Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - THERMO FISHER SCIENTIFIC INC. | d521494dex993.htm |

| EX-99.1 - EX-99.1 - THERMO FISHER SCIENTIFIC INC. | d521494dex991.htm |

| 8-K - FORM 8-K - THERMO FISHER SCIENTIFIC INC. | d521494d8k.htm |

April 15, 2013

Thermo Fisher Scientific to Acquire

Life Technologies

The world leader in serving science

Proprietary & Confidential

Exhibit 99.2 |

2

Safe Harbor Statement / Use of Non-GAAP Financial Measures

The following constitutes a "Safe Harbor" statement under the Private Securities Litigation

Reform Act of 1995: This presentation contains forward-looking statements that involve a

number of risks and uncertainties. Important factors that could cause actual results to differ

materially from those indicated by forward-looking statements include risks and uncertainties relating to: the need to

develop new products and adapt to significant technological change; implementation of strategies for

improving growth; general economic conditions including economic conditions in the countries in

which Thermo Fisher and Life Technologies sell products, and related uncertainties; dependence

on customers' capital spending policies and government funding policies; the effect of exchange

rate fluctuations on international operations; the effect of healthcare reform legislation; use and protection of intellectual

property; the effect of changes in governmental regulations; and the effect of laws and regulations

governing government contracts, as well as the possibility that expected benefits related to the

transaction may not materialize as expected; the transaction not being timely completed, if

completed at all; prior to the completion of the transaction, Life Technologies’ business experiencing

disruptions due to transaction-related uncertainty or other factors making it more difficult to

maintain relationships with employees, licensees, other business partners or governmental

entities; difficulty retaining certain key employees; and the parties being unable to

successfully implement integration strategies or to achieve expected synergies and operating efficiencies within the expected

time-frames or at all. Additional important factors that could cause actual results to

differ materially from those indicated by such forward-looking statements are set forth in

Thermo Fisher’s Annual Report on Form 10-K for the fiscal year ended December 31,

2012, which is on file with the SEC and available in the “Investors” section of Thermo

Fisher’s website under the heading “SEC Filings,” and in Life Technologies’

Annual Report on Form 10-K for the fiscal year ended December 31, 2012 and recent current

report on form 8-K, each of which are on file with the SEC and available in the “Investor

Relations” section of Life Technologies’ website under the heading “SEC

Filings”. While Thermo Fisher or Life Technologies may elect to update forward-looking

statements at some point in the future, each of Thermo Fisher and Life Technologies specifically

disclaims any obligation to do so, even if estimates change and, therefore, you should not rely

on these forward-looking statements as representing either of Thermo Fisher’s or Life

Technologies’ respective views as of any date subsequent to today.

In addition to the financial measures prepared in accordance with generally accepted accounting

principles (GAAP), we use certain non-GAAP financial measures, including adjusted EPS,

adjusted operating income, adjusted EBITDA, adjusted net income and adjusted ROIC, which

exclude restructuring and other costs/income and amortization of acquisition-related intangible assets.

Adjusted EPS, adjusted net income and adjusted ROIC also exclude certain other gains and losses, tax

provisions/benefits related to the previous items, benefits from tax credit carryforwards, the

impact of significant tax audits or events and discontinued operations. We exclude the above

items because they are outside of our normal operations and/or, in certain cases, are difficult to

forecast accurately for future periods. We also use the non-GAAP measure, free cash flow,

which excludes operating cash flows from discontinued operations and deducts net capital

expenditures. We believe that the use of non-GAAP measures helps investors to gain a better

understanding of our core operating results and future prospects, consistent with how management

measures and forecasts the company's performance, especially when comparing such results to previous

periods or forecasts. |

3

Additional Information and Where to Find It

This

communication

may

be

deemed

to

be

solicitation

material

in

respect

of

the

proposed

acquisition

of

Life

Technologies

by

Thermo

Fisher.

In

connection

with

the

proposed

acquisition,

Life

Technologies

intends

to

file

relevant

materials

with

the

SEC,

including

Life

Technologies’

proxy

statement

in

preliminary

and

definitive

form.

Stockholders

of

Life

Technologies

are

urged

to

read

all

relevant

documents

filed

with

the

SEC,

including

Life

Technologies’

definitive

proxy

statement,

because

they

will

contain

important

information

about

the

proposed

transaction.

Investors

and

security

holders

are

able

to

obtain

the

documents

(once

available)

free

of

charge

at

the

SEC’s

web

site,

http://www.sec.gov,

or

for

free

from

Life

Technologies

by

emailing

ir@lifetech.com

or

calling

(760)

603-7208.

Such

documents

are

not

currently

available.

Participants in Solicitation

Thermo

Fisher

and

its

directors

and

executive

officers,

and

Life

Technologies

and

its

directors

and

executive

officers,

may

be

deemed

to be

participants

in

the

solicitation

of

proxies

from

the

holders

of

Life

Technologies

common

stock

in

respect

of

the

proposed

transaction.

Information

about

the

directors

and

executive

officers

of

Thermo

Fisher

is

set

forth

in

its

proxy

statement

for

Thermo

Fisher’s

2013

Annual

Meeting

of

stockholders,

which

was

filed

with

the

SEC

on

April

9,

2013.

Information

about

the

directors

and

executive

officers

of

Life

Technologies

is

set

forth

in

the

proxy

statement

for

Life

Technologies’

2013

Annual

Meeting

of

stockholders,

which

was

filed

with

the

SEC

on

March

15,

2013.

Investors

may

obtain

additional

information

regarding

the

interest

of

such

participants

by reading

the

proxy

statement

regarding

the

acquisition

(once

available). |

4

Technology and Innovation Leader

Ultimate Customer Partner

Compelling Financial Profile

Combination Creates Unrivaled Industry Leader |

5

Key product categories

•

Research consumables

•

Genetic analysis

•

Applied sciences

Attractive revenue profile*

Premier life sciences brands

* Based on FY 2012 revenues

Life Technologies Company Profile

Mix

Instruments

15%

Consumables

& Services

85%

Regions

Americas

45%

Europe

31%

APAC

14%

Japan

10%

•

A global leader in life sciences

•

2012 Revenue: $3.8 billion

•

10,000 Employees

•

50,000+ Products |

6

Enhances scale and depth of capabilities in research, specialty

diagnostics and applied markets

Technology leadership in proteomics, genomics and cell biology

World-class e-commerce and supply-chain infrastructure

Industry-leading presence in high-growth emerging markets

Strengthens Value Proposition for Our Customers

Creates Compelling Value for Our Shareholders

Strategic Rationale

Attractive returns and new growth opportunities

Meaningful synergies and strong cash flow

Significant accretion to adjusted EPS

Next-generation sequencing platform provides new long-term growth

opportunities |

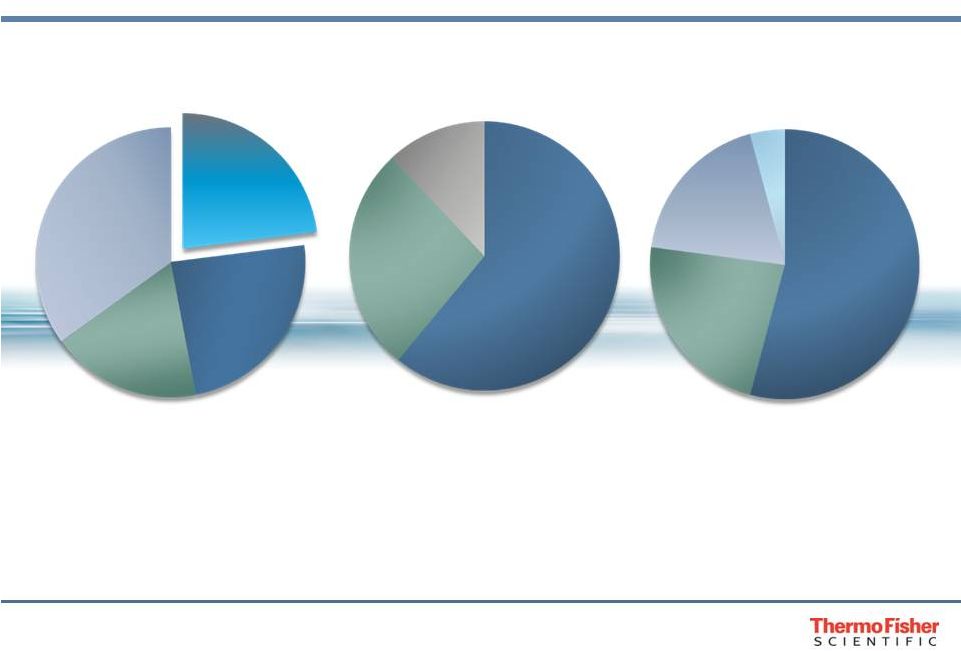

7

Products

Portfolio**

Geographies

Pro forma revenues: $16.3B*

* Based on FY 2012 revenues of both companies

**Percentages calculated before inter-company eliminations

Increased recurring revenue and scale in emerging markets

Instruments &

Equipment

27%

Consumables

61%

Lab Products &

Services

35%

Services

12%

Unrivaled Industry Leadership

Analytical

Technologies

24%

Specialty

Diagnostics

18%

Lab Products &

Services

XX%

Life

Technologies

23%

Europe

26%

North

America

52%

Asia-Pacific

18%

ROW

4% |

8

•

Mass spectrometry

•

Liquid chromatography

•

Spectroscopy

Research and Discovery

Production

Specialty

Diagnostics

•

Protein sample prep

•

Laboratory consumables

•

Research chemicals

•

Single-use

bioprocess

technologies

•

Cell factories

•

Next-generation

sequencing

•

q-PCR

•

Capillary

electrophoresis

•

Cell biology

•

Molecular biology

reagents

•

Sera and media

•

Chromatography

•

Cancer

•

Infectious

disease

•

Biomarkers

•

Transplant

•

Microbiology

•

Allergy

Unique ability to accelerate customer innovation

Applied

Markets

•

Food safety

•

Environmental

Technology and Innovation Leader

•

Forensics

•

Animal health |

9

•

Global key accounts and strategic

partnerships

•

Unparalleled customer access

•

Unmatched customer channels in

research and healthcare

•

Leading e-commerce capability

•

10,000 field sales and service

employees

•

2,700 scientists

•

>8,000 patents and licenses

•

Industry’s largest R&D budget

Commercial Reach

Deep Applications Expertise

•

World-class inventory and logistics

management

•

Cold-chain expertise

•

50,000 orders / shipments every day

Operational Excellence

Ultimate Customer Partner

Leading capabilities to enable

customer productivity |

10

Price

•

Total cash consideration of $13.6 billion ($76 per fully diluted

share)

•

Plus assumption of Life Technologies net debt, $2.2 billion

as of year-end 2012

Returns

•

Attractive return profile and strong cash flow

•

Adjusted ROIC* to exceed cost of capital in year 4

•

Significantly and immediately accretive to adjusted EPS

•

Expected to add $0.90 to $1.00 to adjusted EPS in first full year

Synergies

•

Estimated to generate $275 million of adjusted operating income

synergies

by

3rd

full

year

–

$85

million

in

first

full

year

•

Cost: $250 million by combining global infrastructure

•

Revenue: $25 million by combining commercial capabilities

Tax Benefit

•

Greater tax efficiencies from leveraging combined global structure

* Adjusted return on invested capital is annual adjusted net income,

excluding net interest expense, net

of

related

tax

benefit,

divided

by

trailing

five

quarters’

average

invested

capital.

Compelling Financial Profile

Significant opportunity to create shareholder value |

11

Financing

•

Fully committed bridge facility in place

•

Permanent financing from available cash, and issuance

of new debt and equity prior to close

•

Expected mix: $9.5 -

$10 billion of cash and debt and

up to $4 billion of equity financing

Leverage

•

Pro

forma

leverage

ratio

of

4.3

-

4.4x

TTM

adjusted

EBITDA

at close

•

Financing structured to maintain investment-grade debt ratings

•

Combined annual free cash flow of >$2.5 billion will allow for rapid

reduction of debt

•

Expect

to

achieve

target

leverage

ratio

of

2.5

–

3.0x

by end of year 2

Path to

Completion

•

Life Technologies shareholder approval

•

Customary regulatory approvals in relevant jurisdictions

•

Expected to close early in 2014

Transaction Overview |

12

Technology and Innovation Leader

Ultimate Customer Partner

Compelling Financial Profile

Combination Creates Unrivaled Industry Leader |