Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bridge Capital Holdings | v345309_8k.htm |

May 15, 2013 13 th Annual Shareholders’ Meeting Daniel P. Myers President Chief Executive Officer Allan C. Kramer, M.D. Chairman NASDAQ: BBNK www.bridgecapitalholdings.com

2 Forward Looking Statements Certain matters discussed herein constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , and are subject to the safe harbors created by that Act . Forward - looking statements describe future plans, strategies, and expectations, and are based on currently available information, expectations, assumptions, projections, and management's judgment about the Bank, the banking industry and general economic conditions . These forward looking statements are subject to certain risks and uncertainties that could cause the actual results, performance or achievements to differ materially from those expressed, suggested or implied by the forward looking statements . These risks and uncertainties include, but are not limited to : ( 1 ) competitive pressures in the banking industry ; ( 2 ) changes in interest rate environment ; ( 3 ) general economic conditions, nationally, regionally, and in operating markets ; ( 4 ) changes in the regulatory environment ; ( 5 ) changes in business conditions and inflation ; ( 6 ) changes in securities markets ; ( 7 ) future credit loss experience ; ( 8 ) the ability to satisfy requirements related to the Sarbanes - Oxley Act and other regulation on internal control ; ( 9 ) civil disturbances or terrorist threats or acts, or apprehension about the possible future occurrences of acts of this type ; and ( 10 ) the involvement of the United States in war or other hostilities . The reader should refer to the more complete discussion of such risks in Bridge Capital Holdings reports on Forms 10 - K and 10 - Q on file with the SEC . 2

3 Board of Directors Allan C. Kramer, M.D. Chairman Investor Thomas M. Quigg Vice Chairman Investor Daniel P. Myers President & CEO Bridge Bank, N.A. Bridge Capital Holdings Dr. Francis J. Harvey 19 th Secretary of the Army Owen Brown Owen Brown Enterprises, Ltd . Robert P. Latta Wilson Sonsini Goodrich & Rosati Howard N. Gould Carpenter Community BancFund Terry Schwakopf Consultant Barry A. Turkus B.T. Commercial Christopher B. Paisley Professor, SCU Thomas A. Sa Executive Vice President Chief Financial Officer Chief Risk and Strategy Officer

Chairman’s Comments Allan C. Kramer, M.D. Chairman NASDAQ: BBNK www.bridgecapitalholdings.com

Shareholder briefing Daniel P. Myers President Chief Executive Officer NASDAQ: BBNK www.bridgecapitalholdings.com

■ Total Assets $ 1.35 billion ■ Total Loans $ 954.2 m illion ■ Total Deposits $ 1.2 billion ■ Total Stockholders' Equity $ 151.4 million ■ Market Cap $ 240.0 million ■ TBV/Share $ 9.61 ■ TCE/TA 11.24% ■ Tier 1 RBC Ratio 13.94% ■ Total RBC Ratio 15.19% ■ Cost of Deposits 12 bps ■ Net Interest Margin 5.05% ■ Efficiency Ratio 64.24% ■ ROAA 1.06% ■ ROAE 9.29% ■ Net Income $ 3.4 million ■ EPS $ 0 .23 Financial Highlights Balance sheet data at QE 3 - 31 - 13;operating data 1Q13 The only small - and mid - market specialist crafting the flexible solutions that businesses need to thrive in the modern economy Be bold, venture wisely. 6

Bridge Bank Franchise ▪ Focus Business banking • 70% business C&I loan portfolio Silicon Valley geography and technology - centric regions ▪ Fundamental Value Drivers Relationship banking model Core deposit - centric model to fund the business • 96% core deposits • 62% DDA • 12 bps cost of deposits “Fit” among diversified revenue streams ▪ Execution Full range of corporate banking products delivered through experienced advisors 2 regional business centers + 5 business offices Effective use of banking technology 7

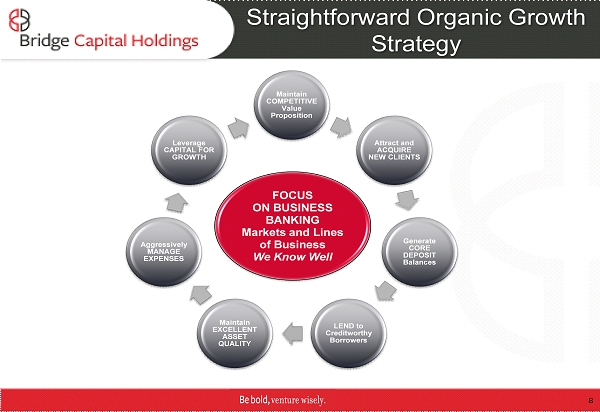

Maintain COMPETITIVE Value Proposition Attract and ACQUIRE NEW CLIENTS Generate CORE DEPOSIT Balances LEND to Creditworthy Borrowers Maintain EXCELLENT ASSET QUALITY Aggressively MANAGE EXPENSES Leverage CAPITAL FOR GROWTH FOCUS ON BU SINESS BANKING Markets and Lines of Business We Know Well Straightforward Organic Growth Strategy 8

Expanding Market Presence $250 $500 $750 $1,000 $1,250 $1,500 2005 2006 2007 2008 2009 2010 2011 2012 Q1'13 $ Millions Average Total Assets • Purely organic growth • Core deposit driven $ 1.35b Total Assets EOP Q1 ’13 9 CAGR=18.4%

FY 2012* Q1’13** BUSINESS Deposits (EOP) + 16% + 17% (YoY) GROWTH Loans (EOP) + 19% + 17% (YoY) REVENUE +26% + 6% (YoY) EFFICIENCY 62.81% + 64.24% EARNINGS Net Income $13.8 M +76% $3.4 M + 26% (YoY) EPS (common, FD) $0.92 +77% $0.23 + 28% (YoY) ASSET QUALITY NPA’s ($10.1M) / (37%) ($9.6M) / (26%) ALLLR/NPL’s 200% 214% CAPITAL TCE 10.92% 11.24% Improvement In Most Operating Metrics = Improvement Deterioration Stable Net Interest Income + Non Interest Income Non Interest Expense Revenue 10 * FY/FYE 2012 v FY/FYE 2011 ** Q1’13 v Q1’12

$(7,341) $1,505 $3,037 $5,725 $8,634 $10,866 $ 1,435 $2,591 $ 7,847 $13,804 $3,421 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 1Q13 Improved Earnings Preferred Dividends ’09: $4,203 ‘ 10: $ 1,955 ’11: $200 ($000) *Operating profit before payment of preferred dividends 11 Great Recession & Financial Crisis

Market View BBNK SIVB S & P CYN HTBK

14 17 Months 70k + Surveys 600 + Interviews 10 Person Project Team 2,500 + Hours Brand Project

‘Army of Advocates’ 15 -20 -10 0 10 20 30 40 50 60 70 80 90 100 Largest US Banks All US Banks All US Community Banks Apple Amazon Satmetrix Net Promoter Score © 48 ~4X the average of all U.S. banks

Culture: Shared Values ▪ Earn Trust ▪ Take Ownership ▪ Exceed Expectations 16 16 16

17 Culture: Position & Promise

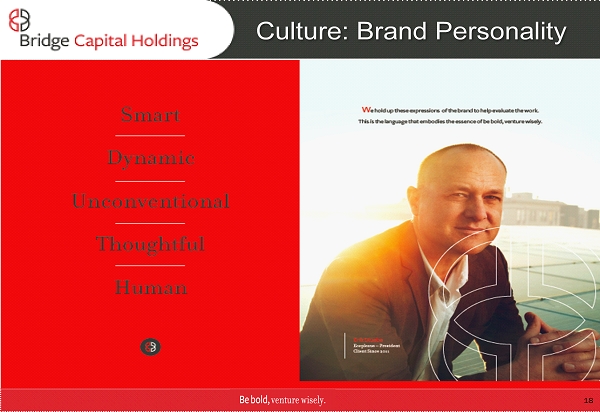

18 Culture: Brand Personality

19 Culture: Brand Pillars

20 Culture: More Human

Discoverable & Accessible

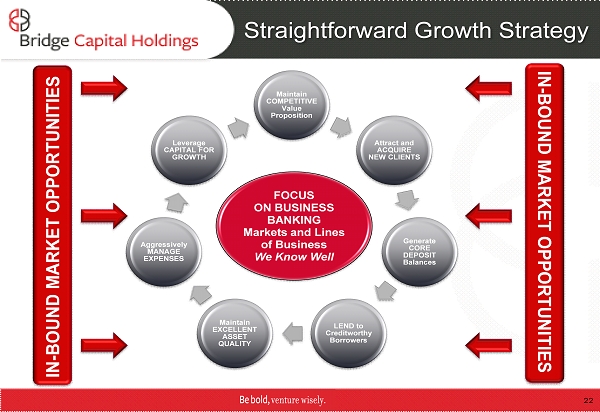

Maintain COMPETITIVE Value Proposition Attract and ACQUIRE NEW CLIENTS Generate CORE DEPOSIT Balances LEND to Creditworthy Borrowers Maintain EXCELLENT ASSET QUALITY Aggressively MANAGE EXPENSES Leverage CAPITAL FOR GROWTH FOCUS ON BU SINESS BANKING Markets and Lines of Business We Know Well Straightforward Growth Strategy 22 IN - BOUND MARKET OPPORTUNITIES IN - BOUND MARKET OPPORTUNITIES

Thank You / Q & A Investor Relations Contact Thomas A. Sa Bridge Capital Holdings 55 Almaden Blvd., Suite 100 San Jose, CA 95113 (408) 423 - 8500 ir@bridgebank.com 23