Attached files

| file | filename |

|---|---|

| 8-K - CIRRUS LOGIC, INC. 8-K - CIRRUS LOGIC, INC. | a50617884.htm |

| EX-99.1 - EXHIBIT 99.1 - CIRRUS LOGIC, INC. | a50617884ex99_1.htm |

Exhibit 99.2

1 April 25, 2013 Letter to Shareholders Q4 FY13 CIRRUS LOGIC, INC. 800 WEST SIXTH STREET, AUSTIN, TEXAS 78701

April 25, 2013 Dear

Shareholders, Q4 revenue increased 87 percent year-over-year and

declined 33 percent sequentially. Although gross margins for the quarter

were roughly 10 percentage points below our expectations due to a $20.7

million inventory reserve, we maintained GAAP and non-GAAP operating

profit of 16 percent and 19 percent, respectively. As fiscal year 2013

concludes, we are extremely pleased with our financial performance. On a

year-over-year basis, FY13 revenue grew 90 percent, our GAAP operating

profit increased 153 percent and earnings per share were up 55 percent.

Non-GAAP operating profit increased 141 percent year over year and

non-GAAP earnings per share were up 138 percent. We believe the

significant increase in both revenue and operating profit positions us

at the high end of our peers, validating our business model and

highlighting our ability to deliver profitability. While custom portable

audio products drove revenue growth in FY13, we are also encouraged by

the progress we made with our general market portable audio and LED

lighting products this past year. With one to two-year design cycles, we

are working on projects today that are expected to contribute to growth

over the next few years. We believe the innovation in portable audio

surrounding the audio and voice experience is in the early stages of

development. In LED lighting, while mass-market acceptance is several

years away, we are positioning ourselves today with key players and

helping to accelerate adoption by providing solutions that improve LED

light performance while also contributing to a lower bill of

materials. We believe Cirrus Logic is uniquely positioned in both of

these rapidly growing markets given our analog and mixed signal

technology expertise, culture of innovation and our ability to execute.

We remain excited about the opportunities for growth in audio and energy

over the long term by increasing content and adding additional features

for both custom and general market products. 2

Revenue and Gross Margins

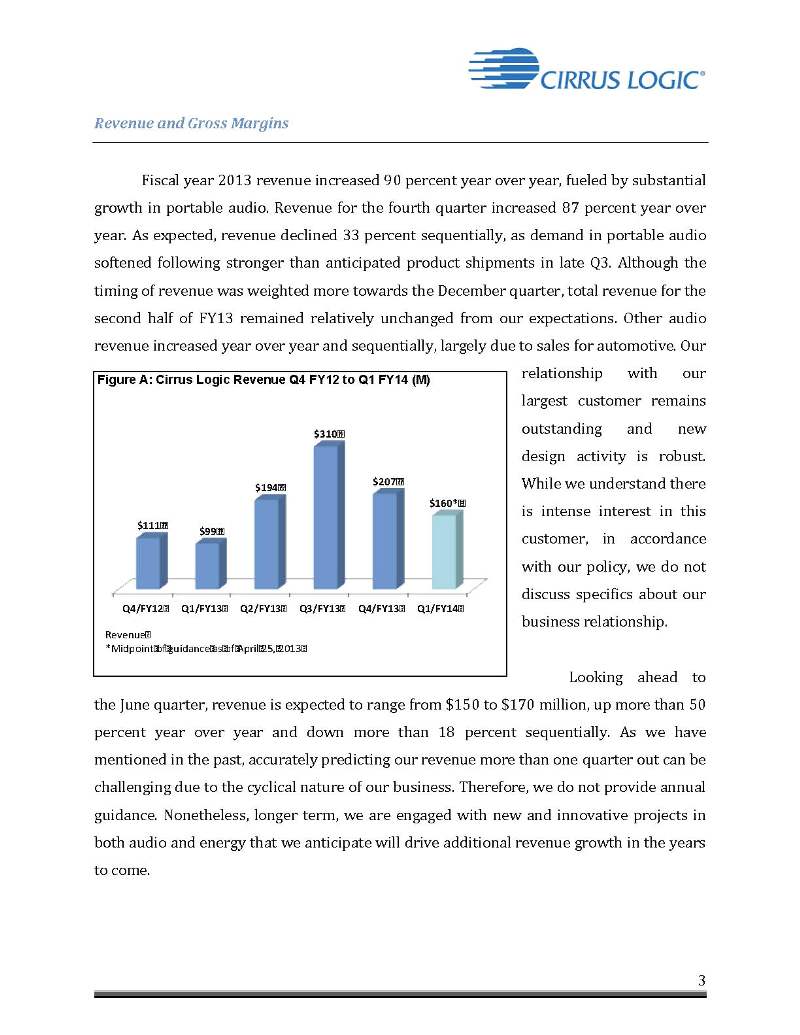

Fiscal year 2013 revenue increased 90 percent year over year, fueled by

substantial growth in portable audio. Revenue for the fourth quarter

increased 87 percent year over year. As expected, revenue declined 33

percent sequentially, as demand in portable audio softened following

stronger than anticipated product shipments in late Q3. Although the

timing of revenue was weighted more towards the December quarter, total

revenue for the second half of FY13 remained relatively unchanged from

our expectations. Other audio revenue increased year over year and

sequentially, largely due to sales for automotive. Our relationship with

our largest customer remains outstanding and new design activity is

robust. While we understand there is intense interest in this customer,

in accordance with our policy, we do not discuss specifics about our

business relationship. Looking ahead to the June quarter, revenue is

expected to range from $150 to $170 million, up more than 50 percent

year over year and down more than 18 percent sequentially. As we have

mentioned in the past, accurately predicting our revenue more than one

quarter out can be challenging due to the cyclical nature of our

business. Therefore, we do not provide annual guidance. Nonetheless,

longer-term, we are engaged with new and innovative projects in both

audio and energy that we anticipate will drive additional revenue growth

in the years to come.3

Gross margins were

approximately 40.4 percent in Q4, below the company’s previous

expectations of 50 to 52 percent. During the quarter, we recorded a

total net inventory reserve of $23.3 million, including

approximately $20.7 million due to a decreased forecast for a high

volume product. The $20.7 million inventory reserve resulted in a

decrease in gross margin for the quarter of slightly more than 10

percentage points. Looking ahead to the June quarter, we expect gross

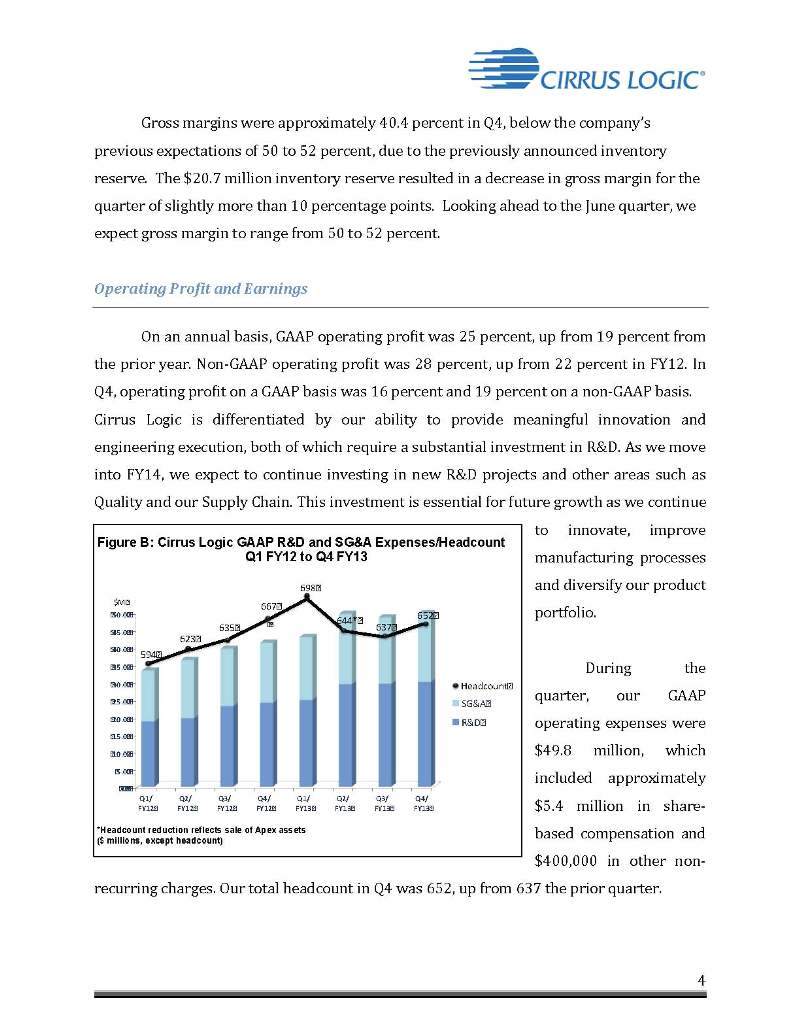

margin to range from 50 to 52 percent. Operating Profit and Earnings On

an annual basis, GAAP operating profit was 25 percent, up from 19

percent from the prior year. Non-GAAP operating profit was 28 percent,

up from 22 percent in FY12. In Q4, operating profit on a GAAP basis was

16 percent and 19 percent on a non-GAAP basis. Cirrus Logic is

differentiated by our ability to provide meaningful innovation and

engineering execution, both of which require a substantial investment in

R&D. As we move into FY14, we expect to continue investing in new R&D

projects and other areas such as Quality and our Supply Chain. This

investment is essential for future growth as we continue to innovate,

improve manufacturing processes and diversify our product

portfolio.During the quarter, our GAAP operating expenses were $49.8

million, which included approximately $5.4 million in share-based

compensation and $400 thousand in 4

other non-recurring

charges. Our total headcount in Q4 was 652, up from 637 the prior

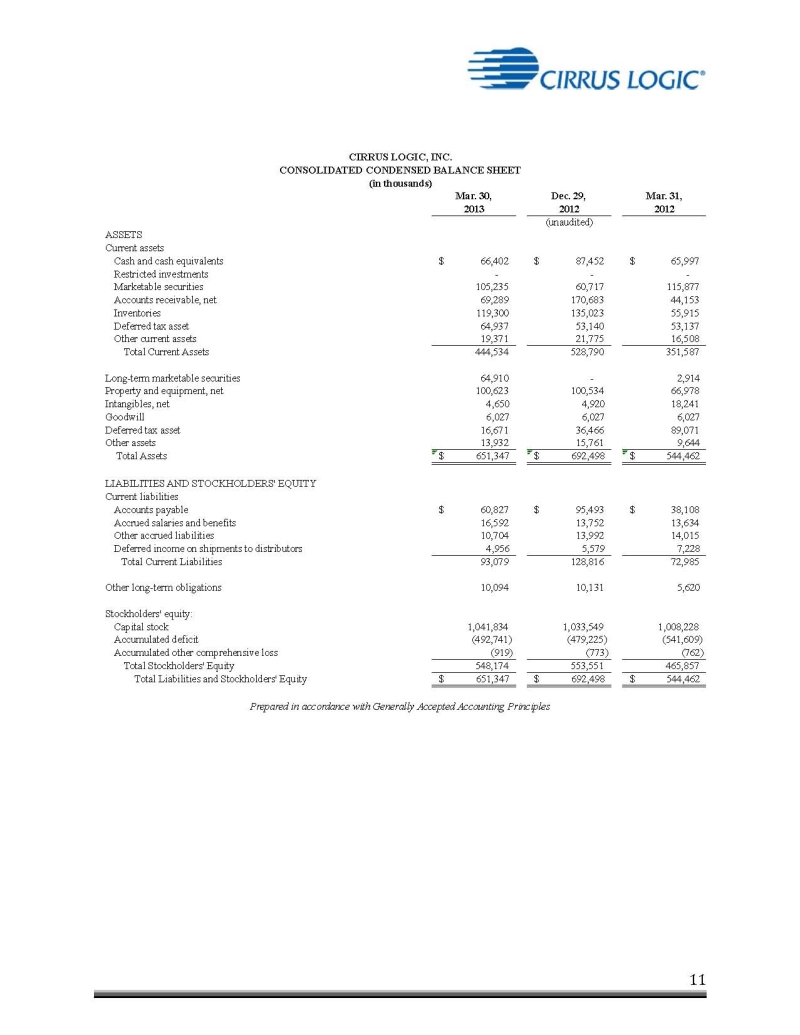

quarter. The Q4 ending cash balance was approximately $237 million, up

$89 million sequentially. Cash flow from operations in Q4 was roughly

$130 million. During the quarter, we repurchased approximately 1.5

million shares of common stock at an average price of $26.09. As of

March 30, 2013, we have approximately $114 million remaining in our

share repurchase program. While we may continue to repurchase shares

opportunistically from time to time, we are also actively evaluating

alternative uses of cash that could enhance our market opportunities We

are pleased with our earnings growth in FY13, as GAAP EPS was $2.00, up

from $1.29 in FY12 and as non-GAAP EPS increased to $3.24 from $1.36

from the prior year. In Q4, GAAP EPS was $0.39, versus $0.75 the year

ago quarter and non-GAAP EPS was $0.59, up from $0.36. Taxes Our GAAP

tax expense during the quarter was $7.6 million, which includes $7

million of non-cash expense associated with our deferred tax asset. We

have approximately $81.6 million of deferred tax assets remaining on our

balance sheet. For FY14, we expect our effective quarterly cash tax rate

to be less than four percent, until we have utilized the remaining

deferred tax assets. At that time, our initial cash tax rate is expected

to be approximately 35 percent. Company Strategy FY13 was a year focused

on ramping new custom products and introducing general market portable

audio and energy products that we expect to drive revenue growth and

customer diversification longer-term. Cirrus Logic’s strategy is to

target tier-one customers 5

in growing markets who are

able to differentiate their products with our innovative technology. We

take pride in our ability to solve complex problems, while meeting

customer timelines and helping reduce overall product costs by

eliminating or integrating functionality and components into our chips.

This past quarter, momentum with our general market portable audio

products accelerated, as the value placed on the audio and voice

experience in mobile devices is increasing. Interest in voice interface

and content awareness features, which require ultra-low power and

intelligent signal processing, are key to the expansion of this market.

Building on Cirrus Logic’s core audio processing competencies, our low

power DSP is well positioned for this market and continues to gain

traction in applications that require small, efficient, low-power DSPs.

Our new low power general market analog-to-digital converter, which

significantly enhances the voice experience for multi-microphone

applications, began shipping in the March quarter. We are excited about

the opportunities with multi-microphone applications and continue to

receive positive feedback and strong customer interest from other

tier-one players. In LED lighting, this past year we launched new,

industry-leading products, developed meaningful relationships with

tier-one accounts and positioned Cirrus Logic as a key player in the LED

lighting market ahead of mass consumer adoption over the coming years.

There are several factors driving the adoption of LED lighting,

including the government mandated phasing out of incandescent bulbs,

environmental benefits (no mercury) and the lower cost of LEDs; however,

the retail price for LED light bulbs remains relatively high. In-line

with our strategy to help reduce the LED overall bill of materials, we

have launched our next-generation single-stage LED controller. This

product maintains best-in-class performance while reducing the

electronic bill of materials cost by 30 percent, versus our first

generation dual-stage LED controller. During the fourth quarter, we

expanded into more SKUs and are now shipping with two tier-one lighting

customers. We continued to see design activity with our new and existing

products into A-type, GU10, BR and PAR bulbs, and we are encouraged by

early 6

progress in the MR16

replacement market. Looking ahead into FY14, we expect revenue in LED

lighting to increase as we continue to be meaningfully engaged with key,

tier-one accounts and ship into more models with new and existing

customers.Summary and Guidance For the June quarter, we expect the

following results: Revenue to range between $150 million and $170

million;Gross margin to be between 50 percent and 52 percent; and

Combined R&D and SG&A expenses to range between $51 million and $55

million, including approximately $6 million in share-based compensation

expense. In summary, FY13 was a tremendous year for Cirrus Logic. We

experienced substantial growth in our revenue and operating profit,

significantly expanded our footprint in portable audio and launched our

new LED lighting products. We believe our financial results are

directly attributable to our business model and long-term focus on

pursuing our vision to be the first choice in high-performance analog

and mixed signal processing. Sincerely, Jason Rhode Thurman Case 7

President and Chief

Executive Officer Chief Financial Officer Conference Call Q&A

SessionCirrus Logic will host a live Q&A session at 5 p.m. EST today to

answer questions related to its financial results and business outlook.

Participants may listen to the conference call on the Cirrus Logic

website. Participants who would like to submit a question to be

addressed during the call are requested to email investor.relations.com.

A replay of the webcast can be accessed on the Cirrus Logic website

approximately two hours following its completion, or by calling (404)

537-3406, or toll-free at (855) 859-2056 (Access Code: 32769785).Use of

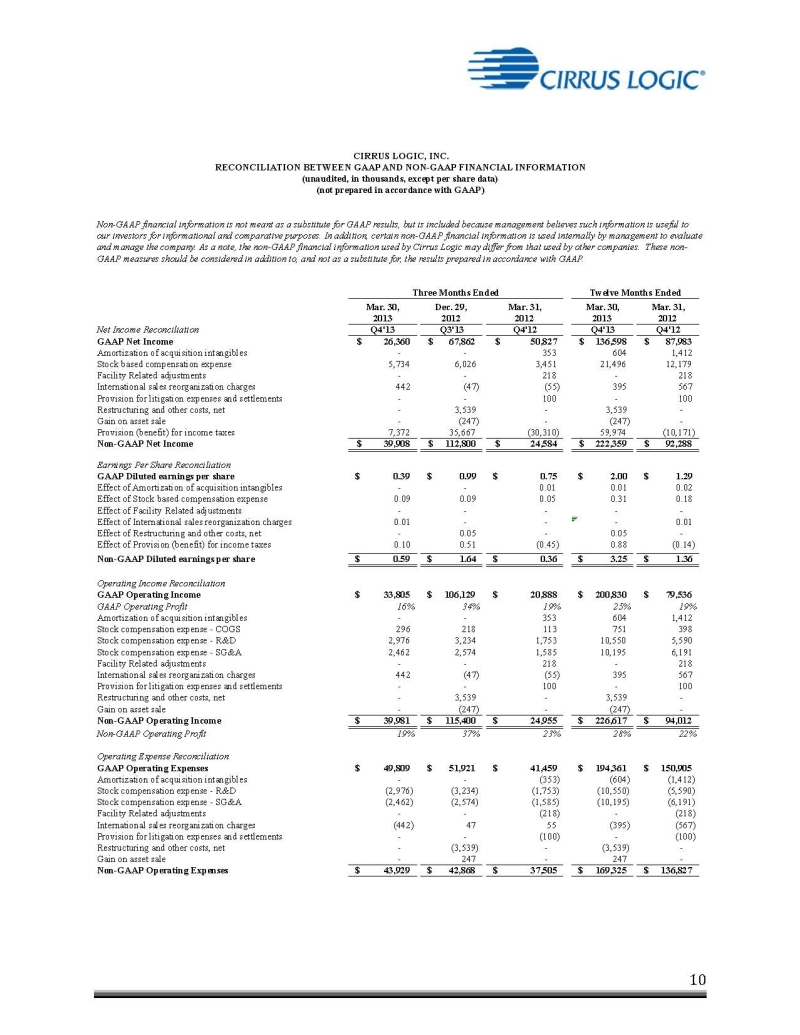

Non-GAAP Measures This shareholder letter and its attachments include

references to non-GAAP financial information, including operating

expenses, net income, operating profit and diluted earnings per

share. A reconciliation of the adjustments to GAAP results is included

in the tables below. Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management believes

such information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage the

company. As a note, the non-GAAP financial information used by Cirrus

Logic may differ from that used by other companies. These non-GAAP

measures should be considered in addition to, and not as a substitute

for, the results prepared in accordance with GAAP. Safe Harbor Statement

Except for historical information contained herein, the matters set

forth in this news release contain forward-looking statements, including

our future growth expectations and our estimates of first quarter fiscal

year 2014 revenue, gross margin, combined research and development and

selling, general and administrative expense levels, and share-based

compensation expense. In some cases, forward-looking statements are

identified by words such as “expect,” “anticipate,” “target,” “project,”

“believe,” “goals,” “opportunity,” “estimates,” “intend,” and variations

of these types of words and similar expressions. In addition, any

statements that refer to our plans, expectations, strategies or other

characterizations of future events or circumstances are forward-looking

statements. These forward-looking statements are based on our current

expectations, estimates and assumptions and are subject 8

to certain risks and

uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, but are not limited to, the level

of orders and shipments during the first quarter of fiscal year 2014, as

well as customer cancellations of orders, or the failure to place orders

consistent with forecasts; and the risk factors listed in our Form 10-K

for the year ended March 31, 2012, and in our other filings with the

Securities and Exchange Commission, which are available at www.sec.gov.

The foregoing information concerning our business outlook represents our

outlook as of the date of this news release, and we undertake no

obligation to update or revise any forward-looking statements, whether

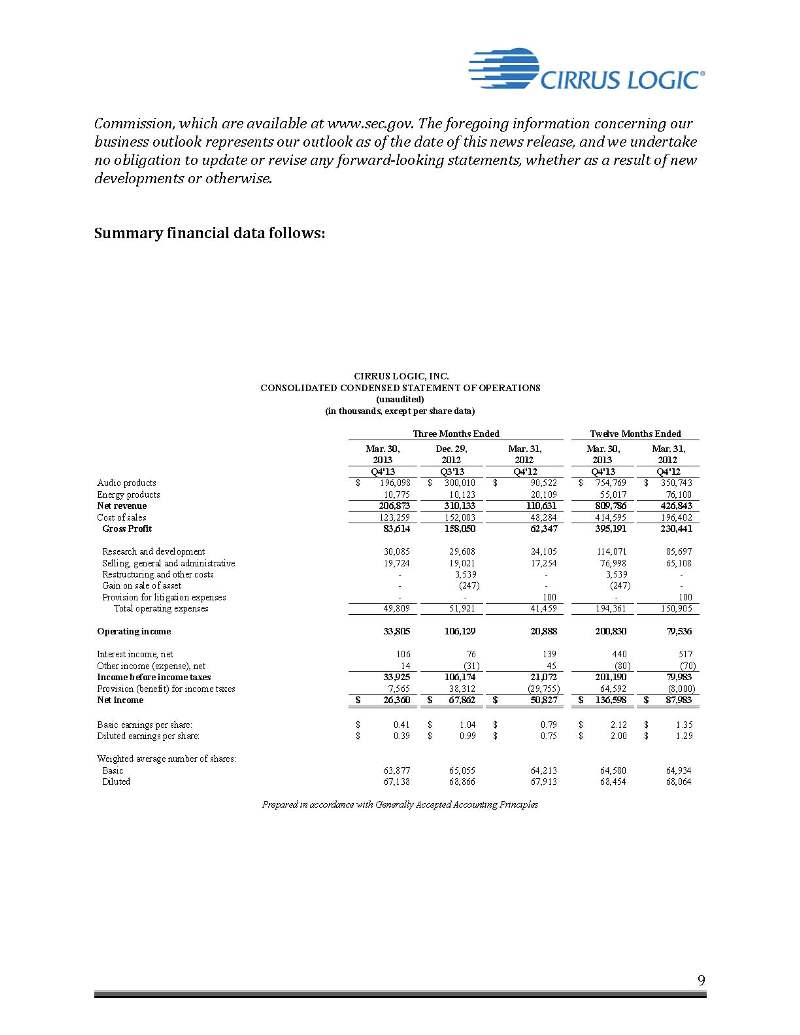

as a result of new developments or otherwise. Summary financial data

follows: 9