Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - MUSTANG ALLIANCES, INC. | Financial_Report.xls |

| EX-31 - CERTIFICATION - MUSTANG ALLIANCES, INC. | mstg_ex31.htm |

| EX-32 - CERTIFICATION - MUSTANG ALLIANCES, INC. | mstg_ex32.htm |

UNIED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

for the fiscal year ended December 31, 2012

|

|

OR

|

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

for the transition period from __ to __

|

Commission file number: 000-54212

MUSTANG ALLIANCES, INC.

(Exact name of Registrant as Specified in its Charter)

|

Nevada

|

74-3206736

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

410 Park Avenue, 15th Floor

New York, New York 10022

(Address of Principal Executive Offices)

(888) 251-3422

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

None

|

None

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.0001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter: $4,540,126 based upon $0.05 per share which was the last price at which the common equity purchased by non-affiliates was last sold, since there is no public bid or ask price.

The number of shares of the issuer’s common stock outstanding as of April 9, 2013 was 107,037,834 shares.

.

Documents Incorporated By Reference: None

TABLE OF CONTENTS

|

PART I

|

|||||

|

Item 1

|

Business

|

3 | |||

|

Item 1A

|

Risk Factors

|

7 | |||

|

Item 1B

|

Unresolved Staff Comments

|

15 | |||

|

Item 2

|

Properties

|

15 | |||

|

Item 3

|

Legal Proceedings

|

15 | |||

|

Item 4

|

Mine Safety Disclosures

|

15 | |||

|

PART II

|

|||||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

16 | |||

|

Item 6

|

Selected Financial Data

|

17 | |||

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

17 | |||

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

22 | |||

|

Item 8

|

Financial Statements and Supplementary Data

|

23 | |||

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

47 | |||

|

Item 9A

|

Controls and Procedures

|

47 | |||

|

Item 9B

|

Other Information

|

48 | |||

|

PART III

|

|||||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

49 | |||

|

Item 11

|

Executive Compensation

|

50 | |||

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

54 | |||

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

54 | |||

|

Item 14

|

Principal Accountant Fees and Services

|

56 | |||

|

PART IV

|

|||||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

58 | |||

|

SIGNATURES

|

59 | ||||

2

PART I

Forward-Looking Statements

This Annual Report on form 10-K contains forward-looking statements. For this purpose, any statements contained in this Report that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management, and other matters. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “will,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “continue” or the negative of these similar terms. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking information to encourage companies to provide prospective information about themselves without fear of litigation so long as that information is identified as forward-looking and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the information.

These forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In evaluating these forward-looking statements, you should consider various factors, including the following: (a) those risks and uncertainties related to general economic conditions, (b) whether we are able to manage our planned growth efficiently and operate profitable operations, (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations, (d) whether we are able to successfully fulfill our primary requirements for cash, which are explained below under “Liquidity and Capital Resources”. We assume no obligation to update forward-looking statements, except as otherwise required under the applicable federal securities laws.

Item 1. Business.

As used in this Annual Report on Form 10-K (this “Report”), references to the “Company,” the “Registrant,” “we,” “our” or “us” refer to Mustang Alliances, Inc., unless the context otherwise indicates.

Corporate Background

Mustang Alliances, Inc. was incorporated on February 22, 2007, in the State of Nevada. We were focused on the business of marketing and selling anti-lock braking systems produced in China to the auto parts and auto manufacturing market of the United States. Since inception, the Company conducted virtually no business other than organizational matters, filing its Registration Statement on a Form SB-2 with the Securities and Exchange Commission, file number 333-148431 (the “Registration Statement”) in January 2008, and filing periodic reports with the SEC pursuant to the reporting requirements of Securities Exchange Act of 1934, as amended.

On February 22, 2007, we issued an aggregate of 64,000,000 shares of our common stock to our officers and directors for the total consideration of $800. On January 30, 2008, the Company commenced its offering of up to a maximum of 32,000,000 shares of common stock at $0.002 per share (adjusted for the 1 for 8 stock split effective on December 27, 2010) pursuant to the Registration Statement. On February 29, 2008, we closed the offering after selling 22,400,000 shares of common stock.

On November 22, 2010, we borrowed $25,000 from Sara Laufer pursuant to the terms of a promissory note,. The $25,000 loan plus interest at the rate of 5% per annum is due and payable on November 22, 2012. The loan may be prepaid at any time without penalty or interest and is unsecured. The loan was repaid in full in August, 2011.

3

On November 29, 2010, Joseph Levi, the then principal shareholder of the Company, entered into a Stock Purchase Agreement which provided for the sale of 60,000,000 shares of common stock (which represented 55.97% of the then issued and outstanding share capital of the Company on a fully-diluted basis), to Leonard Sternheim for $7,500.

Effective as of November 29, 2010, in connection with the sale Joseph Levi resigned from his positions as officer and director of the Company, and the Board of Directors of the Company elected Leonard Sternheim as President, Chief Executive Officer, Chief Financial Officer and a director of the Company.

On December 15, 2010, the Company notified the FINRA of its intention to implement a 1 for 8 share dividend or forward stock split of its issued and outstanding common stock to the holders of record as of December 27, 2010. The forward stock split became effective on January 3, 2011.

On March 17, 2011, we appointed Mark Holcombe and Mendel Mochkin as directors and Mr. Mochkin as a Vice President.

On July 22, 2011, Mr. Holcombe resigned as a director and Lawrence Wolfe was appointed a director and Chief Financial Officer and Robert Faber was appointed director and, on February 1, 2012 President of the Company.

On August 23, 2012 Messrs. Mochkin and Wolfe resigned as officers and directors of the Company.

Business Overview

Currently, we have a specific business plan that we are pursuing as aggressively as possible within the limits of our resources. We are an exploration-stage company as defined by the SEC and as a result of the execution and delivery of the Lease Agreements described below, we are now in the business of exploring, and if warranted, advancing mineral properties. Our primary focus is in the gold sector and our current mineral properties consist of the properties known as Corpus I, II, II and IV mining concessions and the Potosi concession (collectively, the “Properties”) located in Honduras.

On December 2, 2010, we executed a Lease Agreement with Compania Minera Cerros Del Sur, S.A., a corporation organized under the laws of Honduras (“Cerros”), and Mayan Gold, Inc., a Nevada corporation (“Mayan Gold”) pursuant to which Cerros, the registered owner of Corpus IV, leased us the exclusive right to prospect, explore and mine for minerals in this property in Honduras. The Lease Agreement continues until the Honduran government grants Cerros the right to assign the property's mining concessions to the Company, at which time Cerros will transfer title to the mining concessions to us. In consideration for such rights, we issued an aggregate of 200,000,000 shares of common stock to Mayan Gold, the beneficial owner of 100% interest in Corpus IV. In accordance with the Lease Agreements, as further consideration for the rights granted, we agreed to pay Cerros $1,500 no later than April 1st of each year. Cerros also granted us an option to acquire exclusive rights to properties known as Corpus I, II, and III concessions and the Potosi concession.

Prior to February 9, 2010, Cerros was a wholly owned subsidiary of Mayan Gold. When Mayan Gold sold all of its shares in Cerros to Razor Resources, Inc. (“Razor”) on such date, Mayan Gold retained all mining rights to the Properties and certain other assets that were in the name of Cerros. As a part of the sales transaction, Cerros and Razor entered into an agreement pursuant to which Cerros is contractually obligated to transfer those concessions and the other assets to transferees as directed by Mayan Gold from time to time. Since Razor is the title owner of all the shares of Cerros, Razor was required to represent to Mayan Gold and us that it has absolutely no direct or indirect title or interest in any of the Properties or any of the shares being issued to Mayan Gold.

4

On February 22, 2011, we entered into another Lease Agreement with Cerros and Mayan Gold pursuant to which we exercised our option to acquire the exclusive rights to the properties known as Corpus I, II, and III concessions and the Potosi concession and the Potosi ground lease. The Lease Agreement continues until the Honduras government grants Cerros the right to assign these properties to the Company, at which time Cerros will transfer title to the mining concession to us. In consideration for such right, we issued 20,000,000 shares of common stock to Mayan Gold, the beneficial owner of 100% interest in these properties. As further consideration for the rights granted, we agreed to pay Cerros an annual sum of $3,200 no later than April 1st of each year with the first payment due on April 1, 2011.

We are dependent upon making a gold deposit discovery at the Properties. Should we be able to make an economic find, we would then be solely dependent upon the mining operation for our revenue and profits, if any. The probability that reserves that meet SEC guidelines will be discovered on the property is undeterminable at this time. The Properties presently do not have any mineral resources or reserves. Currently, there is no power supply to the mineral claims. A great deal of work is required on our property before a determination as to the economic and legal feasibility of a mining venture on it can be made.

Our Exploration Project

We are a natural resource company engaged in the exploration of mineral properties located in Honduras known as the Corpus I, II, II, IV mining concessions and the Potosi concession. The Properties are presently in the exploration stage.

Strategy

We are a company early in the implementation of our business plan and performing those tasks necessary to raise the appropriate funding to complete our business plan. Our primary focus in the natural resource sector is gold. Our strategic initiatives are to undertake cost efficient and effective exploration activities to discover mineralization and potentially mineral reserves.

Though it is possible to take a resource property that hosts a viable ore deposit into mining production, we believe that the costs and time frame for doing so are considerable, and the subsequent return on investment for our shareholders would be very long term. Therefore, we intend to develop joint ventures or sell any ore bodies that we may discover to a major mining company. Many major mining companies obtain their ore reserves through the purchase of ore bodies found by junior exploration companies. Although these major mining companies do some exploration work themselves, many of them rely on the junior resource exploration companies to provide them with future deposits for them to mine. We believe that selling or partnering a deposit found by us to major mining companies, would provide an immediate return to our shareholders without the long time frame and cost of putting a mine into operation ourselves and future capital for the Company to continue operations.

The Properties

Description and Location of the Properties

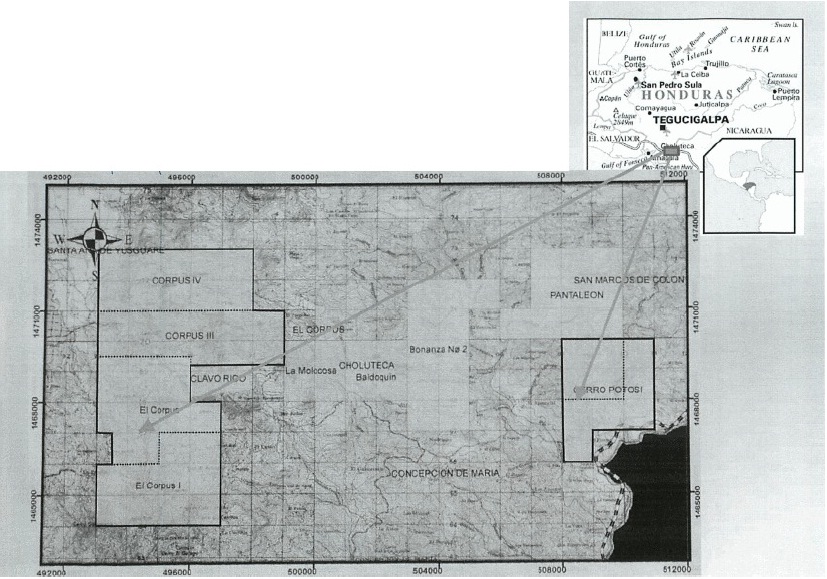

Honduras is bounded on the north and east by the Caribbean Sea, on the south by Nicaragua, on the south-west by the Pacific Ocean and El Salvador, and on the west by Guatemala. Honduras is the second largest country in Central America. Spanish is the country's official language, although English is widely understood and spoken. Its capital city is Tegucigalpa which hosts an international airport.

Except for two coastal strips, one extending about 640 km along the Caribbean Sea and the other 64 km on the Pacific Ocean, Honduras is a plateau consisting of broad, fertile plains broken by deep valleys and traversed by mountain ranges. The mountains, which are volcanic in origin, rise to heights of more than 2,800 m. The climate of Honduras is tropical, but is tempered by the higher elevations of the interior.

5

The Properties are located within the western Interior Highlands topographical province, a mountainous area that is covered mainly by short grasses and open pine and oak forests. Moderate relief with relatively steep slopes characterizes the area. The Property area occurs in one of the major mining districts in Honduras. It is located within the El Tabanco gold trend. It is in the municipality of El Corpus, in the eastern part of the state of Choluteca, SW Honduras. The Properties have a total area of approximately 11,860 acres (4,8000 hectares). It is situated approximately 85 kilometers SSE of the capital city of Tegucigalpa and approximately 30 kilometers East of a deep water port on the Gulf of Fonseca. Access to the district is by paved highway South from Tegucigalpa to Choluteca, and from there east on secondary and tertiary roads for approximately 20 kilometers.

Exploration History

In order to advance the Properties to a stage that would make the properties of interest to a major mining company we will need to undertake the early stages of exploration ourselves. There are no proven resources on the Properties.

Geology of the Properties

The region containing Honduras and Nicaragua hosts a number of mines and mineral deposits with a similar style of mineralization as the Property area. On the Property are a series of discontinuous veins and breccia zones which are all part of a single main continuous ENE trending structure. Quartz constitutes more than 90% of the ore. Sulphide mineral content is relatively high, consisting mainly of pyrite with minor chalcopyrite. Individual veins have been recognized to have strike lengths of 150 to 300 m. Major veins can have widths of from 1.5 to 3.0 m. Grades range from 1 to 15 g/T gold, with small high grade pockets of up to several thousand tonnes and up to 200 g/T gold. It was part of the Battle mountain consortium list of areas needing further exploration. The concession contains several abandoned mines.

Current State of Exploration

The Properties’ claims presently do not have any mineral resources or reserves. There is no mining plant or equipment located within the property boundaries. Currently, there is no power supply to the mineral claims. A great deal of work is required on our property before a determination as to the economic and legal feasibility of a mining venture on it can be made.

Geological Exploration Program

The Company will need to raise funds to finance geological exploration on the Properties.

Intellectual Property

We do not have any intellectual property rights.

6

Competition

The mineral exploration industry is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. Competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

Governmental Regulations

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of governmental agencies. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out exploration program.

Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry. We believe that compliance with the laws will not adversely affect our business operations.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulation could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the cost of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Employees

We currently have no employees other than our current officers. All functions including development, strategy, negotiations and administration are currently being provided by our officers.

Item 1A. Risk Factors

RISK FACTORS RELATING TO OUR BUSINESS

We are an exploration stage company, have generated no revenues to date and have a limited operating history upon which we may be evaluated.

We were incorporated on February 22, 2007 and have generated no revenues from operations to date. To date, the Properties that we have leased are early stage mineral properties without known resources or reserves. It is difficult to evaluate our business because we have a limited history, do not have any resources or experience in this business before. We are an exploration stage company with no known commercially viable deposits, or “resources”, or "reserves" on the Properties. Determination of the existence of a resource or reserve will depend on appropriate and sufficient exploration work and the evaluation of legal, economic, and environmental factors. Even if we obtain the resources to mine the property, if we fail to find a commercially viable deposit on the Properties, our financial condition and results of operations will suffer. If we cannot generate income from the Properties, we will have to cease operations which will result in the loss of your investment.

7

We expect losses in the future because we have no revenue to offset losses.

Since inception on February 22, 2007 through December 31, 2012, we have incurred a net loss of $2,175,151 and a loss from operations of $2,132,674. As we have no current revenue, we are expecting losses over the next 12 months because we do not yet have any revenues to offset the expenses associated with the exploration of our Properties. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations. We can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

Our success is dependent on our ability to explore and develop our mineral Properties.

We hope to generate revenues from the sale of minerals from our leased exploration Properties located in Honduras. We cannot guarantee that we will ever be successful in doing this. Currently we do not even possess sufficient funds to explore the Properties. Therefore, it is not possible for us to predict the future level of production, if any, or if we will be able to effectuate our business plan. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations.

Our independent auditor has issued a going concern opinion after auditing our financial statements; our ability to continue is dependent on our ability to raise additional capital and our operations could be curtailed if we are unable to obtain required additional funding when needed.

We will be required to expend substantial amounts of working capital in order to explore and develop the Properties. The Company had no revenues and incurred a net loss of $1,081,699 for the year ended December 31, 2012. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company is attempting to address its lack of liquidity by raising additional funds, either in the form of debt or equity or some combination thereof. Any additional equity financing may involve substantial dilution to our then existing shareholders. During the year ended December 31, 2012, the Company borrowed $80,170 for working capital purposes. Notwithstanding the loans, we will continue to require additional financing to execute our business strategy. We are totally dependent on external sources of financing for the foreseeable future, of which we have no commitments and on our ability to attract and receive additional funding from the sale of securities or outside sources such as private investment or a strategic partner. We currently have no agreements or arrangements with respect to any such financing and there can be no assurance that any needed funds will be available to us on acceptable terms or at all. Our failure to raise additional funds in the future will adversely affect our business operations, and may require us to suspend our operations. After auditing our financial statements, our independent auditor issued a going concern opinion and our ability to continue is dependent on our ability to raise additional capital. If we are unable to obtain necessary financing, we will likely be required to curtail our development plans which could cause us to become dormant.

There is no assurance that we can establish the existence of any mineral resource on the Properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

Since we have not yet begun exploration work on the Properties, we have not established that such Properties contain any mineral reserve. There can be no assurances that we will be able to explore such Properties. If we are unable to do so, our business could fail.

A mineral reserve is defined by the Securities and Exchange Commission (“SEC”) in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the SEC's Industry Guide 7 is extremely remote; in all probability our mineral resource property does not contain any “reserve” and any funds that we spend on exploration will probably be lost.

8

Even if we do eventually discover a mineral reserve on the Properties, there can be no assurance that we will be able to develop such Property into a producing mine and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on our Properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs or at all. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral Properties. If we cannot accomplish these objectives, our business could fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to remain in compliance. Current laws and regulations could be amended and we might not be able to comply with them, as amended.

We currently do not have the resources to explore the Properties and will require capital to determine if there are resources on the Properties. If we establish the existence of a mineral resource on the Properties in a commercially exploitable quantity, we will require additional capital in order to develop the Properties into a producing mine. If we cannot raise capital, we will not be able to exploit the resource, and our business could fail.

We must raise capital to determine if there are resources on the Properties. If we do discover mineral resources in commercially exploitable quantities on our Properties, we will need to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, we will not be able to effectuate our business plan and our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks.

Mineral exploration, development and production involve many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantities, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material adverse impact on our company.

9

An additional risk exists from trespassers entering the Properties and absconding with our property, both exploration equipment as well as soil and possible resources. We currently do not have anything to protect ourselves from this risk.

The loss of our executive officers or the failure to hire qualified employees or consultants would damage our business.

Because of the highly technical nature of our business, we will need to depend greatly on attracting and retaining experienced management and highly qualified and trained personnel. We compete with other companies intensely for qualified and well trained professionals in our industry. Failure to hire a sufficient number of qualified and experienced professionals, will have a material adverse effect on our capacity to sustain and grow our business.

Because of the speculative nature of exploration and development, there is a substantial risk that our business will fail.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. The risks associated with mineral exploration include:

|

●

|

the identification of potential mineralization based on superficial analysis;

|

|

●

|

the quality of our management and our geological and technical expertise; and

|

|

●

|

the capital available for exploration and development.

|

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities.

Since our Properties are located in a third world country, we are subject to additional risks.

The Company is undertaking a mining venture in Honduras, a third world country. As such, it is possible that the political environment could become unstable and a foreign operation such as our proposed one could be adversely affected by government expropriation, the inability to secure needed government permits and cooperation, and a condition not physically safe for foreign laborers or management. If any of these situations would occur, we would have to suspend operations in Honduras, which would prevent us from exploring our Properties..

We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

10

We have no meaningful assets and may not have the funds to purchase all of the supplies, manpower and materials we need to begin exploration which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, manpower and certain equipment such as bulldozers and excavators that we might need to conduct exploration. If there is a shortage or scarcity, we cannot compete with larger companies in the exploration industry for supplies, manpower and equipment. Currently we have no funds to explore the Properties in Honduras. In the event that the prices for such resources rise above our affordability levels, we may have to delay or suspend operations. In the event we are forced to limit our exploration activities, we may not find any minerals, even though our Properties may contain mineralized material. Without any minerals we cannot generate revenues and you may lose your investment.

The prices of metals are highly volatile and a decrease in metals prices could result in us incurring losses.

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the metals markets from the time development of a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop a mineral property at a time when the price of the underlying metals make such exploration economically feasible and, subsequently, incur losses because metals prices have decreased. Adverse fluctuations of metals market price may force us to curtail or cease our business operations.

Because our business involves numerous operating hazards, we may be subject to claims of a significant size which would cost a significant amount of funds and resources to rectify.

Our proposed business is subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure, and cratering. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of the equipment involved and injury or death to personnel. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs and force us to cease our operations, which will cause you a loss of your investment.

Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. We do not currently carry insurance to protect against these risks and we may not obtain such insurance in the future. Even if we do obtain insurance, the nature of these risks is such that liabilities could over exceed policy limits or be excluded from coverage. There are also risks against which we cannot, or may not elect to insure. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, thereby hurting our financial position, future earnings, and/or competitive positions. We may not have enough capital to continue operations and you will lose your investment.

Damage to the environment could result from our operations which could subject us to substantial fines and penalties.

Our operations and property are subject to extensive federal, state, and local laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to safety and health. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences, (ii) restrict the types, quantities and concentration of various substances that can be released into the environment in connection with exploration activities, (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas,(iv) require remedial measures to mitigate pollution from former operations and (v) impose substantial liabilities for pollution resulting from our proposed operations.

11

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulation could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, state and federal governments, non-compliance with applicable regulatory requirements could subject us to substantial penalties, fines and regulatory actions, the cost of which could harm our results of operations. Our cost of doing business may be affected by the regulatory burden on the mineral industry since the rules and regulations frequently are amended or interpreted. We cannot predict the future cost or impact of complying with these laws. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Access to our Properties is limited during inclement weather conditions which could result in delays in our explorations.

The business of mining for gold and other metals is generally subject to a number of risks and hazards including natural phenomena such as inclement weather conditions, floods, blizzards and earthquakes. Access to our Properties may be restricted during these weather conditions. As a result, any attempt to test or explore the property is largely limited to the times when weather conditions permits such activities. These limitations may result in significant delays in exploration efforts. Such delays may have a significant negative effect on our results of operations.

RISK FACTORS RELATING TO OUR COMMON STOCK

We may, in the future, issue additional common stock, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorizes the issuance of 500,000,000 shares of common stock, par value $0.0001 per share, of which 104,537,834 shares were outstanding as of December 31, 2012. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

Our common stock is subject to the "penny stock" rules of the SEC, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $4.00 per share or with an exercise price of less than $4.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person's account for transactions in penny stocks; and (ii) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must: (i) obtain financial information and investment experience objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: (i) sets forth the basis on which the broker or dealer made the suitability determination; and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and may cause a decline in the market value of our stock.

12

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

The market for penny stocks has experienced numerous frauds and abuses which could adversely impact investors in our stock.

We believe that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

|

●

|

Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

|

|

●

|

Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

|

|

●

|

"Boiler room" practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons;

|

|

●

|

Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and

|

The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses.

State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus.

Secondary trading in common stock sold in this offering will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

13

We may be exposed to potential risks resulting from new requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

As a company registered with the SEC, we will be required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We expect to incur significant continuing costs, including accounting fees and staffing costs, in order to maintain compliance with the internal control requirements of the Sarbanes-Oxley Act of 2002. Development of our business will necessitate ongoing changes to our internal control systems, processes and information systems. Currently, we have no employees, other than our officers and directors. As we engage in the exploration of our mineral claims and hire employees and consultants, our current design for internal control over financial reporting will not be sufficient to enable management to determine that our internal controls are effective for any period, or on an ongoing basis. Accordingly, as we develop our business, such development and growth will necessitate changes to our internal control systems, processes and information systems, all of which will require additional costs and expenses.

In the future, if we fail to complete the annual Section 404 evaluation in a timely manner, we could be subject to regulatory scrutiny and a loss of public confidence in our internal controls. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and NYSE AMEX Equities exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than necessary, we have not yet adopted these measures.

None of our two directors are independent. We do not currently have independent audit or compensation committees. As a result, the directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our shareholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 are substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

As a public entity subject to the reporting requirements of the Exchange Act of 1934, we incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $25,000 per year for the next few years and will be higher if our business volume and activity increases but lower during the first year of being public because our overall business volume will be lower, and we will not yet be subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002. As a result, we may not have sufficient funds to grow our operations.

14

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

We currently maintain our corporate offices at 410 Park Avenue, 15th floor, New York, NY 10022. We do not pay rent for this space because the amount of the space we use at such office is de minimis. We believe that this space will be sufficient until we start generating revenues and need to hire employees.

Item 3. Legal Proceedings.

Other than described below, there are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

On July 23, 2012, the Company was named a defendant in a lawsuit George Sharp v. Mustang Alliances, Inc. et al which was filed in the Superior Court of the State of California, San Diego County. The lawsuit alleges violations of California restrictions on unsolicited commercial e-mail advertisers and seeks damages and punitive damages in an unspecified amount. The Company believes that this lawsuit is without merit and intends to vigorously defend the action. Currently, a trial date has been set for March of 2014.

Item 4. Mine Safety Disclosures.

During the fiscal year ended December 31, 2012, with respect to the Company’s mines located in Honduras there were:

No violations of mandatory health or safety standards that could significantly and substantially contribute to the cause and effect of a coal or other mine safety or health hazard under section 104 of the Federal Mine Safety and Health Act of 1977 (30 U.S.C. 814) for which the operator received a citation from the Mine Safety and Health Administration;

No orders issued under section 104(b) of such Act (30 U.S.C. 814(b));

No citations and orders for unwarrantable failure of the mine operator to comply with mandatory health or safety standards under section 104(d) of such Act (30 U.S.C. 814(d));

No flagrant violations under section 110(b)(2) of such Act (30 U.S.C. 820(b)(2));

No imminent danger orders issued under section 107(a) of such Act (30 U.S.C. 817(a));

15

No proposed assessments from the Mine Safety and Health Administration under such Act (30 U.S.C. 801 et seq. ); and

No mining-related fatalities.

No mine of which the Company or a subsidiary of the Company is an operator, that received written notice from the Mine Safety and Health Administration of:

(i) A pattern of violations of mandatory health or safety standards that are of such nature as could have significantly and substantially contributed to the cause and effect of coal or other mine health or safety hazards under section 104(e) of such Act (30 U.S.C. 814(e)); or

(ii) The potential to have such a pattern.

There are no pending legal actions before the Federal Mine Safety and Health Review Commission involving such mines.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock is eligible to be traded on the Over-The-Counter Bulletin Board under the ticker symbol MSTG.

The following table sets forth the high and low closing prices for the shares of our common stock for the periods indicated.

|

QUARTER ENDING

|

HIGH

|

LOW

|

||||||

|

March 31, 2011

|

$

|

0.85

|

$

|

0.25

|

||||

|

June 30, 2011

|

0.40

|

0.14

|

||||||

|

September 30, 2011

|

0.24

|

0.15

|

||||||

|

December 31, 2011

|

0.75

|

0.22

|

||||||

|

QUARTER ENDING

|

HIGH

|

LOW

|

||||||

|

March 31, 2012

|

$

|

0.041

|

$

|

0.0125

|

||||

|

June 30, 2012

|

0.018

|

0.006

|

||||||

|

September 30, 2012

|

0.0185

|

0.009

|

||||||

|

December 31, 2012

|

0.0121

|

0.04

|

||||||

The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

16

Holders

As of April 9, 2013, there were 107,037,834 shares outstanding, which were held by 1,325 stockholders of record.

Dividends

We have never declared or paid any cash dividends on our common stock nor do we anticipate paying any in the foreseeable future. Furthermore, we expect to retain any future earnings to finance our operations and expansion. The payment of cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

Equity Compensation Plans

We currently do not have any equity compensation plans but are contemplating adopting a stock option/incentive plan.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

None.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

Item 6. Selected Financial Data.

Smaller reporting companies are not required to provide the information required by this Item 6.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Certain statements contained in this Annual Report, including statements regarding the anticipated development and expansion of our business, our intent, belief or current expectations, primarily with respect to our future operating performance and other statements contained herein regarding matters that are not historical facts, are "forward-looking" statements. Future filings with the SEC, future press releases and future oral or written statements made by us or with our approval, which are not statements of historical fact, may contain forward-looking statements, because such statements include risks and uncertainties, and actual results may differ materially from those expressed or implied by such forward-looking statements. All forward-looking statements speak only as of the date on which they are made and reflect our plans, estimates and beliefs. Our actual results could differ materially from those anticipated in these forward-looking statements. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made. The following discussion and analysis should be read in conjunction with the audited financial statements and notes thereto included elsewhere in this Annual Report.

17

Plan of Operation

We are dependent upon making a gold deposit discovery at the Properties. Should we be able to make an economic find, we would then be solely dependent upon the mining operation for our revenue and profits, if any. The probability that reserves that meet SEC guidelines will be discovered on the property is undeterminable at this time. The Properties presently do not have any mineral resources or reserves. There is currently no mining plant or equipment located within the Properties boundaries. Currently, there is no power supply to the mineral claims. A great deal of work is required on the Properties before a determination as to the economic and legal feasibility of a mining venture on it can be made.

Results of Operations

Years Ended December 31, 2012 and 2011

As of December 31, 2012 we had $247 in cash and cash equivalents, and have experienced losses since inception. We did not generate any revenues from operations during the years ended December 31, 2012 and 2011. Operating expenses during the year ended December 31, 2012 were $1,078,760 and a net loss of $1,081,699 compared to operating expenses of $873,096 for a net loss of $898,473 for the year ended December 31, 2011. Expenses for the year ended December 31, 2012 and 2011 consisted primarily of professional fees, consulting fees and mining and exploration cost relating to our organization aggregating $1,078,760 in 2012 and 873,096 in 2011. During 2012, an impairment loss of $106,000 on equipment not in use was included in operating expenses. We have incurred a cumulative net loss of $2,175,151 for the period February 22, 2007 (inception) to December 31, 2012.

Liquidity and Capital Resources

Our balance sheet as of December 31, 2012 reflects cash in the amount of $247. In addition, on December 31, 2012, the Company had working capital deficiency of $492,581 and a stockholders' deficiency of $492,581 at December 31, 2012 as compared to a working capital deficiency of $119,097 and a stockholders' deficiency of $144,097 at December 31, 2011. The increase in working capital deficiency was primarily due to the increase of accounts payable resulting from mining costs incurred and payable at year end, and related party debt primarily from accrued consulting fees as required by certain contracts and agreements in place as well as loans to the Company to pay for certain corporate expenses during the year ended December 31, 2012.

In August 2012, we received an aggregate investment of $34,000 in consideration for the issuance of 680,000 shares and five-year warrants purchasing 340,000 shares of common stock exercisable at $0.20 per share.

Current cash on hand is insufficient for all of the Company’s commitments for the next 12 months. We anticipate that the additional funding that we require will be in the form of equity financing.

We will require additional capital to mine and explore the Property in Honduras and estimate that within the next 12 months we will need approximately $1,000,000 for those specific exploration and mining costs.

We cannot be certain that the required additional financing will be available or available on terms favorable to us. We currently do not have any arrangements or commitments in place for any other financings. If additional funds are raised by the issuance of our equity securities, existing stockholders will experience dilution of their ownership interest. If adequate funds are not available or not available on acceptable terms, we may be unable to fund our operations.

Subsequent Events:

On February 15, 2013, the Company issued a 12% promissory note, due in sixty days for $45,000. Additionally, the note holder will be issued 2,500,000 shares of common stock. The note holder has the right to convert at any time, the unpaid principal for $0.01 per share. The Note Holder is an existing shareholder of the company.

On February 28, 2013 the Company issued two 12 % promissory notes for $100,000 each, due in sixty days, to two independent third parties. Each of the note holders have the right to convert, at any time, the unpaid principal balance for $0.01 per share.

18

Critical Accounting Policies

Use of Estimates

In preparing financial statements in conformity with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported period. Actual results could differ from those estimates. Significant estimates include the valuation of deferred tax assets and valuation of equity instruments.

Cash and Cash Equivalents

The Company considers all highly liquid temporary cash investments with an original maturity of three months or less to be cash equivalents. At December 31, 2012 and 2011, the Company had no cash equivalents.

Property, Plant and Equipment

Property, plant and equipment are stated at cost, less accumulated depreciation. Expenditures for maintenance and repairs, which are not considered improvements and do not extend the useful life of the asset, are expensed as incurred; additions, renewals and betterments are capitalized. When assets are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in the statement of operations in other income and expenses.

Depreciation is provided to recognize the cost of the asset in the results of operations. The Company calculates depreciation using the straight-line method with estimated useful life as follows:

|

Item

|

Useful Life

|

|

Mining equipments

|

10 years

|

Loss Per Share

Basic and diluted net loss per common share is computed based upon the weighted average common shares outstanding as defined by Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 260, Earnings Per Share. As of December 31, 2012, the Company has 2,175,000 warrants and 0 options that are anti-dilutive and not included in diluted loss per share.

19

Income Taxes

The Company accounts for income taxes under FASB ASC Topic 740, Income Taxes (“ASC Topic 740”). Under ASC Topic 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under ASC Topic 740, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company’s 2010 to 2012 tax returns are subject to examination by Internal Revenue Services.

Business Segments

The Company operates in one segment and therefore segment information is not presented.

Revenue Recognition

The Company will recognize revenue on arrangements in accordance with FASB ASC 605, Revenue Recognition. In all cases, revenue is recognized only when the price is fixed and determinable, persuasive evidence of an arrangement exists, the service is performed and collectability of the resulting receivable is reasonably assured.

Fair Value of Financial Instruments

The carrying amounts reported in the balance sheet for accounts payable and notes payable – related party approximate fair value based on the short-term maturity of these instruments.

Mining Properties (Exploration Costs)

Costs of acquiring mining properties and any exploration costs are capitalized as incurred,in accordance with FASB ASC Topic 930, Extractive Activities – Mining, when proven and probable reserves exist and the property is a commercially mineable property. Mine exploration costs incurred either to develop new gold, silver, lead and copper deposits, expand the capacity of operating mines, or to develop mine areas substantially in advance of current production are capitalized. Costs incurred to maintain current production or to maintain assets on a standby basis are charged to operations. Costs of abandoned projects are charged to operations upon abandonment. The Company evaluates, at least quarterly, the carrying value of capitalized mining costs and related property, plant and equipment costs, if any, to determine if these costs are in excess of their net realizable value and if a permanent impairment needs to be recorded. The periodic evaluation of the carrying value of capitalized costs and any related property, plant and equipment costs are based upon expected future cash flows and/or estimated salvage value.

The Company capitalizes costs for mining properties by individual property and defers such costs for later amortization only if the prospects for economic productions are reasonably certain. Capitalized costs are expensed in the period when the determination has been made that economic production does not appear reasonably certain. As of December 31, 2012, the Company recorded an impairment of $106,000.

Stock-Based Compensation

In December 2004, the FASB issued ASC Topic 718, Compensation–Stock Compensation (“ASC Topic 718”). Under ASC Topic 718, companies are required to measure the compensation costs of share-based compensation arrangements based on the grant-date fair value and recognize the costs in the financial statements over the period during which employees are required to provide services. Share-based compensation arrangements include stock options, restricted share plans, performance-based awards, share appreciation rights and employee share purchase plans. As such, compensation cost is measured on the date of grant at their fair value. Such compensation amounts, if any, are amortized over the respective vesting periods of the option grant. Equity instruments (“instruments”) issued to other than employees are recorded on the basis of the fair value of the instruments, as required by ASC Topic 718.

20

ASC Topic 505, Equity Based Payments to Non-Employees defines the measurement date and recognition period for such instruments. In general, the measurement date is when either a performance commitment, as defined, is reached or the earlier of the non-employee performance is complete or the instruments are vested. The measured value related to the instruments is recognized over a period based on the facts and circumstances of each particular grant as defined in the FASB Accounting Standards Codification.

Fair Value Measurement

The authoritative guidance for fair value measurements defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or the most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Market participants are buyers and sellers in the principal market that are (i) independent, (ii) knowledgeable, (iii) able to transact, and (iv) willing to transact. The guidance describes a fair value hierarchy based on the levels of inputs, of which the first two are considered observable and the last unobservable, that may be used to measure fair value which are the following:

• Level 1 Quoted prices in active markets for identical assets or liabilities.

• Level 2 Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active, or other inputs that are observable or corroborated by observable market data or substantially the full term of the assets or liabilities.

• Level 3 Unobservable inputs that are supported by little or no market activity and that are significant to the value of the assets or liabilities.

The Company's financial instruments include cash and equivalents, accounts payable and accrued expenses, and notes and loans payable. All these items were determined to be Level 1 fair value measurements. The carrying amounts of cash and equivalents, accounts payable and accrued expenses, and notes and loans payable approximated fair value because of the short maturity of these instruments.

Recent Accounting Pronouncements

In February 2013, FASB issued Accounting Standards Update 2013-04, Liabilities (Topic 405): Obligations Resulting from Joint and Several Liability Arrangements for Which the Total Amount of the Obligation Is Fixed at the Reporting Date (a consensus of the FASB Emerging Issues Task Force). This guidance requires an entity to measure obligations resulting from joint and several liability arrangements for which the total amount of the obligation within the scope of this guidance is fixed at the reporting date. This stipulates that (1) it will include the amount the entity agreed to pay for the arrangement between them and the other entities that are also obligated to the liability and (2) any additional amount the entity expects to pay on behalf of the other entities. The objective of this update is to provide guidance for the recognition, measurement, and disclosure of obligations resulting from joint and several liability arrangements. The amendments in this update are effective for fiscal periods (and interim reporting periods within those years) beginning after December 15, 2013. This standard is not expected to have a material impact on the Company’s reported results of operations or financial position.

In February 2013, FASB issued Accounting standards update 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified out of Accumulated Other Comprehensive Income. This update requires an entity to provide information amount the amount reclassified out of accumulated other comprehensive income by component. The entity is also required to disclose significant amounts reclassified out of accumulated other comprehensive income by the respective line items of net income but only if the amount reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting periods. For other amounts that are not required under U.S. GAAP to be reclassified in their entirety to net income, an entity is required to cross-reference to other discourses required under U.S. GAAP that provide additional detail about those amounts. The objective in this Update is to improve the reporting of reclassifications out of accumulated other comprehensive income. The amendments in this update should be applied prospectively for reporting periods beginning after December 15, 2013. This standard is not expected to have a material impact on the Company’s reported results of operations or financial position.

21

Going Concern Consideration

The Company is in the exploration stage and has no revenues, has incurred a net loss of approximately $1,081,699 for the year ended December 31, 2012 and a cumulative net loss of $2,175,151 for the period from February 22, 2007 (inception) to December 31, 2012. In addition, at December 31, 2012, there is a working capital deficit of $492,581. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

There can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or available from external sources such as debt equity financings, or other potential sources. The inability to generate cash flow from operations or to raise capital from external sources will force the Company to substantially curtail and cease operations, therefore, have a material adverse effect on its business. Furthermore, there can be no assurance that any funds, if available, will possess attractive terms or have a significant dilutive effect on the Company’s existing stockholders.

The Company is attempting to address its lack of liquidity by raising additional funds, either in the form of debt, equity, or some combination thereof. There can be no assurances that the Company will be able to raise the additional funds it requires

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

A smaller reporting company is not required to provide the information required by this Item 7A.

22

Item 8. Financial Statements.

MUSTANG ALLIANCES, INC.

(AN EXPLORATION STAGE COMPANY)

Financial Statements

For the years ended December 31, 2012 and 2011

TABLE OF CONTENTS

|

Report of Independent Registered Public Accounting Firm

|

24 | |||

|

Balance Sheets

|

25 | |||

|

Statements of Operations

|

26 | |||

|

Statements of Stockholders’ Deficit

|

27 | |||

|

Statements of Cash Flows

|

29 | |||

|

Notes to the Financial Statements

|

30 |

23

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of:

Mustang Alliances, Inc.

We have audited the accompanying balance sheets of Mustang Alliances, Inc. (an “exploration company”) (the “Company”) as of December 31, 2012 and 2011, and the related statements operations, changes in stockholders’ deficit and cash flows for the years ended December 31, 2012 and 2011 and the period February 22, 2007 (Inception) to December 31, 2012. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.