| Item 3. | 36 | ||||

| Item 4. | 36 | ||||

| Item 5. | 36 | ||||

| Item 6. | 37 | ||||

| SIGNATURES | 38 | ||||

As used in this Form 10-Q Quarterly Report, unless the context requires or is otherwise indicated, the terms “we,” “us,” “our,” the “Registrant,” the “Company,” “our company” and similar expressions include the following entities (as defined below):

(i) China Liaoning Dingxu Ecological Agriculture Development, Inc., formerly known as

Hazlo! Technologies, Inc., a Nevada corporation (“Company”, “we”, or “us”), which is a publicly traded company;

(ii) China Liaoning DingXu Ecological Agriculture Development Co, Ltd., a BVI company ( “DingXu BVI”)

(iii) Panjin Hengrun Biological Technology Development Co., Ltd. 盘锦恒润生物技术开发有限公司, a limited liability company organized under the laws of the People’s Republic of China and a ninety-nine percent owned subsidiary of DingXu BVI (“Panjin Hengrun”)

(iv) Liaoning Dingxu Ecological Agriculture Development Co., Ltd.辽宁鼎旭生态农业发展有限公司, a limited liability company organized under the laws of the People’s Republic of China and an affiliated entity of Panjin Hengrun through contractual arrangements (“Liaoning Dingxu”).

“China” or “PRC” refers to the People’s Republic of China, excluding Hong Kong, Macau and Taiwan. “RMB” or “Renminbi” refers to the legal currency of China and “$” or “U.S. Dollars” refers to the legal currency of the United States. We make no representation that the RMB or U.S. Dollar amounts referred to in this report could have been or could be converted into U.S. Dollars or RMB, as the case may be, at any particular rate or at all. “GAAP” unless otherwise indicated refers to accounting principles generally accepted in the United States.

| AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS

|

|

(AMOUNTS EXPRESSED IN US DOLLARS)

|

|

|

As of

|

As of

|

||||||

|

|

March 31,

2013

|

December 31,

2012

|

||||||

|

(Unaudited)

|

(Audited)

|

|||||||

| ASSETS | ||||||||

|

|

|

|||||||

|

Cash and cash equivalents

|

518,229 | 21,245 | ||||||

|

Inventories

|

76,368 | 139,915 | ||||||

|

Advances to suppliers

|

150,446 | 148,895 | ||||||

|

Other receivables – related parties, net

|

- | 8,662 | ||||||

|

Other current assets

|

86,700 | 85,914 | ||||||

|

Total Current Assets

|

831,743 | 404,631 | ||||||

|

Property and equipment, net

|

10,959,310 | 11,090,729 | ||||||

|

Construction in progress

|

1,086,475 | 1,083,604 | ||||||

|

Land use right

|

5,723,972 | 5,768,262 | ||||||

|

Prepaid lease for land

|

868,337 | 879,470 | ||||||

|

Total Assets

|

$ | 19,469,837 | $ | 19,226,696 | ||||

|

|

|

|

||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

|

Current Liabilities:

|

|

|

||||||

|

Account payable

|

3,738 | 3,729 | ||||||

|

Accrued expenses

|

17,495 | 18,519 | ||||||

|

Other payable

|

1,516,021 | 2,879,287 | ||||||

|

Due to related parties

|

5,292,608 | 5,301,552 | ||||||

|

Total Current Liabilities

|

6,829,862 | 8,203,087 | ||||||

|

|

|

|

||||||

|

Long term payable

|

1,548,644 | 1,548,644 | ||||||

|

|

|

|

||||||

|

Total Liabilities

|

8,378,506 | 9,751,731 | ||||||

|

|

|

|

||||||

|

Stockholders' Equity:

|

|

|

||||||

|

|

|

|

||||||

|

Common stock ($0.001 par value; 75,000,000 shares authorized; 46,450,000 and

66,450,000 shares issued and outstanding at March 31, 2013 and December 31, 2012)

|

46,450 | 66,450 | ||||||

|

Additional paid-in capital

|

8,340,410 | 8,215,126 | ||||||

|

Retained earnings

|

2,264,093 | 806,192 | ||||||

|

Accumulated other comprehensive income

|

333,374 | 296,297 | ||||||

|

Non-controlling interests

|

107,004 | 90,900 | ||||||

|

|

|

|||||||

|

Total Stockholders' Equity

|

11,091,331 | 9,474,965 | ||||||

|

|

|

|

||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 19,469,837 | $ | 19,226,696 | ||||

See accompanying notes to unaudited consolidated financial statements

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

|

|

(AMOUNTS EXPRESSED IN US DOLLARS)

|

|

|

Three Months Ended

|

Three Months Ended

|

||||||

|

March 31,

2013

|

March 31,

2012

|

|||||||

|

(Unaudited)

|

(Unaudited and Restated)

|

|||||||

|

|

|

|||||||

|

NET REVENUES

|

$ | 3,348,006 | $ | 1,705,928 | ||||

|

|

|

|

||||||

|

COST OF REVENUES

|

1,535,050 | 1,401,862 | ||||||

|

|

|

|

||||||

|

GROSS PROFIT

|

1,812,956 | 304,066 | ||||||

|

|

|

|

||||||

|

OPERATING EXPENSES:

|

|

|

||||||

|

Depreciation and amortization

|

174,038 | 145,342 | ||||||

|

General and administrative

|

59,842 | 177,519 | ||||||

|

Total Operating Expenses

|

233,880 | 322,861 | ||||||

|

|

|

|

||||||

|

INCOME FROM OPERATIONS

|

1,579,076 | (18,795 | ) | |||||

|

|

|

|

||||||

|

OTHER INCOME (EXPENSE):

|

|

|

||||||

|

Other income

|

- | 353,475 | ||||||

|

Interest expense

|

(106,043 | ) | (99,312 | ) | ||||

|

|

|

|

||||||

|

INCOME BEFORE PROVISION FOR INCOME TAX

|

1,473,033 | 235,368 | ||||||

|

|

|

|

||||||

|

PROVISION FOR INCOME TAXES

|

- | - | ||||||

|

|

|

|

||||||

|

NET INCOME (LOSS) BEFORE NON-CONTROLLING INTERESTS

|

$ | 1,473,033 | $ | 235,368 | ||||

|

|

|

|

||||||

|

LESS: NET INCOME (LOSS) ATTRIBUTABLE TO NON-CONTROLLING INTERESTS

|

15,132 | 2,663 | ||||||

|

|

|

|

||||||

|

NET INCOME (LOSS)

|

$ | 1,457,901 | $ | 232,705 | ||||

|

|

|

|

||||||

|

OTHER COMPREHENSIVE INCOME:

|

|

|

||||||

|

Unrealized foreign currency translation gain(loss)

|

37,391 | (22,127 | ) | |||||

|

|

||||||||

|

LESS: OTHER COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO NON-CONTROLLING INTERESTS

|

314 | (220 | ) | |||||

|

|

|

|

||||||

|

COMPREHENSIVE INCOME

|

$ | 1,494,978 | $ | 210,798 | ||||

|

|

|

|

||||||

|

NET INCOME PER COMMON SHARE:

|

|

|

||||||

|

Basic

|

$ | 0.03 | $ | - | ||||

|

Diluted

|

$ | 0.03 | $ | - | ||||

|

|

|

|

||||||

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING:

|

|

|||||||

|

Basic

|

48,005,556 | 66,450,000 | ||||||

|

Diluted

|

48,005,556 | 66,450,000 | ||||||

See accompanying notes to unaudited consolidated financial statements

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|||||||

|

(AMOUNTS EXPRESSED IN US DOLLARS)

|

|

|

Three Months Ended March 31,

|

|||||||

|

|

2013

|

2012

|

||||||

|

|

(Unaudited)

|

(Unaudited and Restated)

|

||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|||||||

|

Net income

|

1,457,901 | 232,705 | ||||||

|

Net income attributable to non-controlling interests

|

15,132 | 2,663 | ||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

||||||

|

Depreciation and amortization

|

218,792 | 248,064 | ||||||

|

Imputed interest

|

105,942 | 89,310 | ||||||

|

Changes in assets and liabilities:

|

|

|

||||||

|

Account receivables

|

- | (256,734 | ) | |||||

|

Inventories

|

63,547 | 38,939 | ||||||

|

Other receivables – related parites

|

8,662 | - | ||||||

|

Other current assets

|

(786 | ) | - | |||||

|

Prepaid expense

|

9,582 | 602,650 | ||||||

|

Accounts payable and accrued liabilities

|

(1,410,235 | ) | (615,945 | ) | ||||

|

NET CASH PROVIDED BY OPERATING ACTIVITIES

|

468,537 | 341,652 | ||||||

|

|

|

|

||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

||||||

|

Purchase of property, plant and equipment

|

- | (18,907 | ) | |||||

|

Construction in progress

|

- | (39,718 | ) | |||||

|

Acquisition of land use right

|

- | (1,207,442 | ) | |||||

|

NET CASH USED IN INVESTING ACTIVITIES

|

- | (1,266,067 | ) | |||||

|

|

|

|

||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

||||||

|

Proceeds from bank loan

|

- | (1,326 | ) | |||||

|

Proceeds from related parties

|

- | 2,107,838 | ||||||

|

Repayment to related parties

|

(8,944 | ) | - | |||||

|

NET CASH PROVIDED BY(USD IN) FINANCING ACTIVITIES

|

(8,944 | ) | 2,106,512 | |||||

|

|

|

|

||||||

|

EFFECT OF EXCHANGE RATE ON CASH

|

37,391 | (22,127 | ) | |||||

|

|

|

|

||||||

|

NET INCREASE IN CASH AND CASH EQUIVALENTS

|

496,984 | 1,159,970 | ||||||

|

|

|

|

||||||

|

CASH AND CASH EQUIVALENTS - beginning of period

|

21,245 | 31,863 | ||||||

|

|

|

|

||||||

|

CASH AND CASH EQUIVALENTS - end of period

|

518,229 | 1,191,833 | ||||||

|

|

|

|

||||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

|

|

|

||||||

|

Cash paid for Interest

|

- | 10,001 | ||||||

|

Cancellation of common shares by shareholder

|

20,000 | |||||||

|

NON-CASH INVESTING ACTIVITIES

|

||||||||

|

Payable incurred due to land use right acquisition

|

- | 1,548,644 | ||||||

See accompanying notes to unaudited consolidated financial statements

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013 AND 2012

NOTE 1. ORGANIZATION AND DESCRIPTION OF BUSINESS

China Liaoning Dingxu Ecological Agriculture Development Inc. (the "Company") was incorporated under the laws of State of Nevada on August 19th, 2010. The Company is primarily engaged in the growing and selling of agriculture products in People’s Republic of China (“PRC”).

On December 12, 2011, the Company entered a Share Exchange Agreement with DingXu BVI Shareholder (Chin Yung Kong) under which the Company issued 60,000,000 shares of common stock to Chin Yung Kong to acquire 100% of the issued and outstanding shares of DingXu BVI.

China Liaoning DingXu Ecological Agriculture Development Co, Ltd., a BVI company (the “DingXu BVI”) was incorporated under the laws of British Virgin Islands on April 15, 2011. Chin Yung Kong was the sole shareholder and director of DingXu BVI.

On July 5, 2011, DingXu BVI formed Panjin Hengrun Biological Technology Development Co, Ltd., a limited liability company organized under the laws of the People’s Republic of China (“Panjin Hengrun”). DingXu BVI owns 99% of the total ownership of Panjing Hengrun.

On November 28, 2011, Panjin Hengrun entered into a set of contractual arrangements with Liaoning Dingxu Ecological Agriculture Development Co., Ltd., a limited liability company organized under the laws of the People’s Republic of China and an affiliated entity of Panjin Hengrun through contractual arrangements (“Liaoning Dingxu”). The contractual arrangements are comprised of a series of agreements, including a Consulting Service Agreement and an Operating Agreement, through which Panjin Hengrun has the right to advise, consult, manage and operate Liaoning Dingxu to collect and own all of Liaoning Dingxu’s net profits and net losses. Additionally, under a Proxy Agreement, the shareholders of Liaoning Dingxu have vested their voting control over Liaoning Dingxu to Panjin Hengrun. In order to further reinforce Panjin Hengrun’s rights to control and operate Liaoning Dingxu. Liaoning Dingxu and its shareholders have granted Panjin Hengrun, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in Liaoning Dingxu, or, alternatively, all of the assets of Liaoning Dingxu. Further, the shareholders of Liaoning Dingxu agreed to pledge all of their rights, titles and interests in Liaoning Dingxu under an Equity Pledge Agreement.

Upon entry of these contractual arrangements, Liaoning Dingxu became the Variable Interest Entities (“VIE”) of Panjin Hengrun pursuant to FIN 46 (R) and Panjin Hengrun was able to carry out business operations through Liaoning Dingxu.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States of America (“US GAAP”). The company maintains its books and accounting records in Renminbi (“RMB”), and its reporting currency is United States dollars.

ACCOUNTING METHOD

The Company’s financial statements are prepared using the accrual method of accounting. The Company has elected a fiscal year ending on December 31.

USE OF ESTIMATES

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. In the opinion of management, all adjustments necessary in order to make the financial statements not misleading have been included. Actual results could differ from those estimates.

CASH AND CASH EQUIVALENTS

The Company considers all highly liquid investments with maturity of three months or less when purchased to be cash equivalents. The Company recroded cash balance of $518,229 and $21,245 as of March 31, 2013 and December 31, 2012, respectively. Company did not have cash equivalent as of March 31, 2013 and December 31, 2012.

INVENTORIES

Inventories are stated at the lower of cost or market value. Cost is determined using moving weighted average method. Inventories consist of raw materials, finished goods and growing crops. Cost of finished goods comprises direct material and direct production cost based on normal operating capacity.

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are stated at cost less accumulated depreciation and impairment. Depreciation on property, plant and equipment is calculated on the straight-line method after taking into account their respective estimated residual values over the estimated useful lives of the assets as follows:

|

Building

|

20

|

years | |

|

Plant equipment

|

5-10

|

years | |

|

Office equipment

|

3-5

|

years | |

|

Vehicles

|

4 | years |

Maintenance and repair costs are expensed as incurred, whereas significant renewals and betterments are capitalized.

Construction in progress represents capital assets under construction or being installed and is stated at cost. Cost comprises original cost of plant and equipment, installation, construction and other direct costs prior to the date of reaching the expected usable condition. Construction in progress is transferred to the property, plant and equipment and depreciation commences when the asset has been substantially completed and reaches the expected usable condition.

LAND USE RIGHTS

The Company states land use right at cost less accumulated amortization. The land use right is amortized on straight line method during the contract period.

The Company has land use rights to 24,806 square meters of land. The term of the land use rights is 50 years, starting in March 2011. The land use right in the amount of $579,580 was fully paid during 2011. For the three months ended March 31, 2013 and 2012, the Company recorded amortization expense of $2,913 and $2,901, respectively. The Company recorded the land use right net value of $559,236 and $560,664 as of March 31, 2013 and December 31, 2012 respectively.

The Company has land use rights to 56,139 square meters of land. The term of the land use rights is 46 years, starting in March 2011. The land use right in the amount of $2,698,027 was not yet fully paid for as of December 31, 2012 and was fully paid as of March 31,2013. Company recorded liabilities related to this land use right in the amount of $nil and $491,926 as of March 31, 2013 and December 31, 2012 respectively. For the three months ended March 31, 2013 and 2012, the Company recorded amortization expense of $14,553 and $14,495, respectively. The Company recorded the land use right net value of $2,595,372 and $2,603,032 as of March 31, 2013 and December 31, 2012 respectively.

The Company has land use rights to 428,214 square meters of land. The term of the land use rights is 18 years, starting in January 2012. The Company recorded amortization expense of $38,404 and $38,303 for the three months ended March 31, 2013 and 2012 respectively. The Company recorded the land use right net value of $2,569,364 and $2,757,776 as of March 31, 2013 and December 31, 2012 respectively. As the land use right was not yet fully paid for as of March 31, 2013, the Company recorded long term liabilities related to this land use right in the amount of $1,548,644 as of March 31, 2013 and December 31, 2012 respectively.

LONG TERM PREPAID LEASE

Leases where substantially all the risks and rewards of ownership of assets remain with the lessor are accounted for as operating leases. Payments made under operating leases net of any incentives received from the lessor are charged to the consolidated statements of operations on a straight-line basis over the terms of the underlying lease.

The Company records lease payments at cost less accumulated. The Company entered into long term agreements with certain unrelated parties to rent land. The lease payments are recorded as operating lease expenses using the straight line method during the contract period of 20 years. The lease payments for the entire contract period in the amount of $1,030,900 were prepaid during 2011. For the three months ended March 31, 2013 and 2012, the Company recorded lease expense of $13,643 and $13,588, respectively. Company recorded prepaid lease expenses at net, in the amount of $868,337 and $879,470 as of March 31, 2013 and December 31, 2012 respectively.

REVENUE RECOGNITION

Sales revenue is recognized at the date of shipment from the Company’s facilities to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, ownership has passed, no other significant obligations of the Company exist and collectibility is reasonably assured.

The Company’s revenue consists of the invoiced value of goods, net of value-added tax (“VAT”).

The Company currently has no warranty or return policy as all sales are final.

TAXATION

Taxation on profits earned in the PRC has been calculated on the estimated assessable profits for the year at the rates of taxation prevailing in the PRC where the Company operates after taking into effect the benefits from any special tax credits or “tax holidays” allowed in the county of operations.

The Company does not accrue United States income tax since it has no operating income in the United States. The operating subsidiary is organized and located in the PRC and do not conduct any business in the United States.

Enterprise income tax

In accordance with the relevant tax laws in the PRC, as an agriculture growing enterprise, the operating subsidiary is exempted from enterprise income tax from 2010 to 2012 and sequentially exempted from enterprise income tax

TAXATION (CONTINUED)

from 2013 to 2015. Accordingly, the Company statutory rate was 0% and 0% for the three months ended March 31, 2013 and 2012, respectively.

Value added tax

The Provisional Regulations of The People’s Republic of China Concerning Value Added Tax promulgated by the State Council came into effect on January 1, 1994. Under these regulations and the Implementing Rules of the Provisional Regulations of the PRC Concerning Value Added Tax, value added tax is imposed on goods sold in or imported into the PRC and on processing, repair and replacement services provided within the PRC.

In accordance with the relevant tax laws in the PRC, as an agriculture growing enterprise, the Company is exempted from VAT from 2010 to 2012 and sequentially exempted from VAT from 2013 to 2015.

FOREIGN CURRENCY TRANSLATION

The reporting currency of the Company is the U.S. dollar. The functional currency of the parent company is the U.S. dollar and the functional currency of the Company’s operating subsidiaries and variable interest entities is the RMB. For the subsidiaries and variable interest entities whose functional currencies are the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. All of the Company’s revenue transactions are transacted in the functional currency. The Company does not enter any material transaction in foreign currencies and accordingly, transaction gains or losses have not had, and are not expected to have, a material effect on the results of operations of the Company.

In accordance with ASC Topic 230, cash flows from the Company’s operations are calculated based upon the local currencies using the average translation rate. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheets.

ACCUMULATED OTHER COMPREHENSIVE INCOME

Accumulated other comprehensive income represents the change in equity of the Company during the periods presented from foreign currency translation adjustments.

NEW ACCOUNTING PRONOUNCEMENTS

In February 2013, the FASB issued ASU 2013-02, “Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income.” This ASU does not change the current requirements for reporting net income or other comprehensive income in financial statements. However, this guidance requires an entity to provide information about the amounts reclassified out of accumulated other comprehensive income by component. In addition, an entity is required to present, either on the face of the statement, where net income is presented or in the notes, significant amounts reclassified out of accumulated other comprehensive income by the respective line items of net income but only if the amount reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting period. For other amounts that are not required under U.S. GAAP to be reclassified in their entirety to net income, an entity is required to cross-reference to other disclosures required under U.S. GAAP that provide additional detail about those amounts. For public entities, the guidance is effective prospectively for reporting periods beginning after December 15, 2012. For nonpublic entities, the guidance is effective prospectively for reporting periods beginning after December 15, 2013. Early adoption is permitted. The adoption of this standard is not expected to have a material impact on the Company’s consolidated financial position and results of operations.

NEW ACCOUNTING PRONOUNCEMENTS (CONTINUED)

In July 2012, the FASB issued ASU 2012-02, “Intangibles-Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment.” This ASU simplifies how entities test indefinite-lived intangible assets for impairment, which improves consistency in impairment testing requirements among long-lived asset categories. These amended standards permit an assessment of qualitative factors to determine whether it is more likely than not that the fair value of indefinite-lived intangible assets is less than their carrying value. For assets in which this assessment concludes it is more likely than not that the fair value is more than its carrying value, these amended standards eliminate the requirement to perform quantitative impairment testing as outlined in the previously issued standards. The guidance is effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012. Early adoption is permitted. The adoption of this standard is not expected to have a material impact on the Company’s consolidated financial position and results of operations.

NOTE 3. ADVANCE TO SUPPLIER

Advance to supplier was mainly used to record the advance paid as deposit on equipments and raw materials being purchased. Advance to supplier at March 31, 2013 and December 31, 2012 consisted of the following:

|

March 31,

2013

|

December 31,

2012

|

|||||||

|

LanZhou LinMeiKe machine manufacture Co, LTD

|

$ | 27,716 | $ | 27,643 | ||||

|

PanJin JingZe Rice Co, LTD

|

79,759 | 79,548 | ||||||

|

Others

|

42,971 | 41,704 | ||||||

| 150,446 | 148,895 | |||||||

NOTE 4. INVENTORIES

Inventories consist of raw materials, finished goods, and growing crops.

Raw materials that were not put into production as of period end were stated at lower cost or market. Company recorded raw material of $56,538 and $16,781 as of March 31, 2013 and December 31, 2012, respectively.

Finished goods consisted of dried mushroom and rice that was purchased from third parties as of March 31, 2013. Company recorded dried mushroom finished goods of $64 and $63 as of March 31, 2013 and December 31, 2012, respectively. Company recorded rice inventories of $18,450 and $nil as of March 31, 2013 and December 31, 2012 respectively.

Growing crops are valued at the lower of cost or market and are deferred and charged to cost of goods sold when the related crop is harvested and sold. The deferred growing costs included in inventory in the consolidated balance sheets consist primarily of raw material of the crops, direct labor, depreciation of fixed assets used directly in growing, land lease payment for the field used to grow crops, and utilities used in the production site. Cost included in growing crops related to the current crop year.

NOTE 4. INVENTORIES (CONTINUED)

Inventories at March 31, 2013 and December 31, 2012 consisted of the following:

|

March 31,

2013

|

December 31,

2012

|

|||||||

|

Raw materials and supplies

|

$ | 56,538 | $ | 16,781 | ||||

|

Growing crops

|

1,316 | 123,071 | ||||||

|

Finished goods

|

18,514 | 63 | ||||||

| 76,368 | 139,915 | |||||||

NOTE 5. PROPERTY, PLANT AND EQUIPMENT

Property, Plant and Equipment at March 31, 2013 and December 31, 2012 consisted of the following:

|

March 31,

2013

|

December 31,

2012

|

|||||||

|

Building

|

$ | 11,163,773 | $ | 11,134,288 | ||||

|

Plant

|

526,214 | 524,805 | ||||||

|

Vehicles

|

33,460 | 33,372 | ||||||

|

Office equipment

|

73,777 | 73,580 | ||||||

| 11,797 ,224 | 11,766,045 | |||||||

|

Less: Accumulated depreciation

|

837,914 | 675,316 | ||||||

|

Property, plant and equipment, net

|

10,959,310 | 11,090,729 | ||||||

For the three months ended March 31, 2013 and 2012, the Company recorded depreciation expense of $162,598 and $192,221, respectively.

NOTE 6. CONSTRUCTION IN PROGRESS

Construction in progress movement for the three months ended March 31, 2013 and the year ended December 31, 2012 consisted of the following:

|

March 31,

2013

|

December 31,

2012

|

|||||||

|

The beginning balance:

|

||||||||

|

Greenhouse and Planting structures

|

$ | 354,943 | $ | 314,400 | ||||

|

Factory workshop

|

728,661 | 711,010 | ||||||

| 1,083,604 | 1,025,410 | |||||||

|

The movement:

|

||||||||

|

Add : Investments during the period

|

- | 4,088,199 | ||||||

|

Unrealized foreign currency translation gain

|

2,871 | |||||||

|

Less: Transfer to fixed assets

|

- | (4,030,005 | ) | |||||

| 2,871 | 58,194 | |||||||

|

The ending balance:

|

||||||||

|

Greenhouse and Planting structures

|

355,884 | 354,943 | ||||||

|

Factory workshop

|

730,591 | 728,661 | ||||||

| 1,086,475 | 1,083,604 | |||||||

NOTE 7. OTHER PAYABLE

Company acquired land use right and engaged contractors to build various factories, outstanding balances due to these third parties were recorded in other payable. Other payable balances as of March 31, 2013 and December 31, 2012 consisted of the following:

|

March 31,

2013

|

December 31,

2012

|

|||||||

|

Land use right

|

$ | - | $ | 491,926 | ||||

|

Factory construction

|

1,515,417 | 2,386,445 | ||||||

|

Others

|

604 | 916 | ||||||

| 1,516,021 | 2,879,128 | |||||||

NOTE 8. LOAN PAYABLE

The Company became indebted to Bank of China in December 2011 for $476,122, payable in December 2012, interest at 8.46% per annum. The loan was repaid in full as of December 31, 2012.

For the three months ended March 31, 2013 and 2012, the Company recorded interest expense of nil and $10,001, respectively.

NOTE 9. RELATED PARTY TRANSACTIONS

Due to related party: The total amount of due to related parties consisted of the borrowing of the shareholders. The balance was $5,292,608 and $5,301,552 as of March 31, 2013 and December 31, 2012, respectively. The Company makes payments to shareholders from time to time as the loans are due on demand with no stated term.

Imputed interest: The stockholders lent money without interest to the Company, the interest was valued at $105,942 and $89,311 for the three months ended March 31, 2013 and 2012, respectively. The total interest was reflected in the statement of operations as interest expenses in the three months ended March 31, 2013 and 2012 with a corresponding amount recorded as a contribution of paid-in capital.

NOTE 10. COMMON STOCK

During the three months ended March 31, 2013 and 2012, Company recorded imputed interest on outstanding due to related party balance in the amount of $105,942 and $89,310, respectively.

On January 8, 2013, majority shareholder, Chin Yung Kong cancelled 20,000,000 common shares.

The Company’s capitalization is 75,000,000 common shares with a par value of $0.001 per share. 46,450,000 and 66,450,000 common shares issued and outstanding at March 31, 2013 and December 31, 2012, respectively. No preferred shares have been authorized or issued. The Company has not granted any stock options and has not recorded any stock-based compensation since inception.

NOTE 11. FAIR VALUE OF FINANCIAL INSTRUMENTS

Under FASB ASC 820-10-05, the Financial Accounting Standards Board establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. This Statement reaffirms that fair value is the relevant measurement attribute. The adoption of this standard did not have a material effect on the Company’s financial statements as reflected herein. The carrying amounts of cash, accounts payable and accrued expenses reported on the balance sheet are estimated by management to approximate fair value primarily due to the short term nature of the instruments. The Company had no other items that required fair value measurement on a recurring basis.

The Company’s financial assets and liabilities are measured using inputs from the three levels of the fair value hierarchy. The three levels are as follows:

Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 - Inputs include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates, yield curves, etc.), and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market corroborated inputs).

Level 3 - Unobservable inputs that reflect our assumptions about the assumptions that market participants would use in pricing the asset or liability.

The following table provides a summary of the fair values of assets and liabilities:

|

Balance as of

|

|

Balance as of |

|

|

Fair Value Measurements at | |||||||||||||

|

March 31, 2013

|

|

December 31, 2012

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

| $ | - |

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

||

NOTE 14. NON-CONTROLLING INTEREST

Non-controlling interest represents the 1% interest in the subsidiaries. The net income and unrealized foreign currency translation gain attributable to the non-controlling interest were total $15,446 and $2,442 in the three months ended March 31, 2013 and 2012, respectively. The Company recorded $107,004 and $90,900 non-controlling interest as of March 31, 2013 and December 31, 2012, respectively.

NOTE 15. COMMITMENT AND CONTINGENCIES

The Company had a long term payable for the acquisition of land use right. Based on the contract agreement, the future minimum rental payments required for the coming years are as follows:

|

Years ending December 31:

|

||||

|

2019

|

16,544 | |||

|

2020

|

153,210 | |||

|

2021

|

153,210 | |||

|

2022

|

153,210 | |||

|

2023

|

153,210 | |||

|

Remaining payments

|

919,260 | |||

|

Total future minimum payments

|

$ | 1,548,644 | ||

The Company did not have other significant capital commitments or significant guarantees as of March 31, 2013.

NOTE 16. BUSINESS COMBINATION

On December 12, 2011, the Company entered a Share Exchange Agreement with DingXu BVI Shareholder (Chin Yung Kong) under which the Company issued 60,000,000 shares of common stock to Chin Yung Kong to acquire 100% of the issued and outstanding shares of DingXu BVI.

China Liaoning DingXu Ecological Agriculture Development Co, Ltd., a BVI company (the “DingXu BVI”) was incorporated under the laws of British Virgin Islands on April 15, 2011. Chin Yung Kong was the sole shareholder and director of DingXu BVI.

On July 5, 2011, DingXu BVI formed Panjin Hengrun Biological Technology Development Co, Ltd., a limited liability company organized under the laws of the People’s Republic of China (“Panjin Hengrun”). DingXu BVI owns 99% of the total ownership of Panjing Hengrun.

On November 28, 2011, Panjin Hengrun entered into a set of contractual arrangements with Liaoning Dingxu Ecological Agriculture Development Co., Ltd., a limited liability company organized under the laws of the People’s Republic of China and an affiliated entity of Panjin Hengrun through contractual arrangements (“Liaoning Dingxu”). The contractual arrangements are comprised of a series of agreements, including a Consulting Service Agreement and an Operating Agreement, through which Panjin Hengrun has the right to advise, consult, manage and operate Liaoning Dingxu to collect and own all of Liaoning Dingxu’s net profits and net losses. Additionally, under a Proxy Agreement, the shareholders of Liaoning Dingxu have vested their voting control over Liaoning Dingxu to Panjin Hengrun. In order to further reinforce Panjin Hengrun’s rights to control and operate Liaoning Dingxu. Liaoning Dingxu and its shareholders have granted Panjin Hengrun, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in Liaoning Dingxu, or, alternatively, all of the assets of Liaoning Dingxu. Further, the shareholders of Liaoning Dingxu agreed to pledge all of their rights, titles and interests in Liaoning Dingxu under an Equity Pledge Agreement.

Upon entry of these contractual arrangements, Liaoning Dingxu became the Variable Interest Entities (“VIE”) of Panjin Hengrun pursuant to FIN 46 (R) and Panjin Hengrun was able to carry out business operations through Liaoning Dingxu.

Per ASC-805-50-45,”Transactions Between Entities Under Common Control”, the presentation of the financial statements pertain to financial statements of all consolidating subsidiaries for the period January 1, 2012 through December 31, 2012 for fiscal year 2012, January 1, 2012 through

March 31, 2012 for the first three month of 2012, and for the period January 1, 2013 through March 31, 2013 for first three months of 2013.

NOTE 17. RESTATEMENT OF THE PERIOD ENDED MARCH 31, 2012

The Company has restated its financial statements from amounts previously reported for the first three months ended March 31, 2012.

CONSOLIDATED BALANCE SHEET AS OF MARCH 31, 2012

|

|

Mar 31,

2012

( As reported)

|

Adjustment

|

|

As restated

|

|||||||||

|

ASSETS

|

|

||||||||||||

|

Cash and cash equivalents

|

1,203,724 | (11,891 | ) |

(a)

|

1,191,833 | ||||||||

|

Inventories

|

10,023 | 17,896 |

(b)

|

27,919 | |||||||||

|

Advances to suppliers

|

81,844 | - |

|

81,844 | |||||||||

|

Other receivables, net

|

334,249 | (72,389 | ) |

(c)

|

261,860 | ||||||||

|

Total Current Assets

|

1,629,840 | (66,384 | ) |

|

1,563,456 | ||||||||

|

|

|

|

|

|

|||||||||

|

Property and equipment, net

|

4,655,930 | 2,247,958 |

(d)

|

6,903,888 | |||||||||

|

Construction in progress

|

5,871,741 | (2,999,913 | ) |

(d)

|

2,871,828 | ||||||||

|

Land use right

|

3,199,161 | 1,510,341 |

(e)

|

4,709,502 | |||||||||

|

Prepaid lease for land

|

983,605 | (68,479 | ) |

(f)

|

915,126 | ||||||||

|

Total Assets

|

$ | 16,340,277 | $ | 623,523 |

|

$ | 16,963,800 | ||||||

|

|

|

|

|

||||||||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|||||||||||

|

|

|

|

|

||||||||||

|

Current Liabilities:

|

|

|

|

||||||||||

|

Other payables

|

1,263,752 | (10,943 | ) |

(g)

|

1,252,809 | ||||||||

|

Short-term loan

|

474,796 | - |

|

474,796 | |||||||||

|

Due to related parties

|

5,634,908 | 102,382 |

(g)

|

5,737,290 | |||||||||

|

Total Current Liabilities

|

7,373,456 | 91,439 |

|

7,464,895 | |||||||||

|

|

|

|

|

|

|||||||||

|

Long term payable

|

- | 1,548,644 |

(e)

|

1,548,644 | |||||||||

|

|

|

|

|

||||||||||

|

Total Liabilities

|

7,373,456 | 1,640,083 |

|

9,013,539 | |||||||||

|

|

|

|

|

|

|||||||||

|

Stockholders' Equity:

|

|

|

|

|

|||||||||

|

Common stock ($0.001 par value; 75,000,000 shares authorized;

66,450,000 shares issued and outstanding at March 31, 2012)

|

66,450 | - |

|

66,450 | |||||||||

|

Additional paid-in capital

|

7,659,544 | 289,518 |

(h)

|

7,949,062 | |||||||||

|

Statutory reserve

|

122,910 | (122,910 | ) |

(i)

|

- | ||||||||

|

Retained earnings

|

885,899 | (1,256,557 | ) |

(j)

|

(370,658 | ) | |||||||

|

Accumulated other comprehensive income

|

232,018 | (2,264 | ) |

(k)

|

229,754 | ||||||||

|

Non-controlling interests

|

- | 75,653 |

(k)

|

75,653 | |||||||||

|

|

|

|

|

||||||||||

|

Total Stockholders' Equity

|

8,966,821 | (1,016,560 | ) |

|

7,950,261 | ||||||||

|

|

|

- |

|

|

|||||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 16,340,277 | $ | 623,523 |

|

$ | 16,963,800 | ||||||

CONSOLIDATED STATEMENTS OF OPERATION AND COMPREHENSIVE IMCOM AS OF MARCH 31, 2012

|

|

Mar 31,

2012

(As reported)

|

Adjustments

|

|

Restated

|

|||||||||

|

|

|

||||||||||||

|

NET REVENUES

|

$ | 1,705,928 | $ | - |

|

$ | 1,705,928 | ||||||

|

|

|

|

|

||||||||||

|

COST OF REVENUES

|

1,308,469 | 93,393 |

(l)

|

1,401,862 | |||||||||

|

|

|

|

|

||||||||||

|

GROSS PROFIT

|

397,459 | (93,393 | ) |

|

304,066 | ||||||||

|

|

|

|

|

||||||||||

|

OPERATING EXPENSES:

|

|

|

|

||||||||||

|

Depreciation and amortization

|

105,968 | 39,374 |

(d)

|

145,342 | |||||||||

|

General and administrative

|

163,381 | 14,138 |

(g)

|

177,519 | |||||||||

|

|

|

|

|

||||||||||

|

Total Operating Expenses

|

269,349 | 53,512 |

|

322,861 | |||||||||

|

|

|

|

|

||||||||||

|

INCOME FROM OPERATIONS

|

128,110 | (146,905 | ) |

|

(18,795 | ) | |||||||

|

|

|

|

|

||||||||||

|

OTHER INCOME(EXPENSE):

|

|

|

|

||||||||||

|

Other income

|

353,475 | - |

|

353,475 | |||||||||

|

Interest expense

|

(10,001 | ) | (89,311 | ) |

(h)

|

(99,312 | ) | ||||||

|

|

|

|

|

||||||||||

|

INCOME BEFORE PROVISION FOR INCOME TAX

|

471,584 | (236,216 | ) |

|

235,368 | ||||||||

|

|

|

|

|

||||||||||

|

PROVISION FOR INCOME TAXES

|

- | - |

|

- | |||||||||

|

|

|

|

|

||||||||||

|

NET INCOME (EXPENSE) BEFORE NON-CONTROLLING INTERESTS

|

$ | 471,584 | $ | (236,216 | ) |

|

$ | 235,368 | |||||

|

|

|

|

|

||||||||||

|

LESS: NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS

|

- | 2,663 |

(k)

|

2,663 | |||||||||

|

|

|

|

|

||||||||||

|

NET INCOME (LOSS)

|

$ | 471,584 | $ | (238,879 | ) |

|

$ | 232,705 | |||||

|

|

|

|

|

||||||||||

|

OTHER COMPREHENSIVE INCOME:

|

|

|

|

||||||||||

|

Unrealized foreign currency translation gain(loss)

|

(22,034 | ) | (93 | ) |

(m)

|

(22,127 | ) | ||||||

|

|

|

|

|

||||||||||

|

LESS: OTHER COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO NON-CONTROLLING INTERESTS

|

$ | - | $ | (220 | ) |

(k)

|

$ | (220 | ) | ||||

|

|

|

|

|

||||||||||

|

COMPREHENSIVE INCOME

|

$ | 449,550 | $ | (238,752 | ) |

|

$ | 210,798 | |||||

|

|

|

|

|

||||||||||

|

NET INCOME PER COMMON SHARE:

|

|

|

|

||||||||||

|

Basic

|

$ | 0.01 |

|

|

$ | 0.00 | |||||||

|

Diluted

|

$ | 0.01 |

|

|

$ | 0.00 | |||||||

|

|

|

|

|

||||||||||

|

WEIGHTED AVERAGE COMMON SHARES :

|

|

|

|

||||||||||

|

Basic

|

66,450,000 |

|

|

66,450,000 | |||||||||

|

Diluted

|

66,450,000 |

|

|

66,450,000 | |||||||||

a. Company has determined that bridge construction that was completed and fully paid in 2010, and recorded adjustment to reflect this payment.

b. Company has determined that growing crops inventory as of March 31, 2012 was included in cost of revenue. An adjustment was recorded to reclassify a portion of growing crops inventory from cost of revenue to inventory.

c. Company has determined that a portion of prepaid expense in other receivable which should be expensed. An adjustment was recorded to write off these assets.

d. Company has determined that certain construction projects were completed during 2011, but didn’t get reclassified to fixed assets and were not depreciated properly. An adjustment was recorded to appropriately reflect the assets placed into use from the construction in progress account.

e. Company recorded the payment portion of the purchased land use right in 2012. An adjustments was recorded to reflect the unpaid portion.

f. Company has determined the lease commenced on January 1, 2010, but prepaid expenses for the lease did not reflect amortization of the lease payment for fiscal year 2010 and for the period January 1, 2011 – April 30, 2011. An adjustment was recorded to reflect this amortization.

g. Company has reclassified a portion of other payables into due to related party. Company also has recorded omitted expenses that were paid by related parties on behalf of the Company.

h. Company has determined that certain equipments were contributed by existing shareholders. Company also has determined that imputed interest was necessary on outstanding balance due to related parties. Adjustments were recorded to reflect these changes.

i. Company has determined that statutory reserve was not necessary for consolidating financial statement presentation and has reflected this change.

j. This adjustment pertains to the net effect of adjustments that impact profit and loss.

k. Company has determined that non-controlling interest held 1% interest in the subsidiaries, Panjin Hengrun Bilogical Technology Development Co., Ltd. and Liaoning DingXu Ecological Agriculture Development Co., Ltd. and the financial statements have been adjusted to reflect this non-controlling interest.

l. Company has determined certain direct cost was omitted and/or recorded in operating expenses and this error was corrected by recording an adjustment.

m. Company has recorded adjustment related foreign currency exchange.

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

Overview

We mainly engage in the business of growing and marketing fresh mushroom, dried mushroom and mushroom crops and mushroom seeds through our affiliated variable interest entity LiaoNing DingXu.

We mainly produce and sell two types of products:

|

(1)

|

Fresh mushrooms. We grow fresh mushrooms in our greenhouse and sell them to markets. Our fresh mushrooms include oyster mushroom, king oyster mushroom, king trumpet mushroom, and button mushroom. The revenues from the sales of fresh mushrooms constitute approximately 62% and 53% of our total revenues in the first three months of 2013 and 2012, respectively.

|

|

(2)

|

Mushroom crops and mushroom seeds. The revenues from the sales of mushroom crops and mushroom seeds approximately 11% and 47% of our total revenues in the first three months of 2013 and 2012, respectively.

|

|

(3)

|

As the manufacture workshop completed in 2012, the Company began to produce the dried mushroom from fourth quarter in 2012. The revenues from the sales of dried mushroom approximately 27% of our total revenues in the first three months of 2013.

|

History

We were incorporated under the name “Hazlo! Technologies, Inc.” on August 19, 2010 in the State of Nevada. Our initial business plan was to modify and translate software and web applications originally written in English into Spanish and to focus on the needs of the Arizona business community to better serve the Spanish-speaking population. We did not generate any revenue from the said. IT services and data translation services.

On December 12, 2011, we entered a Share Exchange Agreement with DingXu BVI Shareholder (Chin Yung Kong) under which we issue 60,000,000 shares of common stock to Chin Yung Kong to acquire 100% of the issued and outstanding shares of DingXu BVI. Upon closing of the Share Exchange transaction, DingXu BVI became the wholly owned subsidiary of Hazlo! Technologies, Inc.

China Liaoning DingXu Ecological Agriculture Development Co, Ltd., a BVI company (the “DingXu BVI”) was incorporated under the laws of British Virgin Islands on April 15, 2011. Chin Yung Kong was the sole shareholder and director of DingXu BVI.

On July 5, 2011, DingXu BVI formed Panjin Hengrun Biological Technology Development Co., Ltd. 盘锦恒润生物技术开发有限公司, a limited liability company organized under the laws of the People’s Republic of China (“Panjin Hengrun”). DingXu BVI owns 99% of the total ownership of Panjing Hengrun.

On November 28, 2011, Panjin Hengrun entered into a set of contractual arrangements with Liaoning Dingxu Ecological Agriculture Development Co., Ltd.辽宁鼎旭生态农业发展有限公司, a limited liability company organized under the laws of the People’s Republic of China and an affiliated entity of Panjin Hengrun through contractual arrangements (“Liaoning Dingxu”). The contractual arrangements are comprised of a series of agreements, including a Consulting Service Agreement and an Operating Agreement, through which Panjin Hengrun has the right to advise, consult, manage and operate Liaoning Dingxu to collect and own all of Liaoning Dingxu’s net profits and net losses. Additionally, under a Proxy Agreement, the shareholders of Liaoning Dingxu have vested their voting control over Liaoning Dingxu to Panjin Hengrun. In order to further reinforce Panjin Hengrun’s rights to control and operate Liaoning Dingxu. Liaoning Dingxu and its shareholders have granted Panjin Hengrun, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in Liaoning Dingxu, or, alternatively, all of the assets of Liaoning Dingxu. Further, the shareholders of Liaoning Dingxu agreed to pledge all of their rights, titles and interests in Liaoning Dingxu under an Equity Pledge Agreement.

Upon entry of these contractual arrangements, Liaoning Dingxu became the Variable Interest Entities (“VIE”) of Panjin Hengrun pursuant to FIN 46(R) and Panjin Hengrun was able to carry out business operations through Liaoning Dingxu.

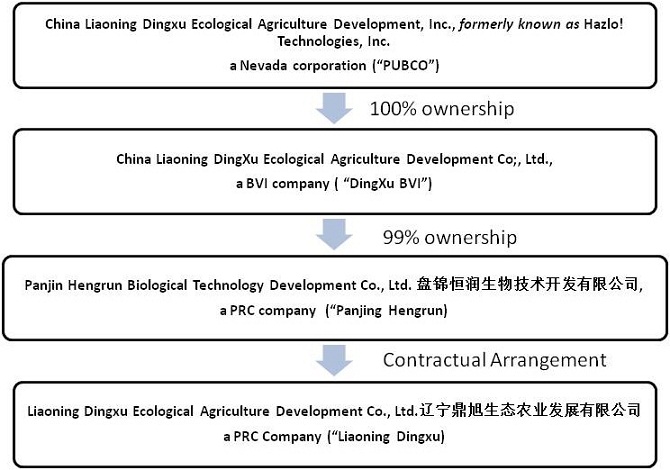

Set forth below is our organizational chart upon completion of the share exchange transaction:

Liaoning Dingxu Ecological Agriculture Development Co., Ltd.辽宁鼎旭生态农业发展有限公司 (“Liaoning Dingxu”) was formed as a limited liability company organized under the laws of the People’s Republic of China on August 6, 2009. It mainly engages in the business of growing mushrooms and marketing mushroom and related agricultural products.

Since the completion of the share exchange transaction, our business operations are carried out through Panjin Hengrun and its affiliated operating entity Liaoning Dingxu. On December 12, 2011, we ceased the business of development stage IT service and data translation services and started to engage in the business of growing mushrooms and marketing mushroom and related agricultural products through Liaoning Dingxu.

Financial condition as of March 31, 2013 and December 31, 2012

The following table presents an overview of assets, liabilities and shareholders’ equity as of March 31, 2013 and December 31, 2012.

|

March 31,

|

December31,

|

Increase

|

||||||||||

|

2013

|

2012

|

(decrease)

|

||||||||||

|

Current assets

|

||||||||||||

|

Cash

|

518,229 | 21,245 | 496,984 | |||||||||

|

Other Receivables

|

- | 8,662 | (8,662 | ) | ||||||||

|

Advance to suppliers

|

150,446 | 148,895 | 1,551 | |||||||||

|

Inventory

|

76,368 | 139,915 | (63,547 | ) | ||||||||

|

Other current assets

|

86,700 | 85,914 | 786 | |||||||||

|

Total current assets

|

831,743 | 404,631 | 427,112 | |||||||||

|

Non-current assets

|

||||||||||||

|

Property, plant and equipment - net of accumulated depreciation

|

10,959,310 | 11,090,729 | (131,419 | ) | ||||||||

|

Construction in progress

|

1,086,475 | 1,083,604 | 2,871 | |||||||||

|

Land use rights

|

5,723,972 | 5,768,262 | (44,290 | ) | ||||||||

|

Long term prepaid lease

|

868,337 | 879,470 | (11,133 | ) | ||||||||

|

Total non-current assets

|

18,638,094 | 18,822,065 | (183,971 | ) | ||||||||

|

Total assets

|

19,469,837 | 19,226,696 | 243,141 | |||||||||

|

Current liabilities

|

||||||||||||

|

Account payable

|

3,738 | 3,729 | 9 | |||||||||

|

Accrued expenses

|

17,495 | 18,519 | (1,024 | ) | ||||||||

|

Other payables

|

1,516,021 | 2,879,287 | (1,363,426 | ) | ||||||||

|

Due to Related Parties

|

5,292,608 | 5,301,552 | (8,944 | ) | ||||||||

|

Total current assets

|

6,829,862 | 8,203,087 | (1,373,385 | ) | ||||||||

|

Long term payable

|

1,548,644 | 1,548,644 | 160 | |||||||||

|

Total liabilities

|

8,378,506 | 9,751,731 | (1,373,225 | ) | ||||||||

|

Shareholders’ liabilities

|

||||||||||||

|

Common stock

|

46,450 | 66,450 | (20,000 | )- | ||||||||

|

Paid-in capital

|

8,340,410 | 8,215,126 | 125,284 | |||||||||

|

Retained earnings

|

2,264,093 | 806,192 | 1,457,901 | |||||||||

|

Accumulated comprehensive income - foreign currency

|

333,374 | 296,297 | 37,077 | |||||||||

|

Non-controlling interests

|

107,004 | 90,900 | 16,104 | |||||||||

|

Total shareholders’ equity of the Company

|

11,091,331 | 9,474,965 | 1,616,366 | |||||||||

|

Total liabilities and shareholders’ equity

|

19,469,837 | 19,226,696 | 243,141 | |||||||||

Liquidity and Capital Resources:

To date, our operations have been funded by contributions to “due to related parties” and the net cash provided by our fast developing operations. As a result, at March 31, 2013 we had $831,743 current assets, and $6,829,862 current liabilities mainly consisted of the $1,515,417 Factory seed cultivation workshop constructing payment, the $5,292,608 due to related party and others. We had working capital deficit of $5,998,119 as of March 31, 2013, which contains liquidity risk for the coming period. Although we believe management will continue to fund the Company on an as needed basis, we do not have a written agreement requiring such funding. For the due to related party, the shareholders promise that they would not demand repayment from the Company with in next fiscal year.

We believe that our operation would have fast development in future which would provide sufficient net cash to fund our business. During the three months ended March 31, 2013, we got a net profit $1,473,033 and our operating activities provided $468,537 in net cash. Over the long term, our expectation is to see a trend of growing sales for our mushroom series products, including fresh mushrooms, dried mushroom and mushroom crops and seeds, resulting from the improving of general agriculture industry, improving of the planting skills and the quality of our products, and the continuing encouragement from local government. As we continue to invest to develop our mushroom planting greenhouse and structures, and factory workshop, the categories and total quantities of our products will be much higher than we produce now.

Assets:

1. Inventory

The balance at the end of this period consisted of raw materials, growing crops and finished goods.

Inventories at March 31, 2013 and December 31, 2012 consisted of the following:

|

March 31,

2013

|

December 31,

2012

|

|||||||

|

Raw materials and supplies

|

$ | 56,538 | $ | 16,781 | ||||

|

Growing crops

|

1,316 | 123,071 | ||||||

|

Finished goods

|

18,514 | 63 | ||||||

| 76,368 | 139,915 | |||||||

2. Property, plant and equipment and Construction in progress

Our property, plant and equipment are stated at cost less accumulated depreciation and impairment. Depreciation on property, plant and equipment is calculated on the straight-line method after taking into account their respective estimated residual values over the estimated useful lives of the assets as follows:

| Building | 20 | years | |

| Plant equipment | 5-10 | years | |

| Office equipment | 3-5 | years | |

| Vehicles | 4 | years |

As consistent with the policies, maintenance and repair costs are expensed as incurred, whereas significant renewals and betterments are capitalized.

Construction in progress represents capital assets under construction or being installed and is stated at cost. Cost comprises original cost of plant and equipment, installation, construction and other direct costs prior to the date of reaching the expected usable condition. Construction in progress is transferred to the property, plant and equipment and depreciation commences when the asset has been substantially completed and reaches the expected usable condition.

Property, Plant and Equipment consists of the following:

|

March 31,

2013

|

December 31,

2012

|

|||||||||

| USD |

USD

|

|||||||||

|

Building

|

a | $ | 11,163,773 | 11,134,288 | ||||||

|

Plant equipment

|

b | 526,214 | 524,805 | |||||||

|

Vehicles

|

c | 33,460 | 33,372 | |||||||

|

Office equipment

|

d | 73,777 | 73,580 | |||||||

|

Less: Accumulated depreciation

|

e | 837,914 | 675,316 | |||||||

|

Property, plant and equipment, net

|

10,959,310 | 11,090,729 | ||||||||

|

Construction in progress

|

f | 1,086,475 | 1,083,604 | |||||||

|

Total property, plant & equipment

|

12,045,785 | 12,174,333 | ||||||||

a. The building mainly represented the greenhouses, manufacturing workshops, warehouse, office building and supporting facilities, most of which were transferred from the construction in progress (CIP).

b. The plant equipment represented the production equipment purchased from third parties.

c. The vehicles were the truck for transporting raw materials or finish goods.

d. The office equipment represented for office computers, printers, desks and other office appliances.

e. For the three months ended March 31, 2013 and 2012, the Company recorded depreciation expense of $162,598 and $192,221, respectively.

f. The detailed information of the construction projects in progress which was not yet transfer to fixed assets is as below:

|

March 31,

2013

|

December31,

2012

|

|||||||

|

USD

|

USD

|

|||||||

|

Factory workshop

|

730,591 | 728,661 | ||||||

|

Greenhouse and Planting structures

|

355,884 | 354,943 | ||||||

|

Total amount of Construction In Progress

|

1,086,475 | 1,083,604 | ||||||

3. Land use right

The Company states land use rights at cost less accumulated amortization. The land use right was used to build up greenhouse and planting structures, manufacturing workshop and other buildings. As of March 31, 2013 and December 31, 2012, the net values of land use rights are $5,723,972 and $5,768,262, respectively.

The land use rights are amortized using the straight line method during the contract period. For the three months ended March 31, 2013 and 2012, amortization expense amounted to $55,870 and $55,699, respectively.

4. Long-term prepaid lease

Leases where substantially all the risks and rewards of ownership of assets remain with the lessor are accounted for as operating leases. Payments made under operating leases net of any incentives received from the lessor are charged to the consolidated statements of operations on a straight-line basis over the terms of the underlying lease.

The Company records lease payments at cost less accumulated amortization and amount that to be amortized within one year. The amount to be amortized within one year is recorded as current portion of prepaid leases. The Company entered into long term agreements with local government to rent land. The rental payments of $1,030,900 for the entire contract period are prepaid in 2011. The rental payments are recorded as operating lease expenses using the straight line method during the contract period of 20 years.

Lease expense of $13,643 and $13,588 were recorded for the three months ended March 31, 2013 and 2012.

Liabilities:

5. Short-term loan

The Company became indebted to Bank of China in December 2011 for $476,122, payable in December 2012, interest at 8.46% per annum. The loan was repaid in full as of December 31, 2012.

For the three months ended March 31, 2013 and 2012, the Company recorded interest expense of nil and $10,001, respectively.

6. Other payables

The balance at the end of this period mainly consisted of the $1,515,417 Factory seed cultivation workshop construction payment and others. The Company made payments to the seller of the land use right and to contractor for factory construction during the first quarter of 2013, which resulted in the decrease of other payables balance.

7. Due to related parties

The total amount of due to related parties consisted of the borrowing of the shareholders. The balance was $5,292,608 and $5,301,552 as of March 31, 2013 and December 31, 2012, respectively.

The stockholders lent money without interest to the Company, the interest was valued at $105,942 and $89,311 for the three months ended March 31, 2013 and 2012, respectively. The total of interest was reflected in the statement of operations as interest expenses in the three months ended March 31, 2013 and 2012 with a corresponding amount recorded as a contribution of paid-in capital.

8. Long term payable

The Company had a long term payable for the acquisition of land use right. Based on the contract agreement, the future minimum rental payments required for the coming years are as follows:

|

Years ending December 31:

|

||||

|

2019

|

16,544 | |||

|

2020

|

153,210 | |||

|

2021

|

153,210 | |||

|

2022

|

153,210 | |||

|

2023

|

153,210 | |||

|

Remaining payments

|

919,260 | |||

|

Total future minimum payments

|

$ | 1,548,644 | ||

Shareholders’ equity

9. Additional paid-in capital

Additional paid-in capital increased from the imputed interest was necessary on outstanding balance due to related parties and the cancelled shares reclassified to additional paid-in capital.

10. Retain earnings

The retain earnings increased from net profit in the first quarter of 2013.

Results of Operations for the three months ended March 31, 2013 and 2012

The following table presents an overview of our results of operation for the three months ended March 31, 2013 and 2012.

|

Increase

|

||||||||||||

|

2013

|

2012

|

(decrease)

|

||||||||||

|

Total revenue

|

3,348,006

|

1,705,928

|

1,642,078

|

|||||||||

|

Total cost of revenue

|

(1,535,050)

|

(1,401,862)

|

(133,188)

|

|||||||||

|

Gross profit

|

1,812,956

|

304,066

|

1,508,890

|

|||||||||

|

General and administrative

|

(59,842)

|

(177,519)

|

117,677

|

|||||||||

|

Depreciation and amortization

|

(174,038)

|

(145,342)

|

(28,696)

|

|||||||||

|

Income from operations

|

1,579,076

|

(18,795)

|

1,597,871

|

|||||||||

|

Other income

|

-

|

353,475

|

373,843

|

|||||||||

|

Interest expense

|

(106,043)

|

(99,312)

|

(239,480)

|

|||||||||

|

Income before income taxes

|

1,473,033

|

235,368

|

1,237,665

|

|||||||||

|

Income taxes

|

-

|

-

|

-

|

|||||||||

|

Net income

|

1,473,033

|

235,368

|

1,237,665

|

|||||||||

The following table sets forth the breakdown of our revenue for the three months ended March 31, 2013 and 2012, respectively:

|

2013

|

2012

|

|||||||||||||||

|

USD

|

%

|

USD

|

%

|

|||||||||||||

|

Fresh mushrooms sales

|

2,080,603

|

62.14%

|

904,349

|

53.01%

|

||||||||||||

|

Mushroom crops and seeds sales

|

347,469

|

10.38%

|

801,579

|

46.99%

|

||||||||||||

|

Dried mushroom

|

919,934

|

27.48%

|

-

|

-

|

||||||||||||

|

Total revenue

|

3,348,006

|

100%

|

1,705,928

|

100%

|

||||||||||||

Sales revenue is recognized at the date of shipment from the Company’s facilities to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, ownership has passed, no other significant obligations of the Company exist and collectability is reasonably assured.

We derived our revenues predominantly from sales of our fresh mushrooms, mushroom crops and seeds and dried mushroom. For the three months ended March 31, 2013 and 2012, revenues from sales of our fresh mushrooms sales were $2,080,603 and $904,349 respectively representing an increase of $1,176,254. Revenues from sales of our mushroom crops and seeds were $347,469 and $801,579 for the three months ended March 31, 2013 and 2012 respectively, which indicated $454,110 decrease. Revenues from sales of our dried mushroom were 919,934 for the three months ended March 31, 2013, which also resulted in a sales increase.

The increase of the fresh mushroom and dried mushroom was primarily due to the increase of the sales volume and price. To be specific, the increase in our revenue was attributable to the following reasons:

|

a.

|

As most of the greenhouse and planting structures under construction are completed in second half of 2012, productions in the first quarter of 2013 was higher than that in the same period of 2012.

|

|

b.

|

The company got the Organic products identification by the authorized government institution in the fourth quarter of 2012, the fresh mushroom price increased significantly, which resulted in a sales increase.

|

|

c.

|

As the manufacture workshop completed in 2012, the Company began to produce the dried mushroom in the fourth quarter of 2012. Dried mushroom production was further expanded during the first quarter of 2013.

|

We expect to see a trend of growing sales for our mushroom series products, including fresh mushroom dried mushroom, resulting from the growing of the market, improving of general agriculture industry, improving of the planting skills and the quality of our products, and the continuing encouragement from local government.