Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Howmet Aerospace Inc. | d520161dex991.htm |

| 8-K - FORM 8-K - Howmet Aerospace Inc. | d520161d8k.htm |

[Alcoa

Logo] 1

Quarter Earnings Conference

April 8, 2013

1

[Alcoa Logo]

Exhibit 99.2

st

[Alcoa Logo] |

2

Cautionary Statement

Forward-Looking Statements

This presentation contains statements that relate to future events and expectations and as

such constitute forward-looking statements. Forward-looking statements include those

containing such words as “anticipates,” “estimates,”

“expects,” “forecasts,” “intends,” “outlook,” “plans,” “projects,” “should,” “targets,” “will,” or other words of similar meaning. All

statements that reflect Alcoa’s expectations, assumptions, or projections about the

future other than statements of historical fact are forward-looking statements, including, without

limitation, forecasts concerning global demand growth for aluminum, end-market

conditions, supply/demand balances, and growth opportunities for aluminum in automotive,

aerospace and other applications, trend projections, targeted financial results or operating

performance, and statements about Alcoa’s strategies, outlook, and business and financial

prospects. Forward-looking statements are subject to a number of known and unknown

risks, uncertainties, and other factors and are not guarantees of future performance. Important

factors that could cause actual results to differ materially from those in the

forward-looking statements include: (a) material adverse changes in aluminum industry conditions, including

global supply and demand conditions and fluctuations in London Metal Exchange-based

prices for primary aluminum, alumina, and other products, and fluctuations in indexed-based

and spot prices for alumina; (b) deterioration in global economic and financial market

conditions generally; (c) unfavorable changes in the markets served by Alcoa, including

automotive and commercial transportation, aerospace, building and construction,

distribution, packaging, defense, and industrial gas turbine; (d) the impact of changes in foreign

currency exchange rates on costs and results, particularly the Australian dollar, Brazilian

real, Canadian dollar, euro, and Norwegian kroner; (e) increases in energy costs, including

electricity, natural gas, and fuel oil, or the unavailability or interruption of energy

supplies; (f) increases in the costs of other raw materials, including calcined petroleum coke, caustic

soda, and liquid pitch; (g) Alcoa’s inability to achieve the level of revenue growth,

cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or

strengthening of competitiveness and operations (including moving its alumina refining and

aluminum smelting businesses down on the industry cost curves and increasing revenues

in its Global Rolled Products and Engineered Products and Solutions segments) anticipated

from its restructuring programs and productivity improvement, cash sustainability, and

other initiatives; (h) Alcoa's inability to realize expected benefits, in each case as

planned and by targeted completion dates, from sales of non-core assets, or from newly constructed,

expanded, or acquired facilities, such as the upstream operations in Brazil and the

investments in hydropower projects in Brazil, or from international joint ventures, including the joint

venture in Saudi Arabia; (i) political, economic, and regulatory risks in the countries in

which Alcoa operates or sells products, including unfavorable changes in laws and

governmental policies, civil unrest, or other events beyond Alcoa’s control; (j) the

outcome of contingencies, including legal proceedings, government investigations, and

environmental remediation; (k) the business or financial condition of key customers,

suppliers, and business partners; (l) adverse changes in tax rates or benefits; (m) adverse

changes in discount rates or investment returns on pension assets; (n) the impact of cyber

attacks and potential information technology or data security breaches; and (o) the other

risk factors summarized in Alcoa's Form 10-K for the year ended December 31, 2012 and

other reports filed with the Securities and Exchange Commission. Alcoa disclaims any

obligation to update publicly any forward-looking statements, whether in response to new

information, future events or otherwise, except as required by applicable law.

Non-GAAP Financial Measures

Some of the information included in this presentation is derived from Alcoa’s

consolidated financial information but is not presented in Alcoa’s financial statements prepared in

accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data

are considered “non-GAAP financial measures” under SEC rules. These non-GAAP

financial measures supplement our GAAP disclosures and should not be considered an

alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP

financial measures and management’s rationale for the use of the non-GAAP financial

measures can be found in the Appendix to this presentation and on our website at www.alcoa.com under the “Invest” section. Any

reference during the discussion today to EBITDA means adjusted EBITDA, for which we have provided calculations and reconciliations

in the Appendix and on our website.

[Alcoa Logo] |

Klaus Kleinfeld

Chairman and Chief Executive Officer

April 8, 2013

[Alcoa Logo]

[Alcoa Logo] |

[Alcoa

Logo] Delivering Strong Quarterly Results

4

All segments profitable; Best net income

excluding special items since 3Q 2011

Adjusted EBITDA up 16% sequentially and 11% YoY

Record profitability in the Downstream

Improved Upstream performance YoY

despite lower metal price

Strong liquidity; $1.6 Billion cash on hand

Solid global end market growth;

Reaffirm 2013 global aluminum demand growth of 7%

[Alcoa Logo] |

William Oplinger

Executive Vice President and Chief Financial Officer

5

April 8, 2013

[Alcoa Logo]

[Alcoa Logo] |

Income Statement Summary

6

[Alcoa Logo]

$ Millions, except per-share amounts

1Q12

4Q12

1Q13

Sequential

Change

Revenue

$6,006

$5,898

$5,833

($65)

Cost of Goods Sold

$5,098

$4,968

$4,847

($121)

COGS % Revenue

84.9%

84.2%

83.1%

(1.1 % pts.)

Selling,

General Administrative, Other

$241

$277

$251

($26)

SGA % Revenue

4.0%

4.7%

4.3%

(0.4 % pts.)

Other Income

, Net

($16)

($345)

($27)

$318

Restructuring and Other Charges

$10

$60

$7

($53)

Effective Tax Rate

28.3%

35.8%

27.4%

(8.4 % pts.)

Net

Income

$94

$242

$149

($93)

Net Income Per Diluted Share

$0.09

$0.21

$0.13

($0.08) |

[Alcoa Logo]

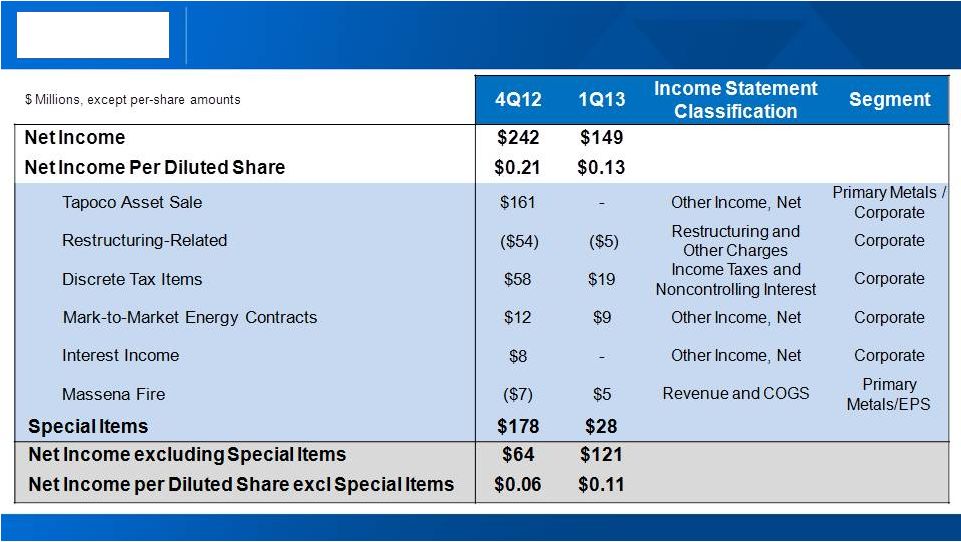

Restructuring and Other Special Items

See appendix for Adjusted Income reconciliation

7

[Alcoa Logo] |

121

64

4

11

Net Income Excluding Restructuring & Other Special Items ($

millions)

Profitability increases nearly 90% driven by performance

See appendix for Adjusted Income reconciliation

8

4Q 2012

1Q 2013

45

Raw

Materials

0

Energy

15

Portfolio

Actions

Productivity

44

Price

/Mix

21

Volume

15

Currency

0

LME

Cost

Increases

/ Other

Market

-$4m

Performance

+$91m

Cost Headwinds

-$30m

[Alcoa Logo] |

1Q13

Actual

and

2Q13

Outlook

-

EPS

9

Record results for Engineered Products and Solutions

See

appendix

for

Adjusted

EBITDA

reconciliation.

*

Prior

period

amounts

have

been

revised

to

conform

to

the

current

period

presentation.

See

appendix

for

additional

information.

[Alcoa Logo]

$ Millions

1Q 12

4Q 12

1Q 13

Party Revenue

1,390

1,348

1,423

ATOI*

157

140

173

Adjusted EBITDA Margin*

19.4%

18.0%

20.9%

rd

3

Quarterly ATOI up $16M year-

over-

year to

record level

Record ATOI

driven by

productivity & Aerospace volume

offsetting

weakness

Non-

Residential Construction

Commercial Transportation

Achieved

record

adjusted EBITDA

margin of 20.9%

Generated

$19M of productivity

savings;

improvements

achieved by

all business units

in

and

$ Millions

1Q 13

$173

Cost Increase

$1

Productivity

$19

Price / Mix

$0

Volume

$15

4Q 12

$140

-

Aerospace

market remains

strong

European Non-

Residential Construction

market continues

recovery in North America

Share gains

through innovation continue

across all market

sectors

Productivity

improvements

to continue

ATOI

is expected to

increase ~5% sequentially

to decline

; signs of |

1Q13

Actual

and

2Q13

Outlook

-

GRP

Improved sequential performance for Global Rolled Products

10

[Alcoa Logo]

Aero & auto demand

expected to remain strong

Seasonal demand

increases in Packaging

Pricing pressures

continue in European and N.A.

Industrials and China markets

Productivity improvements

to continue

Excluding

LME

and

currency,

ATOI

is

expected

to

increase 15%-20% sequentially

1

st

Quarter Results

1

st

Quarter Business Highlights

2

nd

Quarter Outlook

1

st

Quarter Performance Bridge

$11

$14

$9

$7

$4

$1

$81

$77

1Q13

Cost

Increase

Productivity

Price/Mix

Volume

Currency

LME

4Q12

$ Millions

1Q 12

4Q 12

1Q 13

3

Party Revenue

1,845

1,771

1,779

ATOI*

102

77

81

Adjusted EBITDA/mt*

447

370

385

Aerospace and auto

demand remained strong

Higher volumes

in Packaging and Auto

Price and mix

was impacted by weaker pricing

Productivity

driven by higher utilizations offset

by

costs related to

energy, maintenance, and labor

Days working capital improved ~7 days year-over-year

$ Millions

See appendix for Adjusted EBITDA reconciliation. * Prior period amounts have been revised to

conform to the current period presentation. See appendix for additional information.

rd |

41% ATOI improvement in the Alumina segment

11

[Alcoa Logo]

Raw

Materials

Energy

Prod-

uctivity

Price

/Mix

Volume

/ Fixed

Cost

Currency

LME

4Q 12

1Q 13

Cost

Increase

$1

$3

$5

$6

$7

$4

$27

$58

$6

$41

+$23m

-$6m

Market

Performance

$ Millions

1Q 12

4Q 12

1Q 13

Production (kmt)

4,153

4,079

3,994

3

Party Shipments (kmt)

2,293

2,440

2,457

3

Party Revenue ($ Millions)

775

803

826

ATOI ($ Millions)

35

41

58

1

Quarter Results

st

1

st

Quarter Business Highlights

2

Quarter Outlook

1

st

Quarter Performance Bridge

1Q13 Actual and 2Q13 Outlook - Alumina

rd

rd

rd

nd

Mining cost increases

of $20m in Australia (Myara

crusher move) and Suriname

Record

days working capital of 23 days; ~9 day

improvement

year-over-year

Production lower

due to 2 fewer days in the quarter

Alumina Price

Index and

spot pricing

continued

positive trend

Productivity improvements

continued

Increased costs driven by the Myara crusher move

Production

increases by 150 kmt

Productivity improvements

to continue

52%

of 3 party shipments on spot or alumina price

index with 30 day lag

for 2013 |

[Alcoa Logo]

Primary Metals performance overcomes cost headwinds

12

1 Quarter Business Highlights

st

Price/Mix improved as regional premiums rose

and

value-added product mix

strengthened

Productivity improvements

continued

Rockdale outage

neared completion

Achieved record days working capital

of 18.8 days

Ahead of schedule

startup and cost control of Saudi

Arabia JV

minimized equity charge

1 Quarter Results

st

1 Quarter Performance Bridge

st

2 Quarter Outlook

nd

Pricing

to follow 15 day lag

to LME

Production increases by 15 kmt

Power plant outages

with $25m impact in Anglesea

(4-year overhaul) and Warrick

Saudi Arabia

JV

impact to remain flat

Productivity improvements

to continue

rd

rd

rd

$ Millions

market

performance

$39

$15

$17

$11

$275

$8

$13

$19

$316

$17

$41

Price

/Mix &

Vol.

Rockdale/

Anglesea

Cost

Increase

Energy

Portfolio

Actions

Prod-

uctivity

4Q 12

LME

4Q 12

adj.

1Q 13

Tapoco

Sale

Production (kmt)

951

912

891

Party Shipments (kmt)

771

768

705

Party Revenue ($ Millions)

1,944

1,890

1,758

Party Price ($/MT)

2,433

2,325

2,398

ATOI ($ Millions)

10

316

39

3

3

3

-$19m

+$17m

1Q13 Actual and 2Q13 Outlook – Primary Metals

1Q 12

4Q 12

1Q 13 |

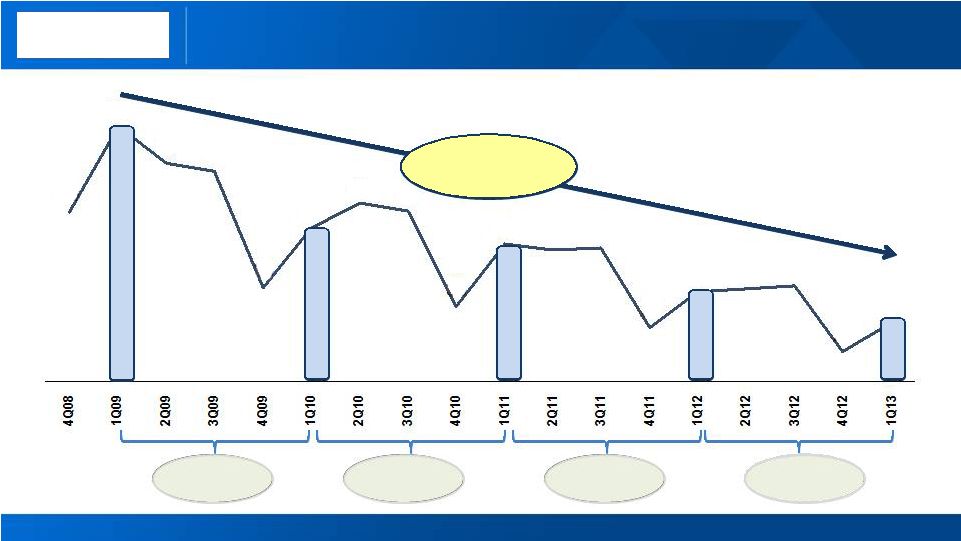

Continued sustainable days working capital reductions

[Alcoa Logo]

7 days

lower

2 days

lower

14 days

lower

4 days

lower

27 days;

$1.8 B

7 days

lower

Days Working Capital since Fourth Quarter 2008

2 days

lower

14 days

lower

4 days

lower

27 days;

$1.8 B

43

55

50

48

33

41

44

43

30

39

38

38

27

32

33

33

24

28

See appendix for days working capital reconciliation

13 |

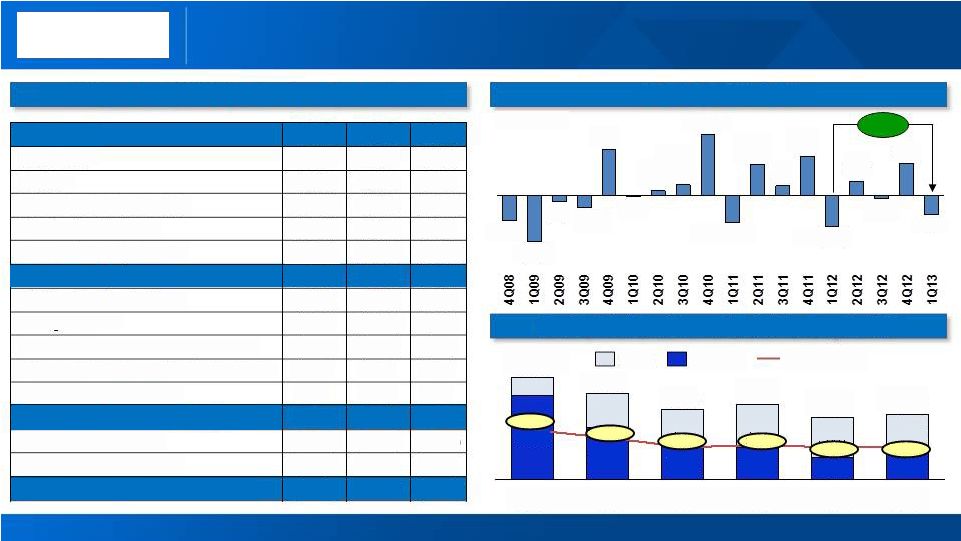

[Alcoa Logo]

See appendix for Free Cash Flow, Net Debt and Net Debt-to-Capital

reconciliations 1 Quarter Cash Flow Overview

14

Net Income

$99

$257

$170

DD&A

$369

$363

$361

Change in Working Capital

($289)

$536

($323)

Pension Contributions

($213)

($46)

($83)

Taxes / Other Adjustments

($202)

($177)

($195)

Cash from Operations

($236)

$933

($70)

Dividends to Shareholders

($33)

($33)

($33)

Change in Debt

$357

($692)

$90

Distributions

to

Noncontrolling

Interests

($26)

($24)

($25)

Contributions

from

Noncontrolling

Interests

$90

$39

$15

Other Financing Activities

$6

($2)

$0

Cash from Financing Activities

$394

($712)

$47

Capital Expenditures

($270)

($398)

($235)

Other Investing Activities

($80)

$605

($50)

Cash from Investing Activities

($350)

$207

($285)

1 Quarter 2013 Cash Flow Overview

st

($ Millions)

1Q12

4Q12

1Q13

2010

2009

2008

1Q13

2012

2011

7,622

8,338

9,816

7,370

6,968

7,432

34.7%

42.5%

38.7%

34.9%

35.3%

34.8%

762

1,481

1,543

1,939

1,861

1,555

9,165

9,819

10,578

8,925

8,829

9,371

(millions)

Debt to Cap

Net Debt

Cash

(305)

(39)

(506)

(440)

(22)

(186)

(90)

(742)

(409)

535

246

656

164

526

1,005

176

87

761

+201

(millions)

Free Cash Flow

Debt, Net Debt and Debt-to-Capital %

st |

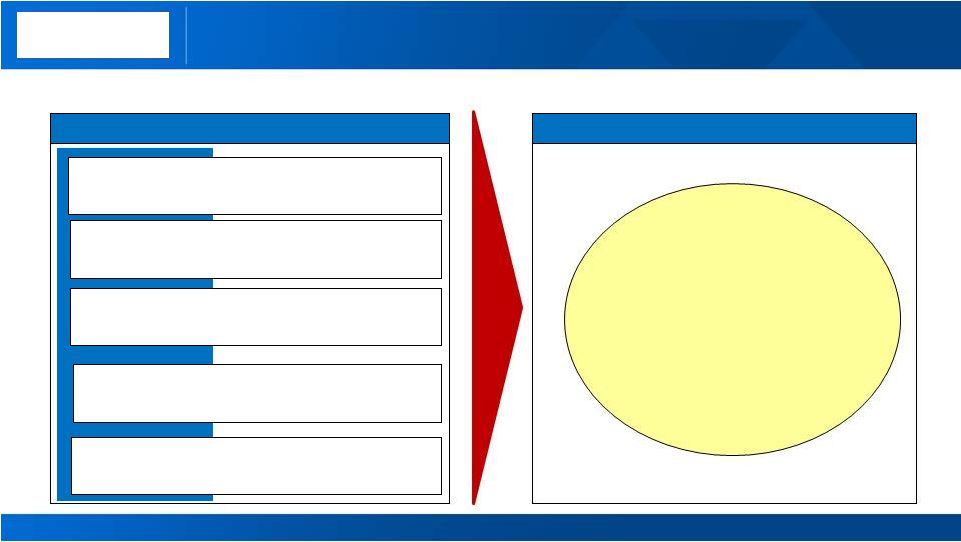

2013 Targets: Key Actions to Execute 2013 Cash Sustainability

Program Aggressive targets set to maximize

cash in 2013 15

Maintain 30%-35% Debt-to-Capital

Manage Growth Capital of $550M

Generate Productivity Gains of $750M

Target Saudi JV Investment of $350M

Overarching 2013 Financial Target

Taking the right actions

Control Sustaining Capital of $1.0B

Positive

Free Cash

Flow

[Alcoa Logo] |

16

[Alcoa Logo]

Capital Flows Into Equities from Commodities

2013 Global Aluminum Demand Will Grow at 7%

Supply and Demand Tightening On Curtailments

Inventories Are Stable, Premiums Remain Strong |

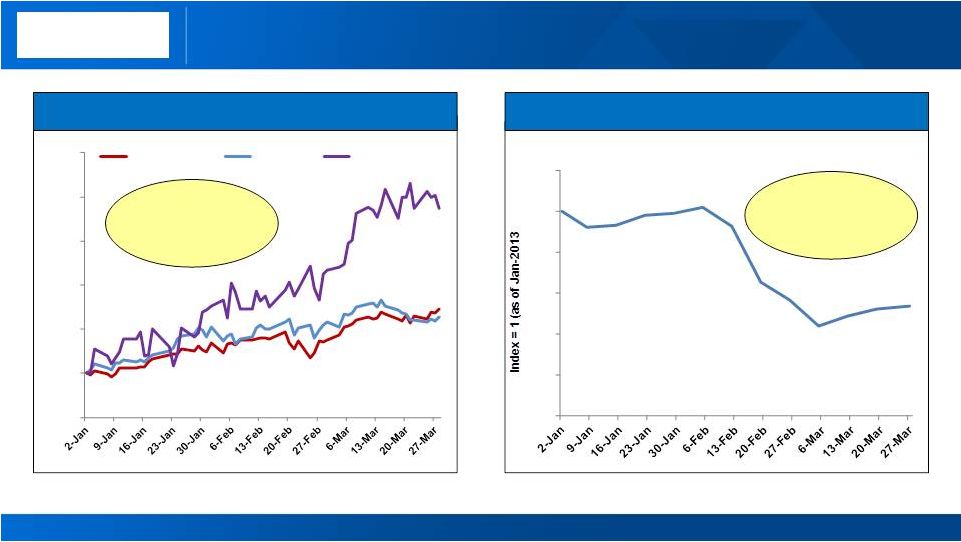

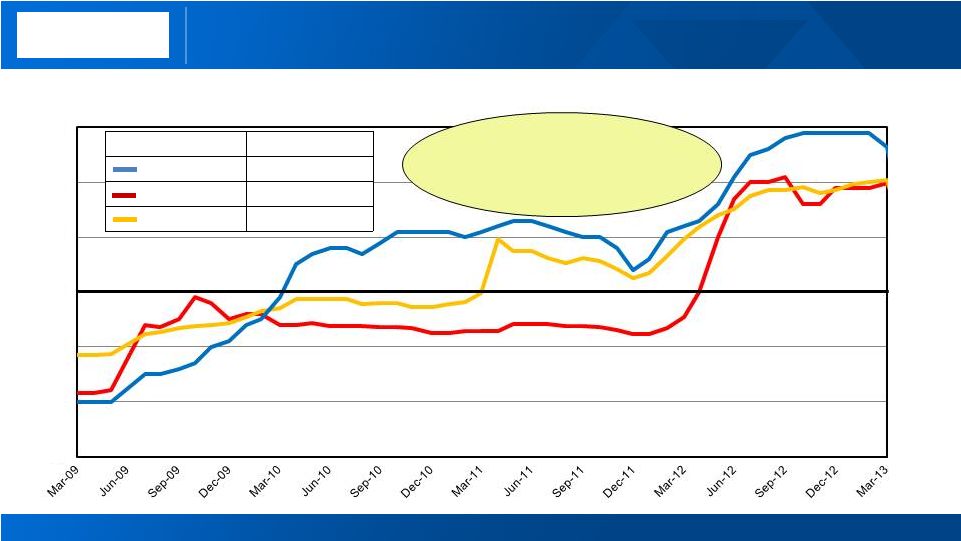

Capital flows into equities and out of commodities

17

Source: Bloomberg, CFTC COT Reports (excl. energy futures)

…attracting capital from commodities

Net Managed Money Positions

($ billion)

Major equity exchanges rally…

95%

100%

105%

110%

115%

120%

125%

S&P 500 Index

FTSE 100

NIKKEI

~50% decline

in 1Q13

~20%

increase in

1Q13

-

0.2

0.4

0.6

0.8

1.0

1.2

[Alcoa Logo] |

[Alcoa Logo]

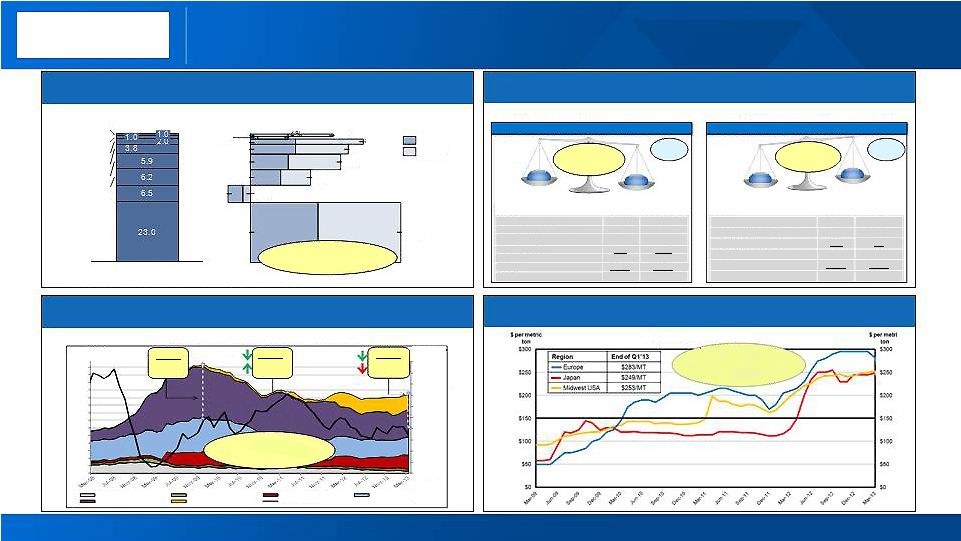

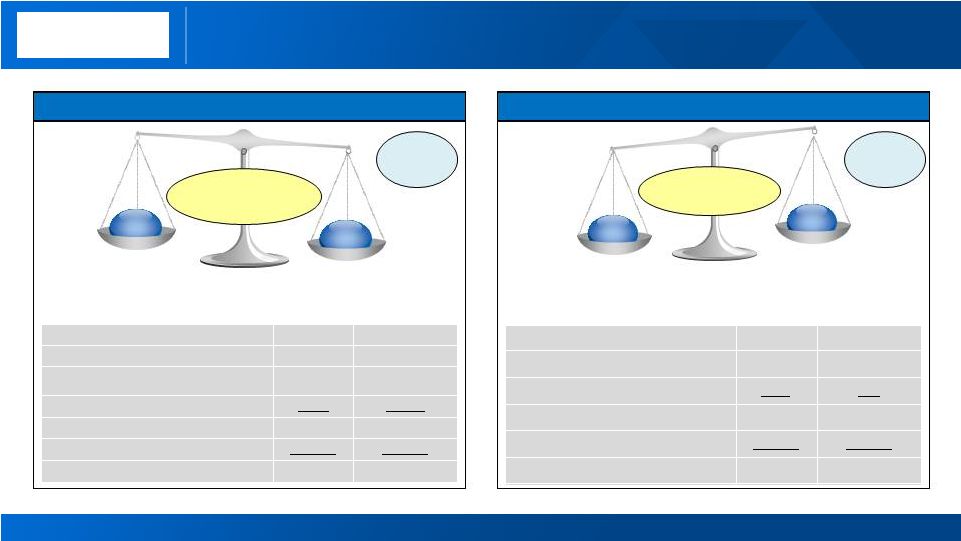

Market fundamentals are stable

18

Market Tightening

On Curtailments

Inventory

is Stable

Regional Premiums Remain Strong

2013 Primary Aluminum Consumption (mmt) and Annualized Growth (%)

Global Inventories vs. LME Price Over Time $

Supply/Demand analysis

See appendix for full scale charts

2013 Global Demand

Growth Rate 7%

(World ex China 4%)

Decline 28 days

Global Inventories

from the ’09 peak

Year on Year Change

Europe +35%

Japan + 96%

Midwest USA +27%

Deficit

(100)

4Q2012

(200)

Deficit

Surplus

155

4Q2012

535

Surplus

2013E Alumina Supply/Demand Balance

2013E Aluminum Supply/Demand Balance

‘000 mt

China

Rest of World

2013 Production

(Feb annualized)

41,600

53,700

2013 Production to be added

600

2,400

2013 Capacity to be curtailed

(1,000)

0

Imports/(exports)

3,900

(3,900)

Total supply

45,100

52,200

Demand

(45,100)

(52,300)

Net Balance

0

(100)

Supply

Demand

Supply

Demand

‘000 mt

China

Rest of World

2013 Production

(Feb annualized)

21,330

25,360

2013 Production to be added

2,270

1,190

2013 Capacity to be curtailed

Total supply

23,075

26,500

Demand

(23,000)

(26,420)

Net Balance

75

80

(525)

(50)

Regional Premiums over time

Global Aluminum Demand Growth at 7%

Producer

Japan Port

China Incl SRB

Off Exchange

LME On Warrant

Cancelled Warrants

LME 3 Mon

1%

8%

6%

5%

9%

11%

-2%

-1%

4%

4%

5%

7%

7%

6%

Asia ex. China

Other

India

Brazil

Russia

China

Europe

North America

2012

2013E

Other includes Middle East, Latin America ex Brazil, Eastern Europe and Rest of

World 49.4 mmt

(1)

(1)

6%

$1,250

$1,450

$1,650

$1,850

$2,050

$2,250

$2,450

$2,650

$2,850

$3,050

$3,250

$ per metric

ton

Days of

Consumption

Days of

Consumption

108 days

LME Price

$2,214/MT

LME Price

$2,686/MT

LME Price

$1,951/MT

Days of

Consumption

83 days

Days of

Consumption

80 days

7

21

28

35

42

49

56

63

70

77

84

91

98

105

14 |

Klaus Kleinfeld

Chairman and Chief Executive Officer

April 8, 2013

[Alcoa Logo]

[Alcoa Logo] |

Source: Alcoa analysis

Alcoa End Markets: Current Assessment of 2013 vs. 2012

Growth continues in global end markets

20

[Alcoa Logo]

North America

China

Global

Europe

-

Aerospace

Automotive

Heavy Truck &

Trailer

Beverage Can

Packaging

Commercial Building

and Construction

Industrial Gas

Turbine

9% -

10%

sales growth

2% -

3%

sales growth

4% -

5%

sales growth

3% -

5%

airfoil market

growth rate

1% -

4%

prod growth

2% -

7%

prod growth |

[Alcoa Logo]

Value add businesses driving 71% of segment profits

Alcoa business mix shift and GRP/EPS margins

21

EPS: Continuing to Grow Profitability

Business mix shifted toward value add

After tax operating income (ATOI) by segment

(% of total segment ATOI)

2003

2012

75%

29%

16%

26%

9%

45%

GPP

GRP

EPS

100%

100%

GRP: Generating Record Margins

10-YR Average ~ $248/MT

385

380

332

69

83

284

292

276

261

1Q’13

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

Adjusted EBITDA per MT

15%

1Q’13

21%

2012

19%

2011

18%

2010

17%

2009

13%

2008

2007

13%

2006

13%

2005

11%

2004

12%

2003

9%

Adjusted EBITDA

Margin

25%

71%

2.3x 2003 level

1.5x average

184

321

GPP: Combined Alumina and Primary Metals segments, GRP: Global Rolled Products, EPS:

Engineered Products and Solutions. Prior period amounts have been revised to conform to the current period presentation. See appendix for

additional information. |

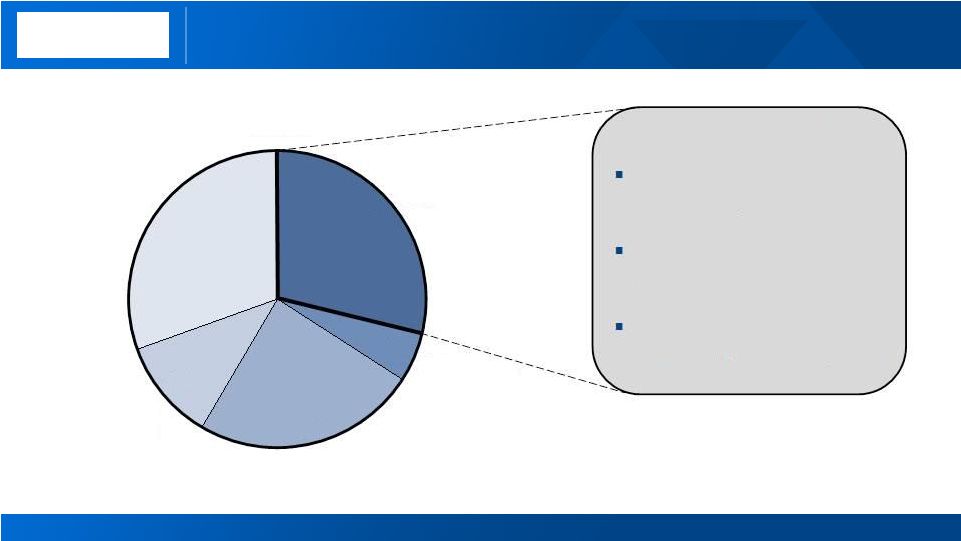

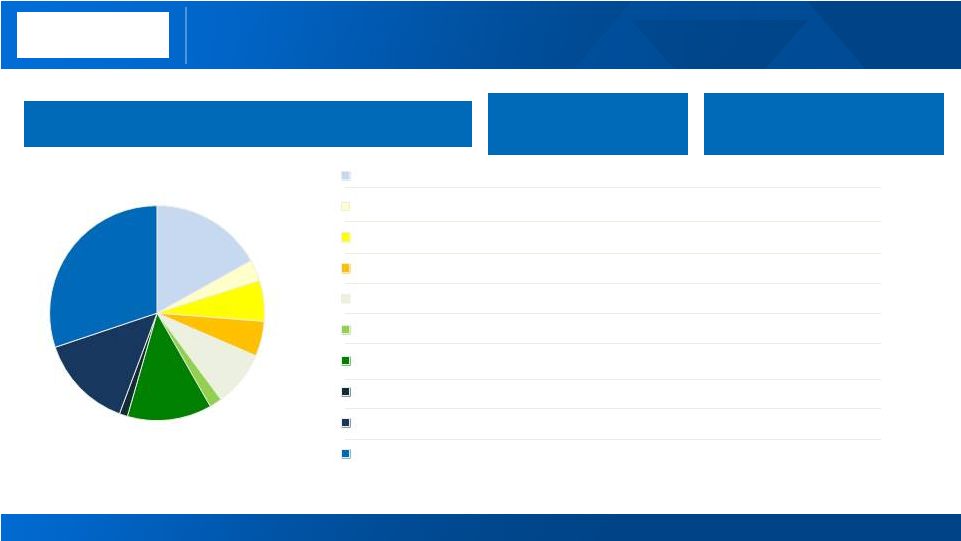

[Alcoa Logo]

Aerospace accounts for $3.8B of value add revenue

Breakdown of 2012 Alcoa value-add revenue by market ($B)

22

Other

3.8

Aerospace

0.7

Automotive

3.2

Packaging

1.4

Building and

Construction

4.1

End Market Highlights

$13.2B

11.6%

End

Market

CAGR

(2012 -

2015)

~

(at 2012 rates)

8

year

backlog

of

production

Alcoa

well

positioned

on

both

Aluminum

and

CFRP

planes |

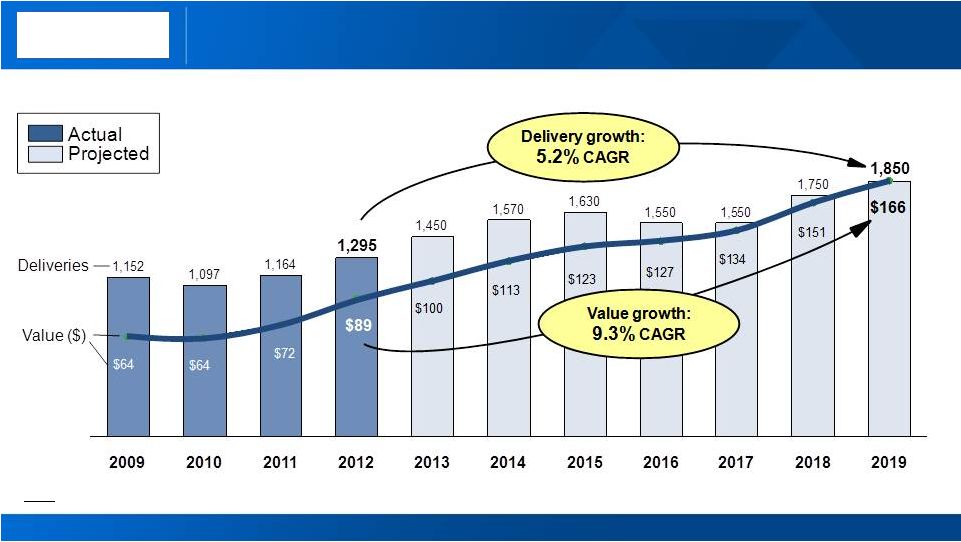

Sources: The Airline Monitor February 2013

Vibrant growth projected for the aerospace market

23

Aero

market

growth:

Commercial

Jet

Deliveries

1

and

Value

in

$B

Notes: (1) All figures include both Large Commercial Aircraft & Regional

Jets [Alcoa Logo] |

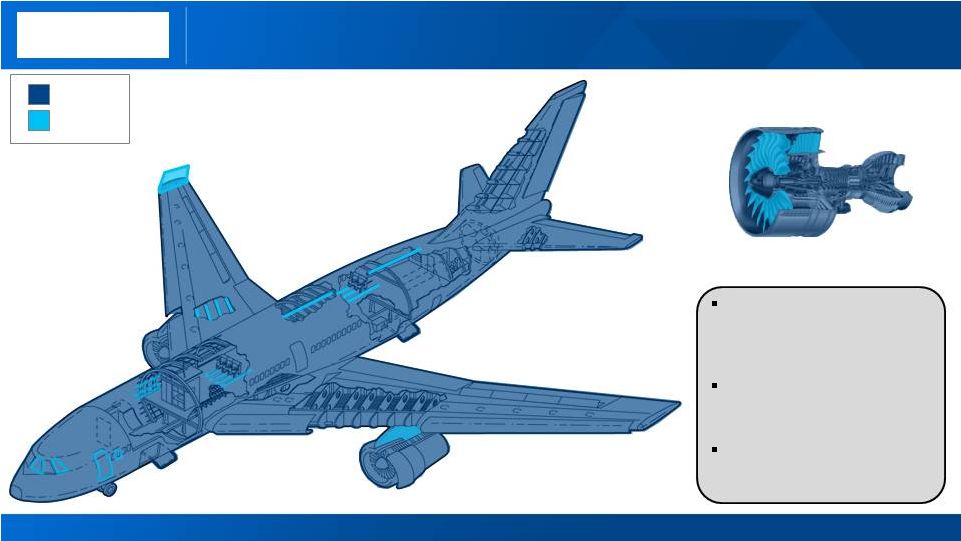

Alcoa Blue Flies From Nose to Tail

Wing ribs (plate

and extrusions)

Wing tips

Hydraulic vessels

Fuel connectors

Torque rods

Seat

frames

Window and

door frames

Wheels, brakes

and torque tubes

Fuselage to

wing

connection

Wing box

fasteners

Engine pylon

structure and

fasteners

Wing spars

(forgings

and plate)

Lower wing skins

Wing flap

fasteners

Wing

stringers

Wing gear ribs,

trunions and support fittings

Upper wing skins

Crown frames

Auxiliary power unit

exhaust ducts

Vertical stabilizer

fasteners

Fuselage

stringers

Fuselage

skins

Seat tracks

Landing gear,

bay frames

Sleeved fasteners

Fan blades

Guide vanes

Hot section

blades and

vanes

Compressor cases

Fuel metering

unit

Fan hub and

compressor

frames

Bearing

housings

Current

Future

More

than

90%

of

all

aluminum aerospace alloys

have been developed by

Alcoa

Every

Western Commercial

aircraft

flying

today

uses

Alcoa

fasteners

Every

Western Commercial

and military aircraft engine

uses Alcoa

castings

24

[Alcoa Logo] |

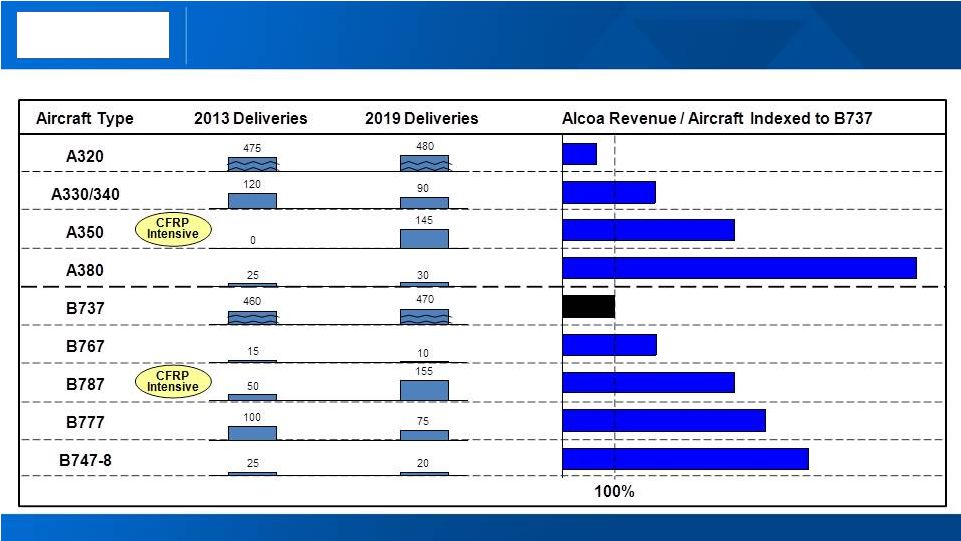

Sources: 1) The Airline Monitor February 2013

Notes: All figures include both Large Commercial Aircraft & Regional

Jets. CFRP refers to carbon fiber reinforced plastic Alcoa is well

positioned on both Aluminum and CFRP planes Commercial jet deliveries and

Alcoa Indexed Revenue by aircraft type 25

[Alcoa Logo] |

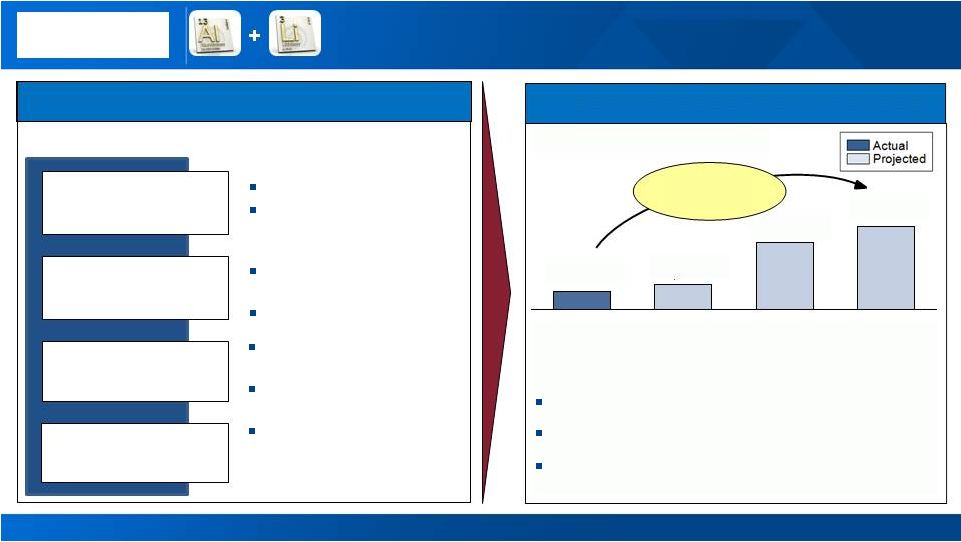

Innovation creating long term value for Alcoa

Aluminum Lithium Meeting Customer Needs

Reduce inspection

Improve comfort

20% fuel efficiency

improvement

Lower capital costs

Customer Needs

Al-Li Value Proposition

Improved corrosion and

fatigue

properties

2X

inspection

intervals

5% to 7% lower density

7% higher stiffness

Capital

costs

avoided

by

using existing Aluminum

infrastructure

Meets 787 humidity and

pressure benchmarks

30%-50% larger windows

26

Key Platforms Drivers:

Twin Aisle: Airbus A380 & A350, Boeing 787

Single Aisle: Bombardier CSeries, Comac

C919

Regional/Business Jet: Gulfstream G650,

Bombardier Global 7000/8000

Projected Al-Li Revenue in $M

Al-Li Revenue quadrupling by 2019

+350%

= 29% CAGR

2019

$197

2017

$161

2015

$61

2013

$43

[Alcoa Logo] |

[Alcoa Logo]

Automotive accounts for $700M of value add revenue

Breakdown of 2012 Alcoa value-add revenue by market ($B)

27

Building and

Construction

1.4

Packaging

3.2

Automotive

0.7

Aerospace

3.8

Other

4.1

$13.2B

End Market Highlights

2-3% End Market CAGR

(2012

-

2015)

30-35%

CAGR

for NA Auto

Sheet

(

2012

-

2015

)

3.6x

increase

in

Auto

Sheet

revenue

from

2012

to

2015 |

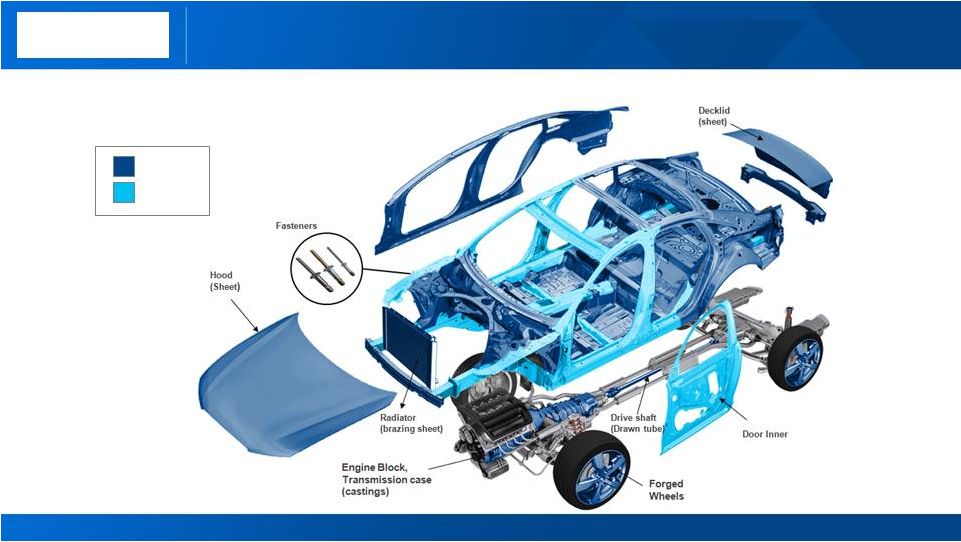

Alcoa’s content runs from bumper to bumper

Alcoa participation in automotive parts

Current

Future

28

[Alcoa Logo] |

[Alcoa Logo]

Aluminum intensity amplifying automotive market growth

Auto industry growth and projected incremental aluminum content

Sources: Ducker Worldwide , IHS , Alcoa analysis, *)

Extrapolated based on IHS 2020 forecast 29

Growth in Automotive Market…

Global light vehicle production (in millions of units)

19

25

31

19

20

23

15

17

18

China

Europe

North

America

2025*

72

2015

62

2012

53

…amplified by increasing Al intensity

136

55

14

2025

2015

2012

North America Aluminum Body Sheet

Content Per Vehicle (in lbs) |

[Alcoa Logo]

Consumers and regulations drive auto light-weighting

30

Consumers want it

US Corporate Average

Fuel Economy (MPG)

35.5

2011

27.2

2025

54.5

2016

Regulations demand it

2011

83%

2008

54%

% willing to pay for

better fuel efficiency

Consumers Outpace Regulation

US Consumer Buying vs. Regulation

miles per gallon

2000

29.7

30.8

50

45

40

35

30

25

0

2025

2020

2015

2010

2005

Regulations

Consumer Buying

Safety benefits

Changing body

structure from steel

to aluminum can

reduce stopping

distances

from 45

mph to zero by up to

7 feet –

this can

mean the difference

between a

serious

collision and a

near-miss

NHTSA

1)

says:

Lightweighting

conserves fuel,

maintains footprint,

and may improve

the car’s structural

strength and

handling

1)

National

Highway

Traffic

Safety

Admin.

Source: Ducker Worldwide , Consumer Reports, The Aluminum Association ,

NHTSA 1)

September 17, 2012, Alcoa Analysis |

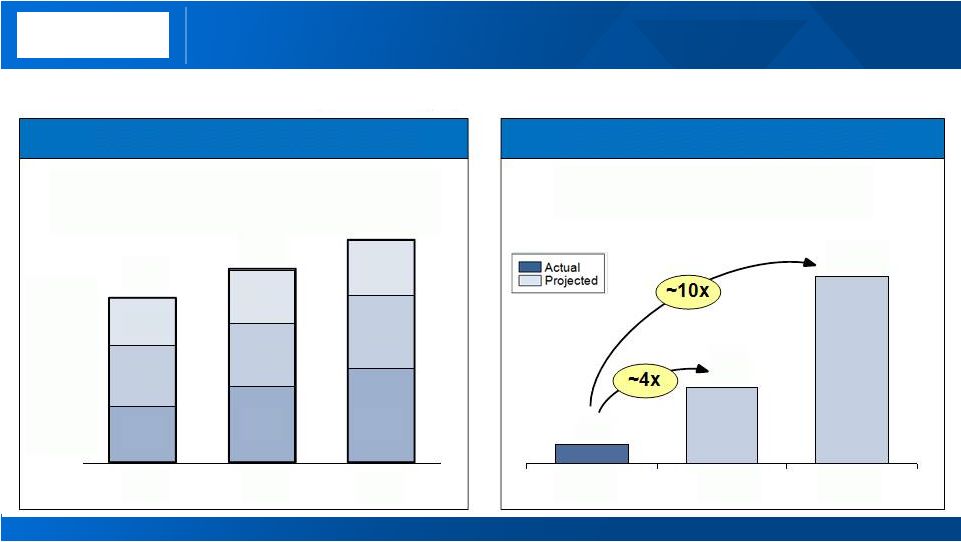

[Alcoa Logo]

Alcoa is capturing auto sheet opportunity

Source: Ducker Worldwide , IHS , Alcoa analysis

31

$300M expansion

to capture

auto demand

Supported by

secured

contracts

On time and on budget

First coil

by December 2013

Auto Sheet Driving Growth

580

250

200

160

2015

2014

2013

2012

Delivers

~4x

Revenue

Increase

Projected Alcoa Auto Sheet

Revenues ($M)

Auto Treatment Line –

Davenport, IA

North America Market Demand –

Auto Aluminum (kMT)

2025

4,410

3,320

1,090

2015

3,080

2,660

420

2012

2,400

2,300

100

Other Auto Aluminum

(Castings, etc.)

Auto Sheet

4x increase

in

auto sheet already

locked into

designs

of 2015 models

3.6x

Positioned to Capture Demand

Actual

Projected |

[Alcoa Logo]

We continue to focus on coming down the cost curves

Alumina and Aluminum cost curves and Alcoa targets

32

0

100

200

300

400

500

600

700

0

20,000

40,000

60,000

80,000

100,000

120,000

Cumulative Production

(000MT)

Alcoa 2010

30

Percentile

Alumina Cost Curve

Alcoa 2015

23

Percentile

Refining Cost Curve Holding Steady

$/mt

Alcoa 2012

30

Percentile

Smelting Cost Curve Down 4% Points

0

500

1,000

1,500

2,000

2,500

3,000

3,500

0

20,000

40,000

60,000

Cumulative

Production

(000MT)

Alcoa 2015

41

Percentile

Alcoa 2010

51

Percentile

Aluminum Cost Curve

$/mt

Alcoa 2012

47

Percentile

-10 points

7 points

-

th

th

th

st

st

rd |

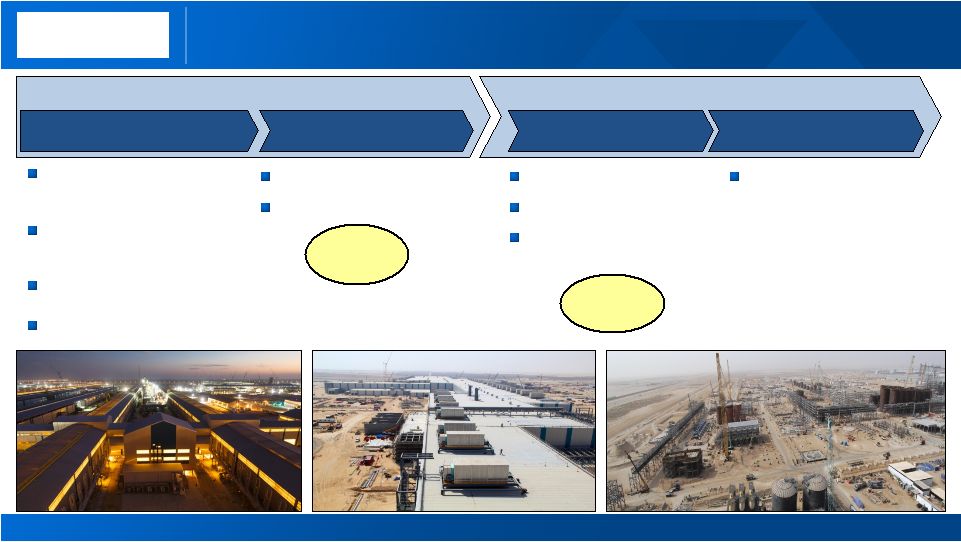

[Alcoa Logo]

Phase 2

Phase 1

Phase 1 and 2 Construction Progressing As Planned

Mine

Refinery

First hot coil 4Q 2013

Auto

hot coil 4Q 2014

First alumina 4Q 2014

Lowest

cost

refinery

2%

point

reduction

on

the refining cost curve

On track to provide

bauxite in 2014

33

Smelter

First Hot Metal December

Full operating capacity in

2014

Lowest

cost

smelting

facility

2%

point

reduction

on

the

smelting cost curve

74%

46%

Rolling Mill

12

, 2012

Complete

Complete

th |

[Alcoa Logo]

Executing on our targets to deliver long term value

34

All segments achieved solid financial performance

Strong commitment to cash generation

Capturing opportunities in growing markets |

[Alcoa Logo] |

[Alcoa Logo]

Kelly Pasterick

Director, Investor Relations

Alcoa

390 Park Avenue

New York, NY 10022-4608

Telephone: (212) 836-2674

www.alcoa.com

Additional Information

36 |

[Alcoa Logo]

Annual Sensitivity Summary

Currency Annual Net Income Sensitivity

+/-

$100/MT = +/-

$240 million

LME Aluminum Annual Net Income Sensitivity

Australian $

+/-

$11 million

per 0.01 change in USD / AUD

Brazilian $

+/-

$ 3 million

per 0.01 change in BRL / USD

Euro €

+/-

$ 2 million

per 0.01 change in USD / EUR

Canadian $

+/-

$ 5 million

per 0.01 change in CAD / USD

Norwegian Kroner

+/-

$ 5 million

per 0.10 change in NOK / USD

37 |

[Alcoa Logo]

Revenue Change by Market

4%

3%

0%

9%

7%

2%

(2%)

(39%)

3%

(7%)

6%

0%

(1%)

(11%)

(4%)

17%

(5%)

1%

7%

(10%)

1Q’13 Third-Party Revenue

Sequential

Change

Year-Over-Year

Change

38

17%

3%

6%

5%

9%

2%

13%

1%

14%

30%

Aerospace

Automotive

B&C

Comm. Transport

Industrial Products

IGT

Packaging

Distribution/Other*

Alumina

Primary Metals |

[Alcoa Logo]

Reconciliation of ATOI to Consolidated Net Income (Loss)

Attributable to Alcoa

39

*

On January 1, 2013, management revised the inventory-costing method used by

certain locations within the Global Rolled Products and Engineered Products

and Solutions segments in order to improve internal consistency and enhance

industry comparability. This revision does not impact the consolidated results of

Alcoa. Segment information for all prior periods presented was revised to

reflect this change. (in millions)

1Q12

2Q12

3Q12

4Q12

2012

1Q13

Total segment ATOI*

$ 304

$ 255

$ 224

$ 574 $ 1,357

$ 351

Unallocated amounts (net of tax):

Impact of LIFO

–

19

(7)

8

20

(2)

Interest expense

(80)

(80)

(81)

(78)

(319)

(75)

Noncontrolling interests

(5)

17

32

(15)

29

(21)

Corporate expense

(64)

(69)

(62)

(87)

(282)

(67)

Restructuring and other charges

(7)

(10)

(2)

(56)

(75)

(5)

Other*

(54)

(134)

(247)

(104)

(539)

(32)

Consolidated net income (loss) attributable to

Alcoa

$ 94

$ (2)

$ (143)

$ 242

$ 191

$ 149 |

[Alcoa Logo]

Reconciliation of Adjusted Income

40

(in millions, except per-share

amounts)

Income

Diluted EPS

Quarter ended

Quarter ended

March 31,

2012

December 31,

2012

March 31,

2013

March 31,

2012

December 31,

2012

March 31,

2013

Net income attributable to

Alcoa

$ 94

$ 242

$ 149

$ 0.09

$ 0.21

$ 0.13

Restructuring and other

charges

7

54

5

Discrete tax items*

–

(58)

(19)

Other special items**

4

(174)

(14)

Net income attributable to

Alcoa –

as adjusted

$ 105

$ 64

$ 121

0.10

0.06

0.11

* Discrete tax items include the following:

Net income attributable to Alcoa – as adjusted is a non-GAAP financial measure.

Management believes that this measure is meaningful to investors because management reviews the

operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax

items, and other special items (collectively, “special items”). There can be no assurances

that additional special items will not occur in future periods. To compensate for this

limitation, management believes that it is appropriate to consider both Net income attributable to Alcoa

determined under GAAP as well as Net income attributable to Alcoa – as adjusted.

** Other special items include the following:

for the quarter ended March 31, 2013, a benefit related to the reinstatement under the American

Taxpayer Relief Act of 2012 of two tax provisions that will be applied in 2013 to Alcoa’s

U.S income tax return for calendar year 2012 ($19); and for the quarter ended December 31,

2012, a benefit related to the interim period treatment of losses in jurisdictions for which no tax benefit was recognized during the nine

months ended September 30, 2012 ($39); a benefit for a change in the legal structure of an investment

($13); and a net benefit for other miscellaneous items ($6). for the quarter ended March 31,

2013, a net favorable change in certain mark-to-market energy derivative contracts ($9) and a net insurance recovery related to the March 2012

cast house fire at the Massena, NY location ($5);

for the quarter ended December 31, 2012, a gain on the sale of the Tapoco Hydroelectric Project ($161:

$275 is included in the Primary Metals segment and $(114) is included in Corporate); a net

favorable change in certain mark-to-market energy derivative contracts ($12); interest income on an escrow deposit ($8); and uninsured losses related to

fire damage to the cast house at the Massena, NY location ($7); and

for the quarter ended March 31, 2012, a net unfavorable change in certain mark-to-market

energy derivative contracts. •

•

•

•

• |

[Alcoa Logo]

Reconciliation of Alcoa Adjusted EBITDA

41

($ in millions)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

1Q12

4Q12

1Q13

Net income (loss)

attributable to Alcoa

$ 938

$ 1,310

$ 1,233

$ 2,248

$ 2,564

$ (74)

$ (1,151)

$ 254

$ 611

$ 191

$ 94

$ 242

$ 149

Add:

Net income (loss)

attributable to

noncontrolling

interests

212

233

259

436

365

221

61

138

194

(29)

5

15

21

Cumulative effect of

accounting changes

47

–

2

–

–

–

–

–

–

–

–

–

–

Loss (income) from

discontinued

operations

–

27

50

(22)

250

303

166

8

3

–

–

–

–

Provision (benefit) for

income taxes

367

546

464

853

1,623

342

(574)

148

255

162

39

143

64

Other (income)

expenses, net

(278)

(266)

(478)

(236)

(1,920)

(59)

(161)

5

(87)

(341)

(16)

(345)

(27)

Interest expense

314

271

339

384

401

407

470

494

524

490

123

120

115

Restructuring and other

charges

(28)

(29)

266

507

268

939

237

207

281

87

10

60

7

Provision for

depreciation,

depletion, and

amortization

1,110

1,142

1,227

1,252

1,244

1,234

1,311

1,450

1,479

1,460

369

362

361

Adjusted EBITDA

$ 2,682

$ 3,234

$ 3,362

$ 5,422

$ 4,795

$ 3,313

$ 359

$ 2,704

$ 3,260

$ 2,020

$ 624

$ 597

$ 690

Sales

$18,879

$21,370

$24,149

$28,950

$29,280

$26,901

$18,439

$21,013

$24,951

$23,700

$ 6,006

$ 5,898

$ 5,833

Adjusted EBITDA

Margin

14%

15%

14%

19%

16%

12%

2%

13%

13%

9%

10%

10%

12%

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes,

depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales

minus the following items: Cost of goods sold; Selling, general administrative, and

other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. Adjusted EBITDA is

a non-GAAP financial measure. Management believes that this measure is

meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the

Company’s ability to meet its financial obligations. The Adjusted EBITDA

presented may not be comparable to similarly titled measures of other companies. |

[Alcoa Logo]

Reconciliation of Alumina Adjusted EBITDA

42

($ in millions, except per

metric ton amounts)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

1Q12

4Q12

1Q13

After-tax operating income

(ATOI)

$ 415

$ 632

$ 682

$ 1,050

$ 956

$ 727

$ 112

$ 301

$ 607

$ 90

$ 35

$ 41

$ 58

Add:

Depreciation, depletion,

and amortization

147

153

172

192

267

268

292

406

444

455

114

107

109

Equity (income) loss

–

(1)

–

2

(1)

(7)

(8)

(10)

(25)

(5)

(1)

(1)

(1)

Income taxes

161

240

246

428

340

277

(22)

60

179

(27)

(1)

2

14

Other

(55)

(46)

(8)

(6)

2

(26)

(92)

(5)

(44)

(8)

–

(4)

(3)

Adjusted EBITDA

$ 668

$ 978

$ 1,092

$ 1,666

$ 1,564

$ 1,239

$ 282

$ 752

$ 1,161

$ 505

$ 147

$ 145

$ 177

Production (thousand

metric tons) (kmt)

13,841

14,343

14,598

15,128

15,084

15,256

14,265

15,922

16,486

16,342

4,153

4,079

3,994

Adjusted EBITDA /

Production ($ per metric

ton)

$ 48

$ 68

$ 75

$ 110

$ 104

$ 81

$ 20

$ 47

$ 70

$ 31

$ 35

$ 36

$ 44

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes,

depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales

minus the following items: Cost of goods sold; Selling, general administrative, and

other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line

in the table above includes gains/losses on asset sales and other nonoperating

items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors

because Adjusted EBITDA provides additional information with respect to Alcoa’s

operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be

comparable to similarly titled measures of other companies.

|

[Alcoa Logo]

Reconciliation of Primary Metals Adjusted EBITDA

43

($ in millions, except per metric

ton amounts)`

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

1Q12

4Q12

1Q13

After-tax operating income

(ATOI)

$ 657

$ 808

$ 822

$ 1,760

$ 1,445

$ 931

$ (612)

$ 488

$ 481

$ 309

$ 10

$ 316

$ 39

Add:

Depreciation, depletion,

and amortization

310

326

368

395

410

503

560

571

556

532

135

134

135

Equity (income) loss

(55)

(58)

12

(82)

(57)

(2)

26

(1)

7

27

2

11

9

Income taxes

256

314

307

726

542

172

(365)

96

92

106

(13)

157

1

Other

12

20

(96)

(13)

(27)

(32)

(176)

(7)

2

(422)

–

(423)

(1)

Adjusted EBITDA

$ 1,180

$ 1,410

$ 1,413

$ 2,786

$ 2,313

$ 1,572

$ (567)

$ 1,147

$ 1,138

$ 552

$ 134

$ 195

$ 183

Production (thousand

metric tons) (kmt)

3,508

3,376

3,554

3,552

3,693

4,007

3,564

3,586

3,775

3,742

951

912

891

Adjusted EBITDA /

Production ($ per metric

ton)

$ 336

$ 418

$ 398

$ 784

$ 626

$ 392

$ (159)

$ 320

$ 301

$ 148

$ 141

$ 214

$ 205

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent

to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other

expenses; Research and development expenses; and Provision for depreciation, depletion, and

amortization. The Other line in the table above includes gains/losses on asset sales and other

nonoperating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this

measure is meaningful to investors because Adjusted EBITDA provides additional information with respect

to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The

Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

|

[Alcoa Logo]

Reconciliation of Global Rolled Products Adjusted EBITDA

44

($ in millions, except

per metric ton

amounts)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

1Q12

4Q12

1Q13

After-tax operating

income (ATOI)*

$ 232

$ 290

$ 300

$ 317

$ 151

$ (41)

$

(106)

$ 241

$ 260

$ 346

$ 102

$ 77

$ 81

Add:

Depreciation,

depletion, and

amortization

190

200

220

223

227

216

227

238

237

229

57

58

57

Equity loss

1

1

–

2

–

–

–

–

3

6

1

2

4

Income taxes*

77

97

135

113

77

14

12

103

98

159

51

35

39

Other

(5)

1

1

20

1

6

(2)

1

1

(2)

–

–

(1)

Adjusted EBITDA*

$ 495

$ 589

$ 656

$ 675

$ 456

$ 195

$ 131

$ 583

$ 599

$ 738

$ 211

$ 172

$ 180

Total shipments

(thousand metric

tons) (kmt)

1,893

2,136

2,250

2,376

2,482

2,361

1,888

1,755

1,866

1,943

472

465

468

Adjusted EBITDA

/ Total shipments

($ per metric ton)*

$ 261

$ 276

$ 292

$ 284

$ 184

$ 83

$ 69

$ 332

$ 321

$ 380

$ 447

$ 370

$ 385

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes,

depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to

Sales minus the following items: Cost of goods sold; Selling, general

administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization.

The

Other

line

in

the

table

above

includes

gains/losses

on

asset

sales

and

other

nonoperating

items.

Adjusted

EBITDA

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful to investors because Adjusted EBITDA provides additional information with

respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted

EBITDA presented may not be comparable to similarly titled measures of other

companies. * On January 1, 2013, management revised the inventory-costing

method used by certain locations within the Global Rolled Products segment in order to improve internal consistency and enhance

industry comparability. This revision does not impact the consolidated results

of Alcoa. Segment information for all prior periods presented was revised to reflect this change. |

[Alcoa Logo]

Reconciliation of Engineered Products and Solutions

Adjusted EBITDA

45

($ in millions)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

1Q12

4Q12

1Q13

After-tax operating

income (ATOI)*

$ 126

$ 161

$ 276

$ 382

$ 423

$ 522

$ 311

$ 419

$ 537

$ 612

$ 157

$ 140

$ 173

Add:

Depreciation,

depletion, and

amortization

166

168

160

152

163

165

177

154

158

158

40

40

40

Equity loss

(income)

–

–

–

6

–

–

(2)

(2)

(1)

–

–

–

–

Income taxes*

57

70

120

164

184

215

138

198

258

296

73

71

84

Other*

11

106

(11)

(2)

(7)

2

1

–

(1)

(8)

–

(9)

–

Adjusted EBITDA*

$ 360

$ 505

$ 545

$ 702

$ 763

$ 904

$ 625

$ 769

$ 951

$ 1,058

$ 270

$ 242

$ 297

Third-party sales

$ 3,905

$ 4,283

$ 4,773

$ 5,428

$ 5,834

$ 6,199

$ 4,689

$ 4,584

$ 5,345

$ 5,525

$ 1,390

$ 1,348

$ 1,423

Adjusted EBITDA

Margin*

9%

12%

11%

13%

13%

15%

13%

17%

18%

19%

19%

18%

21%

* On January 1, 2013, management revised the inventory-costing method used

by certain locations within the Engineered Products and Solutions segment in order to improve internal consistency and enhance

industry comparability. This revision does not impact the consolidated results

of Alcoa. Segment information for all prior periods presented was revised to reflect this change.

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent

to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other

expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization.

The Other line in the table above includes gains/losses on asset sales and other nonoperating

items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is

meaningful to investors because Adjusted EBITDA provides additional information with respect to

Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted

EBITDA presented may not be comparable to similarly titled measures of other companies.

|

[Alcoa Logo]

Reconciliation of Free Cash Flow

46

(in millions)

Quarter ended

March 31,

2011

June 30,

2011

September 30,

2011

December 31,

2011

March 31,

2012

June 30,

2012

September 30,

2012

December 31,

2012

March 31,

2013

Cash from

operations

$ (236)

$ 798

$ 489

$ 1,142

$ (236)

$ 537

$ 263

$ 933

$ (70)

Capital

expenditures

(204)

(272)

(325)

(486)

(270)

(291)

(302)

(398)

(235)

Free cash flow

$ (440)

$ 526

$ 164

$ 656

$ (506)

$ 246

$ (39)

$ 535

$ (305)

Free Cash Flow is a non-GAAP financial measure. Management believes that

this measure is meaningful to investors because management reviews cash flows generated from operations after taking

into consideration capital expenditures due to the fact that these expenditures are

considered necessary to maintain and expand Alcoa’s asset base and are expected to generate future cash flows from

operations. It is important to note that Free Cash Flow does not represent the

residual cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory

debt service requirements, are not deducted from the measure.

|

[Alcoa Logo]

Reconciliation of Free Cash Flow, con’t

47

(in millions)

Quarter ended

December 31,

2008

March 31,

2009

June 30,

2009

September 30,

2009

December 31,

2009

March 31,

2010

June 30,

2010

September 30,

2010

December 31,

2010

Cash from

operations

$ 608

$ (271)

$ 328

$ 184

$ 1,124

$ 199

$ 300

$ 392

$ 1,370

Capital

expenditures

(1,017)

(471)

(418)

(370)

(363)

(221)

(213)

(216)

(365)

Free cash flow

$ (409)

$ (742)

$ (90)

$ (186)

$ 761

$ (22)

$ 87

$ 176

$ 1,005

Free Cash Flow is a non-GAAP financial measure. Management believes that

this measure is meaningful to investors because management reviews cash flows generated from operations after taking into

consideration

capital

expenditures

due

to

the

fact

that

these

expenditures

are

considered

necessary

to

maintain

and

expand

Alcoa’s

asset

base

and

are

expected

to

generate

future

cash

flows

from

operations.

It is important to note that Free Cash Flow does not represent the residual cash

flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service

requirements, are not deducted from the measure. |

[Alcoa Logo]

Days Working Capital

($ in millions)

Quarter ended

March 31,

2012

June 30,

2012

September 30,

2012

December 31,

2012

March 31,

2013

Receivables from customers, less

allowances

$ 1,526

$ 1,575

$ 1,619

$ 1,399

$ 1,680

Add: Deferred purchase price receivable

*

254

141

81

18

14

Receivables from customers, less

allowances, as adjusted

1,780

1,716

1,700

1,417

1,694

Add: Inventories

3,097

3,051

2,973

2,825

2,982

Less: Accounts payable, trade

2,734

2,633

2,590

2,702

2,860

Working Capital

$ 2,143

$ 2,134

$ 2,083

$ 1,540

$ 1,816

Sales

$ 6,006

$ 5,963

$ 5,833

$ 5,898

$ 5,833

Days Working Capital

32

33

33

24

28

Days Working Capital = Working Capital divided by (Sales/number of days in the quarter).

*

The deferred purchase price receivable relates to an arrangement to sell certain customer receivables

to a financial institution on a recurring basis. Alcoa is adding back this receivable for

the purposes of the Days Working Capital calculation. 48

|

[Alcoa Logo]

Reconciliation of Net Debt

49

(in millions)

December 31,

March 31,

2008

2009

2010

2011

2012

2013

Short-term borrowings

$ 478

$ 176

$ 92

$ 62

$ 53

$ 51

Commercial paper

1,535

–

–

224

–

104

Long-term debt due within one year

56

669

231

445

465

1,025

Long-term debt, less amount due

within one year

8,509

8,974

8,842

8,640

8,311

7,745

Total debt

10,578

9,819

9,165

9,371

8,829

8,925

Less: Cash and cash equivalents

762

1,481

1,543

1,939

1,861

1,555

Net debt

$ 9,816

$ 8,338

$ 7,622

$ 7,432

$ 6,968

$ 7,370

Net debt is a non-GAAP financial measure. Management believes that this

measure is meaningful to investors because management assesses Alcoa’s leverage position after

factoring in available cash that could be used to repay outstanding debt.

|

[Alcoa Logo]

Reconciliation of Net Debt-to-Capital

50

($ in millions)

December 31, 2012

March 31, 2013

Debt-to-Capital

Cash and Cash

Equivalents

Net Debt-to-

Capital

Debt-to-Capital

Cash and Cash

Equivalents

Net Debt-to-

Capital

Total Debt

Short-term borrowings

$ 53

$

51

Commercial paper

–

104

Long-term debt due within one

year

465

1,025

Long-term debt, less amount

due within one year

8,311

7,745

Numerator

$ 8,829

$ 1,861

$ 6,968

$ 8,925

$ 1,555

$ 7,370

Total Capital

Total debt

$ 8,829

$ 8,925

Total equity

16,523

16,774

Denominator

$ 25,352

$ 1,861

$ 23,491

$ 25,699

$ 1,555

$ 24,144

Ratio

34.8%

29.7%

34.7%

30.5%

Net debt-to-capital is a non-GAAP financial measure. Management believes that this

measure is meaningful to investors because management assesses Alcoa’s leverage position

after factoring in available cash that could be used to repay outstanding debt.

|

[Alcoa Logo]

Composition of Upstream Production Costs

51

Refining Cost Structure

Smelting Cost Structure

1

Natural gas information corresponds to Point Comfort, as Australia is priced on a

rolling 16 quarter average Input Cost

Inventory flow

Pricing

convention

Annual ATOI

Sensitivity

Fuel oil

1 –

2 months

Prior month

$4m per $1/bbl

Natural gas

N/A

Spot

1

$16m per $1/GJ

1

Caustic soda

3 -

6 months

Spot & semi-

annual

$9m per

$10/DMT

Input Cost

Inventory flow

Pricing convention

Annual ATOI

Sensitivity

Coke

1 -

2 months

Spot, quarterly &

semi-annual

$9m per

$10/MT

Pitch

1 -

2 months

Spot, quarterly &

semi-annual

$2.5m per

$10/MT

Alumina

32%

Carbon

15%

Power

25%

Materials

6%

Conversion

22%

Fuel Oil

14%

Natural gas

10%

Caustic

11%

Bauxite

23%

Conversion

42% |

[Alcoa Logo]

Global Aluminum Demand Growth at 7%

52

2013 Primary Aluminum Consumption (mmt), Annualized Growth (%) and Change (% pts) by

Region (1)

Other includes Middle East, Latin America ex Brazil, Eastern Europe and Rest of

World 4.0%

5%

6%

-1%

-2%

11%

9%

5%

4%

7%

4%

6%

7%

6%

8%

1%

3.8

2.0

1.0

1.0

China

Europe

North America

Asia ex. China

Other

(1)

India

Brazil

Russia

23.0

6.5

6.2

5.9

2013 Global Demand

49.4 mmt

2013 versus 2012

Source: Alcoa analysis

2013 Global Demand

Growth Rate 7%

(World ex China 4%)

2012

2013E |

53

2013E Aluminum Supply/Demand Balance

Supply

Demand

Surplus

155

‘000 mt

China

Rest of World

2013 Production (Feb annualized)

21,330

25,360

2013 Production to be added

2,270

1,190

2013 Capacity to be curtailed

(525)

(50)

Total supply

23,075

26,500

Demand

(23,000)

(26,420)

Net Balance

75

80

2013E Alumina Supply/Demand Balance

‘000 mt

China

Rest of World

2013 Production (Feb annualized)

41,600

53,700

2013 Production to be added

600

2,400

2013 Capacity to be curtailed

(1,000)

0

Imports/(exports)

3,900

(3,900)

Total supply

45,100

52,200

Demand

(45,100)

(52,300)

Net Balance

0

(100)

Supply

Demand

Deficit

(100)

Source: Alcoa analysis, Brook Hunt, CRU, CNIA, NBS, Chinese Customs

Market Tightening

On Curtailments

4Q2012

Deficit

(200)

4Q2012

Surplus

535

[Alcoa Logo] |

54

Global Inventories vs. LME Price Over Time $

Source: Alcoa analysis, LME, SHFE, CRU, IAI, Marubeni Corp.

Inventory

is Stable

[Alcoa Logo] |

[Alcoa Logo]

Regional Premiums

Remain strong

55

Regional Premiums over time

$ per metric

ton

$ per metric

ton

Region

End of Q1’13

Europe

$283/MT

Japan

$249/MT

Midwest USA

$253/MT

Year on Year Change

Europe +35%

Japan +96%

Midwest USA +27%

Source:

Month

end

pricing

-

Platts

Metals

Week

and

Metal

Bulletin

$0

$50

$100

$150

$200

$250

$300

$0

$50

$100

$150

$200

$250

$300 |