Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - STEMLINE THERAPEUTICS INC | a13-9040_1ex31d1.htm |

| EX-31.2 - EX-31.2 - STEMLINE THERAPEUTICS INC | a13-9040_1ex31d2.htm |

| EX-32.1 - EX-32.1 - STEMLINE THERAPEUTICS INC | a13-9040_1ex32d1.htm |

| EX-32.2 - EX-32.2 - STEMLINE THERAPEUTICS INC | a13-9040_1ex32d2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012.

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File Number: 001-35619

STEMLINE THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

45-0522567 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

750 Lexington Avenue

Sixth Floor

New York, New York 10022

(Address of principal executive offices) (Zip Code)

(646)-502-2310

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Common Stock, par value $0.0001 per share (Title of Class) |

|

NASDAQ Capital Market (Name of Each Exchange on Which Registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. oYes x No

Indicate by check mark where the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). xYes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

|

Large-accelerated filer o |

Accelerated filer o |

|

|

|

|

Non-accelerated filer x |

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

The aggregate market value of voting common stock held by non-affiliates of the registrant (assuming, for purposes of this calculation, without conceding, that all executive officers and directors are “affiliates”) was $53,375,306 as of March 27, 2013, based on the closing sale price of such stock as reported on the NASDAQ Capital Market. The registrant has provided this information as of March 27, 2013 because its common stock was not publicly traded as of the last business day of its most recently completed second fiscal quarter.

There were 7,458,561 shares of the registrant’s common stock outstanding as of March 27, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2013 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K.

This Annual Report on Form 10-K contains trademarks and trade names of Stemline Therapeutics, Inc., including our name and logo. All other trademarks, service marks, or trade names referenced in this Annual Report on Form 10-K are the property of their respective owners.

SPECIAL CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (“Form 10-K”) includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. They appear in a number of places throughout this Form 10-K and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ongoing and planned discovery and development of drugs targeting cancer stem cells, the strength and breadth of our intellectual property, our ongoing and planned preclinical studies and clinical trials, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for our product candidates, the degree of clinical utility of our products, particularly in specific patient populations, expectations regarding clinical trial data, our results of operations, financial condition, liquidity, prospects, growth and strategies, the length of time that we will be able to continue to fund our operating expenses and capital expenditures, our expected financing needs and sources of financing, the industry in which we operate and the trends that may affect the industry or us.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and healthcare, regulatory and scientific developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Form 10-K, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this Form 10-K. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in this Form 10-K, they may not be predictive of results or developments in future periods.

Some of the factors that we believe could cause actual results to differ from those anticipated or predicted include:

· the success and timing of our preclinical studies and clinical trials;

· our ability to obtain and maintain regulatory approval of our product candidates, and the labeling under any approval we may obtain;

· our plans to develop and commercialize our product candidates;

· the loss of key scientific or management personnel;

· the size and growth of the potential markets for our product candidates and our ability to serve those markets;

· regulatory developments in the United States and foreign countries;

· the rate and degree of market acceptance of any of our product candidates;

· our available cash;

· the accuracy of our estimates regarding expenses, future revenues, capital requirements and needs for additional financing;

· our ability to obtain additional funding;

· our ability to obtain and maintain intellectual property protection for our product candidates;

· the successful development of our sales and marketing capabilities;

· the performance of third-party manufacturers; and

· our ability to successfully implement our strategy.

Any forward-looking statements that we make in this Form 10-K speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this Form 10-K. You should also read carefully the factors described in the “Risk Factors” section of this Form 10-K to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Form 10-K will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all.

This Form 10-K includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third party research, surveys and studies are reliable, we have not independently verified such data.

We qualify all of our forward-looking statements by these cautionary statements. In addition, with respect to all of our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Unless the context requires otherwise, references in this report to “Stemline,” “Company,” “we,” “us” and “our” refer to Stemline Therapeutics, Inc.

Overview

We are a clinical-stage biopharmaceutical company focused on discovering, acquiring, developing and commercializing proprietary therapeutics that target both cancer stem cells, or CSCs, and tumor bulk. We are currently developing two clinical-stage product candidates, SL-401 and SL-701. SL-401 is a biologic targeted therapy directed to CSCs and tumor bulk, and is currently being developed for orphan indications: blastic plasmacytoid dendritic cell neoplasm, or BPDCN, a rare hematologic cancer, and third-line acute myeloid leukemia, or AML. SL-701 is a subcutaneously-delivered therapeutic cancer vaccine comprised of synthetic peptides, and is currently being developed for use in advanced pediatric and adult brain cancer. In completed Phase 1/2 clinical trials, both SL-401 and SL-701 have demonstrated single agent activity, including durable complete responses, or CRs, and longer overall survival, or OS, in heavily pretreated patients compared with that achieved in the past with traditional therapies. We plan to complete a pivotal Phase 2b single-arm trial of SL-401 in patients with BPDCN, with overall response rate as the primary endpoint. We also plan to advance SL-401 into a registration-directed randomized Phase 2b clinical trial to treat adult relapsed or refractory AML patients who failed two previous treatments (i.e., third-line AML) with CR rate and OS as co-primary endpoints. We plan to advance SL-701 into a Phase 2b clinical trial to treat pediatric patients with malignant brainstem and non-brainstem glioma. In addition, we plan to advance SL-701 into a Phase 2b clinical trial in adult recurrent or refractory glioblastoma multiforme, or GBM. We have an extensive intellectual property portfolio, a deep preclinical pipeline, and an innovative discovery platform which we believe establishes us as a leader in the CSC field.

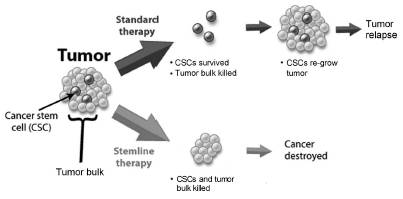

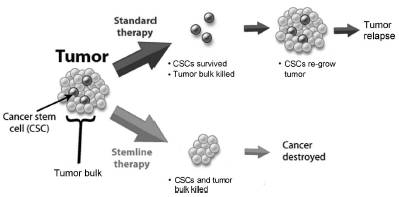

The field of CSCs is an emerging area of cancer biology with the potential to fundamentally alter the approach to oncology drug development. CSCs have been identified in virtually all major tumor types, including leukemia and cancers of the brain, breast, colon, prostate and pancreas. CSCs are the highly malignant “seeds” of a tumor that self-renew and generate more mature cells that comprise the bulk of the tumor, or “the tumor bulk.” As such, we believe that CSCs are responsible for tumor initiation, propagation, and metastasis. Many of the characteristics of CSCs, such as their slow growth, presence of multi-drug resistance proteins, anti-cell death mechanisms, and increased activity of cellular mechanisms that repair damaged DNA, may enable CSCs to resist therapeutic agents traditionally used to treat cancer. Further, while standard therapies may initially shrink tumors by targeting the tumor bulk, which excludes CSCs, we believe there is a body of evidence indicating that treatment failure, tumor relapse and poor survival are largely the result of the failure of conventional cancer treatments to eradicate CSCs. Accordingly, we believe that targeting CSCs, in addition to the tumor bulk, may represent a major advance in the fight against cancer. This premise has formed the basis of our drug development strategy, as illustrated below.

Since our inception, we have leveraged our knowledge of CSCs to anticipate and establish a leadership position in this new field of oncology. During this time, we have developed or strategically in-licensed key intellectual property, built and validated a drug discovery platform and developed clinically active drug candidates. We believe that our early and comprehensive effort to develop a new generation of oncology therapeutics that target CSCs as well as the tumor bulk provides us with a competitive advantage.

Our Company

We were incorporated under the laws of the State of Delaware in August 2003. Our principal executive offices are located at 750 Lexington Avenue, Sixth Floor, New York, New York 10022 and our telephone number is (646) 502-2310.

Our website address is www.stemline.com. We will make available free of charge through our Internet website our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and any amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC. We are not including the information on our website as a part of, nor incorporating it by reference into, this report. You may read and copy any materials we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 on official business days during the hours of 10:00 a.m. to 3:00 p.m. Please call the SEC at 1-800-SEC-0330 for information on the Public Reference Room. Additionally, the SEC maintains a website that contains annual, quarterly, and current reports, proxy statements, and other information that issuers (including us) file electronically with the SEC. The SEC’s website address is http://www.sec.gov.

Management

We are led by a team with extensive experience in managing biopharmaceutical companies and in oncology drug development, including:

· Ivan Bergstein, M.D. — Chairman, Chief Executive Officer and President, Dr. Bergstein, founded Stemline and has advanced the Company from concept to late-stage clinical development. He was previously Medical Director of Access Oncology Inc., a private clinical stage oncology-focused biotechnology company, which was subsequently acquired. Prior to that, Dr. Bergstein was a biopharmaceuticals industry research analyst. He previously completed a residency and fellowship in internal medicine and hematology-oncology at the New York Presbyterian Hospital — Weill Medical College of Cornell University.

· Eric K. Rowinsky, M.D. — Chief Medical Officer and Head of Research and Development, Dr. Rowinsky, was previously the Chief Medical Officer for ImClone Systems, Inc. Dr. Rowinsky has more than 25 years of experience managing clinical trials and developing drugs in oncology, including leading the FDA approval of Erbitux® for head and neck and colorectal cancers. Dr. Rowinsky currently serves on the Board of Directors of Biogen Idec Inc., as well as several other public biopharmaceutical companies.

Strategy

Our goal is to maintain and fortify a leadership position in the discovery, acquisition and development of novel oncology therapies that target CSCs. The fundamental components of our business strategy to achieve this goal include the following:

· Be the first anti-CSC-focused company to commercialize a CSC-directed oncology drug. As the most clinically advanced anti-CSC-focused company, we aim to fortify our leadership position and be the first to commercialize a CSC-directed oncology drug.

· Develop and commercialize SL-401 in multiple hematological cancers. We plan to complete a pivotal Phase 2b single-arm trial of SL-401 in patients with relapsed or refractory BPDCN, with overall response rate as the primary endpoint. We also plan to advance SL-401 into a registration-directed randomized Phase 2b clinical trial, with CR rate and OS as co-primary endpoints, in AML patients as a third-line treatment. BPDCN and AML are orphan indications, i.e., rare diseases or conditions affecting fewer than 200,000 people in the United States and each represent an unmet medical need. The SL-401 target, IL-3R, is expressed on a wide variety of hematologic cancers including AML, BPDCN, CML, MDS, and acute lymphoid leukemia, as well as lymphomas, such as non-Hodgkin’s lymphoma and Hodgkin’s disease, and multiple myeloma. Accordingly, we believe that SL-401 should be active in multiple hematologic cancers. These indications could represent significant market opportunities for SL-401.

· Develop and commercialize SL-701 in brain cancer. We plan to advance SL-701 into a Phase 2b clinical trial for the treatment of pediatric patients with brainstem and non-brainstem glioma. We also plan to initiate a Phase 2b clinical trial in adult second-line GBM.

· Leverage our proprietary drug discovery platform, StemScreen®, to identify new therapeutics. We intend to utilize our proprietary discovery platform to identify new CSC-targeted drug candidates. We may conduct some of these efforts internally and/or leverage our platform to forge strategic collaborations. To date, we have utilized StemScreen® to identify a number of drug candidates.

· Develop commercialization capabilities in North America and Europe. We believe that the infrastructure required to commercialize our oncology products is relatively limited, which may make it cost-effective for us to internally develop a marketing effort and sales force. If SL-401 and SL-701 are approved by the FDA and other regulatory authorities for first use, we plan to commercialize these drugs ourselves in North America and Europe through direct sales and distribution. However, we will remain opportunistic in seeking strategic partnerships in these and other markets when advantageous to us.

· Continue to both leverage and fortify our CSC intellectual property portfolio. We believe that we have a strong intellectual property position relating to the development and commercialization of CSC-targeted therapeutics, diagnostics, and drug discovery. We plan to continue to leverage this portfolio to create value. In addition to fortifying our existing intellectual property position, we intend to file new patent applications, in-license new intellectual property and take other steps to strengthen, leverage, and expand our intellectual property position.

Clinical Pipeline

The following table summarizes key information about our two most advanced product candidates:

SL-401 — An IL-3R-Directed Compound Targeting CSCs and Tumor Bulk

Overview

SL-401 is a clinically active biologic targeted therapy directed to the interleukin-3 receptor, or IL-3R, which is overexpressed on CSCs and more mature cancer cells derived from CSCs (i.e., tumor bulk) of multiple hematologic cancers. In AML, for example, IL-3R is overexpressed on both CSCs and tumor bulk of leukemia (i.e., blast cells). In a completed Phase 1/2 clinical trial in patients with advanced hematologic cancers, a single cycle of SL-401 alone demonstrated anti-tumor activity, including durable CRs, in relapsed or refractory patients. Specifically, a single cycle of SL-401 induced four durable CRs in relapsed or refractory patients: two CRs in BPDCN and two CRs in AML. Notably, a single cycle of SL-401 also improved the median OS of the 35 most heavily pretreated AML patients who had failed at least two previous therapies (i.e., third-line or greater) by more than two-fold compared with historical data. Moreover, a single cycle of SL-401 administered at therapeutically relevant doses (i.e., the maximum tolerated dose, or MTD, or one or two dose levels below the MTD) improved the median OS by more than three-fold compared with the historical median OS. Further, SL-401 was shown to be non-toxic to bone marrow, which is a key differentiating feature relative to many other hematologic cancer therapies and which we believe is due to the lack of IL-3R expression on normal bone marrow stem cells. Currently, there are limited effective treatment options for patients with relapsed or refractory hematologic cancers including BPDCN and AML. We believe that a major reason for the failures of traditional treatments to provide long term benefit is that these traditional treatments target tumor bulk rather than CSCs, and are often toxic to the bone marrow. Accordingly, by pursuing hematologic cancer indications with SL-401, a therapeutic that uniquely targets both CSCs and tumor bulk and is not toxic to the bone marrow, we hope to provide benefit to patients who historically have been difficult to treat with traditional therapies.

We plan to complete a pivotal Phase 2b single-arm trial in patients with relapsed or refractory BPDCN, with overall response rate as the primary endpoint. We also plan to advance SL-401 into a registration-directed randomized Phase 2b clinical trial, with CR rate and OS as co-primary endpoints, in AML patients as a third-line treatment. We also plan to evaluate the potential of SL-401 in additional hematologic cancer indications, including earlier stages of AML as well as other leukemia, lymphomas, and multiple myeloma.

In February 2011, SL-401 received Orphan Drug designation from the FDA for the treatment of AML.

Blastic Plasmacytoid Dendritic Cell Neoplasm (BPDCN)

BPDCN is a rare and aggressive hematologic cancer that carries a poor prognosis. BPDCN was previously classified by the World Health Organization, or WHO, as blastic NK cell lymphoma, agranular CD4+/CD56+ hematodermic neoplasm, and plasmacytoid dendritic cell cancer. BPDCN most commonly affects middle-aged and older patients and is approximately three times more common in men than women. BPDCN derives from plasmacytoid dendritic cells, which are specialized immune cells that express high levels of IL-3R, the target for SL-401. This malignancy most typically presents with skin lesions, as well as extracutaneous manifestations that may include the bone marrow, blood, lymph nodes, and spleen. BPDCN growth in the bone marrow results in decreased blood cell counts, thereby causing serious infections, bleeding, and invariably death. Although BPDCN can be controlled for brief periods with standard chemotherapy, including high dose chemotherapy with bone marrow transplantation, used to treat other hematologic cancers, durable clinical responses are rare and overall prognosis remains poor. There are currently no approved therapies for BPDCN, and an optimal therapeutic regimen for BPDCN has not yet been established.

Acute Myeloid Leukemia

AML is a hematologic cancer characterized by dysregulated maturation of myeloid cells and failure of the bone marrow to properly function. AML is the most common type of acute leukemia in adults. Approximately 14,000 new AML cases occur annually in the United States, and approximately 16,000 to 18,000 new cases occur annually in Europe. The average age of an AML patient is 67 years. The National Cancer Institute estimated in 2007 that the one-year survival rate for adult patients with AML was approximately 34%. The one-year survival rate for AML after first relapse is approximately 20%, and after second relapse is approximately 8%. The median OS for AML patients after failing second-line treatment, based on two large series, is 1.5 months. Current first-line treatments for AML include chemotherapy drugs such as cytarabine, daunorubicin and mitoxantrone. In certain circumstances, bone marrow transplantation is also used. In second-line AML, while there are currently no approved treatments, typical therapies include additional chemotherapy, often cytarabine again at various dosages and regimens. In third-line AML, there are currently no approved treatments, and these patients frequently have depressed bone marrow function and are often no longer optimal candidates for additional chemotherapy. As such, third-line AML constitutes an unmet medical need.

Myelodysplastic Syndrome

Myelodysplastic syndrome, or MDS, is a group of hematologic malignancies characterized by dysfunction of the blood and bone marrow, resulting in decreased peripheral blood counts and, at times, evolution into AML. Approximately 16,000 new cases of MDS are reported annually in the United States and approximately 15,000 to 25,000 new MDS cases are reported annually in Europe. MDS occurs most commonly in males 70 years or older. Five-year survival rates for MDS patients vary significantly depending on disease severity and prognosis and range from approximately 55% for low-risk patients, to 7% to 35% for intermediate-risk patients. Virtually all high-risk MDS patients die within five years. Treatment paradigms for MDS patients vary depending on disease classification and risk category. Current first-line treatments include azacitidine (Vidaza®), decitabine (Dacogen®), lenalidomide (Thalomid®), growth factors, chemotherapy, and stem cell transplantation in certain cases. We believe that a large number of patients either do not respond or relapse following first-line treatment, and there are no approved therapies and limited effective treatment options in this high-risk setting.

Chronic Myeloid Leukemia

Chronic myeloid leukemia, or CML, is a hematopoietic stem cell disease resulting in impaired bone marrow function. Annually, approximately 5,000 new cases are reported in the United States each year and approximately 4,000 to 9,000 new cases are reported each year in Europe. The five-year OS rate for CML patients is 57%. When CML advances to an accelerated or blastic phase, the median OS is less than one year. In patients who have failed or are intolerant to tyrosine kinase inhibitors (or TKIs), a relapsed or refractory setting, the median OS is four to 11 months. Current first-line treatments for CML include three TKIs: imatinib (Gleevec®), nilotinib (Tasigna®) and dasatinib (Sprycel®). In cases of relapse, second- and third-line treatments include a TKI not previously used in that patient. In certain circumstances, interferon or bone marrow transplantation is also used.

Design of SL-401 and Mechanism of Action

SL-401 is a biologic targeted therapy directed to the IL-3R. SL-401 consists of IL-3, genetically linked to a truncated diphtheria toxin payload. Mechanistically, the IL-3 domain of SL-401 directs the cytotoxic payload to IL-3R+ cells. SL-401 is then internalized by target cells, leading to intracellular release of the payload, inhibition of protein synthesis and cell death, or apoptosis. Accordingly, the targeting and mechanism by which SL-401 kills cells differs from therapeutics that are commonly used to treat hematologic malignancies including BPDCN and AML. Traditional therapies, such as chemotherapy, largely target rapidly dividing cells, whether malignant or normal, by interfering with DNA replication and other processes. SL-401, in contrast, is a targeted therapy that specifically recognizes and binds to cells expressing IL-3R, a target which is overexpressed on leukemia cells relative to normal cells. Thus, SL-401 preferentially targets malignant, not normal cells, a feature expected to result in fewer toxicities relative to traditional therapies. Moreover, by inhibiting protein synthesis, we believe that SL-401 is able to kill not just rapidly dividing cells, but also slower-growing cells such as CSCs. In addition, the SL-401 payload does not appear to be subject to multi-drug resistance highly expressed on CSCs and tumor bulk. Therefore, unlike traditional therapies which largely target and kill tumor bulk only, SL-401 is designed to target and kill both CSCs and tumor bulk.

IL-3R is normally expressed on certain maturing hematopoietic cells, including maturing myeloid cells, B cells and dendritic cells, but not normal hematopoietic stem cells, and is involved in cell maturation, differentiation, and survival. IL-3R is overexpressed on multiple hematological malignancies including AML, BPDCN, MDS, CML, B cell acute lymphoid leukemia, hairy cell leukemia, Hodgkin’s disease, and certain aggressive Non-Hodgkin’s lymphomas. In addition to expression on tumor bulk, IL-3R is also expressed on the CSCs of multiple hematologic cancers including AML, CML, MDS, and T-cell acute lymphoid leukemia. Elevated IL-3R expression has been correlated with poor patient prognosis. For example, as described by Vergez in Haematologica in 2011, a higher percentage of IL-3R-expressing, or IL-3R+, CSCs within a patient’s entire tumor correlates with poor outcome. In particular, AML patients with IL-3R+ CSCs that comprise greater than or equal to 1% of their entire leukemia were found to have a worse prognosis than patients with IL-3R+ CSCs that comprise less than 1% of their entire leukemia. We believe that these findings further validate that IL-3R is an important oncology target.

SL-401 Preclinical Activity and Safety

SL-401 has demonstrated preclinical in vitro and in vivo activity against both leukemia blasts (i.e., tumor bulk) and CSCs of a variety of human leukemia cell lines and primary leukemia cells from patients. In particular, SL-401 demonstrated potent cytotoxicity against leukemic cells in vitro in a dose-dependent fashion with IC50 (concentration that inhibits the growth of 50% of leukemia cells) values in the low picomolar range. Notably, normal bone marrow progenitor cells were relatively insensitive to SL-401. SL-401 also exhibited anti-CSC activity. In particular, SL-401 inhibited AML colony formation, an assay for stem cell activity, compared with normal human bone marrow. As further validation of an anti-CSC effect, SL-401 reduced the incorporation and growth (i.e., tumorigenicity) of AML cells, relative to normal human bone marrow, when treated ex vivo and reimplanted into immunodeficient mice — indicating activity at the level of the CSC. In addition, SL-401 prolonged the survival of mice implanted with human leukemia xenografts compared with untreated mice. In addition, SL-401 demonstrated high potency against BPDCN cells from patients, with an IC50 in the femtomolar range.

To support first-in-man clinical studies, repeat-dose animal safety studies were conducted in mice and monkeys. Toxicokinetic studies were performed to evaluate the relationships between toxicity and exposure to SL-401. Additionally, dose-limiting toxicity, or DLT, and maximum tolerated dose, or MTD, were determined from these studies to inform the subsequent Phase 1/2 human clinical trial.

SL-401 has also demonstrated preclinical activity against a variety of additional hematologic cancers. In particular, SL-401 has shown potent in vitro anti-leukemia activity against CML tumor bulk and CML CSCs, and increased survival in mouse models of human CML. SL-401 has also demonstrated potent in vitro anti-tumor activity against several lymphoid cancer types, including lymphoid leukemia, Hodgkin’s and non-Hodgkin’s lymphoma, and multiple myeloma.

Completed Phase 1/2 Clinical Trial — Advanced Hematologic Cancers

Overview

SL-401 was evaluated in a completed multi-center Phase 1/2 clinical trial of patients with advanced hematologic cancers, which we refer to as the 401 AHC Study. As described below, SL-401 demonstrated single agent anti-tumor activity, including durable CRs, and was well-tolerated at clinically active doses. Specifically, a single cycle of SL-401 induced four durable CRs in relapsed or refractory patients: two CRs in BPDCN and two CRs in AML. Although the study was designed so that all patients received only a single cycle of SL-401 treatment, the median OS was improved in the 35 most heavily pretreated AML patients who had failed at least two previous therapies (i.e., third-line or greater) by more than two-fold compared with historical data. Moreover, a single cycle of SL-401 administered at therapeutically relevant doses (i.e., the maximum tolerated dose, or MTD, or one or two dose levels below the MTD) improved the median OS by more than three-fold compared with the historical median OS of similar patients receiving traditional treatments. Of note, we intend to administer multiple cycles of SL-401 in our future trials, which we believe may increase the efficacy with respect to both clinical response and survival. Further, SL-401 was shown to be non-toxic to bone marrow, which we believe is a key differentiating feature relative to other hematologic cancer therapies.

The 401 AHC Study was undertaken in 80 patients with advanced hematologic cancers, including relapsed or refractory AML patients (n=59), AML patients who were poor risk and not candidates for chemotherapy (n=11), high risk MDS patients (n=7), or patients with blastic plasmacytoid dendritic cell neoplasm (BPDCN) (n=3), with “n” representing the number of patients. The median patient age was 66 years, with a range of seven to 84 years of age. Patients received a single cycle of SL-401 of doses ranging from 4.0 to 22.1 µg/kg/day, consisting of a 15-minute intravenous infusion on either an every-other-day schedule for up to six treatments, or daily for a five-day schedule.

Dr. Arthur E. Frankel was the sponsor of the 401 AHC Study and the principal investigator at the Scott and White Cancer Research Institute/Texas A&M (Temple, TX). The other principal investigators and co-investigators of the 401 AHC Study have been Dr. Hagop M. Kantarjian and Dr. Marina Konopleva at MD Anderson Cancer Center (Houston, TX), Dr. David A. Rizzieri at Duke University (Durham, NC), and Dr. Donna E. Hogge at the British Columbia Cancer Agency (Vancouver, Canada). Updated 401 AHC Study results were presented at the American Society of Hematology (ASH) Annual Conference in December 2012.

Well-Tolerated at Clinically Active Doses

SL-401 was well-tolerated at clinically active doses. The side effect profile of SL-401 was similar to that of denileukin diftitox (Ontak®), a compound comprised of human interleukin-2 linked to a shortened form of diphtheria toxin, which is FDA approved and has been marketed for certain forms of cutaneous T-cell lymphoma for over a decade. Similar to Ontak®, the SL-401 profile consisted of mild to moderate fever and chills, which were manageable and not dose-limiting. Moderate to severe adverse events included liver enzyme elevations, which were mostly transient and not dose limiting, and manifestations of early capillary leak syndrome (e.g., reduced albumin, edema and weight gain) in fewer than 10% of patients. It is important to note that the side effects of Ontak® decrease over time with each successive cycle administered. In contrast, the anticancer activity of Ontak® is retained, and at times augmented, with each successive cycle in patients receiving multiple cycles. In particular, patients who partially responded in an initial or early cycle have been shown capable of converting to complete responders in subsequent cycles, and patients who do not respond in an initial cycle have also been shown to respond in later cycles. In fact, Ontak® is approved on a daily for five-day schedule for up to eight cycles due to the improved safety and antitumor activity associated with multiple cycles.

The MTD of SL-401 was 16.6 µg/kg/day, with tolerable and active (i.e., therapeutically relevant) doses at 16.6 µg/kg/day as well as one and two dose levels below the MTD (12.5 and 9.4 µg/kg/day).

Non-Toxic to Bone Marrow

SL-401 was not toxic to the bone marrow, which is a key distinguishing feature relative to other hematologic cancer chemotherapies, such as nucleoside inhibitors and anthracyclines. Prior to starting treatment with SL-401, the majority of patients in the 401 AHC Study had pre-existing bone marrow suppression, likely due to the extent of their disease and/or previous exposure to myelosuppressive therapies. During and after SL-401 treatment, these patients exhibited largely stable bone marrow function relative to their pre-treatment condition, as determined by mean absolute neutrophil, hemoglobin and platelet counts of evaluable patients. As a result, we expect that SL-401, in contrast to traditional chemotherapy, may not increase a patient’s susceptibility to infection, anemia, or bleeding, or increase the frequency of red blood cell or platelet transfusions or growth factor infusions. Further, because SL-401 does not appear to have overlapping toxicity with traditional hematologic cancer therapies, SL-401 may be potentially combined with more traditional agents, without the need to reduce the doses of any of the agents, in future studies involving earlier-stage AML.

Anti-Tumor Activity

In the 401 AHC Study, one cycle of SL-401 administered alone demonstrated anti-tumor activity, including reductions in leukemia blast cells in the bone marrow (i.e., reductions in tumor bulk) or disease stabilizations, in approximately half of all treated patients, the majority of whom were heavily pretreated, as summarized below. More specifically, reductions in leukemia blasts or disease stabilizations were seen in 46% of patients with relapsed or refractory AML, 55% of AML who were poor risk and thus not candidates for chemotherapy, 43% of high-risk MDS patients and 67% of relapsed or refractory BPDCN patients. Durable CRs were induced in two patients with relapsed or refractory AML. There were also multiple additional cases of robust blast reductions in response to a single cycle of SL-401 treatment. Two additional CRs occurred after a single cycle of SL-401 in heavily pre-treated patients with BPDCN.

SL-401 Clinical Anti-Tumor Activity in Patients with Advanced Hematological Cancers

After Only a Single Cycle of SL-401 Therapy

|

|

|

AML |

|

AML |

|

AML |

|

MDS |

|

BPDCN |

|

|

Blast reductions/ disease stabilization |

|

46% |

|

43% |

|

55% |

|

43% |

|

67% |

|

|

Blast reductions |

|

25% |

|

23% |

|

27% |

|

29% |

|

67% |

|

AML = Acute myeloid leukemia; MDS = Myelodysplastic syndrome; BPDCN = Blastic plasmacytoid dendritic cell neoplasm.

CR = Complete response

*Subpopulation of relapsed, refractory

Of the two AML patients who sustained durable CRs following a single cycle of SL-401 treatment, one was a patient refractory to standard induction chemotherapy, and the other was a fourth-line AML patient. SL-401 induced a CR in an AML patient who failed standard induction chemotherapy prior to entry into the 401 AHC Study. Following SL-401 treatment, this patient’s leukemic blast count decreased from 30% to undetectable levels and peripheral blood counts normalized. This CR was durable and lasted eight months. SL-401 also induced a CR in a fourth-line AML patient who had failed three previous treatment regimens, including two previous bone marrow transplantations prior to entry into the 401 AHC Study. Following SL-401 treatment, this patient’s leukemic blast count decreased from 52% to undetectable levels and peripheral blood counts normalized. This CR currently exceeds 25 months in duration. It is notable that following only a single cycle of SL-401, both of these patients achieved durable CRs with normalization of blood counts and bone marrow examinations.

In addition, a single cycle of SL-401 induced CRs in two patients with heavily pre-treated BPDCN, a rare and aggressive hematologic malignancy that highly overexpresses IL-3R. The first BPDCN patient was third-line, having received several prior intensive treatment regimens including high-dose chemotherapy and bone marrow transplantation. Following SL-401 treatment, this patient’s leukemic blasts, which had been in the bone marrow and bloodstream before treatment, were no longer detectable. Additionally, this patient’s peripheral blood counts normalized. Furthermore, this patient’s enlarged spleen

and lymph nodes, which were enlarged due to infiltration by malignant cells, also normalized. This CR is ongoing and currently exceeds four months.

The second BPDCN patient was fourth-line, having previously been treated with three intensive regimens of chemotherapy, including high-dose chemotherapy with bone marrow transplantation. The patient had malignant disease involving the skin and bone marrow, resulting in multiple cutaneous lesions and low blood counts. Following SL-401 treatment, the patient achieved a CR with no evidence of BPDCN in the skin, bone marrow, or bloodstream. In addition, the patient’s blood cell counts returned to normal levels and no serious side effects were observed. This CR is ongoing and currently exceeds two months.

Anti-CSC Effect

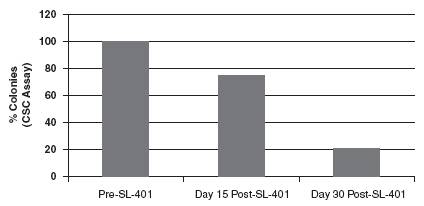

In addition to SL-401’s clinical activity, SL-401 was also shown to have activity against leukemic CSCs collected from three patients enrolled in the 401 AHC Study. In this translational study that was coordinated with the 401 AHC Study, bone marrow samples collected from several patients both before and after SL-401 treatment were tested for CSC activity in a colony formation assay (an assay that measures the ability of CSCs to form colonies). As demonstrated by Konopleva in Blood in 2010 describing a study of samples collected from patients enrolled in the 401 AHC Study, and as illustrated below, a substantial anti-CSC effect by SL-401 was observed, as demonstrated by considerable decreases in bone marrow CSC activity at 15 and 30 days after SL-401 treatment. At 30 days post-treatment, CSC activity decreased by an average of 79% of that measured at pretreatment. We believe that these studies also provided preliminary evidence that the beneficial clinical effects noted in some patients in the 401 AHC Study may have been due, in part, to the anti-CSC activity of SL-401. In particular, reductions in leukemic CSC activity 30 days post-treatment of 79% and 84% were observed in two patients, both of whom outlived the historical median OS of heavily pretreated AML patients of 1.5 months by multiple fold, with overall survival values of 7.2 months and 13.6 months, respectively. We intend to follow-up on these positive preliminary data in future clinical trials.

SL-401 Demonstrates Clinical Anti-CSC Effect

(adapted from Konopleva et al. Blood 2010; 116:21: Abstract #3298)(1)

(1) The study was conducted as a collaboration among us, MD Anderson Cancer Center and Scott and White Memorial Hospital and was completed after we licensed SL-401 from Scott and White Memorial Hospital in 2006.

Survival Benefit

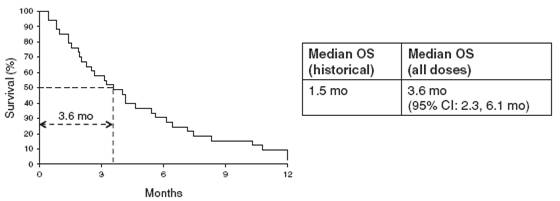

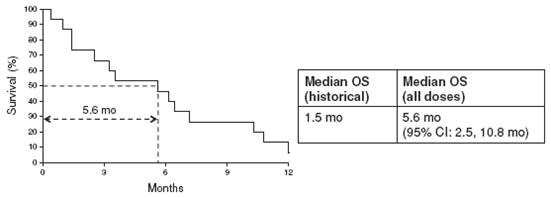

In the 401 AHC Study, SL-401, after only a single cycle of therapy, demonstrated an improvement in overall survival, or OS, of the 35 most heavily pretreated AML patients compared with historical survival results. In particular, in AML patients who had failed at least two previous therapies (i.e., third-line or greater), the median OS following a single cycle of SL-401 was 3.6 months, which is more than double the historical median OS of 1.5 months. Notably, the median OS following a single cycle of SL-401 was 5.6 months, which is more than three times the historical median OS of 1.5 months, in a cohort of 16 patients who received SL-401 at therapeutically relevant doses. The six-month and 12-month OS were also longer relative to comparable patients in a large contemporary series reported by Giles et al. in Cancer in 2005 and another large series reported by Keating et al., in the Journal of Clinical Oncology in 1989. These results are illustrated below.

SL-401 (Single Cycle): Overall Survival

Survival benefit in AML patients (>3rd line) treated with

only a single cycle (all doses, n = 35 patients)

(Konopleva et al. American Society of Hematology 2012 Abstract #3625)

SL-401 (Single Cycle): Overall Survival

Survival benefit in AML patients (>3rd line) treated with

only a single cycle (therapeutically relevant doses*; n = 16 patients)

(Konopleva et al. American Society of Hematology 2012 Abstract #3625)

*Patients received the MTD (16.6 µg/kg/d) or one or two doses below the MTD (9.4 and 12.5 µg/kg/d)

Notably, these results are based on the 401 AHC Study regimen of only one cycle of SL-401. We believe that multiple-cycle administration of SL-401 will further increase the clinical benefit of SL-401. Accordingly, to maximize the potential benefits of SL-401, we plan to administer multiple cycles of SL-401 in our planned Phase 2b clinical trials, as well as in other clinical evaluations of SL-401.

Planned Pivotal Program in BPDCN and Registration-Directed Program in Third-Line AML and Regulatory Strategy

We plan to complete a pivotal Phase 2b single-arm trial of patients with relapsed or refractory blastic plasmacytoid dendritic cell neoplasm, or BPDCN, with overall response rate as the primary endpoint. BPDCN, a rare hematologic cancer for which SL-401 has demonstrated clinical activity, is an orphan disease for which there is no approved or standard treatment. Accordingly, we believe that a registration path based on a relatively small nonrandomized trial with a surrogate endpoint can be pursued to potentially obtain accelerated approval of SL-401 in BPDCN. While we plan to enroll up to between 40 and 50 patients in the trial, if during the course of the trial the results are sufficiently robust, we will seek approval with even fewer patients.

We also plan to advance SL-401 into a registration-directed randomized Phase 2b clinical trial to treat relapsed or refractory AML patients who failed two previous treatments (i.e., third line AML). Patients with relapsed or refractory AML in the third-line setting will be randomized to treatment with either SL-401 or “physician’s choice”, which consists of either an available, non-investigational (i.e., “standard”) therapeutic agent or combination regimen. The primary endpoints for the study will be CR rate and OS. Up to 240 patients will be randomized in a 2:1 manner whereby two patients will be treated with SL-401 for every one patient treated with physician’s choice. The CR rate and OS will be evaluated in the course of various interim analyses throughout this study. Interim analyses are periodic evaluations throughout a clinical study to assess for efficacy and safety. If the study treatment is determined to be highly beneficial or futile, the study could be stopped early.

In contrast to the 401 AHC Study, which was designed so that all patients received only one cycle of treatment, multiple cycles of SL-401 will be administered in the planned trials to maximize efficacy. We believe that multiple cycle administration of SL-401 may increase the rate and duration of disease stabilization and response and, ultimately, further improve survival.

We also plan to evaluate the potential of SL-401 in additional hematologic cancer indications, including earlier stages of AML as well as other leukemias, lymphoma, and multiple myeloma.

SL-701 — A Multi-Epitope Brain Cancer Vaccine

Overview

SL-701, a clinically active therapeutic cancer vaccine comprised of synthetic peptides, is designed to direct the immune system to targets present on the CSCs and tumor bulk of brain cancer. High-grade gliomas, or HGGs, are the most aggressive brain cancers and have a poor prognosis. Treatment options are limited, particularly for pediatric patients with newly diagnosed HGG, including brainstem glioma, or BSG, and adult patients with recurrent or refractory HGG, including glioblastoma multiforme, or GBM. In two completed Phase 1/2 clinical trials, SL-701 demonstrated uncommon single agent anti-tumor activity in these indications, inducing tumor shrinkage or disease stabilization in 86% (19/22) of HLA-A2+ (as defined below) pediatric glioma patients (the 701 Ped-G Study), and 59% (13/22) of HLA-A2+ adult patients with recurrent or refractory HGG (the 701 Adult-RHGG Study). To date, there have been seven major objective tumor responses (i.e., tumor regressions) in these two studies, consisting of two CRs and five partial responses, or PRs.

Dr. Hideho Okada of the University of Pittsburgh School of Medicine was the sponsor of both the 701 Ped-G Study and the 701 Adult-RHGG Study. The principal investigators of the 701 Ped-G Study were Dr. Okada, Dr. Regina Jakacki of the Children’s Hospital of Pittsburgh and Dr. Ian Pollack of the University of Pittsburgh School of Medicine. Dr. Okada was the principal investigator of the 701 Adult-RHGG Study. Trial results were delivered via oral presentation at the American Society of Clinical Oncology (ASCO) Annual Conference in June 2011. Trial results were also presented at the American Association for Cancer Research (AACR) Annual Meeting in April 2012.

We plan to advance SL-701 into a Phase 2b clinical trial to treat HLA-A2+ pediatric patients with malignant brainstem and non-brainstem glioma. We plan to fund this trial primarily through government funding, if available. We also plan to initiate a Phase 2b clinical trial in HLA-A2+ adult patients with second-line GBM.

High-Grade Glioma (Including Adult Glioblastoma and Pediatric Non-Brainstem and Brainstem Glioma)

Gliomas are histologically heterogeneous tumors that are derived from glial cells in the brain. Gliomas are graded from 1 to 4, based on WHO classifications, with grade 4 glioma (i.e., glioblastoma, or GBM) and grade 3 glioma (i.e., anaplastic astrocytoma, or AG) as the most aggressive gliomas and referred to as high-grade gliomas, or HGGs. GBM makes up the majority of HGG cases, with an annual incidence in adults of approximately 10,000 in the United States and 15,000 to 18,000 in Europe.

The standard of care for newly diagnosed adult GBM is resection, if operable, followed by a combination of radiation and temozolomide (i.e., the Stupp regimen). Although this combination treatment has improved patient outcomes, 85% to 90% of patients ultimately relapse, with a median OS from diagnosis of 15 months. Avastin® is approved as a second-line therapy for adult GBM based on response. However, most recurrent patients receiving Avastin® ultimately relapse, and the median OS for these second-line patients is approximately eight to nine months. Currently, no therapies have been approved for third-line treatment of GBM, which carries a median OS of three to four months.

Pediatric HGG, which includes non-brainstem HGG and BSG, is a highly malignant disease with very poor outcomes. The annual incidence of pediatric HGG is approximately 1,600 to 2,000 in the United States and approximately 3,400 in Europe. No therapy has been shown to have a favorable outcome in this population and almost all patients relapse after receiving first-line treatment. Pediatric patients with newly diagnosed HGG are typically treated with surgery, chemotherapy and/or radiation and have an expected median OS from diagnosis of less than one year.

Design of SL-701 and Mechanism of Action

SL-701 is a therapeutic cancer vaccine comprised of short synthetic peptides that correspond to epitopes of the brain cancer targets IL-13Rα2 and EphA2. The IL-13Rα2 synthetic peptide is a mutant specifically designed to be highly immunogenic to amplify the vaccine’s anti-tumor immune response.

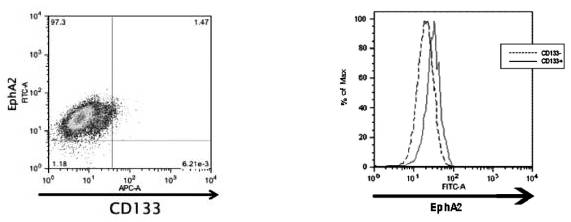

Both the IL-13Rα2 and EphA2 targets are overexpressed on brain cancer cells. We determined that EphA2 was overexpressed, not only on brain tumor bulk, but also on brain CSCs. In particular, EphA2 was found to be overexpressed on the surface of brain cancer cells expressing CD133, a marker of brain CSCs.

EphA2 Over-Expression on CSCs of GBM By Flow Cytometry

(Stemline Therapeutics, Inc.; unpublished data)

SL-701, like other cancer vaccines, is combined with additional elements designed to promote an immune response, including a helper peptide and an adjuvant. A helper peptide helps activate cytotoxic T-cells, and is mixed with SL-701 prior to administration. An adjuvant similarly helps stimulate the immune system, and is injected into the patient concurrently with SL-701 administration.

Immune response analyses, including enzyme-linked immunosorbent spot, or ELISPOT, and tetramer assays, were used to assess peripheral blood immune responses of patients to SL-701 administration.

Completed Phase 1/2 Clinical Trial — Pediatric Glioma

In a completed Phase 1/2 trial, SL-701 was evaluated in pediatric patients with glioma. We refer to this trial as the 701 Ped-G Study. The 701 Ped-G Study was undertaken in 27 HLA-A2+ pediatric patients with glioma. Sixteen of these patients had newly diagnosed brainstem glioma, or BSG, five had newly diagnosed non-brainstem HGG, three had recurrent non-brainstem HGG and three had multiply recurrent low-grade glioma, or LGG. Patients received a direct subcutaneous injection of SL-701 in the right or left upper arms associated with intact draining auxiliary lymph nodes once every three weeks for up to 24 weeks with a separate concurrent injection of an adjuvant. The 701 Ped-G Study was a single-arm trial whose objectives were to determine the general safety, dosage and efficacy of SL-701. Accordingly, all patients were treated with SL-701 and there was no comparative arm of patients receiving a control treatment or placebo. As such, this trial design was not intended to generate prospective comparative results conducive to calculating their statistical significance and, accordingly, no p-values were generated.

Well-Tolerated at Clinically Active Doses

SL-701 was well-tolerated at clinically active doses. Adverse effects included local injection site reactions and low grade fevers in almost all patients, which were generally mild and controlled with analgesics.

Clinical Activity

In the 701 Ped-G Study, SL-701 demonstrated single agent clinical activity. Eighty-six percent (19/22) of evaluable patients sustained durable tumor reductions or disease stabilizations, including three patients who experienced durable PRs. One of these PR patients is a child with newly diagnosed BSG whose PR demonstrated greater than 50% tumor shrinkage and was 15 months in duration. The second PR occurred in a child with newly diagnosed non-brainstem HGG and was 14 months in duration. The third PR occurred in a child with multiply recurrent LGG and was nine months in duration. An additional child with newly diagnosed non-brainstem HGG had prolonged disease-free status of 20 months following surgery. In addition, there were four stable disease patients who survived at least 13 months.

In four cases, tumor pseudoprogression was seen. Tumor pseudoprogression is believed to represent a positive sign, or surrogate marker, of anti-tumor activity. Tumor pseudoprogression is manifested by edema and contrast enhancement on MRI and can transiently mimic tumor progression prior to regression and thus must be carefully monitored. Pseudoprogression has been noted with the introduction of effective treatments for brain tumors, such as stereotactic radiotherapy, which have led to tumor responses. Notably, the PR patient whose response lasted 15 months is believed to have experienced tumor pseudoprogression prior to the PR.

Positive immunological assays (both ELISPOT and tetramer assays) were demonstrated in six of seven evaluable children, including the newly diagnosed BSG pediatric patient who sustained a durable PR that lasted 15 months. We believe that these data indicate that SL-701 treatment stimulated the immune system in a highly specific fashion.

Completed Phase 1/2 Clinical Trial — Adult, Recurrent, High-Grade Glioma

In a completed Phase 1/2 clinical trial, SL-701 was evaluated in adult patients with recurrent or refractory HGG. We refer to this study as the 701 Adult-RHGG Study. The 701 Adult-RHGG Study enrolled 22 HLA-A2+ adult patients with recurrent or refractory HGG, 13 of which had refractory or recurrent GBM, and nine of which had anaplastic glioma, or AG. 50% of patients were second relapse or greater and two of the refractory or recurrent GBM patients had received prior treatment with Avastin®. SL-701 was loaded ex vivo onto dendritic cells that had been removed from the patient, which were then re-injected intra/peri-nodally back into the patient with a separate concurrent injection of an adjuvant. This delivery method contrasts with that used in the 701 Ped-G Study, in which SL-701 was administered to patients and demonstrated robust antitumor activity as a direct subcutaneous injection. The 701 Adult-RHGG Study was a single-arm trial whose objectives were to determine the general safety, dosage and efficacy of SL-701. Accordingly, all patients were treated with SL-701 and there was no comparative arm of patients receiving a control treatment or placebo. We instead evaluated the results against published historical data for available therapies in the same indication. As such, this trial design was not intended to generate prospective comparative results conducive to calculating their statistical significance and, accordingly, no p-values were generated.

Well-Tolerated at Clinically Active Doses

SL-701 was well-tolerated at clinically active doses. Injection site reactions were the most common adverse events and generally resolved within 24 hours. These side effects do not overlap with those of radiation, chemotherapy agents, and anti-angiogenic agents like Avastin®, which are mainstay therapies used to treat adult HGG. We believe that this implies that the development of SL-701-based combination regimens will likely be feasible.

Clinical Activity

In the 701 Adult-RHGG Study, SL-701 demonstrated single agent clinical activity. Forty-six percent (6/13) of refractory or recurrent GBM and 78% (7/9) of recurrent AG patients sustained an anti-tumor response or disease stabilization. This included two durable CRs, one of which occurred in a 62-year-old male GBM patient who was refractory to prior surgical resection, radiation therapy and temozolomide. Following SL-701 treatment, this patient’s gadolinium enhanced tumor mass

disappeared, and the patient was determined to have sustained a durable CR that exceeded 23 months. Notably, in this patient there was also a significant increase in target-specific T-cells by week 29 as determined by a tetramer assay, consistent with a positive immune response to SL-701. A recurrent AG patient with anaplastic oligoastrocytoma sustained a CR that exceeded nine months. In addition to the two durable CRs, there were also three PRs. One PR was sustained by a patient with recurrent GBM (second salvage, i.e., third-line) and lasted seven months. Notably, a post-SL-701 brain biopsy from this PR patient demonstrated the presence of macrophages and CD8+ T lymphocytes, which are cells of the immune system, within the tumor. We believe this indicates that SL-701 induced the immune system, and cytotoxic T-cells in particular, to migrate to the area of the brain tumor and induce tumor shrinkage by targeting specific antigen-bearing CSCs and tumor bulk, and that this patient experienced a tumor pseudoprogression prior to the PR. This activity is consistent with the proposed mechanism of action of SL-701 wherein SL-701 induces the immune system, and cytotoxic T cell in particular, to home to the tumor by crossing the blood-brain barrier and then attacking the tumor. A second PR was sustained by a patient with recurrent GBM whose PR exceeded 11 months in duration. The third PR was seen in a recurrent AG patient.

Eighty-one percent (13/16) of evaluable patients had at least one positive immunological assay. We believe this indicates that SL-701 treatment stimulated the immune system in a highly specific fashion.

Survival Benefit

SL-701 improved the median, six-month, and 12-month OS of adult patients with refractory or recurrent GBM as well as recurrent AG, compared with historical data. In refractory or recurrent GBM patients treated with SL-701, median OS was 13 months, six-month OS was 80%, and 12-month OS was 55%, as illustrated in the figure below. These rates represent improvements over the historical median OS of five to seven months, the historical six-month OS of 38% to 55%, and the historical 12-month OS of 14% to 25%. Recurrent AG patients treated with SL-701 also experienced an improvement in OS compared with historical results.

Kaplan-Meier Survival Curve

of Recurrent or Refractory Adult HGG Patients Treated with SL-701

(Okada et al., Journal of Clinical Oncology 2011; 29:330-336)

Low-Grade Glioma Trial in Adult Patients

There is currently a study of SL-701 open in adult patients with LGG. 24 HLA-A2+ patients have been enrolled, including 13 with newly diagnosed high-risk LGG without prior radiotherapy, one with newly diagnosed high-risk LGG with prior radiotherapy and ten with recurrent LGG. Patients were treated with SL-701 via direct subcutaneous injection every three weeks for up to eight courses. SL-701 was well tolerated and demonstrated immune responses in high-risk adult patients with LGG. Side effects were minimal with one grade 3 fever. Sustained and specific immune responses, as assessed by ELISPOT assays, were observed in the majority of evaluable patients. Although a thorough evaluation of progression-free survival requires a longer observation period, among 17 patients who completed eight courses, 10 had stable disease. Dr. Hideho Okada of the University of Pittsburgh School of Medicine is the sponsor of the study, and Dr. Frank Lieberman of the University of Pittsburgh School of Medicine is the principal investigator.

Planned Phase 2b Clinical Trials and Regulatory Strategy

Pediatric Trial

We have collaborated with the Pediatric Brain Tumor Consortium, or PBTC, to apply for funding from the National Cancer Institute, or NCI, for the SL-701 trial in pediatric patients with malignant brainstem and non-brainstem glioma. The letter of intent that we and the PBTC submitted for the pediatric trial was approved by the NCI in October 2012. We must still obtain approval of the full protocol, which we are pursuing now, before this pediatric trial may begin. If the final protocol is approved, we and the PBTC plan to oversee execution of the trial and management of clinical trial sites. In addition, we plan to provide SL-701 drug supply and submit a corporate IND. The PBTC was formed by the NCI and consists of participating academic centers and children’s hospitals that are responsible for the diagnosis and treatment of children with primary brain tumors in the United States. The PBTC’s primary objective is to rapidly conduct novel clinical evaluations of new therapeutic drugs and treatment strategies in pediatric patients from infancy to 21 years of age with primary central nervous systems tumors.

Adult Trial

We also plan to initiate a Phase 2b clinical trial in adult patients with second-line GBM. In this trial, which may include up to 30 patients, we plan to administer SL-701 in combination with the standard of care in this indication, which currently is bevacizumab (Avastin®).

The Cancer Stem Cell Opportunity

Limitations of Current Cancer Therapies

According to the National Cancer Institute, cancer is the second leading cause of death in the United States and is responsible for nearly one quarter of all deaths in the United States. The National Institutes of Health estimated that the total cost of treating cancer in 2010 was $125 billion. Current cancer treatments, which often include chemotherapy and radiation as well as newer targeted therapies, have shown a limited overall survival benefit when used in advanced stages of the most common cancers. Moreover, the impact of current treatments on many other cancers, including AML, brain malignancies and multiple other cancer types has also been quite small, if any. We believe that it is becoming increasingly accepted within the oncology field, based on a progressively increasing body of supportive data, that a major reason for such failures is that available therapeutics fail to effectively eliminate CSCs, which continue to repopulate the cancer despite these standard treatments.

Cancer Stem Cell Overview

The field of CSCs is a rapidly emerging new area of cancer biology that we believe may fundamentally alter the approach to oncology drug development. CSCs comprise a highly malignant, self-renewing subpopulation of cancer cells within a tumor, often slow-growing, that is both highly tumorigenic, or tumor-producing, as well as resistant to traditional anti-cancer therapies relative to the rest of the largely fast-growing tumor bulk to which it gives rise.

CSCs have been identified in virtually all of the major tumor types including most of the common solid and hematologic cancer types. As shown in several examples below, researchers have identified numerous tumor types that harbor CSCs, including leukemia and cancers of the brain, breast, colon, prostate, pancreas, and others.

Examples of Tumor Types with CSCs

|

Tumor Types |

|

Published Studies |

|

Acute myeloid leukemia |

|

Bonnet et al. Nat Med 1997; 3:730-737 |

|

Breast cancer |

|

Al-Hajj et al. PNAS 2003; 100:3983-3988 |

|

Brain cancer |

|

Singh et al. Nature 2004; 432:396-401 |

|

Acute lymphoblastic leukemia |

|

Cox et al. Blood 2004; 104:2919-2925 |

|

Myeloma |

|

Matsui et al. Blood 2004; 103:2332-2336 |

|

Chronic myeloid leukemia |

|

Eisterer et al. Leukemia 2005; 19:435-441 |

|

Prostate cancer |

|

Collins et al. Cancer Res 2005; 65:10946-10951 |

|

Lung cancer |

|

Kim et al. Cell 2005; 121:823-835 |

|

Melanoma |

|

Fang et al. Cancer Res 2005; 65:9328-9337 |

|

Ovarian cancer |

|

Bapat et al. Cancer Res 2005; 65:3025-3029 |

|

Pancreatic cancer |

|

Li et al. Cancer Res 2007; 67:1030-1037 |

|

Myelodysplastic syndrome |

|

Nilsson et al. Blood 2007; 110:3005-3014 |

|

Liver cancer |

|

Ma et al. Oncogene 2008; 27:1749-1758 |

|

Colon cancer |

|

O’Brien et al. Nature 2007; 445:106-110 |

|

Bladder cancer |

|

He et al. Stem Cells 2009; 27:1487-1495 |

CSCs are Tumorigenic

CSCs are a small subpopulation of highly malignant cells within a tumor that many within the oncology field believe are responsible for the tumorigenicity, meaning the source of growth, of the entire cancer. CSCs typically comprise approximately 1% to 5% of the entire cancer and give rise to, or “seed”, the tumor bulk that comprises the remaining >95% of the tumor. In particular, isolated CSCs, not tumor bulk, have been shown capable of reconstituting the entire tumor anew when transplanted into immunocompromised mice and, importantly, are able to do so upon repeated serial retransplantation.

CSCs are Relatively Resistant to Traditional Therapies

In addition to being highly tumorigenic, CSCs are also resistant, relative to tumor bulk, to conventional anti-cancer therapies. This may be due to the many challenging characteristics of CSCs, including slow growth, presence of multi-drug resistance proteins, anti-cell death mechanisms, and increased activity of cellular mechanisms that repair damaged DNA. As shown in several examples below, researchers have shown that CSCs are resistant to chemotherapy, radiation, or targeted therapy relative to tumor bulk.

Examples of CSC Resistance to Traditional Therapies

|

CSC Type |

|

Resistance to Therapy |

|

Published Studies |

|

Acute leukemia |

|

Daunorubicin, Mitoxantrone |

|

Wulf et al. Blood 2001; 98:1166-1173 |

|

Acute leukemia |

|

AraC |

|

Guzman et al., Blood 2001; 98:2301-2307 |

|

Brain cancer |

|

BCNU |

|

Kang and Kang, Stem Cells Dev 2007; 16:837-847 |

|

Brain cancer |

|

Radiation |

|

Bao et al. Nature 2006; 444:756-760 |

|

Breast cancer |

|

Radiation |

|

Phillips et al. JNCI 2006; 98:1777-1785 |

|

Chronic leukemia |

|

Gleevec® |

|

Graham et al. Blood 2002; 99:319-325 |

|

Colon cancer |

|

5-FU, Oxaliplatin |

|

Todaro et al. Cell Stem Cell 2007; 1:389-402 |

|

Liver cancer |

|

Doxorubicin, 5-FU |

|

Ma et al. Oncogene 2008; 27:1749-1758 |

|

Lung cancer |

|

Cisplatin |

|

Bertolini et al. PNAS 2009; 106:16281-16286 |

|

Myeloma |

|

Velcade® |

|

Matsui et al. Cancer Res 2008; 68:190-197 |

|

Pancreatic cancer |

|

Gemcitabine |

|

Hermann et al. Cell Cycle 2008; 7:188-193 |

Not only have CSCs been shown to resist traditional therapies, but in some cases CSCs have also been shown to increase, as a percentage of total tumor cells, as a result of exposure to a traditional therapy. For example, as described by Bao et al. in Nature in 2006, CSCs of brain tumors increase as a percentage of the entire cancer following radiation treatment. Similarly, as shown by Hermann et al. in Cell Stem Cell in 2007, pancreatic CSCs increase following gemcitabine treatment in in vivo xenograft models.

CSCs Correlate with Prognosis

Consistent with their pivotal role in the development of tumors and relapse, higher amounts of CSCs in patient tumors as a percentage of their entire cancer have been shown to correlate with poor prognosis. For example, CSC fractions greater than 3.5% and 1% of the entire cancer correlate with poor survival outcomes in patients with AML and brain cancer, respectively, as shown by van Rhenen et al. in Clinical Cancer Research in 2005 (for AML) and Zeppernick et al. in Clinical Cancer Research in 2008 (for brain cancer).

Stemline’s Anti-CSC Drug Development Opportunity

While standard therapies may initially shrink tumors by targeting the tumor bulk, we believe it is increasingly accepted within the oncology field that the failure of these therapies to eradicate CSCs is a major contributor to treatment failure, tumor relapse and poor survival. Accordingly, we believe that targeting CSCs, in addition to tumor bulk, may represent a major advance in the fight against cancer. This premise has formed the basis of our drug development strategy, as illustrated below.

Since our inception, we have leveraged our knowledge of CSCs to anticipate and establish a leadership position in this new field of oncology. During this time, we have developed or strategically in-licensed key intellectual property, built and validated a drug discovery platform, and developed clinically active drug candidates. We believe that our early and comprehensive effort to develop the next generation of oncology therapeutics that target CSCs, as well as the tumor bulk, provides us with a significant competitive advantage.

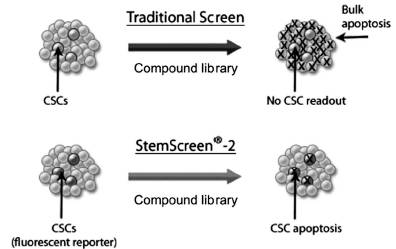

Our Platform Technologies

We have developed an innovative platform technology, called StemScreen®, currently consisting of StemScreen®-1 and StemScreen®-2, for the identification of novel CSC-directed compounds. This platform contrasts with traditional drug discovery methods in oncology that have been designed to identify compounds that target tumor bulk, not CSCs. StemScreen®-1 is a technology developed to discover CSC-targeted compounds and involves the isolation of CSCs, the discovery of potential CSC targets through CSC gene expression analysis, and the identification and validation of compounds that impact candidate CSC targets. StemScreen®-2 utilizes an assay that uses live cells to track and follow CSCs in their natural state during high throughput screening and permits the rapid testing of many compounds on a small scale for enhanced efficiency. We believe that this approach represents a major technological advance in oncology drug discovery. We have utilized StemScreen® to discover several of our product candidates. We believe that this robust platform will be instrumental in the discovery of additional new therapies targeting a wide range of cancer types.

StemScreen®-1

StemScreen®-1 is a validated, proprietary drug discovery platform designed to identify CSC-targeted compounds based on the isolation of CSCs and evaluation of CSC gene expression profiles. CSCs are isolated from primary tumor tissue or cell lines, and then subjected to gene expression analysis using a variety of technologies, including microarray. A control tissue, such as normal bone marrow is analyzed as a comparator against the gene expression profile of the isolated CSCs. These data are then interfaced with an information base of compounds and their mechanisms of action (i.e. which gene products and pathways they impact). Compound classes are then identified as likely to impact CSC-specific pathways discovered by the gene expression analyses. Select compounds within these classes are then tested in our anti-CSC functional in vitro and in vivo assays. Compounds that demonstrate anti-CSC activity are then considered for further development, which may include lead optimization. We have utilized StemScreen®-1 to discover a number of our preclinical drug candidates. These include SL-201, SL-301, and SL-601. In addition, SL-401 demonstrated activity against CSCs as determined by both an in vitro colony formation and in vivo animal implantation assay, thereby validating certain StemScreen®-1 anti-CSC assays.

StemScreen®-2

StemScreen®-2 is a proprietary high throughput drug discovery platform we are developing to discover novel anti-CSC compounds. Traditional oncology drug discovery screens have largely relied upon readouts that measure activity against tumor bulk, and have not been specifically designed to identify compounds with activity against CSCs. StemScreen®-2 is based on a key discovery, covered by intellectual property controlled by Stemline, that immortal cancer cell lines harbor not only tumor bulk but also CSCs. This discovery enables compounds to be screened, in a high throughput manner, for activity against CSCs in their natural state.

StemScreen®-2 utilizes an assay that uses live cells to track and follow CSCs in their natural state during high throughput screening and permits the rapid testing of many compounds on a small scale for enhanced efficiency. In particular, StemScreen®-2 utilizes a CSC-specific promoter linked to a reporter as a method for identifying and following CSCs in their native environment of surrounding tumor bulk, as illustrated below. In this way, StemScreen®-2 enables the identification of compound “hits,” in a high throughput manner, with anti-CSC activity.

Notably, prior to the development of StemScreen®-2, screens for anti-CSC compounds had been limited due to 1) reliance on finite sources of primary tissue specimens rather than immortal cancer cell lines, and 2) purification of CSCs away from the rest of the tumor, each thereby limiting screens to small libraries in relatively low throughput systems. Moreover, other CSC-focused screens have recently been developed that require artificial manipulation to create the CSC phenotype from non-CSCs in the context of an immortal cell line. Thus, we believe that StemScreen®-2, unlike other CSC-focused screening systems, is distinct because it is both high throughput and accurately represents the CSC phenotype in its native, unaltered state.

StemScreen®-2 also allows for further optimization, miniaturization, and screening in a high throughput manner for drug candidates with anti-CSC activity from large libraries of chemical or biologic compounds.

An initial screen of a moderately sized chemical compound library led to the identification of several “hits,” comprising 2.4% of the library, which demonstrated activity against CSCs with greater than 50% growth inhibition. Several of these compounds were then further validated using secondary functional assays to confirm anti-CSC activity. We plan to further optimize StemScreen®-2 for larger scale screening as well as expand its applicability for use in a broad range of tumor types either alone and/or in collaboration with a strategic partner.

Preclinical Pipeline

Stemline has assembled a pipeline of small molecules and monoclonal antibody-based, or mAb-based, compounds directed to targets on CSCs and tumor bulk. This pipeline was built through a variety of methods, including discovery via our proprietary platforms as well as through in-licensing of certain key intellectual property.

We have also in-licensed certain intellectual property directed to mAb-based therapeutics to validated oncology targets including Glypican-3, Tie-1, CD133, Frizzled, Smoothened and Patched. Some of these antibody targets are also being pursued by other biopharmaceutical companies. We may develop, or partner with third parties to develop, any or all of these mAbs.

Patents and Proprietary Rights