Attached files

| file | filename |

|---|---|

| 8-K - INDEPENDENT BANK CORPORATION 8-K 4-23-2013 - INDEPENDENT BANK CORP /MI/ | form8k.htm |

Exhibit 99.1

Independent Bank Corporation 2013 Annual Meeting of Shareholders *

Today’s Agenda Introductions Voting upon the matters listed in the Company’s 2013 Proxy Statement Presentation by IBC President and CEO and CFO Question and answer session *

IBC Board of Directors Donna J. Banks, Ph.D. William J. Boer Jeffrey A. Bratsburg Stephen L. Gulis Jr. Terry L. Haske Robert L. Hetzler William B. Kessel Michael M. Magee Jr., Executive Chairman James E. McCarty, Lead Outside Director Charles A. Palmer Charles C. Van Loan *

IBC Executive Management Michael M. Magee Jr. – Executive Chairman William B. Kessel – President and Chief Executive Officer Robert N. Shuster – EVP/Chief Financial Officer Mark L. Collins – EVP/General Counsel Stefanie M. Kimball – EVP/Chief Risk Officer Dennis J. Mack – EVP/Chief Commercial Lending Officer David C. Reglin – EVP/Retail Banking *

2013 Annual Meeting of Shareholders Secretary for the meeting (Robert Shuster) Inspectors of election (Martha Blandford/Scott Petersen) Record date: February 25, 2013 Approximate mailing date of Proxy Statement: March 20, 2013 Shares entitled to vote: 9,484,756 Determination of quorum Voting on proposals *

Proposal #1 Election of Directors Donna J. Banks Jeffrey A. Bratsburg Charles C. Van Loan * William J. Boer

Proposal #2 Ratification of Auditors Crowe Horwath LLP has served as IBC’s independent registered public accounting firm since 2005 Crowe Horwath was founded in 1942 and is one of the ten largest accounting and consulting firms in the U.S. IBC is served primarily by Crowe Horwath’s Grand Rapids, Michigan, and South Bend, Indiana, offices *

Proposal #3 Advisory Vote on Executive Compensation The Board has solicited a non-binding advisory vote from our shareholders to approve the compensation of our executives as described in our proxy materials. *

Proposal #4 Amendment of Long-Term Incentive Plan Consider and vote upon a proposal to amend the Company’s Long-Term Incentive Plan to make an additional 500,000 shares of the Company’s common stock available for issuance under the Plan as described in our proxy materials. *

IBC Overview *

Safe Harbor Statement This presentation may contain certain forward-looking statements within the meaning of the Private Securities Reform Act of 1995. Forward-looking statements include expressions such as “expects,” “intends,” “believes” and “should” which are statements of belief as to expected outcomes of future events. Actual results could materially differ from those contained in, or implied by such statements. Independent Bank Corporation undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation. *

Presentation Summary 2012 Overview (positive momentum and a year of change) Current economic environment Banking and regulatory environment Goals for 2013 and beyond First quarter 2013 – summary of results *

2012 Summary 2012 – Positive Momentum Four consecutive quarters of profitability Strengthened balance sheet (capital, asset quality and core deposits) 2012 – A Year of Change Sale of branches Consolidation or closure of branches Creation of Chief Risk Officer position and creation of Enterprise Risk Management structure Simplifying our operating structure Creating a leaner workforce *

Sale of Branches *

Consolidation of Branches *

Economic Environment Much uncertainty Unemployment data Real estate values (recovering, but Michigan generally at a slower pace than U.S.) Economic growth (GDP) and inflation (CPI) Interest rate environment – continued low interest rates challenging for banks *

Banking and Regulatory Environment Revenue growth challenges (net interest income and non-interest income) Managing costs through economic cycle Competition (impact on loan growth and margins) Significant new regulations and compliance burden Potential changes to bank capital requirements (Basel III) *

2013 and Beyond 2013 – A Year of Development Our community bankers structure and other employees in new roles Retention of existing customers and expanding new products and services Continued efforts to acquire new customers (both commercial and consumer) Electronic delivery channels Financial Goals Recover valuation allowance on deferred tax asset – totaled $62.5 million at March 31, 2013 Exit Troubled Asset Relief Program (TARP) Generate an annual return on average total assets of 0.75% to 1.00% Improve our efficiency ratio Grow core deposits by 3% to 5% annually Reduce non-performing assets One constant in all of our goals – continuing to provide exceptional customer service! *

First Quarter 2013 Results Fifth consecutive quarter of profitability Reported net income of $5.8 million (compared to $3.5 million in 2012) and net income applicable to common stock of $4.7 million, or $0.27 per diluted share (compared to $2.4 million or $0.07 per diluted share in 2012) Continued improvement in asset quality metrics Growth in core deposits *

IBC Financial Overview *

Net Income (Loss) Applicable to Common Stock Note: 2010 includes a one-time gain of $18.1 million on the extinguishment of debt *

Net Income (Loss) Per Share Applicable to Common Stock *

Total Assets 2008 to 2011 decline due primarily to efforts to preserve regulatory capital ratios * 2012 decline due primarily to branch sale

Select Components of Total Assets Although total loans have been declining, during 2012, the Bank made new loans or renewed existing loans totaling $860 million Includes $124 million of deposits at the Federal Reserve Bank earning 0.25% *

Bank Regulatory Capital Ratios * Minimum for well-capitalized is 5% Minimum for well-capitalized is 10%

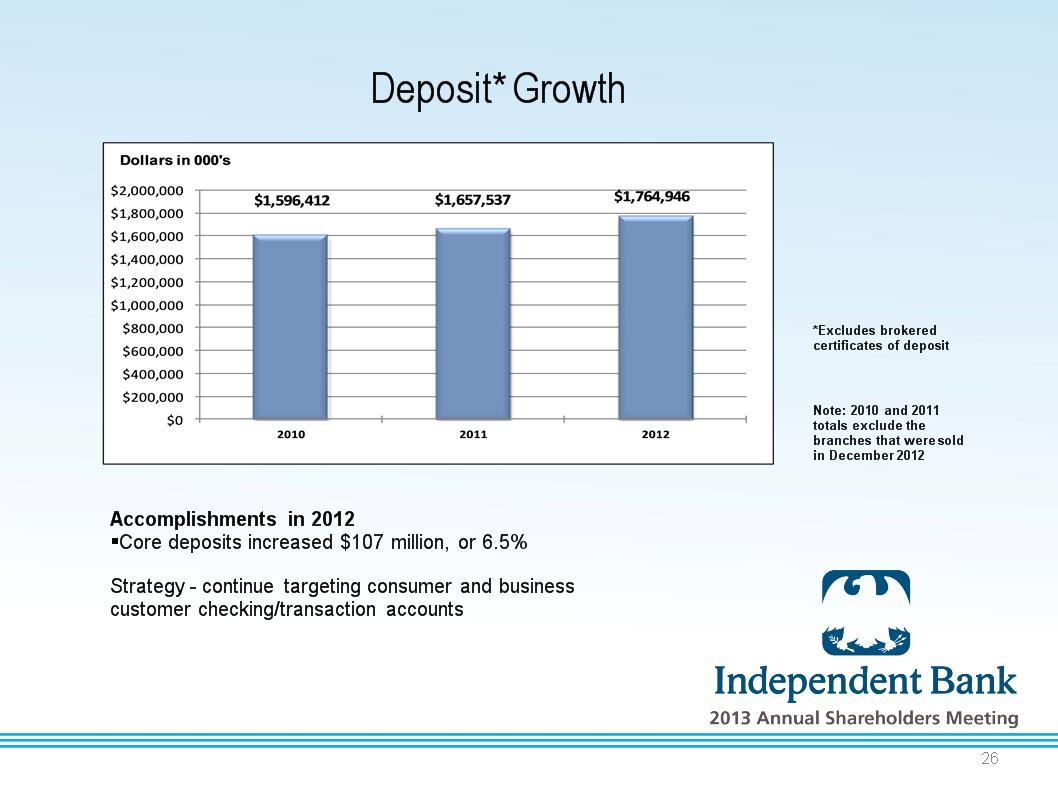

*Excludes brokered certificates of deposit Accomplishments in 2012 Core deposits increased $107 million, or 6.5% Strategy – continue targeting consumer and business customer checking/transaction accounts * Deposit* Growth Note: 2010 and 2011 totals exclude the branches that were sold in December 2012

Net Interest Margin The decline in the net interest margin during 2012 was caused by a planned build-up of lower yielding short-term investments to augment liquidity and provide funding for the Branch Sale. In addition, the current low interest rate environment is adversely impacting the net interest margin for most banks. *

Analysis of Net Interest Income The decline in net interest income since 2009 was driven by a decrease in average interest earning assets and a drop in the net interest margin. *

Non-Interest Income 2010 includes one-time gain on extinguishment of debt of $18.1 million * 2008 includes net securities losses of $15.0 million

Non-Interest Expenses 38% decline from 2009 peak *

Non-Performing Loans* * * Excludes loans that are classified as “troubled debt restructured” that are still performing 74% decline since 2008 peak

Provision for Loan Losses 93% decline from 2009 peak *

Net Loan Charge-offs 74% decline from 2009 peak *

Allowance for Loan Losses *

First Quarter 2013 Summary Net income applicable to common stock of $4.7 million in the first quarter of 2013 compared to $2.4 million in the first quarter of 2012 Improvement in operating results due to declines in the provision for loan losses and non-interest expenses partially offset by decreases in net interest income and non-interest income Total assets of $2.11 billion at March 31, 2013, compared to $2.02 billion at December 31, 2012 Total deposits of $1.85 billion at March 31, 2013, compared to $1.78 billion at December 31, 2012 Continued improvement in asset quality metrics. Non-performing loans and commercial loan “watch” credits declined by 15% and 5%, respectively, since year-end 2012 Bank regulatory capital ratios increased and are now significantly above minimum requirements for “well-capitalized” institutions with an estimated Tier 1 capital ratio of 9.55% and an estimated Total Risk-Based capital ratio of 15.67% *

William B. Kessel President and Chief Executive Officer Robert N. Shuster Executive Vice President and Chief Financial Officer Question & Answer Period *

Voting Results Shares entitled to vote: 9,484,756 Proposal #1 – Election of Directors Proposal #2 – Ratification of Auditors Proposal #3 – Advisory (Non-binding) Vote on Executive Compensation Proposal #4 – Amendment of Long-Term Incentive Plan *

Thank you for attending. *