Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHRISTOPHER & BANKS CORP | form8-ktagpresentation4813.htm |

Charting Our Path to Profitability April, 2013

Certain statements on the slides which follow may be forward-looking statements about Christopher & Banks Corporation (the “Company”). Such forward-looking statements involve risks and uncertainties which may cause actual results to differ. These forward-looking statements may be identified by such terms as “will”, “expect”, “believe”, “anticipate”, “outlook”, “target”, “plan”, “initiatives”, “estimated”, “strategy” and similar terms. You are directed to the cautionary statements regarding risks or uncertainties described in the Company’s filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and other SEC filings made since the date of that 10-K report. Participants are cautioned not to place undue reliance on such forward-looking statements, which reflect management’s views only as of April 9, 2013. The Company undertakes no obligation to update or revise the forward-looking statements. 2 Safe Harbor

Our Vision & Mission Vision: To become her trusted brand by delivering style and value every day. Mission: To provide women of all sizes, apparel and accessories with style and versatility that reflects who she is; lasting quality and affordable value she expects; delivered with the personalized attention she deserves. 3

4 An established brand targeting the baby boomer market with fashionable assortments that meet our customers’ needs for style, versatility and value 605 stores in two primary brand concepts: 381 Christopher & Banks stores – missy & petites - with an average of 3,300 square feet per store 158 CJ Banks stores– size 14 & more - with an average of 3,600 square feet per store We operate an additional 41 dual strategy stores and 25 outlet stores E-commerce sites for each brand Company Overview

Our Core Customer Target baby boomers - 45-60 years Avg. household income $70k-$75k More than 50% higher than US avg. 70% work outside of the home 2/3 married Purchases 3.2 times annually Self-reports that she visits more frequently Spends $139 annually On average, $43 per purchase 5

6 New senior management team and re-energized organization LuAnn Via, President and CEO, joined November 26, 2012; a 30+ year retail executive veteran: President and CEO of Payless ShoeSource, Inc. Group Divisional President of Lane Bryant and Cacique President of Catherines Stores, Inc. Vice President, General Merchandise Manager of Sears Holding Company Senior Vice President, General Merchandise Manager of Product Development at Saks, Inc. Peter Michielutti, joined as SVP and CFO in April 2012; brings more than 20 years retail finance experience: CFO of Whitehall Jewelers CFO of Wilsons Leather CFO of Fingerhut Two Divisional General Merchandise Managers appointed December 2011 New VP of eCommerce and Digital marketing came on board April 1 New Senior Management

Introduction: Senior Leadership Team Michelle Rice – SVP, Store Operations Monica Dahl - SVP, Marketing Luke Komarek - SVP, General Counsel Cindy Stemper – SVP, Human Resources Mike Lyftogt – Chief Accounting Officer Lisa Klein - VP, Information Technology and P&A Ann McDermott – GMM, Christopher & Banks Tricia Perket – GMM, CJ Banks Mike Tripp – VP, Supply Chain and Logistics Donna Fauchald - VP, Real Estate Brad Smith – VP, eCommerce and Digital Marketing 7

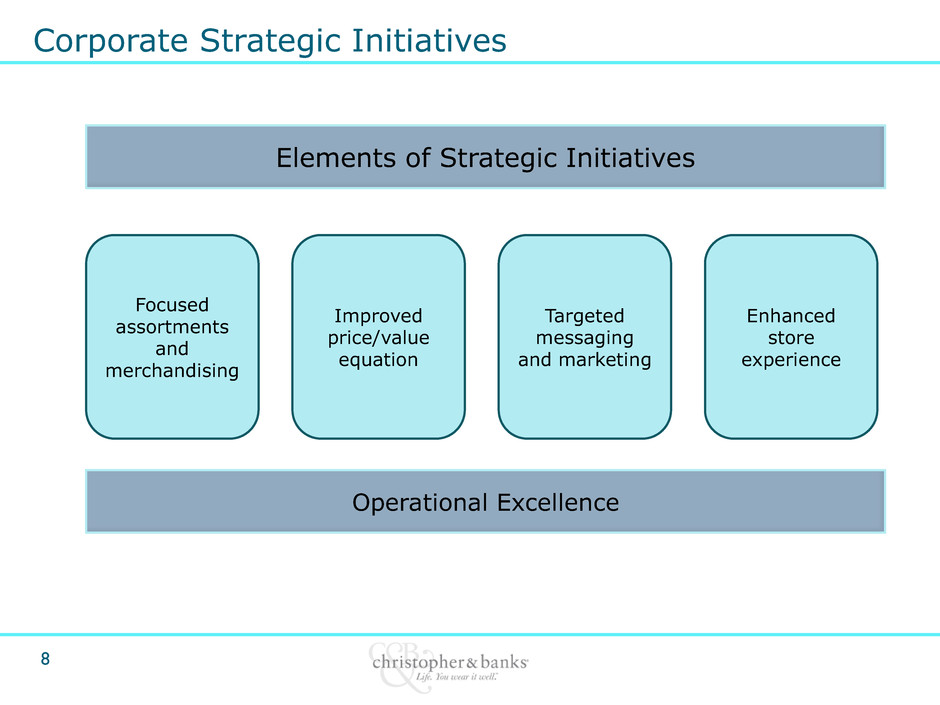

Corporate Strategic Initiatives 8 Elements of Strategic Initiatives Focused assortments and merchandising Improved price/value equation Targeted messaging and marketing Enhanced store experience Operational Excellence

9 Balanced assortments to offer the right mix of merchandise Continued reduction of the number of styles and SKUs while increasing depth in a greater number of key styles Rebalanced mix of good/better/best with greater emphasis on good and better Delivering fashionable, age appropriate clothing that fits a real woman Focused on style, quality and value along with versatility and great fit Providing easy, complete outfitting with complementing accessories Improved inventory flow for freshness and increased productivity Reduced floor sets to six versus twelve, continuing to evaluate further reduction Increased depth and greater number of key styles; supplemented with small deliveries Increased efficiencies with adjustments in the product development cycle to improve speed to market Improved lifecycle performance bodes well for merchandise margins Focused Assortments and Merchandising

10 Offering an improved price/value proposition that has resonated well with customers Providing more attractive opening price points Simplified pricing structure and reduced ticket prices on average by 20% Expanding top 10 key programs at key price points Driving higher full price selling with right product, more balanced mix of good/better/best and clear value message Improved Price/Value Equation

11 Expanding Customer Relationship Management Program (CRM) Continued focus on Friendship Loyalty Program at 3.3 million total with 2.2 million active customers generating 84% of our sales Club Card programs, Smarty Pants, Sweater Club, and Bottom Line (shorts, skorts, skirts, capris, pants) Redeemers shopped 7+ times during the promotion, and spent approximately 50% more than last year Categories other than the featured category represented approximately 70% of spend Increased ROI through effective direct marketing efforts Three direct mail pieces in 4Q12 generated twice the incremental sales of the same numbers of mailings last year Opportunity in the future for increased investment via mail frequency and depth in a variety of formats Continue to integrate merchandise product and promotional messages into email communications Targeted Messaging and Marketing Strategies

12 Enhanced promotional strategy Increased targeted, unique pre-planned category promotions and reduced store-wide events Refined store signage to drive traffic and provide clarity of offer Supplemented in-store offers with effective bounce-backs for repeat visits Private label credit card program (launched in April 2012) To date, cardholders represent 10% of active customers and 15% of overall sales since launch Average transaction size of cardholders is approximately 50% higher than non-card holders Card users in 2012 spent 25% more than they did the prior year, and on average made one additional store visit Incentivize cardholders with offers such as accelerated points and cardholder events communicated via direct mail, email and store front Targeted Messaging and Marketing (cont’d)

Enhanced Store Experience Refreshing “Selling with Care” program Introducing additional selling techniques Supporting with additional learning tools such as videos Adding selling hours to increase service levels Re-enforcing clientelling as key to selling culture Talent Expanded training and development programs Revised and enhanced On-boarding Program by providing updated and cohesive new hire checklists Visual merchandising enhancements Creating strong brand message through signing and overall visual displays of new product offerings Provided additional direction on brand standards to create consistency from store to store Update store presentation with addition of mannequins, tables and props Leveraging special events to foster relationships & differentiate from the competition In-store seasonal Fashion Events Maximize grassroots opportunities i.e.; women’s conventions, leadership conferences & women’s clubs 13

14 Test program provides platform to test strategies in approximately 100 stores before expanding to additional stores Positive results seen thus far: Fourth quarter comparable store sales of 38% versus 18.5% overall Current test initiatives include: Implementing grassroots marketing campaign Updating store visuals and fixtures Optimizing staffing levels Refining inventory levels Learnings from the program will become the basis for store base DNA to maximize profitability and productivity Pilot Store Test Program Focused on Retail Operations Test Program Geared Towards Driving Store Productivity and Increased Profitability

15 Plan to open 5 outlet stores and one dual store in fiscal 2013 Longer term, openings are expected to be primarily outlet stores Evaluating opportunities to convert Christopher & Banks and CJ Banks single brand stores into dual stores Better serve our customer with full complement of missy, petite and women’s sizes in one location Methodical and disciplined bottoms-up approach to real estate Analyze sales and margin productivity across categories and size ranges in each location to determine where there is opportunity to maximize productivity Real Estate Strategy

16 Unique customer niche largely ignored by others Multi-channel strategy with small market focus Strategic initiatives driving improved sales and merchandise margin performance Significant operating margin expansion opportunity Enhanced balance sheet with improved liquidity and flexibility Strengthened management team and Board of Directors Investment Highlights

Financial Highlights

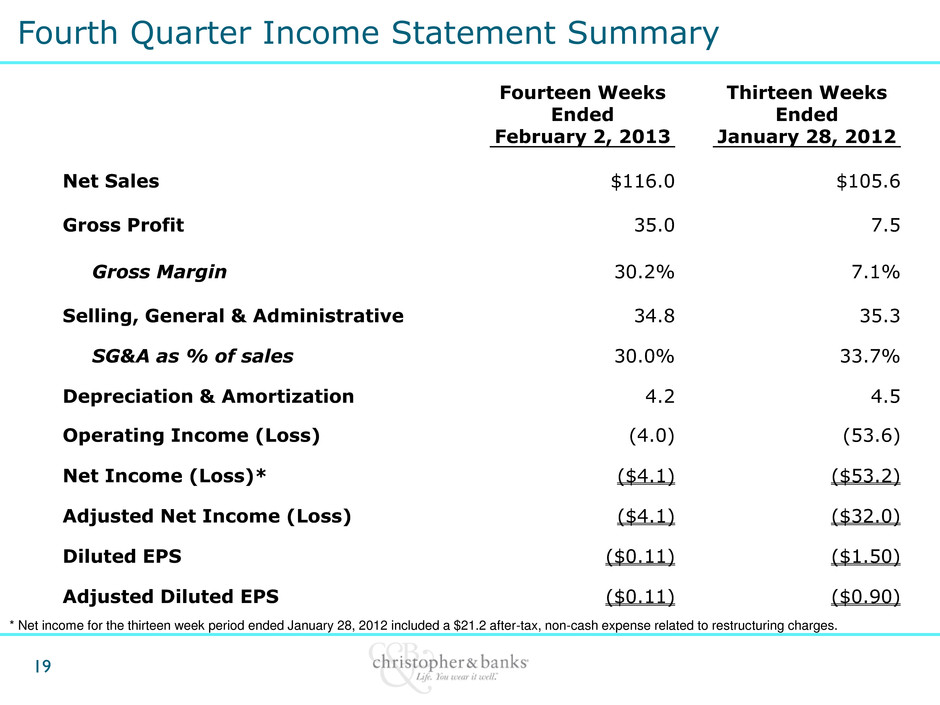

18 Total comparable sales for fourth quarter up 18.5% Compared to a 13.7% increase in the third quarter and an 18.6% decrease in last year’s fourth quarter Improved conversion rates and higher units per transactions led to 7.1% increase in average transactions per store Despite operating an average of 124 (17%) fewer stores, sales for the quarter grew 9.8% as compared to the same period last year Approximately 4.8% due to the 53rd week in fiscal 2012 Gross margin in the fourth quarter of 30.2% compared to 7.1% for last year’s fourth quarter Merchandise margin rate improved on a year-over-year basis Improved inventory flow contributed to stronger sell-through Improved Financial Performance

19 Fourteen Weeks Ended February 2, 2013 Thirteen Weeks Ended January 28, 2012 Net Sales $116.0 $105.6 Gross Profit 35.0 7.5 Gross Margin 30.2% 7.1% Selling, General & Administrative 34.8 35.3 SG&A as % of sales 30.0% 33.7% Depreciation & Amortization 4.2 4.5 Operating Income (Loss) (4.0) (53.6) Net Income (Loss)* ($4.1) ($53.2) Adjusted Net Income (Loss) ($4.1) ($32.0) Diluted EPS ($0.11) ($1.50) Adjusted Diluted EPS ($0.11) ($0.90) * Net income for the thirteen week period ended January 28, 2012 included a $21.2 after-tax, non-cash expense related to restructuring charges. Fourth Quarter Income Statement Summary

20 53 - Weeks Ended February 2, 2013 52 - Weeks Ended January 28, 2012 Net Sales $430.3 $436.2 Gross Profit 126.6 102.9 Gross Margin 29.4% 23.6% Selling, General & Administrative 129.2 141.8 SG&A as % of sales 30.0% 32.5% Depreciation & Amortization 18.6 22.0 Operating Income (Loss) (16.0) (82.1) Net Income (Loss)* ($16.1) ($81.4) Adjusted Net Income (Loss) ($16.1) ($60.9) Diluted EPS ($0.45) ($2.29) Adjusted Diluted EPS ($0.45) ($1.71) * Net income for the 52-week period ended January 28, 2012 included a $21.2 after-tax, non-cash expense related to restructuring charges. Fiscal 2013 Income Statement Summary

21 February 2, 2013 January 28, 2012 Cash and Investments $40.7 $61.7 Merchandise Inventories 42.7 39.5 Property and Equipment, net 41.2 56.4 Total Assets $135.9 $166.0 Long -Term Debt — — Stockholders’ Equity $75.5 $89.4 Balance Sheet Summary

22 Stabilized Balance Sheet and Improved Cash Flow Executed new senior $50 million credit facility in 2Q12 Enhanced liquidity Greater capital flexibility with fewer covenants Plan to utilize for letters of credit for merchandise purchases Filed shelf registration for up to $75 million in equity in 2Q12 Provides financial flexibility to raise capital in the future No current plans to utilize shelf Better inventory management driving improved cash flow Minimized capital expenditures Limiting new store openings Average store count to be down 11% for first quarter and 8% for fiscal year Plan to reassess portfolio after reviewing second half performance and results of pilot tests

23 Expect comparable store sales to increase in the low twenty percent range Expect 800 to 900 basis points of gross margin improvement, split between improved merchandise margins and positive leverage on occupancy expense Expect SG&A dollars to grow at lower pace than sales, due to increased investments in marketing and store payroll For Fiscal 2013, expect capital expenditures to be approximately $9 million Fiscal 2013 First Quarter Outlook