Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PRIVATEBANCORP, INC | d522788d8k.htm |

Exhibit 99.1

For further information:

Media Contact:

Amy Yuhn

312-564-1378

ayuhn@theprivatebank.com

Investor Relations Contact:

Sarah Lewensohn

312-564-3894

slewensohn@theprivatebank.com

FOR IMMEDIATE RELEASE

PrivateBancorp Reports Record First Quarter Earnings

| • | Earnings per share up 35 percent from fourth quarter 2012 and more than double first quarter 2012 results |

| • | Operating profit increased 3 percent from fourth quarter 2012 and 6 percent from first quarter 2012 |

| • | Continued improvement in credit quality led to lower provision expense |

CHICAGO, April 18, 2013 – PrivateBancorp, Inc. (NASDAQ: PVTB) today reported net income available to common shareholders of $27.3 million, or $0.35 per diluted share, for the first quarter 2013, compared to $10.8 million or $0.15 per diluted share for the first quarter 2012, and $20.0 million or $0.26 per diluted share for the fourth quarter 2012.

“Our first quarter results reflect the momentum we have gained as we execute our commercial middle market strategy,” said Larry D. Richman, President and Chief Executive Officer, PrivateBancorp, Inc. “Net income was up 36 percent from fourth quarter and more than doubled from first quarter 2012 largely on reduced credit costs. Despite continued modest loan demand in a competitive market, we have maintained net interest income due to our ability to build client relationships. Non-interest income increased 11 percent year over year, contributing to strong first quarter results.

“Following robust loan growth in the previous quarter, we saw loan balances decrease in the first quarter due in part to planned and opportunistic syndications and repayments,” Richman continued. “Business clients are generally remaining cautious in this slowly recovering Midwest economy. We have teams poised to capitalize on opportunities to develop new business. Based upon our current pipeline of pending transactions and new prospects, I am expecting stronger loan activity in the second quarter as we maintain our selectivity and discipline.”

1

First Quarter 2013 Highlights

Comparison to fourth quarter 2012

| • | Net income was $27.3 million, up 36 percent from the previous quarter, benefiting from reductions in loan loss provision, net foreclosed property expense and employee expense. |

| • | Net interest income of $103.0 million was down slightly from $104.8 million in the previous quarter. A 2 percent increase in average loan balances partially offset lower loan and investment yields. |

| • | Total loans were $10.0 billion at March 31, 2013, a 1 percent decline from year-end, reflecting lower originations in the early part of the first quarter along with increased syndication activity and paydowns of loans, many associated with loans funded late in the fourth quarter 2012. |

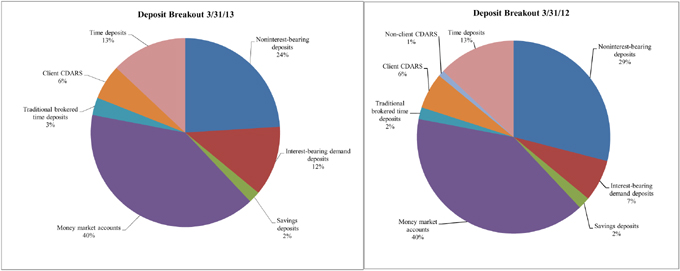

| • | Total deposits were $11.4 billion, a 6 percent decline from year-end 2012, which reduced excess liquidity. Deposits had increased 7 percent as of December 31, 2012 from $11.4 billion at September 30, 2012. |

| • | Asset quality continued to improve with non-performing assets declining 8 percent from last quarter. Non-performing assets to total assets was 1.51 percent at March 31, 2013, compared to 1.57 percent at December 31, 2012. |

Comparison to first quarter 2012

| • | Net income was $27.3 million, an increase of more than 150 percent from the first quarter 2012 net income available to common stockholders, as a result of lower loan loss provision and net foreclosed property expense, and growth in non-interest income. |

| • | Non-interest income of $30.5 million increased 11 percent year over year largely from increased mortgage banking and syndication fees revenue. |

| • | Total loans grew 9 percent over the year to $10.0 billion at March 31, 2013. |

Operating Performance

Net revenue was $134.3 million in the first quarter 2013, compared to $132.6 million in the first quarter 2012 and $135.0 million in the fourth quarter 2012. Operating profit was $55.3 million in the first quarter 2013, compared to $52.3 million in the first quarter 2012 and $53.7 million in the fourth quarter 2012. A 3 percent increase in non-interest income and a 3 percent decline in non-interest expense resulted in higher first quarter operating profit than recorded in the previous quarter.

2

Net interest income was $103.0 million in the first quarter 2013, compared to $104.4 million for the first quarter 2012 and $104.8 million in the fourth quarter 2012. Net interest income was impacted by the reduction in yields from both investments and loans and an increase in average loan balances. Average total loans were $10.2 billion for the first quarter 2013, an increase of $236 million, or 2 percent, from the fourth quarter 2012, and an increase of $1.1 billion over the prior year. The Company issued $125 million of subordinated debt in October 2012, adding long-term debt interest expense that was not incurred in the first quarter 2012.

Net interest margin was 3.19 percent in the first quarter 2013, compared to 3.53 percent in the first quarter 2012 and 3.16 percent in the fourth quarter 2012. Net interest margin benefited from lower liquidity balances and lower cost of interest bearing funds, but was also impacted by a decline in loan and investment yields and lower non-interest bearing deposits during the quarter.

Non-interest income was $30.5 million in the first quarter 2013, compared to $27.5 million in the first quarter 2012 and $29.5 million in the fourth quarter 2012. First quarter 2013 capital markets revenue of $5.0 million declined from $6.7 million, and included a positive credit valuation adjustment of $246,000 as compared to a positive credit valuation adjustment of $854,000 in the fourth quarter 2012. During the quarter, capital markets revenue declined largely due to lower loan origination activity and clients’ outlook on interest rate volatility. Syndication revenue grew 72 percent to $3.8 million from the previous quarter as the Company completed a number of transactions, many associated with a number of loans that funded late in the fourth quarter 2012. First quarter 2013 other income included a $1.1 million gain on loan sale. Loan, letter of credit and commitment fees were $4.1 million, a decline of $594,000 from the previous quarter due to lower origination activity. As compared to the previous quarter, treasury management grew 6 percent to $5.9 million and trust and investments income grew 4 percent to $4.4 million, both benefitting from cross-sell to an expanded base of new and existing clients. Mortgage revenue of $4.2 million was consistent with the prior quarter, reflecting steady demand for refinancings.

Expenses

Non-interest expense was $79.0 million in the first quarter 2013, compared to $80.2 million in the first quarter 2012 and $81.3 million in the fourth quarter 2012. Non-interest expense in the first quarter 2013 reflected a decline in net foreclosed property expenses, salaries and employee benefits expenses and insurance expenses as compared to the fourth quarter 2012, partially offset by a $1.7 million provision for unfunded commitments. Net foreclosed property expense decreased by $2.9 million, or 31 percent, to $6.6 million from the previous quarter, primarily due to reduced charges from loss on sales, valuation adjustments and a decline of ownership costs related to other owned real estate (“OREO”). Net foreclosed property expense remains elevated and may fluctuate from quarter to quarter. Despite seasonally higher payroll taxes, which were $3.1 million greater than the fourth quarter 2012, salaries and benefits expense declined in the first quarter. Salaries and benefits expense benefited from a $2.8 million reduction in share-based compensation that was primarily due to the final vesting of equity awards granted in 2007 and 2008, and a decline in incentive based compensation costs from amounts recorded in the fourth quarter 2012. Insurance expense in the quarter reflected a $700,000 refund of previously paid FDIC assessments. The efficiency ratio for the first quarter 2013 was 58.8 percent, compared to 60.5 percent for first quarter 2012, and 60.2 percent for the fourth quarter 2012.

3

The effective tax rate declined to 38 percent for the first quarter 2013, compared to 42 percent for the previous quarter, due to increased tax benefits resulting from the repayment of TARP and the final vesting in the fourth quarter 2012 of equity awards granted in 2007 and 2008.

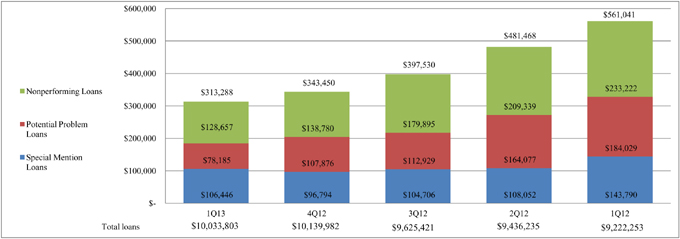

Credit Quality

The allowance for loan losses at March 31, 2013, was 1.53 percent of total loans, down from 1.99 percent at March 31, 2012, and 1.59 percent at December 31, 2012. The allowance for loan losses as a percentage of non-performing loans was 120 percent at March 31, 2013, compared to 79 percent at March 31, 2012, and 116 percent at December 31, 2012. The allowance for loan losses was $154.0 million at March 31, 2013, a decline from $161.4 million at December 31, 2012, primarily due to a 14 percent reduction in the amount of specific reserves from a decrease of the impaired loan population and a modest decline in the general allocated reserve. Net charge-offs of $17.6 million were relatively flat compared to the fourth quarter 2012. For the first quarter 2013, provision for loan loss was $10.1 million, a decline of 19 percent from the previous quarter.

Non-performing loans were $129 million, a 45 percent decline from the first quarter 2012 and a 7 percent decline from the fourth quarter 2012. Special mention and potential problem loans declined 44 percent from the first quarter 2012 and 10 percent from the fourth quarter 2012. Non-performing assets to total assets were 1.51 percent at March 31, 2013, compared to 2.83 percent at March 31, 2012 and 1.57 percent at December 31, 2012. The Company disposed of $28.0 million in problem loans and OREO in the first quarter 2013. In the near term, the Company expects continued progress in reducing non-performing assets through the execution of workout programs and the disposition of problem assets.

Credit quality results exclude covered assets acquired through an FDIC-assisted transaction that are subject to a loss-sharing agreement.

Balance Sheet

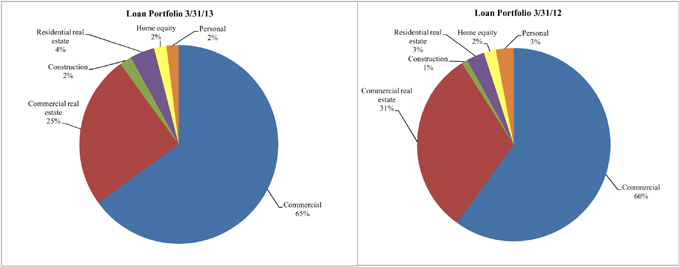

Total assets were $13.4 billion at March 31, 2013, compared to $14.1 billion at December 31, 2012. Total loans were $10.0 billion at March 31, 2013, down slightly from $10.1 billion at December 31, 2012. During the first quarter 2013, commercial and industrial loans grew 1 percent while commercial real estate loans declined 6 percent from the previous quarter.

Total deposits were $11.4 billion at March 31, 2013, compared to $12.2 billion at December 31, 2012. The decrease in total deposits was primarily driven by a 25 percent decline in non-interest bearing demand deposits. A number of factors contributed to the decrease in demand deposits including movement to interest bearing products, expiration of the unlimited guarantee, and client usage. At March 31, 2013, non-interest bearing deposits comprised 24 percent of total deposits, and the loan to deposit ratio was 88.08 percent.

4

The balance sheet at March 31, 2013 included long-term debt of $499.8 million, compared to $379.8 million at March 31, 2012, reflecting $125 million of subordinated debt issued by the Company to refinance a portion of the TARP preferred stock redemption in fourth quarter 2012. The Company’s investment securities portfolio was $2.4 billion at March 31, 2013, up slightly compared to $2.3 billion at December 31, 2012. The securities portfolio is primarily composed of U.S. government agency backed mortgage securities, U.S. Treasuries, agency backed collateralized mortgage obligations, and investment grade municipal bonds.

Capital

As of March 31, 2013, the total risk-based capital ratio was 13.58 percent, the tier 1 risk-based capital ratio was 10.90 percent, and the leverage ratio was 9.81 percent. The tier 1 common capital ratio was 8.89 percent and tangible common equity ratio was 8.48 percent at the end of the first quarter 2013.

Quarterly Conference Call and Webcast Presentation

PrivateBancorp will host a conference call on Thursday, April 18, 2013, at 10 a.m. CT. The call may be accessed by telephone at (888) 782-9127 (U.S. and Canada) or (706) 634-5643 (International) and entering passcode # 29873820. A live webcast of the call can be accessed on the Company website at www.theprivatebank.com by visiting the Investor Relations tab under the About Us section. A rebroadcast will be available beginning approximately two hours after the call until midnight on May 2, 2013, by calling (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (International) and entering passcode # 29873820.

About PrivateBancorp, Inc.

PrivateBancorp, Inc., through its subsidiaries, delivers customized business and personal financial services to middle-market companies, as well as business owners, executives, entrepreneurs and families in all of the markets and communities we serve. As of March 31, 2013, the Company had 36 offices in 10 states and $13.4 billion in assets. The Company website is www.theprivatebank.com.

Forward-Looking Statements

Statements contained in this press release that are not historical facts may constitute forward-looking statements within the meaning of federal securities laws. Our ability to predict results or the actual effects of future plans, strategies or events is inherently uncertain. Factors which could cause actual results to differ from those reflected in forward-looking statements include: unforeseen credit quality problems or further deterioration in problem loans that could result in charge-offs greater than we have anticipated in our allowance for loan losses; slower than anticipated dispositions of other real estate owned which may result in increased losses and ongoing elevated foreclosed property expense;

5

continued uncertainty regarding U.S. and global economic recovery and economic outlook that may impact market conditions and credit quality or prolong weakness in demand for loans or other banking products and services; unanticipated developments in the timing or closing of pending or prospective loan transactions or greater than expected paydowns or payoffs of existing loans; unanticipated changes in interest rates; competitive pricing trends; lack of sufficient or cost-effective sources of liquidity or funding as and when needed; loss of key personnel or an inability to recruit and retain appropriate talent; unexpected increases in non-interest expense; uncertainty relating to recently proposed regulatory capital rules that could, depending on the nature of our assets, require us to maintain higher levels of regulatory capital; uncertainty regarding implications of other changes in regulatory requirements relating to implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act that may negatively affect our revenues or profitability; other legislative, regulatory or accounting changes affecting financial services companies and/or the products and services offered by financial services companies; changes in monetary or fiscal policies of the U.S. Government; or failures or disruptions to our data processing or other information or operational systems, including the potential impact of disruptions or breaches at our third party service providers.

Forward-looking statements are subject to risks, assumptions and uncertainties and could be significantly affected by many factors, including those set forth in the “Risk Factors” section of our Form 10-K for the year ended December 31, 2012 as well as those set forth in our subsequent periodic reports filed with the SEC. These factors should be considered in evaluating forward- looking statements and undue reliance should not be placed on our forward-looking statements. Forward-looking statements speak only as of the date they are made and we assume no obligation to update any of these statements in light of new information, future events or otherwise, unless required under the federal securities laws.

Non-GAAP Measures

This press release contains both financial measures based on accounting principles generally accepted in the United States (GAAP) and non-GAAP based financial measures. The Company believes that these non-GAAP financial measures provide information useful to investors in understanding the underlying operational performance of the Company, its business, and performance trends and facilitates comparisons with the performance of others in the banking industry. If non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in this press release. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

Editor’s Note: Financial highlights attached.

6

| Quarterly Consolidated Income Statements Unaudited (Amounts in thousands, except per share data) |

|

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | ||||||||||||||||

| Interest Income |

||||||||||||||||||||

| Loans, including fees |

$ | 106,787 | $ | 108,172 | $ | 106,358 | $ | 105,142 | $ | 103,539 | ||||||||||

| Federal funds sold and interest-bearing deposits in banks |

208 | 452 | 248 | 133 | 132 | |||||||||||||||

| Securities: |

||||||||||||||||||||

| Taxable |

12,822 | 12,938 | 13,907 | 14,723 | 15,258 | |||||||||||||||

| Exempt from Federal income taxes |

1,502 | 1,462 | 1,389 | 1,336 | 1,300 | |||||||||||||||

| Other interest income |

90 | 168 | 126 | 131 | 122 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest income |

121,409 | 123,192 | 122,028 | 121,465 | 120,351 | |||||||||||||||

| Interest Expense |

||||||||||||||||||||

| Interest-bearing demand deposits |

1,115 | 985 | 958 | 799 | 636 | |||||||||||||||

| Savings deposits and money market accounts |

4,399 | 4,531 | 4,206 | 4,265 | 4,602 | |||||||||||||||

| Brokered and time deposits |

5,129 | 5,561 | 5,860 | 5,394 | 5,017 | |||||||||||||||

| Short-term and secured borrowings |

118 | 77 | 101 | 123 | 142 | |||||||||||||||

| Long-term debt |

7,608 | 7,235 | 5,495 | 5,538 | 5,578 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest expense |

18,369 | 18,389 | 16,620 | 16,119 | 15,975 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

103,040 | 104,803 | 105,408 | 105,346 | 104,376 | |||||||||||||||

| Provision for loan and covered loan losses |

10,357 | 13,177 | 13,509 | 17,038 | 27,701 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after provision for loan and covered loan losses |

92,683 | 91,626 | 91,899 | 88,308 | 76,675 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-interest Income |

||||||||||||||||||||

| Trust and Investments |

4,394 | 4,232 | 4,254 | 4,312 | 4,219 | |||||||||||||||

| Mortgage banking |

4,170 | 4,197 | 3,685 | 2,915 | 2,663 | |||||||||||||||

| Capital markets products |

5,039 | 6,744 | 5,832 | 6,033 | 7,349 | |||||||||||||||

| Treasury management |

5,924 | 5,606 | 5,490 | 5,260 | 5,154 | |||||||||||||||

| Loan, letter of credit and commitment fees |

4,077 | 4,671 | 4,779 | 4,359 | 4,364 | |||||||||||||||

| Syndication fees |

3,832 | 2,231 | 2,700 | 2,013 | 2,163 | |||||||||||||||

| Deposit service charges and fees and other income |

2,391 | 1,582 | 1,308 | 1,644 | 1,487 | |||||||||||||||

| Net securities gains (losses) |

641 | 191 | (211 | ) | (290 | ) | 105 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest income |

30,468 | 29,454 | 27,837 | 26,246 | 27,504 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-interest Expense |

||||||||||||||||||||

| Salaries and employee benefits |

43,140 | 45,253 | 44,820 | 42,177 | 42,698 | |||||||||||||||

| Net occupancy expense |

7,534 | 7,762 | 7,477 | 7,653 | 7,679 | |||||||||||||||

| Technology and related costs |

3,464 | 3,249 | 3,432 | 3,273 | 3,296 | |||||||||||||||

| Marketing |

2,317 | 2,448 | 2,645 | 3,058 | 2,160 | |||||||||||||||

| Professional services |

1,899 | 1,998 | 2,151 | 2,247 | 1,957 | |||||||||||||||

| Outsourced servicing costs |

1,634 | 1,814 | 1,802 | 2,093 | 1,710 | |||||||||||||||

| Net foreclosed property expenses |

6,643 | 9,571 | 8,596 | 11,894 | 8,235 | |||||||||||||||

| Postage, telephone, and delivery |

843 | 909 | 837 | 882 | 869 | |||||||||||||||

| Insurance |

2,539 | 3,290 | 3,352 | 4,239 | 4,305 | |||||||||||||||

| Loan and collection expense |

2,777 | 2,227 | 3,329 | 2,918 | 3,157 | |||||||||||||||

| Other expenses |

6,173 | 2,794 | 3,289 | 3,424 | 4,163 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest expense |

78,963 | 81,315 | 81,730 | 83,858 | 80,229 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

44,188 | 39,765 | 38,006 | 30,696 | 23,950 | |||||||||||||||

| Income tax provision |

16,918 | 16,682 | 14,952 | 13,192 | 9,695 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

27,270 | 23,083 | 23,054 | 17,504 | 14,255 | |||||||||||||||

| Preferred stock dividends and discount accretion |

— | 3,043 | 3,447 | 3,442 | 3,436 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income available to common stockholders |

$ | 27,270 | $ | 20,040 | $ | 19,607 | $ | 14,062 | $ | 10,819 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Per Common Share Data |

||||||||||||||||||||

| Basic earnings per share |

$ | 0.35 | $ | 0.26 | $ | 0.27 | $ | 0.19 | $ | 0.15 | ||||||||||

| Diluted earnings per share |

$ | 0.35 | $ | 0.26 | $ | 0.27 | $ | 0.19 | $ | 0.15 | ||||||||||

| Cash dividends declared |

$ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | ||||||||||

| Weighted-average common shares outstanding |

76,143 | 75,035 | 71,010 | 70,956 | 70,780 | |||||||||||||||

| Weighted-average diluted common shares outstanding |

76,203 | 75,374 | 71,274 | 71,147 | 70,932 | |||||||||||||||

Note: Certain reclassifications have been made to prior period financial statements to place them on a basis comparable with the current period financial statements.

| Consolidated Balance Sheets (Dollars in thousands) |

|

| 03/31/13 | 12/31/12 | 09/30/12 | 06/30/12 | 03/31/12 | ||||||||||||||||

| unaudited | audited | unaudited | unaudited | unaudited | ||||||||||||||||

| Assets |

||||||||||||||||||||

| Cash and due from banks |

$ | 118,583 | $ | 234,308 | $ | 143,573 | $ | 141,563 | $ | 166,062 | ||||||||||

| Fed funds sold and interest-bearing deposits in banks |

203,647 | 707,143 | 470,984 | 315,378 | 193,571 | |||||||||||||||

| Loans held for sale |

38,091 | 49,696 | 49,209 | 35,342 | 29,185 | |||||||||||||||

| Securities available-for-sale, at fair value |

1,457,433 | 1,451,160 | 1,550,516 | 1,625,649 | 1,705,649 | |||||||||||||||

| Securities held-to-maturity, at amortized cost |

959,994 | 863,727 | 784,930 | 693,277 | 598,066 | |||||||||||||||

| Federal Home Loan Bank (“FHLB”) stock |

34,288 | 43,387 | 43,387 | 43,467 | 40,695 | |||||||||||||||

| Loans - excluding covered assets, net of unearned fees |

10,033,803 | 10,139,982 | 9,625,421 | 9,436,235 | 9,222,253 | |||||||||||||||

| Allowance for loan losses |

(153,992 | ) | (161,417 | ) | (166,859 | ) | (174,302 | ) | (183,844 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans, net of allowance for loan losses and unearned fees |

9,879,811 | 9,978,565 | 9,458,562 | 9,261,933 | 9,038,409 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Covered assets |

176,855 | 194,216 | 208,979 | 244,782 | 276,534 | |||||||||||||||

| Allowance for covered loan losses |

(24,089 | ) | (24,011 | ) | (21,500 | ) | (21,733 | ) | (26,323 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Covered assets, net of allowance for covered loan losses |

152,766 | 170,205 | 187,479 | 223,049 | 250,211 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other real estate owned, excluding covered assets |

73,857 | 81,880 | 97,833 | 109,836 | 123,498 | |||||||||||||||

| Premises, furniture, and equipment, net |

38,373 | 39,508 | 40,526 | 38,177 | 37,462 | |||||||||||||||

| Accrued interest receivable |

39,205 | 34,832 | 36,892 | 37,089 | 36,033 | |||||||||||||||

| Investment in bank owned life insurance |

52,873 | 52,513 | 52,134 | 51,751 | 51,356 | |||||||||||||||

| Goodwill |

94,509 | 94,521 | 94,534 | 94,546 | 94,559 | |||||||||||||||

| Other intangible assets |

12,047 | 12,828 | 13,500 | 14,152 | 14,683 | |||||||||||||||

| Capital markets derivative assets |

81,805 | 90,405 | 104,697 | 102,613 | 97,805 | |||||||||||||||

| Other assets |

134,948 | 152,837 | 149,798 | 154,354 | 145,920 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 13,372,230 | $ | 14,057,515 | $ | 13,278,554 | $ | 12,942,176 | $ | 12,623,164 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Liabilities |

||||||||||||||||||||

| Demand deposits: |

||||||||||||||||||||

| Noninterest-bearing |

$ | 2,756,879 | $ | 3,690,340 | $ | 3,295,568 | $ | 2,920,182 | $ | 3,054,536 | ||||||||||

| Interest-bearing |

1,390,955 | 1,057,390 | 893,194 | 785,879 | 714,522 | |||||||||||||||

| Savings deposits and money market accounts |

4,741,864 | 4,912,820 | 4,381,595 | 4,146,022 | 4,347,832 | |||||||||||||||

| Brokered time deposits |

983,625 | 993,455 | 1,290,796 | 1,484,435 | 961,481 | |||||||||||||||

| Time deposits |

1,518,980 | 1,519,629 | 1,498,287 | 1,398,012 | 1,344,341 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

11,392,303 | 12,173,634 | 11,359,440 | 10,734,530 | 10,422,712 | |||||||||||||||

| Short-term and secured borrowings |

107,775 | 5,000 | 5,000 | 335,000 | 355,000 | |||||||||||||||

| Long-term debt |

499,793 | 499,793 | 374,793 | 374,793 | 379,793 | |||||||||||||||

| Accrued interest payable |

6,787 | 7,141 | 5,287 | 5,855 | 5,425 | |||||||||||||||

| Capital markets derivative liabilities |

84,210 | 93,029 | 108,094 | 105,773 | 100,109 | |||||||||||||||

| Other liabilities |

49,297 | 71,752 | 62,500 | 52,071 | 47,971 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

12,140,165 | 12,850,349 | 11,915,114 | 11,608,022 | 11,311,010 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Equity |

||||||||||||||||||||

| Preferred stock |

— | — | 241,585 | 241,185 | 240,791 | |||||||||||||||

| Common stock |

76,680 | 77,015 | 71,884 | 71,843 | 71,611 | |||||||||||||||

| Treasury stock |

(9,631 | ) | (24,150 | ) | (22,736 | ) | (22,639 | ) | (21,749 | ) | ||||||||||

| Additional paid-in capital |

1,014,443 | 1,026,438 | 956,356 | 951,127 | 946,034 | |||||||||||||||

| Retained earnings |

106,288 | 79,799 | 60,533 | 41,651 | 28,315 | |||||||||||||||

| Accumulated other comprehensive income, net of tax |

44,285 | 48,064 | 55,818 | 50,987 | 47,152 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total equity |

1,232,065 | 1,207,166 | 1,363,440 | 1,334,154 | 1,312,154 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

$ | 13,372,230 | $ | 14,057,515 | $ | 13,278,554 | $ | 12,942,176 | $ | 12,623,164 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Note: Certain reclassifications have been made to prior period financial statements to place them on a basis comparable with the current period financial statements.

| Selected Financial Data Unaudited (Amounts in thousands except per share data) |

|

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | ||||||||||||||||

| Selected Statement of Income Data: |

||||||||||||||||||||

| Net interest income |

$ | 103,040 | $ | 104,803 | $ | 105,408 | $ | 105,346 | $ | 104,376 | ||||||||||

| Net revenue (1) (2) |

$ | 134,292 | $ | 135,022 | $ | 133,974 | $ | 132,291 | $ | 132,560 | ||||||||||

| Operating profit (1) (2) |

$ | 55,329 | $ | 53,707 | $ | 52,244 | $ | 48,433 | $ | 52,331 | ||||||||||

| Provision for loan and covered loan losses |

$ | 10,357 | $ | 13,177 | $ | 13,509 | $ | 17,038 | $ | 27,701 | ||||||||||

| Income before taxes |

$ | 44,188 | $ | 39,765 | $ | 38,006 | $ | 30,696 | $ | 23,950 | ||||||||||

| Net income available to common stockholders |

$ | 27,270 | $ | 20,040 | $ | 19,607 | $ | 14,062 | $ | 10,819 | ||||||||||

| Per Common Share Data: |

||||||||||||||||||||

| Basic earnings per share |

$ | 0.35 | $ | 0.26 | $ | 0.27 | $ | 0.19 | $ | 0.15 | ||||||||||

| Diluted earnings per share |

$ | 0.35 | $ | 0.26 | $ | 0.27 | $ | 0.19 | $ | 0.15 | ||||||||||

| Dividends declared |

$ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | ||||||||||

| Book value (period end) (1) |

$ | 15.87 | $ | 15.65 | $ | 15.49 | $ | 15.09 | $ | 14.79 | ||||||||||

| Tangible book value (period end) (1) (2) |

$ | 14.49 | $ | 14.26 | $ | 14.00 | $ | 13.59 | $ | 13.29 | ||||||||||

| Market value (close) |

$ | 18.89 | $ | 15.32 | $ | 15.99 | $ | 14.76 | $ | 15.17 | ||||||||||

| Book value multiple |

1.19 | x | 0.98 | x | 1.03 | x | 0.98 | x | 1.03 | x | ||||||||||

| Share Data: |

||||||||||||||||||||

| Weighted-average common shares outstanding |

76,143 | 75,035 | 71,010 | 70,956 | 70,780 | |||||||||||||||

| Weighted-average diluted common shares outstanding |

76,203 | 75,374 | 71,274 | 71,147 | 70,932 | |||||||||||||||

| Common shares issued (at period end) |

78,050 | 78,062 | 73,291 | 73,273 | 73,205 | |||||||||||||||

| Common shares outstanding (at period end) |

77,649 | 77,115 | 72,436 | 72,424 | 72,415 | |||||||||||||||

| Performance Ratios: |

||||||||||||||||||||

| Return on average assets |

0.81 | % | 0.67 | % | 0.70 | % | 0.55 | % | 0.46 | % | ||||||||||

| Return on average common equity |

9.01 | % | 6.64 | % | 7.00 | % | 5.18 | % | 4.05 | % | ||||||||||

| Return on average tangible common equity (1)(2) |

10.04 | % | 7.45 | % | 7.91 | % | 5.92 | % | 4.68 | % | ||||||||||

| Net interest margin (1) (2) |

3.19 | % | 3.16 | % | 3.35 | % | 3.46 | % | 3.53 | % | ||||||||||

| Fee revenue as a percent of total revenue (1) |

22.45 | % | 21.83 | % | 21.02 | % | 20.12 | % | 20.79 | % | ||||||||||

| Non-interest income to average assets |

0.91 | % | 0.85 | % | 0.85 | % | 0.83 | % | 0.89 | % | ||||||||||

| Non-interest expense to average assets |

2.35 | % | 2.35 | % | 2.49 | % | 2.64 | % | 2.59 | % | ||||||||||

| Net overhead ratio (1) |

1.44 | % | 1.50 | % | 1.64 | % | 1.81 | % | 1.70 | % | ||||||||||

| Efficiency ratio (1) (2) |

58.80 | % | 60.22 | % | 61.00 | % | 63.39 | % | 60.52 | % | ||||||||||

| Balance Sheet Ratios: |

||||||||||||||||||||

| Loans to deposits (period end) (3) |

88.08 | % | 83.29 | % | 84.73 | % | 87.91 | % | 88.48 | % | ||||||||||

| Average interest-earning assets to average interest- bearing liabilities |

141.21 | % | 150.03 | % | 147.76 | % | 146.44 | % | 149.68 | % | ||||||||||

| Capital Ratios (period end): |

||||||||||||||||||||

| Total risk-based capital (1) |

13.58 | % | 13.17 | % | 13.90 | % | 14.12 | % | 14.20 | % | ||||||||||

| Tier 1 risk-based capital (1) |

10.90 | % | 10.51 | % | 12.24 | % | 12.25 | % | 12.31 | % | ||||||||||

| Tier 1 leverage ratio (1) |

9.81 | % | 9.50 | % | 11.15 | % | 11.20 | % | 11.35 | % | ||||||||||

| Tier 1 common equity to risk-weighted assets (1) (2) |

8.89 | % | 8.52 | % | 8.12 | % | 8.05 | % | 8.04 | % | ||||||||||

| Tangible common equity to tangible assets (1) (2) |

8.48 | % | 7.88 | % | 7.70 | % | 7.67 | % | 7.69 | % | ||||||||||

| Total equity to total assets |

9.21 | % | 8.59 | % | 10.27 | % | 10.31 | % | 10.39 | % | ||||||||||

| (1) | Refer to Glossary of Terms for definition. |

| (2) | This is a non-U.S. GAAP financial measure. Refer to “Non-U.S. GAAP Financial Measures” for a reconciliation from non-U.S. GAAP to U.S. GAAP. |

| (3) | Excludes covered assets. Refer to Glossary of Terms for definition. |

| Selected Financial Data (continued) Unaudited (Dollars in thousands) |

|

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | ||||||||||||||||

| Additional Selected Information: |

||||||||||||||||||||

| Credit valuation adjustment on capital markets derivatives (1) |

$ | 246 | $ | 854 | $ | 5 | $ | (830 | ) | $ | 19 | |||||||||

| Salaries and employee benefits: |

||||||||||||||||||||

| Salaries and wages |

$ | 24,015 | $ | 24,333 | $ | 24,373 | $ | 23,728 | $ | 23,174 | ||||||||||

| Share-based costs |

2,863 | 5,665 | 5,181 | 5,239 | 4,569 | |||||||||||||||

| Incentive compensation, retirement costs and other employee benefits |

16,262 | 15,255 | 15,266 | 13,210 | 14,955 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total salaries and employee benefits |

$ | 43,140 | $ | 45,253 | $ | 44,820 | $ | 42,177 | $ | 42,698 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Provision for unfunded commitments |

$ | 1,723 | $ | (867 | ) | $ | — | $ | — | $ | 933 | |||||||||

| Assets under management and administration (AUMA) (1) |

$ | 5,515,199 | $ | 5,196,094 | $ | 5,007,235 | $ | 4,738,973 | $ | 4,879,947 | ||||||||||

| Custody assets included in AUMA |

$ | 2,438,600 | $ | 2,345,410 | $ | 2,192,530 | $ | 2,073,777 | $ | 2,060,455 | ||||||||||

Loan Composition (excluding covered assets(1))

(Dollars in thousands)

| % of | % of | % of | % of | % of | ||||||||||||||||||||||||||||||||||||

| 03/31/13 | Total | 12/31/12 | Total | 09/30/12 | Total | 06/30/12 | Total | 03/31/12 | Total | |||||||||||||||||||||||||||||||

| unaudited | audited | unaudited | unaudited | unaudited | ||||||||||||||||||||||||||||||||||||

| Commercial and industrial |

$ | 4,951,951 | 49 | % | $ | 4,901,210 | 48 | % | $ | 4,666,375 | 48 | % | $ | 4,523,780 | 48 | % | $ | 4,325,558 | 47 | % | ||||||||||||||||||||

| Commercial - owner-occupied CRE |

1,640,064 | 16 | % | 1,595,574 | 16 | % | 1,437,935 | 15 | % | 1,384,831 | 15 | % | 1,175,729 | 13 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total commercial |

6,592,015 | 65 | % | 6,496,784 | 64 | % | 6,104,310 | 63 | % | 5,908,611 | 63 | % | 5,501,287 | 60 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Commercial real estate |

2,002,833 | 20 | % | 2,132,063 | 21 | % | 2,069,423 | 21 | % | 2,124,492 | 23 | % | 2,378,640 | 26 | % | |||||||||||||||||||||||||

| Commercial real estate-multi-family |

517,418 | 5 | % | 543,622 | 5 | % | 544,775 | 6 | % | 499,250 | 5 | % | 493,218 | 5 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total commercial real estate |

2,520,251 | 25 | % | 2,675,685 | 26 | % | 2,614,198 | 27 | % | 2,623,742 | 28 | % | 2,871,858 | 31 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Construction |

174,077 | 2 | % | 190,496 | 2 | % | 162,724 | 2 | % | 171,014 | 2 | % | 127,837 | 1 | % | |||||||||||||||||||||||||

| Residential real estate |

368,569 | 4 | % | 373,580 | 4 | % | 360,094 | 4 | % | 330,254 | 3 | % | 308,880 | 3 | % | |||||||||||||||||||||||||

| Home equity |

162,035 | 2 | % | 167,760 | 2 | % | 170,068 | 2 | % | 174,131 | 2 | % | 175,972 | 2 | % | |||||||||||||||||||||||||

| Personal |

216,856 | 2 | % | 235,677 | 2 | % | 214,027 | 2 | % | 228,483 | 2 | % | 236,419 | 3 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total loans |

$ | 10,033,803 | 100 | % | $ | 10,139,982 | 100 | % | $ | 9,625,421 | 100 | % | $ | 9,436,235 | 100 | % | $ | 9,222,253 | 100 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| (1) | Refer to Glossary of Terms for definition. |

| Loan Composition (excluding covered assets(1)) (Dollars in thousands) Unaudited |

|

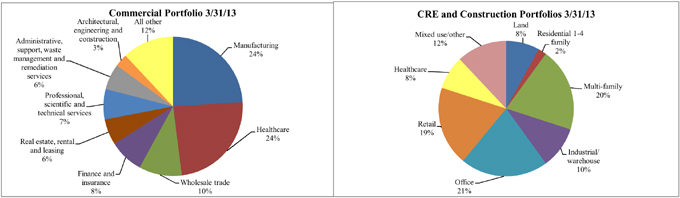

Commercial Loans Composition by Industry Segment

(Classified pursuant to the North American Industrial Classification System standard industry descriptions and represents our client’s primary business activity)

| 03/31/13 | 12/31/12 | |||||||||||||||||||||||||||||||

| Amount | Amount | |||||||||||||||||||||||||||||||

| % of | Non- | % Non- | % of | Non- | % Non- | |||||||||||||||||||||||||||

| Amount | Total | performing | performing (2) | Amount | Total | performing | performing (2) | |||||||||||||||||||||||||

| Manufacturing |

$ | 1,599,688 | 24 | % | $ | — | — | $ | 1,496,719 | 23 | % | $ | — | — | ||||||||||||||||||

| Healthcare |

1,565,431 | 24 | % | 314 | * | 1,514,496 | 23 | % | 322 | * | ||||||||||||||||||||||

| Wholesale trade |

684,791 | 10 | % | — | — | 635,477 | 10 | % | — | — | ||||||||||||||||||||||

| Finance and insurance |

504,311 | 8 | % | 186 | * | 584,763 | 9 | % | 194 | * | ||||||||||||||||||||||

| Real estate, rental and leasing |

362,060 | 6 | % | 512 | * | 359,947 | 6 | % | 16,550 | 5 | % | |||||||||||||||||||||

| Professional, scientific and technical services |

434,650 | 7 | % | 5,525 | 1 | % | 391,976 | 6 | % | 10,805 | 3 | % | ||||||||||||||||||||

| Administrative, support, waste management and remediation services |

398,024 | 6 | % | — | — | 426,960 | 7 | % | — | — | ||||||||||||||||||||||

| Architecture, engineering and construction |

229,797 | 3 | % | 9,415 | 4 | % | 225,199 | 3 | % | 629 | * | |||||||||||||||||||||

| All other (3) |

813,263 | 12 | % | 15,371 | 2 | % | 861,247 | 13 | % | 13,413 | 2 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total commercial (4) |

$ | 6,592,015 | 100 | % | $ | 31,323 | * | $ | 6,496,784 | 100 | % | $ | 41,913 | 1 | % | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Commercial Real Estate and Construction Loans Portfolio by Collateral Type

| 03/31/13 | 12/31/12 | |||||||||||||||||||||||||||||||

| Amount | Amount | |||||||||||||||||||||||||||||||

| % of | Non- | % Non- | % of | Non- | % Non- | |||||||||||||||||||||||||||

| Amount | Total | performing | performing (2) | Amount | Total | performing | performing (2) | |||||||||||||||||||||||||

| Commercial Real Estate Portfolio |

|

|||||||||||||||||||||||||||||||

| Land |

$ | 223,880 | 9 | % | $ | 23,335 | 10 | % | $ | 240,503 | 9 | % | $ | 19,747 | 8 | % | ||||||||||||||||

| Residential 1-4 family |

48,100 | 2 | % | 6,148 | 13 | % | 58,704 | 2 | % | 13,213 | 23 | % | ||||||||||||||||||||

| Multi-family |

517,418 | 20 | % | 9,704 | 2 | % | 543,622 | 20 | % | 6,553 | 1 | % | ||||||||||||||||||||

| Industrial/warehouse |

273,017 | 11 | % | 7,674 | 3 | % | 272,535 | 10 | % | 8,902 | 3 | % | ||||||||||||||||||||

| Office |

542,737 | 22 | % | 2,715 | 1 | % | 566,834 | 21 | % | 5,849 | 1 | % | ||||||||||||||||||||

| Retail |

463,915 | 18 | % | 7,452 | 2 | % | 472,024 | 18 | % | 8,873 | 2 | % | ||||||||||||||||||||

| Healthcare |

183,359 | 7 | % | — | — | 205,318 | 8 | % | — | — | ||||||||||||||||||||||

| Mixed use/other |

267,825 | 11 | % | 6,615 | 2 | % | 316,145 | 12 | % | 5,417 | 2 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total commercial real estate |

$ | 2,520,251 | 100 | % | $ | 63,643 | 3 | % | $ | 2,675,685 | 100 | % | $ | 68,554 | 3 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Construction Portfolio |

||||||||||||||||||||||||||||||||

| Residential 1-4 family |

$ | 11,796 | 7 | % | $ | — | — | $ | 14,160 | 7 | % | $ | — | — | ||||||||||||||||||

| Multi-family |

22,230 | 13 | % | — | — | 36,129 | 19 | % | — | — | ||||||||||||||||||||||

| Industrial/warehouse |

2,800 | 1 | % | — | — | 29,633 | 16 | % | — | — | ||||||||||||||||||||||

| Office |

14,212 | 8 | % | 402 | 3 | % | 8,863 | 5 | % | 402 | 5 | % | ||||||||||||||||||||

| Retail |

51,846 | 30 | % | — | — | 37,457 | 20 | % | — | — | ||||||||||||||||||||||

| Healthcare |

27,005 | 16 | % | — | — | 14,196 | 7 | % | — | — | ||||||||||||||||||||||

| Mixed use/other |

44,188 | 25 | % | — | — | 50,058 | 26 | % | 155 | * | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total construction |

$ | 174,077 | 100 | % | $ | 402 | * | $ | 190,496 | 100 | % | $ | 557 | * | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Refer to Glossary of Terms for definition. |

| (2) | Calculated as nonperforming loans in the respective industry segment or collateral type divided by total loans of the corresponding industry segment or collateral type presented above. |

| (3) | All other consists of numerous smaller balances across a variety of industries with no category greater than 3%. |

| (4) | Includes owner-occupied commercial real estate of $1.6 billion at March 31, 2013 and December 31, 2012. |

| * | Less than 1%. |

| Asset Quality (excluding covered assets(1)) Unaudited (Dollars in thousands) |

|

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | ||||||||||||||||

| Credit Quality Key Ratios |

||||||||||||||||||||

| Net charge-offs (annualized) to average loans |

0.70 | % | 0.73 | % | 0.87 | % | 1.16 | % | 1.57 | % | ||||||||||

| Nonperforming loans to total loans |

1.28 | % | 1.37 | % | 1.87 | % | 2.22 | % | 2.53 | % | ||||||||||

| Nonperforming loans to total assets |

0.96 | % | 0.99 | % | 1.35 | % | 1.62 | % | 1.85 | % | ||||||||||

| Nonperforming assets to total assets |

1.51 | % | 1.57 | % | 2.09 | % | 2.47 | % | 2.83 | % | ||||||||||

| Allowance for loan losses to: |

||||||||||||||||||||

| Total loans |

1.53 | % | 1.59 | % | 1.73 | % | 1.85 | % | 1.99 | % | ||||||||||

| Nonperforming loans |

120 | % | 116 | % | 93 | % | 83 | % | 79 | % | ||||||||||

| Nonperforming assets |

||||||||||||||||||||

| Loans past due 90 days and accruing |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Nonaccrual loans |

128,657 | 138,780 | 179,895 | 209,339 | 233,222 | |||||||||||||||

| OREO |

73,857 | 81,880 | 97,833 | 109,836 | 123,498 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming assets |

$ | 202,514 | $ | 220,660 | $ | 277,728 | $ | 319,175 | $ | 356,720 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Restructured loans accruing interest |

$ | 46,591 | $ | 60,980 | $ | 58,431 | $ | 97,690 | $ | 136,521 | ||||||||||

| Special mention loans |

$ | 106,446 | $ | 96,794 | $ | 104,706 | $ | 108,052 | $ | 143,790 | ||||||||||

| Potential problem loans |

$ | 78,185 | $ | 107,876 | $ | 112,929 | $ | 164,077 | $ | 184,029 | ||||||||||

| Nonperforming Loans Rollforward |

||||||||||||||||||||

| Beginning balance |

$ | 138,780 | $ | 179,895 | $ | 209,339 | $ | 233,222 | $ | 259,852 | ||||||||||

| Additions: |

||||||||||||||||||||

| New nonaccrual loans |

32,125 | 28,527 | 38,948 | 57,717 | 69,581 | |||||||||||||||

| Reductions: |

||||||||||||||||||||

| Return to performing status |

(794 | ) | (3,824 | ) | (236 | ) | (1,953 | ) | (14,291 | ) | ||||||||||

| Paydowns and payoffs, net of advances |

(885 | ) | (21,454 | ) | (11,094 | ) | (9,961 | ) | (4,806 | ) | ||||||||||

| Net sales |

(12,809 | ) | (20,544 | ) | (21,351 | ) | (25,954 | ) | (27,479 | ) | ||||||||||

| Transfer to OREO |

(6,266 | ) | (2,826 | ) | (3,250 | ) | (9,968 | ) | (13,513 | ) | ||||||||||

| Transfer to loans held for sale |

(2,240 | ) | — | (9,200 | ) | — | — | |||||||||||||

| Charge-offs |

(19,254 | ) | (20,994 | ) | (23,261 | ) | (33,764 | ) | (36,122 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total reductions |

(42,248 | ) | (69,642 | ) | (68,392 | ) | (81,600 | ) | (96,211 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at end of period |

$ | 128,657 | $ | 138,780 | $ | 179,895 | $ | 209,339 | $ | 233,222 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| OREO Rollforward |

||||||||||||||||||||

| Beginning balance |

$ | 81,880 | $ | 97,833 | $ | 109,836 | $ | 123,498 | $ | 125,729 | ||||||||||

| New foreclosed properties |

6,266 | 2,826 | 3,250 | 9,968 | 13,513 | |||||||||||||||

| Valuation adjustments |

(4,458 | ) | (5,274 | ) | (6,245 | ) | (9,207 | ) | (4,522 | ) | ||||||||||

| Disposals: |

||||||||||||||||||||

| Sales proceeds |

(9,067 | ) | (11,526 | ) | (8,041 | ) | (13,517 | ) | (9,078 | ) | ||||||||||

| Net loss on sale |

(764 | ) | (1,979 | ) | (967 | ) | (906 | ) | (2,144 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at end of period |

$ | 73,857 | $ | 81,880 | $ | 97,833 | $ | 109,836 | $ | 123,498 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Restructured Loans Accruing Interest Rollforward |

||||||||||||||||||||

| Beginning balance |

$ | 60,980 | $ | 58,431 | $ | 97,690 | $ | 136,521 | $ | 100,909 | ||||||||||

| Additions: |

||||||||||||||||||||

| New restructured loans accruing interest |

458 | 6,552 | 2,001 | 1,864 | 47,673 | |||||||||||||||

| Restructured loans returned to accruing status |

— | 3,823 | — | 157 | — | |||||||||||||||

| Reductions: |

||||||||||||||||||||

| Paydowns and payoffs, net of advances |

36 | (3,995 | ) | (3,935 | ) | (14,593 | ) | (4,661 | ) | |||||||||||

| Transferred to nonperforming loans |

(14,883 | ) | (2,988 | ) | (15,464 | ) | (25,688 | ) | (6,665 | ) | ||||||||||

| Net sales |

— | — | — | (170 | ) | — | ||||||||||||||

| Removal of restructured loan status |

— | (843 | ) | (21,861 | ) | (401 | ) | (735 | ) | |||||||||||

| Charge-offs, net |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at end of period |

$ | 46,591 | $ | 60,980 | $ | 58,431 | $ | 97,690 | $ | 136,521 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Refer to Glossary of Terms for definition. |

| Asset Quality (excluding covered assets(1)) Unaudited (Dollars in thousands) |

|

Credit Quality Indicators (1)

| Special | % of | Potential | % of | Non- | % of | |||||||||||||||||||||||

| Mention | Portfolio | Problem | Portfolio | Performing | Portfolio | Total | ||||||||||||||||||||||

| Loans | Loan Type | Loans | Loan Type | Loans | Loan Type | Loans | ||||||||||||||||||||||

| As of March 31, 2013 |

||||||||||||||||||||||||||||

| Commercial |

$ | 87,966 | 1.3 | % | $ | 31,198 | 0.5 | % | $ | 31,323 | 0.5 | % | $ | 6,592,015 | ||||||||||||||

| Commercial real estate |

11,412 | 0.5 | % | 33,462 | 1.3 | % | 63,643 | 2.5 | % | 2,520,251 | ||||||||||||||||||

| Construction |

— | — | — | — | 402 | 0.2 | % | 174,077 | ||||||||||||||||||||

| Residential real estate |

5,739 | 1.6 | % | 9,109 | 2.5 | % | 14,966 | 4.1 | % | 368,569 | ||||||||||||||||||

| Home equity |

1,325 | 0.8 | % | 4,312 | 2.7 | % | 13,615 | 8.4 | % | 162,035 | ||||||||||||||||||

| Personal |

4 | * | 104 | * | 4,708 | 2.2 | % | 216,856 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 106,446 | 1.1 | % | $ | 78,185 | 0.8 | % | $ | 128,657 | 1.3 | % | $ | 10,033,803 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| As of December 31, 2012 |

||||||||||||||||||||||||||||

| Commercial |

$ | 72,651 | 1.1 | % | $ | 40,495 | 0.6 | % | $ | 41,913 | 0.6 | % | $ | 6,496,784 | ||||||||||||||

| Commercial real estate |

21,209 | 0.8 | % | 48,897 | 1.8 | % | 68,554 | 2.6 | % | 2,675,685 | ||||||||||||||||||

| Construction |

— | — | — | — | 557 | 0.3 | % | 190,496 | ||||||||||||||||||||

| Residential real estate |

2,364 | 0.6 | % | 13,844 | 3.7 | % | 11,224 | 3.0 | % | 373,580 | ||||||||||||||||||

| Home equity |

562 | 0.3 | % | 4,351 | 2.6 | % | 11,710 | 7.0 | % | 167,760 | ||||||||||||||||||

| Personal |

8 | * | 289 | 0.1 | % | 4,822 | 2.0 | % | 235,677 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 96,794 | 1.0 | % | $ | 107,876 | 1.1 | % | $ | 138,780 | 1.4 | % | $ | 10,139,982 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Refer to Glossary of Terms for definition. |

| * | Less than 0.1%. |

| Loan Portfolio Aging (excluding covered assets(1)) Unaudited (Dollars in thousands) |

|

| Current | 30-59 Days Past Due |

60-89 Days Past Due |

90 Days Past Due and Accruing |

Nonaccrual | Total Loans | |||||||||||||||||||

| As of March 31, 2013 |

||||||||||||||||||||||||

| Loan balances: |

||||||||||||||||||||||||

| Commercial |

$ | 6,551,320 | $ | 5,647 | $ | 3,725 | $ | — | $ | 31,323 | $ | 6,592,015 | ||||||||||||

| Commercial real estate |

2,448,577 | 5,666 | 2,365 | — | 63,643 | 2,520,251 | ||||||||||||||||||

| Construction |

173,675 | — | — | — | 402 | 174,077 | ||||||||||||||||||

| Residential real estate |

350,943 | 2,175 | 485 | — | 14,966 | 368,569 | ||||||||||||||||||

| Personal and home equity |

359,460 | 647 | 461 | — | 18,323 | 378,891 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total loans |

$ | 9,883,975 | $ | 14,135 | $ | 7,036 | $ | — | $ | 128,657 | $ | 10,033,803 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Aging as a percent of loan balance: |

||||||||||||||||||||||||

| Commercial |

99.37 | % | 0.09 | % | 0.06 | % | — | 0.48 | % | 100.00 | % | |||||||||||||

| Commercial real estate |

97.16 | % | 0.22 | % | 0.09 | % | — | 2.53 | % | 100.00 | % | |||||||||||||

| Construction |

99.77 | % | — | — | — | 0.23 | % | 100.00 | % | |||||||||||||||

| Residential real estate |

95.22 | % | 0.59 | % | 0.13 | % | — | 4.06 | % | 100.00 | % | |||||||||||||

| Personal and home equity |

94.87 | % | 0.17 | % | 0.12 | % | — | 4.84 | % | 100.00 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total loans |

98.51 | % | 0.14 | % | 0.07 | % | — | 1.28 | % | 100.00 | % | |||||||||||||

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | ||||||||||||||||

| Nonaccrual loans: |

||||||||||||||||||||

| Commercial |

$ | 31,323 | $ | 41,913 | $ | 61,182 | $ | 59,841 | $ | 40,186 | ||||||||||

| Commercial real estate |

63,643 | 68,554 | 88,057 | 119,444 | 159,255 | |||||||||||||||

| Construction |

402 | 557 | 557 | 555 | 2,781 | |||||||||||||||

| Residential real estate |

14,966 | 11,224 | 12,502 | 11,028 | 12,069 | |||||||||||||||

| Personal and home equity |

18,323 | 16,532 | 17,597 | 18,471 | 18,931 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 128,657 | $ | 138,780 | $ | 179,895 | $ | 209,339 | $ | 233,222 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Nonaccrual loans as a percent of total loan type: |

||||||||||||||||||||

| Commercial |

0.48 | % | 0.65 | % | 1.00 | % | 1.01 | % | 0.73 | % | ||||||||||

| Commercial real estate |

2.53 | % | 2.56 | % | 3.37 | % | 4.55 | % | 5.55 | % | ||||||||||

| Construction |

0.23 | % | 0.29 | % | 0.34 | % | 0.32 | % | 2.18 | % | ||||||||||

| Residential real estate |

4.06 | % | 3.00 | % | 3.47 | % | 3.34 | % | 3.91 | % | ||||||||||

| Personal and home equity |

4.84 | % | 4.10 | % | 4.58 | % | 4.59 | % | 4.59 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

1.28 | % | 1.37 | % | 1.87 | % | 2.22 | % | 2.53 | % | ||||||||||

| Loans past due 60-89 days and still accruing: |

||||||||||||||||||||

| Commercial |

$ | 3,725 | $ | 1,365 | $ | 1,129 | $ | 5,064 | $ | 3,963 | ||||||||||

| Commercial real estate |

2,365 | 5,278 | 3,588 | 2,543 | 2,081 | |||||||||||||||

| Construction |

— | — | — | — | 68 | |||||||||||||||

| Residential real estate |

485 | — | 655 | 21 | 1,135 | |||||||||||||||

| Personal and home equity |

461 | 462 | 1,569 | 1,017 | 253 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 7,036 | $ | 7,105 | $ | 6,941 | $ | 8,645 | $ | 7,500 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans past due 60-89 days and still accruing as a percent of total loan type: |

||||||||||||||||||||

| Commercial |

0.06 | % | 0.02 | % | 0.02 | % | 0.09 | % | 0.07 | % | ||||||||||

| Commercial real estate |

0.09 | % | 0.20 | % | 0.14 | % | 0.10 | % | 0.07 | % | ||||||||||

| Construction |

— | — | — | — | 0.05 | % | ||||||||||||||

| Residential real estate |

0.13 | % | — | 0.18 | % | 0.01 | % | 0.37 | % | |||||||||||

| Personal and home equity |

0.12 | % | 0.11 | % | 0.41 | % | 0.25 | % | 0.06 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

0.07 | % | 0.07 | % | 0.07 | % | 0.09 | % | 0.08 | % | ||||||||||

| Loans past due 30-59 days and still accruing: |

||||||||||||||||||||

| Commercial |

$ | 5,647 | $ | 2,195 | $ | 6,141 | $ | 901 | $ | 3,216 | ||||||||||

| Commercial real estate |

5,666 | 4,073 | 5,232 | 1,314 | 6,590 | |||||||||||||||

| Construction |

— | — | — | — | — | |||||||||||||||

| Residential real estate |

2,175 | 3,260 | 240 | 341 | 4,960 | |||||||||||||||

| Personal and home equity |

647 | 1,837 | 2,072 | 1,983 | 1,754 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 14,135 | $ | 11,365 | $ | 13,685 | $ | 4,539 | $ | 16,520 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans past due 30-59 days and still accruing as a percent of total loan type: |

||||||||||||||||||||

| Commercial |

0.09 | % | 0.03 | % | 0.10 | % | 0.01 | % | 0.06 | % | ||||||||||

| Commercial real estate |

0.22 | % | 0.15 | % | 0.20 | % | 0.05 | % | 0.23 | % | ||||||||||

| Construction |

— | — | — | — | — | |||||||||||||||

| Residential real estate |

0.59 | % | 0.87 | % | 0.07 | % | 0.10 | % | 1.61 | % | ||||||||||

| Personal and home equity |

0.17 | % | 0.46 | % | 0.54 | % | 0.49 | % | 0.43 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

0.14 | % | 0.11 | % | 0.14 | % | 0.05 | % | 0.18 | % | ||||||||||

| (1) | Refer to Glossary of Terms for definition. |

| * | Less than 0.01%. |

| Asset Quality (excluding covered assets(1)) Unaudited (Dollars in thousands) |

|

Nonaccrual Loans Stratification

| $10.0 Million

or More |

$5.0 to

$9.9 Million |

$3.0 to

$4.9 Million |

$1.5 to

$2.9 Million |

Under $1.5 Million |

Total | |||||||||||||||||||

| As of March 31, 2013 |

||||||||||||||||||||||||

| Amount: |

||||||||||||||||||||||||

| Commercial |

$ | 12,074 | $ | 8,769 | $ | 3,082 | $ | 4,733 | $ | 2,665 | $ | 31,323 | ||||||||||||

| Commercial real estate |

15,890 | 5,915 | 8,313 | 14,977 | 18,548 | 63,643 | ||||||||||||||||||

| Construction |

— | — | — | — | 402 | 402 | ||||||||||||||||||

| Residential real estate |

— | — | 4,789 | 2,417 | 7,760 | 14,966 | ||||||||||||||||||

| Personal and home equity |

— | — | 3,760 | — | 14,563 | 18,323 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 27,964 | $ | 14,684 | $ | 19,944 | $ | 22,127 | $ | 43,938 | $ | 128,657 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Number of borrowers: |

||||||||||||||||||||||||

| Commercial |

1 | 1 | 1 | 2 | 22 | 27 | ||||||||||||||||||

| Commercial real estate |

1 | 1 | 2 | 7 | 37 | 48 | ||||||||||||||||||

| Construction |

— | — | — | — | 1 | 1 | ||||||||||||||||||

| Residential real estate |

— | — | 1 | 1 | 29 | 31 | ||||||||||||||||||

| Personal and home equity |

— | — | 1 | — | 44 | 45 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

2 | 2 | 5 | 10 | 133 | 152 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| As of December 31, 2012 |

||||||||||||||||||||||||

| Amount: |

||||||||||||||||||||||||

| Commercial |

$ | 26,756 | $ | — | $ | 7,709 | $ | 2,869 | $ | 4,579 | $ | 41,913 | ||||||||||||

| Commercial real estate |

15,890 | 12,425 | 4,274 | 15,473 | 20,492 | 68,554 | ||||||||||||||||||

| Construction |

— | — | — | — | 557 | 557 | ||||||||||||||||||

| Residential real estate |

— | — | 4,789 | — | 6,435 | 11,224 | ||||||||||||||||||

| Personal and home equity |

— | — | 3,760 | — | 12,772 | 16,532 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 42,646 | $ | 12,425 | $ | 20,532 | $ | 18,342 | $ | 44,835 | $ | 138,780 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Number of borrowers: |

||||||||||||||||||||||||

| Commercial |

2 | — | 2 | 1 | 26 | 31 | ||||||||||||||||||

| Commercial real estate |

1 | 2 | 1 | 7 | 38 | 49 | ||||||||||||||||||

| Construction |

— | — | — | — | 2 | 2 | ||||||||||||||||||

| Residential real estate |

— | — | 1 | — | 26 | 27 | ||||||||||||||||||

| Personal and home equity |

— | — | 1 | — | 39 | 40 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

3 | 2 | 5 | 8 | 131 | 149 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Restructured Loans Accruing Interest Stratification

| $10.0 Million

or More |

$5.0 to

$9.9 Million |

$3.0 to

$4.9 Million |

$1.5 to

$2.9 Million |

Under $1.5 Million |

Total | |||||||||||||||||||

| As of March 31, 2013 |

||||||||||||||||||||||||

| Amount: |

||||||||||||||||||||||||

| Commercial |

$ | 22,145 | $ | 13,919 | $ | — | $ | — | $ | 783 | $ | 36,847 | ||||||||||||

| Commercial real estate |

— | 5,090 | — | 2,159 | 877 | 8,126 | ||||||||||||||||||

| Construction |

— | — | — | — | — | — | ||||||||||||||||||

| Residential real estate |

— | — | — | — | — | — | ||||||||||||||||||

| Personal and home equity |

— | — | — | — | 1,618 | 1,618 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 22,145 | $ | 19,009 | $ | — | $ | 2,159 | $ | 3,278 | $ | 46,591 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Number of borrowers: |

||||||||||||||||||||||||

| Commercial |

2 | 2 | — | — | 3 | 7 | ||||||||||||||||||

| Commercial real estate |

— | 1 | — | 1 | 3 | 5 | ||||||||||||||||||

| Construction |

— | — | — | — | — | — | ||||||||||||||||||

| Residential real estate |

— | — | — | — | — | — | ||||||||||||||||||

| Personal and home equity |

— | — | — | — | 2 | 2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

2 | 3 | — | 1 | 8 | 14 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| As of December 31, 2012 |

||||||||||||||||||||||||

| Amount: |

||||||||||||||||||||||||

| Commercial |

$ | 25,073 | $ | 13,661 | $ | 4,460 | $ | — | $ | 1,073 | $ | 44,267 | ||||||||||||

| Commercial real estate |

— | 11,667 | — | 2,193 | 898 | 14,758 | ||||||||||||||||||

| Construction |

— | — | — | — | — | — | ||||||||||||||||||

| Residential real estate |

— | — | — | — | 465 | 465 | ||||||||||||||||||

| Personal and home equity |

— | — | — | — | 1,490 | 1,490 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 25,073 | $ | 25,328 | $ | 4,460 | $ | 2,193 | $ | 3,926 | $ | 60,980 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Number of borrowers: |

||||||||||||||||||||||||

| Commercial |

2 | 2 | 1 | — | 3 | 8 | ||||||||||||||||||

| Commercial real estate |

— | 2 | — | 1 | 3 | 6 | ||||||||||||||||||

| Construction |

— | — | — | — | — | — | ||||||||||||||||||

| Residential real estate |

— | — | — | — | 1 | 1 | ||||||||||||||||||

| Personal and home equity |

— | — | — | — | 1 | 1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

2 | 4 | 1 | 1 | 8 | 16 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Refer to Glossary of Terms for definition. |

| Foreclosed Real Estate (OREO), excluding covered assets(1) Unaudited (Dollars in thousands) |

|

OREO Properties by Type

| March 31, 2013 | December 31, 2012 | |||||||||||||||||||||||

| Number of | % of | Number of | % of | |||||||||||||||||||||

| Properties | Amount | Total | Properties | Amount | Total | |||||||||||||||||||

| Single-family homes |

21 | $ | 1,861 | 2 | % | 50 | $ | 6,337 | 8 | % | ||||||||||||||

| Land parcels |

151 | 30,875 | 42 | % | 170 | 33,072 | 40 | % | ||||||||||||||||

| Multi-family |

6 | 8,089 | 11 | % | 6 | 8,111 | 10 | % | ||||||||||||||||

| Office/industrial |

31 | 21,263 | 29 | % | 40 | 27,585 | 34 | % | ||||||||||||||||

| Retail |

8 | 6,709 | 9 | % | 8 | 6,775 | 8 | % | ||||||||||||||||

| Mixed use |

2 | 5,060 | 7 | % | — | — | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

219 | $ | 73,857 | 100 | % | 274 | $ | 81,880 | 100 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

OREO Property Type by Location

| South | Mid | |||||||||||||||||||||||||||

| Illinois | Colorado | Wisconsin | Eastern (2) | Western (3) | Other | Total | ||||||||||||||||||||||

| March 31, 2013 |

||||||||||||||||||||||||||||

| Single-family homes |

$ | 1,642 | $ | — | $ | — | $ | — | $ | 219 | $ | — | $ | 1,861 | ||||||||||||||

| Land parcels |

18,700 | — | — | 9,250 | 2,925 | — | 30,875 | |||||||||||||||||||||

| Multi-family |

939 | 7,150 | — | — | — | — | 8,089 | |||||||||||||||||||||

| Office/industrial |

15,152 | — | 2,070 | 501 | 3,540 | — | 21,263 | |||||||||||||||||||||

| Retail |

5,583 | — | — | 1,126 | — | — | 6,709 | |||||||||||||||||||||

| Mixed use |

— | — | 5,060 | — | — | — | 5,060 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 42,016 | $ | 7,150 | $ | 7,130 | $ | 10,877 | $ | 6,684 | $ | — | $ | 73,857 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| % of Total |

56 | % | 10 | % | 10 | % | 15 | % | 9 | % | 0 | % | 100 | % | ||||||||||||||

| December 31, 2012 |

||||||||||||||||||||||||||||

| Single-family homes |

$ | 4,301 | $ | — | $ | — | $ | — | $ | 1,866 | $ | 170 | $ | 6,337 | ||||||||||||||

| Land parcels |

18,913 | — | — | 10,446 | 3,713 | — | 33,072 | |||||||||||||||||||||

| Multi-family |

1,178 | 6,933 | — | — | — | — | 8,111 | |||||||||||||||||||||

| Office/industrial |

17,960 | — | 2,300 | 3,450 | 3,875 | — | 27,585 | |||||||||||||||||||||

| Retail |

5,584 | — | — | 1,191 | — | — | 6,775 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 47,936 | $ | 6,933 | $ | 2,300 | $ | 15,087 | $ | 9,454 | $ | 170 | $ | 81,880 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| % of Total |

59 | % | 8 | % | 3 | % | 18 | % | 12 | % | * | 100 | % | |||||||||||||||

| (1) | Refer to Glossary of Terms for definition. |

| (2) | Represents the Southeastern states of Arkansas, Florida and Georgia. |

| (3) | Represents the Midwestern states of Kansas, Michigan, Missouri, Indiana and Ohio. |

| * | Less than 1%. |

| Allowance for Loan Losses (excluding covered assets(1)) Unaudited (Dollars in thousands) |

|

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | ||||||||||||||||

| Change in allowance for loan losses: |

||||||||||||||||||||

| Balance at beginning of period |

$ | 161,417 | $ | 166,859 | $ | 174,302 | $ | 183,844 | $ | 191,594 | ||||||||||

| Loans charged-off: |

||||||||||||||||||||

| Commercial |

(11,146 | ) | (10,388 | ) | (4,062 | ) | (7,769 | ) | (9,549 | ) | ||||||||||

| Commercial real estate |

(7,566 | ) | (8,105 | ) | (16,790 | ) | (17,924 | ) | (25,280 | ) | ||||||||||

| Construction |

70 | 30 | 64 | (828 | ) | (1,245 | ) | |||||||||||||

| Residential real estate |

(436 | ) | (621 | ) | (299 | ) | (1,006 | ) | (1,084 | ) | ||||||||||

| Home equity |

(374 | ) | (1,640 | ) | (1,001 | ) | (4 | ) | (483 | ) | ||||||||||

| Personal |

(5 | ) | (612 | ) | (1,006 | ) | (6,341 | ) | (2,085 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total charge-offs |

(19,457 | ) | (21,336 | ) | (23,094 | ) | (33,872 | ) | (39,726 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Recoveries on loans previously charged-off: |

||||||||||||||||||||

| Commercial |

396 | 947 | 919 | 634 | 1,679 | |||||||||||||||

| Commercial real estate |

1,364 | 2,133 | 544 | 4,150 | 1,882 | |||||||||||||||

| Construction |

9 | 16 | 594 | 1,664 | 41 | |||||||||||||||

| Residential real estate |

2 | 106 | 7 | 2 | 11 | |||||||||||||||

| Home equity |

61 | 52 | 117 | 314 | 26 | |||||||||||||||

| Personal |

52 | 43 | 229 | 163 | 702 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total recoveries |

1,884 | 3,297 | 2,410 | 6,927 | 4,341 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net charge-offs |

(17,573 | ) | (18,039 | ) | (20,684 | ) | (26,945 | ) | (35,385 | ) | ||||||||||

| Provisions charged to operating expense |

10,148 | 12,597 | 13,241 | 17,403 | 27,635 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at end of period |

$ | 153,992 | $ | 161,417 | $ | 166,859 | $ | 174,302 | $ | 183,844 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Allocation of allowance for loan losses: |

||||||||||||||||||||

| General allocated reserve: |

||||||||||||||||||||

| Commercial |

$ | 57,280 | $ | 50,450 | $ | 49,115 | $ | 47,210 | $ | 45,850 | ||||||||||

| Commercial real estate |

45,030 | 52,700 | 54,500 | 53,700 | 57,750 | |||||||||||||||

| Construction |

2,011 | 2,317 | 2,200 | 2,635 | 1,900 | |||||||||||||||

| Residential real estate |

5,800 | 5,700 | 5,100 | 5,200 | 5,400 | |||||||||||||||

| Home equity |

3,700 | 4,000 | 3,980 | 4,200 | 4,700 | |||||||||||||||

| Personal |

2,900 | 2,860 | 2,800 | 3,260 | 3,295 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total allocated |

116,721 | 118,027 | 117,695 | 116,205 | 118,895 | |||||||||||||||

| Specific reserve |

37,271 | 43,390 | 49,164 | 58,097 | 64,949 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 153,992 | $ | 161,417 | $ | 166,859 | $ | 174,302 | $ | 183,844 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Allocation of reserve by a percent of total allowance for loan losses: |

||||||||||||||||||||

| General allocated reserve: |

||||||||||||||||||||

| Commercial |

37 | % | 31 | % | 29 | % | 27 | % | 25 | % | ||||||||||

| Commercial real estate |

29 | % | 33 | % | 33 | % | 31 | % | 31 | % | ||||||||||

| Construction |

1 | % | 1 | % | 1 | % | 2 | % | 1 | % | ||||||||||

| Residential real estate |

4 | % | 4 | % | 3 | % | 3 | % | 3 | % | ||||||||||

| Home equity |

3 | % | 2 | % | 2 | % | 2 | % | 3 | % | ||||||||||

| Personal |