Attached files

| file | filename |

|---|---|

| 8-K - 8-K CURRENT REPORT - Texas Mineral Resources Corp. | v339677_8k.htm |

Texas Rare Earth Resources “Carajas of Rare Minerals” March 28, 2013

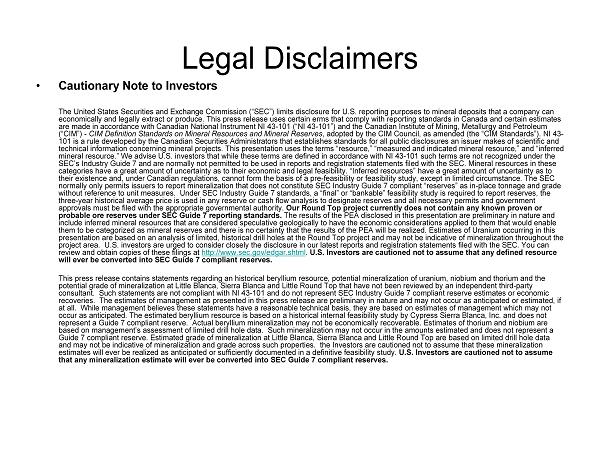

Legal Disclaimers • Cautionary Note to Investors The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. This press release uses certain erms that comply with reporting standards in Canada and certain estimates are made in accordance with Canadian National Instrument NI 43-101 (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) -CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43- 101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosures an issuer makes of scientific and technical information concerning mineral projects.This presentation uses the terms “resource,”“measured and indicated mineral resource,”and “inferred mineral resource.”We advise U.S. investors that while these terms are defined in accordance with NI 43-101 such terms are not recognized under the SEC’s Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Mineral resources in these categories have a great amount of uncertainty as to their economic and legal feasibility. “Inferred resources”have a great amount of uncertainty as to their existence and, under Canadian regulations, cannot form thebasis of a pre-feasibility or feasibility study, except in limited circumstance.The SEC normally only permits issuers to report mineralization that doesnot constitute SEC Industry Guide 7 compliant “reserves”as in-place tonnage and grade without reference to unit measures. Under SEC Industry Guide 7standards, a “final”or “bankable”feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. Our Round Top project currently does not contain any known proven or probable ore reserves under SEC Guide 7 reporting standards.The results of the PEA disclosed in this presentation are preliminary in nature and include inferred mineral resources that are considered speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the results of the PEA will be realized. Estimates of Uranium occurring in this presentation are based on an analysis of limited, historical drill holes at the Round Top project and may not be indicative of mineralization throughout the project area. U.S. investors are urged to consider closely the disclosure in our latest reports and registration statements filed with the SEC. You can review and obtain copies of these filings at http://www.sec.gov/edgar.shtml. U.S. Investors are cautioned not to assume that any defined resource will ever be converted into SEC Guide 7 compliant reserves. This press release contains statements regarding an historical beryllium resource, potential mineralization of uranium, niobium and thorium and the potential grade of mineralization at Little Blanca, Sierra Blanca and Little Round Top that have not been reviewed by an independent third-party consultant. Such statements are not compliant with NI 43-101 and do not represent SEC Industry Guide 7 compliant reserve estimates or economic recoveries. The estimates of management as presented in this press release are preliminary in nature and may not occur as anticipated or estimated, if at all. While management believes these statements have a reasonable technical basis, they are based on estimates of managementwhich may not occur as anticipated. The estimated beryllium resource is based on a historical internal feasibility study by Cypress Sierra Blanca, Inc. and does not represent a Guide 7 compliant reserve. Actual beryllium mineralization may not be economically recoverable. Estimates of thorium and niobium are based on management’s assessment of limited drill hole data. Such mineralization may not occur in the amounts estimated and does not represent a Guide 7 compliant reserve. Estimated grade of mineralization at Little Blanca, Sierra Blanca and Little Round Top are based on limited drill hole data and may not be indicative of mineralization and grade across such properties. the Investors are cautioned not to assume that these mineralization estimates will ever be realized as anticipated or sufficiently documented in a definitive feasibility study. U.S. Investors are cautioned not to assume that any mineralization estimate will ever be converted into SECGuide 7 compliant reserves.

Legal Disclaimers • Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the U.S. Securities Actof 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended. The estimated resources at the Round Top project, potential recoverability of resources, the possibility of selling the Company in 2014 and the potential value of such sale, the possible 15,000 mtpd heap leach project, the potential beryllium, uranium, thorium and niobium mineralization at the property, exploration potential of Little Blanca, Little Round Top, Sierra Blanca and other geologic features at the site, possible whole rock recoveries, anticipated climate, labor and regulation at the Round Top project, potential unit costs compared to FCX Morenci, anticipated processing choices, possible PEA in late 2013, potential heap leach recovery, possible “no frills”or “extra processing”heap leach, potential market and values for REEs, including ytterbium, erbium, holmium, thulium, lutetium and thorium, process economic objectives, including gross margin and potential for margin growth with increased tonnage, future financing possibilities and anticipated balance sheet objectives, management objectives and the likely business friendly environment in Texas are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of mineralized material and mineral resource estimates, risks relating to completing metallurgical testing atthe Round Top project, risks related to project development determinations, risks related to fluctuations in theprice of rare earth minerals, the inherently hazardous nature of mining-related activities, potential effects on the Company’s operations of environmental regulations, risks due to legal proceedings, risks related to uncertainty of being able to raise capital on favorable terms or at all, as well as those factors discussed under the heading “Risk Factors”in the Company’s latest annual report on Form 10-K as filed on November 15, 2012 and other documents filed with the U.S. Securities and Exchange Commission. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, the Company assumes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise.

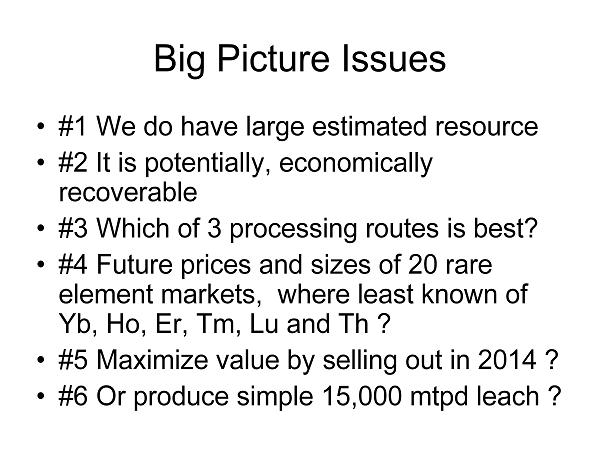

Big Picture Issues • #1We do have large estimated resource • #2 It is potentially, economically recoverable • #3Which of 3 processing routes is best? • #4Future prices and sizes of 20 rare element markets, where least known of Yb, Ho, Er, Tm, Lu and Th ? • #5Maximize value by selling out in 2014 ? • #6Or produce simple 15,000 mtpd leach ?

Round Top Resources • Potentially largest deposit of Dy, Y, Yb, Ho, Er, Lu, Tm with estimated 1.5 bil lbs in situ host rock with 72% heavy REOs • 1,034 mmt* = 188.9 yrs @ 15,000 mtpd • Separate Beryllium zone estimated 298,000 t @ 1.9% BeO Cyprus Minerals 1988 historical resource** • Potentially 100+ mm lbs uranium***, from May 16, 2011 TRER press release • Potentially 400+ mm lbs thorium*** • Potentially 850 mm lbs in situ niobium*** based on May 16, 2011 TRER press release, where a portion of Nb only dissolves into “acid bake”extra process step. * Combines measured and indicated resources of 359,150,000 tonnes and inferred resources of 674,675,000 tonnes. See Cautionary Note to Investors. **Based on historical resource estimate of Cyprus Sierra Blanca,Inc. and does not represent Guide 7 compliant reserves. See Cautionary Note to Investors. ** Estimates of uranium, thorium and niobium are based on analysis of limited drill hole data and are not contained in the Company’s June 2012 PEA. These elements may not exist in amounts currently estimated and investors should not assume that they will ever be converted into Guide 7 compliant reserves. See Cautionary Note to Investors.

TRER a Strategic Company • Establishes large U.S.A. comparative advantage in rare earth elements Dy, Y, Yb, Er, Ho, Tm, Lu • Unique Yttrofluorite mineralogy potentially permits simple sulphuric acid whole ore heap leach recovery, unlike other deposits’monazite or bastnasite minerals • TRER has rare heavy REE of which China Baotou or Molycorp have little • TRER a potential major Uranium and Thorium energy discovery in Texas • Beryllium potential growth in Thorium reactors • Very large deposit key wealth creation in West Texas

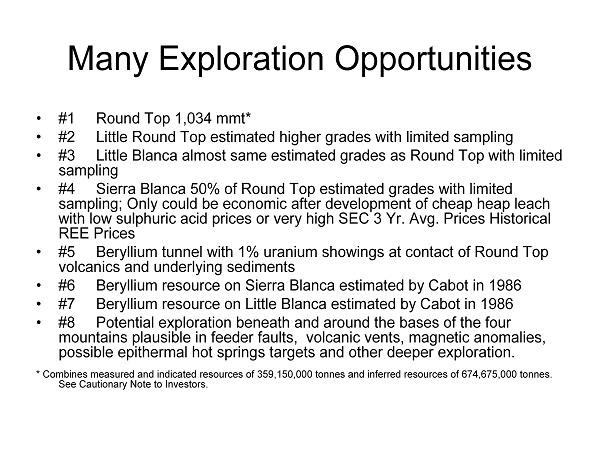

Many Exploration Opportunities • #1 Round Top 1,034 mmt* • #2 Little Round Top estimated higher grades with limited sampling • #3 Little Blanca almost same estimated grades as Round Top with limited sampling • #4 Sierra Blanca 50% of Round Top estimated grades with limited sampling; Only could be economic after development of cheap heapleach with low sulphuric acid prices or very high SEC 3 Yr. Avg. Prices Historical REE Prices • #5 Beryllium tunnel with 1% uranium showings at contact of Round Top volcanics and underlying sediments • #6 Beryllium resource on Sierra Blanca estimated by Cabot in 1986 • #7 Beryllium resource on Little Blanca estimated by Cabot in 1986 • #8 Potential exploration beneath and around the bases of the four mountains plausible in feeder faults, volcanic vents, magnetic anomalies, possible epithermal hot springs targets and other deeper exploration. * Combines measured and indicated resources of 359,150,000 tonnes and inferred resources of 674,675,000 tonnes. See Cautionary Note to Investors.

Process Development Team Effort • Current directors, past employees and several outside consultants at multiple outside labs made important contributions. • No one member takes or deserves credit. • After new board appointed August 6, 2012, yours truly established goal of a 10-40,000 mtpd heap leach. • Whole Rock (we have not done any tests that could be called heap leach yet) recoveries > 72% for June 2012 floatation mill PEA exceed our objectives.

Round Top Ideal Logistics • $1.94/tonne June 2012 PEA did not consider gravity conveyor byproduct electricity. • Anticipated favorable climate, labor and regulation • Paved road four miles from Interstate 10 • Existing rail serves RCL Rocks7,000 mtpd aggregate quarry on Sierra Blanca • Near zero strip ratio of 1:16 • High recoveries to sulphuric acid solution

Morenci, AZ Copper Mine Model • FCX Morenci is without Round Top’s highway and existing rail comparative advantages • FCX Morenci heap leaches 4 lbs per tonne copper/t with sulphuric acid solution with zero strip and near 85% recoveries • FCX Morenci near $15 per tonne revenue and $8 direct costs. We estimate Morenci’s direct costs break down as $2.50/t acid, $2.10/t mining, $0.15/t SGA and $3.25/t for all processing. • FCX Morenci expansion to 800,000 from 700,000 tons per day heap leach and 115,000 from 50,000 tons per day mill underway. • TRER will likely have higher unit costs than $8/t due to anticpated higher acid consumption and smaller throughput of perhaps 15,000 tonnes per day, as REE markets are smaller than the copper market.

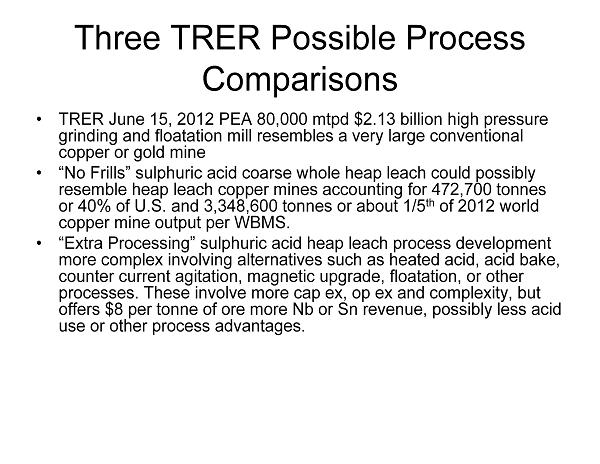

Three Process Choices • 80,000 mtpd June 2012 floatation $2.13 Bil. • 15,000 mptd coarse whole ore “no frills”sulphuric acid simple heap leach like a copper mine heap leach. • 15,000 mptd “extra processing”considers making a floatation or other concentrate and processing by acid bake or agitated leach. • Possible next PEA late-2013 to compare and select best among the three process. • Next study a large step to define “plan of operation,” attract acquirers or attract capital.

Budget Whole Ore Sulphuric Acid HeapLeach REE Recovery • March 21 press release up to 94% Yttrium tests for 41% or 221 of 531 REE g/t • Potential 90% recoveries into solution in whole rock testing • Currently conducting further testing to determine potential for complete heap leach recovery

Regional Heap Leach Mine Cap Ex* • $72 mm Mt. Hamilton near Ely, NV 8,500 ton/day gold heap leach Solitario Royalty & Explo. • $100 mm Pan near Eureka, NV 17,000 ton/day gold heap leach of Midway Gold • $280 mm El Pilar copper mine sulphuric acid heap leach 55,000 mtpd with 1,300 mtpd acid plant of Mercator Minerals • TRER working concept: potential $150 to $400 mm for 15,000 mtpd with acid plant and refinery where upper end of range depends on outlays for extra processing steps such as “Bake & Shake.” * Cap Ex for regional projects is provided for informational purposes only. Actual Cap Ex for a heap leach project at Round Top may not be comparable.

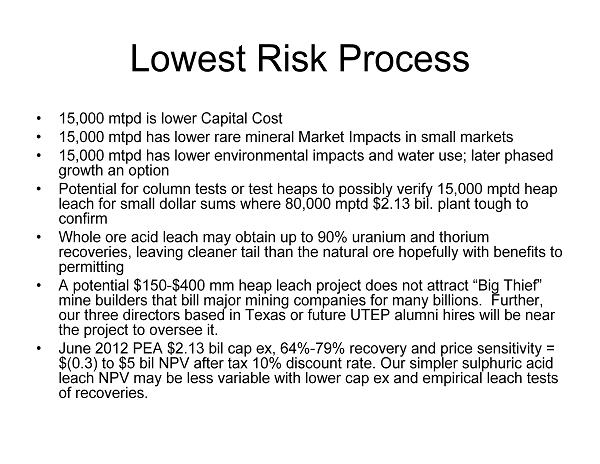

Lowest Risk Process • 15,000 mtpd is lower Capital Cost • 15,000 mtpd has lower rare mineral Market Impacts in small markets • 15,000 mtpd has lower environmental impacts and water use; laterphased growth an option • Potential for column tests or test heaps to possibly verify 15,000 mptd heap leach for small dollar sums where 80,000 mptd $2.13 bil. plant tough to confirm • Whole ore acid leach may obtain up to 90% uranium and thorium recoveries, leaving cleaner tail than the natural ore hopefully with benefits to permitting • A potential $150-$400 mm heap leach project does not attract “Big Thief” mine builders that bill major mining companies for many billions. Further, our three directors based in Texas or future UTEP alumni hires will be near the project to oversee it. • June 2012 PEA $2.13 bil cap ex, 64%-79% recovery and price sensitivity = $(0.3) to $5 bil NPV after tax 10% discount rate. Our simpler sulphuric acid leach NPV may be less variable with lower cap ex and empirical leach tests of recoveries.

Three TRER Possible Process Comparisons • TRER June 15, 2012 PEA 80,000 mtpd $2.13 billion high pressure grinding and floatation mill resembles a very large conventional copper or gold mine • “No Frills”sulphuric acid coarse whole heap leach could possibly resemble heap leach copper mines accounting for 472,700 tonnes or 40% of U.S. and 3,348,600 tonnes or about 1/5 th of 2012 world copper mine output per WBMS. • “Extra Processing”sulphuric acid heap leach process development more complex involving alternatives such as heated acid, acid bake, counter current agitation, magnetic upgrade, floatation, or other processes. These involve more cap ex, op ex and complexity, but offers $8 per tonne of ore more Nb or Sn revenue, possibly less acid use or other process advantages.

Process Development of others • TRER admires the technical studies or business progress of other companies. • Ucore PEA to use Intellimet process to separate individual REE from solution. • Mercator Minerals El Pilar copper mine PEA has 1,300 mptd sulphuric acid plant design. • Avalon Rare Metals refinery in Baton Rouge, LA. • We may not ship a concentrate to Asia or other refineries, but the development of REE process plants develops know how and technologies. TRER studies the advances of other companies.

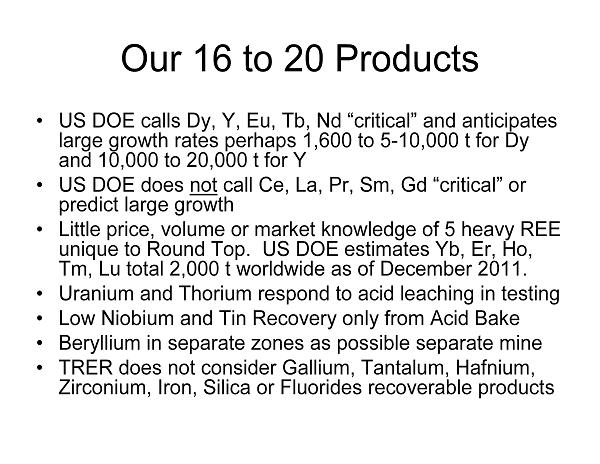

Our 16 to 20 Products • US DOE calls Dy, Y, Eu, Tb, Nd “critical”and anticipates large growth rates perhaps 1,600 to 5-10,000 t for Dy and 10,000 to 20,000 t for Y • US DOE does notcall Ce, La, Pr, Sm, Gd “critical”or predict large growth • Little price, volume or market knowledge of 5 heavy REE unique to Round Top. US DOE estimates Yb, Er, Ho, Tm, Lu total 2,000 t worldwide as of December 2011. • Uranium and Thorium respond to acid leaching in testing • Low Niobium and Tin Recovery only from Acid Bake • Beryllium in separate zones as possible separate mine • TRER does not consider Gallium, Tantalum, Hafnium, Zirconium, Iron, Silica or Fluorides recoverable products

Process Economic Objectives • Aiming for at least $15 to $20 per tonne gross margin at 15,000 mtpd at base case prices • Looking for at least $50 per tonne gross margin with SEC-compliant 3 yr avg historic prices; it is possible we are too conservative in heavy REE price outlooks • Margins may grow with higher tonnages as unit costs per tonne will hopefully fall with more tonnes. • Management looking for attractive returns

Ytterbium Yb TRER #4 to #6 Potential Revenue Generator after Dy, Y, U • At 56.5 g/t Yb is #3 REE in Round Top after Yttrium and Cerium by weight. It is half of the TRER “5 ultra rare heavies.” This is a high potential end market. • Priced at nil in TRER June 2012 PEA, $102.79/kg as oxide 3 yr avg in Ucore Jan 2013 PEA & $55/kg=$25/lb in “base case.” • US DOE Dec 2011 estimated total 2,000 t market Yb, Er, Ho, Tm, and Lu together. • Used as radiation source in portable xrays, stress gauges after earthquakes or underground explosions, laser amplifiers, catalysts and stainless alloys to improve grain and strength. Uses in dentistry, fiber optics, ceramics, solid state lasers, disk lasers, other lasers.

Erbium Er • At 32.8 g/t Erbium is the #4 REE Round Top, followed by Dy 31.6 g/t as #5 and Nd 28.8 g/t as #6. • Priced at nil in TRER June 2012 PEA, $88.20/kg as oxide 3 yr avg in Ucore Jan 2013 PEA & $55/kg=$25/lb in “base case.” • US DOE Dec 2011 estimated total 2,000 t market Yb, Er, Ho, Tm, and Lu together. • Used as neutron absorber in nuclear reactor control rods, pink coloring in glasses, vanadium alloys to reduce metal hardness, amplifiers, lasers, photographic filters to absorb infrared light and Yttrium-Al garnet lasers in skin surgery to remove acne scars, warts, moles and tattoos.

Holmium Ho • At 8.0 g/t a smaller part of 531 g/t TRER REE basket. • Priced at nil in TRER June 2012 PEA, $219.39/kg as oxide 3 yr avg in Ucore Jan 2013 PEA & $55/kg=$25/lb in “base case.” • US DOE Dec 2011 estimated total 2,000 t market Yb, Er, Ho, Tm, and Lu together. • Ho-Cr-Tm lasers widely used in military, medicine, meteorology. Uses include magnet alloys, flux for high magnetic fields, yellow or red coloring for glass or zirconia, neutron absorbers in nuclear reactor control rods.

Thulium Tm • At 7.1 g/t a smaller part of the 531 g/t TRER REE basket. • Priced at nil in TRER June 2012 PEA, nil in Ucore Jan 2013 PEA and $55/kg=$25/lb in “base case.” • US DOE Dec 2011 estimated total 2,000 t market Yb, Er, Ho, Tm, and Lu together. • Ho-Cr-Tm active laser widely used in military, medicine, meteorology. Tm alone lasers very efficient for surgery with minimal tissue coagulation. Used as radiation source in Xrays, high temp semiconductors, microwave magnets.

Lutetium Lu • At 8.9 g/t also a smaller part of the TRER REE basket. • Priced at nil in TRER June 2012 PEA, $1,036.40/kg as oxide 3-yr avg in Ucore Jan 2013 PEA and $55/kg=$25/lb in “base case.” • US DOE Dec 2011 estimated total 2,000 t market Yb, Er, Ho, Tm, and Lu together. • Uses include chemical catalysts, metal alloys and radionuclide therapy on neuroendocrine tumors. Lu-176 used to date age of meteorites.

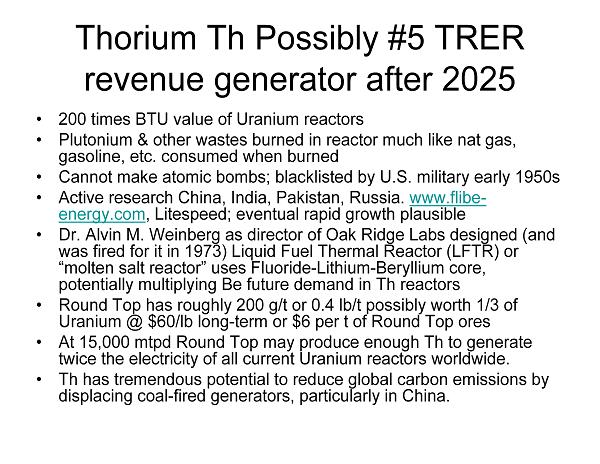

Thorium Th Possibly #5 TRER revenue generator after 2025 • 200 times BTU value of Uranium reactors • Plutonium & other wastes burned in reactor much like nat gas, gasoline, etc. consumed when burned • Cannot make atomic bombs; blacklisted by U.S. military early 1950s • Active research China, India, Pakistan, Russia. www.flibe- energy.com, Litespeed; eventual rapid growth plausible • Dr. Alvin M. Weinberg as director of Oak Ridge Labs designed (and was fired for it in 1973) Liquid Fuel Thermal Reactor (LFTR) or “molten salt reactor”uses Fluoride-Lithium-Beryllium core, potentially multiplying Be future demand in Th reactors • Round Top has roughly 200 g/t or 0.4 lb/t possibly worth 1/3 of Uranium @ $60/lb long-term or $6 per t of Round Top ores • At 15,000 mtpd Round Top may produce enough Th to generate twice the electricity of all current Uranium reactors worldwide. • Th has tremendous potential to reduce global carbon emissions by displacing coal-fired generators, particularly in China.

Option of Selling TRER in 2014 after Next Technical Study PEA • Will not issue TRER stock < $2.50 • Will not build mine ourselves unless (1) cap ex < $300 mm and (2) TRER > $15; pleasant surprise cap ex < $300 possible with “no frills”sulphuric acid heap leach; more testing needed to determine • We believe the potential of our company is favorable and no setback, impairment or share dilution prevents higher share price as seen in 2011 prior to June 15, 2012 $2.13 bil cap ex disclosurein NI 43-101 PEA study • Will not sell TRER < one times estimated base case EBITDA • Future market growth, Round Top expansion > 15,000 mtpd, price upsides > low rare heavy REE “base case”prices, unusual long resource life and exploration potential suggests appropriate valuation > 5 to 10x EBITDA. • Engaged Asian financial advisor 1-24-13 due to preliminary indication of possible interest

Option of Building Mine Ourselves • 15,000 mtpd whole ore heap leach with coarse ore “no frills”heap leach process near low end; we are aiming for $150-$400 mm • Processes near definition, recoveries subject to verification and started permitting 12-20-12 • Requires development of operating team in El Paso or Sierra Blanca • Preparing to build our mine makes a better bargaining position to sell out to big companies • Requires stronger balance sheet and financing

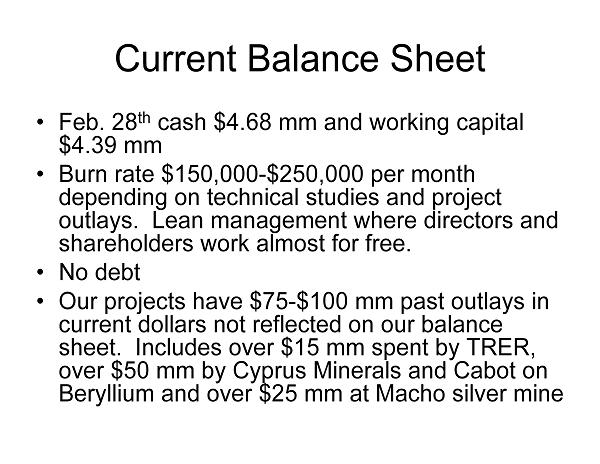

Current Balance Sheet • Feb. 28 th cash $4.68 mm and working capital $4.39 mm • Burn rate $150,000-$250,000 per month depending on technical studies and project outlays. Lean management where directors and shareholders work almost for free. • No debt • Our projects have $75-$100 mm past outlays in current dollars not reflected on our balance sheet. Includes over $15 mm spent by TRER, over $50 mm by Cyprus Minerals and Cabot on Beryllium and over $25 mm at Macho silver mine

Stronger Balance Sheet Objective • Adding $20 mm in equity or cash a step to listing on a major stock exchange • Adding $20 mm in equity or cash provides a stronger bargaining position to sell out • Adding $20 mm in equity or cash a step towards building the simpler whole ore sulphuric acid heap leach mine ourselves • Policy to fund next fiscal year in advance; requires $3.6 mm from current funds at 8-31-13 to fund FY 2014 • Permanent financing needed to fund FY 2015 if we do not sell out in FY 2014; May be efficient to fund several years at once as February and June 2011 financings are anticipated to fund us to August 2014.

Balance Sheet Alternatives to Build Without Selling Any Common Stock • Sell beryllium developed mine 887’tunnel 10’x 10’with steel sets each 5’ with Historical Resource of Cyprus Minerals 298,000 tons 1.9% BeO. • Sell Macho silver-lead-zinc exploration property and former mine • Sell a royalty on Round Top minerals; 1% royalty worth $28 mm @ 15,000 mtpd at 75% of June 2013 PEA prices at 10% discount rate without considering higher volumes; nearer $100 mm @ 5% and 27,000 mtpd • Offtake agreement • Sell future production, a form of debt; Ask $60 mm for either 1 mm lbs U, 3 mm lbs Th, 0.75 mm lbs Yb, 4 mm lbs Nb, or some other combination of our products delivered 2018 to 2025 • Borrow $1 of debt for each $1 of asset sale, royalty or offtake monies raised; Assuming over $50 mm raised separately, a lender may accept debt = one times EBITDA = $82-$110 mm = 5.5 mmt x $15-$20/t • Build in phases such as sulphuric acid plant in third year, lease equipment or use a contract miner in early years to defray capital. • Very last resort would be to sell equity or subdivide the property among the four large mountains or other zones to finance final stages of mine construction.

Management Aims to Maximize Value • Management and directors own approximately 45% of primary shares • Management and directors depend on share price appreciation for rewards given minimal directors fees and $10,000/mo CEO salary

God Bless Texas • Possibly the best place on earth to do business • 6.25% revenue royalty to support school system and 8% specific to uranium • TRER is the “home team”in West Texas • Round Top or Sierra Blanca seen from up to 50 miles on a clear day • God bless Texas