Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - AVANIR PHARMACEUTICALS, INC. | Financial_Report.xls |

| EX-31.1 - EX-31.1 - AVANIR PHARMACEUTICALS, INC. | d500632dex311.htm |

| EX-32.1 - EX-32.1 - AVANIR PHARMACEUTICALS, INC. | d500632dex321.htm |

| EX-31.2 - EX-31.2 - AVANIR PHARMACEUTICALS, INC. | d500632dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the quarterly period ended March 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to .

Commission File No. 1-15803

AVANIR PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 33-0314804 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 20 Enterprise Suite 200, Aliso Viejo, California | 92656 | |

| (Address of principal executive offices) | (Zip Code) | |

(949) 389-6700

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

As of May 1, 2013, the registrant had 145,109,251 shares of common stock issued and outstanding.

Table of Contents

| Page | ||||||

| Item 1. | Financial Statements | |||||

| Condensed Consolidated Balance Sheets | 3 | |||||

| Condensed Consolidated Statements of Operations | 4 | |||||

| Condensed Consolidated Statements of Cash Flows | 5 | |||||

| Notes to Condensed Consolidated Financial Statements | 6 | |||||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 | ||||

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 32 | ||||

| Item 4. | Controls and Procedures | 33 | ||||

| Item 1. | Legal Proceedings | 34 | ||||

| Item 1A. | Risk Factors | 35 | ||||

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 53 | ||||

| Item 3. | Defaults Upon Senior Securities | 53 | ||||

| Item 4. | Mine Safety Disclosures | 53 | ||||

| Item 5. | Other Information | 53 | ||||

| Item 6. | Exhibits | 53 | ||||

| 54 | ||||||

2

Table of Contents

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, 2013 | September 30, 2012 | |||||||

| (unaudited) | (audited) | |||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 67,859,426 | $ | 69,778,406 | ||||

| Restricted cash and cash equivalents |

654,624 | 652,913 | ||||||

| Trade receivables, net |

9,679,775 | 7,231,759 | ||||||

| Inventories, net |

428,969 | 415,475 | ||||||

| Prepaid expenses |

1,763,941 | 1,569,255 | ||||||

| Other current assets |

806,133 | 865,335 | ||||||

| Restricted short-term investment |

— | 401,550 | ||||||

|

|

|

|

|

|||||

| Total current assets |

81,192,868 | 80,914,693 | ||||||

| Restricted long-term investments |

1,303,938 | 1,302,136 | ||||||

| Property and equipment, net |

1,680,317 | 1,808,594 | ||||||

| Non-current inventories, net |

908,366 | 908,364 | ||||||

| Other assets |

625,196 | 1,078,009 | ||||||

|

|

|

|

|

|||||

| TOTAL ASSETS |

$ | 85,710,685 | $ | 86,011,796 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 7,557,046 | $ | 2,932,961 | ||||

| Accrued expenses and other liabilities |

7,946,270 | 7,062,159 | ||||||

| Accrued compensation and payroll taxes |

5,231,342 | 5,603,546 | ||||||

| Current portion of deferred royalty revenues |

2,557,464 | 2,557,464 | ||||||

| Current portion of note payable, net of debt discount |

7,812,014 | 2,162,263 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

31,104,136 | 20,318,393 | ||||||

| Accrued expenses and other liabilities, net of current portion |

1,073,265 | 666,179 | ||||||

| Notes payable, net of current portion and debt discount |

21,325,055 | 26,698,263 | ||||||

| Deferred royalty revenues, net of current portion |

117,022 | 1,491,854 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

53,619,478 | 49,174,689 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock - $0.0001 par value, 10,000,000 shares authorized, no shares issued or outstanding as of March 31, 2013 and September 30, 2012 |

— | — | ||||||

| Common stock - $0.0001 par value, 200,000,000 shares authorized; 145,103,001 and 136,435,492 shares issued and outstanding as of March 31, 2013 and September 30, 2012, respectively |

14,510 | 13,643 | ||||||

| Additional paid-in capital |

485,739,506 | 461,883,490 | ||||||

| Accumulated deficit |

(453,662,809 | ) | (425,060,026 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

32,091,207 | 36,837,107 | ||||||

|

|

|

|

|

|||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ | 85,710,685 | $ | 86,011,796 | ||||

|

|

|

|

|

|||||

The accompanying notes to condensed consolidated financial statements are an integral part of this statement.

3

Table of Contents

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| Three Months Ended March 31, | Six Months Ended March 31, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| REVENUES |

||||||||||||||||

| Net product sales |

$ | 16,535,059 | $ | 9,141,873 | $ | 31,414,321 | $ | 14,630,636 | ||||||||

| Revenues from royalties |

899,129 | 898,515 | 2,525,139 | 2,574,635 | ||||||||||||

| Revenues from research grant services |

— | — | 15,000 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

17,434,188 | 10,040,388 | 33,954,460 | 17,205,271 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EXPENSES |

||||||||||||||||

| Cost of product sales |

933,426 | 534,345 | 1,771,555 | 844,148 | ||||||||||||

| Cost of research grant services |

69,090 | — | 78,488 | — | ||||||||||||

| Research and development |

8,874,298 | 6,395,155 | 15,522,389 | 10,139,670 | ||||||||||||

| Selling and marketing |

16,061,408 | 14,814,014 | 29,583,827 | 28,596,850 | ||||||||||||

| General and administrative |

6,978,684 | 5,346,990 | 13,517,087 | 10,639,173 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

32,916,906 | 27,090,504 | 60,473,346 | 50,219,841 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(15,482,718 | ) | (17,050,116 | ) | (26,518,886 | ) | (33,014,570 | ) | ||||||||

| OTHER INCOME (EXPENSE) |

||||||||||||||||

| Interest income |

15,065 | 7,882 | 34,396 | 22,173 | ||||||||||||

| Interest expense |

(1,059,245 | ) | — | (2,118,490 | ) | — | ||||||||||

| Other, net |

197 | 75 | 197 | 4,081 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (16,526,701 | ) | $ | (17,042,159 | ) | $ | (28,602,783 | ) | $ | (32,988,316 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted net loss per share |

$ | (0.12 | ) | $ | (0.13 | ) | $ | (0.21 | ) | $ | (0.25 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted weighted average number of common shares outstanding |

139,173,746 | 133,463,300 | 137,959,958 | 130,683,671 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes to condensed consolidated financial statements are an integral part of this statement.

4

Table of Contents

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| Six Months Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| OPERATING ACTIVITIES: |

||||||||

| Net loss |

$ | (28,602,783 | ) | $ | (32,988,316 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Depreciation and amortization |

408,261 | 336,105 | ||||||

| Amortization of debt discount and debt issuance costs |

326,892 | — | ||||||

| Share-based compensation expense |

3,196,310 | 2,396,287 | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Trade receivables, net |

(2,448,016 | ) | (1,781,655 | ) | ||||

| Inventories, net |

(13,496 | ) | (327,494 | ) | ||||

| Prepaid expenses and other assets |

668,530 | 165,967 | ||||||

| Accounts payable |

4,624,085 | 1,909,844 | ||||||

| Accrued expenses and other liabilities |

1,291,197 | 1,751,036 | ||||||

| Accrued compensation and payroll taxes |

(372,204 | ) | 515,895 | |||||

| Deferred product revenues, net |

— | (1,652,788 | ) | |||||

| Deferred royalty revenues |

(1,374,832 | ) | (936,629 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in operating activities |

(22,296,056 | ) | (30,611,748 | ) | ||||

|

|

|

|

|

|||||

| INVESTING ACTIVITIES: |

||||||||

| Purchase of property and equipment |

(279,984 | ) | (789,494 | ) | ||||

| Purchase of restricted investments and restricted cash and cash equivalents |

(3,513 | ) | (53,120 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(283,497 | ) | (842,614 | ) | ||||

|

|

|

|

|

|||||

| FINANCING ACTIVITIES: |

||||||||

| Proceeds from issuances of common stock, net of commissions and offering costs |

19,101,955 | 10,062,996 | ||||||

| Proceeds from exercise of stock options and warrants |

1,558,618 | 8,551,165 | ||||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

20,660,573 | 18,614,161 | ||||||

|

|

|

|

|

|||||

| Net decrease in cash and cash equivalents |

(1,918,980 | ) | (12,840,201 | ) | ||||

| Cash and cash equivalents at beginning of period |

69,778,406 | 79,542,564 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 67,859,426 | $ | 66,702,363 | ||||

|

|

|

|

|

|||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: |

||||||||

| Interest paid |

$ | 1,342,500 | $ | — | ||||

| Income taxes paid |

$ | 3,200 | $ | 3,200 | ||||

| SUPPLEMENTAL DISCLOSURES OF NON-CASH INVESTING AND FINANCING ACTIVITIES: |

||||||||

| Release of restriction on short-term investment |

$ | 401,550 | $ | — | ||||

| Purchase of property and equipment in accounts payable and accrued expenses and other liabilities |

$ | — | $ | 65,250 | ||||

The accompanying notes to condensed consolidated financial statements are an integral part of this statement.

5

Table of Contents

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1. DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION

Description of Business

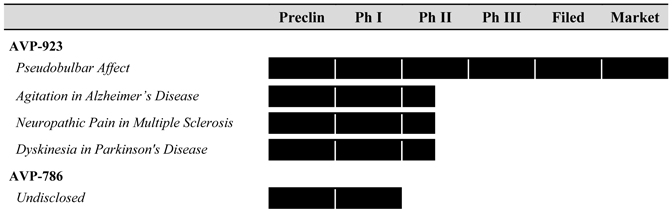

Avanir Pharmaceuticals, Inc. (“Avanir”, “we”, or the “Company”) is a biopharmaceutical company focused on acquiring, developing, and commercializing novel therapeutic products for the treatment of central nervous system disorders. The Company’s lead product NUEDEXTA® (referred to as AVP-923 during clinical development), is a first-in-class dual NMDA receptor antagonist and sigma-1 agonist. NUEDEXTA, 20/10 mg, is approved in the United States for the treatment of pseudobulbar affect (“PBA”) and two dose strengths of NUEDEXTA, 20/10 mg and 30/10 mg capsules, have been recommended by the Committee for Medicinal Products for Human Use for approval in the European Union.

The Company is studying the clinical utility of AVP-923 in other mood/behavior disorders, movement disorders and pain. The Company currently has two ongoing Phase II clinical trials exploring the potential treatment of agitation in patients with Alzheimer’s disease and treatment of central neuropathic pain in patients with multiple sclerosis. In addition, the Company plans on starting enrollment in a Phase II study for the treatment of levodopa-induced-dyskinesia in Parkinson’s disease supported by a grant from the Michael J. Fox Foundation.

The Company is also developing AVP-786, a next generation drug product containing deuterium-modified dextromethorphan, (“d-DM”) and quinidine for the treatment of neurologic and psychiatric disorders. The Company completed a pharmacokinetic study with AVP-786 and based on this data, the Company believes that it has identified a formulation of AVP-786 with a comparable pharmacokinetic, safety and tolerability profile to AVP-923. This AVP-786 formulation contains significantly less quinidine than used in AVP-923.

The Company’s operations are subject to certain risks and uncertainties frequently encountered by companies in the early stages of operations, particularly in the evolving market for small biotech and specialty pharmaceutical companies. Such risks and uncertainties include, but are not limited to, the occurrence of adverse safety events with NUEDEXTA; that NUEDEXTA may not gain broader acceptance by the medical field or that the indicated use may not be clearly understood; the Company’s dependence on third parties for manufacturing and distribution of NUEDEXTA; that the Company may not adequately build or maintain the necessary sales, marketing, supply chain management and reimbursement capabilities on its own or enter into arrangements with third parties to perform these functions in a timely manner or on acceptable terms; the ability to successfully protect and enforce its intellectual property rights relating to NUEDEXTA; timing and uncertainty of achieving milestones in clinical trials; obtaining approvals by the FDA, European Medicines Agency (“EMA”) and regulatory agencies in other countries; and the progress of the Company’s d-DM development program. The Company’s ability to generate revenues in the future may depend on market acceptance of NUEDEXTA for the treatment of PBA and the timing and success of reaching clinical development milestones and obtaining regulatory approvals for other formulations for AVP-923. The Company’s operating expenses depend substantially on the level of expenditures for the ongoing marketing of NUEDEXTA, clinical development activities for NUEDEXTA, AVP-923 and AVP-786 and the rate of progress being made on such activities.

Avanir was incorporated in California in August 1988 and was reincorporated in Delaware in March 2009.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of Avanir have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim reporting including the instructions to Form 10-Q. These condensed consolidated financial statements do not include all disclosures for annual audited financial statements required by accounting principles generally accepted in the United States of America (“U.S. GAAP”) and should be read in conjunction with the Company’s audited consolidated financial statements and related notes included in the Company’s Annual Report on Form 10-K for the

6

Table of Contents

year ended September 30, 2012. The Company believes these condensed consolidated financial statements reflect all adjustments (consisting only of normal, recurring adjustments) that are necessary for a fair presentation of the financial position and results of operations for the periods presented. Results of operations for the interim periods presented are not necessarily indicative of results to be expected for the year.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts and the disclosures of commitments and contingencies in the financial statements and accompanying notes. Actual results could differ from those estimates.

Certain amounts in the accompanying condensed consolidated financial statements have been reclassified to conform to the current period presentation.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following represents an update for the six months ended March 31, 2013 to the significant accounting policies described in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2012.

Concentration of credit risk and sources of supply

As of March 31, 2013, $35.4 million of the Company’s cash and cash equivalents were maintained in three separate money market mutual funds, and approximately $32.5 million of the Company’s cash and cash equivalents were maintained at three major financial institutions in the United States. Deposits held with financial institutions often exceed the amount of insurance provided by the Federal Deposit Insurance Corporation (“FDIC”), which provides basic deposit coverage with limits up to $250,000 per owner. At March 31, 2013, such uninsured deposits totaled approximately $66.8 million of the $67.9 million of total cash and cash equivalents. Generally, these deposits may be redeemed upon demand and, therefore, are believed to bear minimal risk.

Financial instruments that potentially subject the Company to concentrations of credit risk consist of cash and cash equivalents and trade receivables. The Company’s cash and cash equivalents are placed in various money market mutual funds and at financial institutions of high credit standing. The Company performs ongoing credit evaluations of customers’ financial condition and would limit the amount of credit extended if necessary; however, the Company has historically required no collateral.

The Company currently has sole suppliers for the active pharmaceutical ingredients for NUEDEXTA and a sole manufacturer for the finished form of NUEDEXTA. In addition, these materials are custom-made and available from only a limited number of sources. Any material disruption in manufacturing could cause a delay in shipments and possible loss of revenue. If the Company is required to change manufacturers, the Company may experience delays associated with finding an alternative manufacturer that is properly qualified to produce NUEDEXTA in accordance with FDA requirements and the Company’s specifications.

Deferred rent

The Company accounts for rent expense related to operating leases (excluding leases related to exit activities) by determining total minimum rent payments on the leases over their respective periods and recognizing the rent expense on a straight-line basis. The difference between the actual amount paid and the amount recorded as rent expense in each fiscal year is recorded as an adjustment to deferred rent.

7

Table of Contents

Fair value of financial instruments

The Company measures the fair value of certain of its financial assets on a recurring basis. A fair value hierarchy is used to rank the quality and reliability of the information used to determine fair values. Financial assets and liabilities carried at fair value will be classified and disclosed in one of the following three categories:

| • | Level 1 – Quoted prices (unadjusted) in active markets for identical assets and liabilities. |

| • | Level 2 – Inputs other than Level 1 that are observable, either directly or indirectly, such as unadjusted quoted prices for similar assets and liabilities, unadjusted quoted prices in the markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

| • | Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. |

The Company’s financial instruments include cash and cash equivalents, restricted cash and cash equivalents, trade receivables, restricted investments, short-term investments (included in other current assets in the condensed consolidated balance sheets), accounts payable, accrued expenses and other liabilities, accrued compensation and payroll taxes, and notes payable. The carrying amount of cash and cash equivalents, trade receivables, accounts payable, accrued expenses and other liabilities, and accrued compensation and payroll taxes approximates fair value due to the short-term maturities of these instruments. The Company’s restricted cash and cash equivalents, restricted investments and short-term investments are carried at amortized cost which approximates fair value. Based on borrowing rates currently available to the Company, the carrying value of notes payable approximates fair value.

Restricted cash and cash equivalents and restricted investments

Restricted cash and cash equivalents and restricted investments consist of certificates of deposit, which are classified as held-to-maturity.

Restricted cash and cash equivalents consist of a certificate of deposit relating to the Company’s corporate credit card agreement. Restricted short-term investment consists of a certificate of deposit related to an irrevocable standby letter of credit connected to the short-term portion of an office lease which expired in February 2013.

Long-term restricted investments consist of two certificates of deposit related to irrevocable standby letters of credit connected to fleet rentals and an office lease with an expiration date in 2016.

Revenue recognition

The Company has historically generated revenues from product sales, collaborative research and development arrangements, and other commercial arrangements such as royalties, the sale of royalty rights and sales of technology rights. Payments received under such arrangements may include non-refundable fees at the inception of the arrangements, milestone payments for specific achievements designated in the agreements, royalties on sales of products resulting from collaborative arrangements, and payments for the sale of rights to future royalties.

The Company recognizes revenue when all of the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services have been rendered; (3) the Company’s price to the buyer is fixed or determinable; and (4) collectability is reasonably assured. In addition, certain product sales are subject to rights of return. For products sold where the buyer has the right to return the product, the Company recognizes revenue at the time of sale only if (1) the Company’s price to the buyer is substantially fixed or determinable at the date of sale, (2) the buyer has paid the Company, or is obligated to pay the Company and the obligation is not contingent on resale of the product, (3) the buyer’s obligation to the Company would not be changed in the event of theft or physical destruction or damage of the product, (4) the buyer acquiring the product for resale has economic substance apart from that provided by the seller, (5) the Company does not have significant obligations for future performance to directly bring about resale of the product by the buyer, and (6) the amount of future returns can be reasonably estimated. The Company recognizes such product revenues when either it has met all the above criteria, including the ability to reasonably estimate future returns, or when it can reasonably estimate that the return privilege has substantially expired, whichever occurs first.

8

Table of Contents

Product Sales – NUEDEXTA. NUEDEXTA is sold primarily to third-party wholesalers that, in turn, sell this product to retail pharmacies, hospitals, and other dispensing organizations. The Company has entered into agreements with wholesale customers, certain medical institutions and third-party payers throughout the United States. These agreements frequently contain commercial terms, which may include favorable product pricing and discounts and rebates payable upon dispensing the product to patients. Additionally, these agreements customarily provide the customer with rights to return the product, subject to the terms of each contract. Consistent with pharmaceutical industry practice, wholesale customers can return purchased product during an 18-month period that begins six months prior to the product’s expiration date and ends 12 months after the expiration date. The Company recognizes revenue upon shipment of NUEDEXTA to its wholesalers and other customers.

The Company’s net product sales represent gross product sales less allowances for customer credits, including estimated discounts, rebates, chargebacks and co-pay assistance. These allowances provided by the Company to a customer are presumed to be a reduction of the selling prices of the Company’s products or services and, therefore, are characterized as a reduction of revenue when recognized in the Company’s condensed consolidated statement of operations. Allowances for discounts, rebates, chargebacks and co-pay assistance are estimated based on contractual terms with customers and sell-through data purchased from third parties. The Company believes the assumptions used to estimate these allowances are reasonable considering known facts and circumstances. However, actual rebates and chargebacks could differ materially from estimated amounts because of, among other factors, unanticipated changes in prescription trends and any change in assumptions affecting sell-through data purchased from third parties. Product shipping and handling costs are included in cost of product sales.

Prior to the second quarter of fiscal 2012, the Company was unable to reasonably estimate future returns due to the lack of sufficient historical return data for NUEDEXTA. Accordingly, the Company invoiced the wholesaler, recorded deferred revenue at gross invoice sales price less estimated cash discounts and distribution fees, and classified the inventory shipped as finished goods. The Company deferred recognition of revenue and the related cost of product sales on shipments of NUEDEXTA until the right of return no longer existed, i.e. when the Company received evidence that the products had been dispensed to patients. The Company estimated patient prescriptions dispensed using an analysis of third-party information.

Product Sales – Active Pharmaceutical Ingredient docosanol (“docosanol”). Revenue from sales of the Company’s docosanol is recorded when title and risk of loss have passed to the buyer, provided the criteria for revenue recognition have been met. The Company sells the docosanol to various licensees upon receipt of a written order for the materials. Shipments generally occur fewer than three times a year. The Company’s contracts for sales of the docosanol include buyer acceptance provisions that give the Company’s buyers the right of replacement if the delivered product does not meet specified criteria. That right requires that they give the Company notice within 30 days after receipt of the product. The Company has the option to refund or replace any such defective materials; however, it has historically demonstrated that the materials shipped from the same pre-inspected lot have consistently met the specified criteria and no buyer has rejected any of the Company’s shipments from the same pre-inspected lot to date. Therefore, the Company recognizes revenue at the time of delivery without providing any returns reserve.

Multiple Element Arrangements. The Company has, in the past, entered into arrangements whereby it delivers to the customer multiple elements including technology and/or services. Such arrangements have included some combination of the following: antibody generation services; licensed rights to technology, patented products, compounds, data and other intellectual property; and research and development services. At the inception of the arrangement, the Company analyzes its multiple element arrangements to determine whether the elements can be separated. If a product or service is not separable, the combined deliverables will be accounted for as a single unit of accounting.

A delivered element can be separated from other elements when it meets both of the following criteria: (1) the delivered item has value to the customer on a standalone basis; and (2) if the arrangement includes a general right of return relative to the delivered item, delivery or performance of the undelivered item is considered probable and substantially in the Company’s control. If an element can be separated, the Company allocates amounts based upon

9

Table of Contents

the selling price of each element. The Company determines the selling price of a separate deliverable using the price it charges other customers when it sells that product or service separately; however, if the Company does not sell the product or service separately, it uses third-party evidence of selling price of a similar product or service to a similarly situated customer. The Company considers licensed rights or technology to have standalone value to its customers if it or others have sold such rights or technology separately or its customers can sell such rights or technology separately without the need for the Company’s continuing involvement. The Company has not entered into any multiple element arrangements which required the Company to estimate selling prices during the first half of fiscal 2013 and fiscal 2012.

License Arrangements. License arrangements may consist of non-refundable upfront license fees, data transfer fees, research reimbursement payments, exclusive licensed rights to patented or patent pending compounds, technology access fees, and various performance or sales milestones. These arrangements are often multiple element arrangements.

Non-refundable, up-front fees that are not contingent on any future performance by the Company, and require no consequential continuing involvement on its part, are recognized as revenue when the license term commences and the licensed data, technology and/or compound is delivered. Such deliverables may include physical quantities of compounds, design of the compounds and structure-activity relationships, the conceptual framework and mechanism of action, and rights to the patents or patents pending for such compounds. The Company defers recognition of non-refundable upfront fees if it has continuing performance obligations without which the technology, right, product or service conveyed in conjunction with the non-refundable fee has no utility to the licensee that is separate and independent of the Company’s performance under the other elements of the arrangement. In addition, if the Company has required continuing involvement through research and development services that are related to its proprietary know-how and expertise of the delivered technology, or can only be performed by the Company, then such up-front fees are deferred and recognized over the period of continuing involvement.

Payments related to substantive, performance-based milestones in a research and development arrangement are recognized as revenues upon the achievement of the milestones as specified in the underlying agreements when they represent the culmination of the earnings process.

Royalty Arrangements. The Company recognizes royalty revenues from licensed products when earned in accordance with the terms of the license agreements. Net sales amounts generally required to be used for calculating royalties include deductions for returned product, pricing allowances, cash discounts, freight and warehousing. These arrangements are often multiple element arrangements.

Certain royalty arrangements provide that royalties are earned only if a sales threshold is exceeded. Under these types of arrangements, the threshold is typically based on annual sales. For royalty revenue generated from the license agreement with GlaxoSmithKline (“GSK”), the Company recognizes royalty revenue in the period in which the threshold is exceeded. During the six months ended March 31, 2013 and 2012, sales in excess of the threshold resulted in recognized royalty revenues from GSK of approximately $1.2 million in each period.

When the Company sells its rights to future royalties under license agreements and also maintains continuing involvement in earning such royalties, it defers recognition of any upfront payments and recognizes them as revenues over the life of the license agreement. The Company recognizes revenues for the sale of an undivided interest of its Abreva® license agreement to Drug Royalty USA under the “units-of-revenue method.” Under this method, the amount of deferred revenues to be recognized in each period is calculated by multiplying the ratio of the royalty payments due to Drug Royalty USA by GSK for the period to the total remaining royalties the Company expects GSK will pay Drug Royalty USA over the remaining term of the agreement.

Share-based compensation

The Company grants options, restricted stock units and restricted stock awards to purchase the Company’s common stock to employees, directors and consultants under stock option plans. The benefits provided under these plans are share-based payments that the Company accounts for using the fair value method. The fair value of each option award is estimated on the date of grant using a Black-Scholes-Merton option pricing model (“Black-Scholes model”) that uses assumptions regarding a number of complex and subjective variables.

10

Table of Contents

Share-based compensation expense recognized during a period is based on the value of the portion of share-based payment awards that is ultimately expected to vest amortized under the straight-line attribution method. As share-based compensation expense recognized in the accompanying condensed consolidated statements of operations for periods in fiscal 2013 and 2012 is based on awards ultimately expected to vest, it has been reduced for estimated forfeitures. The fair value method requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. The Company estimates forfeitures based on historical experience. Changes to the estimated forfeiture rate are accounted for as a cumulative effect of change in the period the change occurred.

Total compensation expense related to all of the Company’s share-based awards for the three and six month periods ended March 31, 2013 and 2012, was comprised of the following:

| Three months ended March 31, |

Six months

ended March 31, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Share-based compensation classified as: |

||||||||||||||||

| Research and development expense |

$ | 287,669 | $ | 267,133 | $ | 555,813 | $ | 507,935 | ||||||||

| Selling and marketing expense |

419,066 | 235,196 | 734,595 | 365,072 | ||||||||||||

| General and administrative expense |

1,082,567 | 731,921 | 1,905,902 | 1,523,280 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 1,789,302 | $ | 1,234,250 | $ | 3,196,310 | $ | 2,396,287 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Three months ended March 31, |

Six months ended March 31, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Share-based compensation expense from: |

||||||||||||||||

| Stock options |

$ | 1,071,664 | $ | 930,430 | $ | 2,119,650 | $ | 1,740,965 | ||||||||

| Restricted stock units |

717,638 | 303,820 | 1,076,660 | 655,322 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 1,789,302 | $ | 1,234,250 | $ | 3,196,310 | $ | 2,396,287 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Since the Company has a net operating loss carry-forward as of March 31, 2013, no excess tax benefits for the tax deductions related to share-based awards were recognized in the accompanying condensed consolidated statements of operations. Additionally, no incremental tax benefits were recognized from stock options exercised in the six month periods ended March 31, 2013 and 2012, that would have resulted in a reclassification from cash flows from operating activities to cash flows from financing activities.

Income taxes

The Company accounts for income taxes and the related accounts under the liability method. Deferred tax assets and liabilities are determined based on the differences between the consolidated financial statement carrying amounts and the income tax bases of assets and liabilities. A valuation allowance is applied against any net deferred tax asset if, based on available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized.

The Company recognizes any uncertain income tax positions on income tax returns at the largest amount that is more-likely-than-not to be sustained upon audit by the relevant taxing authority. An uncertain income tax position will not be recognized if it has less than a 50% likelihood of being sustained.

The total unrecognized tax benefit resulting in a decrease in deferred tax assets and corresponding decrease in the valuation allowance at March 31, 2013 is $3.1 million. There are no unrecognized tax benefits included in the condensed consolidated balance sheet that would, if recognized, affect the effective tax rate.

The Company’s policy is to recognize interest and/or penalties related to income tax matters in income tax expense. The Company had $0 accrued for interest and penalties on the Company’s condensed consolidated balance sheets at March 31, 2013 and September 30, 2012.

11

Table of Contents

The Company is subject to taxation in the U.S. and various state jurisdictions. The Company’s tax years for 1995 and forward for federal purposes and 1989 and forward for California purposes are subject to examination by the U.S. and California tax authorities due to the carryforward of unutilized net operating losses and research and development credits.

The Company does not foresee material changes to its gross uncertain income tax position liability within the next twelve months.

Recent authoritative guidance

Proposed Amendments to Current Accounting Standards. The Financial Accounting Standard Board (“FASB”) is currently working on amendments to existing accounting standards governing a number of areas including, but not limited to, revenue recognition and lease accounting.

In June 2010, the FASB issued an exposure draft, Revenue from Contracts with Customers, which would supersede most of the existing guidance on revenue recognition in Accounting Standards Codification (“ASC”) Topic 605, Revenue Recognition. In November 2011, the FASB re-exposed this draft and it expects a final standard to be issued during the first half of calendar 2013. As the standard-setting process is still ongoing, the Company is unable to determine the impact this proposed change in accounting will have in the Company’s consolidated financial statements at this time.

In August 2010, the FASB issued an exposure draft, Leases, which would result in significant changes to the accounting requirements for both lessees and lessors in ASC Topic 840, Leases. In July 2011, the FASB announced its intention to re-expose the draft which is currently scheduled for the first half of calendar 2013. As the standard-setting process is still ongoing, the Company is unable to determine the impact this proposed change in accounting will have in the Company’s consolidated financial statements at this time.

3. INVENTORIES

Inventories are comprised of NUEDEXTA product and the active pharmaceutical ingredients of NUEDEXTA, dextromethorphan and quinidine, as well as the active pharmaceutical ingredient docosanol.

The composition of inventories as of March 31, 2013 and September 30, 2012 is as follows:

| March 31, 2013 |

September 30, 2012 |

|||||||

| (audited) | ||||||||

| Raw materials |

$ | 993,186 | $ | 1,026,250 | ||||

| Work in progress |

41,669 | 43,828 | ||||||

| Finished goods |

302,480 | 253,761 | ||||||

|

|

|

|

|

|||||

| Total inventory |

1,337,335 | 1,323,839 | ||||||

| Less: current portion |

(428,969 | ) | (415,475 | ) | ||||

|

|

|

|

|

|||||

| Non-current portion |

$ | 908,366 | $ | 908,364 | ||||

|

|

|

|

|

|||||

The amount classified as non-current inventories is comprised of the raw material components for NUEDEXTA, dextromethorphan and quinidine, which will be used in the manufacture of NUEDEXTA capsules in the future.

12

Table of Contents

4. ACCRUED EXPENSES AND OTHER LIABILITIES

Accrued expenses and other liabilities at March 31, 2013 and September 30, 2012 are as follows:

| March 31, 2013 |

September 30, 2012 |

|||||||

| (audited) | ||||||||

| Accrued royalties, rebates, chargebacks, and distribution fees (1) |

$ | 4,109,675 | $ | 2,851,140 | ||||

| Accrued research and development expenses |

1,559,159 | 1,222,140 | ||||||

| Accrued selling and marketing expenses |

801,066 | 1,075,387 | ||||||

| Accrued general and administrative expenses |

780,358 | 1,094,755 | ||||||

| Other liabilities |

1,769,277 | 1,484,916 | ||||||

|

|

|

|

|

|||||

| Total accrued expenses and other liabilities |

9,019,535 | 7,728,338 | ||||||

| Less: current portion |

(7,946,270 | ) | (7,062,159 | ) | ||||

|

|

|

|

|

|||||

| Non-current total accrued expenses and other liabilities |

$ | 1,073,265 | $ | 666,179 | ||||

|

|

|

|

|

|||||

| (1) | Accrued royalties, rebates, chargebacks and distribution fees are directly impacted by product revenue and will fluctuate over time in relation to the change in product revenue. |

5. NET DEFERRED REVENUES

The following table sets forth as of March 31, 2013, the deferred royalty revenue balance for the Company’s sale of future Abreva® royalty rights to Drug Royalty USA:

| Drug Royalty USA Agreement |

||||

| Net deferred revenues as of September 30, 2012 |

$ | 4,049,318 | ||

| Changes during the period: |

||||

| Recognized as revenues during period |

(1,374,832 | ) | ||

|

|

|

|||

| Net deferred revenues as of March 31, 2013 |

$ | 2,674,486 | ||

|

|

|

|||

| Classified and reported as: |

||||

| Current portion of deferred revenues |

$ | 2,557,464 | ||

| Deferred revenues, net of current portion |

117,022 | |||

|

|

|

|||

| Total deferred revenues |

$ | 2,674,486 | ||

|

|

|

|||

In November 2002, the Company sold to Drug Royalty USA an undivided interest in the Company’s rights to receive future Abreva royalties under the license agreement with GlaxoSmithKline for $24.1 million (the “Drug Royalty Agreement” and the “GSK License Agreement,” respectively). Under the Drug Royalty Agreement, Drug Royalty USA has the right to receive royalties from GlaxoSmithKline on sales of Abreva until the later of December 2013, or the expiration of the patent for Abreva on April 14, 2014. The Company retained the right to receive 50% of all royalties (a net of 4%) under the GSK License Agreement for annual net sales of Abreva in the U.S. and Canada in excess of $62 million.

Revenues are recognized when earned, collection is reasonably assured and no additional performance of services is required. The Company classified the proceeds received from Drug Royalty USA as deferred revenue and is recognizing the revenue over the life of the license agreement because of the Company’s continuing involvement over the term of the Drug Royalty Agreement. Such continuing involvement includes overseeing the performance of GlaxoSmithKline and its compliance with the covenants in the GSK License Agreement, monitoring patent infringement, adverse claims or litigation involving Abreva, and undertaking to find a new license partner in the event that GlaxoSmithKline terminates the agreement. The Drug Royalty Agreement contains both covenants and events of default that require such performance on the Company’s part. Therefore, nonperformance on the Company’s part could result in default of the arrangement, and could give rise to additional rights in favor of Drug

13

Table of Contents

Royalty USA under a separate security agreement with Drug Royalty USA, which could result in loss of the Company’s rights to share in future Abreva royalties if wholesale sales by GlaxoSmithKline exceed $62 million a year. The deferred revenue is being recognized as revenue using the “units-of-revenue method” over the life of the license agreement. Based on a review of the Company’s continuing involvement, the Company concluded that the sale proceeds did not meet any of the rebuttable presumptions that would require classification of the proceeds as debt.

6. NOTES PAYABLE

In fiscal 2012, the Company entered into a Loan and Security Agreement (the “Loan Agreement”) with Oxford Finance LLC and Silicon Valley Bank. The Loan Agreement provides for a term loan of $30.0 million which was funded upon closing of the transaction in June 2012. Under the terms of the Loan Agreement, interest accrues on the outstanding balance at a rate of 8.95% per annum. The Company will make monthly payments of interest only until July 1, 2013, or upon meeting certain conditions, until January 1, 2014 (the “Amortization Date”). Beginning on the Amortization Date, the outstanding loan balance will be repaid in thirty equal monthly payments of principal and interest. In addition to the original principal, a final payment equal to 7% of the original principal amount of the loan will be due thirty months from the Amortization Date. The final payment is being accreted as interest expense over the term of the debt using the interest method and the related liability is included in accrued expenses and other liabilities in the accompanying condensed consolidated balance sheets.

In accordance with the terms of the Loan Agreement, the Company issued to the lenders warrants to purchase shares of the Company’s common stock equal to 4.55% of the original principal at a price per share equal to the lower of the 10-day average share price prior to closing or the price per share on the day of funding. Accordingly, the Company issued to the lenders warrants to purchase 491,007 shares of the Company’s common stock at an exercise price of $2.78 per share. The fair value of the warrants was approximately $1.2 million and was estimated using the Black-Scholes model with the following assumptions: fair value of the Company’s common stock at issuance of $2.80 per share; ten year contractual term; 96.7% volatility; 0% dividend rate; and a risk-free interest rate of 1.8%. The fair value of the warrants was recorded as a debt discount, decreasing notes payable and increasing additional paid-in capital on the accompanying condensed consolidated balance sheets. The debt discount is being amortized to interest expense over the term of the debt using the interest method. For the three and six months ended March 31, 2013, debt discount amortization was approximately $139,000 and $277,000, respectively.

The loan is secured by a first priority security interest in all of the Company’s assets, other than its intellectual property and its rights under license agreements granting it rights to intellectual property.

The Loan Agreement contains standard affirmative and restrictive covenants. The affirmative covenants include, among other items, that the Company maintain a minimum sales level relative to projected NUEDEXTA revenues, measured on a trailing three-month basis, or maintain cash and cash equivalents in accounts subject to control agreements in favor of the collateral agent equal to at least 1.5 times the outstanding amount of obligations under the Loan Agreement. Additionally, the affirmative and restrictive covenants, among other items, restrict the Company’s ability to incur additional indebtedness or guarantees; incur liens; make investments, loans and acquisitions; consolidate or merge; sell assets, including capital stock of subsidiaries; alter the business of the Company; engage in transactions with affiliates; and enter into agreements limiting dividends and distributions of certain subsidiaries. The Loan Agreement also includes events of default, including, among other things, payment defaults; breaches of representations, warranties or covenants; certain bankruptcy events; the occurrence of certain material adverse changes; and a commercial, generic version of NUEDEXTA (for the treatment of PBA) becoming available. Upon the occurrence of an event of default and following any cure periods (if applicable), a default interest rate of an additional 5.0% per annum may be applied to the outstanding loan balances, and the lenders may declare all outstanding obligations immediately due and payable and take such other actions as set forth in the Loan Agreement. As of March 31, 2013, the Company was in compliance with all the covenants in the Loan Agreement.

7. COMPUTATION OF NET LOSS PER COMMON SHARE

Basic net loss per common share is computed by dividing net loss by the weighted-average number of common shares outstanding during the period, excluding restricted stock that has been issued but is not yet vested. Diluted net loss per common share is computed by dividing net loss by the weighted-average number of common shares outstanding during the period plus additional weighted-average common equivalent shares outstanding during the period. Common equivalent shares result from the assumed exercise of outstanding stock options and warrants (the

14

Table of Contents

proceeds of which are then presumed to have been used to repurchase outstanding stock using the treasury stock method) and the vesting of restricted shares of common stock. In loss periods, certain of the common equivalent shares are excluded from the computation of diluted net loss per share, because their effect would have been anti-dilutive.

For the three and six month periods ended March 31, 2013 and 2012, the following options and warrants to purchase shares of common stock and restricted stock units were excluded from the computation of diluted net loss per share, as the inclusion of such shares would be anti-dilutive:

| 2013 | 2012 | |||||||

| Stock options |

9,424,703 | 8,625,468 | ||||||

| Stock warrants |

53,957 | 710,109 | ||||||

| Restricted stock units (1) |

3,086,758 | 2,583,805 | ||||||

| (1) | Includes 1,162,465 and 1,505,564 shares of restricted stock at March 31, 2013 and 2012, respectively, awarded to directors that have vested but are still restricted until the directors resign. |

8. STOCKHOLDERS’ EQUITY

Common Stock

In August 2012, the Company filed with the SEC a shelf registration statement on Form S-3 to sell an aggregate of up to $100.0 million in common stock, preferred stock, debt securities and warrants. Included in this shelf registration on Form S-3 is a prospectus relating to a financing facility with Cowen and Company, LLC (“Cowen”), providing for the sale of up to $25.0 million worth of shares of the Company’s common stock from time to time into the open market at prevailing prices in accordance with the terms of a sales agreement entered into on August 8, 2012. During the six months ended March 31, 2013, the Company issued 6,820,000 shares of common stock under the sales agreement raising proceeds of approximately $19.1 million, net of offering costs, including commissions.

During the six months ended March 31, 2013, the Company received proceeds of approximately $1.0 million from the exercise of warrants to purchase 710,109 shares of the Company’s common stock. The warrants had been issued in connection with the Company’s registered securities offering in April 2008 at an exercise price of $1.43 per share.

During the six months ended March 31, 2013, the Company issued 510,188 shares of common stock in connection with restricted stock units which were awarded to directors and vested at September 30, 2012, but were restricted until the resignation of the directors, 165,246 shares of common stock in connection with the vesting of restricted stock units and 389,781 shares of common stock in connection with the exercise of stock options resulting in proceeds of approximately $543,000.

Warrants Outstanding

In May 2012, the Company issued warrants to purchase 491,007 shares of the Company’s common stock at an exercise price of $2.78 per share in connection with the financing transaction in May 2012. (See Note 6, “Notes Payable”). In November 2012, 437,050 of these warrants were exercised in a cashless transaction resulting in the issuance of 72,185 shares of the Company’s common stock. As of March 31, 2013, 53,957 warrants remain outstanding and exercisable. The warrants expire in May 2022.

9. EMPLOYEE EQUITY INCENTIVE PLANS

The Company currently has three equity incentive plans under which awards are outstanding (the “Plans”), one of which is currently in active use as described below. The Plans are: the 2005 Equity Incentive Plan (the “2005 Plan”), the 2003 Equity Incentive Plan (the “2003 Plan”) and the 2000 Stock Option Plan (the “2000 Plan”), which are described in the Company’s Annual Report on Form 10-K for the year ended September 30, 2012. All of the Plans were approved by the stockholders, except for the 2003 Plan, which was approved solely by the Board of Directors. Share-based awards are subject to terms and conditions established by the Compensation Committee of the Company’s Board of Directors. The Company’s policy is to issue new common shares upon the exercise of stock options, conversion of restricted share units or purchase of restricted stock.

15

Table of Contents

During the six month periods ended March 31, 2013 and 2012, the Company granted share-based awards under both the 2003 Plan and the 2005 Plan. Under the 2003 Plan and the 2005 Plan, options to purchase shares, restricted stock units, restricted stock and other share-based awards may be granted to the Company’s directors, employees and consultants. Effective March 2013, the Company is no longer able to issue grants from the 2003 Plan. Pursuant to the provisions of annual increases of the 2005 Plan, the number of authorized shares of common stock for issuance increased by 325,000 shares effective November 15, 2012. As of March 31, 2013, the Company had an aggregate of 13,515,843 shares of its common stock reserved for future issuance. Of those shares, 12,511,461 shares were related to outstanding options and other awards and 1,004,382 shares were available for future grants of share-based awards. As of March 31, 2013, no equity awards were outstanding to consultants. The Company may also, from time to time, issue share-based awards outside of the Plans to the extent permitted by NASDAQ rules. As of March 31, 2013, there were no equity awards that were issued outside of the Plans (inducement option grants) outstanding. None of the share-based awards are classified as a liability as of March 31, 2013.

Stock Options. Stock options are granted with an exercise price equal to the current market price of the Company’s common stock at the grant date and have 10-year contractual terms. For option grants to employees, generally 25% of the option shares vest and become exercisable on the first anniversary of the grant date and the remaining 75% of the option shares vest and become exercisable quarterly in equal installments thereafter over three years. Certain option awards provide for accelerated vesting if there is a change in control (as defined in the Plans).

Summaries of stock options outstanding and changes during the six months ended March 31, 2013 are presented below.

| Number of Shares |

Weighted Average Exercise Price per Share |

Weighted Average Remaining Contractual Term (In Years) |

Aggregate Intrinsic Value |

|||||||||||||

| Outstanding, September 30, 2012 |

8,142,468 | $ | 2.67 | |||||||||||||

| Granted |

1,859,107 | $ | 2.64 | |||||||||||||

| Exercised |

(389,781 | ) | $ | 1.39 | ||||||||||||

| Forfeited |

(187,091 | ) | $ | 3.37 | ||||||||||||

|

|

|

|||||||||||||||

| Outstanding March 31, 2013 |

9,424,703 | $ | 2.71 | 7.6 | $ | 5,313,772 | ||||||||||

|

|

|

|||||||||||||||

| Vested and expected to vest in the future, March 31, 2013 |

9,072,526 | $ | 2.71 | 7.5 | $ | 5,218,502 | ||||||||||

|

|

|

|||||||||||||||

| Exercisable, March 31, 2013 |

4,346,368 | $ | 2.68 | 6.5 | $ | 3,696,086 | ||||||||||

|

|

|

|||||||||||||||

The weighted average grant-date fair value of options granted during the six month periods ended March 31, 2013 and 2012 was $1.79 and $1.59 per share, respectively. The total intrinsic value of options exercised during the six month periods ended March 31, 2013 and 2012 was approximately $576,000 and $1.8 million, respectively, based on the differences in market prices on the dates of exercise and the option exercise prices. As of March 31, 2013, the total unrecognized compensation cost related to unvested options was approximately $9.8 million which is expected to be recognized over the weighted-average period of 2.8 years, based on the vesting schedules. No tax benefit was realized for the tax deductions from option exercise of the share-based payment arrangements in the six month periods ended March 31, 2013 and 2012.

The fair value of each option award is estimated on the date of grant using the Black-Scholes model, which uses the assumptions noted in the following table. Expected volatilities are based on historical volatility of the Company’s common stock and other factors. The expected term of options granted is based on analyses of historical employee termination rates and option exercises. The expected risk-free interest rate is based on the U.S. Treasury yield for a period consistent with the expected term of the option in effect at the time of the grant. The dividend yield is based on the Company’s expectation of not paying dividends in the foreseeable future.

16

Table of Contents

Assumptions used in the Black-Scholes model for options granted during the six months ended March 31, 2013 were as follows:

| Expected volatility |

83%-84% | |

| Expected term in years |

5.4 | |

| Expected risk-free interest rate (zero coupon U.S. Treasury Note) |

0.8%-0.9% | |

| Expected dividend yield |

0% |

Restricted stock units (“RSU”). RSUs granted to employees generally vest based on three or four years of continuous service from the date of grant. RSUs granted to non-employee directors generally vest over the term of one year from the grant date and are not released until the awardee’s termination of service. Vesting for non-employee director grants allow for accelerated vesting of RSUs in the case of a non-employee director’s resignation where either: (i) he/she has served for at least four years as a member of the Board and is in good standing at the time of resignation, or (ii) he/she resigns for reasons related to health or family matters and is otherwise in good standing at the time of resignation.

The following table summarizes the RSU activities for the six months ended March 31, 2013:

| Number of Shares | Weighted Average Grant Date Fair Value |

|||||||

| Unvested, September 30, 2012 |

1,016,624 | $ | 2.23 | |||||

| Granted |

1,166,301 | $ | 2.65 | |||||

| Vested |

(237,335 | ) | $ | 3.07 | ||||

| Forfeited |

(21,297 | ) | $ | 2.24 | ||||

|

|

|

|||||||

| Unvested, March 31, 2013 |

1,924,293 | $ | 2.38 | |||||

|

|

|

|||||||

The grant-date fair value of RSUs granted during the six month periods ended March 31, 2013 and 2012 was approximately $3.1 million and $2.1 million, respectively. As of March 31, 2013, the total unrecognized compensation cost related to unvested shares was approximately $3.7 million which is expected to be recognized over a weighted-average period of 3.0 years, based on the vesting schedules.

At March 31, 2013, there were 1,162,465 shares of restricted stock with a weighted-average grant date fair value of $2.01 per share awarded to directors that have vested but are still restricted until the director resigns.

Performance RSUs. During the six months ended March 31, 2013, the Company granted performance RSUs to purchase 325,434 shares of common stock from the 2003 Stock Option Plan. The performance RSUs are included in the above unvested RSU table. The RSUs have a performance goal related to fiscal 2013 revenue that determines when vesting begins and the actual number of shares to be awarded ranging from 0% to 100% of target. Vesting is over three years beginning on the date the performance goal is achieved (“Achievement Date”), with 50% of the RSU shares vesting on the first anniversary of the Achievement Date and the remaining 50% of the RSU shares vesting annually in equal installments thereafter over two years. At March 31, 2013, the performance goal had not been met and 321,434 performance RSUs were outstanding.

Additionally, during fiscal 2012, the Company granted performance RSUs to purchase 30,000 shares of common stock from the 2003 Stock Option Plan. The performance RSUs are included in the above unvested RSU table. The RSUs have a performance goal related to revenue that determines when vesting begins and the actual number of shares to be awarded ranging from 0% to 100% of target. Vesting is over 4 years beginning on the Achievement Date, with 25% of the RSU shares vesting on the first anniversary of the Achievement Date and the remaining 75% of the RSU shares vesting quarterly in equal installments thereafter over three years. At March 31, 2013, the performance goal had not been met and all 30,000 performance RSUs were outstanding.

17

Table of Contents

10. COMMITMENTS AND CONTINGENCIES

Center for Neurologic Study (“CNS”) – The Company holds the exclusive worldwide marketing rights to NUEDEXTA for certain indications pursuant to an exclusive license agreement with CNS.

The Company paid a $75,000 milestone upon FDA approval of NUEDEXTA for the treatment of PBA in the first quarter of fiscal 2011. In addition, the Company is obligated to pay CNS a royalty ranging from approximately 5% to 8% of net U.S. GAAP revenue generated by sales of NUEDEXTA. During the six months ended March 31, 2013 and 2012, royalties of approximately $1.6 million and $727,000, respectively, are recorded to cost of product sales in the accompanying condensed consolidated statements of operations. Under certain circumstances, the Company may have the obligation to pay CNS a portion of net revenues received if the Company sublicenses NUEDEXTA to a third party.

Under the agreement with CNS, the Company is required to make payments on achievements of up to a maximum of ten milestones, based upon five specific medical indications. Maximum payments for these milestone payments could total approximately $1.1 million if the Company pursued the development of NUEDEXTA for all five of the licensed indications. In general, individual milestones range from $75,000 to $125,000 for each accepted new drug application (“NDA”) and a similar amount for each approved NDA in addition to the royalty discussed above on net U.S. GAAP revenues. The Company does not have the obligation to develop additional indications under the CNS license agreement.

Concert Pharmaceuticals, Inc. (“Concert”) – The Company holds the exclusive worldwide marketing rights to develop and commercialize Concert’s d-DM compounds for the potential treatment of neurological and psychiatric disorders, as well as certain rights to other deuterium-modified dextromethorphan compounds pursuant to a license agreement with Concert.

Under the agreement with Concert, the Company is obligated to make milestone and royalty payments to Concert based on successful advancement of d-DM products for one or more indications in the United States, Europe, and Japan. Individual milestone payments range from $2.0 – 6.0 million, $1.5 – 15.0 million, and $25.0 – 60.0 million for clinical, regulatory and commercial targets respectively, and in aggregate could total over $200 million. Royalty payments are tiered, beginning in the single-digits and increasing to the low double-digits for worldwide net sales of d-DM products exceeding $1 billion annually. As of March 31, 2013, the Company has accrued $2.0 million, for milestones that have been achieved pursuant this agreement, as research and development expense in the condensed consolidated statement of operations.

Legal Contingencies –

NUEDEXTA ABBREVIATED NEW DRUG APPLICATION (“ANDA”) Litigation

In fiscal 2011 and 2012, the Company received Paragraph IV certification notices from five separate companies contending that certain of its patents listed in the FDA’s publication, “Approved Drug Products with Therapeutic Equivalence Evaluation” (“FDA Orange Book”) (U.S. Patents 7,659,282 (“’282 Patent”), 8,227,484 (“’484 Patent”) and RE 38,115 (“’115 Patent”), which expire in August 2026, July 2023 and January 2016, respectively) are invalid, unenforceable and/or will not be infringed by the manufacture, use, sale or offer for sale of a generic form of NUEDEXTA as described in those companies’ abbreviated new drug application (“ANDA”). The FDA Orange Book provides potential competitors, including generic drug companies, with a list of issued patents covering approved drugs. In August 2011 and March 2012, the Company filed lawsuits in the U.S District Court for the District of Delaware against Par Pharmaceutical, Inc. and Par Pharmaceutical Companies, Inc. (collectively “Par”), Actavis South Atlantic LLC and Actavis, Inc. (collectively “Actavis”), Wockhardt USA, LLC and Wockhardt, Ltd. (collectively, “Wockhardt”), Impax Laboratories, Inc. (“Impax”) and Watson Pharmaceuticals, Inc., Watson Laboratories, Inc. and Watson Pharma, Inc. (collectively “Watson”) (Par, Actavis, Wockhardt, Impax and Watson, collectively the “Defendants”). In March 2012, the Company also filed a protective suit in the U.S District Court for the District of New Jersey against Watson. The New Jersey suit was voluntarily dismissed by the Company in May 2012. In September and October 2012, the Company filed lawsuits in the U.S. District Court for the District of Delaware against the Defendants. All lawsuits (collectively, the “ANDA Actions”) were filed on the basis that the

18

Table of Contents

Defendants’ submissions of their respective ANDAs to obtain approval to manufacture, use, sell, or offer for sale generic versions of NUEDEXTA prior to the expiration of the ’282 Patent, the ’484 Patent and the ’115 Patent listed in the FDA Orange Book constitute infringement of one or more claims of those patents. In October 2012, Watson announced that it completed the acquisition of Actavis and the divestiture of its ANDA for a generic form of NUEDEXTA to Sandoz, Inc.

On December 3, 2012, the Company received a Memorandum Opinion and Order (the “Order”) issued by Judge Leonard P. Stark of the United States District Court for the District of Delaware (the “Court”) related to the Markman hearing held October 5, 2012 in the Company’s ongoing patent infringement case against the Defendants. The Order establishes the meaning of the seven patent claim terms in dispute between the parties. After comprehensive briefing and oral argument, Judge Stark’s Order adopted the Company’s proposed or stipulated patent term constructions.

Pursuant to the provisions of the Hatch-Waxman Act, FDA final approval of the ANDAs submitted by the Defendants can occur no earlier than October 29, 2013. Further, as a result of the 30-month stay associated with the filing of the ANDA Actions, the FDA cannot grant final approval to any ANDA before December 30, 2013, unless there is an earlier court decision holding that the Orange Book-listed ’282, ’484 and ’115 patents are not infringed and/or are invalid. The Company intends to vigorously enforce its intellectual property rights relating to NUEDEXTA, but the Company cannot predict the outcome of these matters.

Alamo and Azur Litigation

In October 2011, Neal R. Cutler, M.D., the founder of Alamo Pharmaceuticals, LLC (“Alamo”), filed a lawsuit in California Superior Court against Azur Pharma International III Limited and Azur Pharma Limited (collectively, “Azur”) and Avanir (the “Cutler Action”). The Company purchased Alamo in 2006 to acquire rights to FazaClo, an approved anti-psychotic drug. In connection with this acquisition of Alamo, the Company agreed to provide the Alamo equity holders, including Dr. Cutler, with milestone payments tied to the aggregate net revenues of FazaClo. In 2007, the Company sold FazaClo and its related assets and operations to Azur. In connection with this sale, Azur agreed to assume the milestone payment obligations due to Dr. Cutler under the Alamo purchase agreement, although the Company could remain liable for these payments if Azur defaults on these obligations. In the Cutler Action, Dr. Cutler alleges a breach of contract and a breach of implied covenant of good faith and fair dealing. Dr. Cutler alleges that Azur has failed to make certain information reasonably available to Dr. Cutler and has withheld payments to which Dr. Cutler is entitled. Dr. Cutler alleges that Avanir has acquiesced in this conduct, and Dr. Cutler seeks to hold both Azur and Avanir liable for these actions. Azur Ltd. and Jazz Pharmaceuticals, Inc. entered into a business combination creating Jazz Pharmaceuticals, plc (“Jazz”). As successor in interest to Azur Ltd., Jazz agreed to indemnify Avanir in full for the claims asserted in the Cutler Action.

General and Other

In the ordinary course of business, the Company may face various claims brought by third parties and it may, from time to time, make claims or take legal actions to assert the Company’s rights, including intellectual property rights as well as claims relating to employment and the safety or efficacy of its products. Any of these claims could subject the Company to costly litigation and, while the Company generally believes that it has adequate insurance to cover many different types of liabilities, the Company’s insurance carriers may deny coverage or the Company’s policy limits may be inadequate to fully satisfy any damage awards or settlements. If this were to happen, the payment of any such awards could have a material adverse effect on the Company’s operations, cash flows and financial position. Additionally, any such claims, whether or not successful, could damage the Company’s reputation and business. Management believes the outcomes of currently pending claims and lawsuits are not likely to have a material effect on the Company’s operations or financial position.

In addition, it is possible that the Company could incur termination fees and penalties if it elected to terminate contracts with certain vendors.

Guarantees and Indemnities – The Company indemnifies its directors and officers to the maximum extent permitted under the laws of the State of Delaware, and various lessors in connection with facility leases for certain claims arising from such facilities or leases. Additionally, the Company periodically enters into contracts that contain indemnification obligations, including contracts for the purchase and sale of assets, wholesale distribution

19

Table of Contents

agreements, clinical trials, pre-clinical development work and securities offerings. These indemnification obligations provide the contracting parties with the contractual right to have the Company pay for the costs associated with the defense and settlement of certain claims, typically in circumstances where the Company has failed to meet its contractual performance obligations in some fashion.

The maximum amount of potential future payments under such indemnifications is not determinable. The Company has not incurred significant costs related to these guarantees and indemnifications, and no liability has been recorded in the condensed consolidated financial statements for guarantees and indemnifications as of March 31, 2013.

11. SEGMENT INFORMATION

The Company operates its business on the basis of a single reportable segment, which is the business of discovery, development and commercialization of novel therapeutics for chronic diseases. The Company’s chief operating decision-maker is the Chief Executive Officer, who evaluates the Company as a single operating segment.

The Company categorizes revenues by geographic area based on selling location. All the Company’s operations are currently located in the United States; therefore, total revenues for the three and six month periods ended March 31, 2013 and 2012 are attributed to the United States. All long-lived assets at March 31, 2013 and September 30, 2012 are located in the United States.

The Company sells NUEDEXTA to a limited number of wholesalers. Three wholesalers accounted for 89% of net product sales for the six month periods ended March 31, 2013 and 2012. In addition, the three wholesalers accounted for 92% and 91% of trade receivables at March 31, 2013 and September 30, 2012, respectively.

For the three month periods ended March 31, 2013 and 2012, the revenues from prior sale of rights to royalties under the GSK license agreement were less than 10% total revenues. For the six month periods ended March 31, 2013 and 2012, the revenues from prior sale of rights to royalties under the GSK license agreement were less than 10% and 12% of total revenues, respectively.

12. SUBSEQUENT EVENTS

The Company has evaluated subsequent events through the filing date of this Form 10-Q, and determined that no subsequent events have occurred that would require recognition in the condensed consolidated financial statements or disclosure in the notes thereto other than discussed in the accompanying notes.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Quarterly Report on Form 10-Q contains forward-looking statements concerning future events and performance of the Company. When used in this report, the words “intend,” “estimate,” “anticipate,” “believe,” “plan” or “expect” and similar expressions are included to identify forward-looking statements. These forward-looking statements are based on our current expectations and assumptions and many factors could cause our actual results to differ materially from those indicated in these forward-looking statements. You should review carefully the factors identified in “Risk Factors” in this report in Part II, Item 1A. and in Part I, Item 1A. in our most recent Annual Report on Form 10-K filed with the SEC. We disclaim any intent to update or announce revisions to any forward-looking statements to reflect actual events or developments. Except as otherwise indicated herein, all dates referred to in this report represent periods or dates fixed with reference to the calendar year, rather than our fiscal year ending September 30. The three months ended March 31, 2013 are also referred to as the second quarter of fiscal 2013.

20

Table of Contents

EXECUTIVE OVERVIEW