Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITIL CORP | d522379d8k.htm |

Annual Meeting of Shareholders

Presentation by

Robert G. Schoenberger

Chairman, President & Chief Executive Officer

April 18, 2013

Exhibit 99.1 |

1

Safe Harbor Provision

This

presentation

contains

“forward-looking

statements”

made

pursuant

to

the

safe

harbor

provisions of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include statements regarding Unitil

Corporation’s (“Unitil”) financial condition, results of

operations, capital expenditures, business strategy, regulatory strategy, market opportunities,

and other plans and objectives. In some cases, forward-looking statements

can be identified by terminology such as “may,”

“will,”

“should,”

“expects,”

“plans,”

“anticipates,”

“believes,”

“estimates,”

“predicts,”

“potential”

or “continue”, the negative of such terms, or other comparable

terminology.

These forward-looking statements are neither promises nor guarantees, but

involve risks and uncertainties that could cause the actual results to

differ materially from those set forth in the forward-looking

statements. Those risks and uncertainties include: Unitil’s regulatory

environment (including regulations relating to climate change, greenhouse gas

emissions and other environmental matters); fluctuations in the supply of,

demand for, and the prices of energy commodities and transmission capacity

and Unitil’s ability to recover energy commodity costs in its rates;

customers’ preferred energy sources; severe storms and Unitil’s

ability to recover storm costs in its rates; general economic conditions;

variations in weather; long-term global climate change; Unitil’s

ability to retain its existing customers and attract new customers; Unitil’s

energy brokering customers’

performance and energy used under multi-year energy brokering

contracts; increased competition; integrity and security of operational and

information systems; publicity and reputational risks; and other risks

detailed in Unitil's filings with the Securities and Exchange

Commission,

including

those

appearing

under

the

caption

"Risk

Factors"

in

Unitil's

Annual Report on Form 10-K for the year ended December 31, 2012.

Readers should not place undue reliance on any forward looking statements, which

speak only as of the date they are made. Unitil undertakes no

obligation to update any forward- looking statements to reflect any

change in Unitil’s expectations or in events, conditions, or

circumstances

on

which

any

such

statements

may

be

based,

or

that

may

affect

the

likelihood

that actual results will differ from those set forth in the forward-looking

statements. |

2

Our mission is to provide energy for life—safely, reliably, cost-

effectively and responsibly—to a growing number of customers

with a high-performing workforce |

3

Unitil Overview

Unitil Service Areas

•

Electric and natural gas utility

operations in Maine, New Hampshire

and Massachusetts

•

176,000 total gas and electric

customers

•

Regulated utility business model

•

Growing operations and customers

•

Rate base growth

•

Natural gas system expansion

•

Usource

•

Non-regulated energy brokering

operations conducted through

Usource

•

Historic dividend stability

•

Experienced management team |

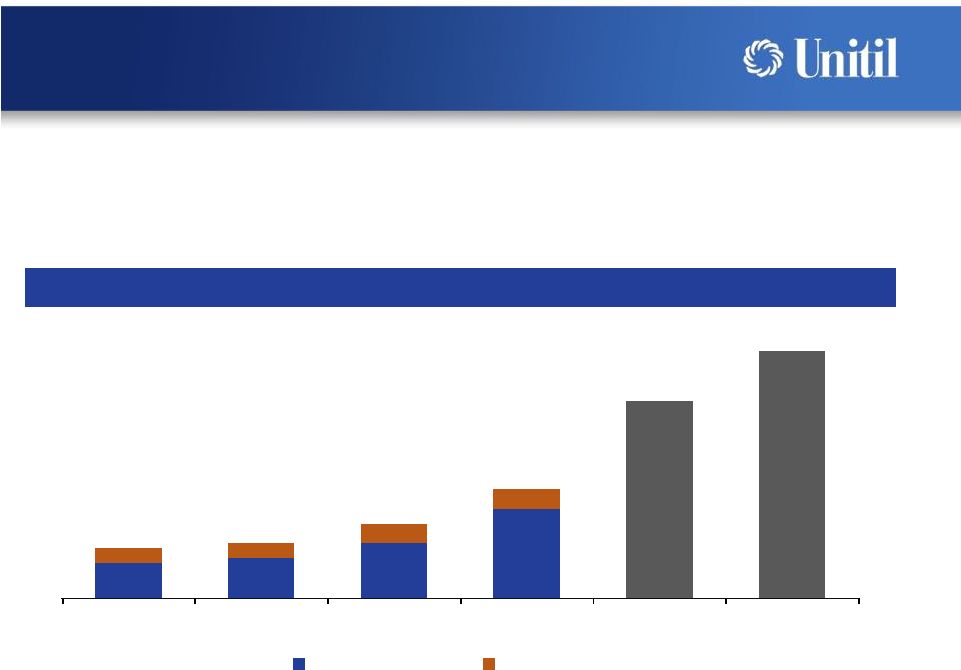

2012

Net Income 4

•

Record Earnings Applicable to Common Shareholders of $18.1 million in 2012

•

Mild winter weather in 2012 negatively affected earnings by an estimated $1.7

million Earnings Applicable to Common Shareholders

($ in millions)

$9.5

$16.3

$18.1

2010

2011

2012 |

5

Balanced Capital Structure

•

Completed public offering of

common stock in May 2012

•

2.76 million shares issued

•

$66 million in net proceeds

•

Net proceeds were principally

used to contribute equity to all

utility subsidiaries

•

Significant improvement in overall

credit statistics, including a

balanced capital structure

Capitalization Ratios

(December 31, 2012)

Preferred

Stock

<0.1%

Common

Equity

48%

Long

Term Debt

52% |

Financial Highlights

6

($ in millions)

($ in millions)

($ in millions)

($ in millions)

$121

$141

$154

2010

2011

2012

$9.5

$16.3

$18.1

2010

2011

2012

$487

$517

$557

$601

2009

2010

2011

2012

$28

$37

$37

2010

2011

2012

Operating Income

Sales Margin

Net Income to Common

Net Utility Plant |

7

Premier Storm Response

•

Unitil selected as one of the winners of the 2012

Emergency Recovery Award from the Edison

Electric Institute for extraordinary recovery

efforts following Hurricane Sandy

•

Unitil received praise from customers,

municipalities, elected officials and regulators

•

In October 2012, Hurricane Sandy struck with

flooding rain and damaging winds

•

During the storm, approximately 69,000 customer

outages were reported, representing 70% of

electric customer base

•

Responded to 40,000-plus calls during the event;

99% of those calls picked up in 20 seconds or less

•

All impacted customers were back online in less

than 48 hours

Hurricane Sandy

Edison Electric Institute Award

“

[Unitil’s] storm management is now a model for other New Hampshire

companies.” -

New Hampshire Public Utilities Commission |

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

Annual Residential Heating Cost ($)

Gas

Fuel Oil

8

Source: Energy Information Administration

U.S. Natural Gas Production, 1990-2035

Retail Cost Comparison

Source: Unitil estimates

Gas Growth -

Fundamentals

Natural gas is

currently ~50%

the cost of

retail fuel oil

•

Changing natural gas fundamentals are creating significant opportunities for growth

in the local natural gas distribution industry

•

Increase in domestic natural gas production driven largely by shale gas

resources •

On a retail-delivered basis, natural gas is approximately 50% the cost of

retail fuel oil •

Typical residential customer saves on average ~$1,500 / year with natural

gas 0

5

10

15

20

25

30

Shale

Tight

Non-associated offshore

Associated with oil

Non-associated onshore

Coalbed methane

Alaska |

9

Gas Growth -

Market Potential

Current On-the-Main Penetration (2012)

Projected On-the-Main Penetration (2016)

•

Serving 74,000 total gas customers currently

•

Identified

55,000

potential

new

customers

who

are

“on-the-main”,

but

not

currently

taking

gas

service

-

(90% residential / 10% C&I)

•

Over 250,000 homes and businesses within existing service areas do not have

natural gas •

Growth plan target is to serve 92,000 total customers by 2016

•

Represents 5% CAGR in customer growth

74,000

(57%)

55,000

(43%)

Current Customers

On-the-Main Prospects

92,000

(71%)

37,000

(29%)

Projected Customers

On-the-Main Prospects |

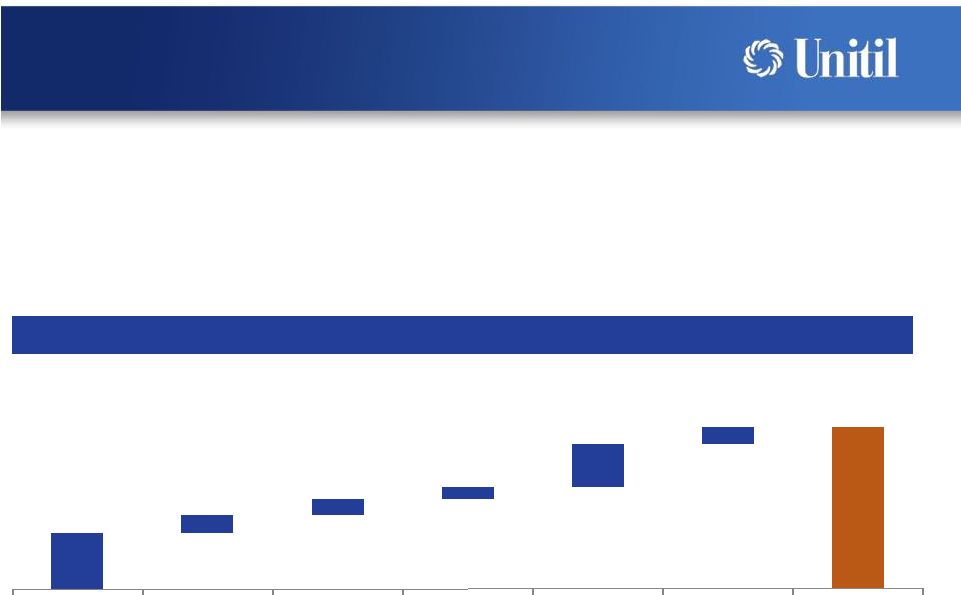

10

Gas Customer Additions

Gas Growth -

Customers

•

Gas customer additions significantly increasing since 2008 acquisition of Northern

Utilities •

Added and converted over 2,000 customers in 2012, up approximately 50% from

2011 •

In 2013, plan to target 4,000 customer additions and conversions

700

800

1,100

1,800

250

250

350

350

950

1,050

1,450

2,150

4,000

5,000

2009

2010

2011

2012

2013F

2014F+

Net Additions

Conversions |

11

Rate Cases

•

Strong

regulatory

track

record

–

base

rate

relief

to

date

has

increased

sales

margins over 30%

•

Continue to have favorable longer term rate plans including cost

tracker

mechanisms at Unitil Energy and Granite State through 2014

Base Rate Relief

($ in millions)

$11.7

$3.7

$3.3

$2.5

$8.7

$3.7

$33.6

Unitil Energy

5/1/2011 &

5/1/2012

Fitchburg Gas

8/1/2011

Fitchburg Electric

8/1/2011

Granite State

1/1/2011

8/1/2011

8/1/2012

Northern ME

1/1/2012 &

5/1/2012

Northern NH

5/1/2012

Total to Date |

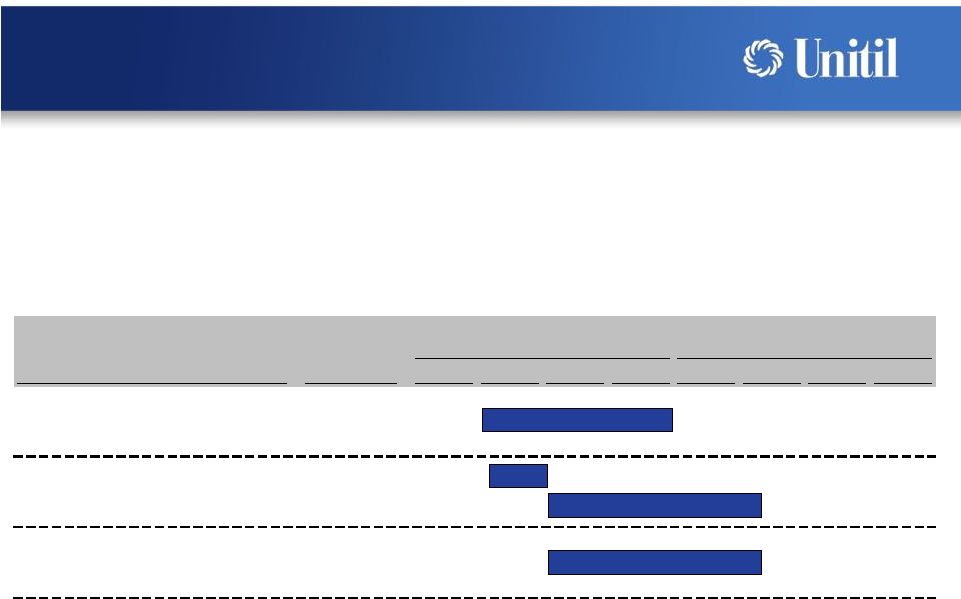

12

2013 Rate Case Filings

Rate

Relief

2013

2014

Company

Requested

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Northern Utilities (New Hampshire)

$5.2mm

Northern Utilities (Maine)

$4.6mm

Fitchburg (Electric)

TBD

Rates

Expected

Q2 2014

~9 mos.

Rates

Expected

Q1 2014

~10 mos.

~3 mos.

Temporary Rates Expected Q3 2013

Permanent Rates

Expected Q2 2014

~10 mos.

•

Total of $9.8 million of rate relief requested for Northern Utilities in Maine and

New Hampshire

•

Both filings include a comprehensive multi-year rate plan with cost

tracker •

Fitchburg Electric rate case to be filed early third quarter 2013

|

Usource

13

Competitive Energy Markets

Customers

Connecticut

Minnesota

Delaware

New Hampshire

Florida

New Jersey

Georgia

New York

Illinois

Ohio

Indiana

Pennsylvania

Maine

Rhode Island

Maryland

Texas

Massachusetts

West Virginia

Gas & Electric

Gas

only

Not

fully

open

•

Manages over $660 million annually

in electric and gas energy contracts

•

Serves over 1,200 customers

•

>90%

customer retention rate

•

Currently serves electricity and/or

natural gas clients in 18 states

•

2012 revenue of $5.5 million

•

Year-end 2012 forward book of

revenue at an all-time high of $8.2

million |

14

Key Investment Highlights

•

Regulated local distribution utility

business model

•

Diversified natural gas and electric sales

•

Growing operations and customer base

•

Utility rate base growth

•

Natural gas system expansion

•

Usource contribution

•

Historic dividend stability

•

Experienced management team |

Question & Answer Session

15 |