Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - China Hefeng Rescue Equipment, Inc. | Financial_Report.xls |

| EX-32 - RULE 13A-14(B) CERTIFICATIONS - China Hefeng Rescue Equipment, Inc. | f10k2012ex32_chinahefeng.htm |

| EX-31.1 - RULE 13A-14(A) CERTIFICATION ? CEO - China Hefeng Rescue Equipment, Inc. | f10k2012ex31i_chinahefeng.htm |

| EX-31.2 - RULE 13A-14(A) CERTIFICATION ? CFO - China Hefeng Rescue Equipment, Inc. | f10k2012ex31ii_chinahefeng.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the transition period from _________ to __________

Commission File Number 0-54224

|

CHINA HEFENG RESCUE EQUIPMENT, INC.

(Name of Registrant in its Charter)

|

|

Delaware

|

80-0654192

|

|

|

(State of Other Jurisdiction of incorporation or organization)

|

(I.R.S.) Employer I.D. No.)

|

|

No. 88, Taishan Street, Beigang Industrial Zone, Longgang District,

Huludao, Liaoning Province, P.R. China 125000

|

|

|

(Address of Principal Executive Offices)

|

Issuer's Telephone Number: 86-0429-3181998

Securities Registered Pursuant to Section 12(b) of the Exchange Act: NONE

Securities Registered Pursuant to Section 12(g) of the Exchange Act:

COMMON STOCK, $0.0001 PAR VALUE

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 406 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

As of June 30, 2012, the last day of the registrant’s most recent fiscal second quarter, the aggregate market value of the common stock held by non-affiliates was nil, as there is no trading market for the common stock.

As of April 11, 2013, there were 33,600,000 shares of common stock outstanding.

Documents incorporated by reference: NONE

PART I

FORWARD-LOOKING STATEMENTS: NO ASSURANCES INTENDED

In addition to historical information, this Annual Report contains forward-looking statements, which are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,” “projects,” or similar expressions. These forward-looking statements represent Management’s belief as to the future of China Hefeng Rescue Equipment, Inc. Whether those beliefs become reality will depend on many factors that are not under Management’s control. Many risks and uncertainties exist that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in Section 1A of this Report, entitled “Risk Factors.” Readers are cautioned not to place undue reliance on these forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements.

ITEM 1. BUSINESS

We conduct our operations through our consolidated affiliated Huludao Hefeng Rescue Equipment Co., Ltd. (“Huludao Rescue”). Huludao Rescue, founded in May 2010, specializes in marketing mining equipment and also designs mining equipment and mine safety systems. Huludao Rescue is located in the Beigang Industrial Park in Huludao City, People’s Republic of China (“PRC”).

Although we have always been involved with mine safety equipment, within the past year the focus of our business has shifted from exclusively providing hardware design and software development services to a primary focus on serving as a sales and leasing agent for other manufacturers. In the course of providing hardware design services for mining hardware manufacturers and mining security software development for middle and smaller private mines, we have developed a number of channels into the mining market. Our new marketing business takes advantage of these connections, as we introduce the mining hardware manufacturers to the middle and small private mines, and receive a sales commission on the resulting transactions.

Our Corporate History and Background

China Hefeng Rescue Equipment, Inc. (the “Company”) was incorporated in the State of Delaware on October 22, 2010 with the name “Bridgeway Acquisition Corp.” The Company was organized as a vehicle to pursue a business combination through the acquisition of an operating business. Until June 2012, the Company had no business operations.

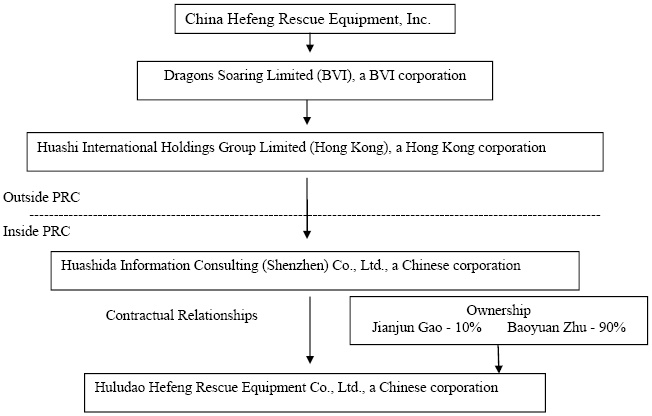

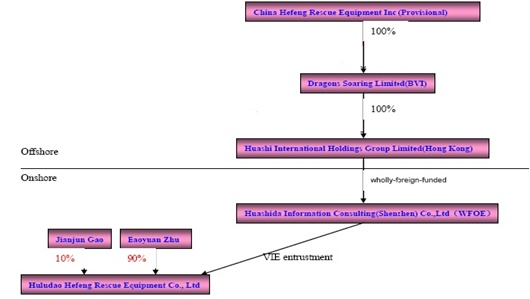

On June 15, 2012, we completed a reverse acquisition through a share exchange with Dragons Soaring Limited (BVI) (“Dragons Soaring”) and its shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Dragons Soaring in exchange for 31,920,000 shares of our Common Stock, which constituted 95% of our issued and outstanding capital stock. As a result of the reverse acquisition, Dragons Soaring became our wholly-owned subsidiary and the former shareholders of Dragons Soaring became our controlling stockholders. For accounting purposes, the share exchange was treated as a reverse acquisition, with Dragons Soaring as the acquirer and Bridgeway Acquisition Corp. as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Dragons Soaring and its consolidated subsidiaries and controlled affiliates.

2

Dragons Soaring is a holding company organized in December 2011, at which time it acquired 100% of the equity in Huashi International Holdings Group Limited (Hong Kong), a Hong Kong corporation (“Huashi International”). Huashi International was organized in 2010 to serve as a holding company for Huashida Information Consulting (Shenzhen) Co., Ltd. (“Huashida Consulting”). Huashida Consulting was organized in 2010 in the PRC as a wholly foreign owned entity (“WFOE”). The acquisition of Huashida Consulting by Huashi International was approved by China’s State Administration of Foreign Exchange (“SAFE”) in October 2010.

The business of Huashida Consulting is to provide management services to Huludao Rescue. The services are provided pursuant to a set of four agreements among Huashida Consulting, Huludao Rescue and the shareholders of Huludao Rescue: Baoyuan Zhu and Jianjun Gao. The four agreements assign to Huashida Consulting over 95% of the benefit arising from the operations of Huludao Rescue as well as control of the corporate activities of that entity. As a result, for accounting purposes, Huludao Rescue is considered a variable interest entity with respect to Huashida Consulting, and the balance sheet and financial results of Huludao Rescue are consolidated with those of the Company in our financial statements. Accordingly, the four agreements that govern the relationship are known as variable interest agreements (the “VIE Agreements”). A summary of the terms of the four agreements is set forth below in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Under the terms of the VIE Agreements, Huludao Rescue and its shareholders are contractually required to operate Huludao Rescue prudently and effectively in a manner intended to maximize profits. Without the consent of Huashida Consulting, Huludao Rescue’s shareholders may not allow it to: dispose of or mortgage its assets or income (except in the ordinary course of business); increase or decrease its registered capital (including issuing any equity securities); enter into any material agreements with its shareholders outside of the ordinary course of business; appoint or remove any of Huludao Rescue’s directors or management; make any distribution of profits or dividends; or be terminated, liquidated or dissolved.

However, Huludao Rescue is not specifically prohibited from acting in certain ways which could reduce its value to the Company. For example, Huludao Rescue can pay its officers and directors compensation without Huashida Consulting’s consent, and such compensation could reduce the net profits payable by Huludao Rescue to Huashida Consulting

The use of VIE agreements is a common structure used to acquire control of PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. However, the VIE Agreements may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. To date, Huludao Rescue has not made any payment to Huashida Consulting, but all amounts due from Huludao Rescue to Huashida Consulting have been accrued. Our plan for the foreseeable future is that Huludao Rescue will make payments to Huashida Consulting to the extent necessary for that entity and Huashi International to pay their expenses. Huludao Rescue may also make payments to Huashida Consulting for the purpose of funding the expenses of our U.S. parent company, although in the near term we expect to fund those expenses by borrowing U.S. Dollars from related parties. The remainder of the obligations of Huludao Rescue to Huashida Consulting will be accrued without interest, penalties or other compensation for the delay in payment. See “Risk Factors - Risks Relating to the VIE Agreements.”

3

After the share exchange between Bridgeway Acquisition Corp. and Dragons Soaring in June 2012, the name of the Company was changed to “China Hefeng Rescue Equipment, Inc.” As a result of the share exchange, our current organizational structure is as follows:

Our Industry

Coal mine safety monitoring technology was introduced late into the PRC. In the early 1980’s, safety monitoring systems were introduced from Poland, France, Germany, England and the U.S., but not all coal mines were equipped with them. Moreover, due to the inadequacies in the early technology and inadequate site maintenance, many early monitoring systems were phased out.

In recent years, however, China’s government has placed a growing emphasis on mine safety. The primary obstacle to mine safety efforts has been the relatively low level of mechanization in China’s mines. According to the China Coal Machinery Industry Association, 80% of China’s large coal mines and 40% of its medium size coal mines are mechanized. A much smaller percentage of China’s small coal mines are mechanized. Small domestic coal mines have low-level mechanization, often utilizing older technology. Even those that have adopted mine safety technology, often fail to maintain the condition of the equipment, which results in a risky environment. In order to comprehensively improve the production level and safety of small coal mines, in 2010 the State Council issued No.23 Document Notice requiring that the mechanization of exploring and excavating loading exceed 45% and 70%, respectively, by the end of 2012, and that the numbers should increase to 55% and 80% by the end of 2015. Additional mandates from government offices provided that by 2013, coal mines, no matter what size, must each establish six safety systems: a security monitoring system, a miners positioning system, an emergency system, a wind pressure self-rescue system, a water rescue system and a communication system.

4

The government’s recent emphasis on mine safety comes at the same time as a rapid expansion of the Chinese mining industry, driven by China’s explosive demand for fuel and raw materials. The mandate to install mechanized safety equipment has provided the mine safety equipment industry with a substantial business opportunity. As a result of Chinese coal producers increased investment in machinery, the production and sale of the Chinese coal exploring machinery industry has risen dramatically. Due to significant price advantages, improved quality and technology standards, and the availability of after-sale service, most Chinese coal mines purchase domestic coal exploring machines. According to the report of Chinese coal machinery industry association issued in 2009, imported coal exploring machines constitute only 3% of the machines purchased in China. Therefore, we believe that the continued growth in the Chinese mining industry and ongoing government mandates of mechanization will cause a continued expansion of the market for mine safety equipment.

Our Services

The primary business of the Company in 2010 and 2011 was mine safety equipment design and safety system development. However, beginning in the second half of 2011, the Company’s focus and main source of revenue shifted to the commission-based business. This occurred because the Company developed a significant clientele and contacts and a good reputation while engaged in the design and development business. This enabled Huludao Rescue to move into the agency business, which is typically more profitable and less costly to engage in.

The Company’s most important asset is its relationships. Currently, the network of relationships that supports the business of Huludao Rescue includes:

|

●

|

Mining equipment distributors, to whom the Company introduces potential customers;

|

|

●

|

Rescue capsule manufacturers, to whom Company introduces clients to lease their rescue capsules;

|

|

●

|

Mining equipment manufacturers, for whom the Company provides equipment design services; and

|

|

●

|

Mining enterprises, for whom the Company designs safety systems.

|

Sales and Leasing Agency Business

Sales Agency Business

In the course of its history, Huludao Rescue has established long-term strategic cooperative relationships with a number of China’s mining machine manufacturing enterprises. Recently we have endeavored to utilize these relationships to develop channels for marketing mining machinery. Among the manufacturers for whom Huludao Rescue has provided marketing services are Henan Hongxing Mining Machinery Co., Ltd, Shandong Qiancheng Heavy Mining Equipment Co., Ltd, Shanxi TZ Coal Mine Whole-Set Equipment Co., Ltd, and Tangshan Guanneng Machinery Equipment Co., Ltd.

Our referral contracts with mining equipment sale enterprises are made on a case by case basis: each has a specific term and a specific referral fees determined by the equipment type and sale price. We typically receive payment of our commission within ten days after the seller receives initial payment by the purchaser.

Leasing Agency Business

In 2011 the Company established a leasing agency relationship with Heilongjiang Hefeng Mine Rescue Equipment Co., Ltd. (“Hefeng Mine Rescue”), under which the Company introduces Hefeng Mine Rescue’s rescue capsules to mining companies. If a mine operator introduced by Huludao Rescue leases a rescue capsule from Hefeng Mine Rescue, Hefeng Mine Rescue pays a commission to Huludao Rescue equal to 20% of the rental fee. The first year commission is typically paid within five days after Hefeng Mine Rescue receives the rental deposit. The remaining commissions are paid at the beginning of each year during the rental term.

5

Mining trail-type rescue capsules produced by Hefeng Mine Rescue have acquired patent certificates from SIPO, with six patents of invention and 13 utility model patents. In December 2012 the National Safety Standards Center awarded to Hefeng Mine Rescue’s rescue capsule the state mining product safety mark, which currently is held by only seven other enterprises throughout China.

At present, all of our leasing business is done for Hefeng Mine Rescue. Baoyuan Zhu, who is the Company’s Chairman, is the owner of Hefeng Mine Rescue. In 2012 commissions earned by Huludao Rescue for generating leases of Hefeng Mine Rescue capsules totaled $251,604.

Equipment and System Design and Development

Equipment Design

Huludao Rescue was originated as a specialty design studio for the mine safety equipment industry. Because of the reputation of its management in the mine safety industry, Huludao Rescue was engaged to design equipment for many of the mine equipment manufacturers in China. Huludao Rescue provides its design customers with high technical standards as well as assurance of compliance with the relevant Chinese regulations.

Among its projects, the Company has designed the following types of mining equipment:

|

●

|

All-terrain rescue vehicle. A modular design that includes a foundation platform with multifunctional auxiliary platforms, including a transportation function, medical treatment function and an engineering rescue function, all of which enables the rescue vehicle to complete various types of rescue missions.

|

|

●

|

Hammer crusher, an up-down bracket structure, in which the two brackets are welded with a steel plate and are connected with bolts. A hammer crusher is used to crush medium hard to weak materials.

|

|

●

|

Energy saving fan. Adapting a standard mine fan, through technical improvements the Company has designed a fan that has higher running efficiency, lower noise, larger performance range, and is more efficient at saving electricity than the original model.

|

Huludao Rescue has established a high-level specialty R&D team to fulfill its design orders. Currently, Huludao Rescue is reviewing opportunities to reach cooperative strategic relationships with technically skilled enterprises at home and abroad, so as to improve its business qualifications and competitiveness by adapting the experience of domestic and foreign peer industries.

Our equipment design contracts are made on a case by case basis. Each contract includes a description of the equipment to be designed, the aggregate cost of the design service, a payment installment schedule, and the expected date of project completion.

6

System Research and Development

Huludao Rescue contracts with mine operators to develop safety systems specifically modified to take into account the peculiar subsurface environment of each mine location. After performing many such projects over several years, Huludao Rescue now has a portfolio of technologies with multiple potential applications. With this technology, Huludao Rescue not only provides safety systems with high reliability, but also provides follow-up training and software maintenance service to its customers, to ensure them superior technical support.

Among the safety systems developed by Huludao Rescue are:

|

●

|

A safety monitoring system that monitors operating status and information transfers. Huludao Rescue delivered five such systems in 2012.

|

|

●

|

A gas forecast system, which provides management real-time information on the location and characteristics of mining gas, enabling mining gas control decision making. Huludao Rescue delivered three such systems in 2012.

|

|

●

|

A down-hole crew positioning system. The master computer of the ground monitoring center, through a data transmission interface and an optical/electric cable paved along the roadway, collects real-time data from the wireless acquisition unit assembled down-hole. The wireless acquisition unit receives and transmits data from the miners’ identification cards to the central data station via the transit network. The Company has delivered this system to several mining operators.

|

|

●

|

A down-hole communication system. On an ongoing basis, the system broadcasts safety information and safety regulations and precautions. When needed, the system also broadcasts announcements regarding matters needing attention, such as to enhance the crew's safety awareness in a specified area. If the system detects a report from the safety system that there is an accident down-hole, the pre-set procedure will transfer related emergency plans and instruct the site personnel on withdrawal procedures. The Company has provided this to several mine operators.

|

Our safety system research and development agreements are made on a case by case basis. The agreements include a description of the project to be completed, the aggregate cost of the project, a payment installment schedule and the anticipated date of completion. The Company charges service fees by stages, which alleviates the financial pressure on our customers and lays a solid foundation for future relationships. The agreement provides that all intellectual property that results from our services under the contract becomes the property of the customer.

Huludao Rescue outsources portions of its equipment design and system design work to qualified software engineering companies, in order to permit our in-house R&D staff to focus on the mine-specific aspects of the work. Among the subcontractors to which we have assigned portions of our projects are Qingdao Super Special Automobile Technology Co., Ltd., Zhengzhou Yilong Mining Equipment Co., Ltd., Huludao Qianlong Science Development Co., Ltd., and (4) Topsoft Information Technology (Dalian) Co., Ltd. In recent years, Huludao Rescue has outsourced approximately one-third of its software development projects.

7

Customers

Because we provide a specific service to our customers, our relationships with our customers are generally not perennial, and we do not depend on any specific customer for continuing business. However, fulfillment of a large contract with a specific customer can represent a significant portion of our revenue for the period in which the customer’s work is completed. The fact that fulfillment of large contracts can represent a sizeable portion of the revenue in a single period means that the level of our revenue will tend to rise and fall from quarter to quarter depending on when we complete large contracts.

One leasing customer, the Shanxi Taizhong Coal Mining Machinery Equipment Co., Ltd., has provided a sizeable percentage of our revenue in each of the past two years. During 2012 commissions paid by the Shanxi Taizhong Coal Mining Machinery Equipment Co., Ltd. totaled $6,231,023, representing 53% of our total revenue. In 2011, commissions paid by that customer totaled $1,759,202, representing 31% of our revenue. No other customer provided 10% or more of our revenue in 2012.

Competition and Growth

The Chinese mine rescue products industry is still in its infancy, with few enterprises engaged in rescue product manufacture and sales. A strong competitive environment has not yet formed. Huludao Rescue intends to rely on its strong network of contacts in both the manufacturing sector and among mine operators to secure a market position that will withstand competitive pressures.

The rapidly growing demand for mine safety equipment provides a business opportunity for Huludao Rescue that we intend to exploit fully. Our strategy for growth has three prongs:

Innovating technology. Our staff has a rich experience in the development of mine safety systems. Our plan for the coming years is to use that experience as a foundation for leading-edge research into the development of advanced safety systems. We intend to conduct our own research and development, as well as to utilize the relationships that we have built with foreign manufacturers, to enable us to offer customers the most advanced safety systems available. In addition, we plan to expand the market for our systems by developing multi-purpose safety systems that can be used in projects such as nonferrous metal and tunnel engineering.

Expanding our domestic market. Currently, our business is focused primarily in the provinces of North and Northeast China. This current focus encompasses only a small portion of the potential market for coal mine safety systems, mining equipment and mining rescue capsules in the Chinese domestic coal mine industry. In the coming periods, we intend to establish agent networks in provinces such as Shanxi, Sichuan, and Inner Mongolia, where a significant amount of coal mining is concentrated.

Entering the global markets. We plan in the relatively near term to utilize our mine equipment experience as well as its knowledge of pricing to enter the Indian market, followed by entry into an expanding circle of countries. Since foreign manufactured mining rescue capsules typically sell at prices approximately double the price of the Chinese rescue capsules that we market, we expect to utilize this price advantage and the competitive performance of our client products to enter the Indian market. India, as the third largest coal mine country after China and America, has adapted only 28% of its machinery to its domestic safety requirements and imports most of its colliery equipment. This situation represents an obvious opportunity for Huludao Rescue.

At the same time, our plan is strengthen technical exchange communications with foreign enterprises in the mine safety industry in order to achieve international cooperation in promoting the globalization of our business by absorbing the world’s advanced technology and management experience. We believe this will allow Huludao Rescue to keep up with international standards of the mining industry and improve the quality of our products and our management, as well as our international market competitiveness.

8

Our Employees

As of December 31, 2012, the Company had 90 full time employees and no part time employees. Ten employees are in the administration department, 30 in the training department, 43 in the design department and R&D and seven are in the marketing.

ITEM 1A RISK FACTORS

Investing in our common stock involves substantial risk. You should carefully consider the risks described below together with all of the other information contained in this Report, including the financial statements and the related notes, before deciding whether to purchase any shares of our common stock. If any of the following risks occurs, our business, financial condition or operating results could materially suffer. In that event, the trading price of our common stock could decline and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our management has no experience in managing and operating a public company. Any failure to comply or adequately comply with federal securities laws, rules or regulations could subject us to fines or regulatory actions, which may materially adversely affect our business, results of operations and financial condition.

Our current management has no experience managing and operating a public company and relies in many instances on the professional experience and advice of third parties, including consultants, our attorneys and accountants. None of our middle and top management staff were educated or trained in the Western system, and we may have difficulty hiring new employees in the PRC with such training. As a result, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. Therefore, we may experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002. This may adversely affect the reliability of our financial statements and prevent us from complying with SEC rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002, as amended. Failure to comply or adequately comply with any laws, rules, or regulations applicable to our business may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition and could result in delays in developing of an active and liquid trading market for our common stock. To the extent that the market place perceives that we do not have a strong financial staff and financial controls, the market for, and price of, our stock may be impaired.

We operate in the mining equipment and mine safety industry. A failure of mining equipment designed by us, or the failure of safety systems designed by us, could subject us to liability which may materially adversely affect our business, results of operations and financial conditions.

Huludao Rescue designs mining equipment design for manufacturers. If there are any accidents related to the products that we designed, the government will investigate and identify the parties responsible for the accident. If the accident is confirmed to have been caused by a flaw in the design created by Huludao Rescue, then Huludao Rescue will face liability for the accident. A similar process will occur if an accident occurs in a mine for which Huludao Rescue provided a security system. If the government determines that a flaw in the security system contributed to the accident, Huludao Rescue will face liability for the accident. If the government finds that Huludao Rescue is liable for an accident, the government may impose fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition.

9

Our revenue and earnings may rise and fall from quarter to quarter depending on when we complete large contracts.

The Company’s contracts vary in dollar amount. Because we provide a specific service to our customers, our relationships with our customers are generally not perennial, and we do not depend on any specific customer for continuing business. However, fulfillment of a large contract with a specific customer can represent a significant portion of our revenue for the period in which the customer’s work is completed. As a result, our revenue and earnings may rise and fall from quarter to quarter depending on the size of the contracts for which we record revenue during each the quarter. This lack of consistency in financial results from quarter to quarter will make it difficult for investors and analysts to project growth trends in our business, which may discourage certain investors from acquiring our stock.

We derive all of our revenues from sales in the PRC and any downturn in the Chinese economy could have a material adverse effect on our business and financial condition.

All of our revenues are generated from sales and leases in the PRC or from commissions generated in the PRC. We anticipate that revenues from sales or leases of products in the PRC will continue to represent the greater portion of our revenues in the near future. Our success is influenced by a number of economic factors such as employment levels, business conditions, interest rates, oil and gas prices and taxation rates. Adverse changes in these economic factors, among others, may restrict customer spending, thereby negatively affecting our sales and profitability.

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Our limited operating history may not provide a meaningful basis for evaluating our business. The Company entered into its current line of business in 2010. Although the Company’s revenues have grown rapidly since its inception, we cannot guarantee that we will maintain profitability or that we will not incur net losses in the future. We will continue to encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

|

|

●

|

obtain sufficient working capital to support our expansion;

|

|

|

●

|

expand our service offerings and maintain the high quality of our services;

|

|

|

|

|

●

|

manage our expanding operations and continue to fill customers’ orders on time;

|

|

|

|

|

●

|

maintain adequate control of our expenses allowing us to realize anticipated income growth;

|

|

|

|

|

●

|

implement our service development, sales, and acquisition strategies and adapt and modify them as needed;

|

|

|

|

|

●

|

successfully integrate any future acquisitions; and

|

10

|

|

●

|

anticipate and adapt to changing conditions in the mining industry resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

|

If we are not successful in addressing any or all of the foregoing risks, our results of operations may be materially and adversely affected.

We need additional capital to fund our growing operations, and we may not be able to obtain sufficient capital and may be forced to limit the scope of our operations.

Although we believe our cash on hand and cash flow from operations will meet our present cash needs for the next 12 months, we believe that we will need additional capital to fund our long term growth strategy. If adequate additional financing is not available on reasonable terms, we may not be able to implement our growth strategy successfully, and we would have to modify our business plans accordingly. Additional financing may not be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability, and (ii) our success in developing and implementing our growth plan. We may not be able to obtain capital in the future to meet our needs.

In recent years, the U.S. market for the securities of enterprises located in China has demonstrated a high level of price and volume volatility, and the market prices of securities of many such companies have experienced wide fluctuations that have not been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our securities can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. Any additional funding we may require may not be available on reasonable terms, if at all.

Even if we do find a source of additional capital, we may not be able to receive additional capital that on terms are favorable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing stockholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to the currently outstanding securities. Such additional financing may not be available to us, or if available, may not have terms that are favorable to us.

We require highly qualified personnel and if we are unable to hire or retain qualified personnel, we may not be able to grow effectively.

Our future success depends upon our ability to attract and retain highly qualified personnel. Expansion of our business will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. We may not be able to attract or retain highly qualified personnel. Competition for skilled mining agency personnel is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

11

The loss of the services of our key employees, particularly the services rendered by Baoyuan Zhu, our chairman, Zhengyuan Yan, our chief executive officer, and Wenqi Yao our chief financial officer, could harm our business.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Baoyuan Zhu, our chairman, Zhengyuan Yan, our chief executive officer and Wenqi Yao, our chief financial officer. We currently do not have key employee insurance for our officers and directors. The loss of any these key employees could harm our business.

We will incur significant costs to ensure compliance with United States corporate governance and accounting requirements.

We will incur significant costs associated with our public company reporting requirements, as well as costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the SEC. Since we had no obligations as a public company prior to the reverse acquisition on June 15, 2012, we did not have any such expenses prior to that date. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption law, and any determination that we violated these laws could have a material adverse effect on our business.

We are subject to the U.S. Foreign Corrupt Practices Act, or the "FCPA", and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We are also subject to Chinese anti-corruption law, which strictly prohibits the payment of bribes to government officials.

We are in process of implementing an anticorruption program, which prohibits the offering or giving of anything of value to foreign officials, directly or indirectly, for the purpose of obtaining or retaining business. We believe that to date we have complied in all material respects with the provisions of the FCPA and Chinese anti-corruption law. However, our safeguards may prove to be less than effective, and the employees, consultants or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption law may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition.

RISKS RELATED TO DOING BUSINESS IN CHINA

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We conduct substantially all of our operations and generate most of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

● A higher level of government involvement

12

● An early stage of development of the market-oriented sector of the economy

● A rapid growth rate

● A higher level of control over foreign exchange

● The allocation of resources

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in economic conditions or government policies in China could have a material adverse effect on the overall economic growth in China, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our business and prospects.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiaries in the PRC. Our operating subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

We are a Delaware holding company and most of our assets are located outside of the United States. All of our current operations are conducted in the PRC. In addition, all of our directors and officers are nationals and residents of the PRC. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

13

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

All our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account,” which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, our PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange (“SAFE”), by complying with certain procedural requirements. However, the relevant PRC government authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in RMB, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in RMB to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by our PRC operating subsidiary under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if our PRC operating subsidiary borrows foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiary by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce (“MOFCOM”), or their respective local counterparts. These limitations could affect their ability to obtain foreign exchange through debt or equity financing.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB. Because substantially all of our earnings and cash assets are denominated in RMB, fluctuations in the exchange rate between the U.S. dollar and the RMB will affect our balance sheet and our earnings per share in U.S. dollars. In addition, appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations.

14

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People's Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

We cannot determine whether, under the EIT Law, we may be classified as a “resident enterprise” of China. Such classification would likely result in unfavorable tax consequences to us and our non-PRC stockholders. Our inability to make the determination will subject our shareholders to uncertainty regarding whether sale of their shares will subject them to taxation in China.

Under the New Income Tax Law, enterprises established outside the PRC whose “de facto management bodies” are located in the PRC are considered “resident enterprises” and their global income will generally be subject to the uniform 25% enterprise income tax rate. On December 6, 2007, the PRC State Council promulgated the Implementation Regulations on the New Income Tax Law (the “Implementation Regulations”), which define “de facto management bodies” as bodies that have material and overall management control over the business, personnel, accounts and properties of an enterprise. In addition, a recent circular issued by the State Administration of Taxation on April 22, 2009 provides that a foreign enterprise controlled by a PRC company or a PRC company group will be classified as a “resident enterprise” with its “de facto management bodies” located within the PRC if the following requirements are satisfied:

|

i.

|

the senior management and core management departments in charge of its daily operations function mainly in the PRC;

|

|

ii.

|

its financial and human resources decisions are subject to determination or approval by persons or bodies in the PRC;

|

|

iii.

|

its major assets, accounting books, company seals, and minutes and files of its board and shareholders' meetings are located or kept in the PRC; and

|

|

iv.

|

more than half of the enterprise's directors or senior management with voting rights reside in the PRC.

|

Because the EIT Law, its implementing rules and the recent circular are relatively new, no official interpretation or application of this new “resident enterprise” classification is available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case. Because we lack guidance regarding how the PRC tax authorities will interpret and apply the EIT Law, our management has determined that it will not make a decision as to whether China Hefeng is a resident enterprise for PRC enterprise income tax purposes unless and until we either plan to remit funds from our WFOE to its Hong Kong shareholder or we plan to pay dividends to the shareholders of our U.S. parent corporation. In either situation, our determination would be based on interpretations of the EIT Law prevailing at that time.

15

If the PRC tax authorities determine that China Hefeng is a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow:

|

●

|

First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income. This would mean that any non-China source income would be subject to PRC enterprise income tax at a rate of 25%, the same rate applied to corporate income earned within China. However, since all of our operations are carried out by our Chinese subsidiaries and affiliates, it is unlikely that we will have any non-China source income in the near future.

|

|

●

|

Second, although under the EIT Law and its implementing rules dividends paid to our non-PRC subsidiaries from our PRC subsidiary would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Currently, neither our U.S. parent corporation nor any of our non-PRC subsidiaries has any significant cash resources or liquid assets. Unless and until our U.S. parent corporation obtains funds from the sale of securities, the funds required to operate our U.S. parent corporation and our non-PRC subsidiaries must be obtained either from loans by related parties or by dividends paid by our PRC subsidiary. Imposition of a withholding tax on such dividends could interfere with our ability to finance the operations of our U.S. parent and non-PRC subsidiaries.

|

|

●

|

Third, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which the PRC will attempt to impose a 10% withholding tax on dividends that China Hefeng pays to our non-PRC stockholders.

|

|

●

|

Finally, it is possible that resident enterprise classification could result in the PRC seeking to tax any gains derived by our non-PRC stockholders from transferring their shares in our company. Although most of our non-PRC shareholders would not be subject to the jurisdiction of the PRC tax authorities, the uncertainty regarding whether they may be liable to pay such a tax could be a burden for some of our shareholders, particularly those who have business or other interests in the PRC.

|

If the China Securities Regulatory Commission (“CSRC”) or another PRC regulatory agency determines that CSRC approval is required in connection with the reverse acquisition of Dragons Soaring the, reverse acquisition may be unwound, or we may become subject to penalties.

On August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the “M&A Rule,” which became effective on September 8, 2006. The M&A Rule, among other things, requires that an offshore company controlled by PRC companies or individuals that have acquired a PRC domestic company for the purpose of listing the PRC domestic company's equity interest on an overseas stock exchange must obtain the approval of the CSRC prior to the listing and trading of such offshore company's securities on an overseas stock exchange. In addition, when an offshore company acquires a PRC domestic company, the offshore company is generally required to pay the acquisition consideration within three months after the issuance of the foreign-invested company license unless certain ratification from the relevant PRC regulatory agency is obtained. On September 21, 2006, the CSRC, pursuant to the M&A Rule, published on its official web site procedures specifying documents and materials required to be submitted to it by offshore companies seeking CSRC approval of their overseas listings.

16

We believe the M&A Rule concerning the CSRC approval for acquisition of a PRC domestic company by an offshore company controlled by PRC companies or individuals did not apply to our reverse acquisition of Dragons Soaring because none of Dragons Soaring, Huashi International, and Huashida Consulting is a “Special Purpose Vehicle” or an “offshore company controlled by PRC companies or individuals” at the moment of acquisition. However, we cannot assure you that we would be able to obtain approval of our interpretation by MOFCOM. If the PRC regulatory authorities take the view that the reverse acquisition of Dragons Soaring constituted a round-trip investment without MOFCOM approval on such round-trip investment, they could invalidate our acquisition and ownership of Dragons Soaring.

The M&A Rule establishes more complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China.

The M&A Rule establishes additional procedures and requirements that could make some acquisitions of Chinese companies by foreign investors more time-consuming and complex, including requirements in some instances that the PRC Ministry of Commerce be notified in advance of any change-of-control transaction and in some situations, require approval of the PRC Ministry of Commerce when a foreign investor takes control of a Chinese domestic enterprise. In the future, we may grow our business in part by acquiring complementary businesses, although we do not have any plans to do so at this time. The M&A Rule also requires PRC Ministry of Commerce anti-trust review of any change-of-control transactions involving certain types of foreign acquirers. Complying with the requirements of the M&A Rule to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the PRC Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiary or affiliate, limit our PRC subsidiary’s and affiliate’s ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, SAFE issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75. Circular 75 required PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Internal implementing guidelines issued by SAFE, which became public in June 2007 (known as Notice 106), expanded the reach of Circular 75 by (1) purporting to cover the establishment or acquisition of control by PRC residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; (2) adding requirements relating to the source of the PRC resident’s funds used to establish or acquire the offshore entity; covering the use of existing offshore entities for offshore financings; (3) purporting to cover situations in which an offshore SPV establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; and (4) making the domestic affiliate of the SPV responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations, and Notice 106 makes the offshore SPV jointly responsible for these filings. Failure to comply with the requirements of Circular 75, as applied by SAFE in accordance with Notice 106, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

17

We have advised our shareholders who are PRC residents, as defined in Circular 75, to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiary and affiliate. However, we cannot provide any assurances that their existing registrations have fully complied with, and they have made all necessary amendments to their registration to fully comply with, all applicable registrations or approvals required by Circular 75. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiary’s and affiliate’s ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75. We also have little control over either our present or prospective direct or indirect shareholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident shareholders to comply with Circular 75, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiary’s and affiliate’s ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

RISKS RELATING TO THE VIE AGREEMENTS

The PRC government may determine that the VIE Agreements are not in compliance with applicable PRC laws, rules and regulations.

Huashida Consulting provides support and consulting service to Huludao Rescue pursuant to the VIE Agreements. Almost all economic benefits and risks arising from Huludao Rescue’s operations are required to be transferred to Huashida Consulting under these agreements, although at present all amounts due from Huludao Rescue to Huashida Consulting are being accrued and no payments have been made. Our plan for the foreseeable future is that Huludao Rescue will make payments to Huashida Consulting to the extent necessary for that entity and its parent entities to pay their expenses, but will accrue the remainder of its obligations to Huashida Consulting without interest, penalties or other compensation for the delay in payment. Details of the VIE Agreements are set out in “Management’s Discussion and Analysis of Financial Condition and Results of Operations: Contractual Arrangements with our Controlled Affiliate and its Shareholders” at Item 7 below.

There are risks involved with the operation of our business in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. We believe the VIE Agreements are binding and enforceable under PRC law. But if the VIE Agreements were for any reason determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

|

●

|

imposing economic penalties;

|

18

|

●

|

discontinuing or restricting the operations of Huashida Consulting or Huludao Rescue;

|

|

●

|

imposing conditions or requirements in respect of the VIE Agreements with which Huashida Consulting or Huludao Rescue may not be able to comply;

|

|

●

|

requiring our company to restructure the relevant ownership structure or operations;

|

|

●

|

taking other regulatory or enforcement actions that could adversely affect our company’s business; and

|

|

●

|

revoking the business licenses and/or the licenses or certificates of Huashida Consulting.

|

If it occurred that we required judicial intervention in order to enforce the VIE Agreements and we were unable to persuade the courts of the PRC to do so, the value in our company would disappear. We would no longer be entitled to consolidate the balance sheet and financial results of Huludao Rescue with those of China Hefeng, which would render China Hefeng a shell company.

As the VIE Agreements are governed by PRC law, we would be required to rely on PRC law to enforce our rights and remedies under them; PRC law may not provide us with the same rights and remedies as are available in contractual disputes governed by the law of other jurisdictions.

We conduct our business in the PRC and generate virtually all of our revenues through the VIE Agreements. Our plans for future growth are based substantially on growing the operations of Huludao Rescue. However, the VIE Agreements may not be as effective in providing us with control over Huludao Rescue as direct ownership. The VIE Agreements do not provide us with day-to-day control over the operations of Huludao Rescue. Under the current VIE arrangements, as a legal matter, if Huludao Rescue fails to perform its obligations under these contractual arrangements, we may have to (i) incur substantial costs and resources to enforce such arrangements, and (ii) rely on legal remedies under PRC law, which we cannot be sure would be effective. Therefore, if we are unable to effectively control Huludao Rescue, it may have an adverse effect on our ability to achieve our business objectives and grow our revenues.

The VIE Agreements are governed by PRC law and provide for the resolution of disputes through the jurisdiction of courts in the PRC. If Huludao Rescue or its shareholders fail to perform the obligations under the VIE Agreements, we would be required to resort to legal remedies available under PRC law, including seeking specific performance or injunctive relief, or claiming damages. We cannot be sure that such remedies would provide us with effective means of causing Huludao Rescue or its shareholder to meet their obligations, or recovering any losses or damages as a result of non-performance. Further, the legal environment in China is not as developed as in other jurisdictions. Uncertainties in the application of various laws, rules, regulations or policies in PRC legal system could limit our liability to enforce the VIE Agreements and protect our interests.

The payment arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

We generate our revenues through the payments we receive pursuant to the VIE Agreements. The tax rate in PRC is fixed by the central tax authority, but local tax authorities have the right to adjust entities’ income and expenses. Although it is rare for the local tax authorities to make the adjustment or make significant adjustment, if the PRC tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations, then PRC tax authorities may adjust our income and expenses for PRC tax purposes which could result in our being subject to higher tax liability, or cause other adverse financial consequences.

19

Our Shareholders have potential conflicts of interest with our company which may adversely affect our business.

Baoyuan Zhu is our Chairman and Jianjun Gao is one of our directors. They are also the only shareholders of Huludao Rescue. There could be conflicts that arise from time to time between our interests and the interests of Mr. Zhu and Mr. Gao. There could also be conflicts that arise between us and Huludao Rescue that would require our shareholders and Huludao Rescue’s shareholder to vote on corporate actions necessary to resolve the conflict. There can be no assurance in any such circumstances that Mr. Zhu and Mr. Gao will vote their shares in our best interest or otherwise act in the best interests of our company. If Mr. Zhu and Mr. Gao fail to act in our best interests, our operating performance and future growth could be adversely affected.

Notwithstanding the requirement under the VIE Agreements that it pay over 95% of its net income to Huashida Consulting, Huludao Rescue does not intend that for the foreseeable future it will remit to Huashida Consulting more than is necessary to pay the expenses of Huashida Consulting and its parent entities.

The Exclusive Technical Service and Business Consulting Agreement between Huashida Consulting and Huludao Rescue provides that Huashida Consulting will provide technical support and consulting services to Huludao Rescue in exchange for (i) 95% the total annual net profit of Huludao Rescue and (ii) RMB100,000 per month (US$15,800). To date, Huludao Rescue has not made any payment to Huashida Consulting. Moreover, it is management’s present intent that for the foreseeable future Huludao Rescue will pay to Huashida Consulting only such amounts as are necessary to pay the expenses of Huashida Consulting and its parent entities (although we expect that for the near term our U.S. expenses will be funded by borrowing dollars from related parties). The remainder of the net profits earned by Huludao Rescue will be retained by it to fund its operations and growth. As a result of this plan, investors in China Hefeng should not expect to receive dividend payments or other distributions during the foreseeable future. In addition, any profits earned by Huludao Rescue will be left at risk of a downturn in future operations - in the event of an adverse turn in the operations of Huludao Rescue, cash that might have been earlier paid as dividends if there had been compliance with the Exclusive Technical Service and Business Consulting Agreement will remain available to be taken by the creditors of Huludao Rescue. Finally, as no interest will be paid by Huludao Rescue on account of the delayed payment of net income to Huashida Consulting, the value of the accrued obligation will diminish in proportion to the time/value of money.

We rely on the approval certificates and business license held by Huashida Consulting and any deterioration of the relationship between Huashida Consulting and Huludao Rescue could materially and adversely affect our business operations.

We operate our business in China on the basis of the approval certificates, business license and other requisite licenses held by Huashida Consulting and Huludao Rescue. There is no assurance that Huashida Consulting and Huludao Rescue will be able to renew their licenses or certificates when their terms expire with substantially similar terms as the ones they currently hold. The Business License of Huashida Consulting expires in 2030 and the Business License of Huludao Rescue will expire in 2020.

20

The Business License is the certificate of operating rights of an enterprise or organization. Obtaining a Business License is for the purpose of open bank account, organization code, tax registration certificate and contract signing. Business Licenses go through an annual inspection which period is from March 1 to June 30. Without a license, a company will lose all its legal rights. The Business License can be terminated by application by the licensed entity, failure of the annual inspection, or if its operations violate relevant laws and regulations.

RISKS RELATED TO THE MARKET FOR OUR STOCK GENERALLY

Our Common Stock is not listed for trading or quotation anywhere.

Our common stock is not listed for trading on any exchange and is not listed for quotation on any service. Accordingly, there is currently no trading in our common stock. We cannot provide any assurances as to when our common stock will begin trading or that an active market will develop for our common stock.

Our common stock is subject to penny stock rules.

Our common stock is subject to Rule 15g-1 through 15g-9 under the Exchange Act, which

If and when our common stock is listed for trading or quotation, it may be subject to the SEC regulations for “penny stocks.” Penny stocks include any equity security that is not listed on a national exchange and has a market price of less than $5.00 per share, subject to certain exceptions. The regulations impose certain sales practice requirements on broker-dealers which sell penny stock to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or an annual incomes exceeding $200,000 (or $300,000 together with their spouses)). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to the sale. In addition, prior to any non-exempt buy/sell transaction in a penny stock, a disclosure schedule defined by the SEC relating to the penny stock market must be delivered to the purchaser of such penny stock. This disclosure must include the amount of commissions payable to both the broker-dealer and the registered representative and current price quotations for the common stock. The regulations also require that monthly statements be sent to holders of penny stock that disclose recent price information for the penny stock and information of the limited market for penny stocks. These rules adversely affects the ability of broker-dealers to sell penny stock, and may adversely affect the market liquidity of our common stock if it becomes subject to the penny stock rules.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.

ITEM 2. DESCRIPTION OF PROPERTY

The Company’s principal office has 2,153 square feet and is located at Suite A 10F, Nanhai Fishing Port, Haibin Road, Longgang District, Huludao PRC. The Company pays annual rent of RMB84,000 ($13,217) per year. The current lease expires on December 31, 2014.

The Company also maintains a 1,399 square foot office at Western Room 2, Comprehensive Service Building, No.88,Taishan Street, North Port Industrial Park, Longgang District, Huludao PRC. The Company pays annual rent of RMB168,000 ($26,435) per year. The current lease expires on April 30, 2014.

21

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Currently there is no market for the Company’s securities.

Holders

As of June 15, 2012, there were approximately 19 stockholders of record of our common stock.

Dividends

We have never declared or paid a cash dividend. Any future decisions regarding dividends will be made by our board of directors. We currently intend to retain and use any future earnings for the development and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

PRC regulations restrict the ability of our PRC subsidiary to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiary only out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiary is also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. (The registered capital of Huashida Consulting is 200,000 HK dollars - i.e. US$15,385). Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Restrictions under PRC law on our PRC subsidiary's ability to make dividends and other distributions prevent or limit our ability to pay dividends.

22

Equity Compensation Plans

The information set forth in the table below regarding equity compensation plans (which include individual compensation arrangements) was determined as of December 31, 2012.

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted average

exercise price of

outstanding options,

warrants and rights

|

Number of securities remaining available

for future issuance under equity compensation plans

|

|||||||

|

Equity compensation plans approved by security holders

|

0 |

N.A.

|

0 | ||||||

|

Equity compensation plans not approved by security holders

|

0 |

N.A.

|

0 | ||||||

|

Total

|

0 |