Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - TESSERA TECHNOLOGIES INC | d528270dex993.htm |

| EX-99.2 - EX-99.2 - TESSERA TECHNOLOGIES INC | d528270dex992.htm |

| 8-K - FORM 8-K - TESSERA TECHNOLOGIES INC | d528270d8k.htm |

April 2013

Investor Presentation

Exhibit 99.1 |

2

Safe Harbor

To be updated once deck is

close to final

Tessera Confidential

This presentation contains forward-looking statements, which are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements involve risks and uncertainties that could cause actual results to differ significantly from those projected, particularly with respect

to Tessera Technologies, Inc.’s (the “Company”) financial results, milestones, expected

returns on investments, and financial projections, including the Company's future revenue and

profitability; growth of the Company’s served markets; market opportunities; industry and technology trends; use of the Company’s technology

in additional applications; the Company’s product roadmap and the characteristics and benefits of

such future products; growth opportunities, including with respect to the delivery of next

generation chip packaging, and the production of integrated mems|cam products; growth drivers; the characteristics, benefits,

advantages, features, disruptive qualities and potential of the Company’s technologies and

products, including with respect to 3-D Integrated Circuits and other packaging solutions

in the Company’s Intellectual Property segment and DigitalOptics mems|cam products and the commercialization of such technologies and

products; the effects and duration of the new license agreements with SK hynix; the long term value of

IP business and its portfolios; future payments and running royalties, including from SK hynix;

discussions with other major DRAM players and the ability sign additional long-term licenses; litigation developments and

expectations, including the amount Tessera, Inc. expects to receive from Amkor in connection with the

arbitration award; future investment and research and development resources, including with

respect to strategic growth opportunities; strategic alternatives and partnership opportunities available to the DigitalOptics

segment (DOC) (including the anticipated timing of such alternatives and partnerships); and the

Company’s ability to address upcoming needs of key market segments. Material factors that

may cause results to differ from the statements made include the plans or operations relating to the Company's businesses; market

or industry conditions; changes in patent laws, regulation or enforcement, or other factors that might

affect the Company’s ability to protect or realize the value of its intellectual property;

the expiration of license agreements and the cessation of related royalty income; the failure, inability or refusal of licensees to pay royalties;

initiation, delays, setbacks or losses relating to the Company’s intellectual property or

intellectual property litigations, or invalidation or limitation of key patents; the timing and

results, which are not predictable and may vary in any individual proceeding, of any ICC ruling or award, including in the Amkor arbitration; fluctuations

in operating results due to the timing of new license agreements and royalties, or due to legal costs;

the risk of a decline in demand for semiconductor and camera module products; failure by the

industry to use technologies covered by the Company’s patents; the expiration of the Company’s patents; the Company’s ability to

successfully complete and integrate acquisitions of businesses, including the integration by

DigitalOptics segment (DOC) of its recently acquired camera module manufacturing facility in

Zhuhai, China; the risk of loss of, or decreases in production orders from, customers of acquired businesses; financial and regulatory risks

associated with the international nature of the Company’s businesses; failure of the

Company’s products to achieve technological feasibility or profitability; failure to

successfully commercialize the Company’s products; changes in demand for the products of the Company’s customers; limited opportunities to license

technologies and sell products due to high concentration in the markets for semiconductors and related

products and camera modules; the impact of competing technologies on the demand for the

Company’s technologies and products; failure by DOC to become a vertically integrated camera module supplier; and the

reliance on a limited number of suppliers for the components used in the manufacture of DOC products.

You are cautioned not to place undue reliance on the forward-looking statements, which

speak only as of the date of this document. The Company's filings with the Securities and Exchange Commission, including its

Annual Report on Form 10-K for the year ended Dec. 31, 2012, include more information about

factors that could affect the Company's financial results. The Company assumes no obligation to

update information contained in this document. Although this document may remain available on the Company's website or

elsewhere, its continued availability does not indicate that the Company is reaffirming or confirming

any of the information contained herein. This document includes trademarks, tradenames and tradedress of the Company, its subsidiaries and of

third parties. Those intellectual property rights are owned by their respective

owners.

|

I.

Overview

II.

Intellectual Property Business –

Strategy for Growth

III.

DigitalOptics Business –

Mitigating Stockholder Risk

IV.

Financial Highlights

V.

Why Our Board is Right (and Starboard is Wrong) for

Tessera

3

Tessera Confidential |

interconnectology 4

We Produce Real Technology and Products

Through Leveraged Partnerships

We Are Not a Patent Troll

A Technology Development Company

Selling Advanced Technology

Engineer to Engineer

WE HELP TURN THIS …

INTO THIS

Tessera Confidential |

Overview

Tessera Confidential |

6

Tessera’s “3 x 3”

Plan

1)

Drive IP business to target model

2)

Continue to execute DOC restructuring to

minimize capital requirements and speed time

to market

3)

Drive down corporate overhead

1)

Enhance position as a technology development

partner, not as a troll

2)

IP: Grow revenue from new customers,

Invensas technology and selective IP

acquisitions

3)

DOC: Focus on core competencies, develop

supply chain ecosystem, and explore strategic

alternatives to reduce cost burden

Tessera’s Board and management implemented significant changes to improve

governance and refocus the Company’s business strategy well before

Starboard’s current agitation Governance

Tessera Confidential

1)

Reconstituted Board: 5 of 6 on slate

added within last 9 months

2)

Effected key Executive-Level changes

3)

Enhance stockholder returns through

expanded dividend strategy and stock

repurchase plan

Operations

Strategy

(1)

___________________

(1)

Based on stockholder meeting to be held on May 23, 2013.

|

DOC

2013 Plan •

Tessera is committed to the market but will not fund entire investment

•

Limit additional net spending to $50mm

Complete 8MP mems|cam product commercialization (80-90% rolled yield)

Complete 13MP mems|cam design

Complete initial version of mems|cam computational imaging suite

Execute mems|cam supply agreements with module and lens manufacturing

partners •

Will seek alternatives to reduce commitment while optimizing stockholder ROI

(investment, JV, or sale)

7

Tessera Confidential |

8

____________________

Note: Tessera SG&A includes allocated corporate overhead.

(1)

Assumes tax rate of 30%.

Target Operating Model (IP Business)

IP Business

Target Model

Revenue

100%

Gross Profit

99%

R&D

12%

SG&A

22%

Litigation

15%

Operating

Income

50%

Net Income

After Tax

(1)

35%

Tessera Confidential |

9

____________________

Note: Tessera SG&A includes allocated corporate overhead.

(1)

Assumes 35% corporate overhead allocated to Intellectual Property Segment and 65%

allocated to DigitalOptics Segment. Includes restructuring charge of $2.5mm.

Where We Are Today (2012 Actuals)

Tessera Confidential

IP Business

DOC

Consolidated

Revenue

100%

100%

100%

Gross Profit

99%

4%

83%

R&D

17%

165%

43%

SG&A

(1)

24%

129%

43%

Litigation

18%

--

15%

Operating

Income

41%

(290%)

(18%)

Net Income

(13%) |

With

Critical Changes Behind Us, We Are Executing on Our Refined Strategy

10

Meeting With Top Customers and Partners

Listening to Investors

Working with Board & Outside Advisors to Formulate Strategy

Executing New Strategy

8/29/12

Added 2

independent

directors

(Richard S.

Hill & Timothy

Stultz)

11/14/12

Announced cost

cutting measures

in DigitalOptics

unit in Charlotte

& Tel Aviv

1/15/13

Appointed Bernard

J. Cassidy as

president of

Tessera Intellectual

Property Corp

4/6/11

Appointed

Simon McElrea

as President of

Invensas

4/15/13

Appointed

Richard S. Hill as

Interim CEO and

Executive

Chairman

4/25/13

Company announced

in earnings call they

are seeking strategic

options for DOC to

find a financial or

strategic partner

3/21/13

Announced DOC business

strategy refocusing and DOC

and Corporate Overhead cost

reductions of approximately

$78 million, or 45% on an

annualized basis

12/10/12

Appointed James

Chapman as

DOC SVP of

Sales & Marketing

2/7/13

Appointed

John Thode as

president of

DigitalOptics

Corporation

3/22/13

Stopped vertical

manufacturing in

DOC: executed

corporate overhead

reductions

8/15/12

Announced

appointment

of C. Richard

Neely, Jr. as

Executive

VP and CFO

Tessera Confidential

3/25/13

Restructured board with 3 new

independent directors and

appointed Richard S. Hill Chairman

Announced commencement of a

search for a new CEO |

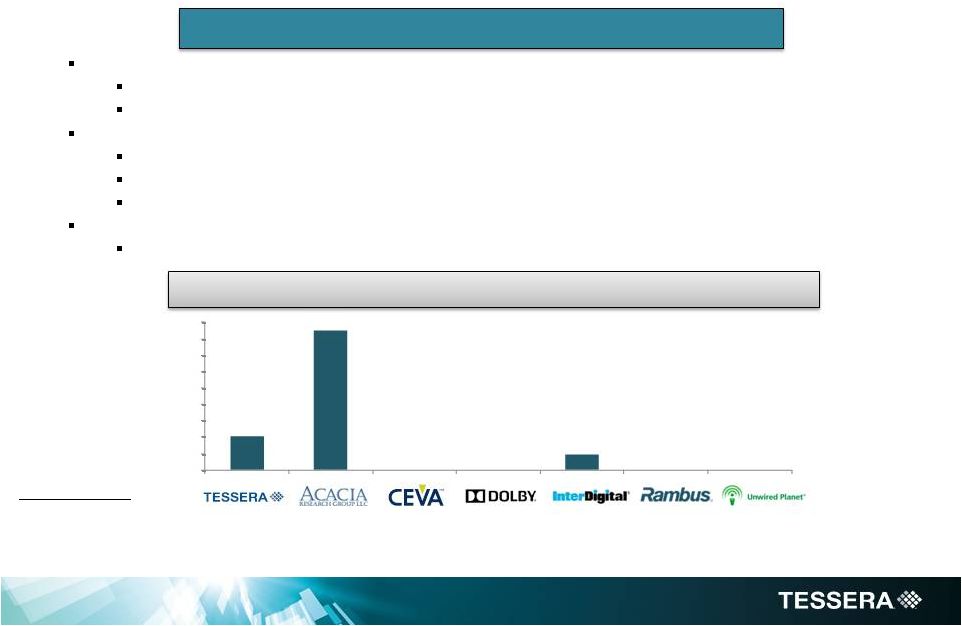

Strategy in place for new phase of growth

under experienced new management and

Board

Proven track record for effective IP

monetization with industry-leading operating

margins

Executing on a plan for growth driven by

innovation

Strong focus on operational excellence and

creating value for stockholders

Demonstrated willingness to make tough

decisions to drive value

Since we began to implement Board and

management changes in August 2012, our

stock has risen ~30% (peers have only risen

~6%

(1)

)

(1)

As of April 23, 2013. Initial closing price based on August 28, 2012, the day before

Tessera announced it had appointed Richard S. Hill and Timothy J. Stultz to its Board and two weeks

after

Tessera

announced

the

appointment

of

C.

Richard

Neely,

Jr.

as

Executive

Vice

President

and

Chief

Financial

Officer.

Peers

consist

of

Acacia

Research,

InterDigital,

CEVA,

Dolby

Laboratories, Unwired Planet and Rambus. Excludes the impact of dividends.

11

The obvious quick fixes suggested by

Starboard

have

been

made

already

They have said they will slash R&D and

implied they will kill DOC

Led by Peter Feld who:

Lacks management experience

Has demonstrated no ability to create

value at Unwired Planet

Presents material conflicts of interest

Has repeatedly refused good faith offers by

Tessera to resolve amicably

Looking to control company without a

premium

Tessera

Starboard

We

believe

the

decision

is

clear

–

Starboard

simply

has

nothing

useful

to

offer

The Facts Before You

Tessera Confidential |

Enhanced Board Poised to Drive Stockholder Value

12

Tessera Board has been enhanced with fresh perspectives and the broad set of skills

necessary to effectively oversee the company though these critical times,

including IP monetization, engineering, marketing, sales, and finance

Each of our nominees has years of operational and director experience with companies

that specialize in introducing complex technologies into the market

___________________

Note:

“*”

denotes “independent director”

as defined in NASDAQ Marketplace Rule 5605(a)(2). Richard S. Hill will return to

independent director status upon appointment of new CEO. (1)

Represents tenure up to May 23, 2013 for Robert J. Boehlke, David C. Nagel and

Anthony J. Tether, the effective date of resignation (March 1, 2013) for John B. Goodrich and Kevin G.

Rivette and the effective date of resignation (April 15, 2013) for Robert A.

Young. Tessera Confidential

Board Members Elected at 2012 Annual Meeting

(1)

Robert J. Boehlke*

8 years, 5 months

John B. Goodrich*

11 years, 7 months

David C. Nagel*

8 years, 0 months

Kevin G. Rivette

1 year, 11 months

Anthony J. Tether*

1 year, 9 months

Robert A. Young

22 years

Current Proposed Slate

Richard S. Hill*

9 months

John Chenault*

2 months

John H.F. Miner*

2 months

David C. Nagel*

8 years, 0 months

Christopher A. Seams*

2 months

Timothy J. Stultz*

9 months

Board Member

Tenure

Board Member

Tenure |

Why is

it Nearly Unprecedented for Stockholders to Give a Dissident Control of the

Board Without a Simultaneous Purchase of the Company at a Premium?

With Board control, Starboard could potentially…

sign

below-market

licenses

or

settle

litigation

for

discounted

sums

to

gain

near-term

profit at the expense of long-term value

ignore R&D investment intended to fund long-term Invensas growth in

exchange for near-term savings

shut down DOC for quick P&L benefit at the expense of a more attractive

alternative that takes longer to consummate

recognize there is limited liquidity in the stock and be first out the door when

their strategy fails, leaving current investors to lose money

buy Unwired Planet to save a poor investment at the expense of Tessera

stockholders

share Tessera's trade secrets and proprietary know-how with an unsuccessful

competitor (Unwired Planet) for free

cause key talent to leave the company

13

Are you willing to take these risks and suffer the

consequences?

Tessera Confidential |

Intellectual Property Business Overview

Tessera Confidential |

Tessera Confidential

Intellectual Property Business

Selective Acquisitions

Original IP business

established Tessera as a key

IP licensing company

Proven technology which is

still used today by most OEM

and other electronics

manufacturers

Over 800 U.S. and foreign

patents issued and pending

Created to enable new

avenues for growth

Holds patents in many key

development areas of the

semi space, including

facedown technology (xFD),

BVA, and 3D packaging

Over 1,000 U.S. and foreign

patents issued and pending

Overview of IP Business

15

Tessera’s new business plan

contemplates inorganic

growth outside of traditional

areas of focus

Established team to acquire

companies, divisions, and

patent assets in a disciplined

way

Collectively, a future-focused

IP-engine enabling new and

more effective monetization

strategies for Tessera’s IP

business |

Tessera Confidential

Customer

Original Portfolio

New Portfolio

Status

Signed new agreements in 2012

Expect significant increase in

revenue

Contract expired in May 2012

Accounted for 13% of 2012

revenue

Renewed through 2017

Key Licensees & Targets for Current Portfolios

16

= Under Contract

= In Negotiations |

Tessera Confidential

Tessera, Inc.

Portfolio

Invensas Portfolio

Patent and know-how licenses to next-gen technology

Patent licenses to broadly implemented original technology

Cross-selling occurs as vendors require patent licenses to original technology

already implemented, but also patent and know-how licenses to

cutting-edge technology Other customer wins expected as

next-generation technologies become adopted xFD already adopted and

quickly gaining traction BVA targets new licensees outside of our

traditional DRAM licensees 3D

packaging

–

widely

recognized

as

an

optimal

path

to

advance

semi

technology

17

Compelling Opportunities to Cross-Sell Tessera and

Invensas Licenses & Know-How |

Tessera Confidential

18

xFD™

BVA™

Current DRAM

Package (TCC™)

Current Package

on Package

3D-IC

(Memory)

3D-IC

(Mobile)

Addressable Markets vs. Innovation Roadmap |

Tessera Confidential

Patent Enrichment

Tessera Compliant Chip Technology

Invensas xFD Multi-Chip Technology

Generated $1.6b in Revenue & Counting

Generating New & Renewal Licenses

19

Window Bonding

through Substrate

Patent #6

Chip-Scale Package

with Compliancy

Patent #1

Encapsulation &

Other Methods

Patent #25

Thermal Solutions &

Improvements

Patent #100+

Multi-Die Face-Down

Structure

Patent #1

Alternate Structures

& New Methods

Patent #16

Improved Electrical

& SI Performance

Patent #44

Thermal Solutions &

Improvements

Patent #140+ |

Tessera Confidential

Successful Use of War Chest in Litigation Battles

20

Track record of attractive returns through litigation: 2x-3x return per dollar

spent on litigation converted to legal settlement or award

Strong cash position = credible threat of litigation: to defend patents and

discourage free riding

Litigation is strategically focused on high-value patents

Major Cases:

Amkor Arbitration: Amkor initiated but Tessera scored a major win with favorable

ruling against Amkor in February 2013

Over $130mm of cash expected over next few years in addition to the $20mm

Amkor paid in 2012, for a total of over $150mm

Anticipated yield of over 400% based on $36mm cash expenditure

“AMD”

cases (Tessera, Inc. v. Advanced Micro Devices

and Tessera v. Motorola):

Federal

Circuit

has

already

ruled

patents

valid

and

infringed

by

two defendants; three

defendants (including AMD) have already settled

PTI case: PTI initiated but case now represents another significant upside

opportunity

IT WORKS!!! |

Tessera Confidential

21

____________________

Note: Peer operating margins are as-reported GAAP; Tessera SG&A includes

allocated corporate overhead. (1)

2012 average of ACTG, CEVA, DLB, IDCC, and RMBS. Note: excludes UPIP due to 2012

revenues of ~$3k and operating expenses of ~$32mm. (2)

Assumes tax rate of 30%.

Actual & Target Operating Margins Exceed Peers

IP Business

Target Model

2012 Peer

Avg.

(1)

Gross Profit

99%

84%

R&D

12%

27%

SG&A

22%

28%

Litigation

15%

5%

Operating

Income

50%

23%

Net Income

After Tax

(2)

35%

16%

IP Business

5-Year Average

2012

Operating

Operating

Rank

Firm

Margin

Margin

1

54%

41%

2

44%

35%

3

44%

63%

4

17%

23%

5

8%

32%

6

(20%)

(39%)

7

(21431%)

(107087%) |

DigitalOptics Business Overview

Tessera Confidential |

Tessera Confidential

Renewed Emphasis on Capital Efficiency & Focus

23

Focus on DOC value (MEMS & SW)

Leverage manufacturing partners

Minimize capital investment

Focus R&D on 8+13MP mems|cam

for smartphones

Integrated product strategy bundling

mems|cam and computational imaging

features

Strengthen OEM ties via software

Divesting Charlotte, Silent Air Cooling

Closing Tel Aviv and Zhuhai

Froze capital investment

Outsourcing lens, MEMS and CM HVM

$53mm

(1)

OpEx run-rate by year-end

New Strategic Approach

(1)

Represents a GAAP figure.

“Samsung Electronics Co., Ltd. has a signed a multi-year license

for DOC’s Face Detection and Face Tracking software. This

software will be used in Samsung Galaxy S

®

4 smartphones.”

—Tessera, April 23, 2013

Element

Manufacturing Model

Lens

Source From Partners

MEMS

Actuator

Fabless (Source via Foundries)

Lens

Barrel

Module

Leverage CM Partners |

Tessera Confidential

12-Month Goals for DOC Business

24

4Q13

Execute mems|cam

supply agreements

with module and lens

manufacturing partners

1Q14

Commence

mems|cam HVM

module production

3Q13

Complete closure of

Zhuhai, China facility

and bring up NPI

module line in Taiwan

Mar ‘14

Develop strategy to extend

mems|cam ecosystem (partners

to design & manufacture using

licensed DOC technology)

Dec ‘13

8MP mems|cam

production release

3Q13

Complete 13MP

mems|cam design

Jan ‘14

Complete optical

image stabilization

design

4Q13

Complete initial version of

mems|cam computational

imaging suite

3Q14

Release 13MP

mems|cam to

production

Dec ‘13

Complete financing

transaction to fund

DOC business |

Tessera Confidential

25

Path Forward –

Implications of Strategic Review

Tessera is committed to the market but

will not fund entire investment

Will seek alternatives to reduce

commitment while optimizing shareholder

ROI (investment, JV, or sale)

Many candidates with strategic overlap

(component, module, OEMs)

Investment bank retained to facilitate

process

Target transaction by year-end

Break-even target mid-2015, ~$100m of

incremental investment |

Tessera Confidential

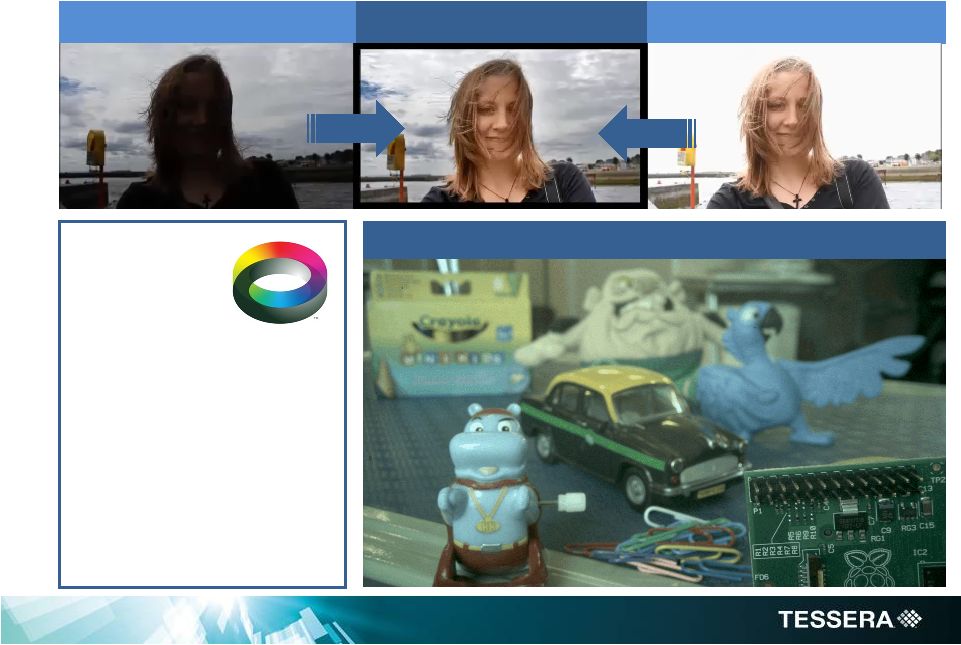

26

Holy Grail: Focus, Low Light, Zoom, & Computational Imaging Features

Autofocus modules doubling from 1Bu to 2Bu in next 4 years

“Never miss a

moment”

“Pocket to picture

in seconds”

“40% Faster

photo capture”

“Never miss a shot”

"We

view

imaging

as

a

core

area

for

differentiation

in

the

smartphone

space,"

-

Crawford

Del

Prete,

EVP

and

Chief

Research

Officer,

IDC |

Tessera Confidential

April 23, 2013

27

Industry Press Praises DOC Technologies

When Samsung unveiled the Galaxy S 4 in March, there was a near-

inescapable emphasis on face detection features. What we

didn't know is just whose technology was making them possible. As it

happens, it's

not

entirely

Samsung's

-

DigitalOptics

has

stepped forward to claim

some of the responsibility. The California firm recently struck a multi-

year licensing deal with Samsung to supply its Face Detection and Face

Tracking software…

it's safe to presume that Samsung isn't dropping its

emphasis on camera-driven software anytime soon. |

Tessera Confidential

Software

Focus

Quality

Silicon

Firmware

•

Scene Analysis

•

Frame Registration

•

HW Face Detection

•

Distortion Correction

•

Frame Registration

•

Object Detection

•

Frame Registration

•

Distortion Correction

Face Analysis

& Registration

Motion

Estimation

Super

Resolution

28

Why DOC is Uniquely Positioned to Compete –

System-Level Approach is Only Viable Option

Zoom

Low Light

Performance &

Image

Stabilization |

Tessera Confidential

29

Future of Imaging…Where Does it Go Next?

DOC Computational Imaging Portfolio

Under Exposure

Over Exposure

HDR Output

HDR Output

Multi-Focus

Best Shot

Panorama

All-in-Focus

Strobe Effect

Night Portrait

Depth Sensing

Super Resolution

SDoF (Bokeh effect)

Background Removal

Gesture Control... |

Financial Highlights

Tessera Confidential |

31

Q1 Financial Highlights

Source:

Note:

(1)

(2)

Company public filings adjusted for the theoretical model allocation of

non-segment portions of financial statements. Financial statistics exclude

the impact of stock-based compensation expense and amortization of intangibles.

Assumes 35% corporate overhead allocated to Intellectual Property Segment and 65%

allocated to DigitalOptics Segment. Includes stock-based compensation,

amortization of intangibles, restructuring/impairment and other charges.

CY2013

Q2

Guidance

Revenue:

$42mm

–

$50mm

GAAP

OpEx:

$77mm

–

$81mm

Litigation:

$16mm

–

$20mm

(included

in

GAAP

OpEx)

Restructuring:

$5.5mm

–

$6.5mm

(included

in

GAAP

OpEx)

GAAP

EPS:

($0.40)

–

($0.45)

Quarter Ended March 31, 2013

Revenues:

Intellectual

Property

Segment

DigitalOptics

Segment

Consolidated

Royalty and License Fees

$25.6

$2.6

$28.2

Product and Service Revenues

0.0

2.9

2.9

Total Revenues

$25.6

$5.5

$31.1

COGS

0.0

6.1

6.1

Gross Profit

25.6

(0.6)

25.0

Research & Development

5.4

17.9

23.3

SG&A

4.9

4.7

9.6

Litigation

14.0

0.0

14.1

Allocated Corporate Overhead

(1)

3.9

7.3

11.2

Total Operating Expenses

28.3

29.9

58.2

Non-GAAP Operating (Loss)

($2.7)

($30.5)

($33.2)

Total Non-GAAP Adjustments

(1)(2)

5.4

25.9

31.4

GAAP Operating (Loss)

($8.1)

($56.4)

($64.5)

Tessera Confidential |

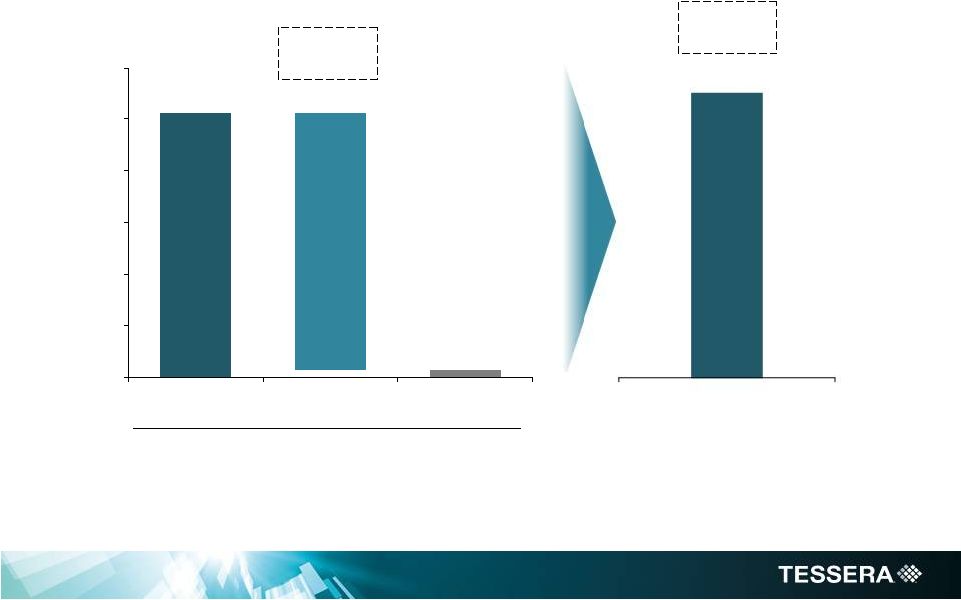

32

Existing

Customer Base

Litigation

New Invensas

Customers

New Verticals

FY2012

FY2016

($mm)

Litigation

Existing

Customer Base

Total CAGR: ~15%

Includes 100%

of DOC

Does Not

Include DOC

(1)

Revenue

Tessera Confidential

Source:

Note:

(1)

Company public filings and Tessera management estimates.

Financial statistics exclude the impact of stock-based compensation expense and

amortization of intangibles. FY2016 revenue excludes impact of DOC.

|

Non-GAAP Operating Margin

51%

2%

0%

10%

20%

30%

40%

50%

60%

IP

Impact of DOC

Tessera

Consolidated

(50%)

(1)

(1)

33

Non-GAAP Operating Margin

Includes 100%

of DOC

Does Not

Include DOC

(2)

FY2012

FY2016

Tessera Confidential

Tessera Consolidated (More

Text)

50 -

60%

____________________

Source:

Company public filings and Tessera management estimates.

Note:

Financial statistics exclude the impact of stock-based compensation expense and amortization of

intangibles. (1)

Assumes 35% of stock-based compensation related to corporate overhead allocated to Intellectual

Property Segment and 65% allocated to DigitalOptics Segment. (2)

FY2016 operating income excludes impact of DOC. |

34

Non-GAAP EPS

FY2012

FY2016

Includes 100%

of DOC

Tessera Confidential

Source:

Company public filings and Tessera management estimates.

Note:

Financial statistics exclude the impact of stock-based compensation expense and amortization of

intangibles. (1)

Assumes 35% of stock-based compensation related to corporate overhead allocated to Intellectual

Property Segment and 65% allocated to DigitalOptics Segment. Assumes tax adjustments

allocated based on proportion of adjustments. (2)

FY2016 EPS includes illustrative impact of DOC per-share earnings.

|

Tessera Confidential

35

Stockholder’s Dilemma: Dividends, Growth and

Liquidity

Dividends

Quarterly Dividend: (liquid assets/share count) * 0.05 / 4 (Assures

all cash is dividended out over 20 years) Special Dividend:

20-30% of Episodic Gain (Distributed once per 12 months)

Growth

“Sinking fund”

for fixed dividend growth: 20-30% of Episodic Gain

Investment in portfolio growth: 20-30% of Episodic Gain

Any unallocated Episodic Gain reinvested in business

Liquidity

Opportunistic “buyback program”

to support investor liquidity: 20-30% of Episodic Gain

(3)

(2)

2.0%

8.5%

1.0%

--

--

--

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

Tessera Will Offer All 3

Dividend

Yield

Comparison:

Tessera

Already

Ahead

of

Most

Competitors

(1)

--

(4)

Company public filings.

As of April 23, 2013.

Announced on April 23, 2013. The first of the quarterly cash dividends of $0.125 per

share will be paid on May 30, 2013. Acacia simultaneously announced an extension of its

$100mm share repurchase plan.

On December 11, 2012, Dolby announced a one-time special dividend of $4.00 per

share on its Class A and Class B common stock. On December 5, 2012,

InterDigital announced a special cash dividend of $1.50 per share on its common stock.

Source:

(1)

(2)

(3)

(4) |

Tessera Confidential

Why Our Board is Right (and Starboard is Wrong) for

Tessera |

Tessera

Already has a Highly Qualified and Experienced Slate of Directors

37

Relevant Experience

Board Nominee

Public CEO / CFO /

C-Level Suite

Public

Company

Board

Technology

Innovation

Location

(1)

Independent

Appointed

Within Last 8

Months

Richard S. Hill

John Chenault

John H.F. Miner

David C. Nagel

Christopher A.

Seams

Timothy J. Stultz

(1)

Checkmark for “location”

indicates nominee is based within a two-hour flight of Tessera’s San Jose,

CA headquarters. (2)

Richard

S.

Hill

will

return

to

independent

director

status

upon

appointment

of

new

CEO.

(2)

Tessera Confidential |

Tessera Confidential

The Dissident Slate is Not Right for Stockholders

38

Relevant Experience

Board Nominee

Public CEO / CFO /

C-Level Suite

Public

Company

Board

Technology

Innovation

Location

(1)

Concerns

Tudor Brown

Cambridge, UK

N/A

George Cwynar

Quebec, Canada

N/A

Peter Feld

New York, NY

Lacks Requisite Experience

and Saddled with Conflicts

from Unwired Planet

Thomas Lacey

Connected with Starboard

George Riedel

Weston, MA

N/A

Donald Stout

(2)

Arlington, VA

Troubling Allegations of

Professional Ethics Violations

(1)

Checkmark for “location”

indicates nominee is based within a two-hour flight of Tessera’s San Jose,

CA headquarters. (2)

Donald Stout serves on the Boards of Directors for Vringo, Inc. (AMEX: VRNG) and for

Augme Technologies, Inc. (OTC: AUGT). |

Tessera Confidential

Peter Feld is Seeking Board Leadership Without the Requisite

Experience Necessary to Keep the Company on the Right Path

39

6

month

tenure

–

ended

in

bankruptcy

1

year

tenure

–

not

re-elected

by

stockholders

25

month

tenure

–

company

has

had

significant decline in revenue

share

price

decline

(1)

10

months

on

Board

–

company

has

had

significant decline in profitability

(1)

Based on UPIP stock price performance from July 28, 2011 (effective date of Peter

Feld’s Board membership) to April 23, 2013. Tessera Stockholders

Deserve Better None

21

months

on

Board

–

very little

revenue

and

~15% |

Tessera Confidential

40

In

the

more

than

20

months

that

Feld

has

been

on

the

UPIP

Board,

the stock has fallen more than 15% (while

NASDAQ has risen 18%)

(1)

NO

new

revenue-bearing

license

agreements

have

been

signed

–

Microsoft

(lump

sum

agreement)

and

Mobixell were both signed before Feld joined the Board

Established a potential $1bn change of control payment to Ericsson if a change of

control occurs in the next three years, effectively a “poison

pill” Since Feld’s appointment as Chairman, the company has:

generated only a small amount of revenues

generated

over

$35mm

(2)

in

net

losses

from

continuing

operations

produced

a

total

cash

loss

from

operations

of

over

$56mm

(2)

spent

approximately

$20mm

(2)

on

patent

litigation

with

no

results

except

an

embarrassing

ITC

loss

to

Apple

Since Feld’s appointment to the Board of Directors, the company has suffered

a leadership exodus including Six senior management departures, including

the resignation of Starboard Value’s own UPIP Board nominee, Michael

Mulica, from the CEO position The

resignations

of

seven

Board

members,

including

all

3

members

with IP experience

UPIP and TSRA compete for the same portfolios, license to the same customers, and

are drawing from the same

pool

of

potential

CEOs

and

other

executives

–

all

giving

the

perception

and

reality

of

a

conflict

of interest

(1)

Based on UPIP stock price performance from July 28, 2011 (effective date of Peter

Feld’s Board membership) to April 23, 2013. (2)

Based on UPIP public filings.

A Recent Example of Peter Feld’s Track Record as

Chairman of Unwired Planet…

Is this what you want for Tessera? |

Tessera Confidential

41

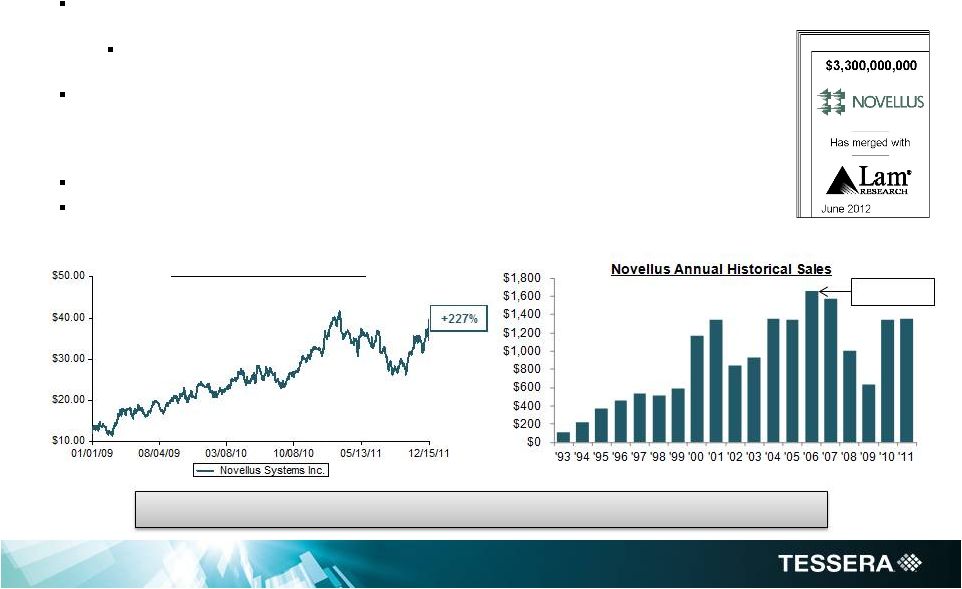

Previously served as CEO and Director of Novellus Systems Inc., until its

acquisition for more than $3 billion by Lam Research Corporation in June

2012 During his nearly 20 years leading Novellus, Mr. Hill grew annual

revenues from ~$100 million to over $1 billion

Previous experience with Tektronix Corporation (12 years; from General Manager of

the Integrated Circuits division to President of the Tektronix Development

Company and Tektronix Components Corporation), General Electric, Motorola

and Hughes Aircraft Company

Director of Arrow Electronics, Cabot Microelectronics and LSI Corporation

Will also join the Board of Planar, in another Proxy battle, in which both the

management and the agitator agreed to choose Mr. Hill to be on their

slate ($mm)

Novellus Historical Stock Price

Richard S. Hill is a Seasoned Industry Veteran with a

Track Record of Delivering Value to Stockholders

Peak Revenue:

$1.7 bn

Richard Hill is Well-Qualified to Lead Tessera |

Tessera Confidential

What Tessera’s Nominees Have Accomplished

42

John

Chenault

John H.F.

Miner

Former CFO, VP of Corporate Development, VP of Operation and Administration,

EVP of Worldwide Sales & Service and EVP of Business Operations of Novellus

Systems

Serves as a Director of Ultra Clean Technology and Synos Technology

Extensive management and operations experience in the semiconductor industry

Venture capitalist and Managing Director of Pivotal Investments LLC

Formerly President of Intel Capital; held various other positions with Intel

including VP and GM of the Communications Products Group, the Enterprise

Server Group, and GM of Intel’s desktop motherboard and PC

building-blocks business Serves as a Director of LSI Corporation and

three private company boards, in addition to his service in numerous

community activities Former President of AT&T Labs and Chief Technology

Officer Led a team which generated more than 5,000 patents

Initiated

a

formal

IP

monetization

program

for

the

first

time

in

company's

history and within 2 years generated annualized patent revenues of more than

$70M

Served for 5 years on a Presidential Advisory Committee on Information Technology

(PITAC) which specifically addressed IP creation and monetization as a key

issue David C.

Nagel |

Tessera Confidential

What Tessera’s Nominees Have Accomplished

43

Christopher

A. Seams

Currently with Cypress Semiconductor, holding various positions including

Executive VP of Sales & Marketing and Executive VP of Worldwide

Manufacturing and R&D Experience at AMD and Philips Research

Laboratories Served as a Director of Sunpower Corporation

Extensive management, sales and marketing, and engineering experience in the

semiconductor industry

David C.

Nagel

(cont’d)

Currently serves on the Executive Committee for the Board of Trustees of the

International Computer Science Institute

Prior experience with Apple Computer (Senior VP, R&D) and NASA (head of the

Human Factors Research division at NASA’s Ames Research Center)

Most recently President and CEO of PalmSource

Also serves as Director of Vonage Holdings and Director and Chairman of

Technology Committee at Align Technology

Timothy J.

Stultz

President, CEO and Director of Nanometrics

Previous experience with Imago Scientific Instruments (President & CEO)

and Veeco Instruments (VP and GM of Metrology Group)

20 years of executive management and operational and strategic development

experience in technology and capital equipment manufacturing

|

Tessera Confidential

Experienced Business Line Leadership

44

C. Richard

Neely, Jr.

Executive VP & CFO

Bernard J.

Cassidy

President, Tessera

Intellectual Property

General Counsel and

Executive VP, Tessera

Technologies

Joined company in August 2012

30+ years of financial and operations management experience in

high technology industries

Previously CFO of Livescribe, CFO of Monolithic Power Systems,

and CFO of NuCORE Technology

Prior senior roles at several semiconductor related companies

including, Synopsys and AMD

Appointed President in January 2013

Extensive patent licensing and litigation experience

Nationally recognized expert on patent licensing

Twice testified before Congress on patents

Practiced law at Wilson, Sonsini, Goodrich & Rosati, and at

Skadden, Arps, Slate, Meagher & Flom

Member of Harvard Law Review

John S. Thode

President,

DigitalOptics

Corporation

Joined company in February 2013

Previously served as General Manager and Executive VP of

McAfee's Consumer, Mobile and Small Business

Prior experience with Dell (GM of Mobility Products Group), ISCO

International (President & CEO), and Motorola (25 years in various

management roles)

Extensive consumer mobile product industry experience

|

Tessera Confidential

If you vote for Tessera’s slate, the Tessera Board commits to:

1)

Immediately expand Board by 2 seats

2)

Interview and select 2 of 3 Starboard nominees (Tudor Brown, George

Cwynar, and George Riedel) to fill those seats

45

You Have the Ability to Drive Compromise –

You Just

Need to Act on It

(1)

See page 51 for additional detail.

Given

Starboard’s

refusal

to

compromise,

you

have

the

power

to

enable

the

creation

of

a

stellar

Board

–

one

with

the

skills

required

to

take

this

Company

to

the

next

level

This gives stockholders 7 of 8 directors new (appointed since August 2012) and with solid

track records

Significant stockholder risk in Board overhaul with Starboard nominees with no familiarity

with the business, customers and products

We have repeatedly tried to work through a compromise with Starboard

(1)

|

Tessera Confidential

Conclusion

46

Our IP business will drive growth through innovation and licensing

at industry-leading operating margins

Our DOC business has been restructured to capitalize on our core

competencies and addresses our massive TAM; we are also exploring

strategic alternatives to maximize stockholder value

Our focus on cost reduction and revenue optimization is well underway and

predates Starboard’s current involvement

We have the right Board and leadership in place to drive this vision and deliver

growth, dividends and liquidity for our stockholders

Don’t Let Starboard Destroy Your Investment –

Support Our Plan and Our Nominees |

Tessera Confidential

Appendix |

Tessera Confidential

•

Customer requirements:

time to market

performance advantage

cost advantage

Pure Troll vs. Value-Added IP Strategy

48

•

No engineers, no know-how

•

Licensing and know-how gets our

customers to market faster

•

Tessera engineers continue to

improve our claims and know-how

•

IP has to offer performance

advantages

•

Engineers convince engineers that

elegant solutions drive down costs

•

Cheaper to license than design

around

Tessera Brings Solutions to Our Partners

Expansions Add Value to Partners |

Tessera Confidential

New Verticals Growth Strategy

Potential IP Sources

Description

High quality patent assets are increasingly available on the market

Patent sales have been increasing in both size and frequency over the past several

years Struggling / failing product companies often develop important

technologies A company’s patent assets are sometimes worth more than

its value as a product company Underperforming divisions of large

conglomerates are potential sources of high-quality patents May present

opportunities to access valuable patents for monetization at below-market prices

Large technology companies often hold significant patent portfolios that they are

unable or unwilling to monetize

In

these

instances,

companies

sometimes

turn

to

external

parties

to

help

monetize their

investments

Large companies sometimes prefer to acquire a patent portfolio rather than take a

license A licensing partner would allow the large company to monetize the

IP, free of any cross-licenses that limit the large company’s

licensing ability 49

Patent Acquisitions

Company

Acquisitions

Divisional Spin-outs

Outsourced

Monetization

Privateering |

Tessera Confidential

Mobile Camera Market Opportunity

Still significant growth opportunity in a highly fragmented market

50

(1)

Source: Derived from median estimate of 10 analysts plus module and AF attach rates

from TSR 12/12 (Includes tablets and mobile phones). (2)

IC Insights Dec ’12.

Mobile Camera Modules

(1)

(mm units)

2,767

4,065

Mobile Camera Module Revenue ($B)

(2)

Autofocus Modules Units Expected

to Double in Next 4 Years

Module Revenue Expected to

Nearly Double by 2016 |

Tessera Confidential

Tessera’s Frustrated Attempts to Collaborate with

Starboard

51

February 12, 2013

The Company contacted Peter Feld to request contact information for four of

Starboard’s director nominees and Starboard’s permission for members of

the Board of Directors to interview such nominees.

February 15, 2013

Bernard Cassidy reiterated to Feld the Company’s request to interview four of

Starboard’s nominees.

February 20, 2013

Press release: “The Board has expressed to Starboard its willingness to

consider Starboard’s nominees.”

February 27, 2013

Richard S. Hill and Robert J. Boehlke in a meeting with Feld noted that the

Nominating

Committee

would

be

open

to

adding

two

candidates

from

Starboard’s

slate of nominees that meet the Company’s criteria, including independence

and business acumen.

March 4, 2013

Open letter to Starboard: “The Board is currently evaluating potential

candidates, and reiterates that it would like to include Starboard’s

nominees in that process.” March 15, 2013

The Company’s chairman of the Nominating Committee on behalf of the Board

Directors

sent

a

letter

to

Feld

offering

to

nominate

two

members

from

Starboard’s

nominees in connection with a settlement of the proxy statement.

March 18, 2013

Skadden, Arps, Slate, Meagher & Flom, on behalf of the Board, indicated that

in connection with a settlement proposal that the Board would include two

of Starboard’s nominees among the Board’s nominees for election

at the Annual Meeting

(but

not

Feld,

unless

he

resigned

from

his

position

as

a

director and

Chairman of the Board of Unwired Planet). |

Tessera Confidential

Property Segment

52

Segment Financials Model

Source:

(1)

(2)

(3)

Year Ended December

31, 2012

Revenues:

Intellectual

DigitalOptics

Segment

Consolidated

Royalty and license fees

$168.1

$14.4

$182.5

Past production fees

24.7

0.0

24.7

Product and service revenues

0.1

26.7

26.8

Total revenues

$192.9

$41.1

$234.0

COGS

0.9

39.5

40.4

Gross profit

192.0

1.7

193.7

Operating expenses

97.1

90.4

187.5

Allocated corporate overhead

(1)

16.5

30.6

47.0

Total operating expenses

113.6

121.0

234.5

Operating income

78.4

(119.3)

(40.9)

Other income and xpense, net

(2)

4.8

1.0

5.9

Income (loss) before taxes

83.3

(118.3)

(35.0)

Provision for (benefit from) income taxes

(3)

29.2

(34.0)

(4.8)

Net income (loss)

$54.1

($84.3)

($30.2)

Basic

and

diluted

net

income

(loss)

per

share:

Net income (loss) per share-basic

$1.04

($1.62)

($0.58)

Net income (loss) per share-diluted

$1.04

($1.62)

($0.58)

Weighted average number of shares used in per share calculations-basic

51,977

51,977

51,977

Weighted average number of shares used in per share calculations-diluted

51,977

51,977

51,977

Gross Margin

99.5%

4.0%

82.8%

Operating Margin

40.7%

(290.1%)

(17.5%)

Net Margin

28.1%

(205.1%)

(12.9%)

Company public filings and Tessera management estimates.

Assumes 35% corporate overhead allocated to Intellectual Property Segment and 65%

allocated to DigitalOptics Segment. Assumes other income and expenses

allocated based on proportion of revenue. Assumes 35% tax rate for

Intellectual Property Segment. |

Tessera Confidential

53

In addition to disclosing financial results calculated in accordance with U.S.

Generally Accepted Accounting Principles (GAAP), this presentation contains

non-GAAP financial measures adjusted for either one-time or ongoing

non-cash acquired intangibles amortization charges, acquired

in-process research and development, all forms of stock- based

compensation, impairment charges on long-lived assets and goodwill, restructuring

and other related exit costs, and related tax effects. The non-GAAP

financial measures also exclude the effects of FASB Accounting Standards

Codification 718, “Stock Compensation”

upon the number of diluted shares used in calculating non-GAAP earnings

per share. Management believes that the non-GAAP measures used in this

presentation provide investors with important perspectives into the

Company’s ongoing business performance. The non-GAAP

financial measures disclosed by the Company should not be considered a

substitute for, or superior to, financial measures calculated in accordance with

GAAP, and the financial results calculated in accordance with GAAP and

reconciliations to those financial statements should be carefully evaluated.

The non-GAAP financial measures

used

by

the

Company

may

be

calculated

differently

from,

and therefore may not

be comparable to, similarly titled measures used by other companies.

Non-GAAP Reconciliation |

Tessera Confidential

54

Non-GAAP Reconciliation

Source:

Company

public

filings

and

Tessera

management

estimates.

(1)

(2)

Assumes 35% of stock-based compensation related to corporate overhead allocated

to Intellectual Property Segment and 65% allocated to DigitalOptics Segment.

Assumes tax adjustments allocated based on proportion of adjustments.

Years Ended December

31, 2012

Intellectual

Property Segment

DigitalOptics

Segment

Consolidated

Segment operating income (loss)

$78.4

($119.3)

($40.9)

Adjustments to GAAP net income (loss):

Stock-based

compensation

5.8

11.3

17.0

Amortization of acquired intangibles

14.5

10.5

25.1

Restructuring and other charges

0.0

2.5

2.5

Non-GAAP operating income (loss)

$98.7

($95.0)

$3.8

Non-GAAP operating margin model

51.2%

(230.9%)

1.6%

GAAP net income (loss)

$54.1

($84.3)

($30.2)

Adjustments to GAAP net income (loss):

Stock-based

compensation

5.8

11.3

17.0

Amortization of acquired intangibles

14.5

10.5

25.1

Restructuring and other charges

0.0

2.5

2.5

Tax adjustments for non-GAAP items

(2)

(5.4)

(6.5)

(11.9)

Non-GAAP net income (loss)

$69.0

($66.5)

$2.5

Non-GAAP net income (loss) per common share -

diluted

$1.30

($1.25)

$0.05

Weighted average number of shares used in per share calculations

excluding the effects of FAS123R -

diluted

53,061

53,061

53,061

(1)

(1) |