Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - Simulations Plus, Inc. | simulations_8k.htm |

| EX-99.1 - PRESS RELEASE - Simulations Plus, Inc. | simulations_8k-ex9901.htm |

Exhibit 99.2

Simulations Plus, Inc. (NASDAQ:SLP) Second Quarter Fiscal Year 2013 Conference Call and Webinar April 10, 2013

With the exception of historical information, the matters discussed in this presentation are forward looking statements that involve a number of risks and uncertainties. The actual results of the Company could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: continuing demand for the Company’s products, competitive factors, the Company’s ability to finance future growth, the Company’s ability to produce and market new products in a timely fashion, the Company’s ability to continue to attract and retain skilled personnel, and the Company’s ability to sustain or improve current levels of productivity. Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports and filed with the Securities and Exchange Commission. Safe Harbor Statement

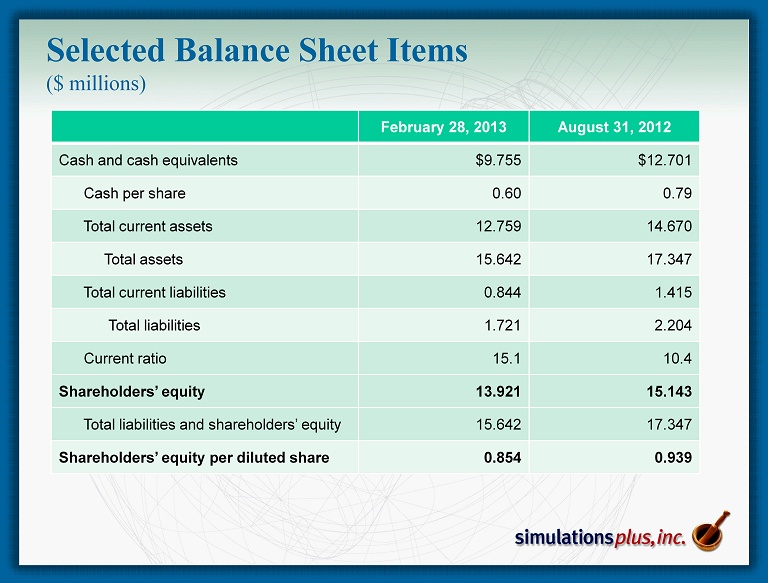

• 2 Q13 compared to 2Q12: – 22nd consecutive profitable quarter, and 44 th of last 46 quarters – Sales up 11.8% to Record for any Quarter $3.118 million from $2.789 million – Gross profit up 9.5% to $2.619 million from $2.393 million – SG&A decreased 10.6% to $0.855 million from $0.956 million • As a percent of revenues, SG&A decreased to 27.4% from 34.3% – R&D expense decreased 6.4% to $0.248 million from $0.265 million • 2Q12 included R&D expenditures for malaria NCE project – Net Income increased 26.5% to $1.061 million from $0.839 million – Diluted earnings per share increased 20% to $0.06 from $0.05 – Advance cash dividend of $0.14/share was distributed during 2Q13 ($2.24 million) • Strong balance sheet: – Cash of $9.75 million at 2/28/13 after approximately $5.4M in dividends ( ttm ) • Cash as of April 5 = $10.4 million – Shareholders’ equity on February 28 = $13.921 million – We continue to have no debt SLP 2Q13 Highlights Three months ended 2/28/13:

Income Statement 2QFY13 vs 2QFY12 ($ millions) 2Q13 2Q12 Net sales 3.118 2.789 Gross profit 2.619 2.393 Gross profit margin 84.0% 85.8% SG&A 0.855 0.956 R&D 0.248 0265 Total operating expenses 1.103 1.221 Income from continuing operations 1.517 1.172 Other income 0.055 0.088 Income from discontinued operations 0 0 Income from continuing operations before income taxes 1.572 1.260 Net income 1.061 0.839 Earnings per share 0.065 0.052

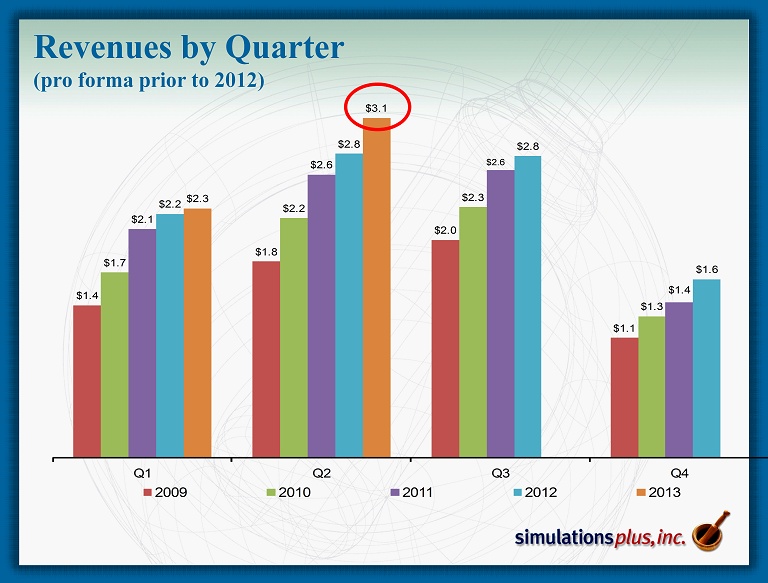

Revenues by Quarter (pro forma prior to 2012) $1.4 $1.8 $2.0 $1.1 $1.7 $2.2 $2.3 $1.3 $2.1 $2.6 $2.6 $1.4 $2.2 $2.8 $2.8 $1.6 $2.3 $3.1 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013

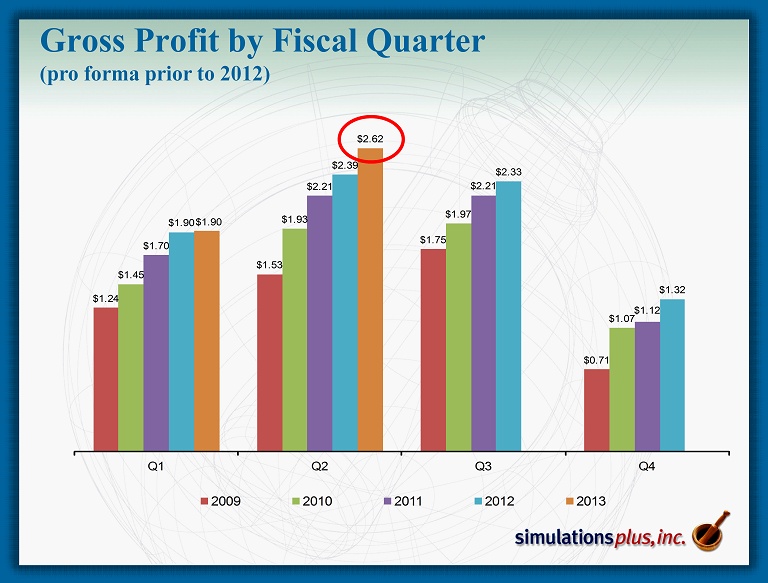

Gross Profit by Fiscal Quarter (pro forma prior to 2012) $1.24 $1.53 $1.75 $0.71 $1.45 $1.93 $1.97 $1.07 $1.70 $2.21 $2.21 $1.12 $1.90 $2.39 $2.33 $1.32 $1.90 $2.62 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013

EBITDA by Fiscal Quarter $0.55 $0.73 $0.93 $0.20 $0.73 $1.28 $1.23 $0.36 $1.00 $1.48 $1.48 $0.33 $1.11 $1.33 $1.40 $0.55 $1.09 $1.57 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013

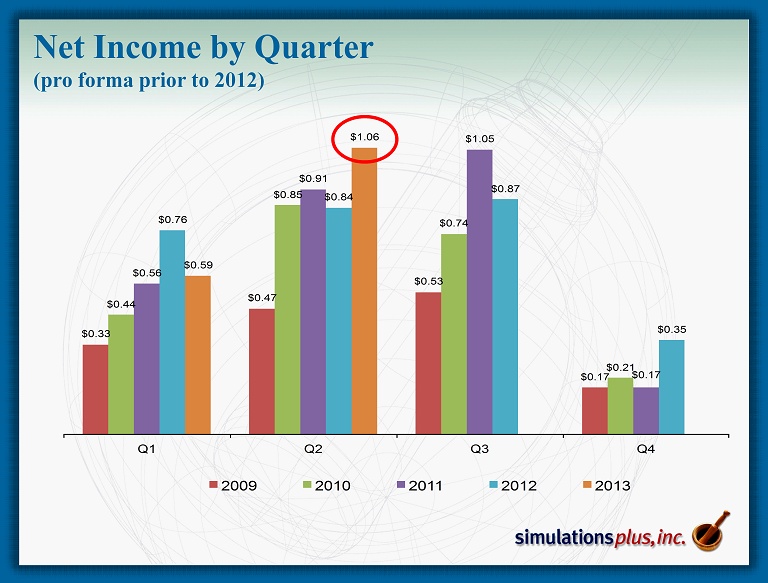

Net Income by Quarter (pro forma prior to 2012) $0.33 $0.47 $0.53 $0.17 $0.44 $0.85 $0.74 $0.21 $0.56 $0.91 $1.05 $0.17 $0.76 $0.84 $0.87 $0.35 $0.59 $1.06 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013

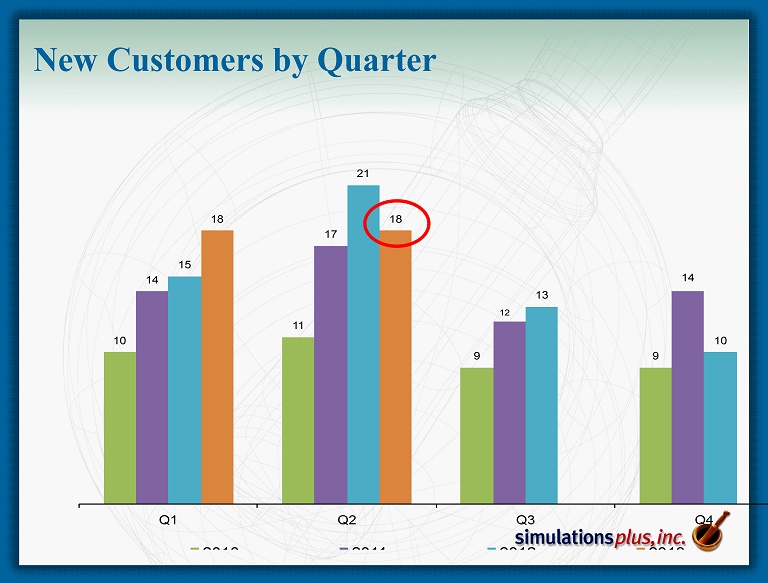

New Customers by Quarter 10 11 9 9 14 17 12 14 15 21 13 10 18 18 Q1 Q2 Q3 Q4 2010 2011 2012 2013

Selected Balance Sheet Items ($ millions) February 28, 2013 August 31, 2012 Cash and cash equivalents $9.755 $12.701 Cash per share 0.60 0.79 Total current assets 12.759 14.670 Total assets 15.642 17.347 Total current liabilities 0.844 1.415 Total liabilities 1.721 2.204 Current ratio 15.1 10.4 Shareholders’ equity 13.921 15.143 Total liabilities and shareholders’ equity 15.642 17.347 Shareholders’ equity per diluted share 0.854 0.939

$1.59 $0.80 $0.80 $2.24 $0.00 $0.00 $1.97 $12.66 $13.24 $12.89 $12.70 $11.38 $9.33 $9.76 $10.60 Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13 10-Apr-13 $ Millions Dividend Paid Proceeds from Sale of Subsidiary Cash Returning Cash to Shareholders

N H O OH O CH 3 CH 3 CH 3 Discovery Preclinical Clinical MedChem Studio™ MedChem Designer™ GastroPlus™ DDDPlus™ ADMET Predictor™ Simulations Plus Products & Services Consulting Services & Collaborations MembranePlus ™

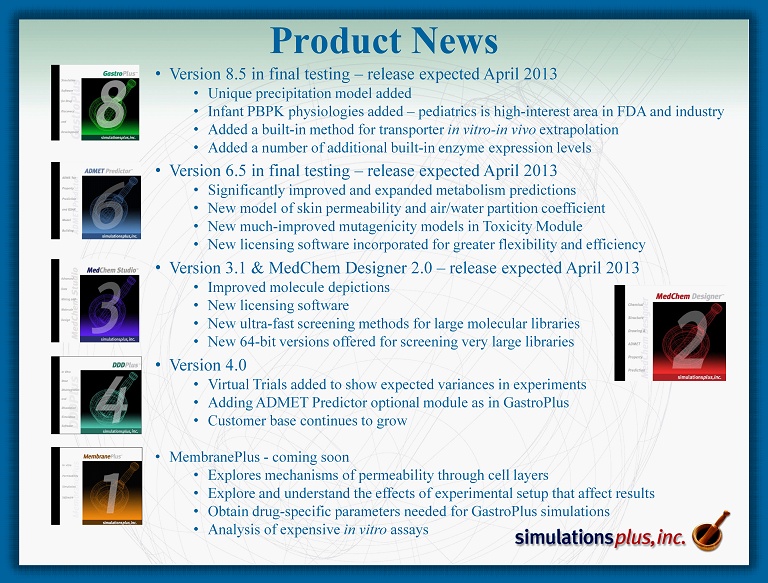

Product News • Version 8.5 in final testing – release expected April 2013 • Unique precipitation model added • Infant PBPK physiologies added – pediatrics is high - interest area in FDA and industry • Added a built - in method for transporter in vitro - in vivo extrapolation • Added a number of additional built - in enzyme expression levels • Version 6.5 in final testing – release expected April 2013 • Significantly improved and expanded metabolism predictions • New model of skin permeability and air/water partition coefficient • New much - improved mutagenicity models in Toxicity Module • New licensing software incorporated for greater flexibility and efficiency • Version 3.1 & MedChem Designer 2.0 – release expected April 2013 • Improved molecule depictions • New licensing software • New ultra - fast screening methods for large molecular libraries • New 64 - bit versions offered for screening very large libraries • Version 4.0 • Virtual Trials added to show expected variances in experiments • Adding ADMET Predictor optional module as in GastroPlus • Customer base continues to grow • MembranePlus - coming soon • Explores mechanisms of permeability through cell layers • Explore and understand the effects of experimental setup that affect results • Obtain drug - specific parameters needed for GastroPlus simulations • Analysis of expensive in vitro assays

Marketing and Sales Program • Conferences /Scientific Meetings continue to be primary source of leads • During Q2 we did 5 conferences in the U.S . and Europe • We presented one scientific poster • Trainings and Workshops • Hosted 3 - day GastroPlus workshop at the FDA for over 30 scientists • Conducted 10 on - site training courses at client sites • Held first Cheminformatics training workshop in March (Q3) in Boston/Cambridge • A GastroPlus introductory workshop was held during the same week with an overflow crowd • Strategic Digital Marketing Initiatives continue • Held two webinars on our Cheminformatics software – over 300 registrations • LinkedIn, Facebook, Twitter • Web site redesign in progress • Collaborations/Consulting/Grants – Ongoing 5 - year collaboration with the FDA Center for Food Safety and Applied Nutrition to build toxicity models with ADMET Predictor/Modeler™ for food additives and contaminants – Consulting studies continue – provides exposure of software to new groups – Ongoing funded collaboration for enhancement of the GastroPlus oral cavity dosing model – Ongoing funded collaboration to incorporate transdermal dosing into GastroPlus • We believe fundamental industry shift continues – Received feedback that two more regulatory submissions with GastroPlus modeling results were accepted – 18 new customers during 2QFY13 (includes new companies as well as new departments within existing large customers)

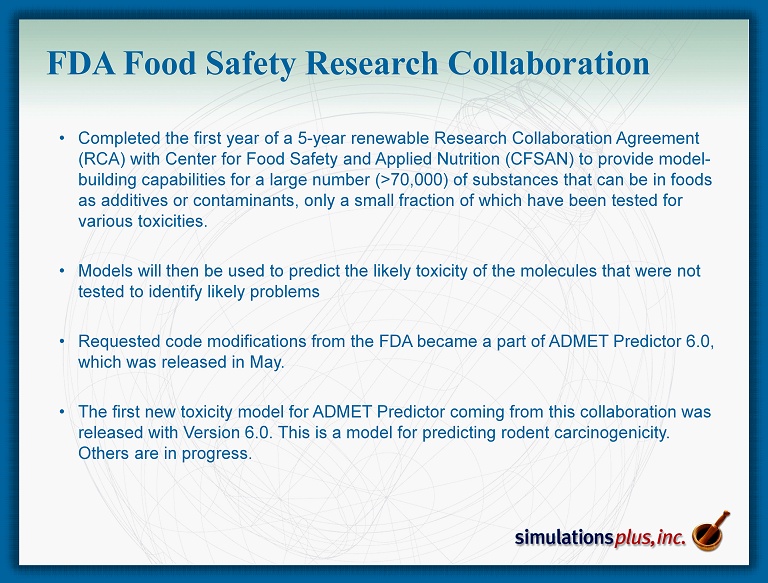

FDA Food Safety Research Collaboration • Completed the first year of a 5 - year renewable Research Collaboration Agreement (RCA) with Center for Food Safety and Applied Nutrition (CFSAN) to provide model - building capabilities for a large number (>70,000) of substances that can be in foods as additives or contaminants, only a small fraction of which have been tested for various toxicities. • Models will then be used to predict the likely toxicity of the molecules that were not tested to identify likely problems • Requested code modifications from the FDA became a part of ADMET Predictor 6.0, which was released in May. • The first new toxicity model for ADMET Predictor coming from this collaboration was released with Version 6.0. This is a model for predicting rodent carcinogenicity. Others are in progress.

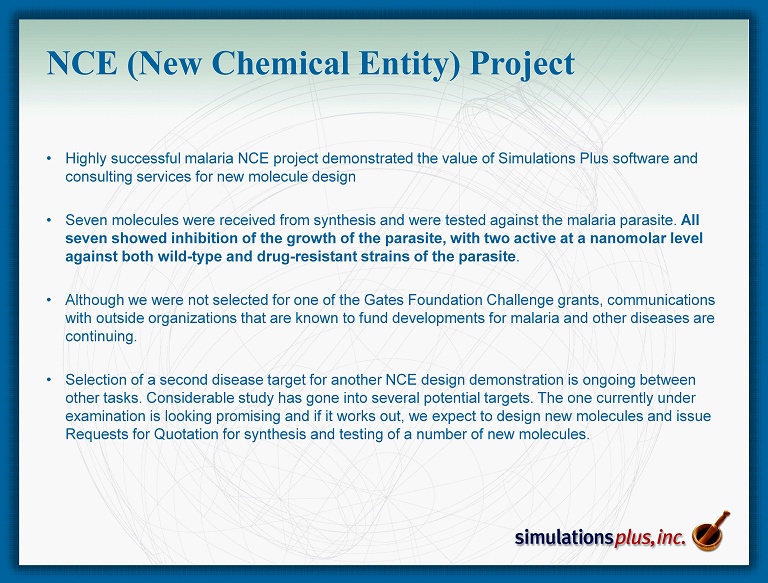

NCE (New Chemical Entity) Project • Highly successful malaria NCE project demonstrated the value of Simulations Plus software and consulting services for new molecule design • Seven molecules were received from synthesis and were tested against the malaria parasite. All seven showed inhibition of the growth of the parasite, with two active at a nanomolar level against both wild - type and drug - resistant strains of the parasite . • Although we were not selected for one of the Gates Foundation Challenge grants, communications with outside organizations that are known to fund developments for malaria and other diseases are continuing. • Selection of a second disease target for another NCE design demonstration is ongoing between other tasks. Considerable study has gone into several potential targets. The one currently under examination is looking promising and if it works out, we expect to design new molecules and issue Requests for Quotation for synthesis and testing of a number of new molecules.

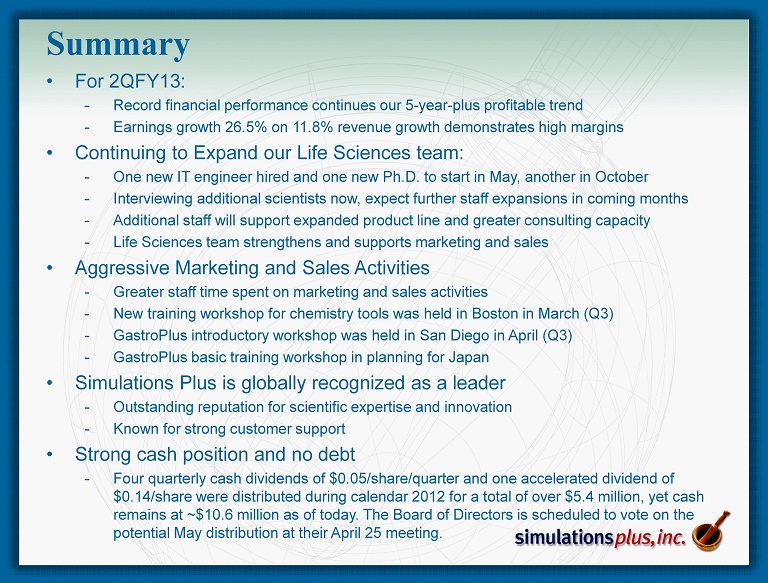

Summary • For 2QFY13: - Record financial performance continues our 5 - year - plus profitable trend - Earnings growth 26.5% on 11.8% revenue growth demonstrates high margins • Continuing to Expand our Life Sciences team: - One new IT engineer hired and one new Ph.D. to start in May, another in October - Interviewing additional scientists now, expect further staff expansions in coming months - Additional staff will support expanded product line and greater consulting capacity - Life Sciences team strengthens and supports marketing and sales • Aggressive Marketing and Sales Activities - Greater staff time spent on marketing and sales activities - New training workshop for chemistry tools was held in Boston in March (Q3) - GastroPlus introductory workshop was held in San Diego in April (Q3) - GastroPlus basic training workshop in planning for Japan • Simulations Plus is globally recognized as a leader - Outstanding reputation for scientific expertise and innovation - Known for strong customer support • Strong cash position and no debt - Four quarterly cash dividends of $0.05/share/quarter and one accelerated dividend of $0.14/share were distributed during calendar 2012 for a total of over $5.4 million, yet cash remains at ~$10.6 million as of today. The Board of Directors is scheduled to vote on the potential May distribution at their April 25 meeting.

Q&A