Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - NCR CORP | form8-kaq12013earningsrele.htm |

| EX-99.1 - EXHIBIT 99.1 - NCR CORP | exhibit991-q12013earningsr.htm |

NCR Confidential Q1 2013 EARNINGS CONFERENCE CALL BILL NUTI, CHAIRMAN AND CEO April 30, 2013 (as revised)* • This presentation has been revised as described In the “Explanatory Note” to the Form 8-K/A of NCR Corporation furnished with the Securities and Exchange Commission on May 8, 2013.

NCR Confidential NOTES TO INVESTORS 2 Comments made during this conference call and in these materials may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements use words such as “seek,” “potential,” “expect,” “strive,” “continue,” “continuously,” “accelerate,” “anticipate,” “outlook,” “intend,” “plan,” “target,” “believe,” “estimate,” “forecast,” “pursue” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could.” They include statements as to NCR’s anticipated or expected results and financial performance, including its outlook for 2013; projections of revenue, profit growth and other financial items, including its anticipated software revenue growth in 2013; future business segment performance; expected benefits from the acquisition of Retalix Ltd., including its effect on the strength of our solutions portfolio; strategies and intentions regarding its pension plans and the effects thereof, including with respect to “Phase III” of its pension strategy and its expected effects on NCR’s pension expense and liability, underfunded pension status, cash flow and pension volatility; discussion of other strategic initiatives and related actions; and beliefs, expectations, intentions and strategies, among other things. Forward-looking statements are based on management’s current beliefs, expectations and assumptions, and involve a number of known and unknown risks and uncertainties, many of which are out of NCR’s control. These forward-looking statements are not guarantees of future performance, and there are a number of factors, risks and uncertainties, including those detailed from time to time in NCR’s SEC reports, including those listed in Item 1a “Risk Factors” of its Annual Report on Form 10-K, that could cause actual outcomes and results to differ materially from the results contemplated by such forward- looking statements. These materials are dated April 30, 2013, and NCR does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. While NCR reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this conference call and the related presentation materials will include “non-GAAP” measures, including non-pension operating income (or NPOI) and free cash flow (FCF), in an effort to provide additional useful information regarding NCR’s financial results. An explanation of these non-GAAP measures and a reconciliation of these non-GAAP measures to comparable GAAP measures are included in the portion of these presentation materials entitled “Supplementary Non-GAAP Materials” and are available on the Investor Relations page of NCR’s website at www.ncr.com. Descriptions of many of these non-GAAP measures, including free cash flow, are also included in NCR’s SEC reports. These presentation materials and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together.

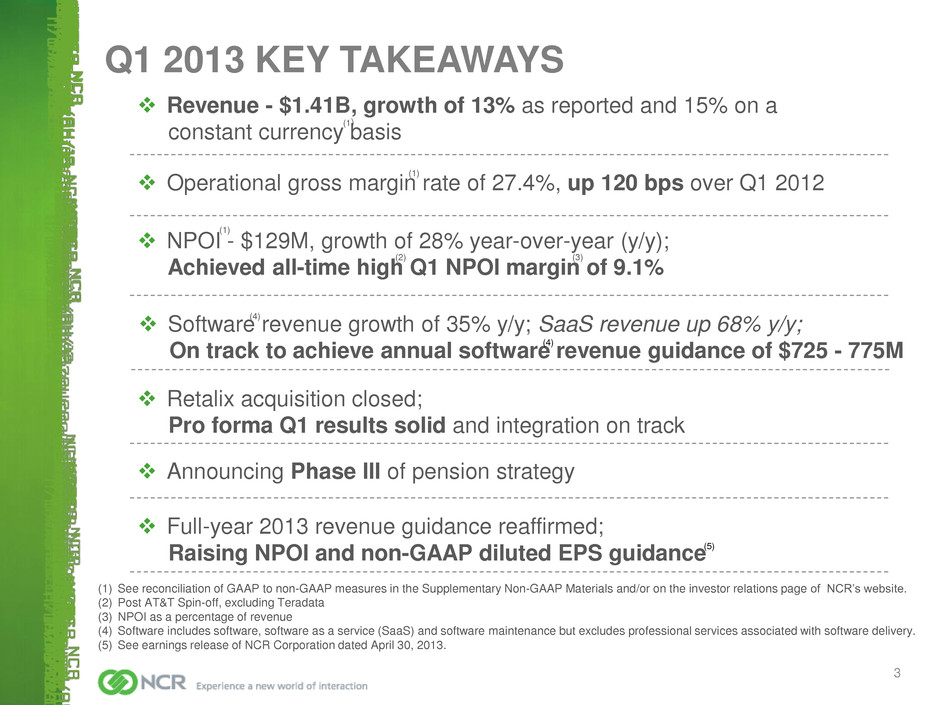

NCR Confidential Q1 2013 KEY TAKEAWAYS 3 (1) See reconciliation of GAAP to non-GAAP measures in the Supplementary Non-GAAP Materials and/or on the investor relations page of NCR’s website. (2) Post AT&T Spin-off, excluding Teradata (3) NPOI as a percentage of revenue (4) Software includes software, software as a service (SaaS) and software maintenance but excludes professional services associated with software delivery. (5) See earnings release of NCR Corporation dated April 30, 2013. Revenue - $1.41B, growth of 13% as reported and 15% on a constant currency basis (1) Operational gross margin rate of 27.4%, up 120 bps over Q1 2012 (1) NPOI - $129M, growth of 28% year-over-year (y/y); Achieved all-time high Q1 NPOI margin of 9.1% (1) (2) (3) Announcing Phase III of pension strategy Retalix acquisition closed; Pro forma Q1 results solid and integration on track Software revenue growth of 35% y/y; SaaS revenue up 68% y/y; On track to achieve annual software revenue guidance of $725 - 775M (4) (4) Full-year 2013 revenue guidance reaffirmed; Raising NPOI and non-GAAP diluted EPS guidance (5)

NCR Confidential Industry Highlights Key Developments Financial Revenue of $714M, an increase of 3% y/y, 5% FX neutral Operating margin of 8.0%, down 20 bps y/y Continued to invest in services and R&D Acquired 25 new customers in the U.S. market during Q1, bringing total to 500 since beginning of 2011 Strong success in Branch Transformation, evidenced by ten-fold order and revenue growth and double-digit percentage growth in Interactive Teller customer base Double-digit y/y revenue growth in EMEA and China Offset domestic headwinds (ADA and PCI upgrade cycles) with strength outside the US market Increased customer commitments for deposit automation and converged-channel APTRA software solutions Retail Revenue of $489M, an increase of 41% y/y; 27% revenue growth excluding Retalix Operating income up $39M over prior year, including $9M from Retalix Operating margin of 8.4%, up 780 bps y/y Self-checkout revenue up 178% y/y Growth in software revenue of 146% y/y, 69% y/y growth excluding Retalix Completed Retalix acquisition; executing integration plan Double-digit y/y revenue growth in EMEA Advancing NCR Silver™ with expanded footprint and distribution channels (Elavon and Cellairis), gift card updates and social media integration Significant wins: Modell’s, DSW & large US organic grocer NCR named a leader in Forrester Point-of-Service and Gartner CRM Vendor Landscape reports Hospitality Revenue of $131M; 16% increase y/y Operating margin of 16.0%, down 80 bps y/y Expense up 30%; significant investments in SaaS, Sales and R&D Securing benefits from integration synergies North American SMB revenue up 33% y/y SaaS application sites up 35% y/y Strong growth and significant gross margin expansion (up 240bps y/y) driven by software/SaaS Strategic partnerships (PayPal) along with SaaS R&D and Sales investment driving higher recurring revenues Launch of Aloha Mobile, innovative software on mobile devices for tableside ordering and payments Customer activity remains strong - Strong win in venue space – PNC Arena - Additional deployments of NCR Aloha POS Emerging Industries Revenue of $76M, down 15% y/y, and operating margin of 13.2%, both down as expected Travel revenue growth up 56% y/y Travel – continue to win business including recent wins at airports in Oman and China and the deployment of NCR TouchPort kiosks for a leading Latin American airline Deliver a record 3M mobile boarding passes in March T&T- New customer win from Blackberry for help desk services and end-user desktop support Q1 2013 LINE OF BUSINESS HIGHLIGHTS 4

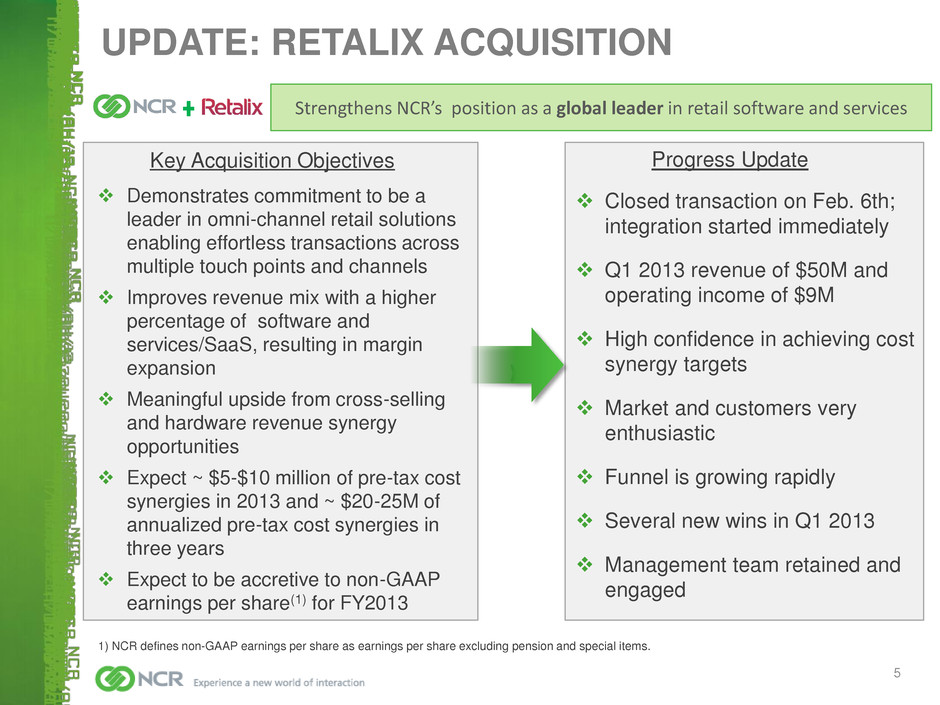

NCR Confidential Key Acquisition Objectives Demonstrates commitment to be a leader in omni-channel retail solutions enabling effortless transactions across multiple touch points and channels Improves revenue mix with a higher percentage of software and services/SaaS, resulting in margin expansion Meaningful upside from cross-selling and hardware revenue synergy opportunities Expect ~ $5-$10 million of pre-tax cost synergies in 2013 and ~ $20-25M of annualized pre-tax cost synergies in three years Expect to be accretive to non-GAAP earnings per share(1) for FY2013 1) NCR defines non-GAAP earnings per share as earnings per share excluding pension and special items. UPDATE: RETALIX ACQUISITION Strengthens NCR’s position as a global leader in retail software and services 5 Progress Update Closed transaction on Feb. 6th; integration started immediately Q1 2013 revenue of $50M and operating income of $9M High confidence in achieving cost synergy targets Market and customers very enthusiastic Funnel is growing rapidly Several new wins in Q1 2013 Management team retained and engaged

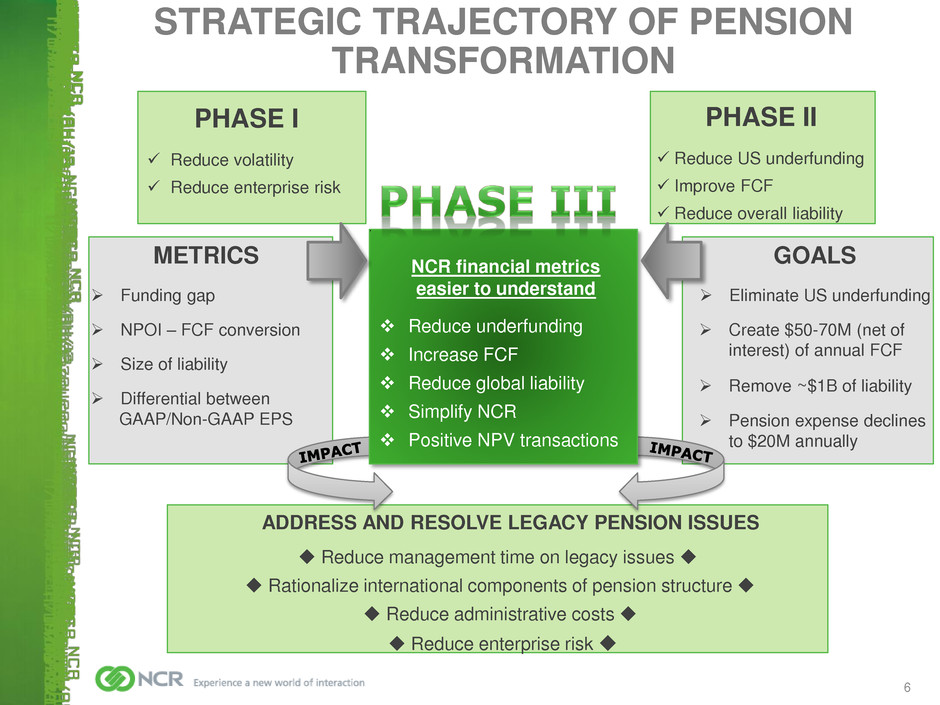

NCR Confidential GOALS Eliminate US underfunding Create $50-70M (net of interest) of annual FCF Remove ~$1B of liability Pension expense declines to $20M annually PHASE II Reduce US underfunding Improve FCF Reduce overall liability ADDRESS AND RESOLVE LEGACY PENSION ISSUES Reduce management time on legacy issues Rationalize international components of pension structure Reduce administrative costs Reduce enterprise risk METRICS Funding gap NPOI – FCF conversion Size of liability Differential between GAAP/Non-GAAP EPS NCR financial metrics easier to understand Reduce underfunding Increase FCF Reduce global liability Simplify NCR Positive NPV transactions STRATEGIC TRAJECTORY OF PENSION TRANSFORMATION PHASE I Reduce volatility Reduce enterprise risk 6

NCR Confidential Executed a balanced approach to strategic growth, while tackling legacy issues to ensure long-term benefits Q1 2013 SUMMARY 7 Retalix integration going well; strong start in Q1 On-going investments in innovation/R&D, Services and Sales Customer-focused approach drove market share gains in most industry segments; increasing activity in Branch Transformation Continued industry, product and geographic diversity; Strong Retail, Hospitality, software/SaaS and Services results Continued to deal with NCR legacy issues (Phase III pension and US severance accounting) 13% revenue growth combined with an increased mix of software/SaaS revenue driving significant gross and operating margin expansion

NCR Confidential PHASE III PENSION STRATEGY BOB FISHMAN, CFO April 30, 2013

NCR Confidential PHASE III PENSION STRATEGY Phase I and Phase II completed in 2012 US: Shifted asset mix to ~100% fixed income by year-end 2012 International: ~ 65% fixed income by year-end 2012 Contributed $600M to the US pension plan financed through attractive capital market borrowings Voluntary lump sum offered to certain deferred vested participants Significant benefits achieved as part of Phase I and Phase II Reduced volatility by moving pension assets to fixed income Improved underfunded status of global plans by $878M in 2012 from $1.346B to $468M Achieved NPV-positive transaction with voluntary lump sum offer and materially reduced ongoing administrative costs Increased free cash flow by eliminating need for US Plan contributions over next 5 years Reduced overall pension liability by ~ $750M in the US Plan Phase III execution has started and will continue for two years with goal of: Further reducing underfunded status and overall pension liability Increasing free cash flow Reducing ongoing administrative costs Simplifying financial metrics Executing economically attractive pension transactions 9

NCR Confidential PHASE III PENSION STRATEGY (cont’d) Key activities as part of Phase III Terminate legacy Executive Non-qualified Retirement Plans Initiated early retirement offer through pension plan driving operational benefits Begin lump sum offer to term-vested participants not included in 2012 offer, as well as retirees in the US-qualified plan(1) Pre-fund and/or terminate one or more international plans Pre-fund US underfunded position to further reduce interest rate/funding risk Implement mark-to-market accounting as of 1/1/13 Phase III expected to drive meaningful benefits in the next two years(2) GAAP pension expense reduced to a run-rate basis of ~$20M in 2013 Underfunded status reduced to ~$100M by end of 2014 Pension liability decreased by at least $1B over next two years(1) Free cash flow improvements of ~$50-70M (net of interest) by 2015, due to reduction of pension contributions Significant reduction of volatility, funding risk, and administrative costs Primarily debt-for-debt exchange and use of plan assets to finance. Expect $300 - $400 million of capital requirements over next 2 years 10 (1) Subject to any necessary regulatory approvals (2) All future funding estimates are approximations based on expected asset returns, discount rates, and local requirements.

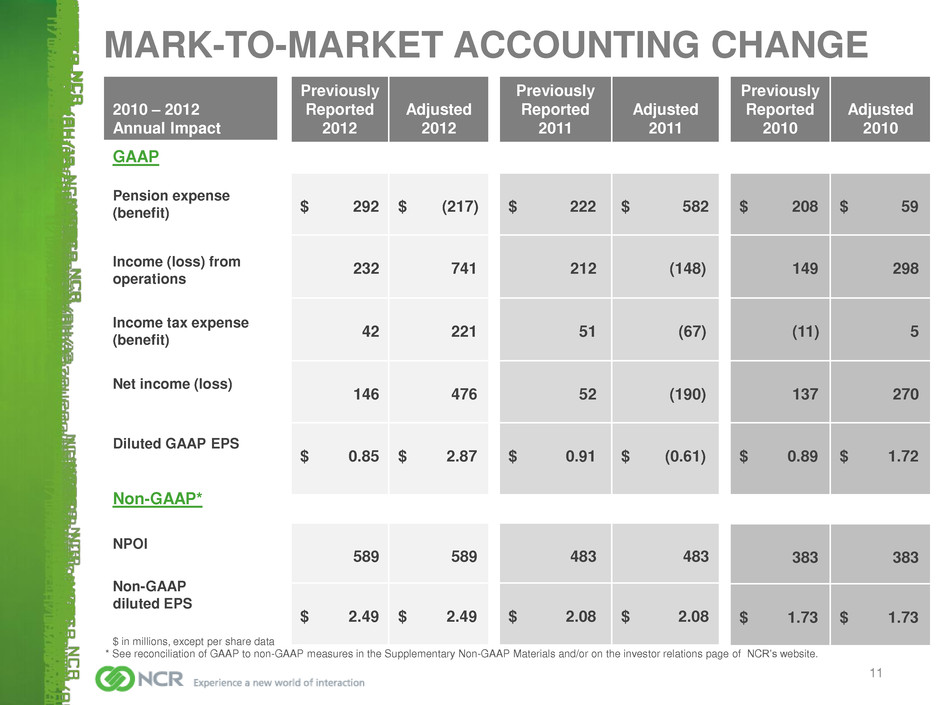

NCR Confidential MARK-TO-MARKET ACCOUNTING CHANGE 11 Previously Reported 2012 Adjusted 2012 $ 292 $ (217) 232 741 42 221 146 476 $ 0.85 $ 2.87 589 589 $ 2.49 $ 2.49 2010 – 2012 Annual Impact GAAP Pension expense (benefit) Income (loss) from operations Income tax expense (benefit) Net income (loss) Diluted GAAP EPS Non-GAAP* NPOI Non-GAAP diluted EPS Previously Reported 2011 Adjusted 2011 $ 222 $ 582 212 (148) 51 (67) 52 (190) $ 0.91 $ (0.61) 483 483 $ 2.08 $ 2.08 Previously Reported 2010 Adjusted 2010 $ 208 $ 59 149 298 (11) 5 137 270 $ 0.89 $ 1.72 383 383 $ 1.73 $ 1.73 $ in millions, except per share data * See reconciliation of GAAP to non-GAAP measures in the Supplementary Non-GAAP Materials and/or on the investor relations page of NCR’s website.

NCR Confidential SUPPLEMENTARY NON- GAAP MATERIALS

NCR Confidential NON-GAAP MEASURES 13 While NCR reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this conference call and the related presentation materials will include non-GAAP measures in an effort to provide additional useful information regarding NCR’s financial results. NCR’s management evaluates the Company’s results excluding certain items, such as pension expense and the effect of foreign currency translation, to assess the financial performance of the Company and believes this information is useful for investors because it provides a more complete understanding of NCR’s underlying operational performance, as well as consistency and comparability with NCR’s past reports of financial results. In addition, management uses certain of these measures to manage and determine effectiveness of its business managers and as a basis for incentive compensation. NCR management’s calculation of these non-GAAP measures may differ from similarly- titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for or superior to results determined in accordance with GAAP. The reconciliations of non-GAAP measures to comparable GAAP measures and other related information on the following slides are also available on the Investor Relations page of NCR’s website at www.ncr.com.

NCR Confidential NON-GAAP MEASURES 14 NPOI and Operational Gross Margin. The non-GAAP income from operations (i.e., non-pension operating income, or NPOI) and operational gross margin included in these materials exclude the impact of pension expense and certain special items. Due to the significant change in its pension expense from year to year and the non- operational nature of pension expense and these special items, including amortization of acquisition related intangibles, NCR’s management uses non-pension operating income to evaluate year-over-year operating performance. NCR may, in addition, segregate special items from its GAAP results from time to time to reflect the ongoing earnings per share performance of the company. NCR also uses non-pension operating income to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. NCR determines non-pension operating income based on its GAAP income (loss) from operations excluding pension expense and special items. Free Cash Flow. Free cash flow (or FCF) does not have a uniform definition under GAAP. NCR defines free cash flow as net cash provided by/used in operating activities and cash flow provided by/used in discontinued operations less capital expenditures for property, plant and equipment, and additions to capitalized software. NCR’s management uses free cash flow to assess the financial performance of the company and believes it is useful for investors because it relates the operating cash flow of the company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures which can be used for, among other things, investment in the company’s existing businesses, strategic acquisitions, strengthening the company’s balance sheet, repurchase of company stock and repayment of the company’s debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Constant Currency. NCR’s period-over-period revenue growth on a constant currency basis excludes the effects of foreign currency translation. Due to the variability of foreign exchange rates from period to period, NCR’s management uses revenue on a constant currency basis to evaluate period-over-period operating performance. Revenue growth on a constant currency basis is calculated by translating prior period revenue at current period monthly average exchange rates.

NCR Confidential NON-GAAP RECONCILIATIONS 15 Q1 2013 Q1 2013 Gross Margin as a % of Revenue (GAAP) 26.2% Income from Operations (GAAP) $85 Pension Expense 0.2% Pension Expense 7 Acquisition-Related Amortization of Intangibles 1.0% Acquisition-Related Amortization of Intangibles 14 Acquisition-Related Costs 16 Acquisition-Related Purchase Price Adjustment 6 OFAC and FCPA Investigations 1 Gross Margin as a % of Revenue Excluding Pension and Special Items (non-GAAP) 27.4% Non-Pension Operating Income (non-GAAP) $129 $ in millions Gross margin as a % of Revenue (GAAP) to Gross Margin as a % of Revenue excluding Pension and Special Items (non-GAAP) Income from Operations (GAAP) to Non-Pension Operating Income (non-GAAP)

NCR Confidential 16 NON-GAAP RECONCILIATIONS Revenue Growth % (GAAP) to Constant Currency Revenue Growth % (non-GAAP) Q1 2013 Revenue growth % (GAAP) 13% Unfavorable foreign currency fluctuation impact 2% Constant currency revenue growth % (non-GAAP) 15%

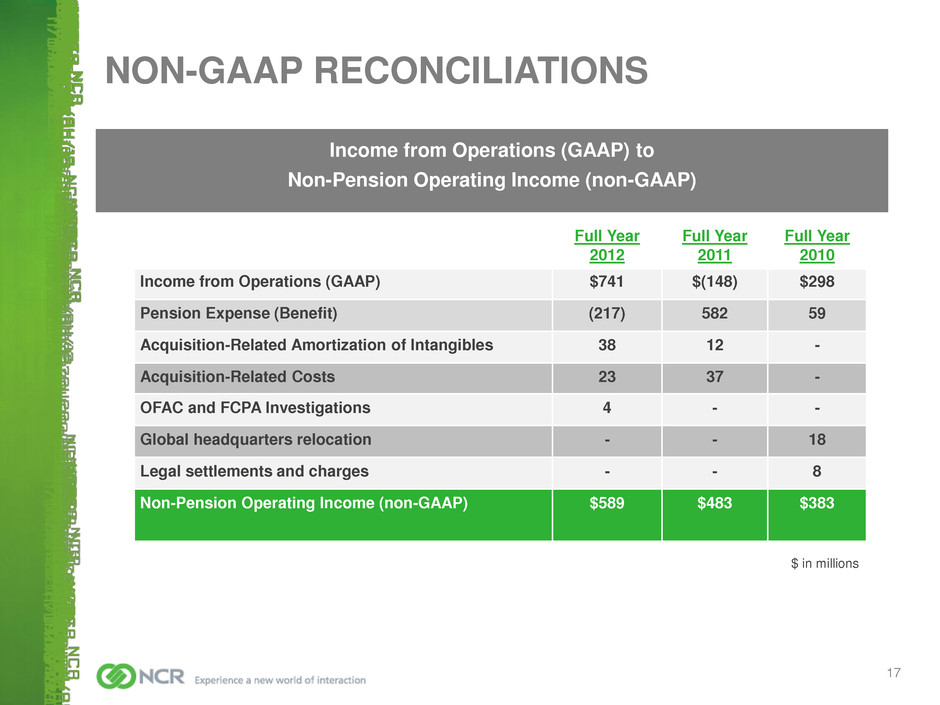

NCR Confidential NON-GAAP RECONCILIATIONS 17 Full Year 2012 Full Year 2011 Full Year 2010 Income from Operations (GAAP) $741 $(148) $298 Pension Expense (Benefit) (217) 582 59 Acquisition-Related Amortization of Intangibles 38 12 - Acquisition-Related Costs 23 37 - OFAC and FCPA Investigations 4 - - Global headquarters relocation - - 18 Legal settlements and charges - - 8 Non-Pension Operating Income (non-GAAP) $589 $483 $383 $ in millions Income from Operations (GAAP) to Non-Pension Operating Income (non-GAAP)

NCR Confidential NON-GAAP RECONCILIATIONS 18 Full Year 2012 Full Year 2011 Full Year 2010 Diluted Earnings Per Share from Continuing Operations (attributable to NCR) (GAAP) $2.87 $(0.61) $1.72 Pension Expense (Benefit) (0.69) 2.48 0.10 Acquisition-Related Amortization of Intangibles 0.15 0.05 - Acquisition-Related Costs 0.10 0.17 - OFAC and FCPA Investigations 0.01 - - Global headquarters relocation - - 0.07 Legal settlements and charges - (0.01) 0.03 Impairment charge 0.05 - 0.05 Japanese subsidiary valuation reserve - - (0.24) Diluted Earnings Per Share from Continuing Operations (attributable to NCR) (non-GAAP) $2.49 $2.08 $1.73 Diluted Earnings Per Share from Continuing Operations (attributable to NCR) (GAAP) to Diluted Earnings Per Share from Continuing Operations (attributable to NCR) (non-GAAP)