Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - ZENOSENSE, INC. | ex311.htm |

| EX-23.1 - CONSENT LETTER FROM MADSEN & ASSOCIATES CPAS - ZENOSENSE, INC. | ex231.htm |

| EX-32.1 - CERTIFICATION - ZENOSENSE, INC. | ex321.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ______________

Commission File Number 001-34212

BRAEDEN VALLEY MINES INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

26-3257291

|

|

|

State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization

|

Identification No.)

|

|

Bella Vista, Calle Gracia, Casa 19A, Panama City, Panama

(Address of principal executive offices) (Zip Code)

| 602-466-3666 | ||

| Registrant’s telephone number, including area code |

Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class

|

Name of each exchange on which registered

|

||

|

None

|

None

|

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.001 Par Value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Exchange Act Yes [ ] No [ X ]

Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ X ]

Indicate by check mark if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B is not contained in this form, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as deifned in Rule 12b-2 of the Act). Yes [ X ] No [ ]

Net revenues for our most recent fiscal year: $0.

The aggregate market value of the voting and non-voting common equity held by non-affiliates cannot be computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed fiscal quarter (June 30, 2012) because the Registrant’s stock is not listed on any exchange nor is it quoted on any electronic market.) The number of outstanding shares, not including shares held by affiliates (officers, directors and 10% shareholders) as of June 30, 2012, is 0.

Number of common voting shares issued and outstanding as of April 1, 2013: 30,000,000 shares of common stock

DOCUMENTS INCORPORATED BY REFERENCE

If the following documents are incorporated by reference, briefly describe them and identify the part of the Form 10-K (e.g. Part I, Part II, etc.) into which the document is incorporated: (1) any annual report to security holders; (2) any proxy or information statement; and (3) any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1990)

Transitional Small Business Disclosure Format (Check one): Yes [ ]No[ X ]

2

BRAEDEN VALLEY MINES INC.

Pre-Exloration Stage

Fiscal Year Ended December 31, 2012

TABLE OF CONTENTS

| Pages | ||||

|

PART I

|

||||

|

Item 1.

|

4

|

|||

|

Item 1A.

|

8

|

|||

|

Item 1B.

|

14

|

|||

|

Item 2.

|

14

|

|||

|

Item 3.

|

23

|

|||

|

Item 4.

|

23 | |||

|

PART II

|

||||

|

Item 5.

|

23

|

|||

|

Item 6.

|

24

|

|||

|

Item 7.

|

27

|

|||

|

Item 7A.

|

27

|

|||

|

Item 8.

|

29

|

|||

|

Item 9.

|

29

|

|||

|

Item 9A.

|

29

|

|||

|

Item 9B.

|

29

|

|||

|

PART III

|

||||

|

Item 10.

|

30

|

|||

|

Item 11.

|

32

|

|||

|

Item 12.

|

32

|

|||

|

Item 13.

|

33

|

|||

|

Item 14.

|

33

|

|||

|

PART IV

|

||||

|

Item 15.

|

34

|

3

PART I

ITEM 1. BUSINESS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that involve risks and uncertainties. Forward-looking statements in this annual report include, among others, statements regarding our capital needs, business plans and expectations. Such forward-looking statements involve assumptions, risks and uncertainties regarding, among others, the success of our business plan, availability of funds, government regulations, operating costs, our ability to achieve significant revenues, our business model and products and other factors. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential" or "continue", the negative of such terms or other comparable terminology. These forward-looking statements address, among others, such issues as:

|

|

·

|

the amount and nature of future exploration, development and other capital expenditures,

|

|

|

·

|

mining claims to be drilled,

|

|

|

·

|

future earnings and cash flow,

|

|

|

·

|

development projects,

|

|

|

·

|

exploration prospects,

|

|

|

·

|

drilling prospects,

|

|

|

·

|

development and drilling potential,

|

|

|

·

|

business strategy,

|

|

|

·

|

expansion and growth of our business and operations, and

|

|

|

·

|

our estimated financial information.

|

In evaluating these statements, you should consider various factors, including the assumptions, risks and uncertainties outlined in this prospectus under "Risk Factors". These factors or any of them may cause our actual results to differ materially from any forward-looking statement made in this prospectus. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events, our actual results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. The forward-looking statements in this prospectus are made as of the date of this prospectus and we do not intend or undertake to update any of the forward-looking statements to conform these statements to actual results, except as required by applicable law, including the securities laws of the United States.

4

GENERAL DEVELOPMENT OF BUSINESS

Braeden Valley Mines Inc. (“we”, “us”, “our” or the “Company”) was organized as a corporation under the laws of the State of Nevada on August 11, 2008 to explore gold and other mineral properties in North America.

We were formed to engage in the exploration of mineral properties for gold and other mineral properties. In August 2008, we acquired the mining rights to the New Dawn Property, which consists of four (4) unpatented lode mining claims situated in the Northern Tuscarora Mountains of Elko County, Nevada. We refer to these mining claims as the “New Dawn Property” or “New Dawn”. We have not been involved in any bankruptcy, receiverships or similar proceedings. We have not conducted any reclassifications, mergers or consolidations nor have we disposed of or acquired any material amount of assets otherwise in the ordinary course of business.

GLOSSARY OF MINING TERMS

|

Assaying

|

Laboratory examination that determines the content or proportion of a specific metal (ie: gold) contained within a sample. Technique usually involves firing/smelting.

|

|

Conglomerate

|

A coarse-grained clastic sedimentary rock, composed of rounded to subangular fragments larger than 2 mm in diameter (granules, pebbles, cobbles, boulders) set in a fine-grained matrix of sand or silt, and commonly cemented by calcium carbonate, iron oxide, silica, or hardened clay; the consolidated equivalent of gravel. The rock or mineral fragments may be of varied composition and range widely in size, and are usually rounded and smoothed from transportation by water or from wave action.

|

|

Dolomite Beds

|

Dolomite beds are associated and interbedded with limestone, commonly representing postdepositional replacement of limestone.

|

|

Dike

|

A tabular igneous intrusion that cuts across the bedding or foliation of the country rock.

|

|

Exploration Stage

|

An “exploration stage” prospect is one which is not in either the development or production stage.

|

|

Fault

|

A break in the continuity of a body of rock. It is accompanied by a movement on one side of the break or the other so that what were once parts of one continuous rock stratum or vein are now separated. The amount of displacement of the parts may range from a few inches to thousands of feet.

|

|

Feldspathic

|

Said of a rock or other mineral aggregate containing feldspar.

|

|

A curve or bend of a planar structure such as rock strata, bedding planes, foliation, or cleavage

|

|

|

Foliation

|

A general term for a planar arrangement of textural or structural features in any type of rock; esp., the planar structure that results from flattening of the constituent grains of a metamorphic rock.

|

|

Formation

|

A distinct layer of sedimentary rock of similar composition.

|

|

Geochemistry

|

The study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere.

|

|

Gneiss

|

A foliated rock formed by regional metamorphism, in which bands or lens-shaped strata or bodies of rock of granular minerals alternate with bands or lens-shaped strata or bodies or rock in which minerals having flaky or elongate prismatic habits predominate.

|

|

Intrusions

|

Masses of igneous rock that, while molten, were forced into or between other rocks.

|

|

Mantle

|

The zone of the Earth below the crust and above the core.

|

|

Mapped or

Geological

|

The recording of geologic information such as the distribution and nature of rock

|

5

|

Mapping

|

Units and the occurrence of structural features, mineral deposits, and fossil localities.

|

|

A naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristic crystal form.

|

|

|

Mineralization

|

A natural occurrence in rocks or soil of one or more metal yielding minerals.

|

|

Mining

|

Mining is the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized.

|

|

Outcrop

|

That part of a geologic formation or structure that appears at the surface of the earth.

|

|

Plagioclase

|

Any of a group of feldspars containing a mixture of sodium and calcium feldspars, distinguished by their extinction angles.

|

|

Probable

Reserve

|

The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

|

|

Pre-exploration stage

|

A pre-exploration stage company is one that has not yet begun a formal exploration program.

|

|

Production

Stage

|

A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

|

|

The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined.

|

|

|

Sedimentary

|

Formed by the deposition of sediment.

|

|

Vein

|

A thin, sheet like crosscutting body of hydrothermal mineralization, principally quartz.

|

The New Dawn Property is located within a fault-bounded wedge of upper plate Paleozoic rocks within the Tuscarora volcanic field, which is an Eocene complex covering approximately 300 square miles and located north of the Carlin trend (in the southern Tuscarora Mountains) and west of the Jerritt Canyon (in the Independence Mountains). The New Dawn property contains part of an alteration zone associated with a nearby altered and locally mineralized Eocene dike. The limited data available indicates that this alteration zone in the lowermost unit of upper plate Paleozoic sediments contains anomalous values in gold and silver with locally high concentrations of arsenic and antimony. No resources have thus far been defined on the property.

The New Dawn property area is in the southwest corner of the Tuscarora mining district. No mineralization or metallic constituents on the property are known to have been reported. A description of the rock formations on the property can be found below under “Local and Property Geology”. The target concept for the New Dawn property is that alteration in upper plate Paleozoic sediments, locally associated with an Eocene porphyritic dike and with epithermal gold-arsenic dominated, Eocene-aged, precious metal mineralization, may represent the top of a mineralizing hydrothermal plume that had the potential to form a high-grade Carlin-type (e.g. Meikle) deposit within lower plate sediments at depth. It is believe that geologic, structural, stratigraphic, geochemical and geophysical studies at the New Dawn property may define such a target at a depth of 2,500 feet.

6

We intend to implement a two-phase work program on the property, with the second phase being contingent upon the successful completion of the first phase. It is believed that the proposed exploration program offers an opportunity to discover new Carlin-type mineralization beneath upper plate Paleozoic sediments on this property.

Phase 1 will focus on defining mineralized outflow structures with strong Au-As geochemical signatures, delineating permissive Paleozoic sedimentary units and structures, and targeting Carlin-type mineralization at a reasonable depth for drilling.

Phase 2 will drill test favorable targets.

The combined estimated expenditures of Phase 1 on the property are US $100,000; and for Phase 2 US $200,000, for a total expenditure of US $300,000.

We are a pre-exploration stage company and we cannot provide assurance to investors that our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is conducted and an evaluation by a professional geologist of the program concludes economic feasibility.

We currently do not have any distribution methods as we have not yet proven the existance of gold or other precious metals on the New Dawn Property. We have not announced any new products or services, we are not dependent on any raw materrials, we are not dependant on any customers and we do not have any patents, trademarks, licenses, franchises, concessions, royalty agreements, except for the mining lease agreement described in “Item 2. PROPERTIES” below.

COMPETITIVE FACTORS

The mining industry, in general, is intensely competitive and there is not any assurance that even if commercial quantities of ore are discovered, a ready market will exist for sale of same. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Braeden not receiving an adequate return on invested capital.

We will be required to conduct all mineral exploration activities in accordance with applicable regulations. Such operations are subject to various laws governing land use, the protection of the environment, production, taxes, labor standards, occupational health, waste disposal, toxic substances, well safety and other matters. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact and cause increases in capital expenditures which could result in a cessation of operations.

RESEARCH AND DEVELOPMENT

We have not spent any money or research and development since inception.

7

ENVIRONMENTAL LAWS

We will also have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our Phase 1 and 2 programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended two phases described above. Because there is presently no information on the size, tenure, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

EMPLOYEES

At present, we have no employees. We anticipate that we will be conducting most of our business through agreements with consultants and third parties.

AVAILABLE INFORMATION

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Such reports, proxy statements and other information may be inspected at the public reference room of the SEC at 100 F Street, N.E., Washington D.C. 20549. Copies of such material can be obtained from the facility at prescribed rates. Please call the SEC toll free at 1-800-SEC-0330 for information about its public reference room. Because we file documents electronically with the SEC, you may also obtain this information by visiting the SEC’s Internet website at http://www.sec.gov.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. IN ADDITION TO THE OTHER INFORMATION CONTAINED IN THIS ANNUAL REPORT, PROSPECTIVE PURCHASERS OF OUR SECURITIES SHOULD CONSIDER CAREFULLY THE FOLLOWING FACTORS IN EVALUATING US AND OUR BUSINESS.

IF ANY OF THE FOLLOWING RISKS OCCUR, OUR BUSINESS, OPERATING RESULTS AND FINANCIAL CONDITION COULD BE SERIOUSLY HARMED. THE RISKS AND UNCERTAINTIES DESCRIBED BELOW ARE NOT THE ONLY ONES WE FACE. ADDITIONAL RISKS AND UNCERTAINTIES, INCLUDING THOSE THAT WE DO NOT KNOW ABOUT OR THAT WE CURRENTLY DEEM IMMATERIAL, ALSO MAY ADVERSELY AFFECT OUR BUSINESS. THE TRADING PRICE OF OUR SHARES OF COMMON STOCK COULD DECLINE DUE TO ANY OF THESE RISKS, AND YOU MAY LOSE ALL OR PART OF YOUR INVESTMENT.

OUR SECURITIES ARE SPECULATIVE BY NATURE AND INVOLVE AN EXTREMELY HIGH DEGREE OF RISK AND SHOULD BE PURCHASED ONLY BY PERSONS WHO CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. WE ALSO CAUTION PROSPECTIVE INVESTORS THAT THE FOLLOWING RISK FACTORS, COULD CAUSE OUR ACTUAL FUTURE OPERATING RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED IN ANY FORWARD LOOKING STATEMENTS, ORAL OR WRITTEN, MADE BY OR ON BEHALF OF US. IN ASSESSING THESE RISKS, WE SUGGEST THAT YOU ALSO REFER TO OTHER INFORMATION CONTAINED IN THIS ANNUAL REPORT, INCLUDING OUR FINANCIAL STATEMENTS AND RELATED NOTES.

8

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our financial statements have been prepared assuming that we will continue as a going concern. The general business strategy of the Company is to explore and research existing mineral properties and to potentially acquire further claims either directly or through the acquisition of operating entities. The continued operations of the Company depends upon the recoverability of mineral property reserves, confirmation of the Company’s interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the development of these claims and upon the future profitable production of the claims. There continues to be insufficient funds to provide enough working capital to fund ongoing operations for the next twelve months, which could result in losing our mining rights. Management intends to raise additional capital through share issuances to finance its exploration on the New Dawn Property, although there can be no assurance that management will be successful in these efforts.

RISKS RELATED TO US AND OUR INDUSTRY

WE HAVE NEVER EARNED A PROFIT AND THERE IS NO GUARANTEE THAT WE WILL EVER EARN A PROFIT.

From our inception on August 11, 2008 to the period ended on December 31, 2012, we have not generated any revenue. We do not currently have any revenue producing operations. We are not currently operating profitably, and it should be anticipated that we will operate at a loss at least until such time when the production stage is achieved, if production is, in fact, ever achieved.

WE WERE RECENTLY FORMED, AND WE HAVE NOT PROVEN THAT WE CAN GENERATE A PROFIT. IF WE FAIL TO GENERATE INCOME AND ACHIEVE PROFITABILITY, AN INVESTMENT IN OUR SECURITIES MAY BE WORTHLESS.

We have no operating history and have not proved we can operate successfully. We face all of the risks inherent in a new business. If we fail, your investment in our common stock will become worthless. From inception on August 11, 2008 to the period ended on December 31, 2012, we incurred a net loss of $102,145 and did not earn any revenue. We do not currently have any revenue producing operations. The purchase of the securities offered hereby must therefore be regarded as the placing of funds at a high risk in a new or "start-up" venture with all the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject.

WE HAVE NO OPERATING HISTORY. THERE CAN BE NO ASSURANCE THAT WE WILL BE SUCCESSFUL IN OUR GOLD OR OTHER MINERAL EXPLORATION ACTIVITIES.

We have no history of operations. As a result of our brief operating history, there can be no assurance that that we will be successful exploring for gold or other minerals. Our success to date in entering into ventures to acquire interests in exploration blocks is not indicative that we will be successful in entering into any further ventures. Any future significant growth in our mineral exploration activities will place additional demands on our Executive Officer, and any increased scope of our operations will present challenges due to our current limited management resources. Our future performance will depend upon our management and their ability to locate and negotiate additional exploration opportunities in which we can participate. There can be no assurance that we will be successful in these efforts. Our inability to locate additional opportunities, to hire additional management and other personnel, or to enhance our management systems, could have a material adverse effect on our results of operations. There can be no assurance that our operations will be profitable.

THERE IS A HIGH RISK OUR BUSINESS WILL FAIL BECAUSE NONE OF OUR OFFICERS AND DIRECTORS, HAVE FORMAL TRAINING SPECIFIC TO THE TECHNICALITIES OF MINERAL EXPLORATION.

None of our Officers or Directors has formal training as a geologist or in the technical aspects of management of a mineral exploration company. They lack technical training and experience with exploring for, starting, and operating a mine. With no direct training or experience in these areas, they may not be fully aware of the specific requirements related to working within this industry. Their decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

9

WE ARE CONTROLLED BY OUR EXECUTIVE OFFICERS AND DIRECTORS, AND, AS SUCH, YOU MAY HAVE NO EFFECTIVE VOICE IN OUR MANAGEMENT.

Two (2) members of our Board of Directors, Mr. Braulio Vasquez and Mr. Hilario Vanegas Guiterrez, beneficially own 50% of our issued and outstanding common stock. Our directors therefore exercise control over all matters requiring shareholder approval, including the possible election of additional directors and approval of significant corporate transactions.

WE ARE SOLELY GOVERNED BY MESSRS. ERICKSON, VASQUEZ AND GUITERREZ OUR ONLY EXECUTIVE OFFICERS AND DIRECTORS, AND, AS SUCH, THERE MAY BE SIGNIFICANT RISK TO US FROM A CORPORATE GOVERNANCE PERSPECTIVE.

Ronald Erickson is our only Executive Officer. Mr. Erickson, along with Messrs. B. Alejandro Vasquez and Hilario Vanegas Guiterrez are the only members of our Board of Directors, and will be relied upon to make decisions such as the approval of related party transactions, the compensation of Executive Officers, and the oversight of the accounting function. Because we only have one (1) Executive Officer, there may be limited segregation of executive duties, and thus, there may not be effective disclosure and accounting controls to comply with applicable laws and regulations, which could result in fines, penalties and assessments against us. In addition, Messrs. Erickson, Vasquez and Guiterrez will exercise full control over all matters that require the approval of a Board of Directors.

Messrs. Erickson, Vasquez and Guiterrez exercise control over all matters requiring shareholder approval including the election of directors and the approval of significant corporate transactions. We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against the transactions implemented by Messrs. Erickson, Vasquez and Guiterrez, conflicts of interest and similar matters. But

We have not adopted corporate governance measures such as an audit or other independent committees as we presently do not have any independent directors. Shareholders should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

BECAUSE OUR EXECUTIVE OFFICER HAS OTHER BUSINESS INTERESTS, HE MAY NOT BE ABLE OR WILLING TO DEVOTE A SUFFICIENT AMOUNT OF TIME TO OUR BUSINESS OPERATIONS, WHICH MAY CAUSE OUR BUSINESS TO FAIL.

It is possible that the demands on Mr. Erickson, our sole Executive Officer, from other obligations could increase with the result that he would no longer be able to devote sufficient time to the management of our business. In addition, Mr. Erickson may not possess sufficient time to manage our business if the demands of managing our business increased substantially. Until we commence development of the New Dawn Property, Mr. Erickson will only devote such number of hours to our company as is necessary which is no more then 5-8 hours per week. After that point, if development does occur, Mr. Erickson will be able to commit up to 30 hours per week to our company.

WE ARE SENSITIVE TO FLUCTUATIONS IN THE PRICE OF GOLD AND OTHER MINERALS, WHICH IS BEYOND OUR CONTROL. THE PRICE OF GOLD AND OTHER MINERALS IS VOLATILE AND PRICE CHANGES ARE BEYOND OUR CONTROL.

The price of gold and other minerals can fluctuate. The prices of gold and other minerals have been and will continue to be affected by numerous factors beyond our control. Factors that affect the price of gold and other minerals include the demand from consumers for products that use gold and other minerals, economic conditions, over supply from secondary sources and costs of production. Price volatility and downward price pressure, which can lead to lower prices, could have a material adverse effect on the costs or the viability of our projects.

10

MINERAL EXPLORATION AND PROSPECTING IS HIGHLY COMPETITIVE AND SPECULATIVE BUSINESS AND WE MAY NOT BE SUCCESSFUL IN SEEKING AVAILABLE OPPORTUNITIES.

The process of mineral exploration and prospecting is a highly competitive and speculative business. In seeking available opportunities, we will compete with a number of other companies, including established, multi-national companies that have more experience and resources than us. We compete with other exploration companies looking for gold and other mineral deposits. Because we may not have the financial and managerial resources to compete with other companies, we may not be successful in our efforts to acquire projects of value, which, ultimately, become productive. However, while we compete with other exploration companies, there is no competition for the exploration or removal of mineral from our claims.

COMPLIANCE WITH ENVIRONMENTAL CONSIDERATIONS AND PERMITTING COULD HAVE A MATERIAL ADVERSE EFFECT ON THE COSTS OR THE VIABILITY OF OUR PROJECTS. THE HISTORICAL TREND TOWARD STRICTER ENVIRONMENTAL REGULATION MAY CONTINUE, AND, AS SUCH, REPRESENTS AN UNKNOWN FACTOR IN OUR PLANNING PROCESSES.

All mining is regulated by the government agencies. Compliance with such regulation has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been related to obtaining licenses and permits from government agencies before the commencement of mining activities. An environmental impact study that must be obtained on each property in order to obtain governmental approval to mine on the properties is also a part of the overall operating costs of a mining company.

The possibility of more stringent regulations exists in the areas of worker health and safety, the dispositions of wastes, the decommissioning and reclamation of mining and milling sites and other environmental matters, each of which could have an adverse material effect on the costs or the viability of a particular project. Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects.

MINING AND EXPLORATION ACTIVITIES ARE SUBJECT TO EXTENSIVE GOVERNMENTAL REGULATION. FUTURE CHANGES IN GOVERNMENTS, REGULATIONS AND POLICIES, COULD ADVERSELY AFFECT OUR RESULTS OF OPERATIONS FOR A PARTICULAR PERIOD AND OUR LONG-TERM BUSINESS PROSPECTS.

Mining and exploration activities are subject to extensive regulation by government. Such regulation relates to production, development, exploration, exports, taxes and royalties, labor standards, occupational health, waste disposal, protection and remediation of the environment, mine and mill reclamation, mine and mill safety, toxic substances and other matters. Compliance with such laws and regulations has increased the costs of exploring, drilling, developing, constructing, operating mines and other facilities. Furthermore, future changes in governments, regulations and policies, could adversely affect our results of operations in a particular period and our long-term business prospects.

The development of mines and related facilities is contingent upon governmental approvals, which are complex and time consuming to obtain and which, depending upon the location of the project, involve various governmental agencies. The duration and success of such approvals are subject to many variables outside our control.

11

RISKS RELATED TO OUR FINANCIAL CONDITION AND BUSINESS MODEL

WE HAVE NOT PAID ANY CASH DIVIDENDS ON OUR SHARES OF COMMON STOCK AND DO NOT ANTICIPATE PAYING ANY SUCH DIVIDENDS IN THE FORESEEABLE FUTURE.

Payment of future dividends, if any, will depend on our earnings and capital requirements, our debt facilities and other factors considered appropriate by our Board of Directors. To date, we have not paid any cash dividends on our Common Stock and do not anticipate paying any such dividends in the foreseeable future.

WE DO NOT HAVE ANY AGREEMENTS WITH OUR LENDERS TO CONTINUE TO ADVANCE FUNDS.

We have received a total of $83,428 in advances from third parties. We do not have any agreeemnts with these third parties for additional advances. Therefore our sole source of financing could elect to stop making advances to us at any time.

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL FAIL.

We will need to obtain additional financing in order to complete our business plan. We currently do not have any operations and we have no income. We do not have any arrangements for financing and we may not be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including investor acceptance of mineral claims and investor sentiment. These factors may adversely affect the timing, amount, terms, or conditions of any financing that we may obtain or make any additional financing unavailable to us.

IF WE DO NOT OBTAIN ADDITIONAL FINANCING WE COULD LOSE OUR MINING RIGHTS

Our rights to explore and mine on the New Dawn Property is subject to the mining lease agreement we entered into with Altair Minerals Inc. Such agreement requires that we make semi-annual payments of $2,500 to Altair Minerals. If we do not obtain sufficient financing to make these payments, we will be in breach of the mining lease agreement and could lose our rights to explore and develop the New Dawn Property, which constitutes our only mining rights.

BECAUSE OF OUR LIMITED RESOURCES AND THE SPECULATIVE NATURE OF OUR BUSINESS, THERE IS A SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE AS A GOING CONCERN.

The report of our independent auditors, on our audited financial statements for the period ended December 31, 2012, indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Our continued operations are dependent on our ability to obtain financing and upon our ability to achieve future profitable operations from the development of our mineral properties. If we are not able to continue as a going concern, it is likely investors will lose their investment.

12

RISKS RELATED TO OUR STOCK

IF WE COMPLETE A FINANCING THROUGH THE SALE OF ADDITIONAL SHARES OF OUR COMMON STOCK IN THE FUTURE, THEN SHAREHOLDERS WILL EXPERIENCE DILUTION.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders. This means that if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

THERE IS NO MARKET FOR OUR COMMON STOCK, WHICH LIMITS OUR SHAREHOLDERS' ABILITY TO RESELL THEIR SHARES OR PLEDGE THEM AS COLLATERAL.

There is currently no public market for our shares, and we cannot assure you that a market for our stock will develop. Consequently, investors may not be able to use their shares for collateral or for loans and may not be able to liquidate at a suitable price in the event of an emergency. In addition, investors may not be able to resell their shares at or above the price they paid for them or may not be able to sell their shares at all.

IF A PUBLIC MARKET FOR OUR STOCK IS DEVELOPED, FUTURE SALES OF SHARES COULD NEGATIVELY AFFECT THE MARKET PRICE OF OUR COMMON STOCK.

If a public market for our stock is developed, then sales of Common Stock in the public market could adversely affect the market price of our Common Stock. There are at present 30,000,000 shares of Common Stock issued and outstanding.

OUR STOCK IS A PENNY STOCK. TRADING OF OUR STOCK MAY BE RESTRICTED BY THE SEC'S PENNY STOCK REGULATIONS AND THE NASD’S SALES PRACTICE REQUIREMENTS, WHICH MAY LIMIT A STOCKHOLDER'S ABILITY TO BUY AND SELL OUR STOCK.

Our common shares may be deemed to be “penny stock” as that term is defined in Regulation Section “240.3a51 -1” of the Securities and Exchange Commission (the “SEC”). Penny stocks are stocks: (a) with a price of less than U.S. $5.00 per share; (b) that are not traded on a “recognized” national exchange; (c) whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ - where listed stocks must still meet requirement (a) above); or (d) in issuers with net tangible assets of less than U.S. $2,000,000 (if the issuer has been in continuous operation for at least three (3) years) or U.S. $5,000,000 (if in continuous operation for less than three (3) years), or with average revenues of less than U.S. $6,000,000 for the last three (3) years.

Section “15(g)” of the United States Securities Exchange Act of 1934, as amended, and Regulation Section “240.15g(c)2” of the SEC require broker dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor’s account. Potential investors in our common shares are urged to obtain and read such disclosure carefully before purchasing any common shares that are deemed to be “penny stock”.

13

Moreover, Regulation Section “240.15g -9” of the SEC requires broker dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to: (a) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (b) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (c) provide the investor with a written statement setting forth the basis on which the broker dealer made the determination in (ii) above; and (d) receive a signed and dated copy of such statement from the investor confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult for investors in our common shares to resell their common shares to third parties or to otherwise dispose of them. Stockholders should be aware that, according to Securities and Exchange Commission Release No. 34-29093, dated April 17, 1991, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

(i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

(ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

(iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons;

(iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and

(v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses.

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Introduction

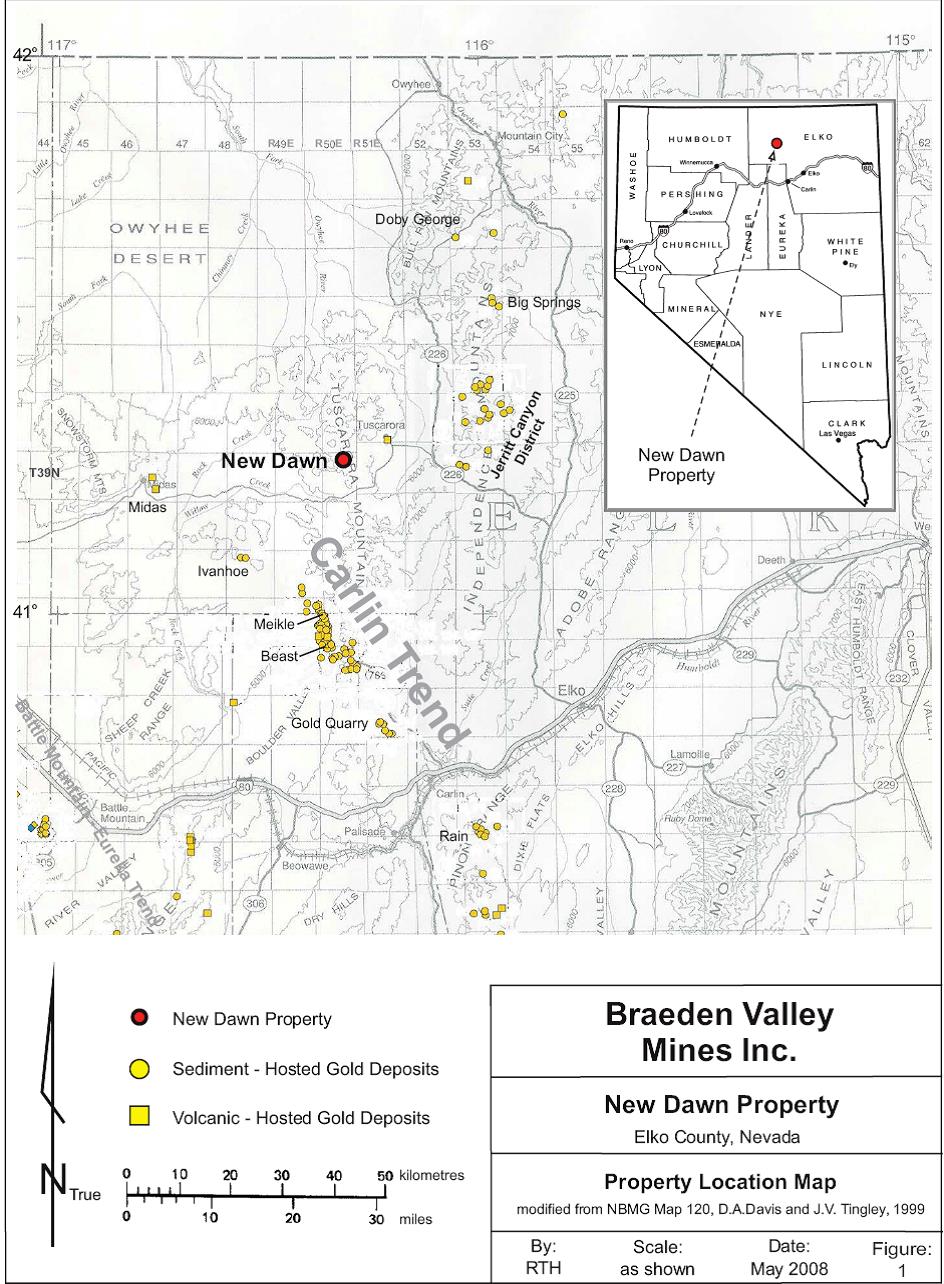

The New Dawn property is a gold prospect located in the northern Tuscarora Mountains in Elko County, Nevada, at the southwest edge of the Tuscarora mining district, approximately 45 miles northwest of the town of Elko. On August 11, 2008, we entered into a lease agreement with Altair Minerals, Inc. to explore and, if warranted, develop the New Dawn property. Altair Minerals, Inc. owns the four claims comprising the New Dawn property. The terms of this lease agreement provide for annual property payments, payment and recordation of annual maintenance fees to the Bureau of Land Management and to Elko County, and net smelter return royalties. The recommendations contained herein are for a two-stage exploration program to define, and then test prospective areas of alteration and gold mineralization. Our officers and directors have not visited the New Dawn Property. We have relied on the findings of the geological report prepared for the Company concerning this property. We believe that this is standard procedure in the mining industry.

14

Pursuant to a mining lease agreement dated August 11, 2008, with Altair Minerals, Inc. for the mining rights to the New Dawn Property, we were required to make the following advanced royalty payments :

i. $5,000 upon the execution of the agreement, to hold the property for one year from the effective date;

ii. $10,000 due on the first anniversary of the agreement;

iii. $15,000 due on the second anniversary of the agreement;

iv. $25,000 on the third anniversary of the agreement; and

v. $25,000 on each subsequent anniversary of the agreement.

We paid the $5,000 advanced royalty payment due upon execution of the agreement but we did not have the necessary funds to make the $10,000 advanced royalty payment on the first anniversary of the agreement. We were able to enter into a series of amendments to the lease whereby we made reduced payments and the term of the lease was extended for an additional six months from the time of the payment. As a result, the following advanced royalty payments replaced the amounts due under the original agreement, and the lease was extended as follows;

| Date | Payment Amount | Extended Term Date | |

| May 15, 2009 | $5,000 | November 15, 2009 | |

| May 13, 2010 | $2,500 | November 15, 2010 | |

| November 19, 2010 | $2,500 | May 15, 2011 | |

| May 12, 2011 | $2,500 | November 15, 2011 | |

| October 21, 2011 | $2,500 | May 15, 2012 | |

| May 4, 2012 | $2,500 | November 15, 2012 | |

If we fail to reach an agreement with the owner of the property before May 15, 2013, we could lose our rights to explore the mining property.

Upon commencing of production of minerals, we are obligated to pay a royalty on production to the landowner equal to 4% of net smelter returns. We have the right to purchase up to 2 of the 4 royalty points, by paying Altair $1,000,000 for the first royalty percentage point, and $2,000,000 for the second royalty percentage point.

Property Acquisition Details

See above.

15

Property Description and Location

Area and Location

The New Dawn property is located in Elko County, in the Tuscarora Mountains of north-central Nevada, at approximately 41° 17’ North Latitude, 116° 20’ West Longitude. The property is about 45 miles northwest of the town of Elko. Elko is the seat of Elko County and lies on Interstate Highway I-80 about halfway between Reno, Nevada, and the Salt Lake City, Utah. The New Dawn property area is included within the Mt. Blitzen U.S. Geological Survey (1:24,000) 7 ½ minute quadrangle topographic map. The New Dawn property is located in Section 4 of Township 39 North, Range 50 East, Mount Diablo Base and Meridian. The property is comprised of four unpatented lode mining claims, with each claim covering approximately 20 acres. There are no known environmental concerns or parks designated for any area contained within the claims. The property has no encumbrances. As advanced exploration proceeds, there may be bonding requirements for reclamation.

Claims and Title

The New Dawn property is comprised of the following four unpatented lode mining claims:

| CLAIM NAME | BLM Nevada Mining Claim# | Elko County Document # | ||||

| ND 1 | 851630 | 507219 | ||||

| ND 2 | 851631 | 507220 | ||||

| ND3 | 851632 | 507221 | ||||

| ND4 | 851633 | 507222 | ||||

16

17

The claims were staked using a GPS unit (with <10 ft accuracy), but have not been legally surveyed. Public lands in the area of the New Dawn property are administered by the U.S. Department of Interior, Bureau of Land Management (“BLM”), under the Federal Land Policy and Management Act of 1976. All claims are subject to an annual maintenance fee of $125.00 per claim, payable to the BLM and due by noon September 1 of each year. In addition, an annual Notice of Intent to Hold and fee of approximately $8.50 per claim is payable to the Elko County Recorder’s Office.

Based on an examination of Certificates of Location and Notices of Intent to Hold on file at the Elko County Recorder’s Office in Elko, Nevada, and at the BLM Nevada State Office in Reno, Nevada, these ND claims were properly recorded. Their 2009 - 2013 annual maintenance fees have been paid, and the claims are now in good standing until noon September 1, 2013, at which time the 2014 annual maintenance fees are due and payable.

The four unpatented lode mining claims comprising the New Dawn property are registered in the name of and are owned by Altair Minerals, Inc., a privately held Nevada corporation. Braeden Valley Mines Inc. has the right to explore and, if warranted, develop the New Dawn Property under the terms of an existing lease agreement.

Environmental Liabilities

There are no open audits, shafts or deep trenches on the New Dawn Property, and thus no mining or exploration associated safety hazards exist at this time. There are no known prospect pits, and to the best of our knowledge, there are no environmental liabilities known to exist on the New Dawn Property that can be attributed to or become the responsibility of either Altair Minerals, Inc. or Braeden Valley Mines Inc. Any exploration a development project proposed under present conditions will inevitably face environmentally driven hurdles.

Permits

The BLM is responsible for the surface and subsurface mineral estate on federal lands. At the time of this writing, no Notice of Intent to Operate, no Plan of Operation has been filed with the BLM. Permitting for the proposed two phases of work on these properties is not anticipated to cause any problems or serous delays, as all of the planned work would involve physical disturbance of less than five acres or more involve a more stringent permitting process.

Accessibility, Climate, Local Resources, Infrastructure and Topography

From Reno, Nevada, access to the New Dawn property is by Interstate Freeway I-80 east for about 280 miles to Elko (Exit 301 on I-80), then north to paved State Highway 225 for about 26 miles, then northwest on paved State Highway 226, and then turning off to the west onto the county maintained gravel road SSR 18 that heads toward the historic mining town of Tuscarora. After about 6 miles this gravel road turns due south. After heading due south about 1 mile, turn onto a secondary gravel road heading due west for about 4 miles past the Quarter Circle S Ranch and along the north side of McCann Creek. Take the west fork onto a dirt track that heads northwest and then curves to the southwest then southeast, and eventually heads south along a ridge top, passing through the New Dawn property after about 2.5 miles.

The climate in this part of Nevada is typical of the high desert country of the American southwest, with hot summers, cold winters and generally dry conditions. Temperature variations recorded for the area extend from a minimum of -40° F to a maximum of 108° F, with average temperatures of 16° F in winter and 84° F in summer (Western Regional Climate Center). This is semi-arid desert, with an average annual precipitation of 12.5 inches. Heavy snowfall can be expected in the higher ranges, but the climate should not be an impediment to mining, especially if the operations were underground. Mining at open pits elsewhere in Nevada, in roughly similar conditions, is continued year round. Physical exploration work could be conducted on the New Dawn property year round, except during early spring when the frozen ground is melting and the unimproved dirt roads become muddy and difficult to travel.

18

Vegetation in this part of Nevada is generally confined to grasses and sagebrush, with local stands of willows, trembling aspen and some cottonwoods in valley bottoms, and local areas with dwarf juniper and pines. The property area includes summer grazing leases for cattle from local ranches. Most of the access roads are officially designated as ranch access roads, meaning that there are few restrictions on their use. But it is imperative to respect ranchers’ rights, especially, to keep gates closed where requested to do so.

Water is relatively short supply, however there is probably sufficient water in McCann Creek for drilling, although it may be necessary to truck water if a diamond drill is employed. Grid electrical power is not available on the New Dawn property, although it does extend to the Quarter Circle S Ranch about 4 miles to the east.

The New Dawn property is in moderately steep terrain, on a north-south trending ridge of the northern Tuscarora Mountains, with Mount Blitzen (el. 8130 ft) located about five miles to the northeast. The north-south trending ridge is between the headwaters of Berry and Lewis Creeks. Within the New Dawn property, elevations range from 7480 ft at the ridge top, sloping down to 6920 ft in the eastern gullies draining into Berry Creek, and sloping down to 7200 ft in the western gullies draining into Lewis Creek. Further to the east, Berry Creek joins McCann Creek, which eventually joins the South Fork of the Owyhee River. Further to the west, Lewis Creek joins other creeks that eventually drain into the Humboldt River.

Elko is located on the Humboldt River, which has I-80 and a transcontinental railway along its course through northern Nevada. Elko is the county seat, and has a regional airport with helicopter services available. Numerous drilling companies operate out of Elko. And in general, Elko is the service centre for large mining operations in the Carlin trend and the Jerritt Canyon district. Given all the mining activity in the Elko region, it is anticipated that sufficient infrastructure and manpower would be available locally to support a mining operation at the New Dawn property.

Geological Setting

Regional Geology

The hilly terrains and the middle level plain contain crystalline hard rocks such as charnockites, granite gneiss, khondalites, leptynites, metamorphic gneisses with detached occurrences of crystalline limestone, iron ore, quartzo-feldspathic veins and basic intrusives such as dolerites and anorthosites. Coastal zones contain sedimentary limestones, clay, laterites, heavy mineral sands and silica sands. The hill ranges are sporadically capped with laterites and bauxites of residual nature. Gypsum and phosphatic nodules occur as sedimentary veins in rocks of the cretaceous age. Gypsum of secondary replacement occurs in some of the areas adjoining the foot hills of the Western Ghats. Lignite occurs as sedimentary beds of tertiary age. The Black Granite and other hard rocks are amenable for high polish. These granites occur in most of the districts except the coastal area.

As described by Teal and Jackson (2002), Bonham (1986), Roberts (1986), and others, regional stratigraphic and isotopic data indicate that during the Cambrian through Early Mississippian, most of eastern Nevada was situated along a stable paleo-continental margin. During this period, a westward-thickening and deepening wedge of sediments was deposited across the paleo-continental shelf and oceanic basin. The sedimentary facies of this Cordilleran geosynclines graded from eastern shallow water (miogeoclinal) carbonates, to deep water (eugeoclinal) fine-grained siliciclastics.

During the Late Devonian through Middle Mississippian, tectonic activity associated with the Antier orogeny resulted in large-scale uplift, folding and thrusting of the eugeoclinical siliceous rocks eastward over the miogenoclinal carbonate rocks, along the Roberts Mountain thrust fault system. The leading edge of the overriding thrust plate formed the emergent Antler highland, from which coarse siliceous clastic sediment eroding from the upper-plate was she eastward into the adjacent foreland basin.

Local terminology refers to three major Palaeozoic tectonostratigraphic rocks sequences: the eastern or carbonate autochthonous assemblage (PzZc), i.e., the lower plate rocks characterized by limestone and dolomite, with minor shale and quaztzite: the western or siliceous allochthonous assemblage (IPzs), i.e., the upper plate rocks characterized by chert and dark shale, with grey quartzite, greywacke, and minor mafic volcanic and limestone; and the overlap assemblage (uPzc), i.e., the foreland basin rocks characterized by coarser clastic flysch.

Teritiary rocks in northern Nevada include volcanic rocks ranging from silicic tuffs to basalt flows. Silicic tuffs predominate in the older, mid-Eocene to mid-Miocene. Teritiary volcanic (Tvl). The New Dawn property is located within a fault-bounced wedge of Palaeozoic IPzs rocks, within the Eocene Tuscarora volcanic field, which is included in Tvl. The Tuscarora volcanic field consists of andesitic to rhyolitic tuffs and flows that erupted from several volcanic centres; these igneous rocks intruded and locally covered sequences of upper and lower plate Palaeozoic sediments.

19

Local and Property Geology

Three of the regional rock units outcrop in the immediate vicinity of the New Dawn property: 1) upper plate Palaeozoic rocks IPzs; 2) Tertiary volcanic Tvl; and 3) contemporaneous and younger dikes TMzi. In addition, there are unconsolidated 4) Quaternary surficial deposits Qa. As mapped by Henry and Boden (1998), these regional units are locally subdivided and described as follows:

1) The Palaeozoic (Ordovician – Devonian) rocks are locally distinguished into a siltstone-dominated assemblage Pzs and a chert-dominated assemblage Pzc. These rocks outcrop as a fault-bounded wedge in the Tuscarora volcanic field. These are the rocks exposed at the New Dawn property, where they are strongly deformed, with folds and thrusts striking east-northeast and mostly dipping northwest.

2) In the area of the New Dawn property, the Tertiary (Eocene) volcanic are lavas, tuffs and volcaniclastic sediments of the Pleasant Valley volcanic complex, part of the Tuscarora volcanic field. Local sources for these volcanic rocks include a probable psyclastic vent located in the upper part of Pleasant Valley volcanic complex, part of the Tuscarora volcanic field.

The rock unit exposed within the boundaries of the New Dawn property is Pzs, which includes Paleozoic petroliferous (oil-bearing) carbonate (limestone) sediments interpreted as being the lowermost unit of the upper plate rocks which are immediately above the Roberts Mountain thrust. It is the immediately underlying lower plate Palaeozoic petrliferous carbonate sediments that host most of the Carlin-type deposits of the Carlin trend.

Moreover, many of these deposits are associated with altered and locally mineralized Eocene porphyritic dikes.

Alteration can be observed on the New Dawn property in a northeast trending zone associated with the porphyritic rhyolite dike that outcrops less than 1000ft to the north. This alteration zone crosses with the ridge between the headwaters of Lewis and Berry Creeks and is approximately 8000 ft long and 1500 ft wide, and it is recognizable on Land Sat Thermatic Mapper images.

As described by Henry and Boden (1998, p. 18 and p. 20)

“Quartz-barite veins occur along northeast-striking faults in the ridge between the headwaters of Lewis and Berry Creeks. Struhsacker (1992) reported that one vein lies in the footwall of a 65-85 degree northwest-dipping, finely porphyritic rhyolite dike (Tmrf) that cuts the Palaeozoic rocks. The dike is bleached and mildly argillized, and the vein contains as much as 2 ppm Au and 200 ppm Ag long with high As and Sb (Struhsacker, 1992).”

“Stuhsacker, E.M., 1992, Tuscarora project, Elko County, Nevada: Prospect Summaries: Unpublished Consulting Report for Corona Gold, 21 p. plus figures and plates.”

This mineralization is indicative of an epithermal system, which may represent the top of a hydrothermal plume of mineralizing fluids. However, at this point in time there is no indication of metallic constituents on the New Dawn property.

20

Deposit Types

The deposit being sought at the New Dawn property is a Carlin-type gold deposit, and especially a Meikle-type deposit, i.e., deep, higher grade, structurally controlled, and dike associated, hosted in underlying lower plate Palaeozoic sediments. This is a blind target, whose surface expression is believed to be the alteration halo in the Palaeozoic rocks of the New Dawn property. These rocks are the lowermost unit of the upper plate, and their alteration at the New Dawn property is associated with an altered and locally mineralized Eocene porphyritic rhyolite dike that outcrops to the north of the property.

Carlin-type gold deposits are among the most important being mined at present anywhere in the world. These are sedimentary rock-hosted, disseminated gold deposits, with high Au/Ag ratios, that occur mainly in moderately folded silty carbonate host rocks; the adjacent faults are sometimes intruded by Eocene porphyritic dikes, that are sericitically altered or silicified (Ressel, et al., 2000a). Total production from the Carlin trend, since the original mine began operation in 1964, has now exceeded 60 million troy ounces. Clearly, these deposits are worthwhile and attractive targets.

The contour map of district gold endowment and regional structures of northern Nevada suggests that the most prospective area for finding such blind targets would be north of the Carlin District, e,g, the Tuscarora district. The Tuscarora district contains the New Dawn property in a fault-bounded wedge of the lowermost upper plate Palaeozoic sediments, thus the underlying prospective lower plate rocks are within reasonable distance from the surface (<2,500 ft) at the New Dawn property.

Exploration

Apart from reviewing the available scientific literature, to date Braeden Valley Mines Inc. has not carried out any exploration work on these the New Dawn property, nor on any adjacent or other properties within the district.

Drilling Summary

We have not carried out any drilling on the property, nor on adjacent properties.

Sampling Method, Sample Preparation and Data Verification

During examination of the New Dawn property, several rock specimens from altered outcrop were collected. These specimens were collected for comparison purposes and to characterize the altered rocks.

No samples were collected from the New Dawn property for assaying.

Mineral Processing and Metallurgical Testing

No metallurgical test work has been conducted on the property by us.

Mineral Resource Estimate

There are at present no mineral resources defined on the New Dawn property.

21

Other Relevant Data and Information

There are at present no plans for production from the subject property. All work contemplated at this time is purely of an exploration nature.

The initial stage of the proposed exploration work on the New Dawn property is largely of a preliminary nature, involving geological, structural and alteration mapping, geochemistry and geophysics. Where appropriate, reverse circulation and/or core drilling would follow such work.

Interpretation and Conclusions

The target concept the New Dawn property is as follows: Alteration in upper plate Paleozoic sediments, locally associated with an Eocene porphyritic dike and with epithermal gold-arsenic dominated, Eocene-aged, precious metal mineralization , may represent the top of a mineralizing hydrothermal plume that had the potential to form a high-grade Carlin-type (e.g. Meikle) deposit within lower plate sediments at depth.

Recommendations

The objective is to define a deep drilling target that may lead to the discovery of Carlin-type gold mineralization hosted in lower plate Palaeozoic sediments. It is believed that geologic, structural, stratigraphic, geochemical and geophysical studies at the New Dawn property may define such a target at a depth of 2,500 feet. We believe the property is of sufficient merit to warrant the exploration work recommended herein. We intend to conduct exploration work on this property in two phases, with advancement to the second phase only upon successful completion of the first.

PHASE 1

1. If possible, obtain the data collected during previous exploration campaigns from their respective operators. Establish the provenance of this data, verify it, and if suitable, digitize and transfer all available exploration data onto a base map.

2. Carry out lithologic, structural, and alteration mapping with particular focus on the Eocene rhyolite dike and the adjacent Palaeozoic rocks.

3. Carry out geochemical soil and rock-chip sampling. Analyses should include gold, its pathfinder elements (As, Sb, Hg, Tl), and elements associated with oilfield/basin brines (i.e., B, Br, F, l, Pb, Zn, V).

4. Conduct a CSAMT (Controlled Source Audio-frequency Magneto Tellurics) geophysical survey along profiles across the entire property, and if possible, on the newly staked claims.

5. Review results of Phase 1 work, and, if warranted, select and prioritize targets for drilling.

Contingent on a review of the results of Phase 1 and approval by an independent qualified person, the project should continue to Phase 2.

PHASE 2

1. Drill targets identified by the Phase 1 work.

2. Sample and assay all drill core or cuttings obtained from altered rocks (both Palaeozoic and Eocene).

3. Review results of Phase 2 work, and, where warranted, select targets for further drilling.

22

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business. As of the filing date of this Form 10-K, there were no pending or threatened lawsuits that could reasonably be expected to have a material effect on the results of our operations. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. MINE SAFETY DISCLOSURES

N/A.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market for Common Equity and Related Stockholder Matters

(a) Market Information

On August 11, 2008, the Company sold 15 million shares of our common stock to each of B. Alejandro Vasquez and Hilario Vanegas Guiterrez for $0.0005 per share. Vasquez and Guiterrez are members of our Board of Directors. These shares were issued pursuant to Section 4(2) of the Securities Act. The 30,000,000 shares of common stock were restricted shares as defined in the Securities Act. These issuances were made to sophisticated investors. As our promoter since our inception, Messrs. Vasquez and Guiterrez are in a position to access the relevant and material information regarding our operations. No underwriters were used.

All of the above noted securities were sold in reliance on Regulation D, Section 504 of the Securities Act of 1933. All shareholders are subject to Rule 144 of the Securities Act of 1933 with respect to resale. We relied on the exemption from registration since we were not subject to the reporting requirements of Section 13 or 15(d) of the Securities Act of 1933, not an investment company, we had a specific business plan at the time we sold the securities, we are not a blank check company, as that term is defined in Rule 419(a)(2) of Regulation C or Rule 504 (a)(3) of Regulation D of the Securities Act of 1933, and the aggregate offering price was less than $1,000,000. All of the subscribers are our directors and/or our executive officers.

(b) Holders

As of April 1, 2013, 30,000,000, shares of common stock are issued and outstanding. There are 32 shareholders of record of our common stock.

Transfer Agent and Registrar

The Transfer Agent for our common stock is Holladay Stock Transfer Co., with an address at 2939 North 67th Place, Scottsdale, AZ 85251. Holladay Stock’s telephone number is 480-481-3940.

Penny Stock Regulations

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealers presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

23

(c) Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our common stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of common stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future. See “Risk Factors.”

(d) Securities authorized for issuance under equity compensation plans

None.

RECENT SALES OF UNREGISTERED SECURITIES

None

Use Of Proceeds From Sale Of Registered Securities

Not applicable.

Stock Purchase Warrants

None.

Stock Purchase Options

None.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the notes to those statements included elsewhere in this prospectus. In addition to the historical consolidated financial information, the following discussion and analysis contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under "Risk Factors" and elsewhere in this prospectus.

Our business plan is to proceed with the exploration of the New Dawn Property to determine whether there is a potential for gold or other minerals located on the properties that comprise the mineral claims. We have decided to proceed with the exploration program recommended by the geological report. We anticipate that the two phases of the recommended geological exploration program will cost approximately $100,000 and $200,000. We had $0 in cash reserves as of December 31, 2012. The lack of cash has kept us from conducting any exploration work on the property. Unless and until we obtain adequate financing, we will not be able to execute our business plan.

24

We anticipate that we will incur the following expenses over the twelve (12) month period following commencement of our exploration plans:

|

|

·

|

USD$100,000 in connection with the completion of Phase 1 of our recommended geological work program;

|

| Digitizing data and transfer to base maps | $ 5,000 | |||||

| Lithologic and structural mapping, sampling | $15,000 | |||||

| Geochemical soil and rock chip survey, and analysis | $20,000 | |||||

| Geophysical survey (CSAMT) | $30,000 | |||||

| Independent consultants, supervision, and reports | $10,000 | |||||

| Contingencies | $20,000 | |||||

| Total Phase 1 | $100,000 |

|

|

·

|

USD$200,000 in connection with the completion of Phase 2 of our recommended geological work program; and

|

| Core or Reverse Circulating drilling (5000 ft) | $150,000 | |||||

| Sampling and assays | $10,000 | |||||

| Independent consultants, supervision, and reports | $20,000 | |||||

| Contingencies | $20,000 | |||||

| Total Phase 2 | $200,000 |

|

|

·

|

USD$35,000.00 for operating expenses, including advance minimum royalty payments due to Altair Minerals and professional legal and accounting expenses associated with compliance with the periodic reporting requirements.

|

If we determine not to proceed with further exploration of our mineral claims due to a determination that the results of our initial geological program do not warrant further exploration or due to an inability to finance further exploration, we plan to pursue the acquisition of an interest in other mineral claims. We anticipate that any future acquisition would involve the acquisition of an option to earn an interest in a mineral claim as we anticipate that we would not have sufficient cash to purchase a mineral claim of sufficient merit to warrant exploration. This means that we might offer shares of our stock to obtain an option on a property. Once we obtain an option, we would then pursue finding the funds necessary to explore the mineral claim by one or more of the following means: engaging in an offering of our stock; engaging in borrowing; or locating a joint venture partner or partners.

25

RESULTS OF OPERATIONS

We have not yet earned any revenues. We anticipate that we will not earn revenues until such time as we have entered into commercial production, if any, of our mineral properties. We are presently in the pre-exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such resources are discovered, that we will enter into commercial production of our mineral properties.

LIQUIDITY AND CAPITAL RESOURCES

Fiscal Years 2012 and 2011

Our cash was $0 as of the periods ended on December 31, 2012 and 2011. As of December 31, 2012, we had a negative working in the amount of $87,145, compared to a negative working capital of $61,995 as of December 31, 2011. As of December 31, 2012, our current liabilities consisted of advances of $83,428, accounts payable of $1,686, notes to related party of $1,675 and accrued interest on note payable to related party of $356, compared to as of December 31, 2011, our current liabilities consisted of advances of $59,970, accounts payable of $77, notes payable to related party of $1,675 and accrued interest on note payable to related party of $273. Since our inception on August 11, 2008 to the end of the period on December 31, 2012, we have incurred a loss of $102,145. At December 31, 2012, we had an accumulated deficit of $102,145 and $87,145 in shareholders’ deficit, compared to, as of December 31, 2011, on accumulated deficit of $76,995 and $61,995 in shareholders deficit.

For the year ended December 31, 2012, net cash provided by financing activities was $23,457, which was derived from advances from third parties. For the year ended December 31, 2011, net cash provided by financing activities was $30,588, which was derived from advances from third parties. We do not have financing agreements from these third parties, or any other party. Therefore, future advances from these sources may not be available to us in the future.

For the year ended December 31, 2012, net cash used in the acquisition of the rights under our lease agreement related to the New Dawn Property was $5,000. For the year ended December 31, 2012, net cash used in operating activities was a deficit of $18,457.

For the year ended December 31, 2011, net cash used in the acquisition of the rights under our lease agreement related to the New Dawn Property was $5,000. For the year ended December 31, 2011, net cash used in operating activities was a deficit of $25,588.