Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEWTEK BUSINESS SERVICES, INC. | d534415d8k.htm |

| EX-99.1 - EX-99.1 - NEWTEK BUSINESS SERVICES, INC. | d534415dex991.htm |

www.thesba.com

Newtek Business Services, Inc.

Newtek Business Services, Inc.

“The Small Business Authority®”

“The Small Business Authority®”

Hosted by:

Hosted by:

Barry Sloane, President & CEO

Barry Sloane, President & CEO

Jennifer Eddelson, EVP & CAO

Jennifer Eddelson, EVP & CAO

First Quarter 2013

First Quarter 2013

Financial Results Conference Call

Financial Results Conference Call

May 8, 2013 4:15pm ET

May 8, 2013 4:15pm ET

NASDAQ: NEWT

NASDAQ: NEWT

www.thesba.com

www.thesba.com

Investor Relations

Public Relations

Newtek IR

Hayden Investor Relations

Rubenstein Public Relations, Inc.

Jayne Cavuoto

Director of IR

jcavuoto@thesba.com

(212) 273-8179

Brett Maas

brett@haydenir.com

(646) 536-7331

Peter Seltzberg

peter@haydenir.com

(646) 415-8972

Jonathan Goldberg

jgoldberg@rubensteinpr.com

(212) 843-9335

Exhibit 99.2 |

www.thesba.com

Safe Harbor Statement

Safe Harbor Statement

The statements in this slide presentation including statements regarding anticipated future

financial performance, Newtek's beliefs, expectations, intentions or strategies for the

future, may be "forward-looking statements" under the Private Securities

Litigation Reform Act of 1995. All forward-looking statements involve a number of

risks and uncertainties that could cause actual results to differ materially from the

plans, intentions and expectations reflected in or suggested by the forward-looking

statements. Such risks and uncertainties include, among others, intensified

competition, operating problems and their impact on revenues and profit margins,

anticipated future business strategies and financial performance, anticipated future

number of customers, business prospects, legislative developments and similar matters. Risk

factors, cautionary statements and other conditions which could cause Newtek’s

actual results to differ from management's current expectations are contained in

Newtek’s filings with the Securities and Exchange Commission and available through

http://www.sec.gov 2 |

www.thesba.com

First Quarter 2013

First Quarter 2013

Conference Call Agenda

Conference Call Agenda

3

First Quarter 2013 Consolidated Financial Performance

Segment Performance and Strategy

Reaffirmation of 2013 Guidance

Newtek Growth Strategy

Marketing Initiatives

Future Initiatives

Investment Merits |

www.thesba.com

Consolidated Earnings Performance

Consolidated Earnings Performance

4

*See slide 35

for definition of Modified EBITDA

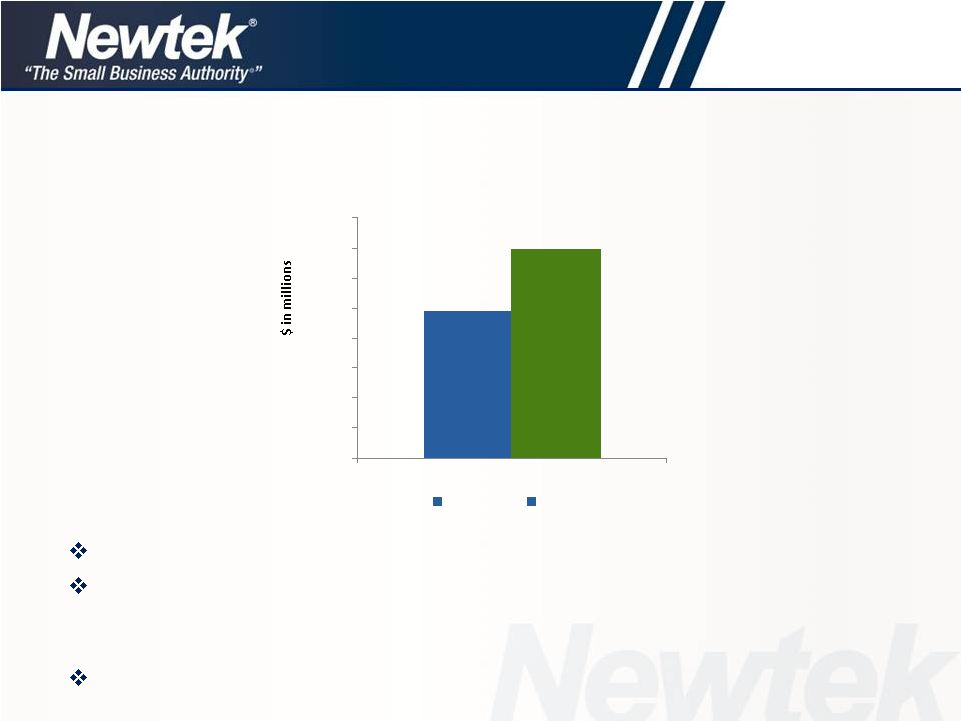

Pretax income of $2.2 million, an increase of $569 thousand, or 34.8%, compared to Q1

2012 Net income of $1.5 million, an increase of $433 thousand, or 42.5%, compared to Q1

2012 Modified EBITDA* of $4.4 million, an increase of $1.3 million, or 41.9%, compared

to Q1 2012 $1.6

$1.0

$3.1

$2.2

$1.5

$4.4

Pre-Tax Income

Net Income

Modified EBITDA*

Q1 2012

Q1 2013 |

www.thesba.com

5

Consolidated Earnings Performance

Consolidated Earnings Performance

Earnings per Diluted Share

33.3% increase year over year in fully diluted EPS

$0.03

$0.04

$0.00

$0.02

$0.04

Earnings Per Diluted Share

Q1 2012

Q1 2013 |

www.thesba.com

2013 Consolidated Financial Guidance

2013 Consolidated Financial Guidance

6

Pretax Income

($ in millions)

Diluted Earnings Per Share

Expect FY 2013 diluted EPS midpoint of $0.18 per share and pretax

income midpoint of $11.5 million

$1.0

$2.0

$9.4

$11.5

2010

2011

2012

2013 Forecasted

Midpoint

$0.04

$0.09

$0.15

$0.18

2010

2011

2012

2013 Forecasted

Midpoint |

www.thesba.com

Consolidated Balance Sheet

Consolidated Balance Sheet

Major Balance Sheet changes:

•

Increase of $4.4 million in cash and cash equivalents*

•

Increase of $1.6 million in total equity

•

Decrease of $2.8 million in Credits and Notes payable in credits

in lieu of cash

7

$ in thousands

Balance

March 31, 2013

Balance

Dec 31, 2012

Total Cash & Cash Equivalents*

$27,108

$22,685

Total Assets

$166,758

$152,742

Total Liabilities

$96,210

$83,840

Total Equity

$70,548

$68,902

Selected Items

*Includes restricted cash of $15.1 million at March 31, 2013, and $8.5 million at December 31,

2012. |

www.thesba.com

Consolidated Cash Position

Consolidated Cash Position

8

Between

December

31,

2012

and

March

31,

2013:

Cash and cash equivalents* increased by $4.4 million

Cash per diluted share increased from $0.63 to $0.72

*Includes restricted cash of $15.1 million at March 31, 2013, and $8.5 million at December 31,

2012. $22.7

$27.1

12/31/2012

3/31/2013

Cash & Cash Equivalents* |

www.thesba.com

Operating Segment Performance

Operating Segment Performance

9

Electronic Payment Processing:

•

Revenue increased by 5.1% over Q1 2012, to $21.7 million

•

Pretax income increased by 15.1% over Q1 2012 to $1.8 million

For the First Quarter 2012 vs. 2013:

Managed Technology Solutions*:

•

Revenue decreased by 6.4% over Q1 2012 to $4.4 million

•

Pretax income decreased by 18.7% over Q1 2012 to $896 thousand

Small Business Lending:

•

Revenue increased by 53.9% over Q1 2012 to $7.4 million

•

Pretax income increased by 48.4% over Q1 2012 to $2.2 million

* In process of repositioning strategy in Managed Technology Solutions – additional

detail beginning on slide 18.

|

www.thesba.com

Small Business Finance

Small Business Finance

10

Q1 2013 SBF revenue increased by 53.9% to $7.4 million from $4.8

million in Q1 2012

Company on track to fund $175 million in SBA 7(a) loans in 2013

Q1 2013 securitization: sold 4% yield to maturity, and improved advance rate by 8%-

9% and our long-term cost of interest by 150 basis points compared to the 2

previous securitizations

Total servicing portfolio expected to grow by 32.4% in 2013

Q1 2013 SBF revenue was 21.8% of total operating revenue

Q1

2013

Total

Operating

Revenue:

$34.1

million

SBF

$7.4M

$1.3

$5.1

$4.8

$7.4

$-

$1

$2

$3

$4

$5

$6

$7

$8

Q1' 10

Q1' 11

Q1' 12

Q1' 13

SBF Revenue Trend |

www.thesba.com

Key Variables in Loan Sale Transaction

Loan Amount

$1,000,000

Guaranty Percent

75%

Guaranteed Balance

$750,000

Unguaranteed Balance

$250,000

Premium*

12.5%

11

Small Business Finance

Small Business Finance

Direct

Revenue

/

Expense

of

a

Loan

Sale

Transaction

–

An

Example

Resulting Revenue (Expense)

Associated Premium**

$93,750

Servicing Asset***

$18,630

Total Premium Income

$112,380

Packaging Fee Income

$2,500

FV Discount

$(18,750)

Referral Fees

$(7,500)

Total Direct Expenses

$(26,250)

Net Risk-adjusted Profit Recognized

$88,630

Net Cash Created pretax

(post securitization)****

$11,250

**Assumes 12.5% of the Guaranteed balance

***

Value determined by GAAP servicing value

**** Assuming the loan is sold in a securitization in

12 months

*Premium above 10% split 50/50 with SBA |

www.thesba.com

Small Business Finance –

Small Business Finance –

Total Pipeline

Total Pipeline

12

As of March 31, 2013, the total Small Business Lending Total Pipeline* has

increased by $225.5 million, or 150.0%, to $375.8 million year over year:

•

Open Referrals increased by $159.6 million, or 171.8%

•

Prequalified volume has increased by $45.3 million, or 348.1%

•

Loans

currently

in

underwriting

have

increased

by

$14.8

million,

or

134.4%

•

Approved –

Pending Closing increased by $5.7 million, or 17.2%

* Total pipeline = Open loan referrals + Prequalified loans + Loans in underwriting + Loans

approved and pending closing. $92.9

$13.0

$11.0

$33.4

$252.5

$58.3

$25.9

$39.2

Open Referrals

Prequalified

In Underwriting

Approved -

Pending

Closing

3/31/2012

3/31/2013 |

www.thesba.com

13

Comparative Loan Portfolio Data

Comparative Loan Portfolio Data

Loan Characteristic

As of 12/31/10

As of 3/31/13

Business Type:

Existing Businesses

53.93%

81.88%

Business Acquisition

25.89%

11.28%

Start-Ups

20.18%

6.84%

Primary Collateral:

Commercial RE

45.33%

50.53%

Machinery & Equipment

22.79%

23.57%

Residential RE

22.27%

15.51%

All Other

9.61%

10.39%

Percentage

First

Lien

on

RE:

Commercial RE

84.84%

93.06%

Residential RE

9.87%

20.49%

Industry:

Restaurant

10.60%

9.81%

Hotel/Motel

9.36%

2.93%

State Concentration:

Florida

21.55%

11.27%

New York

12.66%

11.65%

Other:

Mean FICO

675

700

Weighted Average Current LTV

78.23%

71.60%

(12/31/10 vs. 3/31/2013) |

www.thesba.com

14

Small Business Finance

Small Business Finance

Funded $34.8 million in loans in Q1 2013, a 42.2% increase over Q1 2012

During the 3 months ended March 31, 2013, the Lender funded 35

loans,

totaling $34.8 million, vs. 19 loans, totaling $24.5 million, in the 3 months

ended March 31, 2012

We forecast the Lender to fund between $150 -

$200 million in loans in 2013

Loans Funded

$24.5

$34.8

$-

$5

$10

$15

$20

$25

$30

$35

$40

Loans Funded

Q1 2012

Q1 2013 |

www.thesba.com

Servicing Portfolio

Servicing Portfolio

15

The SBF servicing portfolio –

March 31, 2013 vs. 2012:

•

NEWT portfolio increased by 28.1%; third-party servicing portfolio increased by

23.1% •

Related

servicing

fee

income

on

all

portfolios

increased

by

$379

thousand

to

$1.5

million,

or

35.0%,

for

the

three

months

ended

March

31,

2013

vs.

2012

•

Anticipate

total

servicing

portfolio

to

increase

to

between

$650

and

$750

million

by

12/31/13

In Q1 2013, approximately $65 million transferred to NEWT servicing portfolio from large

multi-billion dollar bank

Expect

2013

funded

loans

to

create

$175

million

of

new

servicing

at

midpoint

*Principal balance of loans serviced (dollars in millions)

$295.9

$135.9

$431.8

$379.2

$167.2

$546.4

NEWT Loans*

Servicing Other Loans*

Total Loans*

31-Mar-12

31-Mar-13 |

www.thesba.com

Q1 2013 pretax income increased by 15.1% to $1.8 million from $1.6 million in Q1

2012

Q1 2013 EPP revenue increased by 5.1% to $21.7 million from $20.6 million in Q1

2012

Eric Turille assumed role as President of EPP division in Q1 2013

Randy

Sagar

and

his

team

in

Louisville,

KY

will

focus

on

growing

revenue

in the

second half

of

2013

through

independent

sales

organization

(ISO)

channel

Electronic Payment Processing

Electronic Payment Processing

16

Q1 2013 EPP revenue was 63.5% of total operating revenue

Q1

2013

Total

Operating

Revenue:

$34.1

million

EPP

Revenue

$21.7M

$18.8

$20.1

$20.6

$21.7

$0

$5

$10

$15

$20

$25

Q1' 10

Q1' 11

Q1' 12

Q1' 13

EPP Revenue Trend |

www.thesba.com

Electronic Payment Processing

Electronic Payment Processing

17

Expect a significant increase in revenue in the EPP segment in the

second half of 2013 through anticipated uptick in contracts

with

ISOs

The Louisville, KY group will focus on adding significant ISO contracts by

December 31, 2013

The Louisville, KY group currently has 30 additional ISO contracts out for

signature

Expect to add 30 to 50 signed contracts by 12/31/2013

On average, we expect each ISO to produce a minimum of 5-10

merchant accounts per month

Independent Sales Organization (ISO) Contribution |

www.thesba.com

Managed Technology Solutions

Managed Technology Solutions

18

Q1 2013 MTS revenue decreased by 6.4% to $4.4 million from $4.7 million in Q1 2012

This segment is being transformed to take advantage of shift to cloud-based business

trends including: eCommerce, Payroll and Insurance

•

Q1 2013 average Cloud revenue per user up 22.5% over Q1 2012

•

Q1 2013 average number of Cloud instances increased by 16.9% to 670 from 573 in Q1

2012

Plan to increase average number of monthly plans with upgrade of

Linux-based

platforms

Q1 2013 MTS revenue was 12.9% of total operating revenue

Q1 2013

Total

Operating

Revenue:

$34.1

million

MTS

$4.4M

$4.8

$4.8

$4.7

$4.4

$-

$1

$2

$3

$4

$5

$6

Q1' 10

Q1' 11

Q1' 12

Q1' 13

MTS Revenue Trend |

www.thesba.com

Shift to Linux-based Platforms

Shift to Linux-based Platforms

Recently upgraded Linux Apache and Linux Nginx platforms

•

Should capture additional market opportunities

•

NTS created associated control panels, service support and billing, which allows

NTS to participate in growth of 100% of the market of new web design (vs. 33%

represented by Microsoft)

•

All platforms are available with NTS’s Cloud and non-Cloud environment, and are

fully managed offerings unlike NTS’s competitors

•

Newtek Advantage™

leverages NTS’s underlying technologies to deliver real-time

information and actionable business intelligence to new and existing customers

•

NTS launched a complete line of Cloud-based business and eCommerce

packages, or Cloud Spaces, to streamline the decision process for business

owners and accommodate designers and developers who wish to build sites in

both Microsoft and Linux environments

19 |

www.thesba.com

Invested for the Future

Invested for the Future

20

During Q1 2013:

•

Total shared Linux accounts increased by 126.3%, to 430 accounts

•

Total cloud service accounts increased by 33.9%, to 21,809* accounts

Q1 2013 average cloud-computing instances increased by 16.9% over Q1 2012, to

670 instances

*Includes the 430 shared Linux accounts

Linux and Cloud

190

251

318

430

0

100

200

300

400

500

December

January

February

March

Growth in New Shared Linux Accounts in

Cloud Environment

16,285

16,861

17,182

21,809

0

5,000

10,000

15,000

20,000

25,000

December

January

February

March

Growth in Total Cloud Services |

www.thesba.com

Cloud Computing

Cloud Computing

21 |

www.thesba.com

MTS Referral Trends

MTS Referral Trends

22

Q1 2012 vs. Q1 2013

Q1 2012 vs. Q1 2013

•

Total MTS referrals increased by 24.6% to 3,983

•

Total closed referrals increased by 32.0% to 2,928

•

Referral close rate increased to 74.3%, from 69.4% in Q1 2012

3,196

3,983

0

1,000

2,000

3,000

4,000

Q1 2012

Q1 2013

Total MTS Referrals

2,217

2,928

0

1,000

2,000

3,000

4,000

Q1 2012

Q1 2013

Total Closed MTS Referrals |

www.thesba.com

Managed Technology Solutions

Managed Technology Solutions

23

6.6% quarter-over-quarter increase

6.4% quarter-over-quarter increase

22.5% quarter-over-quarter increase

7.8% quarter-over-quarter increase

Upward Trend in Average Revenue per User Q1 2012 vs. Q1 2013

$18.1

$19.3

$0

$4

$8

$12

$16

$20

Q1 2012

Q1 2013

Shared

$331.6

$0

$70

$140

$210

$280

$350

Q1 2012

Q1 2013

Dedicated

$352.8

$167.3

$205.0

$0

$70

$140

$210

Q1 2012

Q1 2013

Cloud

$158.3

$170.6

$0

$60

$120

$180

Q1 2012

Q1 2013

Virtual Private Server |

www.thesba.com

Reaffirming 2013 Guidance

Reaffirming 2013 Guidance

24

Operating Revenue:

•

Midpoint of $148.2 million, with a range of $145.1 million and $151.2

million

•

Increase of 12.1% over 2012 revenue of $131.1 million

Pretax Income:

•

Midpoint of $11.5 million, with a range of $10.0 million and $13.0 million

•

Increase of 22.3% over 2012 pretax income of $9.4 million

Diluted EPS:

•

Midpoint

of

$0.18,

with

a

range

of

$0.17

-

$0.19

per

share

•

Increase of 20.0% over 2012 diluted EPS of $0.15 per share

Modified EBITDA*:

•

Midpoint of $20.9 million, with a range of $19.3 million and $22.4 million

•

Increase of 26.7% over 2012 Modified EBITDA* of $16.5 million

*See slide 35 for definition of Modified EBITDA |

www.thesba.com

Managed Technology Solutions

Electronic Payment Processing

2013 Segment Guidance

2013 Segment Guidance

25

Revenue: $90.4 -

$94.1M

Pretax

Income:

$8.2

-

$9.0M

Modified

EBITDA*:

$8.5

-

$9.3M

All Other

Small Business Finance

Revenue: $34.0 -

$35.6M

Pretax

Income:

$10.0

-

$10.8M

Modified

EBITDA*:

$17.1

-

$17.9M

Revenue:

$2.2

-

$2.2M

Pretax

Loss:

$(1.1)

-

$(0.9)M

Modified

EBITDA*:

$(1.0)

-

$(0.8)M

Revenue by Segment

*See slide 35 for definition of Modified EBITDA

EPP

SBF

MTS

Revenue: $18.4 - $19.2M

Pretax Income: $3.9 - $4.7M

Modified EBITDA*: $5.5 - $6.3M

|

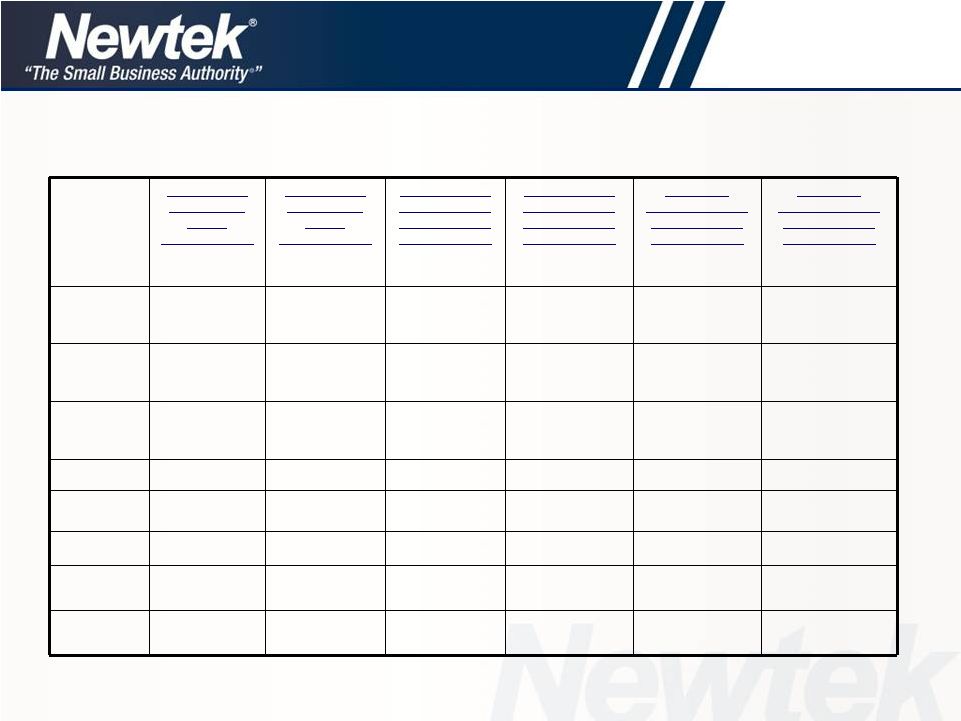

www.thesba.com

2013 Segment Guidance

2013 Segment Guidance

*Note: totals may not add due to rounding

In millions of dollars

Electronic

Small

Managed

Total

Inter-

Payment

Business

Technology

All

Corporate

Business

CAPCO

Company

Processing

Finance

Solutions

Other

Activities

Segments

Segment

Eliminations

Total

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

2013 Full Year

Revenue

90.4

94.1

34.0

35.6

18.4

19.2

2.2

2.2

0.8

0.8

145.8

151.9

0.1

0.1

(0.8)

145.1

151.2

Pretax Income (Loss)

8.2

9.0

10.0

10.8

3.9

4.7

(1.1)

(0.9)

(9.6)

(9.3)

11.4

14.3

(1.5)

(1.3)

-

10.0

13.0

Income from tax credits

-

-

-

-

-

-

-

-

-

-

-

-

(0.1)

(0.1)

-

(0.1)

(0.1)

Net change in fair value of

credits in lieu of cash and

notes payable in credits in

lieu of cash

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Deferred compensation

expense

-

-

-

-

-

-

-

-

0.4

0.4

0.4

0.4

-

-

-

0.4

0.4

Lease loss amortization

-

-

-

-

-

-

-

-

(0.3)

(0.3)

(0.3)

(0.3)

-

-

-

(0.3)

(0.3)

Interest Expense

-

-

5.9

5.9

0.1

0.1

-

-

-

-

6.0

6.0

0.2

0.2

-

6.2

6.2

Depreciation and

Amortization

0.3

0.3

1.2

1.2

1.5

1.5

0.1

0.1

0.1

0.1

3.2

3.2

-

-

-

3.2

3.2

Modified EBITDA

8.5

9.3

17.1

17.9

5.5

6.3

(1.0)

(0.8)

(9.4)

(9.1)

20.7

23.6

(1.4)

(1.2)

-

19.3

22.4

26 |

www.thesba.com

27

Growth Strategy

Growth Strategy

Increased

advertising

budget by

50%

Grow brand

organically & via

www.thesba.com

Corporate

re-brand:

authoritative

presence in small

business economy

Cross sell

and cross

market

Continue to

grow alliance

channels

Grow

applications

hosted in the

Cloud

•

Remain #1 in Non-bank

Government Guaranteed

Lender

•

Grow Newtek Advantage

Platform

•

Grow revenues between

9-11% organically |

www.thesba.com

28

Marketing Campaign –

Marketing Campaign –

National

National

Television Commercials

Television Commercials

•

CNN

•

Fox News

•

Fox Business

On average, 190 or more monthly commercials which have aired on the

following properties:

Commercial

schedule

primarily

Monday

to

Thursday

from

5am

-

11pm

Improvement in Website statistics since start of TV campaign

•

32% increase in average time on site

•

20% improvement in our bounce rate

•

MSNBC

•

Headline News

•

The Outdoor Channel |

www.thesba.com

Visitor Trend to www.thesba.com

Visitor Trend to www.thesba.com

29

As a result of our Direct Marketing Initiatives:

•

Total Quarterly Unique Visitors* increased by 62.0% for Q1 2013 vs. Q1 2012

•

Total Quarterly Visitors** increased by 87.2% in Q1 2013 vs. Q1 2012

*Represents the total of unique visitors that visited

www.thesba.com

during each of the first quarters in 2012 and 2013.

**Represents the total visitors to

www.thesba.com

during each of the first quarters in 2012 and 2013.

Total Visitors and Unique Visitors for Q1 2012 vs. Q1 2013

49,871

80,785

73,903

138,374

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

Q1 2012

Q1 2013

Unique Vistors

Total Visitors |

www.thesba.com

Mobile real-time SMB management platform; puts all of a business’

critical

transactions and economic, eCommerce and web site traffic data on a smartphone,

tablet, laptop or PC

Provides intelligence that businesses require, giving them the advantage to succeed

Allows

owners

and

operators

of

small-

and

medium-sized

businesses

to

manage

their

businesses from their mobile device anywhere, anytime, without an IT department

Developing all inclusive applications, eCommerce in the Cloud, Payroll in the Cloud,

Insurance Agency in the Cloud

The Newtek Advantage™

The Newtek Advantage™

30

The Newtek Advantage ™

is SMART:

S:

Sales

Increased

—

less

time

on

administration;

more

time

spent

on

sales

and

servicing

customers

M:

More

Control,

Fewer

Surprises

—

key

business

stats

and

metrics

available

in

real

time

for

faster, more informed decisions

A:

Accelerated

Profits

—

real-time

information

means

better

and

more

profitable

decisions

R:

Real-time

information

means

key

business

management

data

is

only

seconds

away,

whenever

and wherever the business operator is

T:

Technology

Enhancements

—

decreased

cost

of

an

IT

department

—

everything

in

the

Cloud |

www.thesba.com

Comparable Company Statistics

Comparable Company Statistics

On Deck Capital –

$500 million market valuation

Lending Club –

$1.55 billion market valuation

Digital

River

(DRIV)

announces

purchase

of

LML

Payment

Systems

(LMLP)

Universal Business Payment Solutions (UBPS) announced $179 million planned

acquisition of credit/debit card sales and processing, payroll processing and tax filing

companies

GoDaddy announced strategic purchase of a cloud-based financial management

application company to reach more small businesses

Newtek has the advantage of experience providing a “suite of services”

which operate

on a similar, coordinated platform, and will also be available in the cloud;

it’s called The Newtek Advantage™

Publicly Traded Comparables

Medallion Financial Corp (TAXI)

Heartland Payment Systems (HPY)

Web.com Group, Inc. (WWWW)

Cbeyond, Inc. (CBEY)

8 x 8, Inc. (EGHT)

ReachLocal, Inc. (RLOC)

Stamps.com, Inc. (STMP)

Marchex, Inc. (MCHX)

Vistaprint, NV (VPRT)

31 |

www.thesba.com

Investment Summary

Investment Summary

Publicly traded Company since 2000

Management’s interests aligned with shareholders

•

CEO alone owns over 14.5% of outstanding shares*

Trades at slightly more than 3x 2013 forecasted Modified EBITDA**

•

2013 forecasted Modified EBITDA** of $20.9 million, an increase of approximately

26.7% over FY 2012 Modified EBITDA** of $16.5 million

Trades at 1.1x book value

Growing revenues

•

Expect to grow revenues by approximately 13% in 2013

Tremendous opportunity to penetrate market

•

Over 27 million small businesses in the U.S.

Inexpensive relative to market comparables

•

Market comps: LMLP, VNTV

32

*As of March 31, 2013

**See slide 35 for definition of Modified EBITDA |

www.thesba.com

Key Statistics –

NASDAQ: NEWT

33

Stock Price (at 5/6/13)

$2.05

52-Week Range

$1.14-$2.21

Common Shares O/S

37.7M

Market Cap (at 5/6/13)

$72.2M

Avg. Daily Trading Vol.

34,723

(200-day average as of 5/6/2013)

Share

Statistics

(USD)

-------------------------------------------------------------

Revenue

$148.2M

Pre-tax Income

$11.5M

Diluted EPS

$0.18

Modified EBITDA*

$20.9M

**2013 forecast

*See slide 35 for definition of Modified EBITDA

Financial Highlights**

-------------------------------------------------------------

|

www.thesba.com

Financial Review

Financial Review

Jennifer C. Eddelson -

Jennifer C. Eddelson -

CAO

CAO |

www.thesba.com

Non-GAAP Financial Measures

Non-GAAP Financial Measures

35

In evaluating its business, Newtek considers and uses modified EBITDA as a supplemental measure

of its operating performance. The Company defines modified EBITDA as earnings

before income from tax credits, interest expense, taxes, depreciation and amortization,

stock compensation expense, other than temporary decline in value of investments, Capco

fair value change and the amortization of the 2011 accrued loss on the lease

restructure. Newtek uses modified EBITDA as a supplemental measure to review and

assess its operating performance. The Company also presents modified EBITDA because it

believes it is frequently used by securities analysts, investors and other interested parties as

a measure of financial performance.

The term modified EBITDA is not defined under U.S. generally accepted accounting principles, or

U.S. GAAP, and is not a measure of operating income(loss), operating performance or

liquidity presented in accordance with U.S. GAAP. Modified EBITDA has limitations

as a analytical tool and, when assessing the Company’s operating performance,

investors should not consider modified EBITDA in isolation, or as a substitute for net

income (loss) or other consolidated income statement data prepared in accordance with U.S.

GAAP. Among other things, modified EBITDA does not reflect the Company’s actual cash

expenditures. Other companies may calculate similar measures differently than Newtek,

limiting their usefulness as comparative tools. Newtek compensates for these

limitations by relying primarily on its GAAP results and using modified EBITDA only

supplementally.

Our Capcos operate under a different set of rules in each of the 7 jurisdictions and these place

varying requirements on the structure of our investments. In some cases, particularly in

Louisiana or in certain situations in New York, we do not control the equity or

management of a qualified business, but that cannot always be presented orally or in

written presentations. |

www.thesba.com

In millions of dollars

*Note: totals may not add due to rounding

Q1 2013 Actual vs. Q1 2012 Actual

Q1 2013 Actual vs. Q1 2012 Actual

36

Revenue For

The Quarter

Ended

March 31, 2013

Revenue For

The Quarter

Ended

March 31, 2012

Pretax Income

(Loss) For The

Quarter Ended

March 31, 2013

Pretax Income

(Loss) For The

Quarter Ended

March 31, 2012

MODIFIED

EBITDA For The

Quarter Ended

March 31, 2013

MODIFIED

EBITDA For The

Quarter Ended

March 31, 2012

Electronic

Payment

Processing

21.679

20.618

1.835

1.594

1.950

1.844

Small

Business

Finance

7.449

4.839

2.175

1.466

3.686

2.273

Managed

Technology

Solutions

4.394

4.693

0.896

1.102

1.256

1.430

All Other

0.646

0.546

(0.462)

(0.234)

(0.404)

(0.213)

Corporate

Activities

0.200

0.250

(1.956)

(1.800)

(1.854)

(1.738)

CAPCO

0.050

0.200

(0.286)

(0.495)

(0.275)

(0.482)

Interco

Eliminations

(0.274)

(0.417)

–

–

–

–

Total

34.144

30.729

2.202

1.633

4.359

3.114 |

www.thesba.com

2013 Segment Guidance

2013 Segment Guidance

*Note: totals may not add due to rounding

In millions of dollars

Electronic

Small

Managed

Total

Inter-

Payment

Business

Technology

All

Corporate

Business

CAPCO

Company

Processing

Finance

Solutions

Other

Activities

Segments

Segment

Eliminations

Total

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

2013 Full Year

Revenue

90.4

94.1

34.0

35.6

18.4

19.2

2.2

2.2

0.8

0.8

145.8

151.9

0.1

0.1

(0.8)

145.1

151.2

Pretax Income (Loss)

8.2

9.0

10.0

10.8

3.9

4.7

(1.1)

(0.9)

(9.6)

(9.3)

11.4

14.3

(1.5)

(1.3)

-

10.0

13.0

Income from tax credits

-

-

-

-

-

-

-

-

-

-

-

-

(0.1)

(0.1)

-

(0.1)

(0.1)

Net change in fair value of

credits in lieu of cash and

notes payable in credits in

lieu of cash

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Deferred compensation

expense

-

-

-

-

-

-

-

-

0.4

0.4

0.4

0.4

-

-

-

0.4

0.4

Lease loss amortization

-

-

-

-

-

-

-

-

(0.3)

(0.3)

(0.3)

(0.3)

-

-

-

(0.3)

(0.3)

Interest Expense

-

-

5.9

5.9

0.1

0.1

-

-

-

-

6.0

6.0

0.2

0.2

-

6.2

6.2

Depreciation and

Amortization

0.3

0.3

1.2

1.2

1.5

1.5

0.1

0.1

0.1

0.1

3.2

3.2

-

-

-

3.2

3.2

Modified EBITDA

8.5

9.3

17.1

17.9

5.5

6.3

(1.0)

(0.8)

(9.4)

(9.1)

20.7

23.6

(1.4)

(1.2)

-

19.3

22.4

37 |

www.thesba.com

Addenda

Addenda |

www.thesba.com

Pretax

Income

(Loss)

Income

from Tax

Credits

Net Change

in Fair Value

of Credits in

Lieu of Cash

and Notes

Payable in

Credits in

Lieu of Cash

Deferred

Comp

Expense

Amortization of

2011 Lease

restructuring

charge

Interest

Expense

Depreciation

and

amortization

First

Quarter

2013

Modified

EBITDA

Electronic Payment

Processing

1.835

-

-

0.002

-

-

0.113

1.950

Small Business Finance

2.175

-

-

0.023

-

1.217

0.271

3.686

Managed Technology

Solutions

0.896

-

-

0.009

-

0.024

0.326

1.256

All Other

(0.462)

-

-

0.008

-

-

0.051

(0.404)

Corporate Activities

(1.956)

-

-

0.124

(0.073)

0.005

0.044

(1.854)

CAPCO

(0.286)

(0.026)

(0.019)

-

-

0.056

0.001

(0.275)

Total

2.202

(0.026)

(0.019)

0.166

(0.073)

1.302

0.807

4.359

Modified EBITDA Reconciliation

Modified EBITDA Reconciliation

Modified EBITDA Reconciliation from Pretax Income (Loss)

For the three months ended March 31, 2013

In millions of dollars

*Note: totals may not add due to rounding

39 |

www.thesba.com

Pretax

Income

(Loss)

Income

from Tax

Credits

Net Change

in Fair Value

of Credits in

Lieu of Cash

and Notes

Payable in

Credits in

Lieu of Cash

Deferred

Comp

Expense

Amortization of

2011 Lease

restructuring

charge

Interest

Expense

Depreciation

and

amortization

First

Quarter

2012

Modified

EBITDA

Electronic Payment

Processing

1.594

-

-

0.009

-

-

0.241

1.844

Small Business Finance

1.466

-

-

0.011

-

0.577

0.219

2.273

Managed Technology

Solutions

1.102

-

-

0.008

-

0.022

0.298

1.430

All Other

(0.234)

-

-

0.008

-

-

0.014

(0.213)

Corporate Activities

(1.800)

-

-

0.106

(0.073)

0.001

0.027

(1.738)

CAPCO

(0.495)

(0.191)

(0.036)

-

-

0.237

0.002

(0.482)

Total

1.633

(0.191)

(0.036)

0.142

(0.073)

0.837

0.801

3.114

Modified EBITDA Reconciliation

Modified EBITDA Reconciliation

Modified EBITDA Reconciliation from Pretax Income (Loss)

For the three months ended March 31, 2012

In millions of dollars

*Note: totals may not add due to rounding

40 |